North America Transformer Market Size, Share, Trends & Growth Forecast Report By Power Rating (Small (10 KVA - 750 KVA), Medium (751 KVA - 100 MVA), and Large (above 101 MVA)), Cooling Type, Transformer Type, Country (The United States, Canada, and Rest of North America), Industry Analysis From 2024 to 2033

North America Transformer Market Size

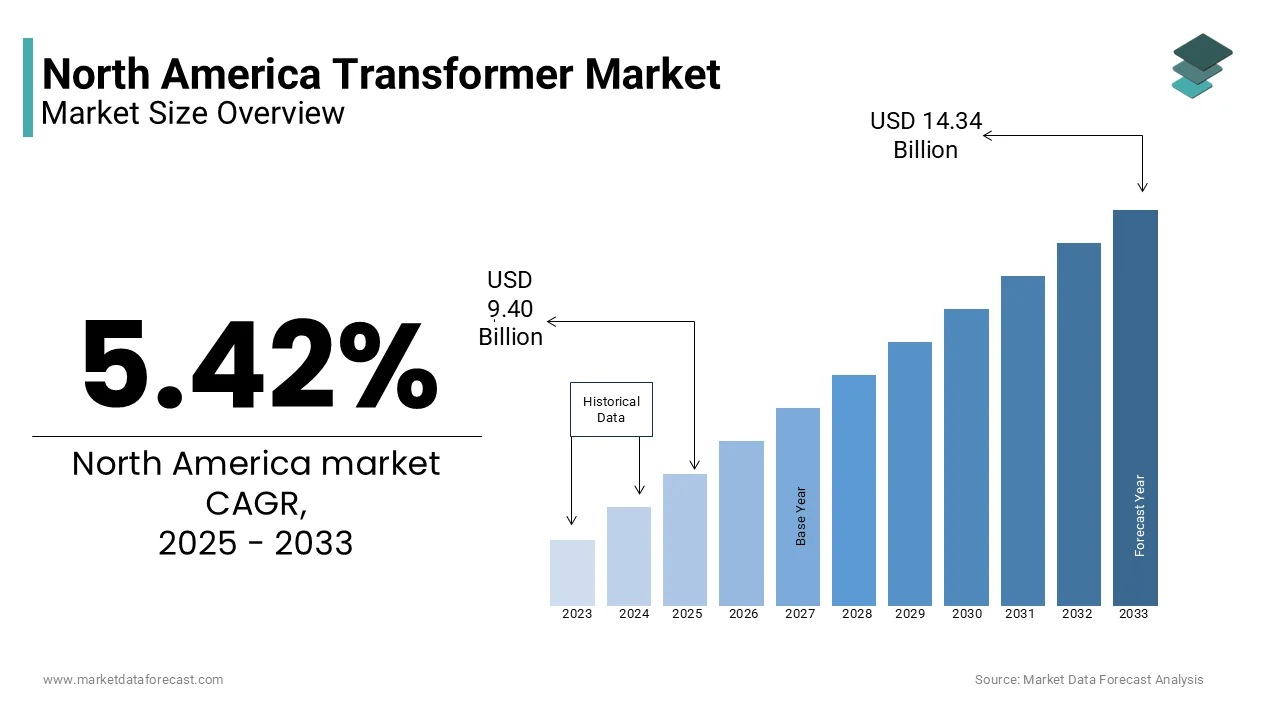

The North America Transformer market was worth USD 8.92 billion in 2024. The North America market is projected to reach USD 14.34 billion by 2033 from USD 9.40 billion in 2025, rising at a CAGR of 5.42% from 2025 to 2033.

The North American transformer market is a critical component of the region's electrical infrastructure, facilitating the transmission and distribution of electricity across vast distances. Transformers play an essential role in stepping up or stepping down voltage levels, ensuring that electricity generated from power plants is efficiently delivered to end-users. The market encompasses various types of transformers, including power transformers, distribution transformers, and specialty transformers, each serving distinct functions within the electrical grid. As per recent analyses, the North American transformer market is projected to witness significant growth, driven by increasing investments in renewable energy sources, modernization of aging infrastructure, and the rising demand for electricity. The market's expansion is further supported by technological advancements that enhance the efficiency and reliability of transformer systems.

MARKET DRIVERS

Transition to Renewable Energy

The demand for transformers in North America is significantly influenced by the ongoing transition towards renewable energy sources. There is a marked increase in the deployment of wind, solar, and hydroelectric power systems as governments and utilities prioritize sustainability. This shift necessitates the integration of advanced transformer technologies to manage the variable nature of renewable energy generation. This transition not only drives the demand for new transformers but also necessitates upgrades to existing infrastructure to accommodate the influx of renewable energy. Furthermore, the increasing focus on energy efficiency and grid reliability is prompting utilities to invest in smart grid technologies, which often require sophisticated transformer solutions.

Aging Electrical Infrastructure

The aging electrical infrastructure in North America presents another significant driver for the transformer market. Many existing transformers are nearing the end of their operational lifespan, necessitating replacement or refurbishment to maintain grid reliability and efficiency. According to the American Society of Civil Engineers, approximately 70% of the U.S. electrical transmission and distribution infrastructure is over 25 years old that is escalating the urgent need for modernization. This aging infrastructure not only poses risks of outages and inefficiencies but also increases maintenance costs for utilities. Consequently, there is a growing emphasis on upgrading transformer systems to enhance performance and reduce operational risks. The U.S. government has recognized this challenge by allocating substantial funding for infrastructure improvements, including transformer replacements. The demand for new transformers is expected to surge by propelling the growth of the North American transformer market.

MARKET RESTRAINTS

High Initial Capital Investment

One of the primary challenges is the high initial capital investment required for transformer installation and maintenance. The cost of advanced transformer technologies, coupled with the expenses associated with installation and integration into existing systems, can be a significant barrier for utilities and energy providers. The average cost of a power transformer can range from $100,000 to over $1 million by depending on its specifications and capacity. This financial burden can deter smaller utilities from upgrading their infrastructure by potentially leading to delays in modernization efforts. Additionally, the economic uncertainties stemming from global events, such as the COVID-19 pandemic, have led to budget constraints for many utilities, further complicating investment decisions.

Competition from Alternative Energy Storage Solutions

Another significant restraint impacting the North American transformer market is the increasing competition from alternative energy storage solutions. The energy storage systems are emerging as viable alternatives to traditional transformer-based solutions as battery technologies advance and become more cost-effective. These systems can provide grid stability, manage peak loads, and facilitate the integration of renewable energy sources without the need for extensive transformer infrastructure. This trend poses a challenge for the transformer market, as utilities may opt for energy storage solutions over traditional transformer installations to enhance grid flexibility and reliability.

MARKET OPPORTUNITIES

Adoption of Smart Grid Technologies

The North American transformer market is poised to capitalize on several emerging opportunities that could drive its growth in the coming years. One of the most significant opportunities lies in the increasing adoption of smart grid technologies. As utilities seek to enhance grid reliability and efficiency, the integration of advanced monitoring and control systems is becoming paramount. Smart transformers equipped with digital capabilities can provide real-time data on performance, enabling utilities to optimize operations and reduce maintenance costs. According to a report by the International Energy Agency, investments in smart grid technologies are expected to reach $100 billion globally by 2025 with North America accounting for a substantial share of this investment. This trend presents a lucrative opportunity for transformer manufacturers to develop innovative solutions that align with the evolving needs of the energy sector.

Focus on Energy Efficiency and Sustainability

Another promising opportunity for the North American transformer market is the growing emphasis on energy efficiency and sustainability. As regulatory frameworks increasingly prioritize environmental considerations, utilities are under pressure to adopt more efficient transformer technologies that minimize energy losses. The U.S. Department of Energy has set stringent efficiency standards for transformers by encouraging manufacturers to innovate and produce high-efficiency models. According to the U.S. Department of Energy, implementing energy-efficient transformers can reduce energy losses by up to 30% by translating into significant cost savings for utilities. This focus on energy efficiency not only aligns with sustainability goals but also enhances the overall performance of the electrical grid. The demand for energy-efficient transformers is expected to rise by creating a substantial opportunity for market players.

MARKET CHALLENGES

Supply Chain Disruptions

The North American transformer market is confronted with several challenges that could impede its growth trajectory. One of the most pressing challenges is the supply chain disruptions that have emerged in recent years. The COVID-19 pandemic has exposed vulnerabilities in global supply chains, leading to delays in the procurement of critical components for transformer manufacturing. These disruptions not only affect production schedules but also escalate costs, as manufacturers may need to source materials from alternative suppliers at higher prices. As a result, the ongoing supply chain challenges pose a significant hurdle for the North American transformer market with strategic planning and risk management to mitigate their impact.

Increasing Regulatory Scrutiny

Another formidable challenge facing the North American transformer market is the increasing regulatory scrutiny surrounding environmental and safety standards. The transformer manufacturers must navigate a complex landscape of compliance requirements as governments implement stricter regulations to address climate change and promote sustainability. This includes adhering to regulations related to emissions, waste management, and energy efficiency. According to the Environmental Protection Agency, compliance with these regulations can impose substantial costs on manufacturers for those that may need to invest in new technologies or processes to meet evolving standards. Additionally, the potential for regulatory changes can create uncertainty in the market by making it challenging for companies to plan long-term investments. Consequently, the regulatory landscape presents a significant challenge for the North American transformer market by requiring manufacturers to remain agile and responsive to changing requirements.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.42% |

|

Segments Covered |

By Power Rating, Cooling Type, Transformer Type, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

The United States, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

General Electric Company, Schneider Electric SE, Emerson Electric Co., Eaton Corporation PLC, and Siemens Energy AG. |

SEGMENTAL ANALYSIS

By Power Rating Insights

The medium power transformer segment held the largest market share by accounting for 45.4% of the total North America transformer market. This dominance can be attributed to the widespread application of medium power transformers in various sectors, including industrial, commercial, and utility applications. The increasing demand for electricity, coupled with the need for efficient voltage regulation, drives the adoption of medium power transformers. According to market research, the medium power transformer segment is projected to grow at a CAGR of 4.5% over the next five years, reflecting the ongoing investments in infrastructure and the modernization of electrical grids. The versatility and reliability of medium power transformers make them a preferred choice for utilities and industries alike, further solidifying their position in the market.

The small power transformer segment is emerging as the fastest-growing segment within the North American transformer market, with a projected CAGR of 6.2% over the next five years. This growth can be attributed to the increasing demand for compact and efficient transformer solutions in residential and commercial applications. As urbanization continues to rise, the need for smaller transformers that can be easily integrated into limited spaces is becoming more pronounced. Additionally, advancements in technology have led to the development of high-efficiency small transformers that minimize energy losses, making them an attractive option for energy-conscious consumers. The small power transformer segment is expected to capture a larger share of the market as more end-users prioritize energy efficiency and space-saving solutions.

By Cooling Type Insights

The oil-cooled transformer segment was the largest and held 60.2% of the share in 2024. This dominance is primarily due to the superior cooling capabilities of oil-cooled transformers, which allow for higher power ratings and improved thermal management. Oil-cooled transformers are widely utilized in utility and industrial applications, where reliability and performance are paramount. The ability of oil-cooled transformers to handle higher loads and their established presence in the market contribute to their continued dominance.

The air-cooled transformer segment is likely to experience a robust CAGR of 5.5% during the forecast period. This growth can be attributed to the increasing preference for environmentally friendly and low-maintenance transformer solutions. Air-cooled transformers are often favored in applications where space is limited, and the need for cooling systems is less critical. Additionally, advancements in air-cooling technology have improved the efficiency and performance of these transformers is making them a viable alternative to traditional oil-cooled models. The air-cooled transformer segment is expected to gain traction as more end-users seek sustainable and cost-effective solutions for their electrical needs.

By Transformer Type Insights

The distribution transformer segment held the largest North America transformer market share by accounting for 53.4% in 2024. This dominance is primarily driven by the essential role distribution transformers play in delivering electricity from substations to end-users. The increasing demand for electricity, coupled with the expansion of the electrical grid, propels the adoption of distribution transformers. The widespread application of distribution transformers in residential, commercial, and industrial settings further solidifies their position in the market.

The power transformer segment is anticipated to register a significant CGAR of 5.7% from 2025 to 2033. This growth can be attributed to the increasing investments in renewable energy projects and the need for efficient voltage regulation in high-capacity applications. Power transformers are critical for stepping up voltage levels for long-distance transmission, making them essential for integrating renewable energy sources into the grid. The power transformer segment is expected to capture a larger share of the market as utilities and energy providers prioritize the modernization of their infrastructure to accommodate the growing demand for electricity.

REGIONAL ANALYSIS

The United States dominated the North America transformer market with a robust share of 85.4% in 2024. The U.S. market is characterized by a robust demand for transformers driven by ongoing investments in infrastructure and the transition towards renewable energy sources. According to the U.S. Energy Information Administration, electricity consumption in the United States is projected to increase by 1.1% annually through 2050 with significant upgrades to the electrical grid. This growth is further supported by government initiatives aimed at modernizing aging infrastructure and enhancing grid reliability. The U.S. transformer market is expected to witness sustained growth as utilities invest in advanced transformer technologies to meet the evolving energy landscape.

Canada transformer market is gaining huge traction with an expected CAGR of 5.8% during the forecast period. The Canadian market is driven by similar factors as the U.S., including the need for infrastructure upgrades and the integration of renewable energy sources. According to Natural Resources Canada, the country aims to achieve a 90% reduction in greenhouse gas emissions by 2050 with growing investments in clean energy technologies. This commitment to sustainability is expected to drive the demand for transformers that support renewable energy integration and enhance grid efficiency. The transformer market is poised for growth by reflecting the country's commitment to a sustainable energy future.

KEY MARKET PLAYERS

The major players in the North America transformer market include General Electric Company, Schneider Electric SE, Emerson Electric Co., Eaton Corporation PLC, and Siemens Energy AG.

MARKET SEGMENTATION

This research report on the North America transformer market is segmented and sub-segmented into the following categories.

By Power Rating

- Small (10 KVA - 750 KVA)

- Medium (751 KVA - 100 MVA)

- Large (above 101 MVA)

By Cooling Type

- Air-Cooled

- Oil-Cooled

By Transformer Type

- Power Transformer

- Distribution Transformer

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

What are the key factors driving the North America transformer market?

The market is driven by increasing electricity demand, grid modernization, renewable energy integration, and industrial expansion.

Which industries are the primary consumers of transformers in North America?

Key industries include power utilities, manufacturing, oil & gas, data centers, and transportation infrastructure.

How is technology influencing the transformer market in North America?

Smart transformers with IoT capabilities, advanced cooling systems, and energy-efficient designs are shaping the market.

What is the future outlook for the North America transformer market?

The market is expected to grow due to rising electrification, grid modernization projects, and increasing investments in renewable energy.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]