Global NPK Fertilizers (Feed Grade and Food Grade) Market Segmentation Size, Share, Trends and Growth Analysis Report – Segmented By Form (Powder, Liquid and Others), Application (Dairy, Bakery Products, Meat and Meat Products and Beverages), Type (Phosphorus, Potassium, Nitrogen, Others) and Region (North America, Europe, Asia – Pacific, Latin America, Middle East and Africa) – Industry Analysis from 2025 to 2033

Global NPK Fertilizers (Feed-Grade and Food-Grade) Market Size

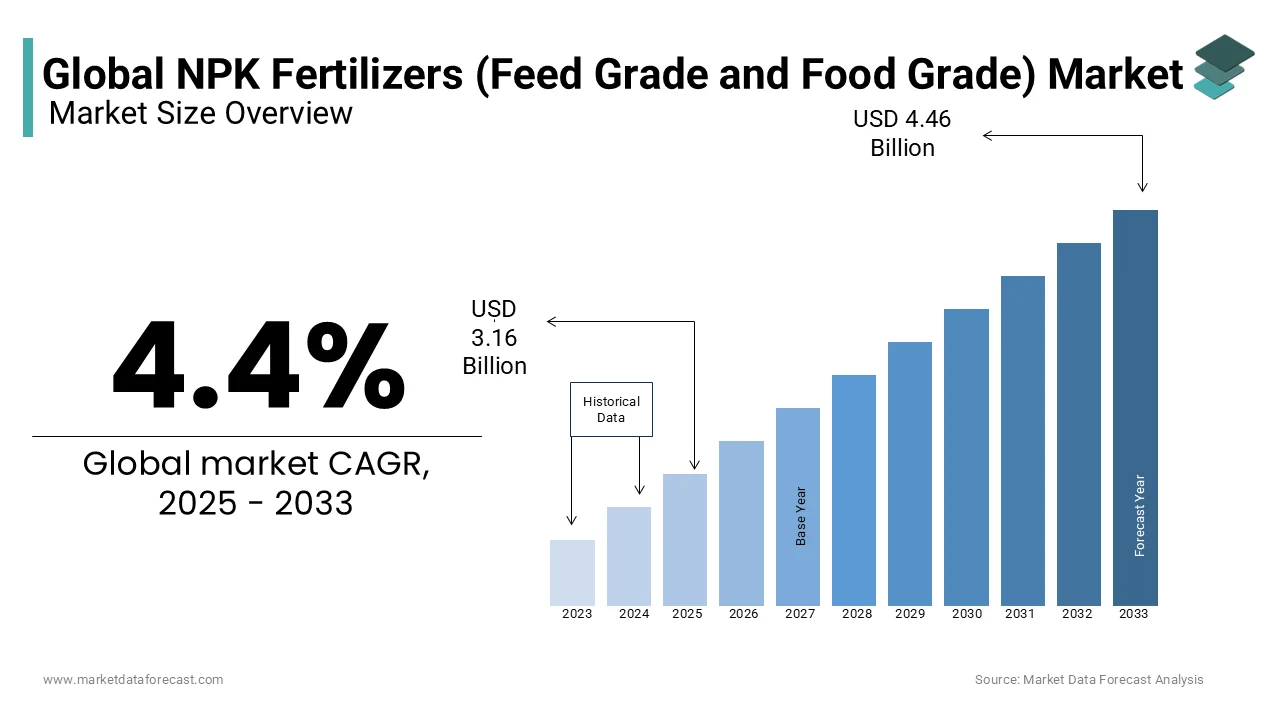

The global NPK fertilizers (feed-grade and food-grade) market was valued at USD 3.03 billion in 2024 and is anticipated to reach USD 3.16 billion in 2025 billion in 2025 from USD 4.46 billion by 2033, growing at a CAGR of 4.4% during the forecast period from 2025 to 2033.

Increased consumption of meat and dairy products due to increased disposable income and interest in nutrition is supposed to drive the market for NPK Fertilizers (feed-grade and food-grade).

NPK Fertilizers (feed-grade and food-grade) are a generic term used for fertilizers containing 2 to 3 fertilizer macronutrients, which can contain multiple scoring formulations and clearly different types of processes. This fertilizer helps increase the efficiency of nutrient and water use and reduces the cost of application. In addition, its use increases the quality and yield of the crop. NPK fertilizer (feed-grade and food-grade) is an important soil fertilizer and provides essential micronutrients to the soil. NPK Fertilizers (feed-grade and food-grade) consist of three chemicals, namely nitrogen, phosphorus, and potassium. NPK Fertilizers (feed-grade and food-grade) form an ideal ratio of 16-16-16 and indicate the amount of nitrogen, phosphorus, and potassium they contain. Nitrogen, phosphorus, and potassium are used most in gardens, grass-fed trees, shrubs, evergreens, flowers, and vegetables for added versatility.

Some plants do not grow due to poor soil nutrition. NPK Fertilizers (feed-grade and food-grade) are used to improve soil fertility and enhance plant growth. If the amount of NPK Fertilizers (feed-grade and food-grade) fertilizer is exceeded, the crop is ruined. There are two types of fertilizers on the market, organic and synthetic. Natural fertilizers are slow compared to synthetic fertilizers, but they are more effective than synthetic fertilizers. Natural fertilizer is extracted from plants and natural products such as mushroom fertilizer, blood meal, bone meal, horse or poultry fertilizer, and compost. Synthetic fertilizers are made from other chemicals, so they work faster than natural fertilizers. Powdered fertilizers have a longer shelf life than liquid ones. It is used as a fertilizer in the agricultural industry to meet the demands of healthy crops. NPK Fertilizers (feed-grade and food-grade) are widely used in the agricultural industry to ensure healthy plant growth and come in a variety of forms, including liquid, gas, and granular. NPK Fertilizers (feed-grade and food-grade) further reduce fertilization costs by improving efficiency in the use of nutrients and water.

MARKET DRIVERS

Growing consumer awareness of the benefits of food-grade phosphates, along with growing demand for dairy and meat products, are some of the key drivers driving the global NPK fertilizer (feed-grade and food-grade) market. The growing need for high-efficiency fertilizers, increased adoption of precision agriculture, ease of use and application, and the improved crop protection provided by NPK Fertilizers (feed-grade and food-grade) are key factors driving business growth. Also, the increased demand for NPK Fertilizers (feed-grade and food-grade) has fueled market growth by increasing overall agricultural production to meet global food needs. The increasing adoption of NPK Fertilizers (feed-grade and food-grade) in emerging economies is estimated to provide favorable opportunities for market growth. The adoption of new agricultural technologies and the improvement of crop fertility are factors driving the growth of NPK Fertilizers (feed-grade and food-grade) on the worldwide market.

Increased consumption of fruits and vegetables and increased productivity of crops have driven the growth of the global NPK fertilizer (feed-grade and food-grade) market. Also, the prospect of livestock diseases and the awareness of food quality have increased the need for NPK Fertilizers (feed-grade and food-grade) products in the international market, and the demand for these fertilizers is higher in the market by increasing the nutrient and moisture content of the floor. Growing consumer awareness of the benefits of food-grade phosphates, along with growing demand for dairy and meat products, are some of the key drivers supporting this market. The NPK fertilizer (feed-grade and food-grade) market has been driven by the growth of the global agricultural sector. Innovations in technology and improved fertilizer efficiency are attracting farmers to use NPK Fertilizers (feed-grade and food-grade) instead of other fertilizers.

Market RESTRAINTS

However, supply cycle issues and fluctuations in storage and handling costs associated with production and use are some of the factors limiting market growth. Strict government regulations and lack of knowledge can hamper the growth of NPK Fertilizers (feed-grade and food-grade) in the global market. Fluctuations in prices, storage, and handling costs are some limitations and can affect the growth of the NPK fertilizer (feed-grade and food-grade) market.

Impact of COVID-19 on the NPK Fertilizers Market

The spread of coronavirus is influencing several activities in the worldwide NPK fertilizer (feed-grade and food-grade) market. The global economy affected by this pandemic has halted other essential industries. The NPK fertilizer (feed-grade and food-grade) market has been hit hard by low demand, tight supply, and lack of storage. International port closures and supply chain shortages are factors influencing the global NPK fertilizer (feed-grade and food-grade) market. In addition, restrictions on agricultural production due to the unfavorable labor shortage of the monsoon are foreseen to mitigate the impact on NPK Fertilizers (feed-grade and food-grade).

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.4% |

|

Segments Covered |

By Type, Form, Application, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Uralchem Group, Kingenta Ecological Engineering Group, PhosAgro Group, Stanley Fertilizer Co. Ltd, Xinyangfeng Fertilizer Co. Ltd, Arabic Chinese Chemical Fertilizer Co. Ltd, Luxi Chem. Industry, Huachang Chem., Batian, Hubei Yihua Fertilizer Industry Co. Ltd., Shandong Hongri Acron Chem., Shindoo chemi-industry co, .ltd., Yangmei Fengxi Fertilizer Ind. Grp, Henan Xinlianxin Chemicals Ltd., Yuntianhua Group Co., Ltd and Liuguo Chem Ltd and Others. |

SEGMENTAL ANALYSIS

Global NPK Fertilizers (Feed-Grade And Food-Grade) Market By Type

into nitrogen, potassium, phosphorus, etc. The phosphorus segment is likely to dominate the market in 2020 and is estimated to grow faster during the conjecture period. The use of phosphates in the food industry is on the rise due to its lower cost compared to traditional food additives.

Global NPK Fertilizers (Feed-Grade And Food-Grade) Market By Form

into liquid, powder, etc. The market is estimated to be dominated by the powders sector in 2020 and is likely to grow at the highest CAGR.

Global NPK Fertilizers (Feed-Grade And Food-Grade) Market By Application

The NPK fertilizer (feed-grade and food-grade) market is segmented into bakery, meat, and meat, dairy, and beverage products. The meat and meat products segment is determined to dominate the market in 2020 as demand for processed and packaged meat increases globally, especially in developing countries such as India, China, and Brazil.

REGIONAL ANALYSIS

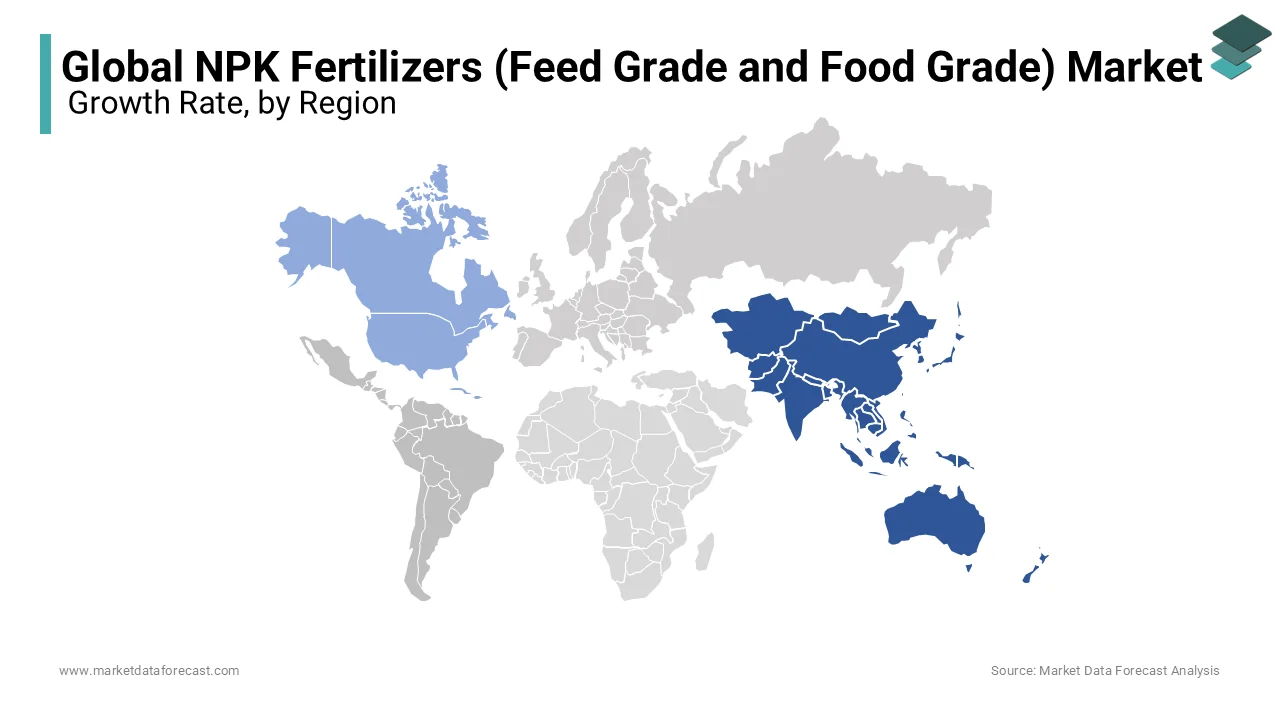

The Asia Pacific region has the largest share in the world and has been a leader for the past two years. The Asia Pacific market is growing due to changes in food consumption patterns driven by rising consumer income and urbanization, especially in South Asian countries. China and India are the main countries in the consumption of NPK Fertilizers (feed-grade and food-grade). North America occupies a third of the market after Asia. In the horticultural industry, higher profits and higher disposable income of farmers are some of the factors driving the demand for NPK Fertilizers (feed-grade and food-grade) in the worldwide market.

KEY MARKET PLAYERS

Key players in the NPK Fertilizers (feed-grade and food-grade) market include Uralchem Group, Kingenta Ecological Engineering Group, PhosAgro Group, Stanley Fertilizer Co. Ltd, Xinyangfeng Fertilizer Co. Ltd, Arabic Chinese Chemical Fertilizer Co. Ltd, Luxi Chem. Industry, Huachang Chem., Batian, Hubei Yihua Fertilizer Industry Co. Ltd., Shandong Hongri Acron Chem., Shindoo chemi-industry co, .ltd., Yangmei Fengxi Fertilizer Ind. Grp, Henan Xinlianxin Chemicals Ltd., Yuntianhua Group Co., Ltd, and Liuguo Chem Ltd.

MARKET SEGMENTATION

This research report on the global NPK fertilizers market is segmented and sub-segmented into the following categories.

By Form

- Power

- Liquid

By Application

- Dairy

- Bakery Products

- Meat and Meat products

- Beverages

By Type

- Phosphorus

- Potassium

- Nitrogen

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What is driving the growth of the global NPK fertilizer market?

Increasing demand for high-yield crops, rising global population, and expanding livestock and poultry industries are major growth drivers.

What is the difference between feed-grade and food-grade NPK fertilizers?

Feed-grade NPK fertilizers are used as nutritional supplements for animal feed, while food-grade NPK fertilizers are used to enhance soil fertility for food crops.

Which regions dominate the NPK fertilizer market?

Asia-Pacific leads due to high agricultural activity, followed by North America and Europe with strong demand for specialty fertilizers.

What are the key challenges in the NPK fertilizer industry?

Rising raw material costs, stringent environmental regulations, and supply chain disruptions affect market growth.

Who are the major players in the global NPK fertilizer market?

Leading companies include Yara International, Nutrien Ltd., ICL Group, K+S AG, and The Mosaic Company.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]