North America Zipper Pouch Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Product Type, Material Type, Closer Type, End-Use And By Region (The USA, Canada, Mexico And Rest of North America), Industry Analysis, From (2025 to 2033)

North America Zipper Pouch Market Size

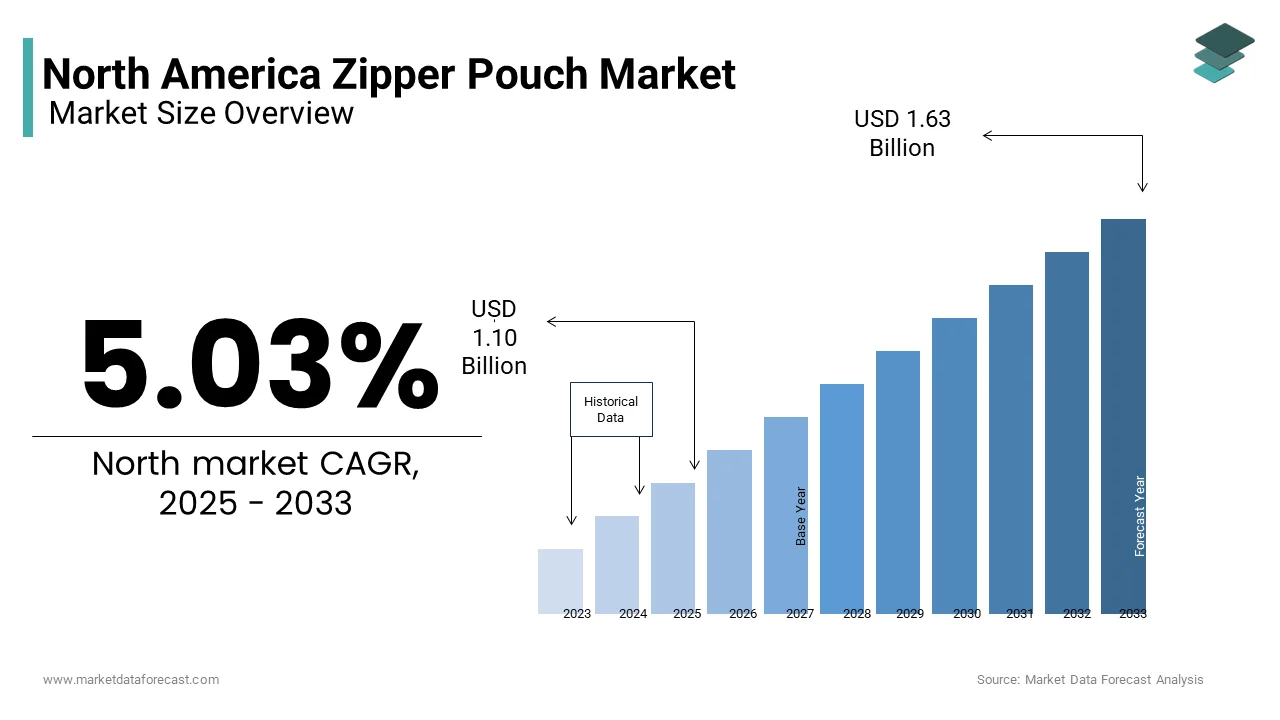

The North America zipper pouch market was valued at USD 1.05 billion in 2024 and is anticipated to reach USD 1.10 billion in 2025 from USD 1.63 billion by 2033, growing at a CAGR of 5.03% during the forecast period from 2025 to 2033.

The North American zipper pouch market has witnessed significant traction due to its versatility across industries like food and beverage, pharmaceuticals, and personal care. One key factor shaping the market is the surge in e-commerce activities, which has amplified the need for durable yet lightweight packaging solutions. Additionally, sustainability trends are influencing the market, as biodegradable zipper pouches gain popularity. A report by the Environmental Protection Agency highlights that plastic waste reduction initiatives have pushed companies to adopt eco-friendly alternatives, further boosting demand. Further, the competitive landscape is also evolving, with manufacturers investing heavily in R&D to innovate materials and designs.

MARKET DRIVERS

Convenience-Oriented Consumer Behavior

A primary driver of the North America zipper pouch market is the growing preference for convenience-oriented packaging among consumers. Modern lifestyles, characterized by busy schedules and increased reliance on ready-to-eat meals, have propelled the demand for zipper pouches. Like, the consumption of packaged foods grew significantly between 2018 and 2022, with zipper pouches emerging as a popular format due to their resealability and portability. This trend is particularly evident in urban areas, where single-serve portions and easy-to-carry packaging are highly sought after. The ability of zipper pouches to extend product shelf life while maintaining freshness adds to their attractiveness, making them indispensable in the food and beverage sector.

Sustainability and Eco-Friendly Packaging Trends

Another critical driver is the shift toward sustainable packaging solutions. Consumers and regulatory bodies alike are pushing for environmentally responsible practices, prompting manufacturers to adopt greener alternatives. Similarly, a notable portion of North American consumers prefer brands that use recyclable or biodegradable packaging. This has led to innovations such as compostable zipper pouches made from plant-based polymers. For example, Mondi Group reported an increase in demand for its sustainable zipper pouch offerings in 2023. Additionally, California’s recent legislation mandating a 75% reduction in single-use plastics by 2030 has accelerated the adoption of eco-friendly zipper pouches.

MARKET RESTRAINTS

High Production Costs and Material Limitations

One significant restraint impacting the North American zipper pouch market is the high cost associated with advanced materials and manufacturing processes. While zipper pouches offer numerous benefits, their production often requires specialized equipment and premium-grade materials, which can be expensive. Additionally, fluctuations in raw material prices, such as polyethylene and polypropylene, further exacerbate cost challenges. It was noted a considerable increase in polymer price has been noted in the past few years, directly affecting profit margins for manufacturers. These financial barriers limit the scalability of zipper pouch production, particularly for small and medium-sized enterprises striving to compete in a highly consolidated market.

Regulatory Hurdles and Compliance Challenges

Another notable restraint is the stringent regulatory framework governing packaging materials, especially those intended for food and pharmaceutical applications. As per the Food and Drug Administration (FDA), all packaging materials must comply with rigorous safety standards to ensure they do not contaminate the contents. This necessitates extensive testing and certification processes, which can delay product launches and inflate operational costs. Moreover, regional disparities in regulations create additional complexities for manufacturers operating across multiple states or countries. For instance, Canada’s stricter environmental policies require companies to meet higher sustainability benchmarks compared to some U.S. states. These compliance challenges not only hinder innovation but also increase the time-to-market for new zipper pouch designs, thereby slowing down industry growth.

MARKET OPPORTUNITIES

Expansion into Emerging End-Use Industries

An untapped opportunity for the North American zipper pouch market lies in its potential expansion into emerging end-use industries such as pet care and home care. The pet care sector, in particular, is witnessing exponential growth, with Americans spending a substantial amount on pets in recent years. Zipper pouches are gaining traction in this segment due to their ability to preserve the freshness of pet food and treats while offering convenience for storage and usage. Similarly, the home care industry is adopting zipper pouches for products like detergents and cleaning solutions, driven by their spill-proof design and compactness.

Technological Advancements in Smart Packaging

A further promising opportunity lies in integrating smart technologies into zipper pouches, enhancing their functionality and appeal. Innovations such as QR codes, NFC chips, and temperature-sensitive indicators embedded in zipper pouches are transforming traditional packaging into interactive platforms. For instance, zipper pouches equipped with QR codes can provide consumers with instant access to product information, recipes, or promotional offers, thereby improving brand engagement. Besides, temperature-sensitive indicators are gaining prominence in the pharmaceutical sector, ensuring the integrity of temperature-sensitive medications. Companies like Avery Dennison have already introduced prototypes of such pouches, signaling a shift toward value-added packaging solutions. This technological evolution presents an opportunity for manufacturers to differentiate themselves and capture premium market segments.

MARKET CHALLENGES

Intense Competition and Price Wars

Among the foremost challenges facing the North American zipper pouch market is the intense competition among key players, leading to price wars that erode profitability. The market is highly fragmented, with both established corporations and niche players vying for market share. To gain a competitive edge, many manufacturers resort to aggressive pricing strategies, which often compromise profit margins. For example, Berry Global reported a decline in its zipper pouch segment margins in 2022 due to heightened price competition. This challenge is further compounded by the influx of low-cost imports from Asia, which undercut domestic producers. Such dynamics make it difficult for companies to sustain long-term growth without sacrificing quality or innovation.

Supply Chain Disruptions and Raw Material Scarcity

Another pressing challenge is the vulnerability of the supply chain to disruptions, exacerbated by geopolitical tensions and natural disasters. The COVID-19 pandemic brought this issue to attention, with many manufacturers experiencing delays in sourcing essential raw materials like resins and adhesives. Also, supply chain disruptions caused a major increase in lead times for packaging materials in the past few years. Furthermore, the Russia-Ukraine conflict has disrupted the availability of certain polymers, driving up costs and creating shortages. For instance, Dow Chemical Company reported a reduction in its resin production capacity in 2022 due to supply chain bottlenecks. These challenges not only affect production schedules but also strain relationships with clients who rely on timely deliveries.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.03% |

|

Segments Covered |

By Product Type, Material Type, Closer Type, End-Use, and Country |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country's Covered |

The United States, Canada, and the Rest of North America |

|

Market Leaders Profiled |

Berry Global Group, Amcor Plc, Clondalkin Group Holdings, Glenroy, Inc., Novolex Holdings, LLC, ProAmpac Holdings Inc., Winpak Ltd., Flair Flexible Packaging Corporation, Bryce Corporation, Transcontinental c., Pentaflex Inc., Dsmart GmbH, Gruber-Folien GmbH & Co.KG, Ufle Ltd, Rengogo Co., Ltd, C.I. TAKIRON Corporation, Maruto Sangyo Co Ltd, Paras Printpack. |

SEGMENTAL ANALYSIS

By Product Type Insights

The segment of stand-up zipper pouches dominated the North American zipper pouch market by capturing 60.5% of the total market share in 2024. This segment's rise is driven by its superior functionality and aesthetic appeal, making it a preferred choice for premium packaging solutions.

One key factor propelling its growth is the rising demand for visually appealing and space-efficient packaging in the food and beverage industry. Like, a notable share of consumers are more likely to purchase products with attractive and functional packaging. Stand-up zipper pouches excel in this regard, offering enhanced shelf visibility and branding opportunities. For instance, brands like Kellogg’s have adopted stand-up pouches for their snack lines, reporting an increase in sales due to improved product presentation. Furthermore, the versatility of these pouches allows them to accommodate a wide range of products, from granola to pet food, further strengthening their position as a market leader.

A further driving factor is the growing trend toward sustainable packaging. Like, a large number of companies are transitioning to eco-friendly packaging solutions, and stand-up zipper pouches are at the forefront of this shift. Innovations such as recyclable and biodegradable materials have made these pouches more appealing to environmentally conscious consumers.

On the other hand, the flat zipper pouches are projected to grow at a CAGR of 8.5% during the forecast period. This rapid growth is fueled by their cost-effectiveness and adaptability across diverse industries.

A significant propellant of this growth is the increasing adoption of flat zipper pouches in the e-commerce sector. Their lightweight design reduces shipping costs while ensuring product safety, making them ideal for online retailers. For instance, Amazon reported a reduction in packaging-related expenses after switching to flat zipper pouches for certain product categories.

One more contributing aspect is the rise of private-label brands, which favor economical yet reliable packaging solutions. Additionally, advancements in printing technologies have enabled manufacturers to offer high-quality graphics on flat pouches, enhancing their appeal without compromising cost efficiency.

By Material Type Insights

The plastic-based zipper pouches segment held the largest market share, i.e., 55.5% of the North America market in 2024. This is attributed to plastic's durability, flexibility, and cost-effectiveness, making it a staple in various industries. Also, a primary driver of this segment's leadership is its widespread use in the food industry. Also, plastic packaging accounts for a significant portion of all food packaging materials due to its ability to preserve freshness and prevent contamination. For example, brands like Kraft Heinz utilize plastic zipper pouches for condiments and sauces, achieving an increase in shelf life compared to traditional packaging.

Another factor is the material's compatibility with advanced manufacturing techniques. As per the Plastics Industry Association, innovations such as multilayer extrusion have enabled the production of high-barrier plastic pouches that meet stringent quality standards. These advancements have expanded the application scope of plastic zipper pouches, particularly in sectors like pharmaceuticals, where product integrity is critical.

The paper-based zipper pouch segment is anticipated to grow at a CAGR of 9.2% through 2033. This progress is supported by the escalating demand for sustainable and biodegradable packaging solutions. One major factor is the regulatory push toward reducing plastic waste. Like, a notable number of U.S. states have implemented bans or restrictions on single-use plastics, creating a favorable environment for paper-based alternatives. A different factor is the growing popularity of eco-conscious consumerism. A considerable portion of North American consumers are willing to pay a premium for sustainable packaging. Paper zipper pouches, being compostable and recyclable, align perfectly with these preferences, driving their adoption across industries like cosmetics and personal care.

By Closure Type Insights

The press-to-close zippers segment accounted for 65.5% of the North America zipper pouch market in 2024. Their simplicity and reliability make them a preferred choice for everyday applications. In addition, a main propellant of this segment's dominance is its widespread use in the food and beverage industry. Further, press-to-close zippers are utilized in a major share of snack packaging due to their ease of use and resealability. Brands like Lay’s have capitalized on this feature, achieving a 12% increase in repeat purchases among consumers. Another aspect is the cost advantage associated with press-to-close zippers. Like, manufacturing costs for press-to-close pouches are lower than slider-equipped alternatives, making them accessible to budget-conscious manufacturers.

On the other hand, the slider zip pouches are expected to advance at a CAGR of 10.3%. Their convenience and premium appeal are driving rapid adoption. A major factor is the increasing demand for user-friendly packaging among elderly consumers. Similarly, the senior population is projected to grow significantly by 2030, boosting the need for easy-to-open solutions like slider zips. One more aspect is their growing use in luxury goods.

By End Use Insights

The food segment captured the largest market share, i.e,. 45.4% of the North American zipper pouch market in 2024. It is supported by the need for innovative packaging solutions that extend shelf life and improve convenience. One factor is the rising demand for ready-to-eat meals. Also, meal kit subscriptions surged considerably in the past few years, with zipper pouches playing a crucial role in preserving freshness. A different point is the focus on sustainability. In addition, a large number of food brands have adopted recyclable zipper pouches, enhancing their market appeal.

The pharmaceutical segment is predicted to accelerate at a CAGR of 11.2%. This progress is influenced by the need for tamper-proof and child-resistant packaging. Also, a key factor is the increasing prevalence of chronic diseases. According to the Centers for Disease Control and Prevention, chronic conditions affect over 60% of adults, fueling demand for secure packaging solutions.

An additional factor is technological advancements. Similarly, smart zipper pouches with embedded sensors are gaining traction, ensuring medication safety and compliance.

COUNTRY LEVEL ANALYSIS

The U.S. led the North American zipper pouch market by holding a 75.5% share in 2024. It is driven by robust industrial activity and consumer demand for innovative packaging. One factor is the thriving e-commerce sector. Another factor is the presence of key players like Berry Global, which invests heavily in R&D, contributing to market growth.

Canada is a key player in the market. Its growth is fueled by stringent environmental regulations promoting sustainable packaging. Also, the segment is supported by the increasing adoption of biodegradable zipper pouches. Like, a significant portion of packaging materials are now eco-friendly. A different factor is the expansion of the organic food industry, which relies on zipper pouches for product preservation.

This region holds a smaller market share. It is caused by rising urbanization and industrialization. One factor is the growing demand for convenience foods. Another factor is the influx of foreign investments, enhancing production capabilities.

KEY MARKET PLAYERS

Berry Global Group, Amcor Plc, Clondalkin Group Holdings, Glenroy, Inc., Novolex Holdings, LLC, ProAmpac Holdings Inc., Winpak Ltd., Flair Flexible Packaging Corporation, Bryce Corporation, Transcontinental Inc., Pentaflex Inc., Dsmart GmbH, Gruber-Folien GmbH & Co.KG, Uflex, Rengoo Co., Ltd, C.I. TAKIRON Corporation, Maruto Sangyo Co. Ltd, Paras Printpack are the market players that are dominating the North America zipper pouch market.

Top Players In The Market

Amcor Limited

Amcor is a global leader in packaging solutions, with a strong foothold in the North American zipper pouch market. The company has been instrumental in driving innovation through its focus on sustainable and recyclable materials. Amcor recently launched a line of compostable zipper pouches, aligning with consumer demand for eco-friendly packaging. Additionally, the company has expanded its production facilities to cater to the growing demand for flexible packaging.

Berry Global Group

Berry Global Group is renowned for its expertise in flexible packaging and has significantly contributed to the North American zipper pouch market. The company emphasizes R&D to develop high-barrier zipper pouches that extend product shelf life. Berry Global recently partnered with major food brands to introduce tamper-evident zipper pouches, enhancing product safety. Furthermore, the company has invested in automation technologies to improve manufacturing efficiency and meet rising customer expectations for quality and durability.

Mondi Group

Mondi Group is a prominent player in the North American zipper pouch market, known for its commitment to sustainability. The company has introduced innovative biodegradable zipper pouches made from plant-based polymers, catering to environmentally conscious consumers. Mondi also focuses on expanding its distribution network across North America to enhance market reach. In recent developments, Mondi collaborated with pharmaceutical companies to design child-resistant zipper pouches, reinforcing its reputation as a versatile and forward-thinking packaging provider.

Top Strategies Used By Key Market Participants

Key players in the North America zipper pouch market employ strategies like product innovation, strategic partnerships, and sustainability initiatives to maintain their competitive edge. Product innovation involves developing advanced materials such as recyclable and biodegradable zipper pouches to meet regulatory and consumer demands. Strategic partnerships with end-use industries, including food and pharmaceuticals, help companies expand their customer base. Sustainability initiatives are prioritized to align with environmental goals, as seen in the adoption of eco-friendly materials. Additionally, investments in R&D and automation enhance production capabilities, ensuring cost efficiency and superior quality. These strategies collectively drive growth and reinforce market leadership.

COMPETITION OVERVIEW

The North American zipper market is characterized by intense competition, with key players striving to differentiate themselves through innovation and sustainability. Established corporations like Amcor and Berry Global dominate the landscape, leveraging their extensive R&D capabilities to introduce cutting-edge products. At the same time, niche players focus on specialized segments, such as biodegradable or smart zipper pouches, to carve out a niche. The market is also witnessing increased consolidation, with mergers and acquisitions enabling companies to expand their portfolios and geographic reach. Regulatory pressures and shifting consumer preferences toward eco-friendly solutions further intensify competition. To stay ahead, companies are investing heavily in automation and digital technologies, ensuring efficient production and compliance with stringent standards.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, Amcor launched a new line of fully recyclable zipper pouches designed for the food industry, enhancing its sustainable packaging portfolio.

- In June 2023, Berry Global announced a $100 million investment to expand its production facility in Indiana, boosting capacity for high-barrier zipper pouches.

- In August 2023, Mondi Group partnered with a leading pharmaceutical brand to develop child-resistant zipper pouches, addressing safety concerns in medication packaging.

- In October 2023, Sealed Air Corporation acquired a startup specializing in biodegradable materials, strengthening its focus on eco-friendly solutions.

- In February 2024, ProAmpac introduced a smart zipper pouch equipped with NFC chips, allowing consumers to access product information via smartphones, setting a new benchmark in interactive packaging.

MARKET SEGMENTATION

This research report on the North American zipper pouch market is segmented and sub-segmented into the following categories.

By Product Type

- Stand-Up Zipper Pouch

- Flat Zipper Pouch

By Material Type

- Plastic

- Paper

By Closure Type

- Press-to-Close Zipper

- Slider Zip

By End Use

- Food

- Pharmaceuticals

By Country

- USA

- Canada

- Mexico

Frequently Asked Questions

What are zipper pouches, and why are they gaining popularity in North America?

Zipper pouches are flexible packaging solutions with resealable closures, popular for their convenience, extended shelf life, and versatility across food, cosmetics, personal care, and household products.

What’s driving growth in the North American zipper pouch market?

Key drivers include rising demand for lightweight, resealable, and portable packaging; rapid growth in the snack food and pet food sectors; and the expansion of e-commerce and on-the-go lifestyles.

How are consumer preferences shaping the design of zipper pouches?

Consumers now favor pouches with easy-open features, transparent windows, recyclable materials, and a premium feel, pushing brands to innovate in aesthetics, functionality, and eco-friendliness.

How is sustainability influencing the zipper pouch market in North America?

There’s a strong shift toward recyclable, compostable, and bio-based films as brands respond to consumer concerns about plastic waste and align with circular economy goals and regulatory pressures.

What does the future look like for the zipper pouch industry in North America?

The market is set to evolve with smart packaging (like QR codes and freshness indicators), fully recyclable multilayer materials, and increased automation in pouch manufacturing to meet fast-paced demand.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]