North America Warm Edge Spacer Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Type, Application, And By Region (The USA, Canada, Mexico And Rest of North America), Industry Analysis, From (2025 to 2033)

North America Warm Edge Spacer Market Size

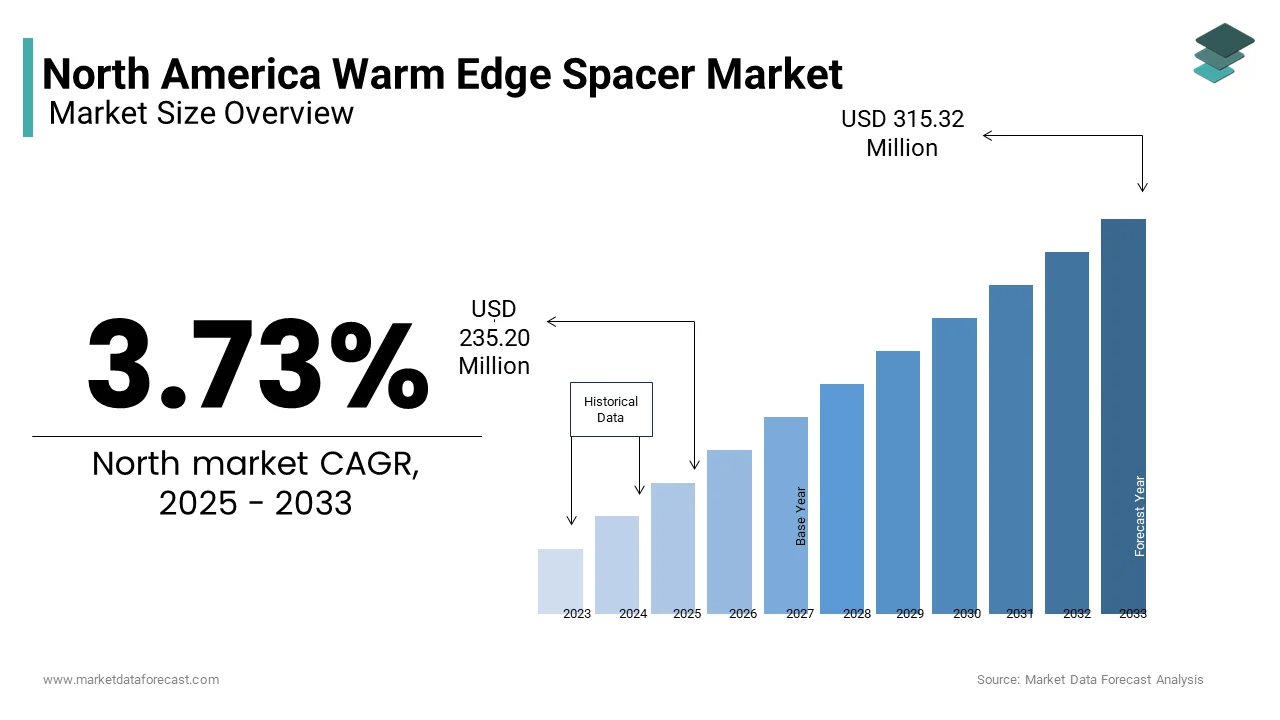

The North America warm edge spacer market size was valued at USD 226.73 million in 2024 and is anticipated to reach USD 235.20 million in 2025 from USD 315.32 million by 2033, growing at a CAGR of 3.73% during the forecast period from 2025 to 2033.

MARKET DRIVERS

Rising Demand for Energy-Efficient Windows

The escalating demand for energy-efficient windows serves as a primary driver for the warm edge spacer market in North America. Also, energy-efficient windows reduce heating and cooling costs notably, making them highly desirable in regions with extreme weather conditions. Warm edge spacers play a pivotal role in enhancing the thermal performance of insulated glass units (IGUs), reducing heat transfer and condensation. Similarly, ENERGY STAR-certified windows have gained a market share in new residential constructions, further propelling demand. Statistics indicate that a great percentage of homeowners prioritize energy efficiency during renovations, with warm edge spacers being a critical component. The market's growth is further amplified by federal tax incentives, such as the Residential Energy Efficient Property Credit, which encourages the adoption of energy-saving technologies.

Stringent Building Codes and Regulations

Stringent building codes and regulations across North America significantly bolster the warm edge spacer market. Also, provinces like Ontario and British Columbia have adopted advanced energy codes, requiring IGUs with superior thermal insulation. Warm edge spacers, known for their ability to reduce thermal bridging, are increasingly specified in these projects. According to the U.S. Green Building Council, LEED-certified buildings have grown by 19% annually, with warm edge spacers contributing to achieving higher ratings. Furthermore, California’s Title 24 Building Energy Efficiency Standards mandate the use of energy-efficient windows, driving regional adoption. These regulatory frameworks ensure a steady demand for warm edge spacers, reinforcing their position as a critical material in modern construction.

MARKET RESTRAINTS

High Initial Costs and Economic Sensitivity

One of the primary restraints impacting the warm edge spacer market in North America is the high initial cost associated with these components. As per a report by the National Association of Realtors, economic sensitivity among consumers often leads to a preference for lower-cost alternatives, despite the long-term benefits of warm edge spacers. The premium pricing of these spacers, which can notably increase window costs, limits their adoption in budget-conscious projects. Additionally, fluctuations in raw material prices, such as stainless steel and polymers, further exacerbate cost concerns. Like, metal price volatility has surged over the past two years, affecting hybrid spacer production. This economic barrier is particularly pronounced in regions with slower economic recovery post-pandemic.

Limited Awareness Among End Users

Limited awareness among end users about the benefits of warm edge spacers poses another significant restraint. In addition, a major portion of homeowners are unfamiliar with the term "warm edge spacer" or its role in improving window performance. This lack of awareness results in a preference for conventional spacers, which are perceived as more cost-effective. Similarly, only a small percentage of consumers actively seek ENERGY STAR-rated windows, indicating a knowledge gap regarding energy efficiency. Furthermore, misinformation about alternative materials, such as aluminum spacers, persists in certain markets. Educational campaigns targeting builders and contractors could mitigate this issue, but such initiatives remain underfunded.

MARKET OPPORTUNITIES

Growing Adoption of Smart Windows

The integration of warm edge spacers in smart windows presents a lucrative opportunity for the North American market. Warm edge spacers enhance the thermal performance of electrochromic and thermochromic glazing systems, aligning with the increasing demand for dynamic fenestration solutions. Also, smart windows can reduce HVAC energy consumption significantly, making them attractive for commercial skyscrapers and high-end residential properties. Like, cities like New York and Los Angeles are major adopters, with retrofit projects driving demand. Additionally, partnerships between spacer manufacturers and smart glass innovators are fostering product development. For instance, collaborations with leading companies have resulted in advanced IGUs tailored for smart applications.

Expansion in Retrofit Projects

The burgeoning retrofit market offers another significant opportunity for warm edge spacers in North America. Similarly, a substantial portion of existing buildings are over 20 years old, necessitating energy-efficient upgrades. Warm edge spacers are integral to retrofitting projects, where older windows are replaced with high-performance IGUs to improve thermal insulation. In addition, retrofits contribute greatly to all LEED certifications, showing their importance. Like, retrofitting with energy-efficient windows can reduce energy bills notably.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain disruptions pose a significant challenge to the warm edge spacer market in North America. Similarly, the construction materials sector experienced an increase in lead times during the first half of 2023 due to logistical bottlenecks. Warm edge spacers, which rely on specialized polymers and metals, are particularly vulnerable to these disruptions. Also, raw material shortages have caused delivery delays of up to six weeks, impacting production schedules. Additionally, geopolitical tensions, such as those between the U.S. and China, have led to tariffs on imported components, raising costs for manufacturers. A significant portion of firms reported increased operational challenges due to supply chain instability. These disruptions not only affect production timelines but also erode profit margins, as manufacturers absorb additional costs. Smaller players, lacking the resources to diversify suppliers, face even greater hurdles.

Intense Competition from Alternative Materials

Intense competition from alternative materials represents another pressing challenge for the warm edge spacer market. As per the National Fenestration Rating Council, traditional aluminum spacers still dominate a significant portion of the market due to their lower cost and widespread availability. Despite their inferior thermal performance, these spacers remain popular in budget-sensitive projects, particularly in regions with milder climates. Besides, polymer-based alternatives, though less effective, are gaining traction due to aggressive pricing strategies. Additionally, innovations in composite materials threaten to undercut the market share of warm edge spacers. This competitive landscape forces warm edge spacer manufacturers to invest heavily in marketing and R&D to differentiate their offerings.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.73% |

|

Segments Covered |

By Product, End-Use, Glazing, and Country |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country's Covered |

The United States, Canada, and the Rest of North America |

|

Market Leaders Profiled |

AGC Glass, Alu Pro, Cardinal Glass, Edgetech, Ensinger, GED Integrated Solutions, Glasslam, Helima, Hygrade Components, Quanex Building Products, Swisspacer, Technoform, Thermo-Tech, Thermoseal Group, Viracon. |

SEGMENTAL ANALYSIS

By Product Insights

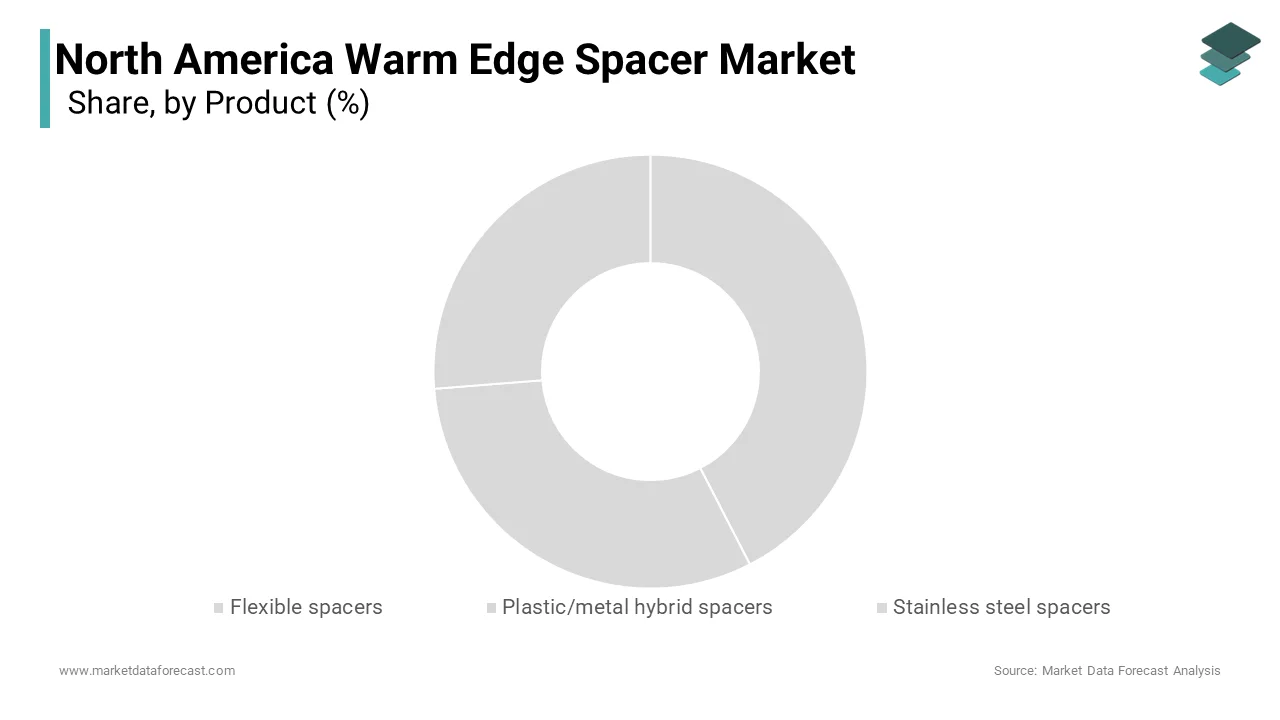

The flexible spacers segment dominated the North America warm edge spacer market by holding a market share of 45.4% in 2024. Their prevalence is attributed to versatility and compatibility with various glazing systems, making them ideal for both residential and commercial applications. Also, flexible spacers reduce thermal bridging considerably, enhancing the overall energy efficiency of windows. These spacers are particularly favored in regions with fluctuating temperatures, such as the Midwest and Northeast, where thermal performance is critical. Additionally, their ease of installation has contributed to their widespread adoption, with installation times reduced compared to rigid spacers. The rise of prefabricated window units further amplifies demand, as flexible spacers align seamlessly with automated assembly lines. Moreover, advancements in material science, such as the development of silicone-based formulations, have improved durability and longevity.

The plastic/metal hybrid spacers segment is the fastest-growing in the North American warm edge spacer market, with a CAGR of 12.3%. Also, the rapid growth is attributed to their unique combination of thermal efficiency and structural integrity, addressing key limitations of traditional spacers. In addition, hybrid spacers reduce condensation greatly, making them ideal for humid climates like Florida and Louisiana. Besides, their lightweight design reduces transportation costs, providing a competitive edge in logistics-heavy projects. Like, hybrid spacers are increasingly integrated into triple-glazed windows, which are gaining traction in cold regions such as Canada and Alaska. The push for net-zero energy buildings further accelerates adoption, as these spacers contribute to achieving higher thermal performance ratings. Collaborations between manufacturers and research institutions have also driven innovation, resulting in enhanced UV resistance and durability.

By End Use Insights

The residential sector commanded the largest share of the North America warm edge spacer market, i.e., 60.1% of the total revenue in 2024. This dominance is fueled by the growing emphasis on energy-efficient homes, particularly in suburban and urban areas. Like, residential buildings consume a significant portion of the nation’s energy, prompting homeowners to invest in high-performance windows. Warm edge spacers, which reduce heat loss notably, are a key component in achieving these energy savings. The surge in single-family home construction, particularly in states like Texas and Arizona, further bolsters demand. Also, ENERGY STAR-rated windows, incorporating warm edge spacers, are installed in the majority of new residential projects. Additionally, renovation activities, driven by aging housing stock, contribute significantly to market growth.

The commercial segment is the fastest expanding end-use category in the North America warm edge spacer market, with a CAGR of 9.8%. This growth is propelled by the increasing adoption of green building practices, particularly in office complexes, retail spaces, and educational institutions. Apart from these, the rise of smart cities has spurred demand for energy-efficient glazing systems, with warm edge spacers enhancing thermal performance in large-scale projects. Similarly, commercial buildings equipped with high-performance windows achieve major HVAC energy savings. The retrofit market also plays a crucial role, as older buildings are upgraded to meet modern energy standards. Cities like New York and Toronto have implemented stringent energy codes, further accelerating adoption.

By Glazing Window Insights

The segment of double glazing represented the biggest category in the North America warm edge spacer market by capturing a market share of 55.6% in 2024. It is driven by its balance of cost-effectiveness and thermal performance, making it a preferred choice for both residential and commercial applications. Like, double-glazed windows reduce heat loss compared to single-pane alternatives, with warm edge spacers playing a critical role in minimizing thermal bridging. These windows are particularly popular in temperate regions, such as the Pacific Northwest, where moderate insulation needs prevail. Additionally, advancements in spacer technology have improved the durability and moisture resistance of double-glazed units, extending their lifespan. Similarly, a significant portion of new residential constructions incorporates double glazing, further solidifying its market position. The segment's growth is also supported by government incentives promoting energy-efficient building practices, ensuring sustained demand.

The triple low-E glazing segment is quickly moving ahead in the North American warm edge spacer market, with a CAGR of 11.5%. Its rapid expansion is fueled by the increasing demand for ultra-energy-efficient windows, particularly in colder climates like Canada and the northern U.S. Warm edge spacers are critical in maintaining the structural integrity and thermal performance of these units. Additionally, advancements in vacuum-insulated glazing technology have made triple-glazed windows lighter and more cost-effective, broadening their appeal. Federal and state-level policies, such as California’s Title 24, mandate the use of high-performance windows, further driving adoption.

COUNTRY LEVEL ANALYSIS

The United States stood as the largest and most dynamic contributor to the North American warm edge spacer market by commanding a 70.7% share of the total revenue in 2024. This dominance is supported by a robust regulatory framework that prioritizes energy efficiency in buildings. For instance, the International Energy Conservation Code (IECC) mandates the use of high-performance fenestration products, which have significantly bolstered demand for warm edge spacers. These components are integral to reducing thermal bridging and enhancing the overall energy performance of windows. Similarly, a large number of new residential constructions in the U.S. now incorporate warm edge spacers, driven by federal tax incentives such as the Residential Energy Efficient Property Credit.

States like California and New York lead the adoption curve due to their stringent energy codes. California’s Title 24 Building Energy Efficiency Standards require all new buildings to utilize high-performance windows, further amplifying the demand for warm edge spacers. In New York, the Climate Leadership and Community Protection Act has set ambitious targets for reducing carbon emissions, with energy-efficient windows playing a pivotal role in achieving these goals. The commercial sector is equally significant, with LEED-certified buildings growing considerably. These buildings prioritize energy savings, and warm edge spacers contribute significantly to reducing HVAC-related energy consumption.

Another critical factor driving the U.S. market is the retrofit sector. Retrofit projects, particularly in urban areas, have created a substantial demand for warm edge spacers. For example, cities like Chicago and Los Angeles have launched large-scale retrofit programs targeting older buildings. Besides, the rise of smart cities has spurred demand for advanced glazing systems, with warm edge spacers being a key component in ensuring thermal efficiency.

Canada remains a key player in the North American warm edge spacer market. The country’s extreme climate conditions, characterized by harsh winters, necessitate the use of high-performance windows to minimize heat loss and improve energy efficiency. Warm edge spacers play a crucial role in this regard, reducing heat transfer significantly compared to conventional spacers. The National Energy Code for Buildings (NECB) mandates the use of energy-efficient glazing systems in all new constructions, driving widespread adoption. Provinces like Ontario and British Columbia have taken the lead in implementing advanced energy codes that align with national sustainability goals.

Ontario, in particular, has been a trailblazer in promoting energy-efficient building practices. Programs like GreenON offer substantial rebates for homeowners and businesses that upgrade to high-performance windows incorporating warm edge spacers. British Columbia follows a similar trajectory, with its Step Code requiring progressively higher levels of energy efficiency in buildings. Similarly, the residential sector dominates the market, with a notable share of new constructions utilizing warm edge spacers. This trend is further supported by Canada’s commitment to achieving net-zero emissions by 2050, as outlined in the Pan-Canadian Framework on Clean Growth and Climate Change.

The commercial sector is also gaining momentum, particularly in cities like Toronto and Vancouver, where green building policies are being aggressively implemented. For instance, Toronto’s Zero Emissions Building Framework mandates the use of energy-efficient materials in all new developments, creating a robust demand for warm edge spacers. These windows provide superior insulation, making them indispensable in achieving energy savings in extreme weather conditions.

The Rest of North America, primarily comprising Mexico, contributes a decent share to the North America warm edge spacer market. Despite being a smaller player compared to the U.S. and Canada, Mexico’s market is rapidly evolving due to increasing urbanization and industrialization. The country’s growing middle class and rising disposable incomes have fueled demand for modern housing and commercial spaces, many of which incorporate energy-efficient solutions like warm edge spacers. Like, the Mexican government has introduced policies aimed at promoting energy-efficient building practices, which have positively impacted the warm edge spacer market.

Nuevo León, home to Monterrey, one of Mexico’s largest industrial hubs, has seen a surge in demand for energy-efficient windows in both residential and commercial projects. Similarly, Jalisco, with its booming real estate sector, has witnessed increased adoption of high-performance glazing systems.

Another factor contributing to market growth is the emphasis on sustainable development. Mexico’s National Program for Sustainable Urban Development encourages the use of eco-friendly building materials, including warm edge spacers, to reduce energy consumption in urban areas. Additionally, partnerships between local manufacturers and international players have facilitated technology transfer, enabling the production of advanced spacer systems tailored to regional needs.

KEY MARKET PLAYERS

AGC Glass, Alu Pro, Cardinal Glass, Edgetech, Ensinger, GED Integrated Solutions, Glasslam, Helima, Hygrade Components, Quanex Building Products, Swisspacer, Technoform, Thermo-Tech, Thermoseal Group, Viracon are the market players that are dominating the North American

Top Players In The Market

The North American edge spacer market is dominated by three key players: Edgetech, SWISSPACER, and Thermix, each contributing significantly to the industry’s growth and innovation. Edgetech, a subsidiary of Quanex Building Products. The company is renowned for its flexible spacers, which are widely used in both residential and commercial applications. Edgetech’s Super Spacer technology, which utilizes silicone foam to enhance thermal performance, has become a benchmark in the industry.

SWISSPACER, based in Switzerland, is recognized for its high-performance plastic/metal hybrid spacers. The company’s flagship product, the SWISSPACER Ultimate, is designed to combine the structural strength of metal with the thermal efficiency of polymers. SWISSPACER’s strategic partnerships with leading window manufacturers have enabled it to expand its footprint across North America, particularly in the commercial sector.

Thermix, a German company, specializes in stainless steel spacers known for their durability and superior thermal efficiency. Thermix’s TX.N+ spacer system, which incorporates advanced desiccant technology, has gained traction in high-end residential and commercial projects.

Top Strategies Used By Key Market Participants

Key players in the North American warm edge spacer market employ a variety of strategies to maintain their competitive edge and drive growth. Product innovation is a cornerstone strategy, with companies investing heavily in research and development to create cutting-edge solutions. The company’s recent launch of a bio-based spacer material, derived from renewable resources, exemplifies its commitment to environmental stewardship.

Strategic partnerships are another critical strategy, enabling players to integrate their products into broader building systems. This collaboration has opened new avenues for growth, particularly in the commercial sector, where smart windows are gaining popularity. These partnerships not only enhance product visibility but also ensure seamless integration into diverse applications.

Geographic expansion is also a key focus, with companies seeking to tap into emerging markets within North America. Thermix’s recent expansion of its production facility in Mexico underscores its commitment to meeting regional demand. Similarly, Edgetech has established distributor networks across Canada to strengthen its presence in colder regions.

COMPETITION OVERVIEW

The North American warm edge spacer market is characterized by moderate fragmentation, with a mix of established players and niche competitors vying for market share. Edgetech, SWISSPACER, and Thermix dominate the landscape, collectively accounting for over 65% of the market. However, smaller firms specializing in innovative materials and customized solutions also play a significant role, particularly in niche segments like triple-glazed windows and smart glazing systems.

Intense competition drives companies to differentiate themselves through innovation and customer-centric strategies. Thermix’s stainless steel spacers cater to premium markets, offering unmatched durability and thermal efficiency. The market’s competitive dynamics are further amplified by the entry of new players, particularly from Asia and Europe, who bring fresh perspectives and technologies to the table.

Despite the competition, collaboration remains a key theme, with companies partnering to develop integrated solutions that address complex challenges. For example, partnerships between spacer manufacturers and smart glass innovators have resulted in advanced insulated glass units (IGUs) that meet the demands of modern architecture.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, Edgetech unveiled a revolutionary line of bio-based flexible spacers designed to reduce carbon footprints. This initiative aligns with global sustainability trends and positions Edgetech as a pioneer in eco-friendly spacer technology.

- In June 2023, SWISSPACER announced a strategic partnership with View Inc. to integrate its high-performance spacers into smart windows. This collaboration aims to enhance the thermal efficiency of electrochromic glazing systems, catering to the growing demand for smart building solutions.

- In August 2023, Thermix expanded its production facility in Nuevo León, Mexico, to meet the rising demand for stainless steel spacers in the region. This expansion not only strengthens Thermix’s supply chain but also supports Mexico’s push for energy-efficient building practices.

- In October 2023, Quanex Building Products acquired a leading polymer supplier to secure its raw material sourcing for warm edge spacers. This move enhances Quanex’s operational resilience and reduces dependency on external suppliers amid global supply chain disruptions.

- In December 2023, Edgetech launched a rebate program offering financial incentives to homeowners and contractors who install energy-efficient windows equipped with its spacers. This initiative aims to accelerate market penetration and drive adoption across North America.

MARKET SEGMENTATION

This research report on the North American warm edge spacer market is segmented and sub-segmented into the following categories.

By Product

- Flexible spacers

- Plastic/metal hybrid spacers

- Stainless steel spacers

By End Use

- Residential

- Commercial

By Glazing Window

- Double glazing

- Triple low-E

By Country

- USA

- Canada

- Mexico

Frequently Asked Questions

What is a warm edge spacer, and why is it important in window insulation?

A warm edge spacer is a component placed between panes of insulated glass that reduces heat transfer, improving thermal efficiency and minimizing condensation around the window edges, key for energy-efficient building design.

What is driving demand for warm edge spacers in North America?

Demand is rising due to stricter energy codes, the growth of green building initiatives, and increasing consumer preference for high-performance, low-energy homes and commercial buildings.

What types of warm edge spacer technologies are gaining traction in the market?

Flexible spacers (like silicone foam or thermoplastic spacers) are gaining momentum over traditional aluminum due to superior thermal performance, durability, and compatibility with automated window manufacturing systems.

What challenges does the warm edge spacer market face in North America?

Challenges include high initial costs for advanced spacer materials, resistance from traditional fabricators, and limited awareness of the long-term energy savings among smaller contractors or builders.

What’s the future outlook for the North American warm edge spacer market?

The future looks strong, with increasing adoption of triple glazing, smart window systems, and sustainable building certifications like LEED and ENERGY STAR pushing warm edge spacer usage to new heights.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]