North America Vacuum Coating Equipment Market Size, Share, Trends & Growth Forecast Report By Equipment Type (Physical Vapor Deposition (PVD), Chemical Vapor Deposition (CVD), Magnetron Sputtering, Electron Beam Evaporation), End-Use Industry, and Country (The United States, Canada and Rest of North America), Industry Analysis From 2024 to 2033

North America Vacuum Coating Equipment Market Size

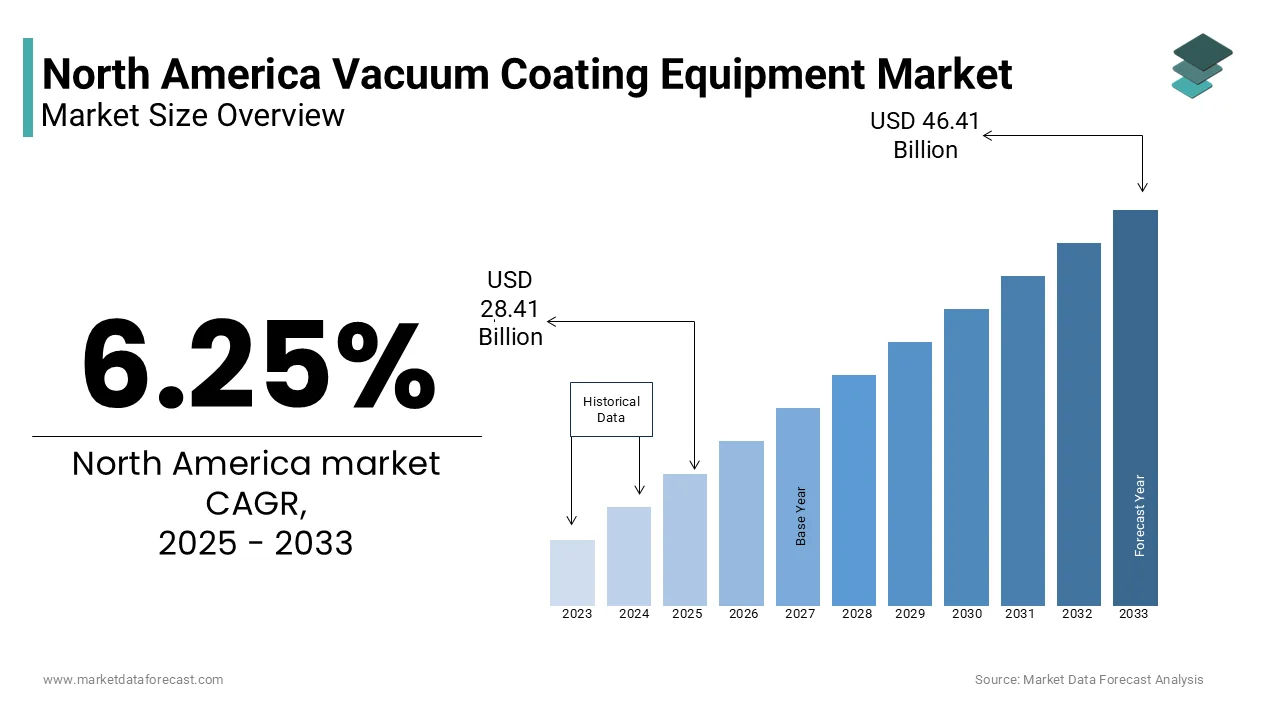

The Vacuum Coating Equipment market size in North America was valued at USD 26.74 billion in 2024 and is predicted to be worth USD 46.14 billion by 2033 from USD 28.41 billion in 2025 and grow at a CAGR of 6.25% from 2025 to 2033.

The vacuum coating equipment is a range of technologies and processes used to deposit thin films onto various substrates in a vacuum environment. This market is integral to numerous industries, including electronics, automotive, aerospace, and medical devices, where the application of coatings enhances product performance, durability, and aesthetics. Vacuum coating techniques, such as physical vapor deposition (PVD) and chemical vapor deposition (CVD), are employed to create coatings that improve surface properties, such as corrosion resistance, electrical conductivity, and optical characteristics. The growth of this market is driven by the increasing demand for advanced materials and coatings in high-tech applications. The need for innovative coating solutions has become paramount as industries strive for greater efficiency and performance. Additionally, the rise of sustainable manufacturing practices is prompting companies to adopt vacuum coating technologies that minimize waste and energy consumption.

MARKET DRIVERS

The increasing demand for advanced materials in the electronics and semiconductor industries is a primary driver of the North America vacuum coating equipment market. There is a growing need for high-performance coatings that enhance the functionality and reliability of electronic components. Vacuum coating techniques, such as PVD and CVD, are essential for producing thin films that improve electrical conductivity, thermal management, and surface protection. According to the Semiconductor Industry Association, global semiconductor sales reached $440 billion in 2021, reflecting a robust growth trajectory that escalates the importance of advanced materials in this sector. Moreover, the proliferation of consumer electronics, including smartphones, tablets, and wearables, is further driving the demand for vacuum coating equipment. The application of advanced coatings has become increasingly critical as manufacturers seek to differentiate their products through enhanced aesthetics and performance. The need for efficient and reliable vacuum coating solutions is expected to grow as the electronics industry continues to expand by positioning the North America vacuum coating equipment market for sustained growth in the coming years.

The rise of renewable energy technologies is another significant driver of the North America vacuum coating equipment market. The demand for high-quality coatings in solar panels and wind turbines is increasing as the world shifts towards sustainable energy sources. Vacuum coating processes are essential for producing thin films that enhance the efficiency and durability of photovoltaic cells and turbine components. According to the U.S. Energy Information Administration, solar energy capacity in the United States is projected to reach 200 gigawatts by 2025 owing to the growing importance of advanced materials in the renewable energy sector. Furthermore, the increasing focus on energy efficiency and sustainability is prompting manufacturers to adopt vacuum coating technologies that minimize waste and energy consumption. The demand for vacuum coating equipment that supports these initiatives is expected to rise as industries prioritize environmentally friendly practices.

MARKET RESTRAINTS

One of the primary restraints affecting the North America vacuum coating equipment market is the high initial investment required for advanced coating technologies. The cost of vacuum coating equipment can be substantial, which may deter smaller manufacturers from adopting these technologies. According to a survey conducted by the National Association of Manufacturers, 65% of small and medium-sized enterprises cited high equipment costs as a significant barrier to adopting advanced manufacturing technologies. This reluctance to invest in vacuum coating solutions can hinder market growth, as companies may opt for less efficient or outdated coating methods to manage their production processes.

Additionally, the complexity of vacuum coating processes can pose challenges for manufacturers. The need for specialized knowledge and expertise in operating and maintaining vacuum coating equipment can lead to increased operational costs and longer implementation times. According to industry experts, the learning curve associated with mastering vacuum coating technologies can be steep, particularly for companies with limited experience in this area. The high costs and operational complexities associated with vacuum coating equipment may restrict widespread adoption by ultimately impacting the growth of the North America vacuum coating equipment market.

Another significant restraint is the rapid pace of technological advancements, which can lead to obsolescence of existing equipment. The older models may quickly become outdated by prompting manufacturers to invest in continuous research and development to stay competitive. This constant need for innovation can strain the resources of manufacturers for particularly smaller companies that may struggle to keep up with the pace of change.

MARKET OPPORTUNITIES

The increasing focus on sustainable manufacturing practices presents a significant opportunity for the North America vacuum coating equipment market. The demand for vacuum coating technologies that minimize waste and energy consumption is expected to rise as industries strive to reduce their environmental impact. Vacuum coating processes are inherently more efficient than traditional coating methods, as they often require fewer materials and generate less waste. According to the U.S. Environmental Protection Agency, sustainable manufacturing practices can lead to a 30% reduction in energy consumption and greenhouse gas emissions. This potential for significant environmental benefits is driving investments in vacuum coating technologies that align with sustainability goals.

Moreover, the rise of electric vehicles (EVs) and renewable energy technologies is creating new opportunities for vacuum coating equipment manufacturers. The need for advanced coatings in battery management systems and electric drivetrains is becoming increasingly critical as the adoption of EVs continues to accelerate. According to the International Energy Agency, global electric vehicle sales reached 3 million units in 2020, and this number is expected to grow significantly in the coming years. Vacuum coating technologies play a vital role in ensuring the performance and reliability of EV components by positioning the North America vacuum coating equipment market for growth in this emerging sector.

The expansion of the aerospace and defense industries also offers substantial opportunities for the North America vacuum coating equipment market. The demand for vacuum coating technologies is expected to grow as these sectors increasingly adopt advanced materials and coatings to enhance the performance and durability of components. According to the Aerospace Industries Association, the U.S. aerospace and defense industry is projected to reach $1 trillion by 2025 owing to the growing importance of advanced materials in this sector.

MARKET CHALLENGES

One of the foremost challenges facing the North America vacuum coating equipment market is the increasing competition from alternative coating technologies. The new methods such as spray coating and electroplating are gaining traction by offering unique advantages over traditional vacuum coating processes. These alternatives can provide cost-effective solutions for certain applications, which may attract customers away from vacuum coating technologies. This competitive landscape necessitates that vacuum coating equipment manufacturers continuously innovate and improve their products to maintain market share.

Another significant challenge is the regulatory environment surrounding manufacturing processes and materials. As governments implement stricter regulations aimed at reducing environmental impact and promoting sustainability, vacuum coating equipment manufacturers must ensure that their products comply with these evolving standards. This can lead to increased costs associated with research and development, testing, and certification processes. According to the National Electrical Manufacturers Association, compliance with regulatory requirements can add up to 20% to the overall cost of product development.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.25% |

|

Segments Covered |

By Equipment Type, End-Use Industry, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

The United States, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

Applied Materials, Inc., Veeco Instruments Inc., Oerlikon Balzers, ULVAC Inc., Lam Research, Kurt J Lesker Company, and Singulus Technologies AG, all of which significantly contribute to the market dynamics through their innovative technologies, extensive product offerings, and others |

SEGMENTAL INSIGHTS

By Equipment Type Insights

The physical vapor deposition (PVD) segment was the largest and held North America vacuum coating equipment market share of 45.6% in 2024. This dominance can be attributed to the widespread use of PVD technologies in various applications, including electronics, optics, and decorative coatings. PVD processes are known for their ability to produce high-quality thin films with excellent adhesion and uniformity by making them ideal for a range of industries. The ability of PVD technologies to provide precise control over film thickness and composition is particularly appealing for applications requiring high performance and reliability. Additionally, the growing emphasis on energy efficiency and sustainability is driving the adoption of PVD equipment, as these processes often require less energy and generate less waste compared to traditional coating methods.

The chemical vapor deposition (CVD) segment is projected to grow at a CAGR of 8.5% during the forecast period. This growth can be attributed to the increasing demand for CVD technologies in applications such as semiconductor manufacturing, solar cells, and advanced materials. CVD processes offer unique advantages by including the ability to deposit conformal coatings on complex geometries and the production of high-purity films. Furthermore, the rise of advanced materials and nanotechnology is driving the adoption of CVD equipment. These technologies can provide enhanced performance and functionality in various applications by making them increasingly attractive to manufacturers.

By End-Use Industry Insights

The electronics and semiconductors segment by accounting for 35.4% of the North America vacuum coating equipment market share in 2024. This dominance can be attributed to the critical role that vacuum coating technologies play in the production of electronic components, such as integrated circuits, displays, and sensors. Vacuum coating processes, including PVD and CVD, are essential for depositing thin films that enhance the performance and reliability of electronic devices. The increasing demand for consumer electronics, including smartphones, tablets, and wearables that is further driving the demand for vacuum coating equipment in the electronics industry.

The renewable energy segment is anticipated to achieve a CAGR of 9.4% in the foreseen years. This growth can be attributed to the increasing demand for high-quality coatings in solar panels and wind turbines, where vacuum coating technologies are essential for optimizing performance and durability. According to the U.S. Energy Information Administration, solar energy capacity in the United States is projected to reach 200 gigawatts by 2025 owing to the growing importance of advanced materials in the renewable energy sector.

Furthermore, the rise of electric vehicles and energy storage systems is driving the adoption of vacuum coating technologies in the renewable energy segment. These technologies can provide critical performance enhancements for battery management systems and energy conversion devices, making them increasingly attractive to manufacturers. The demand for vacuum coating equipment in this segment is likely to grow is positioning it for significant expansion in the North America vacuum coating equipment market.

REGIONAL ANALYSIS

The United States was the largest by holding 75.4% of the North America vacuum coating equipment market share in 2024. The U.S. market is characterized by a robust demand for vacuum coating solutions across various sectors, including electronics, automotive, and renewable energy. According to the U.S. Department of Energy, the increasing focus on energy efficiency and sustainability is driving investments in vacuum coating technologies, further bolstering the market. The rapid adoption of electric vehicles and smart grid technologies is also contributing to the growth of the vacuum coating equipment market in the U.S. Moreover, the presence of key players and a well-established manufacturing base in the United States enhances the market's competitive landscape. Major companies such as Applied Materials, Veeco Instruments, and Oerlikon are actively involved in developing innovative vacuum coating solutions by driving technological advancements in the industry.

Canada vacuum coating equipment market is likely to register a significant CAGR of 12.1% during the forecast period. The Canadian market is driven by a growing interest in renewable energy and advanced manufacturing technologies, as the government emphasizes sustainability and energy efficiency. According to Natural Resources Canada, the country aims to achieve a 30% reduction in greenhouse gas emissions by 2030, which is expected to drive investments in vacuum coating technologies for renewable energy applications. The increasing adoption of electric vehicles and the expansion of charging infrastructure are also contributing to the demand for vacuum coating equipment in Canada.

KEY MARKET PLAYERS

Key players in the North America vacuum coating equipment market are Applied Materials, Inc., Veeco Instruments Inc., Oerlikon Balzers, ULVAC Inc., Lam Research, Kurt J Lesker Company, and Singulus Technologies AG, all of which significantly contribute to the market dynamics through their innovative technologies and extensive product offerings

The competition in the North America vacuum coating equipment market is characterized by a mix of established players and emerging manufacturers, all vying for market share in a rapidly evolving landscape. Major companies such as Applied Materials, Veeco Instruments, and Oerlikon Balzers dominate the market by leveraging their strong brand recognition, extensive distribution networks, and commitment to innovation. These industry leaders continuously invest in research and development to enhance coating performance, efficiency, and compliance with stringent environmental regulations, thereby maintaining their competitive advantage.

Emerging players are also entering the market, often focusing on niche segments or innovative technologies, such as atomic layer deposition and advanced PVD systems. This influx of new entrants intensifies competition, as they seek to capture market share by offering unique value propositions and addressing the growing demand for sustainable solutions. Additionally, the increasing consumer preference for eco-friendly products is prompting established manufacturers to adapt their offerings and invest in cleaner technologies, further heightening competition.

Price competition is another significant factor influencing the market dynamics. They may engage in competitive pricing strategies, which can impact profit margins as manufacturers strive to attract price-sensitive consumers. However, companies that prioritize quality, performance, and customer service are likely to differentiate themselves and build brand loyalty by allowing them to navigate the competitive landscape effectively. Overall, the North America vacuum coating equipment market is poised for continued growth, driven by innovation, evolving consumer preferences, and a dynamic competitive environment.

TOP PLAYERS IN THE MARKET

In the North America vacuum coating equipment market, several key players have established themselves as leaders, contributing significantly to the overall market dynamics. Applied Materials, Inc. is one of the foremost manufacturers, renowned for its high-quality vacuum coating solutions that cater to various applications, including semiconductor manufacturing and display technologies. The company's commitment to innovation and extensive product portfolio has positioned it as a market leader, with a strong focus on developing advanced coating technologies that enhance performance and reliability.

Another major player is Veeco Instruments Inc., a well-known name in the vacuum coating equipment industry. Veeco offers a diverse range of vacuum deposition systems, including PVD and MBE technologies, which are widely used in electronics, optics, and solar applications. The company's emphasis on research and development has led to the introduction of cutting-edge technologies that meet the evolving needs of customers, further solidifying its position in the North America vacuum coating equipment market.

Oerlikon Balzers is also a prominent player in the vacuum coating market, recognized for its innovative coating solutions and commitment to sustainability. Oerlikon's vacuum coating technologies are widely used in various industries, including automotive, aerospace, and medical devices, making them integral to the transition towards cleaner and more efficient manufacturing processes. The company's focus on developing high-performance, energy-efficient coatings has resonated with environmentally conscious consumers by enhancing its reputation as a trusted manufacturer in the North America vacuum coating equipment market.

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

Key players in the North America vacuum coating equipment market employ a variety of strategies to strengthen their market position and enhance competitiveness. One prominent strategy is the focus on innovation and technological advancement. Companies like Applied Materials and Veeco Instruments invest heavily in research and development to create cutting-edge vacuum coating technologies that improve performance, efficiency, and sustainability. By continuously innovating, these manufacturers can meet evolving consumer demands and comply with stringent regulatory standards, thereby maintaining their competitive edge in the market.

Another significant strategy is the expansion of product portfolios to cater to diverse consumer needs. Manufacturers are increasingly offering a wide range of vacuum coating solutions, including PVD, CVD, and hybrid technologies, to appeal to various applications. For instance, Oerlikon Balzers has introduced a range of vacuum coating systems specifically designed for the automotive and aerospace industries by addressing the growing demand for advanced materials in these sectors. Strategic partnerships and collaborations also play a crucial role in enhancing market presence. Companies often collaborate with equipment manufacturers and research institutions to expand their reach and improve distribution channels. For example, partnerships with universities and research organizations enable vacuum coating equipment producers to integrate their technologies into a wider array of applications, thereby increasing sales and market penetration.

RECENT DEVELOPMENTS IN THE MARKET

- In March 2023, Applied Materials launched a new line of advanced vacuum coating systems designed for semiconductor manufacturing, reinforcing its commitment to innovation and market leadership.

- In January 2023, Veeco Instruments introduced a new series of PVD systems aimed at the solar energy sector, catering to the growing demand for efficient coating solutions.

- In February 2023, Oerlikon Balzers expanded its product portfolio by launching a new range of vacuum coating technologies specifically designed for the automotive industry, addressing the increasing demand for advanced materials.

- In April 2023, KLA Corporation partnered with a leading semiconductor manufacturer to integrate its vacuum coating solutions into a new line of advanced chips, enhancing its market presence.

- In May 2023, Tokyo Electron Limited acquired a small vacuum coating technology firm to strengthen its capabilities in the market and expand its product offerings.

- In June 2023, Sputtering Systems announced a strategic collaboration with a major research institution to develop next-generation vacuum coating technologies for aerospace applications.

- In July 2023, ULVAC, Inc. launched a new series of compact vacuum coating systems aimed at small and medium-sized enterprises, reflecting its commitment to innovation and accessibility.

- In August 2023, CVD Equipment Corporation introduced a new line of chemical vapor deposition systems designed for the medical device industry, addressing the growing demand for advanced coatings.

- In September 2023, AIXTRON SE expanded its distribution network by partnering with major retailers to increase the availability of its vacuum coating equipment across North America.

- In October 2023, Plasma-Therm unveiled a new series of plasma-enhanced chemical vapor deposition systems designed for the electronics industry, aiming to capture a larger share of the market.

MARKET SEGMENTATION

This research report on the North America vacuum coating equipment market has been segmented and sub-segmented based on the following categories.

By Equipment Type

- Physical vapor deposition (PVD)

- Chemical vapor deposition (CVD)

- Magnetron sputtering

- Electron beam evaporation

- Thermal evaporation

By End-Use Industry

- Electronics & semiconductors

- Automotive

- Aerospace & defense

- Energy (including Solar)

- Medical

- Others

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

1. What is the expected growth rate of the Vacuum Coating Equipment market?

The market is anticipated to grow at a compound annual growth rate (CAGR) of 6.25% from 2025 to 2033.

2. What factors are driving the growth of the Vacuum Coating Equipment market in North America?

Key drivers include advancements in coating technologies, rising demand for high-quality coated products in various industries, and increasing investments in renewable energy and high-tech manufacturing.

3. Which industries are major consumers of vacuum coating equipment?

Major industries include electronics, automotive, aerospace, healthcare, and renewable energy sectors.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]