North America Video Management Software Market Research Report – Segmented By Technology(IP-based technology segment, analog-based technology segment ) Deployment ( cloud-based deployment segment, on-premise segment) Application ( video analytics application segment ,remote monitoring segment) Vertical ( retail and e-commerce vertical segment, healthcare vertical segment ) and Country (The U.S., Canada and Rest of North America) - Industry Analysis, Size, Share, Growth, Trends, & Forecasts 2025 to 2033.

North America Video Management Software Market Size

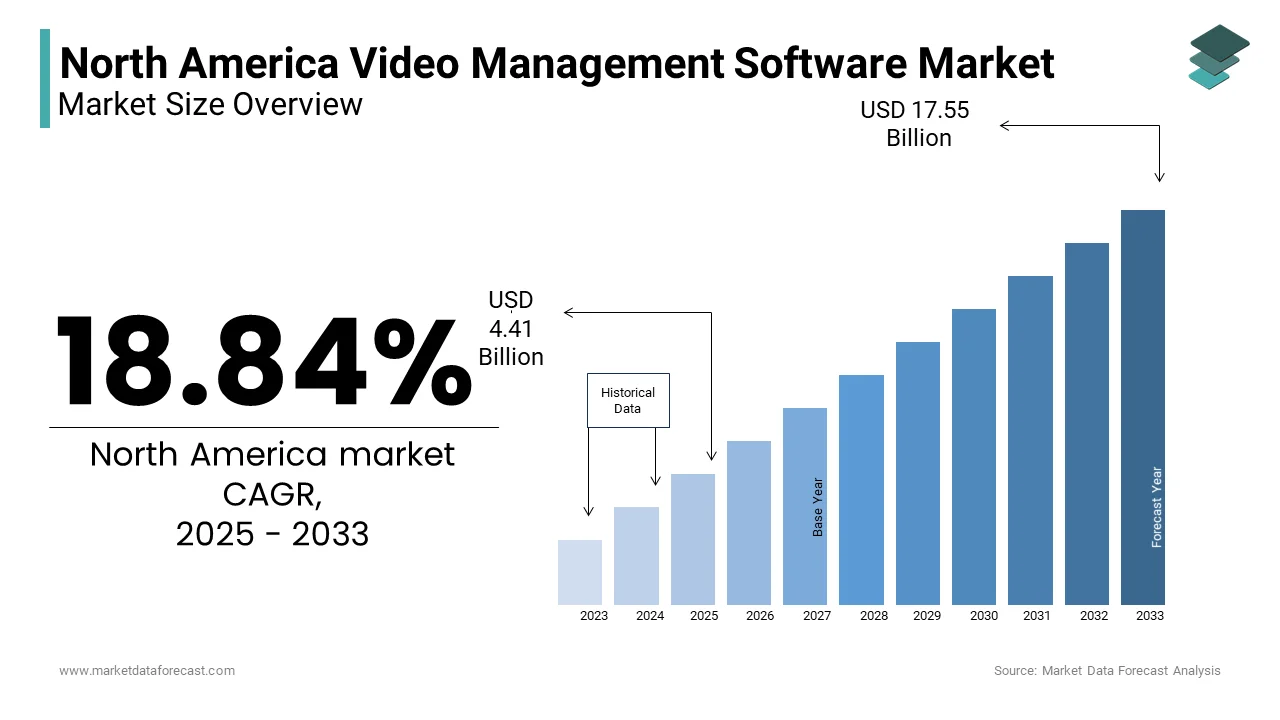

The North America Video Management Software Market Size was valued at USD 3.71 billion in 2024. The North America Video Management Software Market size is expected to have 18.84% CAGR from 2025 to 2033 and be worth USD 17.55 billion by 2033 from USD 4.41 billion in 2025.

The North America video management software (VMS) market encompasses a range of software solutions designed to manage, record, and analyze video footage from surveillance cameras and other video sources. These systems are integral to security and surveillance operations across various sectors, including retail, transportation, government, and healthcare. VMS solutions enable users to monitor live feeds, store recorded footage, and utilize advanced analytics for enhanced security measures. The growth of this market is driven by the increasing need for security and surveillance solutions in response to rising crime rates and security threats. The demand for sophisticated video management systems has intensified. Additionally, the integration of artificial intelligence (AI) and machine learning capabilities into VMS solutions is enhancing their functionality by enabling features such as facial recognition, motion detection, and behavior analysis.

MARKET DRIVERS

Surging Demand for Advanced Security Solutions

The escalating demand for enhanced security solutions is a primary driver of the North America video management software market. The organizations across various sectors are increasingly investing in advanced surveillance systems to protect their assets and personnel. According to the FBI's Uniform Crime Reporting Program, property crime in the United States increased by 4.1% in 2020 with the urgent need for effective security measures. Video management software plays a crucial role in this context by providing users with the ability to monitor live feeds, record footage, and analyze data for improved situational awareness. Moreover, the growing trend of smart cities and the integration of IoT technologies are further driving the demand for video management solutions. As urban areas become more interconnected, the need for comprehensive surveillance systems that can manage multiple video sources and provide real-time analytics is becoming increasingly critical. According to a report by the International Data Corporation, global spending on smart city initiatives is expected to reach $189.5 billion by 2023 with the significant investment in technologies that enhance public safety and security.

AI and Cloud Integration

The rapid advancement of technology in artificial intelligence (AI) and machine learning, is another significant driver of the North America video management software market. The integration of AI capabilities into VMS solutions enables advanced analytics, such as facial recognition, object detection, and behavior analysis, which enhance the effectiveness of surveillance systems. Furthermore, the demand for cloud-based VMS solutions is on the rise, as organizations seek scalable and flexible options for managing their video data. Cloud-based systems offer advantages such as remote access, reduced infrastructure costs, and simplified maintenance, making them attractive to businesses of all sizes. The North America video management software market is expected to experience significant growth as technology continues to evolve and the need for intelligent surveillance solutions grows.

MARKET RESTRAINTS

High Costs and Integration Challenges

One of the primary restraints affecting the North America video management software market is the high cost associated with implementing and maintaining advanced VMS solutions. While these systems offer significant benefits in terms of security and operational efficiency, the initial investment required for hardware, software, and installation can be substantial. According to a survey conducted by the National Association of Manufacturers, 60% of manufacturers cited high equipment costs as a significant barrier to adopting new technologies. This reluctance to invest in advanced video management solutions can hinder market growth, as organizations may opt for less sophisticated or outdated systems to manage their surveillance needs. Additionally, the complexity of integrating video management software with existing security infrastructure can pose challenges for end-users. Many organizations have legacy systems in place, and the process of upgrading to a new VMS can be time-consuming and resource-intensive. The learning curve associated with mastering new video management technologies can be steep for companies with limited experience in this area. The high costs and integration complexities associated with VMS may restrict widespread adoption by impacting the growth of the North America video management software market.

Another significant restraint is the regulatory environment surrounding data privacy and security. The must navigate complex regulations regarding data protection and privacy as video surveillance systems collect and store vast amounts of data, organizations. Compliance with laws such as the General Data Protection Regulation (GDPR) and various state-level privacy laws can impose additional costs and operational challenges for businesses. According to a report by the International Association of Privacy Professionals, 70% of organizations reported that compliance with data protection regulations is a significant challenge. The complex regulatory landscape can pose a significant challenge for video management software manufacturers due to their ability to bring new products to market efficiently.

MARKET OPPORTUNITIES

Data Privacy Regulations and Compliance Challenges

The increasing focus on smart city initiatives presents a significant opportunity for the North America video management software market. The demand for advanced surveillance solutions that can integrate with smart city technologies is expected to rise as urban areas strive to enhance public safety and improve infrastructure. Video management software plays a crucial role in this context by providing real-time monitoring and analytics capabilities that enhance situational awareness for law enforcement and city officials. According to a report by the International Data Corporation, global spending on smart city initiatives is projected to reach $189.5 billion by 2023 with the substantial investment in technologies that improve public safety and security. Moreover, the rise of cloud-based video management solutions offers additional opportunities for growth in the market. the cloud-based VMS solutions are becoming more attractive as organizations increasingly seek scalable and flexible options for managing their video data. These systems provide advantages such as remote access, reduced infrastructure costs, and simplified maintenance, making them suitable for businesses of all sizes.

AI-Driven Analytics Unlock New Growth Opportunities

The growing demand for advanced analytics and artificial intelligence (AI) capabilities in video management systems also presents substantial opportunities for market expansion. As organizations seek to leverage data for improved decision-making and operational efficiency, the integration of AI-driven analytics into VMS solutions is becoming increasingly critical. The North America video management software market is well-positioned to capitalize on these trends as industries increasingly adopt automation and smart technologies.

MARKET CHALLENGES

Rising Competition from Alternative Surveillance Technologies

One of the foremost challenges facing the North America video management software market is the increasing competition from alternative surveillance technologies. As the market evolves, new methods such as cloud-based storage solutions and advanced analytics platforms are gaining traction, offering unique advantages over traditional VMS solutions. These alternatives can provide enhanced flexibility, scalability, and data processing capabilities, which may attract customers away from conventional video management systems. This competitive landscape necessitates that VMS manufacturers continuously innovate and improve their products to maintain market share.

Complex Data Privacy Regulations

Another significant challenge is the regulatory environment surrounding data privacy and security. The organizations must navigate complex regulations regarding data protection and privacy. Compliance with laws such as the General Data Protection Regulation (GDPR) and various state-level privacy laws can impose additional costs and operational challenges for businesses. According to a report by the International Association of Privacy Professionals, 70% of organizations reported that compliance with data protection regulations is a significant challenge. The complex regulatory landscape can pose a significant challenge for video management software manufacturers by potentially impacting their ability to bring new products to market efficiently.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

18.84 % |

|

Segments Covered |

By Technology, Deployment, Application, Vertical and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

Axis Communications AB.,AxxonSoft.,Bosch Sicherheitssysteme GmbH,Dahua Technology Co. |

SEGMENTAL ANALYSIS

By Technology Insights

The IP-based technology segment was the largest and held 65.4% of the North America video management software market share in 2024. This dominance can be attributed to the widespread adoption of IP-based surveillance systems in various applications, including commercial, industrial, and residential settings. IP-based video management software offers enhanced flexibility, scalability, and remote access capabilities by making it a preferred choice for many users. The demand for IP-based VMS solutions is expected to grow as organizations increasingly prioritize efficiency and performance in their surveillance systems. The ability of IP-based video management software to provide high-definition video quality and advanced analytics is particularly appealing for applications requiring high precision and reliability. Additionally, the growing emphasis on energy efficiency and sustainability is driving the adoption of IP-based VMS solutions, as they enable better monitoring and control of security systems. The IP-based technology segment is likely to maintain its leading position owing by ongoing advancements in technology and the increasing demand for effective video management solutions.

The analog-based technology segment is projected to grow at a CAGR of 10.4% during the forecast period. This growth can be attributed to the increasing demand for cost-effective and straightforward video management solutions in various applications. Analog-based VMS solutions are gaining popularity in settings where high-definition video quality is not a primary concern by offering a more affordable option for users. Furthermore, the rise of hybrid systems that combine both IP and analog technologies is driving the adoption of analog-based VMS solutions. These hybrid systems allow organizations to leverage existing analog infrastructure while gradually transitioning to IP-based technologies by providing a flexible and cost-effective approach to video management. The demand for analog-based video management software is likely to grow by positioning this segment for significant expansion in the North America video management software market.

By Deployment Insights

The cloud-based deployment segment dominated the North America video management software market by holding 55.1% of the share in 2024. This dominance can be attributed to the growing preference for cloud solutions among organizations seeking scalable and flexible video management options. Cloud-based VMS offers numerous advantages, including remote access, reduced infrastructure costs, and simplified maintenance, making it an attractive choice for businesses of all sizes. The demand for cloud-based video management solutions is expected to grow as organizations increasingly prioritize efficiency and performance in their surveillance systems. The ability of cloud-based VMS to provide real-time data and analytics is particularly appealing for applications requiring quick response times and straightforward implementation. Additionally, the growing emphasis on energy efficiency and sustainability is driving the adoption of cloud-based video management solutions, as they often require less energy and generate less waste compared to traditional on-premise systems.

The on-premise segment is anticipated to witness a CAGR of 9.3% during the forecast period. This growth can be attributed to the increasing demand for secure and controlled video management solutions in various applications. On-premise VMS allows organizations to maintain complete control over their video data and infrastructure, which is particularly appealing for industries with stringent security and compliance requirements. Furthermore, the rise of hybrid systems that combine both cloud and on-premise technologies is driving the adoption of on-premise VMS solutions. These hybrid systems allow organizations to leverage the benefits of both deployment models by providing a flexible and secure approach to video management. As industries increasingly adopt automation and smart technologies, the demand for on-premise video management software is likely to grow by positioning this segment for significant expansion in the North America video management software market.

By Application Insights

The video analytics application segment was the largest and accounted for 30.4% of the North America video management software market share in 2024. This dominance can be attributed to the increasing demand for advanced analytics capabilities in surveillance systems, which enhance security and operational efficiency. Video analytics solutions enable organizations to extract valuable insights from video footage, such as detecting unusual behavior, monitoring crowd dynamics, and identifying potential security threats. The ability of video analytics to provide actionable insights in real-time is particularly appealing for applications requiring high precision and reliability. Additionally, the growing emphasis on energy efficiency and sustainability is driving the adoption of video analytics solutions, as they enable better monitoring and control of security systems. The video analytics application segment is likely to maintain its leading position with the ongoing advancements in technology and the increasing demand for intelligent video management solutions.

The remote monitoring segment is projected to grow at a CAGR of 11.5% in the next coming years. This growth can be attributed to the increasing need for real-time surveillance and monitoring solutions across various sectors, including retail, transportation, and critical infrastructure. Remote monitoring allows organizations to oversee their operations from anywhere, providing enhanced security and operational oversight. Furthermore, the rise of smart technologies and IoT applications is driving the adoption of remote monitoring solutions. These systems can provide real-time alerts and notifications, enabling organizations to respond quickly to potential security threats or operational issues. The demand for remote monitoring applications in video management software is likely to grow with this segment for significant expansion in the North America video management software market.

By Vertical Insights

The retail and e-commerce vertical segment was the largest by capturing 35.1% of the North America video management software market share in 2024. This dominance can be attributed to the critical role that video surveillance plays in enhancing security and loss prevention in retail environments. Retailers utilize video management software to monitor customer behavior, deter theft, and ensure the safety of both customers and employees. According to the National Association for Shoplifting Prevention, retail theft costs U.S. retailers approximately $46.8 billion annually. The ability of video management software to provide real-time monitoring and analytics is particularly appealing for retail applications, as it enables businesses to respond quickly to incidents and optimize store operations. Additionally, the growing emphasis on customer experience and operational efficiency is driving the adoption of video management solutions in the retail sector, as retailers seek to leverage video data for insights into customer behavior and preferences.

The healthcare vertical segment is projected to grow at a CAGR of 10.4% in the next coming years. This growth can be attributed to the increasing need for enhanced security and monitoring solutions in healthcare facilities, where patient safety and data protection are paramount. Video management software is used in hospitals and clinics to monitor patient areas by ensuring compliance with safety regulations, and protect sensitive information. According to the American Hospital Association, there are over 6,000 hospitals in the United States with the significant market potential for video management solutions in this sector. Furthermore, the rise of telehealth and remote patient monitoring is driving the adoption of video management software in healthcare. These technologies enable healthcare providers to monitor patients remotely by ensuring timely interventions and improving patient outcomes.

Country Level Analysis

United States positioned top in holding the largest share of 75.6% in 2024 in the North America video management software market. The U.S. market is characterized by a robust demand for video management solutions across various sectors, including retail, transportation, government, and healthcare. According to the U.S. Department of Justice, the increasing focus on public safety and crime prevention is driving investments in video surveillance technologies that further bolsters the market growth. The rapid adoption of smart technologies and the push for enhanced security measures are also contributing to the growth of the video management software market in the U.S., as organizations seek effective solutions to monitor and protect their assets. Moreover, the presence of key players and a well-established technology ecosystem in the United States enhances the market's competitive landscape. Major companies such as Genetec, Milestone Systems, and Avigilon are actively involved in developing innovative video management solutions is driving technological advancements in the marketplace.

Canada is swiftly emerging with a fastest CAGR of 13.2% during the forecast period. The Canadian market is driven by a growing interest in security and surveillance solutions, as the government emphasizes the importance of public safety and crime prevention. According to Statistics Canada, the crime rate in Canada has seen fluctuations by prompting increased investments in security technologies. The increasing adoption of smart technologies and the expansion of urban areas are also contributing to the demand for video management solutions in Canada.

Top 3 Players in the market

Genetec is one of the foremost manufacturers, renowned for its high-quality video management solutions that cater to various applications, including security, transportation, and public safety. The company's commitment to innovation and extensive product portfolio has positioned it as a market leader, with a strong focus on developing advanced technologies that enhance performance and reliability.

Another major player is Milestone Systems, a well-known name in the video management software market. Milestone offers a diverse range of VMS solutions that are widely used in various applications, including retail, transportation, and critical infrastructure. The company's emphasis on research and development has led to the introduction of cutting-edge technologies that meet the evolving needs of customers, further boosts its position in the North America video management software market.

Avigilon, a subsidiary of Motorola Solutions, is also a prominent player in the video management software market, recognized for its innovative surveillance solutions and commitment to security. Avigilon's video management software is widely used in various industries, including healthcare, education, and government, making it integral to the transition towards safer and more efficient environments. The company's focus on developing high-performance, intelligent video solutions has resonated with security-conscious consumers by enhancing its reputation as a trusted manufacturer in the North America video management software market.

Top strategies used by the key market participants

Key players in the North America video management software market employ a variety of strategies to strengthen their market position and enhance competitiveness. One prominent strategy is the focus on innovation and technological advancement. Companies like Genetec and Milestone Systems invest heavily in research and development to create cutting-edge video management technologies that improve performance, scalability, and user experience. These manufacturers can meet evolving consumer demands and comply with stringent regulatory standards, thereby maintaining their competitive edge in the market.

Another significant strategy is the expansion of product portfolios to cater to diverse consumer needs. Manufacturers are increasingly offering a wide range of video management solutions, including cloud-based, on-premise, and hybrid systems, to appeal to various applications. For instance, Avigilon has introduced a range of intelligent video analytics solutions specifically designed for security applications, addressing the growing demand for advanced monitoring capabilities. Key players can address varying consumer preferences and capitalize on emerging market opportunities by diversifying their product offerings.

Strategic partnerships and collaborations also play a crucial role in enhancing market presence. Companies often collaborate with technology providers and system integrators to expand their reach and improve distribution channels. For example, partnerships with security service providers enable video management software producers to integrate their technologies into a wider array of applications, thereby increasing sales and market penetration. By leveraging strategic alliances, key players can enhance their competitive positioning and drive growth in the North America video management software market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the North America video management software market are Axis Communications AB.,AxxonSoft.,Bosch Sicherheitssysteme GmbH,Dahua Technology Co., Ltd,Genetec Inc.,Hangzhou Hikvision Digital Technology Co., Ltd.,Honeywell International Inc.,Johnson Controls Inc.,Milestone Systems A/S.,Verint Systems Inc.

The competition in the North America video management software market is characterized by a mix of established players and emerging manufacturers, all vying for market share in a rapidly evolving landscape. Major companies such as Genetec, Milestone Systems, and Avigilon dominate the market, leveraging their strong brand recognition, extensive distribution networks, and commitment to innovation. These industry leaders continuously invest in research and development to enhance video management performance, scalability, and compliance with stringent security regulations, thereby maintaining their competitive advantage.

Emerging players are also entering the market, often focusing on niche segments or innovative technologies, such as cloud-based solutions and AI-driven analytics. This influx of new entrants intensifies competition, as they seek to capture market share by offering unique value propositions and addressing the growing demand for intelligent video management solutions. Additionally, the increasing consumer preference for integrated security systems is prompting established manufacturers to adapt their offerings and invest in cleaner technologies, further heightening competition. Price competition is another significant factor influencing the market dynamics. However, companies that prioritize quality, performance, and customer service are likely to differentiate themselves and build brand loyalty, allowing them to navigate the competitive landscape effectively.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, Genetec launched a new line of advanced video management solutions designed for smart city applications, reinforcing its commitment to innovation and market leadership.

- In January 2023, Milestone Systems introduced a new series of cloud-based video management software aimed at small and medium-sized enterprises, catering to the growing demand for flexible solutions.

- In February 2023, Avigilon expanded its product portfolio by launching a new range of AI-driven video analytics solutions specifically designed for retail applications, addressing the increasing demand for advanced monitoring capabilities.

- In April 2023, Honeywell partnered with a leading technology provider to integrate its video management solutions into a new line of smart home devices, enhancing its market presence.

- In May 2023, Axis Communications acquired a small video analytics technology firm to strengthen its capabilities in the market and expand its product offerings.

- In June 2023, Panasonic announced a strategic collaboration with a major security service provider to develop integrated video management solutions for critical infrastructure applications.

- In July 2023, Hikvision launched a new series of intelligent video management software designed for transportation applications, reflecting its commitment to innovation and addressing the growing demand for advanced solutions.

- In August 2023, D-Link introduced a new line of affordable video management solutions aimed at residential users, targeting the increasing demand for cost-effective security options.

- In September 2023, Bosch Security Systems expanded its distribution network by partnering with major retailers to increase the availability of its video management software across North America.

- In October 2023, Dahua Technology unveiled a new series of cloud-based video management solutions designed for the healthcare sector, aiming to capture a larger share of the market.

MARKET SEGMENTATION

This research report on the North America Video Management Software Market has been segmented and sub-segmented into the following categories.

By Technology

- IP-based technology segment

- analog-based technology segment

By Deployment

- cloud-based deployment segment

- on-premise segment

By Application

- video analytics application segment

- remote monitoring segment

By Vertical

- retail and e-commerce vertical segment

- healthcare vertical segment

By Country

- The U.S.

- Canada

- Rest of North America.

Frequently Asked Questions

What are the key drivers for the growth of the North America VMS market?

The growth of the North America VMS market is driven by factors such as increasing demand for security and surveillance systems.

What are the challenges faced by the North America VMS market?

Key challenges include high implementation costs, data privacy concerns, integration issues with existing systems, and the complexity of managing large volumes of video data.

What is the expected growth rate of the North America VMS market?

The North America VMS market is expected to grow at a significant rate over the next few years due to increased security concerns

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]