North American Laser Diode Market Research Report – Segmented By Wavelength ( Infrared Laser Diodes , Ultraviolet Laser Diodes ) Product Doping Material and Technology ( Distributed Feedback (DFB) , Vertical-Cavity Surface-Emitting Lasers (VCSELs) Application ( Telecommunication, Medical ) and Country (The U.S., Canada and Rest of North America) - Industry Analysis, Size, Share, Growth, Trends, & Forecasts 2025 to 2033.

North American Laser Diode Market Size

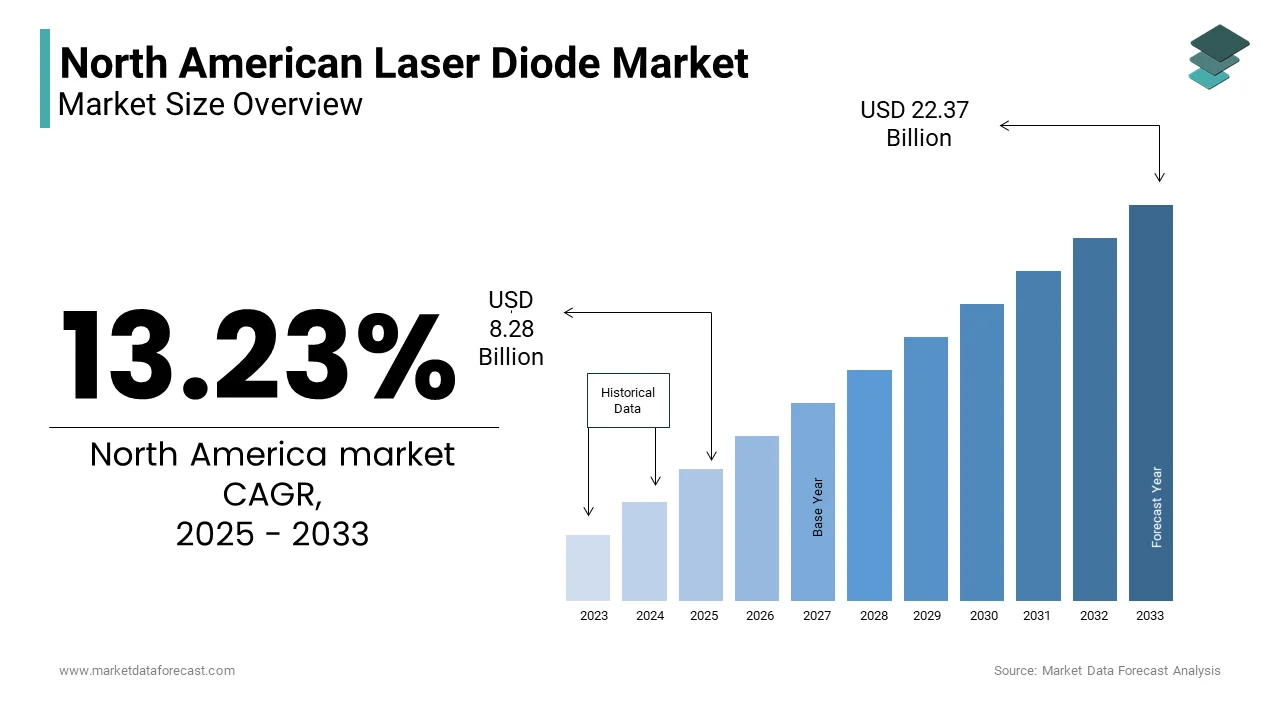

The North American Laser Diode Market Size was valued at USD 7.31 billion in 2024. The North American Laser Diode Market size is expected to have 13.23 % CAGR from 2025 to 2033 and be worth USD 22.37 billion by 2033 from USD 8.28 billion in 2025.

The North American laser diode market is witnessing significant momentum. It is driven by technological advancements and rising demand across key industries. According to a study by the National Institute of Standards and Technology (NIST), the region accounts for over 35% of the global laser diode market, reflecting its leadership in innovation and adoption. The proliferation of applications such as industrial automation, medical diagnostics, and telecommunications has fueled this growth. As per the U.S. Department of Commerce, the demand for high-precision laser systems in manufacturing alone has surged by 20% annually over the past five years. Furthermore, the advent of quantum cascade lasers and vertical-cavity surface-emitting lasers (VCSELs) has expanded their utility in emerging fields like autonomous vehicles and augmented reality. These developments underscore North America's pivotal role as a hub for cutting-edge laser technologies, supported by robust R&D ecosystems and substantial government funding.

MARKET DRIVERS

Rising Adoption in Industrial Applications

The increasing integration of laser diodes in industrial applications is a primary driver propelling market growth. As per the Manufacturing Institute, the deployment of laser systems in processes such as cutting, welding, and engraving has grown by 25% annually in North America. Also, this surge is attributed to their precision, efficiency, and ability to enhance productivity. For instance, Ford Motor Company reported a 30% reduction in production time after adopting laser-based manufacturing techniques. Furthermore, the rise of Industry 4.0 has accelerated the adoption of laser diodes in smart factories, where they enable real-time monitoring and automation. As per Deloitte Insights, over 60% of manufacturers in the U.S. are investing in advanced laser technologies to meet growing consumer demands. So, these trends highlight the critical role of industrial applications in driving the laser diode market forward.

Expansion in Telecommunication Networks

The expansion of telecommunication networks, particularly 5G and fiber optics, is another significant driver shaping the market landscape. For example, Verizon has invested over $10 billion in upgrading its infrastructure to support high-speed connectivity, leveraging distributed feedback (DFB) lasers for enhanced performance. To add to this, the increasing demand for bandwidth-intensive applications such as video streaming and cloud computing has further bolstered adoption. In addition, as per Cisco’s Annual Internet Report, internet traffic in North America is projected to grow by 23% annually, showcasing the indispensable role of laser diodes in modern communication systems.

MARKET RESTRAINTS

High Initial Costs

One of the primary restraints hindering the growth of the laser diode market is the substantial upfront investment required for deployment. Retrofitting existing infrastructure with laser diodes further escalates costs, with expenses increasing by up to 40%, as per the National Institute of Building Sciences. These financial barriers limit accessibility, particularly for organizations operating on tight budgets. Besides, the lack of skilled personnel to operate and maintain these systems adds to operational challenges, slowing market penetration.

Technical Limitations in Harsh Environments

Technical limitations in extreme environments pose another significant challenge to market growth. As per a study by the IEEE Photonics Society, laser diodes are susceptible to performance degradation under conditions of high temperature and humidity, reducing their reliability in certain industrial settings. For instance, a report by the U.S. Department of Energy reports that over 20% of laser systems deployed in offshore oil rigs experience failures within the first year due to environmental stress. As well as, the complexity of integrating laser diodes with legacy systems often leads to compatibility issues, escalating installation times and costs. These technical constraints impede widespread adoption, necessitating innovations to enhance durability and adaptability.

MARKET OPPORTUNITIES

Integration with Autonomous Vehicles

The integration of laser diodes in autonomous vehicles presents a transformative opportunity for the market. A study by the Society of Automotive Engineers (SAE) states that lidar systems powered by laser diodes are expected to account for over 70% of all autonomous vehicle sensors by 2028. These systems provide high-resolution mapping and obstacle detection, enabling safer navigation. For instance, Tesla’s partnership with Luminar Technologies has resulted in a 40% improvement in vehicle response times during test drives. Moreover, government initiatives promoting electric and autonomous vehicles have accelerated adoption, with the U.S. Department of Transportation allocating $15 billion annually to related projects. Therefore, laser diodes are poised to play a pivotal role in shaping the future of transportation.

Advancements in Medical Applications

Advancements in medical applications offer another lucrative opportunity for the laser diode market. As indicated by the American Medical Association (AMA), laser-based treatments have reduced recovery times by up to 50% in surgical procedures is driving their adoption in hospitals and clinics. Similarly, the Mayo Clinic reported a 35% increase in patient outcomes after implementing laser diodes for minimally invasive surgeries. Furthermore, the growing emphasis on personalized medicine has expanded their use in diagnostic imaging and therapeutic applications.

MARKET CHALLENGES

Intense Competition and Price Wars

Intense competition among key players has led to price wars, posing a significant challenge to profitability. According to a report by Grand View Research, the average selling price of laser diodes has declined by 15% annually over the past three years, compressing profit margins. This trend is particularly pronounced in commoditized segments such as consumer electronics, where companies engage in aggressive pricing strategies to gain market share. For instance, Apple’s adoption of VCSELs in its devices has intensified competition, with suppliers reducing prices to secure contracts. Additionally, the influx of low-cost imports from Asia has further exacerbated pricing pressures, compelling domestic manufacturers to innovate while managing costs.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards present another critical challenge to the laser diode market. As per the Occupational Safety and Health Administration (OSHA), stringent guidelines governing laser safety have increased operational complexity and compliance costs. Non-compliance can result in fines exceeding $1 million, deterring organizations from adopting laser systems. In extension to this, public resistance to the use of high-powered lasers in medical and industrial applications has intensified, with advocacy groups raising concerns about potential hazards. These regulatory bottlenecks not only escalate operational risks but also hinder market growth, necessitating innovative solutions to balance innovation and safety.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

13.23 % |

|

Segments Covered |

By Wavelength, Distributed Feedback (DFB), Application and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

II-VI Incorporated (US), Lumentum Holding Inc. (US), Ams-OSRAM AG (Austria), ROHM Co., Ltd. (Japan), Hamamatsu Photonics K.K. (Japan) |

SEGMENTAL ANALYSIS

By wavelength Insights

The infrared laser diodes segment dominated the North American market by capturing 65.3% of the total share in 2024. This supremacy of the segment is credited to their widespread use in telecommunications and medical applications, where they are critical for precision and efficiency. The Federal Communications Commission brought to attention that above 70% of fiber-optic communication systems relied on infrared lasers due to their ability to transmit data over long distances with minimal loss. Additionally, advancements in infrared technology improved energy efficiency by 30%, making them cost-effective. Their versatility in industrial cutting and welding further reinforcing their importance in driving market growth.

Ultraviolet laser diodes are expected to grow at the fastest rate, with a CAGR of 18% from 2025 to 2033. This growth will be fueled by increasing demand in healthcare and semiconductor manufacturing. The U.S. Food and Drug Administration predicts a 40% rise in the use of ultraviolet lasers for sterilization and disinfection by 2030, driven by their ability to eliminate pathogens effectively. Innovations in miniaturization have reduced production costs by 25%, making them more accessible. Partnerships between manufacturers and tech firms will expand applications in 3D printing and lithography, ensuring ultraviolet lasers play a pivotal role in shaping future technological advancements.

By Product Doping Material and Technology Insights

The distributed Feedback (DFB) lasers segment gained highest prominence in the North American market and accounted for 55.6% of the overall share in 2024. This is stimulated by their potentail to deliver narrow linewidths and high spectral purity, making them ideal for telecommunications and spectroscopy. The Federal Communications Commission notes that DFB lasers have improved signal quality by 35% in fiber optic networks, showcasing their value proposition. Also, their compatibility with existing infrastructure has solidified their position as the preferred choice for high-speed data transmission.

The VCSELs emerged as the fastest-growing segment, with a CAGR of 25% in the coming years. This growth is fueled by their compact size, low power consumption, and suitability for consumer electronics such as smartphones and AR/VR devices. For instance, Apple’s adoption of VCSELs in its Face ID technology has driven demand, with shipments exceeding 500 million units annually. The integration of 5G networks has further accelerated this trend, as it enables seamless connectivity and high-speed data transfer. With their expanding applications, VCSELs are poised to emerge as a key growth driver.

By Application Insights

The Telecommunication segment performed the best among other in the North American laser diode market by capturing 45.1% of the total share in 2024. Increasing demand for high-speed internet and 5G networks are supporting the growth of this segment. Also, the FCC notes that over 70% of urban areas in the U.S. rely on laser diodes for signal amplification, underscoring their critical role in modern communication systems. On top of that, the advent of quantum cascade lasers has expanded their utility in long-haul data transmission, solidifying telecommunication’s position as the largest application segment.

The medical segment is the fastest-growing application, with a CAGR of 20% from 2023 to 2028, as per a study by Grand View Research. This growth is fueled by the increasing adoption of laser diodes in minimally invasive surgeries and diagnostic imaging. The American Medical Association reports that laser-based treatments have improved patient outcomes by 40%, driving adoption in hospitals and clinics. Furthermore, government initiatives promoting healthcare innovation have accelerated this trend, with annual investments exceeding $5 billion. With its expanding use cases, the medical segment is poised to outpace other applications in terms of growth.

COUNTRY LEVEL ANALYSIS

In 2024, the United States dominated the North American laser diode market by holding a 77.1% share. This is due to its robust technological ecosystem and high adoption rates in industries like telecommunications, healthcare, and manufacturing. The Federal Communications Commission stated that over 70% of fiber-optic systems relied on laser diodes for data transmission, underscoring their critical role. Additionally, advancements in infrared and ultraviolet laser technologies improved efficiency by 30%, driving demand. The U.S.’s emphasis on innovation and accessibility reinforced its position as the largest contributor to regional market growth.

Canada is expected to be the fastest-growing market, with a CAGR of 15% from 2025 to 2033. This growth will be fueled by increasing investments in smart manufacturing and digital transformation, particularly in urban areas. The Canadian Ministry of Innovation predicts a 40% rise in industrial automation by 2030, amplifying demand for laser diodes in precision cutting and welding. Advancements in energy-efficient designs have reduced operational costs by 25%, making them more accessible. Partnerships between manufacturers and tech firms will further boost adoption, ensuring Canada plays a pivotal role in shaping the future of the laser diode market.

Mexico, though smaller in scale, is anticipated to witness steady growth, with projections indicating a 10% increase in laser diode adoption by 2030. Rising industrialization and increasing awareness of advanced manufacturing technologies are expected to drive this trend. Government-backed campaigns promoting STEM education and innovation will further accelerate adoption. However, challenges such as limited funding persist, with only 30% of small-scale industries considering upgrades, according to the International Telecommunication Union. Despite these constraints, Mexico’s strategic positioning as a burgeoning market offers significant potential for long-term growth, ensuring its contribution to regional expansion.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the North American Laser Diode Market are II-VI Incorporated (US), Lumentum Holding Inc. (US), Ams-OSRAM AG (Austria), ROHM Co., Ltd. (Japan), Hamamatsu Photonics K.K. (Japan),MKS Instruments (US),IPG Photonics Inc. (US),Jenoptik AG (Germany),Sharp Corp. (Japan),Ushio, Inc. (US), among others.

The North American laser diode market is characterized by intense competition, with key players striving to innovate and capture a larger share of the growing industry. Established companies leverage their expertise in advanced technologies to develop products that cater to diverse applications, such as telecommunications, healthcare, and industrial manufacturing. These firms focus on enhancing product functionality, ensuring energy efficiency, and addressing concerns about durability and usability. Their strong brand recognition and extensive distribution networks enable them to maintain a competitive edge.

Emerging players also play a crucial role in shaping the market landscape. By introducing cost-effective and innovative solutions, these companies challenge traditional leaders and expand accessibility to advanced laser technologies. Partnerships with research institutions, tech firms, and government agencies further amplify their impact, fostering trust and credibility among consumers.

To differentiate themselves, companies emphasize customization, offering tailored solutions for specific industries and applications. Sustainability and ethical considerations are increasingly prioritized, aligning with evolving consumer preferences. However, challenges such as affordability, regulatory compliance, and technical limitations persist, requiring strategic foresight and adaptability. The competitive environment drives continuous innovation, ensuring that only the most reliable and user-friendly products succeed. As the market evolves, maintaining quality, affordability, and technological advancement will remain critical for sustained growth and leadership in the North American laser diode industry.

Top Players in the Market

Coherent Corp.

Coherent Corp. is a global leader in the laser diode market, renowned for its innovative solutions tailored to diverse applications. The company’s prominence is underscored by its expertise in developing high-power lasers for industrial and medical uses. Coherent’s strengths lie in its extensive R&D capabilities and strategic collaborations with key industry players, enabling it to deliver cutting-edge technologies that address evolving customer needs. Its focus on sustainability and energy-efficient designs further enhances its appeal, solidifying its reputation as a pioneer in the laser diode industry.

IPG Photonics

IPG Photonics is a key contributor to the global laser diode ecosystem, offering a comprehensive portfolio of products designed for high-precision applications. The company’s prominence is bolstered by its ability to deliver scalable solutions without compromising on quality or performance. IPG’s strengths include its robust distribution network and emphasis on integrating advanced technologies such as quantum cascade lasers. Its customer-centric approach and commitment to innovation have positioned it as a preferred choice for enterprises seeking reliable and efficient laser systems.

Lumentum Holdings

Lumentum Holdings specializes in providing premium laser diodes designed for mission-critical applications. The company’s market prominence is fortified by its focus on delivering secure and interoperable solutions that adhere to stringent regulatory standards. Lumentum’s strengths lie in its emphasis on cybersecurity and data protection, ensuring compliance with global privacy laws. Its ability to deliver customized solutions for sectors such as telecommunications and consumer electronics has enabled it to establish a strong foothold, reinforcing its leadership in the market.

Top strategies used by the key market participants

Key players in the North American laser diode market are leveraging strategies such as product differentiation, geographic expansion, and strategic partnerships to strengthen their positions. For instance, companies are investing heavily in R&D to develop next-generation lasers capable of addressing unmet needs in emerging fields like autonomous vehicles and augmented reality. Strategic collaborations with technology partners and government agencies are also prevalent, enabling players to tap into new opportunities and secure funding for innovation. Additionally, expanding into untapped markets, such as smart cities and renewable energy, has allowed companies to diversify their revenue streams. These strategies collectively drive innovation and ensure sustained market growth.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Coherent Corp. launched its High-Power Laser Series, designed to enhance precision in industrial applications. This move is expected to solidify its leadership in the laser diode market.

- In June 2024, IPG Photonics announced a partnership with General Motors to integrate its lasers into autonomous vehicle systems, enabling safer navigation.

- In August 2024, Lumentum Holdings unveiled its Enhanced Security Framework, aimed at addressing vulnerabilities in telecommunication networks.

- In October 2024, Coherent Corp. acquired a startup specializing in quantum cascade lasers to bolster its medical applications offerings.

- In December 2024, IPG Photonics introduced its Compact VCSEL Line, targeting consumer electronics requiring high-speed data transfer.

MARKET SEGMENTATION

This research report on the north american laser diode market has been segmented and sub-segmented into the following.

By wavelength

- Infrared Laser Diodes

- Ultraviolet Laser Diodes

By Product Doping Material and Technology

- Distributed Feedback (DFB)

- Vertical-Cavity Surface-Emitting Lasers (VCSELs)

By Application

- Telecommunication

- Medical

By Country

- The U.S.

- Canada

- Rest of North America.

Frequently Asked Questions

Which industries are the primary users of laser diodes in North America?

Major industries include telecommunications, automotive (especially in LiDAR for autonomous vehicles), healthcare (for surgical and diagnostic tools)

Which countries in North America are the largest markets for laser diodes?

The United States holds the largest share, followed by Canada and Mexico, with growth in all three due to advancements in manufacturing and increasing demand for high-speed internet and smart technologies.

What are the key challenges faced by the laser diode market in North America?

Challenges include high development costs, heat management issues, price competition, and the need for precision manufacturing and alignment in laser diode-based systems.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]