North America Water Purifier Market Size, Share, Trends & Growth Forecast Report Segmented By Product Type, End-User, And By Country (US, Canada, Mexico, and Brazil), Industry Analysis From 2025 to 2033

North America Water Purifier Market Size

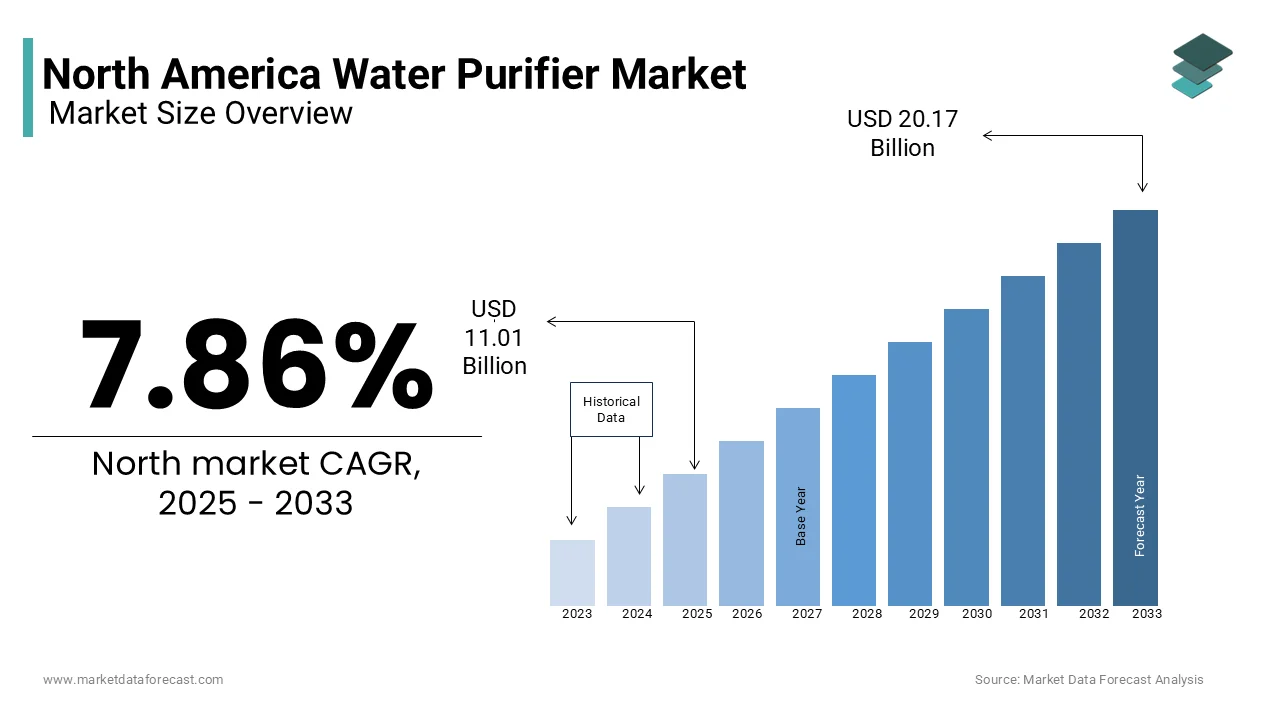

The North America water purifier market was valued at USD 10.21 billion in 2024 and is anticipated to reach USD 11.01 billion in 2025 from USD 20.17 billion by 2033, growing at a CAGR of 7.86% during the forecast period from 2025 to 2033.

Water purifiers are essential for removing contaminants, including bacteria, viruses, heavy metals, and chemical pollutants, thereby ensuring safe and potable water for consumers. The market encompasses a variety of products, including activated carbon filters, ultraviolet (UV) purifiers, reverse osmosis systems, and other advanced filtration technologies. This growth is driven by increasing consumer awareness regarding water quality, rising health concerns related to waterborne diseases, and stringent regulations governing water safety. Additionally, the growing trend of urbanization and the expansion of the residential and commercial sectors further contribute to the demand for effective water purification solutions. The North American water purifier market is poised for significant expansion is driven by technological advancements and evolving consumer preferences.

MARKET DRIVERS

Rising Health Awareness and Water Quality Concerns

The increasing awareness of health issues associated with contaminated water is a significant driver of the North American water purifier market. Consumers are becoming more informed about the potential health risks posed by pollutants in drinking water, including lead, chlorine, and microbial contaminants. According to the Centers for Disease Control and Prevention, approximately 7.2 million people in the United States are affected by waterborne diseases each year is elevating the importance of safe drinking water. This heightened awareness has led to a surge in demand for water purification systems that can effectively remove harmful substances and improve water quality. The adoption of water purifiers has become increasingly prevalent in households across North America as consumers seek to safeguard their health and that of their families. Furthermore, the COVID-19 pandemic has amplified concerns about hygiene and sanitation, further driving the demand for reliable water purification solutions.

Stringent Regulatory Standards

Another critical driver of the North American water purifier market is the implementation of stringent regulatory standards governing water quality and safety. Government agencies, such as the Environmental Protection Agency (EPA) in the United States, have established comprehensive regulations to ensure that drinking water meets specific safety criteria. These regulations mandate regular testing and treatment of water supplies to eliminate contaminants and protect public health. According to the EPA, over 90 contaminants are regulated under the Safe Drinking Water Act, which has prompted utilities and consumers alike to invest in water purification technologies. The demand for effective water purification systems has surged as municipalities and private entities strive to comply with these regulations. Additionally, increasing public scrutiny regarding water quality issues, such as lead contamination in urban areas, has further intensified the need for advanced purification solutions.

MARKET RESTRAINTS

High Initial Costs of Water Purification Systems

The North American water purifier market faces notable restraints, particularly concerning the high initial costs associated with purchasing and installing water purification systems. Advanced purification technologies, such as reverse osmosis and UV purification, can require significant capital investment, which may deter some consumers from adopting these solutions. This financial barrier can be particularly challenging for low-income households or small businesses that may prioritize other essential expenditures. Additionally, the ongoing maintenance and replacement costs of filters and components can further contribute to the overall expense of owning a water purification system. As a result, the high initial investment required for water purifiers represents a significant restraint that could hinder market growth among price-sensitive consumers who may opt for less effective alternatives.

Limited Consumer Awareness of Water Purification Technologies

Another significant restraint impacting the North American water purifier market is the limited consumer awareness regarding the various water purification technologies available. While there is a growing understanding of the importance of clean drinking water, many consumers remain uninformed about the specific benefits and functionalities of different purification systems. This knowledge gap can lead to indecision among consumers when selecting a suitable water purification solution that ultimately hindering market growth. Furthermore, the proliferation of misinformation regarding water quality and purification methods can exacerbate this issue by causing confusion and skepticism among potential buyers. Manufacturers and industry stakeholders must invest in educational initiatives and marketing campaigns to raise awareness about the importance of water purification and the advantages of various technologies.

MARKET OPPORTUNITIES

Technological Advancements in Water Purification

The North American water purifier market is poised to capitalize on several emerging opportunities, particularly advancements in water purification technologies. Innovations in filtration methods, such as nanotechnology and advanced membrane systems, are enhancing the efficiency and effectiveness of water purifiers. These innovations enable manufacturers to develop more compact, efficient, and user-friendly water purification systems that cater to the evolving needs of consumers. The demand for advanced purification technologies is expected to increase in presenting significant opportunities for manufacturers to innovate and expand their product offerings.

Growing Demand for Eco-Friendly Water Purification Solutions

Another promising opportunity for the North American water purifier market lies in the growing demand for eco-friendly and sustainable water purification solutions. There is a rising preference for products that minimize ecological impact. This trend has prompted manufacturers to develop innovative solutions, such as gravity-based filters and solar-powered purifiers, that align with sustainability goals. Additionally, the increasing focus on reducing single-use plastic consumption has led to a surge in demand for refillable water purification systems that promote responsible water usage. The North American water purifier market growing is setting up the opportunity by offering environmentally friendly products that meet consumer expectations as the market shifts towards sustainability. This growing emphasis on eco-friendly solutions is expected to drive significant growth in the water purifier market, as consumers prioritize sustainability in their purchasing decisions.

MARKET CHALLENGES

Intense Competition Among Manufacturers

The North American water purifier market faces significant challenges stemming from intense competition among manufacturers with a diverse range of players, including established brands and emerging startups. This competitive environment can lead to price wars, which may erode profit margins for manufacturers and hinder their ability to invest in research and development. Additionally, the rapid pace of technological advancements necessitates continuous innovation to stay ahead of competitors by placing further pressure on companies to allocate resources effectively. The challenge of maintaining profitability while navigating a competitive market landscape becomes increasingly complex.

Regulatory Compliance and Standards

Another formidable challenge facing the North American water purifier market is the need to comply with stringent regulatory standards and certifications. Government agencies, such as the EPA and NSF International, impose rigorous testing and certification requirements for water purification systems to ensure safety and effectiveness. The process of obtaining necessary certifications can be time-consuming and costly, which often taking several months to complete. This regulatory burden can pose significant challenges for manufacturers, particularly smaller companies that may lack the resources to navigate complex compliance processes. Additionally, changes in regulations or the introduction of new standards can create uncertainty in the market by requiring companies to adapt their products and processes accordingly. As a result, the need for regulatory compliance represents a significant challenge for stakeholders in the North American water purifier market with ongoing investment in quality assurance and product development to meet evolving standards.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.86% |

|

Segments Covered |

By Product Type, End-User And By Country |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

United States, Canada, Mexico, Rest of North America |

|

Market Leaders Profiled |

Suez Water Technologies & Solutions, Halo Source Inc., A. O. Smith Corporation, Amway Corporation, Pentair Plc. |

SEGMENTAL ANALYSIS

By Product Type Insights

The activated carbon filters segment was the largest and held 45.6% of the North American water purifier market share in 2024. This dominance can be attributed to the widespread adoption of activated carbon filtration technology, which effectively removes chlorine, sediment, and volatile organic compounds (VOCs) from drinking water. Activated carbon filters are favored for their affordability, ease of installation, and ability to improve taste and odor, making them a popular choice among consumers. The versatility and reliability of activated carbon filters contribute to their continued dominance in the North American water purifier market.

The UV water purifier segment is esteemed to reach a projected CAGR of 12.4% during the forecast period. This growth can be attributed to the increasing awareness of the effectiveness of UV purification in eliminating harmful microorganisms, including bacteria and viruses. The demand for UV water purifiers is expected to rise significantly as consumers become more concerned about waterborne pathogens. The UV water purifier segment is anticipated to capture a larger share of the market as more households and businesses seek reliable solutions for ensuring safe drinking water. The growing emphasis on health and safety is coupled with advancements in UV technology, positions this segment for substantial growth in the coming years.

By End-User Insights

The residential segment was the largest by capturing a dominant share of the North American water purifier market in 2024. This dominance is driven by the increasing consumer awareness of water quality issues and the growing demand for safe drinking water in households. According to the American Water Works Association, approximately 85% of U.S. households use some form of water treatment system, highlighting the widespread adoption of water purifiers in residential settings. The ongoing investments in water purification technologies to enhance health and safety is likely to fuel the growth of this segment. The rising trend of homeownership and the increasing focus on health-conscious living further contribute to the continued dominance of the residential segment in the North American water purifier market.

The commercial segment is expected to register a CAGR of 10.3% during the forecast period. This growth can be attributed to the increasing demand for water purification solutions in various commercial applications, including restaurants, hotels, and offices. As businesses prioritize the health and safety of their employees and customers, the adoption of water purifiers in commercial settings is becoming increasingly prevalent. The growing emphasis on corporate responsibility and sustainability further positions the commercial segment for significant growth in the water purifier market.

COUNTRY ANALYSIS

The United States led the North America water purifier market with a dominant share of 80.4% during the forecast period. The demand for water purification solutions is driven by increasing consumer awareness of water quality issues and stringent regulatory standards. According to the U.S. Environmental Protection Agency, approximately 15% of the population relies on private wells, which may not be subject to the same regulations as municipal water supplies with the need for effective water treatment solutions. This has prompted a surge in demand for water purifiers among households and businesses alike. Additionally, the growing trend of health-conscious living and the increasing prevalence of waterborne diseases further contribute to the demand for reliable water purification systems.

Canada is likely to experience a fastest CAGR of 11.1% in the next coming years. The Canadian market is driven by similar factors as the U.S., including increasing awareness of water quality issues and the need for effective water treatment solutions. According to Health Canada, approximately 10% of Canadians rely on private water systems, which may not be subject to the same safety regulations as municipal supplies. This has led to a growing demand for water purifiers among Canadian households seeking to ensure safe drinking water. Additionally, the Canadian government has implemented various initiatives aimed at improving water quality and safety. The demand for water purification solutions is expected to rise by reflecting the country's commitment to providing clean and safe drinking water to its citizens.

KEY MARKET PLAYERS

Suez Water Technologies & Solutions, Halo Source Inc., A. O. Smith Corporation, Amway Corporation, Pentair Plc. are the market players that are dominating the North America water Purifier market.

MARKET SEGMENTATION

This research report on the North America water Purifier market is segmented and sub-segmented into the following categories.

By Product Type

- Activated Carbon Filters

- UV Water Purifier

- RO Water Purifier

By End-user

- Commercial

- Residential

By Country

- North America

- U.S.

- Canada

- Mexico

Frequently Asked Questions

Why is the demand for water purifiers rising in North America?

Growing concerns over water contamination, increasing health awareness, and stricter water quality regulations are driving market growth.

What types of water purifiers are most popular in this region?

Reverse osmosis (RO), ultraviolet (UV), and activated carbon filters are widely used, with smart purifiers gaining traction.

Which factors influence consumer choices in the water purifier market?

Consumers consider filtration technology, price, maintenance cost, brand reputation, and certification when purchasing a water purifier.

Which countries lead in water purifier adoption in North America?

The United States and Canada dominate the market, driven by high urbanization, government initiatives, and concerns over waterborne diseases.

Who are the major companies shaping the North America water purifier industry?

Leading players include Brita, A.O. Smith, Culligan, Coway, and 3M, focusing on advanced filtration technologies and eco-friendly solutions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]