North America Tartaric Acid Market Size, Share, Trends & Growth Forecast Report By Type (Natural, Synthetic), End-Use (Food and Beverages, Pharmaceuticals, Cosmetics, and Others), and Country (United States, Canada, Mexico) Industry Analysis From 2025 to 2033.

North America Tartaric Acid Market Size

The size of the tartaric acid market was valued at USD 33 Kilo Tons in 2024. This North America market is expected to grow at a CAGR of 4.8% from 2025 to 2033 and be worth USD 50.32 Kilo Tons by 2033 from USD 34.58 Kilo Tons in 2025.

The North America tartaric acid market has gained significant traction as a crucial component in various industries in food and beverages, pharmaceuticals, and cosmetics. Tartaric acid, a naturally occurring organic acid found in grapes, is widely recognized for its role as a stabilizing agent, acidulant, and emulsifier. It is primarily used in the production of cream of tartar, a common ingredient in baking, as well as in the winemaking process to enhance the quality of wines. This growth is driven by the increasing demand for natural and organic ingredients in food formulations, as well as the rising popularity of tartaric acid in the pharmaceutical sector for its therapeutic properties.

MARKET DRIVERS

Growing Demand for Natural Food Ingredients

The North America tartaric acid market is significantly driven by the growing demand for natural food ingredients. The shift towards products that are perceived as natural and free from artificial additives as consumers become increasingly health-conscious is greatly influencing the growth of the market. Tartaric acid, being a naturally occurring organic acid derived from grapes, aligns perfectly with this trend. According to a survey conducted by the Organic Trade Association, approximately 75% of consumers prefer food products that contain natural ingredients. This preference has led to a surge in the use of tartaric acid in various food applications, including baking, confectionery, and beverages, where it serves as a stabilizer and acidulant. The versatility of tartaric acid allows it to enhance flavor profiles and improve the texture of food products by making it a valuable ingredient for manufacturers. Additionally, the increasing trend of clean-label products has prompted food manufacturers to reformulate their offerings, incorporating tartaric acid as a natural alternative to synthetic additives.

Expansion of the Wine Industry

Another significant driver of the North America tartaric acid market is the expansion of the wine industry. Tartaric acid plays a crucial role in winemaking, as it helps to stabilize the wine and enhance its flavor profile. The increasing popularity of wine consumption in North America has led to a surge in demand for tartaric acid in regions known for wine production, such as California. According to the Wine Institute, California wine sales reached $45 billion in 2020 is reflecting a growing trend in wine consumption. This growth in the wine industry is driving the demand for tartaric acid, as winemakers seek to improve the quality and stability of their products. Additionally, the rise of craft wineries and the increasing interest in organic and natural wines have further propelled the demand for tartaric acid, as these producers often prioritize high-quality, natural ingredients.

MARKET RESTRAINTS

Price Volatility of Raw Materials

One of the primary restraints affecting the North America tartaric acid market is the price volatility of raw materials, particularly grapes. The production of tartaric acid is heavily reliant on the availability and cost of grapes, which can fluctuate due to various factors, including weather conditions, crop yields, and market demand. According to the U.S. Department of Agriculture, fluctuations in grape production can significantly impact the supply and pricing of tartaric acid. This volatility can pose challenges for manufacturers, as rising raw material costs may lead to increased prices for consumers, potentially dampening demand. Additionally, the reliance on a limited number of suppliers for high-quality grapes can create supply chain vulnerabilities, further complicating the market landscape. To mitigate these challenges, manufacturers may need to explore alternative sourcing strategies or invest in long-term contracts with grape producers. Addressing the issue of raw material price volatility will be crucial for maintaining stability and competitiveness in the tartaric acid market.

Regulatory Compliance and Quality Standards

Another significant restraint in the North America tartaric acid market is the stringent regulatory compliance and quality standards imposed by government agencies. The production and sale of tartaric acid are subject to rigorous regulations regarding food safety, labeling, and quality assurance. According to the U.S. Food and Drug Administration, manufacturers must adhere to specific guidelines to ensure the safety and quality of food additives, including tartaric acid. This regulatory landscape can pose challenges for tartaric acid producers for smaller companies that may lack the resources to meet compliance requirements. Additionally, the lack of standardized definitions for terms such as "natural" or "organic" can create confusion among consumers and complicate marketing efforts. Companies must invest time and resources to ensure compliance with regulations while effectively communicating their product benefits to consumers. Failure to meet regulatory standards can result in product recalls, legal issues, and damage to brand reputation.

MARKET OPPORTUNITIES

Growth in the Organic Food Sector

The North America tartaric acid market presents significant opportunities for growth through the expansion into the organic food sector. As consumers increasingly prioritize organic and natural products, there is a growing demand for ingredients that align with these preferences. Tartaric acid, being a naturally derived organic acid, is well-positioned to meet this demand. According to the Organic Trade Association, organic food sales in the United States reached $62 billion in 2020, reflecting a 12.4% increase from the previous year. This trend is driving manufacturers to incorporate tartaric acid into organic food formulations, including baked goods, beverages, and sauces, to enhance their quality and appeal. The versatility of tartaric acid allows it to be used in various applications, making it an attractive ingredient for organic food producers. The companies can position themselves to meet the increasing demand for natural ingredients and expand their market presence. This emphasis on organic formulations is expected to significantly contribute to the growth of the tartaric acid market in North America.

Rising Demand for Functional Foods and Beverages

The rising demand for functional foods and beverages is ascribed to boost the growth of the North America tartaric acid market. There is a growing interest in products that offer additional health benefits beyond basic nutrition as consumers become more health conscious. Tartaric acid is recognized for its potential health benefits by including its role as an antioxidant and its ability to support digestive health. This trend is driving manufacturers to incorporate tartaric acid into functional food and beverage formulations that cater to health-conscious consumers. The versatility of tartaric acid allows it to be used in a variety of applications, including dietary supplements and health drinks by appealing to a wide range of consumer preferences.

MARKET CHALLENGES

Supply Chain Disruptions

One of the significant challenges facing the North America tartaric acid market is the potential for supply chain disruptions. The production of tartaric acid relies on key ingredients such as grapes, which can be affected by fluctuations in supply and demand. Additionally, the sourcing of grapes can be impacted by ethical and sustainability concerns is leading some consumers to seek alternatives. Manufacturers may face challenges in sourcing suitable substitutes that meet consumer expectations for taste and texture as the market shifts towards organic and health-conscious options. Addressing these supply chain challenges will be crucial for maintaining product availability and quality in the tartaric acid market.

Competition from Alternative Acidulants

Another challenge in the North America tartaric acid market is the increasing competition from alternative acidulants. The rise of health-conscious consumers has led to a surge in demand for various natural and plant-based alternatives, such as citric acid and malic acid, which can pose a challenge to the growth of the tartaric acid market. This trend is particularly pronounced among health-conscious consumers who are increasingly seeking snacks and beverages that align with their dietary preferences. The tartaric acid manufacturers must compete not only with other tartaric acid brands but also with a wide array of alternative acidulants that cater to evolving consumer preferences.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, End-Use, and Region. |

|

Various Analysis Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, Mexico and Rest of North America |

|

Market Leader Profiled |

Tarac Technologies, American Tartaric Products, and Cargill, Distillerie Mazzari S.p.A., AUSTRALIAN TARTARIC PRODUCTS, and The Tartaric Chemicals Corporation. |

SEGMENT ANALYSIS

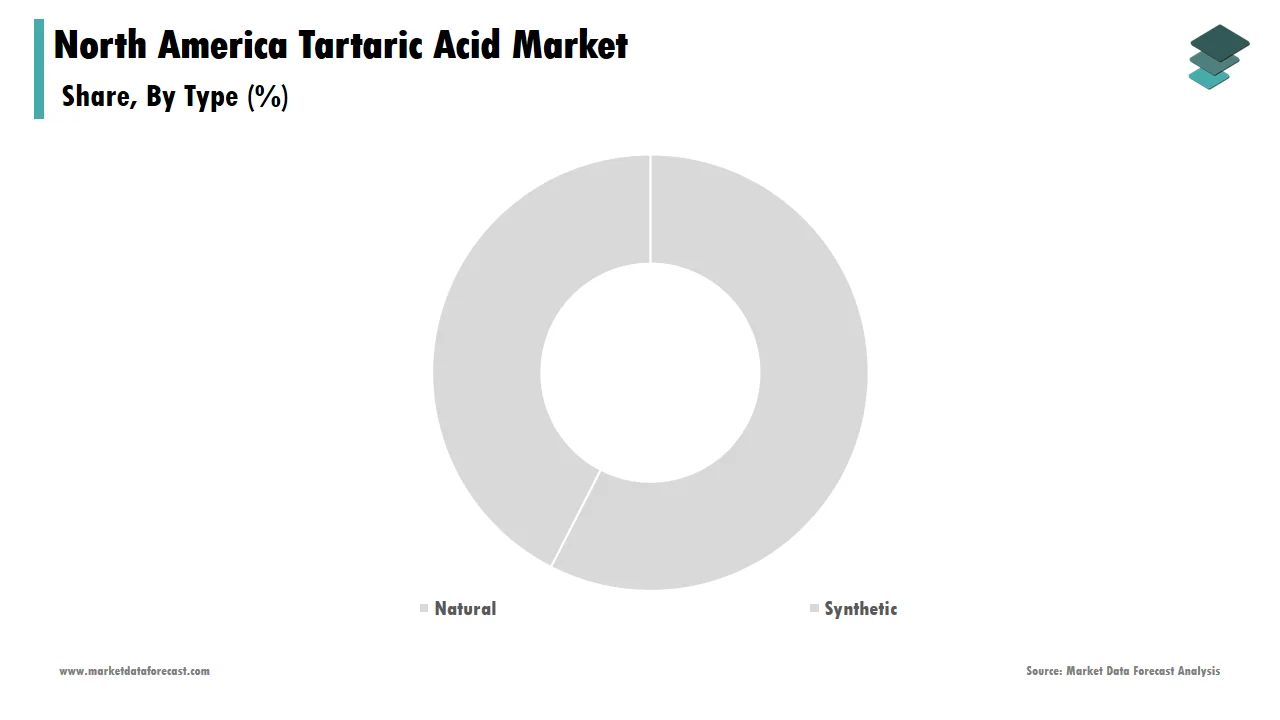

By Type Insights

The natural tartaric acid segment was the largest and held 60.2% of the North America tartaric acid market share in 2024. This dominance can be attributed to the increasing demand for natural ingredients in food and beverage applications, where consumers are increasingly seeking products that are free from synthetic additives. The rising trend of clean-label products and the demand for organic ingredients. The versatility of natural tartaric acid allows it to be used in various applications, including winemaking, baking, and confectionery by appealing to a wide range of consumer preferences. Additionally, the growing trend of sustainability and the increasing focus on health are enhancing the growth of this segment.

The synthetic tartaric acid segment is esteemed to achieve a CAGR of 7.3% in the next coming years. This segment's growth can be attributed to the increasing demand for cost-effective and consistent tartaric acid sources in various industrial applications. Synthetic tartaric acid is often favored in large-scale production due to its lower cost compared to natural sources by making it an attractive option for manufacturers looking to optimize their production processes. The demand for synthetic tartaric acid is on the rise is driven by its applications in food and beverages, pharmaceuticals, and cosmetics, where it serves as an acidulant and stabilizer. The versatility of synthetic tartaric acid allows it to be used in a variety of formulations by appealing to a broad range of consumer preferences. Additionally, the rise of industrial applications, such as in the production of biodegradable plastics and other materials, has further propelled the demand for synthetic tartaric acid.

By End-Use Insights

The food and beverages segment dominated the North America tartaric acid market share in 2024 owing to the widespread use of tartaric acid as a stabilizing agent, acidulant, and emulsifier in various food products, including baked goods, confectionery, and beverages. The increasing demand for natural and organic ingredients in food formulations. The versatility of tartaric acid allows it to enhance flavor profiles and improve the texture of food products by making it a valuable ingredient for manufacturers. Additionally, the growing trend of clean-label products and the increasing focus on sustainability are further solidifying the position of tartaric acid in the food and beverages market. As the demand for high-quality food products continues to rise, the food and beverages segment is expected to maintain its leading position in the North America tartaric acid market.

The pharmaceuticals segment is likely to register a CAGR of 6.5% from 2025 to 2033. This segment's growth can be attributed to the increasing use of tartaric acid in pharmaceutical formulations, where it serves as a stabilizing agent and excipient. The versatility of tartaric acid allows it to be used in various applications, including tablets, syrups, and injectable formulations by making it a popular choice among pharmaceutical manufacturers. Additionally, the rise of personalized medicine and the increasing focus on developing targeted drug delivery systems have further propelled the demand for tartaric acid in the pharmaceutical sector.

REGIONAL ANALYSIS

The United States dominated the North American tartaric acid market share of 80.4% in 2024. The U.S. market growth is driven by a robust demand for tartaric acid products with the increasing popularity of health-oriented food products. The rising trend of clean-label products and the demand for natural ingredients in food formulations. Additionally, the growing interest in organic and health-oriented tartaric acid options has led to increased innovation among manufacturers, further driving market growth. The popularity of tartaric acid in seasonal events, such as winemaking during harvest season, also contributes to its sustained demand. The manufacturers are focusing on clean-label formulations as consumer awareness of product quality and ingredient transparency continues to rise.

Canada tartaric acid market is deemed to exhibit a prominent CAGR of 5.4% during the forecast period. The Canadian market is experiencing a similar trend to that of the U.S., with an increasing number of consumers seeking tartaric acid products for their health benefits. The Canadian market is also witnessing a growing interest in tartaric acid as a stabilizing agent in food and beverage applications by reflecting the broader trend towards healthier eating habits. Manufacturers are responding by introducing innovative products that cater to these demands as consumers become more aware of dietary preferences and ingredient sourcing. The expansion of retail channels, including online shopping, is further enhancing the accessibility of tartaric acid products across Canada.

KEY MARKET PLAYERS

Tarac Technologies, American Tartaric Products, and Cargill, Distillerie Mazzari S.p.A., AUSTRALIAN TARTARIC PRODUCTS, and The Tartaric Chemicals Corporation, are key players in the North America tartaric acid market.

OVERVIEW OF KEY PLAYERS

The North America tartaric acid market is characterized by the presence of several key players who dominate the landscape. Notable companies include Tarac Technologies, which is recognized for its extensive range of tartaric acid products, and American Tartaric Products, a leading supplier of tartaric acid to the food and beverage industry. These companies leverage their extensive distribution networks and brand recognition to capture a significant share of the market. Additionally, smaller, niche players are emerging, focusing on innovative formulations and health-oriented products, such as organic and specialty tartaric acids. The competitive landscape is further intensified by the growing trend of e-commerce, as brands increasingly adopt online sales strategies to reach a broader audience.

MAJOR STRATEGIES USED BY KEY PLAYERS

Key players in the North America tartaric acid market employ various strategies to strengthen their market position and enhance competitiveness. One prominent strategy is product innovation, where companies continuously develop new formulations and applications for tartaric acid to cater to changing consumer preferences. For instance, introducing organic and specialty tartaric acid products has become a popular tactic to attract health-conscious consumers. Additionally, many manufacturers are focusing on sustainability initiatives, such as reducing packaging waste and sourcing ingredients responsibly, to appeal to environmentally aware consumers.

Another strategy involves expanding distribution channels, particularly through e-commerce platforms, to enhance product accessibility. Companies are increasingly partnering with online retailers to reach a wider audience and capitalize on the growing trend of online shopping. Furthermore, marketing campaigns that emphasize the nutritional benefits and versatility of tartaric acid in various culinary applications are being utilized to engage consumers and drive brand loyalty. Collaborations with food influencers and social media promotions are also becoming common practices to create buzz around new product launches.

COMPETITION OVERVIEW

The North America tartaric acid market is characterized by a competitive landscape that includes both established brands and emerging players. Major companies such as Tarac Technologies, American Tartaric Products, and Cargill dominate the market, leveraging their extensive distribution networks and brand recognition to capture significant market shares. These companies invest heavily in product innovation, focusing on new formulations and applications to meet the evolving preferences of health-conscious consumers. Additionally, the rise of niche brands specializing in organic and specialty tartaric acids has intensified competition, as these companies cater to a growing demographic seeking healthier alternatives. The increasing trend of e-commerce has further transformed the competitive landscape, with brands adopting online sales strategies to reach a broader audience. As consumer preferences continue to shift towards unique and health-oriented products, competition is expected to intensify, prompting manufacturers to differentiate themselves through quality, taste, and innovative marketing strategies. Overall, the North America tartaric acid market is poised for continued growth, driven by a dynamic competitive environment that encourages innovation and responsiveness to consumer trends.

MAJOR ACTIONS TAKEN BY COMPANIES

- In January 2023, Tarac Technologies launched a new line of organic tartaric acid, expanding its product portfolio to cater to the growing demand for health-conscious options. This initiative aims to enhance consumer accessibility to clean-label products.

- In March 2023, American Tartaric Products introduced a fortified tartaric acid product line, targeting the increasing interest in nutritional supplements among consumers.

- In May 2023, Cargill announced a partnership with a popular food influencer to promote its tartaric acid products through social media campaigns, aimed at increasing brand awareness and consumer engagement.

- In July 2023, Tarac Technologies expanded its distribution network by partnering with major grocery chains across North America, enhancing the availability of its tartaric acid products to a wider audience.

- In September 2023, American Tartaric Products launched a marketing campaign focused on educating consumers about the versatility of tartaric acid in cooking and baking, aiming to increase brand loyalty and consumer engagement.

- In November 2023, Cargill participated in a major food expo, showcasing its tartaric acid products and engaging with health-conscious consumers to promote brand awareness.

- In January 2024, Tarac Technologies introduced a new line of flavored tartaric acid options, capitalizing on the growing trend of gourmet products among consumers.

- In March 2024, American Tartaric Products announced the launch of a tartaric acid subscription service, allowing consumers to receive regular shipments of their favorite products, thereby enhancing customer convenience and loyalty.

- In April 2024, Cargill collaborated with a renowned chef to create a series of tartaric acid-based recipes, leveraging social media to reach a broader audience and drive interest in tartaric acid as a versatile ingredient.

- In June 2024, Tarac Technologies launched a limited-edition seasonal flavor of tartaric acid, aiming to attract consumers looking for unique and festive options during the holiday season.

MARKET SEGMENTATION

This research report on the North America tartaric acid market is segmented and sub-segmented into the following categories.

By Type

- Natural

- Synthetic

By End Use

- Natural

- Synthetic

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What is the projected growth of the North America tartaric acid market?

The North America tartaric acid market is expected to grow at a CAGR of 4.8% from 2025 to 2033.

2. Which industries drive demand in the North America tartaric acid market?

The market is driven by food and beverages, pharmaceuticals, and cosmetics industries.

3. What are the key challenges in the North America tartaric acid market?

Price volatility of raw materials and regulatory compliance are major challenges.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]