North America Wheat Flour Market Research Report – Segmented By Type (All-Purpose Flour, Whole Wheat Flour, Bread Flour, Cake & Pastry Flour, Semolina Flour, Others), End Use, Distribution Channel, And Country (Us, Canada, And Rest Of North America) - Industry Analysis On Size, Share, Trends & Growth Forecast (2025 To 2033)

North America Wheat Flour Market Size

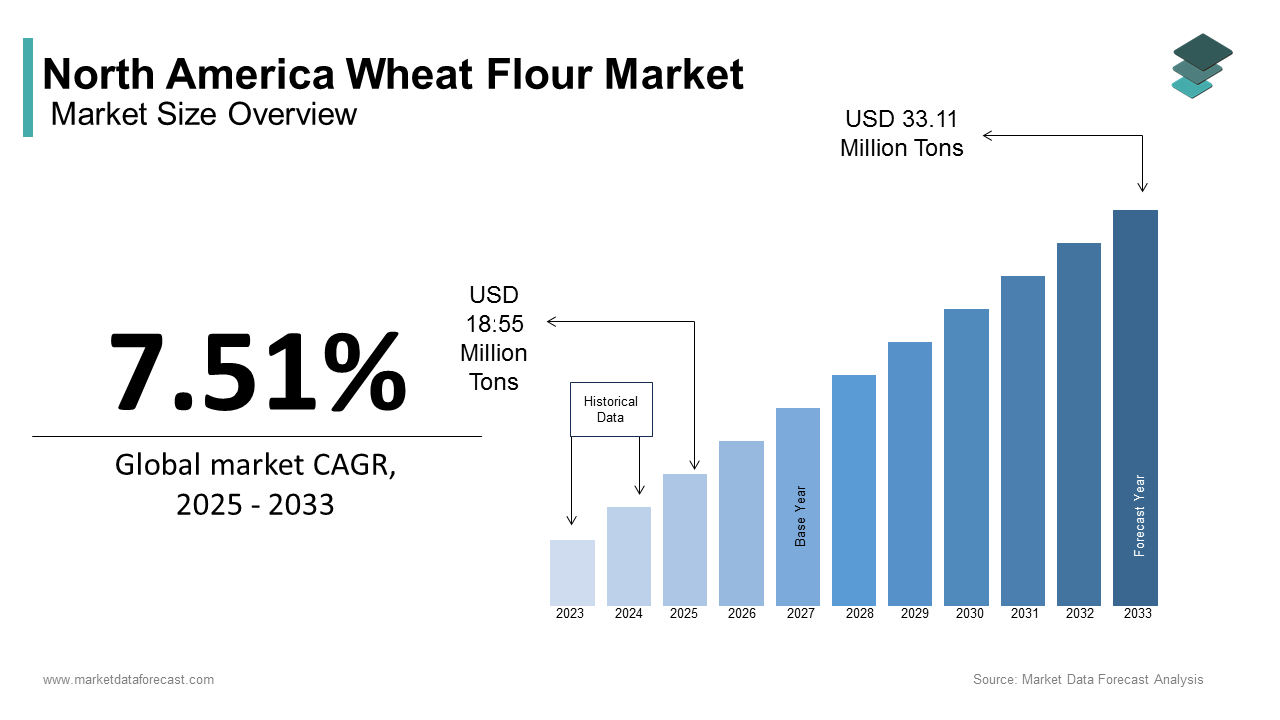

The North America wheat flour market size was valued at USD 17.25 million tons in 2024 and is expected to reach USD 33.11 million tons by 2033 from USD 18.55 million tons in 2025. The market is projected to grow at a CAGR of 7.51%.

Wheat flour is derived from grinding wheat grains and is a fundamental ingredient in a wide array of products, including bread, pastries, pasta, and baked goods. The demand for wheat flour in North America has been steadily growing from the last few years due to factors such as the increasing demand for convenience foods, the rising popularity of home baking, and the expanding use of wheat flour in various culinary applications. The North America wheat flour market is poised for continued expansion, with manufacturers focusing on product innovation, including the development of specialty flours and organic options, to meet evolving consumer preferences for healthier and more diverse food choices. The market is also benefiting from the growing trend of clean-label products, as consumers increasingly seek flour that is free from artificial additives and preservatives.

MARKET DRIVERS

Rising Demand for Convenience Foods in North America

As consumers lead increasingly busy lifestyles, there is a growing preference for ready-to-eat and easy-to-prepare meal options that often rely on wheat flour as a key ingredient. According to a report by the U.S. Department of Agriculture, the demand for processed food in North America is growing rapidly. This trend is particularly evident in the bakery segment, where wheat flour is essential for producing bread, pastries, and other baked goods that are staples in many households. The versatility of wheat flour allows it to be used in various applications, including frozen meals, snacks, and desserts, appealing to a wide range of consumer preferences. Additionally, the rise of meal kits and pre-packaged foods has further propelled the demand for wheat flour, as these products often include it as a key ingredient. As the demand for convenience foods continues to rise in this region, the wheat flour market in North America is expected to benefit significantly.

Growth in Home Baking Trends

The rapid adoption of home baking trends in North America is further propelling the North American wheat flour market expansion. The COVID-19 pandemic has led to a resurgence in home cooking and baking, as consumers seek to recreate their favorite baked goods at home. According to a survey conducted by the American Bakers Association, 60% of consumers reported baking more frequently during the pandemic, leading to increased demand for wheat flour. This trend has prompted manufacturers to innovate and develop new wheat flour products that cater to the growing interest in home baking, including specialty flours for gluten-free and artisan baking. The versatility of wheat flour allows it to be used in a wide range of recipes, from bread and cookies to cakes and pastries, making it a staple ingredient in many households. Additionally, the rise of social media and cooking shows has further fueled interest in home baking, as consumers are inspired to try new recipes and techniques. As the trend of home baking continues to gain momentum in North America, the wheat flour market in this region is expected to experience significant growth over the forecast period.

MARKET RESTRAINTS

Price Volatility of Raw Materials

The price volatility of raw materials, particularly wheat is one of the key factors hindering the growth of the North American wheat flour market. The production of wheat flour is heavily reliant on the availability and cost of wheat grains, which can fluctuate due to various factors, including weather conditions, crop yields, and market demand. According to the U.S. Department of Agriculture, fluctuations in wheat production can significantly impact the supply and pricing of wheat flour. This volatility can pose challenges for manufacturers, as rising raw material costs may lead to increased prices for consumers, potentially dampening demand. Additionally, the reliance on a limited number of suppliers for high-quality wheat can create supply chain vulnerabilities, further complicating the market landscape. To mitigate these challenges, manufacturers may need to explore alternative sourcing strategies or invest in long-term contracts with farmers. Addressing the issue of raw material price volatility will be crucial for maintaining stability and competitiveness in the wheat flour market.

Regulatory Compliance and Quality Standards

The stringent regulatory compliance and quality standards imposed by government agencies are also hampering the growth of the North American wheat flour market. The production and sale of wheat flour are subject to rigorous regulations regarding food safety, labeling, and quality assurance. According to the U.S. Food and Drug Administration, manufacturers must adhere to specific guidelines to ensure the safety and quality of food products, including wheat flour. This regulatory landscape can pose challenges for wheat flour producers, particularly smaller companies that may lack the resources to meet compliance requirements. Additionally, the lack of standardized definitions for terms such as "whole grain" or "organic" can create confusion among consumers and complicate marketing efforts. Companies must invest time and resources to ensure compliance with regulations while effectively communicating their product benefits to consumers. Failure to meet regulatory standards can result in product recalls, legal issues, and damage to brand reputation. As the wheat flour market continues to evolve, manufacturers must remain vigilant in navigating these regulatory challenges to maintain consumer trust and market competitiveness.

MARKET OPPORTUNITIES

Expansion into Gluten-Free and Specialty Flours

The expansion into gluten-free and specialty flours is one of the lucrative opportunities for the North American wheat flour market. As awareness of gluten intolerance and celiac disease rises, more consumers are seeking alternatives to traditional wheat flour. According to the Gluten Intolerance Group, approximately 1 in 100 people worldwide are affected by celiac disease, leading to a growing market for gluten-free flour products. The demand for gluten-free flour in the United States is projected to grow exponentially over the forecast period. This trend has prompted manufacturers to innovate and develop gluten-free flour blends that incorporate alternative grains such as almond, coconut, and rice flour. By diversifying their product offerings to include gluten-free and specialty flours, companies can attract a broader consumer base and capitalize on the increasing trend towards health-oriented food choices. This emphasis on product diversification is expected to significantly contribute to the growth of the wheat flour market in North America.

Rising Demand for Organic and Clean-Label Products

The rising demand for organic and clean-label products in North America is another promising opportunity for the regional market. As consumers become more health-conscious, there is a growing interest in food products that are free from artificial additives and preservatives. According to the Organic Trade Association, organic food sales in the United States reached $62 billion in 2020, reflecting a 12.4% increase from the previous year. This trend is driving manufacturers to develop organic wheat flour products that cater to the growing demographic of health-conscious consumers seeking natural alternatives. The versatility of organic wheat flour allows it to be used in a wide range of applications, including baking, cooking, and specialty foods, appealing to a diverse consumer base. By focusing on organic and clean-label formulations and highlighting the health benefits of these products, companies can tap into this expanding market and attract consumers who prioritize quality and sustainability in their food choices.

MARKET CHALLENGES

Supply Chain Disruptions

One of the significant challenges facing the North America wheat flour market is the potential for supply chain disruptions. The production of wheat flour relies on key ingredients such as wheat grains, which can be affected by fluctuations in supply and demand. According to industry reports, disruptions in the supply chain, particularly during adverse weather conditions or global events like the COVID-19 pandemic, have led to increased prices and shortages of essential ingredients. This situation poses a challenge for manufacturers who must ensure a consistent supply of high-quality ingredients to meet consumer demand. Additionally, the sourcing of wheat can be impacted by ethical and sustainability concerns, leading some consumers to seek alternatives. As the market shifts towards organic and health-conscious options, manufacturers may face challenges in sourcing suitable substitutes that meet consumer expectations for taste and texture. Addressing these supply chain challenges will be crucial for maintaining product availability and quality in the wheat flour market.

Competition from Alternative Flours

The rising competition from alternative flours in North America is another major challenge to the North America wheat flour market. The rise of health-conscious consumers has led to a surge in demand for various natural and plant-based alternatives, such as almond flour, coconut flour, and chickpea flour, which can pose a challenge to the growth of the wheat flour market. This trend is particularly pronounced among health-conscious consumers who are increasingly seeking snacks and meals that align with their dietary preferences. As a result, wheat flour manufacturers must compete not only with other wheat flour brands but also with a wide array of alternative flours that cater to evolving consumer preferences. To remain competitive, companies in the wheat flour market need to innovate and diversify their product offerings, potentially incorporating blends of wheat flour with alternative flours or highlighting the unique benefits of their products to attract a broader audience.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.51% |

|

Segments Covered |

By Type, End Use, Distribution Channel, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

US, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

Archer Daniels Midland Company (ADM), Ardent Mills LLC, General Mills Inc., King Arthur Baking Company, Cargill, ConAgra Brands. |

SEGMENTAL ANALYSIS

By Type Insights

The all-purpose flour segment accounted for 51.8% of the regional market share in 2024. The leading position of all-purpose flour segment in the North American market can be attributed to the widespread use of all-purpose flour in various applications, including baking, cooking, and thickening agents in sauces and gravies and increasing demand for versatile flour options that can be used in a wide range of recipes. The versatility of all-purpose flour allows it to be a staple ingredient in many households, appealing to a broad consumer base. Additionally, the growing trend of home baking and cooking has further propelled the demand for all-purpose flour, as consumers seek to recreate their favorite baked goods at home. As the trend of home cooking continues to gain momentum, the all-purpose flour segment is expected to maintain its leading position in the North America wheat flour market.

On the other end, the whole-wheat flour segment is anticipated to exhibit a CAGR of 6.22% over the forecast period owing to the increasing demand for whole-grain products, which are perceived as healthier alternatives to refined flours. According to industry insights, the demand for whole-wheat flour is on the rise, driven by the growing trend of health-conscious eating and the increasing awareness of the benefits of whole grains. Whole-wheat flour is often marketed as a source of dietary fiber and essential nutrients, making it a popular choice among consumers looking to improve their dietary habits. Additionally, the rise of plant-based diets and the increasing focus on sustainability have prompted manufacturers to explore whole-wheat flour as a viable ingredient for creating innovative food products. As consumers continue to prioritize health and sustainability in their food choices, the whole-wheat flour segment is poised for significant growth in the coming years.

By End-Use Insights

The food use segment ruled the regional market by occupying 81.8% of the regional market share in 2024. The growth of the food use segment in the North American market is driven by the widespread use of wheat flour in various food applications, including baking, cooking, and food processing and the rising demand for processed and convenience foods. The versatility of wheat flour allows it to be a key ingredient in a wide range of products, including bread, pastries, pasta, and sauces, appealing to a broad consumer base. Additionally, the growing trend of home baking, particularly during the COVID-19 pandemic, has further propelled the demand for wheat flour in the food sector, as consumers seek to recreate their favorite baked goods at home. The rise of health-conscious eating has also led to an increased interest in whole-grain and specialty flours, which are often used in healthier food formulations. As the demand for high-quality food products continues to rise, the food use segment is expected to maintain its leading position in the North America wheat flour market.

The biofuels segment is another promising segment and is predicted to witness a CAGR of 5.7% over the forecast period due to the rising focus on renewable energy sources and the rising demand for sustainable fuel alternatives. Wheat flour can be utilized in the production of biofuels, particularly in the form of ethanol, which is derived from the fermentation of starches found in wheat. According to the Renewable Fuels Association, the U.S. ethanol production reached 15 billion gallons in 2020, with a significant portion derived from various feedstocks, including wheat. The growing emphasis on reducing carbon emissions and promoting environmentally friendly energy solutions has led to increased investments in biofuel production. Additionally, government policies and incentives aimed at promoting renewable energy sources are further driving the demand for biofuels derived from agricultural products. As the biofuels market continues to expand, the wheat flour segment is expected to benefit significantly from this trend, providing an additional avenue for growth in the coming years.

By Distribution Channel Insights

The supermarkets and hypermarkets segment accounted for 66.1% of the regional market share in 2024. The domination of supermarkets and hypermarkets segment in the North American market is primarily due to the extensive reach and convenience offered by these retail formats, which provide consumers with easy access to a wide variety of wheat flour products. The ability to find wheat flour alongside other grocery items enhances the shopping experience, making supermarkets and hypermarkets a preferred choice for consumers. Additionally, promotional activities and in-store displays further boost the visibility of wheat flour products, contributing to their sustained popularity in this distribution channel. The growing trend of health-conscious eating has also led supermarkets and hypermarkets to expand their offerings of whole-grain and specialty flours, catering to the increasing demand for healthier cooking options.

The online stores segment is on the rise and is likely to register a CAGR of 9.12% over the forecast period owing to the surge in e-commerce has transformed the way consumers shop for food products, with many opting for the convenience of online purchasing. According to a report by eMarketer, U.S. e-commerce sales are expected to reach $1 trillion by 2023, highlighting the growing trend of online shopping. The online retail segment allows consumers to explore a wider range of wheat flour products, including specialty and organic options that may not be available in physical stores. Additionally, the COVID-19 pandemic has accelerated the shift towards online shopping, as consumers seek to minimize in-store visits. The convenience of home delivery and the ability to compare products easily have made online shopping increasingly appealing. As more consumers embrace the convenience of online shopping, the online stores segment is poised for significant growth in the North America wheat flour market.

COUNTRY ANALYSIS

The United States occupied the major share of 77.9% of the North American market share in 2024. The U.S. market is characterized by a robust demand for wheat flour products, driven by the increasing popularity of health-oriented food products and the growth of the food processing industry. The U.S. market benefits from a well-established retail infrastructure, with a wide range of wheat flour products available in supermarkets, specialty stores, and online platforms. Additionally, the growing interest in organic and health-oriented wheat flour options has led to increased innovation among manufacturers, further driving market growth. The popularity of wheat flour in seasonal events, such as baking during the holidays, also contributes to its sustained demand. As consumer awareness of product quality and ingredient transparency continues to rise, manufacturers are focusing on clean-label formulations, which is expected to enhance the market's growth trajectory in the coming years.

Canada is predicted to account for a notable share of the North American wheat flour market over the forecast period. The Canadian market is experiencing a similar trend to that of the U.S., with an increasing number of consumers seeking wheat flour products for their health benefits. The Canadian market is also witnessing a growing interest in wheat flour as a convenient source of healthy carbohydrates, reflecting the broader trend towards healthier eating habits. As consumers become more aware of dietary preferences and ingredient sourcing, manufacturers are responding by introducing innovative products that cater to these demands. The expansion of retail channels, including online shopping, is further enhancing the accessibility of wheat flour products across Canada. As the market continues to evolve, the Canadian wheat flour market is expected to grow steadily, driven by increasing consumer awareness and demand for healthier options.

OVERVIEW OF KEY PLAYERS IN THE NORTH AMERICA WHEAT FLOUR MARKET

The North America wheat flour market is characterized by the presence of several key players who dominate the landscape. Notable companies include Archer Daniels Midland Company, which is recognized for its extensive range of flour products, and General Mills, a leading producer of consumer food products that has established a strong foothold in the wheat flour segment. These companies leverage their extensive distribution networks and brand recognition to capture a significant share of the market. Additionally, smaller, niche players are emerging, focusing on innovative formulations and health-oriented products, such as organic and specialty wheat flours. The competitive landscape is further intensified by the growing trend of e-commerce, as brands increasingly adopt online sales strategies to reach a broader audience. As consumer preferences continue to evolve, key players are investing in product innovation, marketing strategies, and sustainability initiatives to strengthen their market position and appeal to health-conscious consumers.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Key players in the North America wheat flour market employ various strategies to strengthen their market position and enhance competitiveness. One prominent strategy is product innovation, where companies continuously develop new formulations and applications for wheat flour to cater to changing consumer preferences. For instance, introducing organic and specialty wheat flours has become a popular tactic to attract health-conscious consumers. Additionally, many manufacturers are focusing on sustainability initiatives, such as reducing packaging waste and sourcing ingredients responsibly, to appeal to environmentally aware consumers.

Another strategy involves expanding distribution channels, particularly through e-commerce platforms, to enhance product accessibility. Companies are increasingly partnering with online retailers to reach a wider audience and capitalize on the growing trend of online shopping. Furthermore, marketing campaigns that emphasize the nutritional benefits and versatility of wheat flour in various culinary applications are being utilized to engage consumers and drive brand loyalty. Collaborations with food influencers and social media promotions are also becoming common practices to create buzz around new product launches. By leveraging these strategies, key players aim to solidify their presence in the North America wheat flour market and respond effectively to evolving consumer demands.

KEY MARKET PLAYERS AND COMPETITOR LANDSCAPE

Major Players of the North America wheat flour market include Archer Daniels Midland Company (ADM), Ardent Mills LLC, General Mills Inc., King Arthur Baking Company, Cargill, ConAgra Brands.

The North America wheat flour market is characterized by a competitive landscape that includes both established brands and emerging players. Major companies such as Archer Daniels Midland Company, General Mills, and ConAgra Foods dominate the market, leveraging their extensive distribution networks and brand recognition to capture significant market shares. These companies invest heavily in product innovation, focusing on new formulations and applications to meet the evolving preferences of health-conscious consumers. Additionally, the rise of niche brands specializing in organic and specialty wheat flours has intensified competition, as these companies cater to a growing demographic seeking healthier alternatives. The increasing trend of e-commerce has further transformed the competitive landscape, with brands adopting online sales strategies to reach a broader audience. As consumer preferences continue to shift towards unique and health-oriented products, competition is expected to intensify, prompting manufacturers to differentiate themselves through quality, taste, and innovative marketing strategies. Overall, the North America wheat flour market is poised for continued growth, driven by a dynamic competitive environment that encourages innovation and responsiveness to consumer trends.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Archer Daniels Midland Company introduced a new line of flavored wheat flour options, capitalizing on the growing trend of gourmet products among consumers.

- In March 2024, General Mills announced the launch of a wheat flour subscription service, allowing consumers to receive regular shipments of their favorite products, thereby enhancing customer convenience and loyalty.

- In April 2024, ConAgra Foods collaborated with a renowned chef to create a series of wheat flour-based recipes, leveraging social media to reach a broader audience and drive interest in wheat flour as a versatile ingredient.

- In June 2024, Archer Daniels Midland Company launched a limited-edition seasonal flavor of wheat flour, aiming to attract consumers looking for unique and festive options during the holiday season.

DETAILED SEGMENTATION OF NORTH AMERICA WHEAT FLOUR MARKET INCLUDED IN THIS REPORT

This research report on the North America wheat flour market has been segmented and sub-segmented based on type, end Use, distribution channel & region.

By Type

- All-Purpose Flour

- Whole Wheat Flour

- Bread Flour

- Cake & Pastry Flour

- Semolina Flour

- Others

By End Use

- Food Use

- Baking

- Cooking

- Processed & Convenience Foods

- Home Baking

- Health-Conscious Consumption

- Biofuels

- Wheat-Based Ethanol Production

- Renewable Energy Initiatives

- Government Incentives for Biofuel Production

- Focus on Sustainability & Carbon Emission Reduction

By Distribution Channel

- Supermarkets/Hypermarket

- Convenience Stores

- Online Retail

- Specialty Stores

By Country

- United States

- Canada

- Mexico

Frequently Asked Questions

1. Which factors are driving the growth of the North America wheat flour market?

The market is driven by the increasing demand for processed and convenience foods, rising health consciousness, and the growing popularity of home baking.

2. Who are the key players in the North America wheat flour market?

Major players include Archer Daniels Midland Company (ADM), Ardent Mills LLC, General Mills Inc., King Arthur Baking Company, Cargill, and ConAgra Brands.

3. How is the demand for wheat flour evolving in North America?

The demand is increasing due to shifting consumer preferences toward whole-grain and specialty flours, as well as its use in bakery products, snacks, and biofuel production.

4. What are the major segments of the North America wheat flour market?

The market is segmented by type (all-purpose, whole wheat, bread flour, etc.), source (conventional, organic), application (bakery, pasta, animal feed, etc.), distribution channel, and end-use (food, biofuels, industrial).

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]