North America Warehouse Robotics Market Research Report – Segmented By Type ( industrial robots segment, mobile robots segment), By Function ( storage function segment , packaging function segment ), By End-User ( food and beverage sector, retail sector segment )and Country (The U.S., Canada and Rest of North America) - Industry Analysis, Size, Share, Growth, Trends, & Forecasts 2025 to 2033

North America Warehouse Robotics Market Size

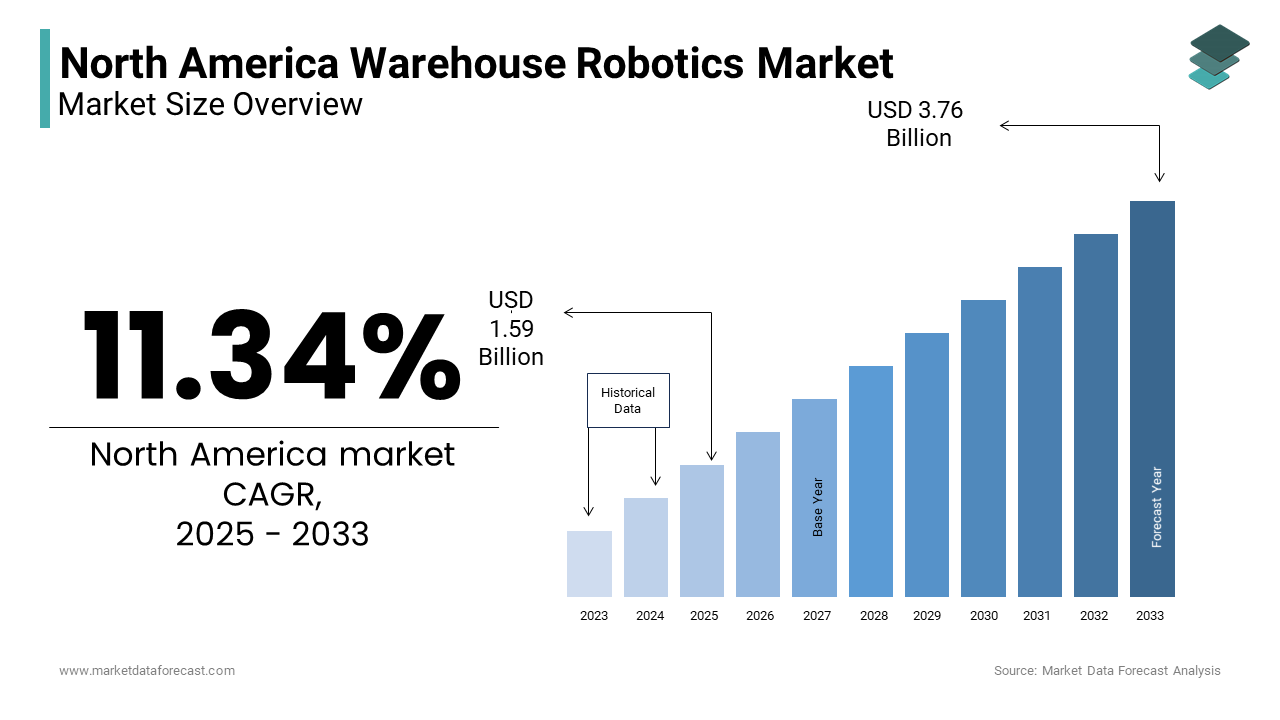

The north america warehouse robotics market Size was valued at USD 1.43 billion in 2024. The north america warehouse robotics market size is expected to have 11.34 % CAGR from 2025 to 2033 and be worth USD 3.76 billion by 2033 from USD 1.59 billion in 2025.

The warehouse robotics is a variety of robotic systems designed to enhance efficiency, accuracy, and productivity in warehouse environments. These systems include industrial robots, automated storage and retrieval systems, mobile robots, sortation systems, and conveyors among others. The increasing demand for automation in warehouses is driven by the need for improved operational efficiency, reduced labor costs, and enhanced inventory management. This growth is fueled by the rising adoption of e-commerce, which necessitates more efficient warehousing solutions to meet consumer demands for faster delivery times. The integration of robotics into warehouse operations is becoming increasingly essential as companies strive to optimize their supply chains and improve customer satisfaction.

MARKET DRIVERS

Increasing Demand for E-commerce Solutions

The surge in e-commerce has emerged as a primary driver of the North American warehouse robotics market. The retailers and logistics providers are compelled to enhance their warehousing capabilities to meet the growing consumer expectations for rapid order fulfillment and delivery as online shopping continues to gain traction. According to the U.S. Department of Commerce, e-commerce sales in the United States reached $870 billion in 2021, representing a 14.2% increase from the previous year. This exponential growth in e-commerce has led to a corresponding rise in demand for automated solutions that can streamline warehouse operations. Robotics technology, including automated guided vehicles (AGVs) and robotic picking systems that enables warehouses to operate more efficiently by reducing the time required for order processing and inventory management. The adoption of warehouse robotics is expected to accelerate as companies seek to optimize their supply chains and improve operational efficiency further propelling market growth. The integration of robotics not only enhances productivity but also allows businesses to scale their operations in response to fluctuating demand by making it a critical component of modern warehousing strategies.

Labor Shortages and Rising Labor Costs

Another significant driver of the North American warehouse robotics market is the ongoing labor shortages and rising labor costs. The logistics and warehousing sectors have faced challenges in attracting and retaining skilled labor by the COVID-19 pandemic. According to the U.S. Bureau of Labor Statistics, the logistics industry experienced a labor shortage of approximately 1.3 million workers in 2021 due to increased operational costs and inefficiencies. In response to these challenges, many companies are turning to automation and robotics to mitigate the impact of labor shortages. The automated solutions such as robotic palletizers and sorting systems can operate continuously, thereby enhancing throughput and minimizing the risk of errors associated with manual labor. The economic justification for investing in warehouse robotics becomes increasingly compelling. This trend is expected to drive significant growth in the North American warehouse robotics market as companies seek to optimize their operations and address labor-related challenges.

MARKET RESTRAINTS

High Initial Investment Costs

The high initial investment costs associated with implementing robotic systems. The acquisition of advanced robotics technology, coupled with the necessary infrastructure modifications, can require substantial capital outlay. The average cost of deploying a comprehensive warehouse robotics system can range from $250,000 to over $1 million by depending on the complexity and scale of the operation. This financial barrier can deter smaller businesses from adopting automation solutions, limiting their ability to compete in an increasingly automated market. Additionally, the return on investment (ROI) for robotics systems may take time to materialize, further complicating the decision-making process for potential adopters. As a result, the high initial investment costs associated with warehouse robotics represent a significant restraint that could hinder market growth, particularly among smaller enterprises that may lack the financial resources to invest in such technologies.

Integration Challenges with Existing Systems

hallenge of integrating robotic systems with existing warehouse management systems (WMS) and infrastructure. Many warehouses operate with legacy systems that may not be compatible with modern robotics technology, leading to potential disruptions in operations during the integration process. These integration challenges can result in increased downtime, operational inefficiencies, and additional costs associated with system upgrades or replacements. Furthermore, the complexity of warehouse operations can vary significantly across different industries by making it challenging to implement standardized robotic solutions. Addressing these integration challenges will be crucial to ensuring a smooth transition and maximizing the benefits of automation. The difficulties associated with integrating robotics into existing systems represent a significant restraint to the growth of the North American warehouse robotics market.

MARKET OPPORTUNITIES

Advancements in Robotics Technology

The North American warehouse robotics market is poised to capitalize on several emerging opportunities, particularly advancements in robotics technology. Innovations in artificial intelligence (AI), machine learning, and computer vision are enhancing the capabilities of warehouse robots, enabling them to perform increasingly complex tasks with greater efficiency and accuracy. These advancements allow for the development of more sophisticated robotic systems capable of handling diverse tasks, such as picking, packing, and sorting, in dynamic warehouse environments. As companies seek to optimize their operations and improve productivity, the demand for advanced robotics solutions is expected to rise. This trend presents a significant opportunity for manufacturers and technology providers to innovate and deliver cutting-edge robotic systems that meet the evolving needs of the warehousing sector. The stakeholders in the North American warehouse robotics market can enhance their competitive advantage and drive sustained growth.

Growing Focus on Supply Chain Resilience

Another promising opportunity for the North American warehouse robotics market lies in the growing focus on supply chain resilience. The COVID-19 pandemic has elevated the importance of robust supply chains capable of adapting to disruptions and fluctuations in demand. There is an increasing emphasis on automation and robotics to enhance flexibility and responsiveness as companies reevaluate their supply chain strategies. This shift towards automation presents a significant opportunity for the warehouse robotics market as companies seek to implement solutions that enable them to respond quickly to changing market conditions. The warehouses can enhance their operational agility, reduce lead times, and improve overall supply chain performance by adopting robotic systems. This growing focus on supply chain resilience is expected to drive substantial demand for warehouse robotics is positioning the market for continued growth in the coming years.

MARKET CHALLENGES

Rapid Technological Changes

The North American warehouse robotics market faces significant challenges stemming from rapid technological changes. The pace of innovation in robotics and automation technologies is accelerating, leading to frequent updates and advancements that can quickly render existing systems obsolete. The average lifespan of warehouse robotics technology is estimated to be around five to seven years by necessitating ongoing investments in upgrades and replacements. This rapid evolution can create uncertainty for businesses considering automation, as they may hesitate to invest in technologies that could soon be surpassed by newer solutions. Additionally, the need for continuous training and skill development for employees to operate and maintain advanced robotic systems adds another layer of complexity. They must remain agile and adaptable to ensure they can leverage the latest advancements in warehouse robotics effectively as companies navigate the challenges posed by rapid technological changes.

Cybersecurity Risks

Another formidable challenge facing the North American warehouse robotics market is the increasing cybersecurity risks associated with the integration of connected robotic systems. The reliance on digital networks and data exchange increases is making them vulnerable to cyberattacks. According to a report by cybersecurity experts, the logistics and transportation sector experienced a 50% increase in cyberattacks in 2021 due to growing threat to supply chain operations. Cybersecurity breaches can lead to significant disruptions in warehouse operations, data loss, and financial repercussions. The companies must prioritize cybersecurity measures to protect their robotic systems and data from potential threats. This challenge necessitates ongoing investment in cybersecurity infrastructure, employee training, and risk management strategies to safeguard against cyber threats. The increasing focus on cybersecurity in the context of warehouse robotics underscores the need for companies to adopt a proactive approach to mitigate risks and ensure the integrity of their automated operations.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

11.34 % |

|

Segments Covered |

By Type , Function , End-User and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

Daifuku Co., Ltd. (Japan), KION GROUP AG (Germany), KUKA AG (Germany), ABB (Switzerland) |

SEGMENTAL ANALYSIS

By Type Insights

The industrial robots segment was the largest and held 35.4% of North America warehouse robotics market share in 2024. This dominance can be attributed to the widespread application of industrial robots in various warehousing functions, including picking, packing, and palletizing. The increasing demand for automation in warehouses that is driven by the need for improved efficiency and reduced labor costs that propels the adoption of industrial robots. The versatility and reliability of industrial robots make them a preferred choice for warehouses is seeking to enhance productivity and streamline operations.

The mobile robots segment is swiftly emerging with a CAGR of 20.3% during the forecast period. This growth can be attributed to the increasing demand for flexible and autonomous solutions that can navigate dynamic warehouse environments. Mobile robots, such as autonomous mobile robots (AMRs), are capable of transporting goods and materials without human intervention, making them ideal for modern warehousing operations. The mobile robots segment is expected to capture a larger share of the market as more warehouses seek to implement agile and efficient automation solutions. The ability of mobile robots to adapt to changing layouts and workflows positions them as a key driver of growth in the warehouse robotics market.

By Function Insights

The storage function segment dominated the market and held 40.3% of the North America warehouse robotics market share. This dominance is primarily driven by the essential role that automated storage and retrieval systems (AS/RS) play in optimizing space utilization and improving inventory management. AS/RS solutions enable warehouses to store and retrieve goods efficiently, reducing the time and labor required for manual handling. The ability of automated systems to enhance accuracy and reduce operational costs contributes to the continued dominance of the storage function segment.

The packaging function segment is anticipated to grow with a CAGR of 18.3% during the forecast period. This growth can be attributed to the increasing emphasis on efficient packaging processes to meet the demands of e-commerce and retail. Automated packaging systems streamline the packing process, reducing labor costs and improving throughput. The growing focus on efficiency and accuracy in packaging operations positions this segment for significant growth in the coming years.

By End-User Insights

The food and beverage sector held the dominant share of the market by accounting for 30.2% in 2024. This dominance is driven by the critical need for automation in food and beverage warehousing to ensure compliance with safety regulations and enhance operational efficiency. The increasing demand for processed and packaged food products, coupled with the need for rapid order fulfillment, propels the adoption of warehouse robotics in this sector.

The retail sector segment is likely to register a CAGR of 19.3% during the forecast period. This growth can be attributed to the rapid expansion of e-commerce and the increasing need for efficient warehousing solutions to meet consumer demands for quick delivery. Retailers are increasingly adopting robotic systems to streamline their operations and enhance inventory management. The growing emphasis on customer satisfaction and operational agility positions the retail sector for significant growth in the warehouse robotics market.

Country Level Analysis

The United States warehouse robotics market led the share of 80.2% in 2024 due to ongoing demand for automation driven by the rapid growth of e-commerce and the need for efficient supply chain solutions. According to the U.S. Census Bureau, e-commerce sales in the United States reached $870 billion in 2021 is reflecting a significant increase in online shopping. This surge in e-commerce has prompted retailers and logistics providers to invest heavily in warehouse robotics to enhance their operational efficiency and meet consumer expectations for fast delivery. The U.S. government’s support for advanced manufacturing and automation technologies further bolsters the growth of the warehouse robotics market. The U.S. is expected to maintain its dominant position in the North American warehouse robotics market as companies continue to prioritize automation to improve productivity and reduce costs.

Canada is attributed to achieve a CAGR of 10.3% during the forecast period. The Canadian market is driven by similar factors as the States, including the increasing demand for automation in response to the growth of e-commerce and the need for efficient supply chain management. According to Statistics Canada, e-commerce sales in Canada reached approximately CAD 39.9 billion in 2021, marking a significant increase from previous years. This growth has prompted Canadian retailers and logistics providers to adopt advanced warehouse robotics solutions to enhance their operational capabilities and improve order fulfillment processes. Additionally, the Canadian government has been actively promoting innovation and technology adoption in the manufacturing and logistics sectors, further supporting the growth of the warehouse robotics market. The warehouse robotics market is expected to experience robust growth in the coming years as Canadian companies continue to invest in automation technologies to optimize their operations and meet consumer demands.

KEY MARKET PLAYERS

Companies playing a prominent role in the north america warehouse robotics market are Daifuku Co., Ltd. (Japan), KION GROUP AG (Germany), KUKA AG (Germany), ABB (Switzerland), FANUC CORPORATION (Japan), Geekplus Technology Co., Ltd. (China), GreyOrange (US), TOYOTA INDUSTRIES CORPORATION (Japan), Omron Corporation (Japan), JBT (US), Honeywell International Inc. (US).

MARKET SEGMENTATION

This research report on the North America Warehouse Robotics Market has been segmented and sub-segmented into the following categories.

By Type

- industrial robots segment

- mobile robots segment

By Function

- storage function segment

- packaging function segment

By End-User

- food and beverage sector

- retail sector segment

By Country

- The U.S.

- Canada

- Rest of North America.

Frequently Asked Questions

What factors are driving the growth of warehouse robotics in North America?

Increasing demand for automation, efficiency in distribution channels, and the rapid expansion of e-commerce are key growth drivers.

Which industries are the primary adopters of warehouse robotics?

Major adopters include e-commerce, automotive, food and beverage, electrical and electronics, and retail sectors.

What types of robots are commonly used in warehouses?

Common types include mobile robots, articulated robots, cylindrical robots, SCARA robots, parallel robots, and Cartesian robots

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]