North America Veterinary Imaging Market Research Report – Segmented By Product (X-ray Imaging, MRI Imaging) Solutions,Animal Type,Application,End-Use and Country (The U.S., Canada and Rest of North America) - Industry Analysis, Size, Share, Growth, Trends, & Forecasts 2025 to 2033.

North America Veterinary Imaging Market Size

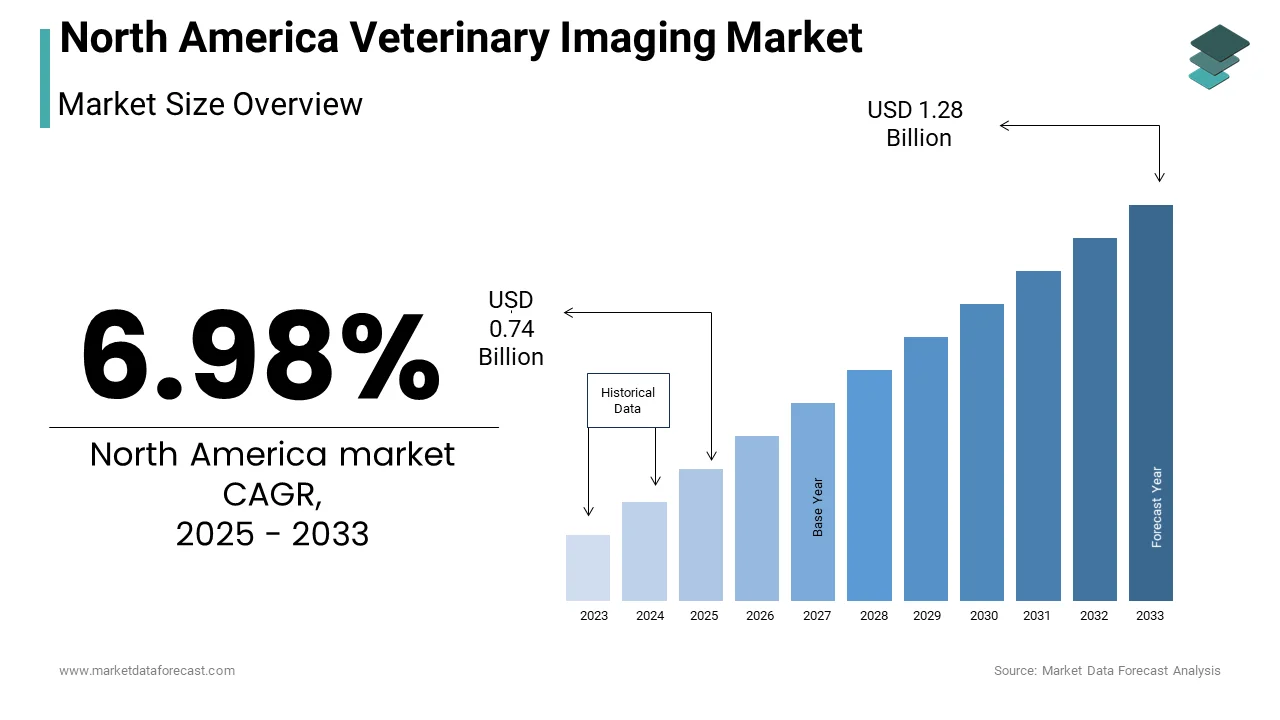

The North America Veterinary Imaging Market Size was valued at USD 0.70 billion in 2024. The North America Veterinary Imaging Market size is expected to have 6.98 % CAGR from 2025 to 2033 and be worth USD 1.28 billion by 2033 from USD 0.74 billion in 2025.

The North America veterinary imaging market has established a robust presence in the region, driven by advancements in diagnostic technologies and an increasing awareness of animal health. Canada follows closely, bolstered by its growing pet insurance penetration rate, which stood at approximately 3% in 2022, according to the North American Pet Health Insurance Association. The market is fueled by a surge in pet ownership, with over 67% of U.S. households owning pets as of 2021, as stated by the American Pet Products Association. This demographic shift has heightened demand for advanced veterinary diagnostics.

Furthermore, the prevalence of chronic diseases among companion animals, such as arthritis and cancer, has necessitated precise imaging solutions. According to the Morris Animal Foundation, cancer affects approximately 50% of dogs over the age of ten, underscoring the need for early detection tools. Regulatory support, including FDA approvals for innovative imaging equipment, has also bolstered market growth. Despite these positive indicators, the market faces challenges such as high equipment costs and limited accessibility in rural areas, which temper its expansion potential.

MARKET DRIVERS

Rising Prevalence of Chronic Diseases in Companion Animals

The escalating incidence of chronic conditions like osteoarthritis, cardiovascular diseases, and cancer among companion animals has become a pivotal driver for the veterinary imaging market. As per the American Veterinary Medical Association, approximately 25% of dogs are diagnosed with osteoarthritis during their lifetime, while feline hyperthyroidism affects 10% of cats aged above ten years. These conditions necessitate advanced imaging modalities such as X-rays, MRIs, and CT scans for accurate diagnosis and treatment planning. Moreover, the rising trend of treating pets as family members has amplified the willingness of pet owners to invest in premium healthcare services. According to a report by the American Pet Products Association, pet owners spent over $34 billion on veterinary care in 2022 alone. This financial commitment showcases the growing reliance on veterinary imaging technologies. The integration of artificial intelligence (AI) into imaging systems has further enhanced diagnostic accuracy, making these tools indispensable for modern veterinary practices.

Technological Advancements and Innovations

Technological breakthroughs in veterinary imaging have significantly propelled market growth. Equipment manufacturers are increasingly incorporating AI-driven algorithms and cloud-based Picture Archiving and Communication Systems (PACS) into their offerings enabling faster and more precise diagnoses. For instance, Canon Medical Systems recently introduced AI-enhanced ultrasound devices that improve image clarity and reduce scanning time. On top of that, the advent of portable imaging devices has expanded access to remote and rural areas, addressing a critical gap in veterinary care. Furthermore, collaborations between academic institutions and industry players have accelerated the development of cutting-edge imaging technologies. For example, partnerships with universities have led to innovations in low-dose radiation imaging reducing health risks for both animals and veterinarians.

MARKET RESTRAINTS

High Initial Costs of Imaging Equipment

One of the primary barriers to the widespread adoption of veterinary imaging technologies is the substantial initial investment required for purchasing and installing advanced equipment. Such expenses are prohibitive for small and medium-sized veterinary clinics, particularly those operating in rural or underserved regions. Even ultrasound systems, which are relatively more affordable. This financial burden is exacerbated by the need for regular maintenance and software updates, which further strain operational budgets. Consequently, many clinics opt for outdated equipment or rely on external diagnostic centers, limiting the accessibility of advanced imaging services for pet owners. This cost barrier not only hinders market penetration but also widens the gap in veterinary care quality across different regions.

Limited Skilled Workforce and Training Gaps

Another significant challenge hindering the growth of the veterinary imaging market is the shortage of skilled professionals capable of operating advanced imaging equipment. Veterinary radiologists, who are essential for interpreting complex imaging results, remain in short supply. According to the American College of Veterinary Radiology, there are fewer than 500 board-certified veterinary radiologists in the United States creating a bottleneck in service delivery. Moreover, the rapid pace of technological advancements has outpaced the availability of comprehensive training programs for veterinary technicians and assistants. A survey conducted by the Veterinary Hospital Managers Association revealed that over 60% of veterinary practices struggle to find adequately trained staff for operating imaging devices. This skill gap not only delays diagnosis and treatment but also increases operational inefficiencies, ultimately impacting the overall effectiveness of veterinary imaging services.

MARKET OPPORTUNITIES

Growing Adoption of Telemedicine and Remote Diagnostics

The integration of telemedicine into veterinary care presents a transformative opportunity for the imaging market. With the rise of digital platforms, veterinarians can now remotely consult specialists and share imaging results for expert analysis. Based on a report by the American Veterinary Medical Association, telehealth consultations increased by 60% during the COVID-19 pandemic exhibiting the growing acceptance of virtual care. This trend has spurred demand for cloud-based PACS and teleradiology services enabling seamless sharing of high-resolution images across geographies. Companies like Vetology and Antech Diagnostics have capitalized on this shift by offering AI-powered diagnostic tools that enhance the accuracy of remote interpretations. In addition, the increasing penetration of broadband internet in rural areas has expanded the reach of telemedicine, bridging gaps in veterinary care accessibility. By leveraging these technologies, the market can address unmet needs in underserved regions while fostering innovation.

Expansion into Emerging Markets and Veterinary Education

The veterinary imaging market stands to benefit significantly from expanding its footprint into emerging markets within North America, particularly Mexico. This growth trajectory creates a fertile ground for introducing advanced imaging solutions tailored to local needs. Simultaneously, enhancing veterinary education programs to include specialized training in imaging technologies can drive long-term market sustainability. Institutions like the Universidad Nacional Autónoma de México have begun incorporating hands-on imaging modules into their curricula, preparing future veterinarians for technological advancements. So, sy investing in educational initiatives and market expansion, stakeholders can unlock new revenue streams while elevating the standard of veterinary care across the region.

MARKET CHALLENGES

Regulatory Hurdles and Compliance Issues

Navigating the complex regulatory landscape poses a significant challenge for the veterinary imaging market. Devices must comply with stringent standards set by agencies such as the FDA and Health Canada, which often involve lengthy approval processes. For instance, obtaining FDA clearance for a new imaging system can take up to two years, as per insights from the Regulatory Affairs Professionals Society. These delays not only increase time-to-market but also escalate development costs, discouraging smaller firms from innovating. Additionally, varying regulations across states and provinces create inconsistencies in compliance requirements, complicating distribution strategies. Non-compliance can result in hefty fines or product recalls, further straining manufacturers’ resources.

Competition from Human Medical Imaging Technologies

The veterinary imaging market faces stiff competition from human medical imaging technologies, which are often repurposed for animal use. While this cross-utilization offers cost advantages, it undermines the development of specialized veterinary solutions. According to a study by the Journal of Veterinary Internal Medicine, nearly 40% of imaging devices used in veterinary clinics are originally designed for human applications. This reliance limits the ability to address unique anatomical and physiological differences in animals, potentially compromising diagnostic accuracy. Moreover, the dominance of human imaging giants like GE Healthcare and Siemens Healthineers in the market stifles innovation tailored specifically for veterinary needs. Smaller players struggle to compete with these industry leaders, leading to a lack of diversity in product offerings. Addressing this challenge requires targeted R&D investments to develop species-specific imaging technologies that cater to the distinct requirements of veterinary medicine.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.98 % |

|

Segments Covered |

By Product,Solutions, Animal Type,Application,End-Use and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

IDEXX Laboratories, Inc.,ESAOTE SPA,Mars, Inc.,GE HealthCare,Midmark Corporation |

SEGMENTAL ANALYSIS

By Product Insights

The X-ray imaging segment held the largest share of the North America veterinary imaging market i.e. 45.3% of the total revenue in 2024. This dominance is attributed to its affordability, ease of use, and widespread adoption across veterinary clinics. X-ray systems are particularly favored for diagnosing orthopedic conditions, fractures, and respiratory issues, which are common ailments among companion animals. As per the American Animal Hospital Association, X-rays are utilized in over 70% of all diagnostic imaging procedures in veterinary practices. The influence is further reinforced by ongoing advancements, such as digital radiography, which reduces radiation exposure and improves image quality. Also, the availability of portable X-ray devices has expanded accessibility, particularly in rural areas where large-scale imaging equipment is impractical. So, these factors collectively ensure the sustained prominence of X-ray imaging in the market.

MRI imaging is the fastest-growing segment in the North America veterinary imaging market, with a projected CAGR of 9.2% from 2025 to 2033. This growth is driven by the increasing prevalence of neurological disorders and soft tissue injuries among animals, which require high-resolution imaging for accurate diagnosis. MRI systems provide unparalleled clarity in visualizing brain and spinal cord abnormalities, making them indispensable for neurology and oncology applications. The development of low-field MRI machines, which are more affordable and compact, has further accelerated adoption. Moreover, partnerships between veterinary hospitals and academic research institutions have facilitated the integration of advanced MRI technologies into clinical practice. For instance, the University of California, Davis, operates a state-of-the-art veterinary MRI facility, setting a benchmark for others to follow. These trends underscore the segment's rapid expansion.

By Solutions Insights

The equipment segment dominated the North America veterinary imaging market by capturing 61.3% of the total share in 2024. This is due to the critical role imaging equipment plays in diagnostic procedures, ranging from routine check-ups to complex surgeries. Ultrasound machines, X-ray systems, and CT scanners are widely adopted due to their versatility and ability to address diverse clinical needs. According to the American Veterinary Medical Association, over 85% of veterinary practices invest in at least one type of imaging equipment to enhance diagnostic capabilities. The segment's rise is further fueled by technological innovations, such as AI-integrated systems that streamline workflows and improve accuracy. Additionally, government incentives for adopting advanced medical technologies have encouraged clinics to upgrade their infrastructure, sustaining the segment's stronghold.

The accessories and consumables segment represent the swiftest expanding category, with a CAGR of 8.7% during the forecast period. This progress is caused by the recurring demand for consumables like contrast agents, probes, and protective gear, which are essential for maintaining imaging equipment and ensuring patient safety. For instance, iodine-based contrast agents are indispensable for enhancing visibility during CT scans, with usage increasing by 12% annually, according to the Radiological Society of North America. As well as, the proliferation of portable imaging devices has boosted demand for compatible accessories, such as specialized probes and calibration kits. Manufacturers are capitalizing on this trend by offering bundled packages that combine equipment with consumables, creating a steady revenue stream. These dynamics position accessories/consumables as a high-growth segment within the market.

By Animal Type Insights

The small animals, including dogs, cats, and rabbits, constituted the biggest section of the North America veterinary imaging market by holding a substantial portion in 2024. This influence is credited to the high population of companion animals, with over 100 million households owning pets in the United States alone, as reported by the American Pet Products Association. Small animals are prone to conditions like dental issues, arthritis, and cancer, which necessitate frequent imaging for diagnosis and treatment. The affordability and accessibility of imaging services for small animals further amplify demand. For example, ultrasound examinations for dogs are priced 30% lower than those for large animals, making them more accessible to pet owners. To add to this, the growing trend of pet insurance has alleviated financial barriers is encouraging more pet owners to seek advanced imaging services.

Large animals such as horses and livestock symbolise as the quickly rising segment, with a CAGR of 7.5% from 2025 to 2033. This is driven by the increasing focus on livestock health and productivity, particularly in the dairy and equine industries. According to the U.S. Department of Agriculture, the dairy sector contributes over $40 billion annually to the economy, underscoring the importance of maintaining animal health. Also, advanced imaging technologies, such as portable X-rays and ultrasound systems, are being adopted to diagnose musculoskeletal injuries and reproductive disorders in large animals. Besides, government initiatives promoting sustainable farming practices have encouraged investments in veterinary care. For instance, the USDA’s Animal Health Program allocates funds for diagnostic tools, boosting the adoption of imaging technologies in rural farming communities

By Application Insights

The orthopedics and traumatology segment accounted for the largest share of the North America veterinary imaging market by representing 35.9% of the total revenue in 2024. This is attributed to the high incidence of fractures, ligament injuries, and joint disorders among companion animals. As per the Orthopedic Foundation for Animals, hip dysplasia affects 20% of large dog breeds necessitating frequent imaging for diagnosis and surgical planning. X-rays and CT scans are widely used in this segment due to their ability to provide detailed skeletal images. The growing emphasis on minimally invasive surgeries has further increased reliance on imaging technologies, as they enable precise pre-operative assessments. Additionally, the rising popularity of sports activities involving dogs, such as agility competitions, has heightened the demand for orthopedic imaging services, reinforcing the segment's dominance.

Oncology segment is accelerating in the market, with a CAGR of 8.9% in the coming years. This progress is propelled by the rising prevalence of cancer among companion animals, with over 6 million dogs diagnosed annually, according to the Morris Animal Foundation. Advanced imaging modalities like MRI and PET scans play a crucial role in detecting tumors and monitoring treatment efficacy. The development of species-specific imaging protocols has enhanced diagnostic accuracy making these technologies indispensable for oncology applications. In support of this, the growing awareness of pet cancer treatments coupled with the availability of pet insurance, has increased the willingness of pet owners to invest in imaging services. Collaborations between veterinary oncologists and imaging technology providers have further accelerated the segment's expansion positioning oncology as a high-potential growth area.

By End-Use Insights

The veterinary hospitals and clinics segment command the North America veterinary imaging market by having a substantial portion of the total revenue in 2024. It is caused by the increasing number of specialized veterinary facilities equipped with advanced imaging technologies. According to the American Veterinary Medical Association (AVMA), there are over 30,000 veterinary clinics in the United States alone, with a significant portion investing in high-end imaging systems like MRI and CT scanners. The growing trend of treating pets as family members has amplified the demand for premium diagnostic services, further cementing the dominance of this segment. As well as, collaborations between veterinary hospitals and academic institutions have facilitated the adoption of cutting-edge imaging technologies. For instance, the University of Pennsylvania’s School of Veterinary Medicine integrates advanced imaging tools into its clinical practice, setting a benchmark for others. The availability of pet insurance has also played a pivotal role, with over 3.45 million pets insured in North America as of 2022, according to the North American Pet Health Insurance Association (NAPHIA). Consequently, these factors collectively ensure the sustained prominence of veterinary hospitals and clinics in the market.

The "Other End-Use" segment, which includes research institutions, universities, and diagnostic laboratories, is the end-use category moving ahead quickly, with a CAGR of 8.6% from 2023 to 2030, as per Allied Market Research. This acceleration is associated with the rising focus on veterinary research and the development of innovative imaging technologies tailored for animal diagnostics. Academic institutions are increasingly adopting imaging systems for educational purposes enabling students to gain hands-on experience with advanced tools. For example, Cornell University’s College of Veterinary Medicine utilizes MRI and ultrasound systems to train future veterinarians. Furthermore, diagnostic laboratories are leveraging AI-driven imaging solutions to enhance accuracy and efficiency, addressing the growing demand for precise diagnostics. The proliferation of public-private partnerships has also accelerated this segment's expansion. For instance, the USDA collaborates with diagnostic labs to develop imaging protocols for livestock health monitoring. So, these trends showcases the segment's rapid growth trajectory and its potential to reshape the veterinary imaging landscape.

COUNTRY LEVEL ANALYSIS

The United States holds a commanding position in the North America veterinary imaging market, contributing 79.2% of the regional revenue in 2024. This dominance of the category is linked to the country’s robust healthcare infrastructure, high pet ownership rates, and significant investments in veterinary research. According to the American Pet Products Association (APPA), over 86 million households in the U.S. own pets, driving demand for advanced imaging services. Moreover, the widespread availability of pet insurance with premiums exceeding $2 billion annually has further bolstered market growth. Technological advancements, such as AI-integrated imaging systems, are widely adopted in U.S. veterinary practices enhancing diagnostic capabilities. For instance, companies like IDEXX Laboratories have pioneered cloud-based imaging platforms enabling seamless data sharing across clinics. Government initiatives, including funding for veterinary research, have also supported innovation. The FDA’s streamlined approval process for imaging devices has encouraged manufacturers to introduce cutting-edge solutions, solidifying the U.S.’s place in the market.

Canada represents a rapidly growing segment within the North America veterinary imaging market, with a projected CAGR of 7.8% from 2024 to 2030. It is driven by increasing awareness of animal health and rising pet insurance penetration. As per the Canadian Animal Health Institute, pet insurance coverage in Canada grew by 15% annually between 2020 and 2022 reaching over 3% of households. This trend has amplified the demand for advanced imaging technologies, particularly in urban centers like Toronto and Vancouver. Similarly, the Canadian government’s focus on sustainable farming practices has also spurred investments in livestock imaging systems, supporting rural veterinary care. For example, the University of Guelph’s Ontario Veterinary College integrates state-of-the-art imaging tools into its curriculum, fostering innovation. Also, collaborations between Canadian firms and global players have facilitated the adoption of portable imaging devices, addressing accessibility challenges in remote areas. Therefore, these factors underscore Canada’s pivotal role in shaping the regional market dynamics.

Mexico is emerging as a promising market for veterinary imaging, propelled by economic growth and rising disposable incomes among the middle class. The increasing prevalence of chronic diseases among companion animals has heightened demand for diagnostic tools like X-rays and ultrasound systems. Mexican veterinary clinics are gradually adopting digital radiography, supported by government initiatives promoting modern healthcare infrastructure. For instance, the Universidad Nacional Autónoma de México (UNAM) has established advanced imaging facilities to cater to both small and large animals. Partnerships with international manufacturers have also played a key role, introducing affordable imaging technologies tailored to local needs. These developments position Mexico as a key contributor to the North America veterinary imaging market.

The Rest of North America including regions like Puerto Rico and the Caribbean represents a niche but growing segment in the veterinary imaging market. Economic development and increased awareness of animal welfare have driven demand for imaging services in these areas. For example, Puerto Rico’s veterinary sector has seen a surge in investments post-Hurricane Maria, with organizations like Humane Society International funding advanced diagnostic tools. The Caribbean region benefits from collaborations with U.S.-based veterinary institutions enabling access to cutting-edge technologies. Portable imaging devices are gaining traction due to their suitability for remote and underserved areas. These trends exhibit the untapped potential of this segment, contributing to the broader regional market dynamics.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the North America Veterinary Imaging Market are IDEXX Laboratories, Inc.,ESAOTE SPA,Mars, Inc.,GE HealthCare,Midmark Corporation,FUJIFILM Holdings America Corporation,Hallmarq Veterinary Imaging,Canon Medical Systems Corporation,Shenzhen Mindray Animal Medical Technology Co., Ltd.,IMV Imaging

The North America vascular stents market is characterized by intense competition, with key players vying for market share through innovation and strategic initiatives. Companies focus on developing next-generation stents, such as bioresorbable and drug-eluting variants, to address unmet clinical needs. The market is dominated by global giants like Abbott Laboratories and Boston Scientific, which leverage their extensive R&D capabilities to maintain leadership. Regional players also compete by offering cost-effective solutions tailored to local demands. The competitive landscape is further shaped by regulatory approvals, technological advancements, and collaborations with healthcare providers, ensuring dynamic market evolution.

Top Players in the Market

IDEXX Laboratories

IDEXX Laboratories is a prominent player in the veterinary imaging market, renowned for its innovative diagnostic solutions. The company offers a comprehensive suite of imaging products, including digital radiography and ultrasound systems, designed specifically for veterinary applications. Its strength lies in its commitment to integrating AI and cloud-based technologies into its offerings, enabling veterinarians to streamline workflows and improve diagnostic accuracy. IDEXX’s partnerships with veterinary clinics and academic institutions have further solidified its market position, making it a trusted name in the industry.

Canon Medical Systems Corporation

Canon Medical Systems Corporation is a leader in advanced imaging technologies, with a strong presence in the veterinary sector. The company leverages its expertise in human medical imaging to develop species-specific solutions for veterinary applications. Its product portfolio includes MRI, CT, and ultrasound systems, known for their precision and reliability. Canon’s focus on R&D and collaboration with veterinary professionals has enabled it to address unmet needs in animal diagnostics, reinforcing its leadership in the market.

Siemens Healthineers

Siemens Healthineers is a global pioneer in medical imaging, extending its expertise to the veterinary domain. The company offers cutting-edge imaging systems, such as low-dose radiation CT scanners and AI-enhanced MRI devices, tailored for animal health. Its strengths include a robust distribution network and a reputation for delivering high-quality, durable equipment. Siemens’ commitment to sustainability and innovation has positioned it as a key contributor to the veterinary imaging market.

Top strategies used by the key market participants

Key players in the North America veterinary imaging market employ strategies like product innovation, strategic partnerships, and geographic expansion to strengthen their positions. Companies invest heavily in R&D to develop AI-driven imaging systems that enhance diagnostic accuracy. Collaborations with veterinary institutions and academic bodies facilitate knowledge exchange and technology adoption. Geographic expansion into emerging markets, such as Mexico, enables players to tap into new revenue streams. Additionally, mergers and acquisitions allow firms to consolidate their market presence and diversify their product portfolios. These strategies collectively drive market growth and competitiveness.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, IDEXX Laboratories launched VetConnect PLUS, an AI-driven imaging platform, enhancing diagnostic capabilities for veterinarians.

- In June 2024, Canon Medical Systems partnered with the University of California, Davis, to develop species-specific MRI protocols for veterinary use.

- In August 2024, Siemens Healthineers introduced a low-dose CT scanner tailored for small animal imaging, improving safety and accuracy.

- In October 2024, Heska Corporation acquired a portable ultrasound manufacturer, expanding its product portfolio for rural veterinary clinics.

- In December 2024, GE Healthcare collaborated with Antech Diagnostics to integrate cloud-based PACS into veterinary imaging workflows.

MARKET SEGMENTATION

This research report on the north america veterinary imaging market has been segmented and sub-segmented into the following.

By Product

- X-ray Imaging

- MRI Imaging

By Solutions

- Equipment

- Accessories/Consumables

By Animal Type

- Small Animals

- Large Animals

By Application

- Orthopedics and Traumatology

- Oncology

By End-Use

- Veterinary Hospitals & Clinics

- Other End-Use

By Country

- The U.S.

- Canada

- Rest of North America.

Frequently Asked Questions

What is the North America Veterinary Imaging Market?

The North America Veterinary Imaging Market refers to the segment of the veterinary healthcare industry that deals with imaging technologies used for diagnosing diseases and injuries in animals.

Which countries lead the veterinary imaging market in North America?

The United States holds the largest share, followed by Canada. The U.S. market is highly developed due to advanced veterinary infrastructure, high pet adoption rates, and strong R&D in veterinary tech.

What trends are shaping the future of veterinary imaging in North America?

Integration of artificial intelligence ,Increased use of teleradiology ,Growing demand for point-of-care imaging solutions

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]