Global Nutricosmetics Market Size, Share, Trends, Growth Forecast Report – Segmented By Product Type (Supplements, Functional Foods and Beverages, Topical Products ), Ingredient, Application, and Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa) – Industry Analysis from 2025 to 2033

Global Nutricosmetics Market Size

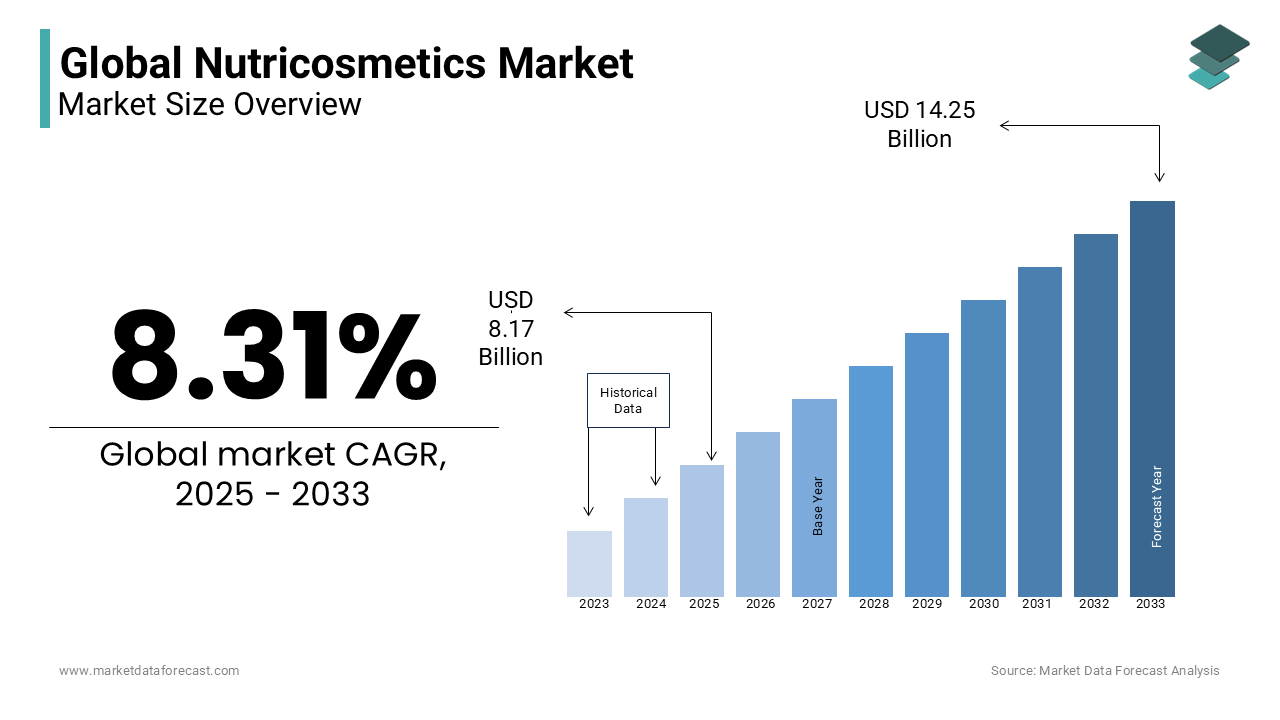

The global nutricosmetics market size was valued at USD 7.54 billion in 2024 and is expected to reach USD 14.25 billion by 2033, growing from USD 8.17 billion in 2025. The market is projected to grow at a CAGR of 8.31%.

The nutricosmetics market is a rapidly growing segment within the global beauty and wellness industry that focuses on ingestible products designed to enhance skin, hair, and overall beauty from inside. Nutritional supplements including vitamins, collagen, antioxidants and other bioactive ingredients are gaining popularity for their potential to improve skin elasticity, hair growth and overall complexion. For example, a study published by the National Institutes of Health found that daily collagen supplementation improved skin elasticity and hydration in women aged 35 to 55. Additionally, the increasing adoption of online shopping is a major factor in the growth of this market. According to the U.S. Department of Commerce, e-commerce sales accounted for over 14% of total retail sales in 2023 and a steady rise is expected in future years. This indicates that more consumers are turning to online platforms for beauty and health-related products.

MARKET DRIVERS

Advancements in Biotechnology

Advancements in biotechnology are significantly influencing the Nutricosmetics Market growth and is particularly through the development of more effective and scientifically validated beauty-from-within products. Innovations such as bioactive peptides, collagen and antioxidants are being refined to enhance their bioavailability and efficacy. According to the U.S. National Institutes of Health (NIH), collagen supplementation has been shown to improve skin elasticity and reduce wrinkles in clinical studies and with another study showing that a 30% improvement in skin elasticity after 12 weeks of collagen supplementation. Biotechnology allows for more targeted, efficient and scientifically backed formulations that appeal to health-conscious consumers.

Rising Consumer Awareness

Consumer understanding of the benefits of nutricosmetics is increasing rapidly and is propelled by a shift toward holistic health and beauty solutions. Data released by the U.S. National Library of Medicine shows that the world market for collagen-based supplements alone grew by more than 10% annually between 2016 and 2021 which drives forward by the rising recognition of their ability to improve skin elasticity, hydration and overall appearance. Demand for these products continues to rise and is especially seen among consumers who prioritize natural ingredients and scientifically validated products because people have become more educated about the internal benefits of ingestible beauty products.

MARKET RESTRAINTS

Lack of Regulatory Standards

One of the key restraints in the Nutricosmetics Market is the lack of standardized regulations and guidelines for product efficacy and safety. In many countries, these products are often not subject to the same stringent regulations as pharmaceuticals or cosmetics. According to the U.S. Food and Drug Administration (FDA), dietary supplements including nutricosmetics are not required to undergo pre-market approval for safety or efficacy and thereby leading to inconsistencies in product quality. This absence of regulation can result in consumer skepticism and hinder the market's growth since consumers demand more reliable and safe products.

High Price Point of Quality Products

The cost of superior-quality nutricosmetics items and particularly those incorporating advanced bioactive ingredients like collagen or antioxidants remains a significant restraint. As per the U.S. Bureau of Labor Statistics, customers in the U.S. spend approximately 10% of their disposable income on health-related goods but premium nutricosmetics can still be viewed as prohibitively expensive. These products often contain specialized as well as clinically tested ingredients which drives up their price. As a result, price sensitivity continues to be a barrier for many consumers and this is especially present in emerging markets where spending on beauty and wellness products is still developing.

MARKET OPPORTUNITIES

Expansion of Preventive Healthcare

One major opportunity in the Nutricosmetics Market lies in the growing trend of preventive healthcare. People are progressively seeking products that stops or deplays aging and improve skin health and maintain overall well-being rather than just addressing existing problems. The U.S. Centers for Disease Control and Prevention (CDC) reports that preventive healthcare has led to a 10 to 15% reduction in the overall healthcare burden in the country that encourages the shift towards products that promote long-term health benefits such as nutricosmetics. This trend is expected to fuel demand for supplements that support skin, hair and overall beauty and ultimately creating a profitable growth opportunity.

Rising Interest in Sustainable and Natural Ingredients

There is a significant opportunity for nutricosmetics brands to expand by focusing on sustainability and natural ingredients owing to consumers turning more environmentally conscious. According to the U.S. Environmental Protection Agency (EPA), 60% of customers prefer purchasing items that are ecologically friendly and contain natural ingredients. This rising preference for eco-friendly and organic products is opening avenues for companies to introduce more sustainable, plant-based and ethically sourced nutricosmetics. Brands which prioritize transparency, sustainability and natural ingredients are well-positioned to attract the growing demographic of environmentally-conscious consumers.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain disruptions present a significant obstacle to the Nutricosmetics Market growth and is particularly there in sourcing raw materials such as collagen and bioactive ingredients. According to the U.S. Department of Agriculture (USDA), global interruptions caused by events like the COVID-19 pandemic resulted in shortages and delays in the importation of key ingredients used in dietary supplements. In 2020, the USDA reported a 20% increase in the price of global raw materials due to transportation delays and labor shortages. These challenges not only surges production costs but also limit product availability and consequently affecting the market’s ability to meet rising consumer demand.

Consumer Skepticism on Efficacy

Consumer skepticism regarding the efficacy of nutricosmetics remains a major challenge for the market. Many people are uncertain about the tangible advantage of ingestible beauty products like collagen, antioxidants and vitamins compared to topical skincare products. Additionally, studies on the effectiveness of collagen supplements have shown mixed results. The U.S. National Institutes of Health (NIH) found that even though some studies report improvements in skin elasticity and hydration from collagen supplementation still some others show minimal or no significant effects. For instance, a 2019 NIH study revealed that daily collagen supplement consumption has led to a 20% increase in skin hydration after 8 weeks and at the same time another trial showed no improvement in skin elasticity or wrinkle reduction.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.31% |

|

Segments Covered |

By Product Type, Ingredient, Application, and Region |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Amway Corporation, Nestlé Skin Health (formerly known as L'Oréal), Pfizer Inc., Shiseido Company Limited, Beiersdorf AG, GlaxoSmithKline plc, BASF SE, Herbalife Nutrition Ltd., NeoCell Corporation, Murad, LLC (a Unilever company), HUM Nutrition Inc., GNC Holdings, Inc., Swisse Wellness Pty Ltd., Perfectil (Vitabiotics Ltd.), Perricone MD (a subsidiary of The Hut Group), Nutrafol, Life Extension Foundation, Solgar (a subsidiary of NBTY) and OLLY Nutrition |

SEGMENTAL ANALYSIS

By Product Type Insights

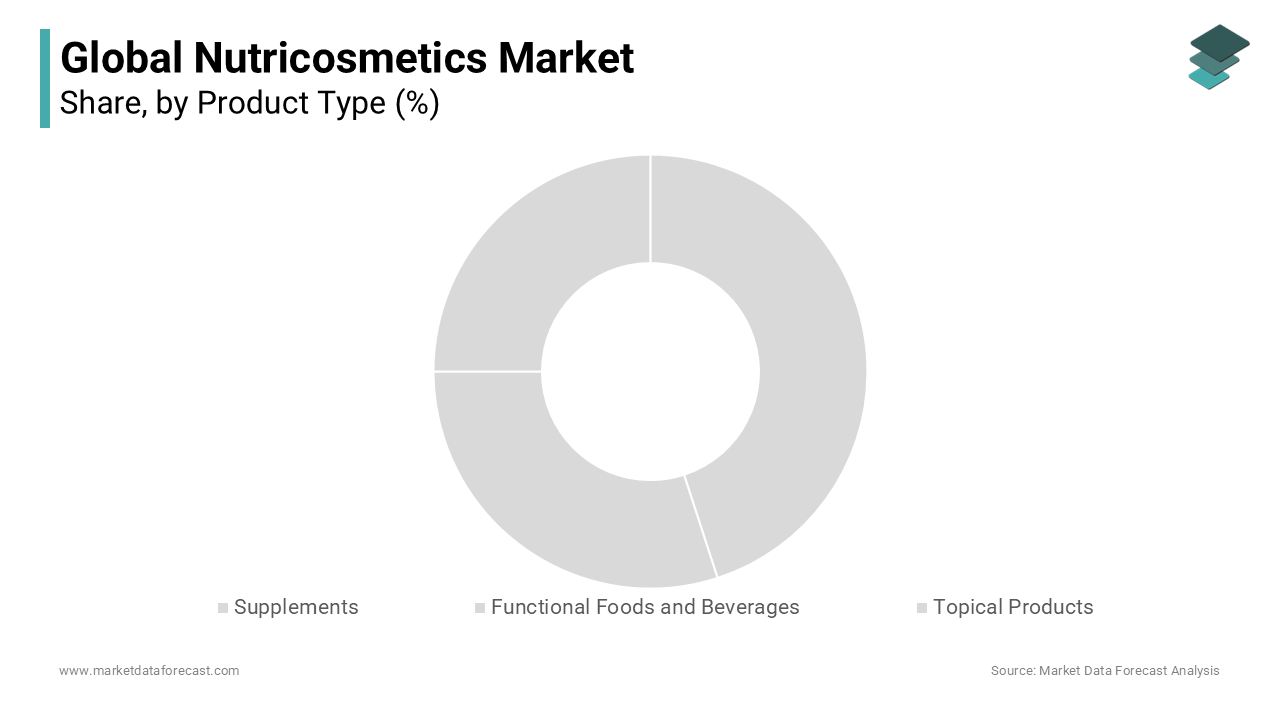

The supplements segment dominated the global nutricosmetics market by accounting 50.9% of the global market share in 2024. The convenience and growing consumer demand for ingestible beauty products that enhance appearance from within have majorly contributed to the supplements segment to register domination in the global market. According to the World Health Organization (WHO), over 2 billion people globally are affected by micronutrient deficiencies, commonly referred to as “hidden hunger.” Supplements containing vitamins (like A, C, and E) and minerals (like zinc and selenium) help combat these deficiencies, which are critical for maintaining healthy skin, hair, and nails. (WHO). Supplements often include ingredients like vitamins, minerals, and collagen, which are sought for their ability to improve skin, hair, and nails. Their ease of consumption and effectiveness continue to make them the most favored option among consumers seeking a hassle-free way to maintain their beauty regimen.

The functional foods and beverages segment is growing at a brisk pace and is expected to witness a CAGR of 8.1% over the forecast period owing to the growing demand for beauty-enhancing products that integrate easily into daily routines. According to World Health Organization (WHO), 50% of consumers globally prioritize health benefits in their food and beverage choices, particularly focusing on products with added vitamins, collagen, and antioxidants. These nutrients are scientifically proven to improve skin elasticity, reduce wrinkles, and promote hair and nail health. These products, such as beauty beverages and fortified snacks, appeal to younger, health-conscious consumers looking for both convenience and beauty benefits. The market's expansion reflects the growing interest in products that combine nutrition with taste by supporting the beauty and wellness trend.

By Ingredient Insights

The vitamins and minerals segment held the largest share of 35.4% of the global nutricosmetics market share in 2024. The widespread use of vitamins like A, C, and E, along with essential minerals such as zinc is driven by their key role in enhancing skin health, hair strength, and overall wellness. Zinc and biotin (a B-vitamin) are critical for healthy hair and nail growth. A deficiency in these nutrients has been linked to brittle nails, hair thinning, and alopecia. According to National Institute of Health, Biotin supplementation has been shown to improve nail thickness by 25% and reduce splitting in individuals with brittle nail syndrome. These ingredients are vital in promoting healthy, youthful skin, protecting against aging, and addressing issues like pigmentation. Their proven effectiveness in beauty products ensures their continued dominance in the nutricosmetics sector.

The collagen segment has been growing significantly and is predicted to register a CAGR of 7.9% over the forecast period. Collagen is the most abundant protein in the human body, making up approximately 30-35% of total body protein. It is a key component of skin, tendons, bones, and connective tissues, providing structural integrity and elasticity. Starting in their mid-20s, individuals lose about 1% of their collagen per year. By the age of 50, collagen production can decrease by up to 30%, leading to visible signs of aging, such as wrinkles, sagging skin, and reduced hydration according to National Institute of Health. Collagen’s role in improving skin elasticity, hydration and reducing wrinkles drives its popularity. Collagen-based products have gained significant traction in markets such as North America and Asia as consumers increasingly look for ways to preserve skin health.

By Application Insights

The skin care segment held the leading share of 50.1% of the global market in 2024. The segment is likely to continue to grow as consumers focus on enhancing skin health. According to American Academy of Dermatology, 80% of people aged 11 to 30 experience acne at some point, and conditions like hyperpigmentation and dryness affect millions globally. These concerns drive the need for skin-nourishing solutions, including nutricosmetics targeting hydration, elasticity, and pigmentation. Products like oral collagen supplements, antioxidant-based formulas and vitamins that target skin aging, dryness and pigmentation contribute to skin care’s dominance. The demand for skin care nutricosmetics continues to rise which is positioning it as the primary segment in the beauty industry because of the increasing awareness of the benefits of internal products.

The hair care segment is another notable segment and is projected to expand at a CAGR of 8.1% in the nutricosmetics market over the forecast period. According to the American Academy of Dermatology, approximately 50% of men and women experience some degree of hair thinning or loss by the age of 50. Hair loss conditions like androgenetic alopecia affect 30 million women and 50 million men in the U.S. alone. This segment's growth is driven by consumers’ increasing interest in promoting hair health, strength and growth. Products containing biotin, amino acids and collagen are becoming popular for addressing concerns such as hair thinning and hair loss and particularly in regions like Asia-Pacific where these issues are prominent.

REGIONAL ANALYSIS

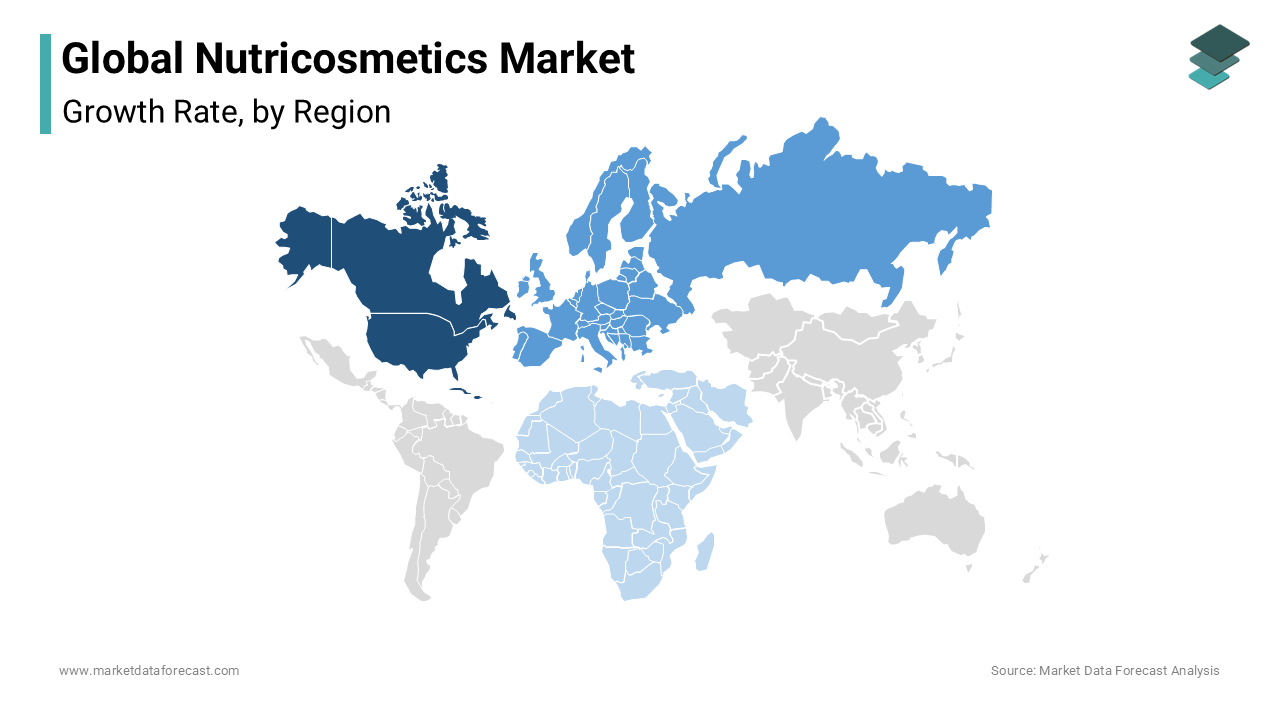

North America is a significant market for Nutricosmetics, driven by a strong emphasis on beauty and wellness trends. The region's consumers are increasingly inclined towards holistic approaches to skincare and beauty, contributing to the popularity of nutricosmetic products.

By following, Europe is another prominent player in the Nutricosmetics market growth, with a strong focus on natural and organic beauty products. Consumers in Europe often prioritize products that align with clean beauty trends, contributing to the popularity of nutricosmetics with natural and plant-based ingredients.

Asia-Pacific has a third significant emphasis on skincare and beauty. The popularity of nutricosmetics in this region is driven by factors such as a strong belief in the connection between nutrition and skin health, a growing middle class, and a robust beauty and wellness industry.

Latin America is embracing a more holistic approach to the beauty industry and contributing to the adoption of nutricosmetic products. The market demand is expected to witness further growth as consumers seek innovative solutions for skincare and overall well-being.

The Middle East and Africa region also holds a combination of rising disposable income, urbanization, and a growing awareness of the importance of skincare. However, this region is evolving as consumers seek products that address specific beauty.

KEY MARKET PARTICIPANTS AND COMPETITIVE LANDSCAPE

The major key players in the global nutricosmetics market are L'Oréal, Nestlé Health Science, Unilever, Amway Corporation, GNC Holdings, Herbalife Nutrition, Beiersdorf AG, The Estée Lauder Companies, Oisix ra daichi Inc., SkinCeuticals (a subsidiary of L'Oréal), and others.

The competition in the Nutricosmetics Market is intensifying as consumer interest in beauty-from-within products continues to grow. Key players in the market include global beauty and wellness giants such as L'Oréal, Nestlé Health Science and Unilever as well as emerging brands specializing in ingestible beauty solutions. These companies are leveraging advancements in biotechnology, clinical studies and consumer behaviour research to create innovative products targeting skin, hair and nail health.

The market is marked by a rising number of collaborations, partnerships and acquisitions as companies seek to expand their portfolios and strengthen their market presence. For example, L'Oréal acquired a stake in Galderma in 2024 which is a move aimed at reinforcing its position in the nutricosmetics space. Meanwhile, newer entrants such as Holidermie and TOSLA Nutricosmetics are introducing unique formulations using natural ingredients and advanced technology to differentiate themselves.

In addition, e-commerce platforms and in that particularly online beauty retailers like Sephora are playing a significant role in the distribution of nutricosmetics by allowing brands to reach a broader and more diverse customer base. The market continues to expand and requires companies to differentiate themselves not only through product innovation but also by emphasizing sustainability, transparency and personalization to meet the growing demands of health-conscious, beauty-savvy consumers.

RECENT HAPPENING IN THE MARKET

- In August 2024, L'Oréal acquired a 10% stake in Swiss skincare company Galderma for an undisclosed premium. This strategic investment aims to strengthen L'Oréal's position in the medical cosmetics market and foster collaboration on research and development.

- In June 2024, TOSLA Nutricosmetics partnered with Foodpairing AI to enhance the flavor technology of their VELIOUS line. This collaboration seeks to refine and elevate the sensory experience of their products by leveraging advanced AI-driven flavor pairing techniques.

MARKET SEGMENTATION

This research report on the global nutricosmetics market has been segmented and sub-segmented based on product type, ingredient, application, and region.

By Product Type

- Supplements

- Functional Foods and Beverages

- Topical Products

By Ingredient

- Vitamins and Minerals

- Collagen

- Antioxidants

- Amino Acids

- Herbal Extracts

By Application

- Skin Care

- Hair Care

- Nail Care

- General Wellness

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current size of the global nutricosmetics market?

The global nutricosmetics market size was worth USD 4.47 bn in 2022.

Which regions are the primary contributors to the nutricosmetics market share?

Major contributors to the nutricosmetics market share include North America, Europe, Asia-Pacific, and regions experiencing a growing interest in beauty and wellness products.

What impact has the COVID-19 pandemic had on the nutricosmetics market?

The COVID-19 pandemic has heightened consumer awareness of health and wellness, positively impacting the nutricosmetics market as individuals seek holistic approaches to beauty and overall well-being.

Who are the key players in the global nutricosmetics market?

Companies playing a leading role in the global nutricosmetics market include Amway Corporation, Nestlé Skin Health (formerly known as L'Oréal), Pfizer Inc., Shiseido Company Limited, Beiersdorf AG, GlaxoSmithKline plc, BASF SE, Herbalife Nutrition Ltd., NeoCell Corporation, Murad, LLC (a Unilever company), HUM Nutrition Inc., GNC Holdings, Inc., Swisse Wellness Pty Ltd., Perfectil (Vitabiotics Ltd.), Perricone MD (a subsidiary of The Hut Group), Nutrafol, Life Extension Foundation, Solgar (a subsidiary of NBTY) and OLLY Nutrition (a Unilever company).

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]