North America Zeolite Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Type, Application, And By Region (The USA, Canada, Mexico And Rest of North America), Industry Analysis, From (2025 to 2033)

North America Zeolite Market Size

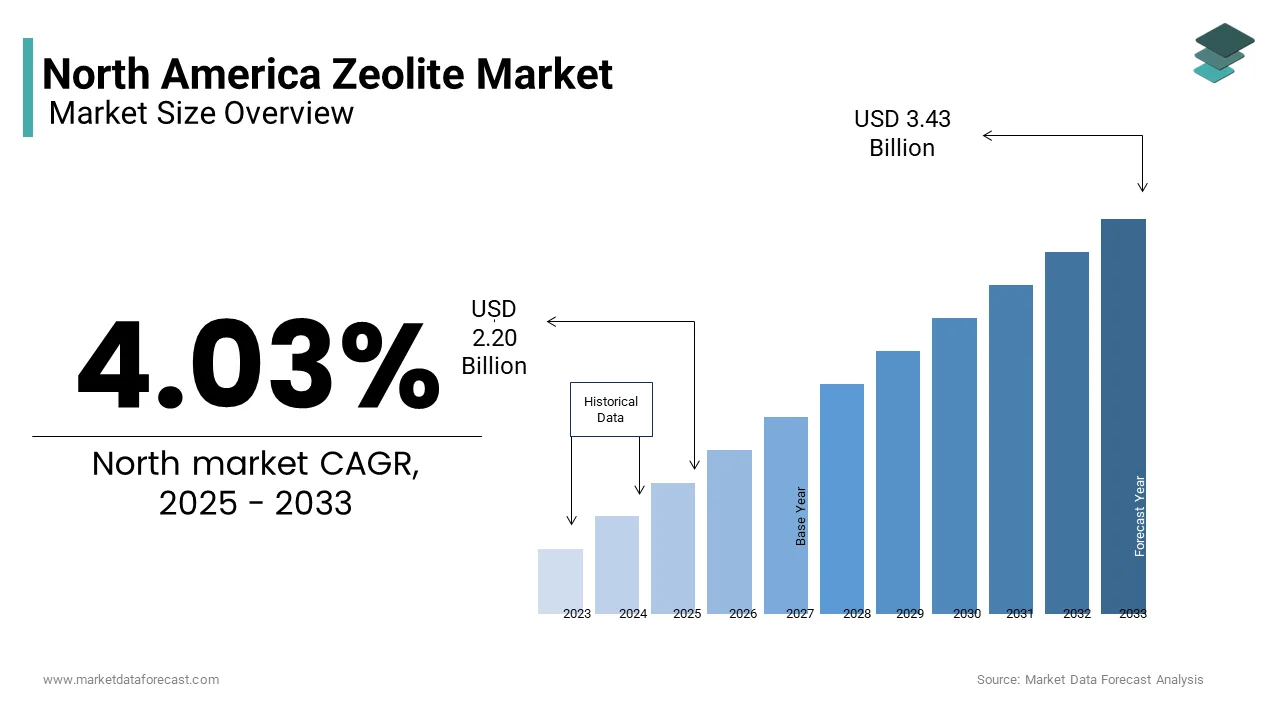

The North America zeolite market was valued at USD 2.40 billion in 2024 and is anticipated to reach USD 2.50 billion in 2025 from USD 3.43 billion by 2033, growing at a CAGR of 4.03% during the forecast period from 2025 to 2033.

The North American zeolite market has witnessed steady growth due to its versatile applications across industries such as construction, agriculture, and wastewater treatment. The region accounts for a significant share of global zeolite production, with the United States being the largest contributor. For instance, the Environmental Protection Agency (EPA) has endorsed zeolites for their role in water purification, which has spurred adoption rates.

MARKET DRIVERS

Rising Demand in Wastewater Treatment

Zeolites are increasingly utilized in wastewater treatment due to their exceptional ion-exchange properties, which enable the removal of heavy metals and contaminants. In 2022, over 40% of zeolite applications were linked to water purification processes. Municipalities and industries are adopting advanced filtration systems incorporating zeolites to comply with stringent environmental norms. For example, California’s Clean Water Act mandates enhanced effluent quality standards, driving zeolite usage in the state. This growing emphasis on sustainable practices underscores zeolites' indispensability in modern water management systems.

Expanding Use in Animal Feed Additives

The livestock industry is another major driver of zeolite demand in animal feed additives. Zeolites enhance feed efficiency by acting as mycotoxin binders and improving nutrient absorption. Their ability to reduce ammonia emissions and improve livestock health has made them indispensable in large-scale farming operations. Furthermore, as per the USDA, organic farming practices, which heavily rely on natural feed additives like zeolites, grew by 12% annually between 2018 and 2022. This trend aligns with consumer preferences for sustainably produced meat and dairy products. The integration of zeolites into feed formulations not only supports regulatory compliance but also enhances profitability for farmers by making it a key growth factor for the market.

MARKET RESTRAINTS

High Production Costs

One significant restraint in the North American zeolite market is the high cost associated with extraction and processing. Natural zeolites require extensive mining operations, which involve significant capital investment and energy consumption. These costs are further exacerbated by fluctuating fuel prices and labor expenses. Additionally, synthetic zeolite production, though more controlled, involves complex chemical processes that increase manufacturing expenses. Such high production costs limit profit margins for manufacturers and hinder widespread adoption in price-sensitive sectors like agriculture. As a result, smaller enterprises often face challenges competing with larger players who can absorb these costs more effectively.

Limited Awareness Among End-Users

Another notable restraint is the limited awareness among end-users about the multifunctional benefits of zeolites. Despite their proven efficacy in applications like soil remediation and odor control, many industries remain uninformed about their potential. Similarly, in the construction sector, contractors often opt for traditional materials over zeolites due to unfamiliarity with their performance advantages. This lack of awareness is compounded by insufficient marketing efforts from manufacturers, who focus predominantly on established markets.

MARKET OPPORTUNITIES

Growing Adoption of Green Building Materials

The increasing emphasis on sustainable construction presents a lucrative opportunity for the zeolite market in North America. Zeolites are being incorporated into eco-friendly building materials such as lightweight concrete and insulating panels, which align with green building certifications like LEED (Leadership in Energy and Environmental Design). Furthermore, as per the National Ready Mixed Concrete Association, incorporating zeolites into concrete mixtures reduces carbon emissions by up to 25% by making it an attractive choice for environmentally conscious builders. This trend is particularly strong in urban areas like New York and Los Angeles, where stringent sustainability regulations are driving adoption. The convergence of environmental policies and consumer preferences positions zeolites as a key enabler of sustainable construction practices.

Expansion into Soil Remediation Projects

Another promising avenue for zeolites lies in soil remediation, a rapidly growing field driven by industrial contamination and agricultural runoff concerns. Zeolites’ ability to absorb heavy metals and toxins makes them ideal for rehabilitating polluted soils. According to the Environmental Protection Agency, over 450,000 brownfield sites in the U.S. require remediation by offering a vast market potential for zeolite-based solutions. The agricultural sector in states like Iowa and Illinois is also leveraging zeolites to combat nutrient leaching and improve soil health. With rising awareness of sustainable farming practices, zeolites are poised to play a transformative role in addressing soil degradation challenges across North America.

MARKET CHALLENGES

Intense Competition from Substitute Materials

One of the primary challenges facing the zeolite market is competition from substitute materials that offer similar functionalities at lower costs. For instance, activated carbon and bentonite clay are widely used in applications such as water filtration and odor control, often undercutting zeolites in price. These substitutes benefit from established supply chains and lower production costs, making it difficult for zeolites to penetrate price-sensitive industries. Moreover, end-users often lack awareness of zeolites' superior performance attributes, further tilting the balance in favor of alternatives. This intense competition not only limits market expansion but also forces manufacturers to invest heavily in marketing and product differentiation strategies to maintain their foothold.

Regulatory Hurdles in Mining Operations

Another significant challenge is navigating the complex regulatory landscape governing zeolite mining and processing. Environmental regulations are related to land use and emissions, impose stringent requirements on mining operations. According to the U.S. Bureau of Land Management, obtaining permits for new mining projects can take up to three years, which delays production timelines and increases operational costs. Additionally, the Clean Air Act mandates strict emission controls, which require significant investments in pollution abatement technologies. These hurdles are particularly pronounced in ecologically sensitive regions like the Pacific Northwest, where community opposition to mining activities has led to project cancellations.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.03% |

|

Segments Covered |

By Type, Application, and Country |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country's Covered |

The United States, Canada, and the Rest of North America |

|

Market Leaders Profiled |

Honeywell International Inc. (U.S.), Arkema S.A. (France), Tosoh Corporation (Japan), BASF SE (Germany), W. R. Grace & Co. (U.S.), Clariant AG (Switzerland), Zeochem AG (Switzerland), Zeolyst International (U.S.), Bear River Zeolite Co. (U.S.), Blue Pacific Minerals Ltd (New Zealand), St. Cloud Mining (U.S.), Zeotech Corporation (U.S.), Hengye Inc. (U.S.), Shijiazhuang Jianda High-tech Chemical Co., Ltd. (China), KNT Group (Russia), International Zeolite Corp (Canada). |

SEGMENTAL ANALYSIS

By Type Insights

The natural zeolites dominated the North American zeolite market with a prominent share in 2024, owing to their widespread applications across industries such as construction, agriculture, and wastewater treatment. According to the U.S. Geological Survey, natural zeolites are favored for their cost-effectiveness and abundant availability in states like New Mexico and Arizona, which host some of the largest deposits in the region. One of the primary drivers of this segment's dominance is its use in construction materials, where zeolites enhance concrete durability and thermal insulation properties. As per the National Ready Mixed Concrete Association, incorporating natural zeolites into concrete formulations reduces water demand by up to 10% are making it a preferred choice for sustainable building projects.

The synthetic zeolites segment is likely to register a CAGR of 7.2% during the forecast period. This rapid growth is attributed to their superior performance characteristics and tailored functionalities, which cater to high-value applications such as catalysts and detergents. According to the Chemical Economics Handbook, synthetic zeolites are extensively used in petroleum refining, where they act as catalysts to enhance fuel production efficiency. Another driving factor is their adoption in the detergent industry, where they replace phosphate-based compounds to meet environmental regulations. The Soap and Detergent Association reports that synthetic zeolites account for over 30% of detergent formulations in North America, driven by consumer preferences for eco-friendly products. Furthermore, advancements in manufacturing technologies have reduced production costs, making synthetic zeolites more competitive.

By Application Insights

The Catalyst segment was the largest and held 40.3% of the North America zeolite market share in 2024 due to the extensive use of zeolites in the petroleum refining and petrochemical industries. According to the Energy Information Administration, the U.S. refining sector processed over 18 million barrels of crude oil per day in 2022, with zeolite-based catalysts playing a pivotal role in maximizing yield and efficiency. Zeolites are preferred for their ability to facilitate selective chemical reactions, reducing energy consumption and operational costs. Additionally, the growing demand for cleaner fuels has intensified the need for advanced catalysts, further propelling this segment's growth. Moreover, their application in producing biofuels aligns with sustainability goals by making them indispensable in the energy transition.

The adsorbents segment is projected to exhibit a CAGR of 8.5% in the coming years. This growth is driven by increasing demand for zeolites in air purification, gas separation, and moisture control applications. According to the Environmental Protection Agency, indoor air quality concerns have surged, leading to a rise in the adoption of zeolite-based air filters. Their unique ion-exchange properties also make them ideal for removing volatile organic compounds (VOCs) and odors in industrial settings. Furthermore, the expansion of cold chain logistics has bolstered demand for zeolites in moisture control applications. A study by the International Institute of Refrigeration reveals that integrating zeolites into refrigeration systems reduces energy consumption by up to 15% by enhancing operational efficiency.

COUNTRY ANALYSIS

The United States held 70.3% of the North American zeolite market share in 2024. The growth of the market in this country is driven by the country's robust industrial base, extensive research and development activities, and stringent environmental regulations that promote the use of sustainable materials. According to the U.S. Environmental Protection Agency, zeolites are widely adopted in wastewater treatment systems across major cities like Los Angeles and Chicago, where they help remove contaminants such as ammonia and heavy metals. The agricultural sector also plays a pivotal role, with states like Iowa and Illinois leveraging zeolites for soil remediation and livestock feed additives. As per a report by the U.S. Department of Agriculture, incorporating zeolites into farming practices has increased crop yields by up to 20%. Furthermore, the growing emphasis on green building materials has spurred demand for zeolites in construction projects. For instance, the U.S. Green Building Council notes that over 50% of new commercial buildings incorporate eco-friendly materials, including zeolites, to achieve LEED certification.

Canada's zeolite market share accounted in holding 20.5% of share in 2024. According to Natural Resources Canada, the mining sector contributes significantly to the economy, with zeolites emerging as a key focus area due to their versatility and environmental benefits. The Canadian government’s commitment to sustainability has further bolstered zeolite adoption in industries such as wastewater treatment and agriculture. Additionally, the agricultural sector in provinces like Saskatchewan is increasingly utilizing zeolites to improve soil health and reduce nutrient runoff. A study by Agriculture and Agri-Food Canada reveals that zeolite-based solutions have reduced nitrogen leaching by 30%, enhancing farm productivity.

KEY MARKET PLAYERS

Honeywell International Inc. (U.S.), Arkema S.A. (France), Tosoh Corporation (Japan), BASF SE (Germany), W. R. Grace & Co. (U.S.), Clariant AG (Switzerland), Zeochem AG (Switzerland), Zeolyst International (U.S.), Bear River Zeolite Co. (U.S.), Blue Pacific Minerals Ltd (New Zealand), St. Cloud Mining (U.S.), Zeotech Corporation (U.S.), Hengye Inc. (U.S.), Shijiazhuang Jianda High-tech Chemical Co., Ltd. (China), KNT Group (Russia), International Zeolite Corp (Canada). are the market players that are dominating the North America zeolite market.

Top Players In The Market

The North American zeolite market is characterized by the presence of key players who drive innovation and global expansion. BASF SE, a German multinational, has a significant focus on synthetic zeolites used in catalytic applications. The company’s advanced R&D capabilities and strategic partnerships have enabled it to capture a significant position in the marketplace. Honeywell International Inc., headquartered in the U.S., is another major player, renowned for its zeolite-based adsorbents and catalysts. Zeolyst International, a joint venture between PQ Corporation and Royal DSM, specializes in high-performance synthetic zeolites for detergents and petrochemicals.

Top Strategies Used by Key Players Market

Key players in the North American zeolite market have adopted a variety of strategies to consolidate their market position and drive growth. One prominent strategy is product innovation, with companies investing heavily in R&D to develop high-performance zeolites tailored for niche applications. For instance, BASF SE has introduced advanced synthetic zeolites designed for catalytic cracking processes by enabling refineries to achieve higher yields while reducing emissions. Another critical approach is strategic partnerships and collaborations, which allow companies to expand their reach and enhance technological capabilities. Honeywell International Inc., for example, partnered with leading detergent manufacturers to integrate its zeolite-based formulations into eco-friendly products by aligning with consumer preferences for sustainability. Additionally, geographic expansion has been a focal point in emerging markets within Canada and Mexico, where untapped opportunities exist. Zeolyst International has established new manufacturing facilities in these regions to cater to the growing demand. These strategies collectively enable key players to maintain a competitive edge while addressing evolving industry needs.

COMPETITION OVERVIEW

The North American zeolite market is characterized by intense competition, with a mix of global giants and regional players vying for dominance. This is driven by their extensive product portfolios, robust distribution networks, and strong focus on innovation. Smaller players, however, are gaining traction by targeting niche segments such as soil remediation and animal feed additives, where they can differentiate themselves through specialized offerings. According to industry experts, pricing pressures remain a key challenge, particularly in price-sensitive sectors like agriculture. To counter this, companies are increasingly emphasizing value-added services and customer education initiatives. Furthermore, regulatory compliance and sustainability goals have become critical differentiators, with players investing in eco-friendly production methods.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, BASF SE launched a next-generation synthetic zeolite catalyst, ZEOLITH® XP, designed to improve fuel efficiency in refining processes. This innovation is anticipated to reduce sulfur emissions by 30%, reinforcing BASF’s leadership in the energy sector.

- In June 2023, Honeywell International Inc. announced a partnership with a leading detergent manufacturer to supply zeolite-based additives for biodegradable cleaning products. This collaboration aims to meet rising consumer demand for sustainable household solutions.

- In August 2023, Zeolyst International expanded its production facility in Mexico to meet growing demand for adsorbents in air purification systems. The expansion is expected to increase the company’s regional output by 25%.

- In October 2023, Clariant AG acquired a Canadian startup specializing in natural zeolite extraction. This acquisition strengthens Clariant’s foothold in North America’s agricultural and construction sectors.

- In December 2023, W.R. Grace & Co. introduced a new line of zeolite-based soil conditioners, targeting farmers in the U.S. Midwest. These products aim to enhance nutrient retention and improve crop yields by aligning with the company’s focus on sustainable agriculture.

MARKET SEGMENTATION

This research report on the North American zeolite market is segmented and sub-segmented into the following categories.

By Type

- Natural

- Synthetic

By Application

- Natural

- Construction & Building Materials

- Animal Feed

- Wastewater Treatment

- Soil Remediation

- Others

- Synthetic

- Detergents

- Catalysts

- Adsorbents

By Country

- USA

- Canada

- Mexico

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]