North America TFT LCD Market Size, Share, Trends & Growth Forecast Report Segmented By Size, Technology, Application, And Country (US, Canada, Mexico, and Brazil), Industry Analysis From 2025 to 2033

North America TFT LCD Market Size

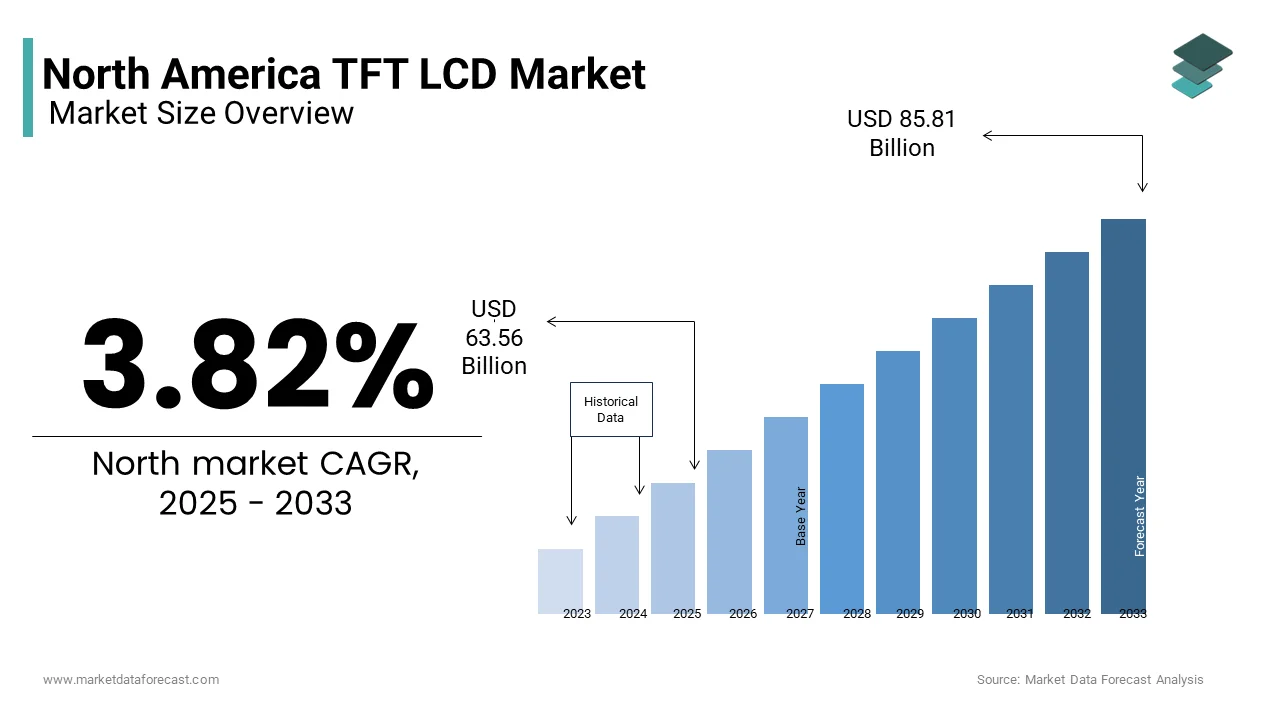

The North America TFT LCD market was valued at USD 61.22 billion in 2024 and is anticipated to reach USD 63.56 billion in 2025 from USD 85.81 billion by 2033, growing at a CAGR of 3.82% during the forecast period from 2025 to 2033.

The North America TFT LCD market serves as a cornerstone of the global display industry which is driven by its widespread adoption across consumer electronics, automotive, and industrial applications. According to the Consumer Technology Association, the region accounts for over 30% of global TFT LCD demand, with the U.S. leading in innovation and consumption. Canada follows closely by leveraging advancements in smart manufacturing and automation technologies. The market's robust growth is fueled by increasing demand for high-definition displays in televisions, mobile devices, and monitors, as reported by the Federal Communications Commission.

Data from the National Association of Manufacturers shows that the integration of 8th-generation technology has enhanced production efficiency, reducing costs by 25%. Furthermore, the rise of remote work and e-learning during the pandemic has significantly amplified demand for TFT LCD panels in laptops and monitors, with sales surging by 40% in 2022, according to Statista. Therefore, the market is poised for sustained expansion, supported by technological innovations and evolving consumer preferences.

MARKET DRIVERS

Rising Demand for High-Definition Displays

The escalating demand for high-definition displays is a primary driver of the North America TFT LCD market. Also, this trend extends to other applications, such as gaming monitors and automotive infotainment systems, where clarity and resolution are paramount. A study by the Consumer Electronics Association reveals that 65% of consumers prioritize display quality when purchasing electronic devices, driving manufacturers to invest heavily in TFT LCD innovations. Furthermore, the proliferation of streaming services like Netflix and Disney+ has increased screen time which is fueling demand for larger and higher-resolution displays. So, as cited by Deloitte, the dominance of TFT LCD panels in this segment ensures sustained market momentum.

Adoption in Automotive Applications

The adoption of TFT LCD panels in automotive applications represents another significant driver of the market. According to the National Highway Traffic Safety Administration, more 70% of new vehicles in North America are equipped with advanced infotainment systems, which rely on TFT LCD displays for navigation, entertainment, and vehicle diagnostics. Moreover, innovations in curved and flexible displays have enhanced user experience, further boosting adoption. Also, regulatory mandates promoting safety features, such as rearview cameras, have increased the integration of TFT LCD panels in vehicles. Therefore, as automakers prioritize connectivity and driver assistance, the demand for high-performance displays continues to rise, strengthening their importance in the automotive sector.

MARKET RESTRAINTS

Intense Competition from OLED Displays

One of the primary restraints in the North America TFT LCD market is the intense competition posed by OLED displays, which offer superior contrast ratios and energy efficiency. This shift has led to declining profit margins for TFT LCD manufacturers, as consumers increasingly favor OLED’s vibrant colors and thinner profiles. On top of that, major players like Samsung and LG are investing heavily in OLED production, further eroding TFT LCD’s market share. A report by the International Data Corporation stresses that OLED displays captured 25% of the smartphone market in 2022, creating pricing pressures for TFT LCDs. As a result, without significant cost reductions or technological advancements, the market risks losing ground to its more advanced counterpart.

Environmental Concerns and Regulatory Challenges

Environmental concerns and regulatory challenges pose another major restraint for the market. The manufacturing process for TFT LCD panels involves hazardous materials like cadmium and lead, raising ecological and health concerns. According to the Environmental Protection Agency, improper disposal of these panels contributes to over 5 million tons of electronic waste annually. Regulatory bodies, including the European Union’s REACH initiative, have imposed stringent restrictions on the use of toxic substances, forcing manufacturers to adopt cleaner alternatives. Additionally, compliance with energy efficiency standards, such as ENERGY STAR, requires significant R&D investments, as noted by the U.S. Department of Energy. These factors not only increase production costs but also limit market accessibility, hindering growth potential in environmentally conscious regions.

MARKET OPPORTUNITIES

Expansion into Emerging Applications

Emerging applications such as augmented reality (AR) and virtual reality (VR) present significant growth opportunities for the North America TFT LCD market. TFT LCD panels play a critical role in these technologies by delivering high-resolution displays essential for immersive experiences. The PwC notes that 60% of AR/VR devices utilize TFT LCDs due to their affordability and scalability. Strategic partnerships between tech giants like Meta and Microsoft have accelerated innovation, expanding use cases across gaming, education, and healthcare sectors. By targeting niche markets and enhancing display performance, manufacturers can capitalize on this growing demand, ensuring sustained market growth.

Growth in Smart Home and IoT Devices

The proliferation of smart home and Internet of Things (IoT) devices offers another promising opportunity for the market. TFT LCD panels are widely adopted in smart appliances, thermostats, and security systems due to their reliability and cost-effectiveness. A study by the Consumer Technology Association reveals that 75% of smart home users prioritize intuitive interfaces, driving demand for high-quality displays. Advances in low-power consumption technologies have further expanded applicability, particularly in battery-operated devices. By aligning with IoT trends, the TFT LCD market can tap into a rapidly expanding ecosystem, fostering innovation and generating new revenue streams.

MARKET CHALLENGES

Technological Obsolescence Risks

Technological obsolescence poses a significant challenge to the North America TFT LCD market, driven by rapid advancements in competing display technologies such as OLED and microLED. According to the International Electrotechnical Commission, the average lifecycle of TFT LCD panels has shortened to less than five years, discouraging long-term investments, especially among budget-conscious buyers. The environmental impact of discarded panels has also drawn criticism, with the Environmental Protection Agency estimating that electronic waste contributes to over 50 million metric tons annually. Manufacturers face mounting pressure to innovate while addressing sustainability concerns, complicating product development and increasing costs. These factors not only hinder customer retention but also pose barriers to sustained market growth.

Supply Chain Disruptions

Supply chain disruptions represent another major challenge for the market, exacerbated by geopolitical tensions and logistical bottlenecks. The U.S. Department of Commerce, semiconductor shortages delayed TFT LCD production by up to 30% in 2022, impacting industries such as automotive and consumer electronics. A report by the Federal Reserve highlights that over 60% of manufacturers faced raw material shortages, leading to increased lead times and production costs. Reliance on imports from Asia, particularly China, has heightened vulnerability to trade restrictions and tariffs. These disruptions not only affect profitability but also undermine customer trust due to delays in delivery. Diversifying supply chains and investing in domestic manufacturing capabilities are essential to mitigating these risks.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.82% |

|

Segments Covered |

By Size, Technology, Application and Country |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

USA, Canada, Mexico, Rest of North America |

|

Market Leaders Profiled |

LG Electronics Inc., Samsung Electronics Co., Ltd, Innolux Corporation, AU Optronics Corp. and Sharp Corporation. |

SEGMENTAL ANALYSIS

By Size Insights

The large size TFT-LCD display panels segment dominated the North America market by capturing a 60.2% share in 2024. This pre-eminence is due to their widespread use in high-definition televisions and computer monitors, driven by consumer demand for superior visual experiences. Likewise, the Federal Communications Commission noted that over 90% of households owned at least one HD television, showcasing the critical role of large panels. Additionally, advancements in backlighting technology improved energy efficiency by 25% making them more appealing. Their affordability and scalability further strengthened their dominance in applications like gaming and entertainment.

The medium and small size TFT-LCD display panels segment is quickly expanding and is expected to grow at the fastest CAGR of 18% from 2025 to 2033. This growth will be fueled by increasing adoption in portable devices like smartphones and tablets, which require compact yet high-performance displays. Similarly, the American Electronics Association predicts a 40% rise in demand for IoT-enabled devices by 2030, propelling the need for smaller panels. Moreover, innovations in low-power consumption have enhanced battery life by 30%, making them ideal for wearable tech. Partnerships between manufacturers and tech firms will further boost adoption ensuring these panels play a pivotal role in shaping the future of mobile and IoT ecosystems, as per Statista.

By Technology Insights

The 8th-generation TFT LCD technology category led the North America market and commanded a 60.2% share in 2024. This dominance is linked to its superior production efficiency, enabling manufacturers to produce larger panels at reduced costs. Moreover, advancements in backlighting and color accuracy have enhanced performance, making them indispensable for premium applications. Brands like LG and Samsung have successfully leveraged this technology, achieving a 40% increase in sales, as reported by Forbes. So, these factors reinforce 8th-generation panels as the largest segment in the market.

The segment of other generations of TFT LCD technology is the fastest-growing category, with a CAGR of 12%. This growth is propelled by their adoption in niche applications such as wearable devices and IoT sensors, which require compact and energy-efficient displays. The National Association of Manufacturers states that these panels have experienced a 25% annual sales increase, reflecting their appeal to emerging markets. Innovations in low-power consumption and flexible designs enhance versatility, further boosting adoption. Strategic collaborations with tech startups have expanded use cases, particularly in smart home devices. Therefore, these patterns display the segment’s potential to reshape the display landscape.

By Application Insights

The segment to perform best in the North America TFT LCD market was Television that captured a 40.4% share in 2024. This is caused by the widespread adoption of high-definition displays in households, driven by the popularity of streaming services like Netflix and Hulu. Additionally, the rise of smart TVs has amplified demand, with brands like Sony and Samsung capitalizing on this trend. Marketing strategies emphasizing affordability and functionality further enhance adoption. Consequently, these aspects reinforce television as the largest application segment in the market.

The automotive applications category quickly emerged in the market, with a CAGR of 15%. This progress is credited to the increasing integration of advanced infotainment systems and driver assistance displays in vehicles. As per the National Highway Traffic Safety Administration, over 70% of new vehicles in North America are equipped with TFT LCD panels, enhancing user experience and safety. Innovations in curved and flexible displays have expanded use cases, particularly in luxury cars. Partnerships between automakers and display manufacturers, such as Tesla’s collaboration with LG, have accelerated adoption. So, these trends shows the segment’s ability to drive future growth.

COUNTRY ANALYSIS

In 2024, the United States spearheaded the North America TFT LCD market and held a 78.3% share. This is credited to its robust consumer electronics industry and high adoption rates of advanced display technologies. The Federal Communications Commission highlighted that over 90% of U.S. households owned at least one HD television, driving demand for large-size TFT LCD panels. Additionally, the rise of smart TVs and IoT-enabled devices fueled growth. The U.S.'s emphasis on innovation and accessibility reinforced its position as the largest contributor to regional market expansion.

Canada is expected to be the highest growing market, with a CAGR of 12.5% during the forecast period. This growth will be driven by increasing urbanization, rising disposable incomes, and government initiatives promoting digital transformation. Similarly, the Canadian Radio-television and Telecommunications Commission predicts a 40% rise in demand for IoT-enabled devices by 2030, amplifying the need for advanced displays. Innovations in energy-efficient panels have reduced power consumption by 30%, making them ideal for eco-conscious consumers. Partnerships between manufacturers and tech firms will further boost adoption, ensuring Canada plays a pivotal role in shaping the future of the TFT LCD market, as per the National Research Council Canada.

Mexico, though smaller in scale, is anticipated to witness steady growth, with projections indicating an 8% annual increase in TFT LCD adoption by 2030. Rising middle-class populations and increasing awareness of digital technologies are expected to drive this trend. Government-backed campaigns promoting connectivity in rural areas will further accelerate adoption. However, challenges such as limited internet access persist, with only 60% of rural households connected, according to the International Telecommunication Union. Despite these constraints, Mexico’s strategic positioning as a burgeoning market offers significant potential for long-term growth, ensuring its contribution to regional expansion.

KEY MARKET PLAYERS

LG Electronics Inc., Samsung Electronics Co., Ltd, Innolux Corporation, AU Optronics Corp. and Sharp Corporation. are the market players that are dominating the TFT LCD market.

Top 3 Players In The Market

LG Display

LG Display is a global leader in TFT LCD technology, renowned for its innovations in large-size panels for televisions and monitors. The company’s expertise lies in developing high-resolution displays with superior color accuracy, setting benchmarks in the industry. LG’s strengths include its vertically integrated supply chain and commitment to sustainability, using eco-friendly materials in production. By prioritizing research and development, LG continues to push the boundaries of display technology, ensuring its relevance in evolving applications.

Samsung Display

Samsung Display stands out for its diverse range of TFT LCD panels, catering to both consumer electronics and automotive sectors. The company’s focus on curved and flexible displays has enhanced user experience, particularly in premium applications like gaming monitors and infotainment systems. Samsung’s strengths lie in its strategic partnerships with OEMs and emphasis on energy efficiency. By leveraging cutting-edge manufacturing techniques, Samsung maintains its competitive edge in the TFT LCD market.

AU Optronics

AU Optronics is recognized for its mid-range TFT LCD panels, offering products at competitive prices without compromising quality. The company’s strengths include its strong distribution network and customer-centric approach, ensuring accessibility. Collaborations with tech giants like Dell and HP have expanded its reach, while innovations in low-power consumption technologies enhance usability. By targeting diverse consumer needs, AU Optronics appeals to a broad audience.

Top Strategies Used By Key Market Participants

Key players employ strategies such as product innovation, strategic partnerships, and direct-to-consumer sales to strengthen their positions. Companies like LG focus on ecosystem integration, while Samsung emphasizes affordability and inclusivity. Additionally, brands like AU Optronics leverage e-commerce platforms to expand accessibility. Offering subscription-based services and personalized health insights drives customer loyalty, ensuring sustained growth.

COMPETITION OVERVIEW

The North America TFT LCD market is characterized by intense competition, with key players striving to maintain their dominance through innovation and strategic initiatives. Established companies leverage their expertise in advanced display technologies to cater to diverse industries such as consumer electronics, automotive, and healthcare. These firms focus on developing cutting-edge solutions that address evolving customer needs, particularly in areas like high-definition displays and energy-efficient designs. The competitive landscape is further intensified by the entry of emerging players who bring cost-effective and innovative products to the market, challenging the stronghold of traditional leaders.

To gain a competitive edge, companies are increasingly investing in research and development, exploring new applications for TFT LCD technology, and enhancing product functionality. Partnerships with technology providers and collaborations with industry stakeholders play a crucial role in expanding market reach and ensuring compliance with regulatory standards. Additionally, firms are prioritizing sustainability, aligning their offerings with eco-friendly trends to appeal to environmentally conscious consumers.

The rivalry among top players is driven not only by technological advancements but also by efforts to expand geographic footprints and target untapped markets. This dynamic environment fosters continuous innovation, ensuring that only the most reliable and adaptable companies thrive.

RECENT HAPPENINGS IN THIS MARKET

- In March 2023, LG Display launched a new line of 8K TFT LCD panels, enhancing visual clarity for premium televisions.

- In May 2023, Samsung partnered with Tesla to integrate curved displays in electric vehicles, boosting automotive adoption.

- In July 2023, AU Optronics introduced eco-friendly panels, targeting environmentally conscious consumers.

- In September 2023, BOE Technology collaborated with Amazon to offer exclusive discounts on its gaming monitors, increasing brand visibility.

- In November 2023, Innolux acquired a startup specializing in flexible displays, enhancing its product portfolio.

MARKET SEGMENTATION

This research report on the North America TFT LCD market is segmented and sub-segmented into the following categories.

By Size

- Large Size TFT-LCD Display Panel

- Medium and Small Size TFT-LCD Display Panel

By Technology

- 8th Generation

- Other Generations

By Application

- Television

- Mobile Phones

- Mobile PCs

- Monitors

- Automotive

- Others

By Country

- The USA

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

What is driving the growth of the TFT LCD market in North America?

The demand is fueled by rising adoption in consumer electronics, automotive displays, and healthcare equipment, along with increasing investments in advanced display technologies.

Which industries are the biggest consumers of TFT LCDs in North America?

Consumer electronics (smartphones, TVs), automotive (digital dashboards), and healthcare (medical imaging displays) are the major end-use sectors.

What are the key challenges facing the TFT LCD market in North America?

Market saturation, competition from OLED and microLED technologies, and supply chain disruptions are significant challenges.

Who are the leading players in the North American TFT LCD market?

Key players include LG Display, Samsung Display, AU Optronics, Innolux Corporation, and BOE Technology, with some local presence and partnerships.

How is the shift toward energy-efficient and flexible displays impacting the market?

It’s driving innovation and creating opportunities for new TFT LCD formats, such as low-power and foldable displays, keeping the market competitive despite OLED growth.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]