North America Sugar-free Chocolate Market Size, Share, Trends & Growth Forecast Report By Product Type (Milk Chocolate, Dark Chocolate, and White Chocolate), Distribution Channel (Supermarkets/ Hypermarkets, Convenience Stores, Specialty Stores, and Online Retail), and Country (United States, Canada, Mexico) Industry Analysis From 2025 to 2033.

North America Sugar-free Chocolate Market Size

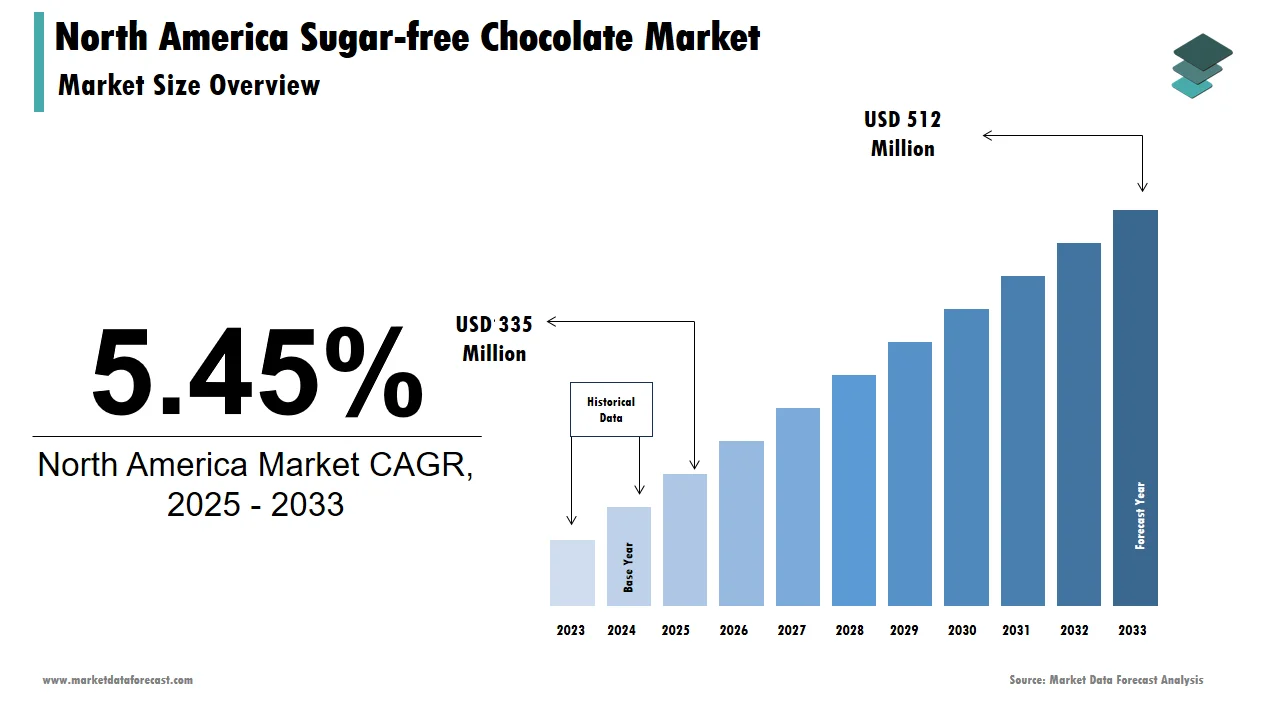

The size of the North America Sugar-free chocolate market was valued at USD 317.8 million in 2024. This market is expected to grow at a CAGR of 5.45% from 2025 to 2033 and be worth USD 512 million by 2033 from USD 335 million in 2025.

Sugar-free chocolate, which is made with sugar substitutes such as stevia, erythritol, and xylitol, is gaining popularity among health-conscious consumers who seek to indulge in chocolate without compromising on their dietary goals. This growth is driven by the rising awareness of the health benefits associated with sugar-free diets and the increasing demand for low-calorie food options. The North America Sugar-free chocolate market is poised for continued expansion, with manufacturers focusing on product innovation and sustainability to meet evolving consumer preferences for healthier and more natural food options.

MARKET DRIVERS

Increasing Demand for Low-Calorie Food Options

The North America Sugar-free chocolate market is significantly driven by the increasing demand for low-calorie food options. There is a growing preference for products that offer reduced sugar content without compromising on taste as consumers become more health-conscious. According to a survey conducted by the International Food Information Council, approximately 70% of consumers are actively trying to reduce their sugar intake, which has led to a surge in demand for sugar-free chocolate products. The versatility of sugar-free chocolate allows it to be used in various applications, including baking, cooking, and as a snack, appealing to a wide range of consumer preferences. Additionally, the growing trend of clean-label products and the increasing focus on sustainability are further solidifying the position of sugar-free chocolate in the market.

Growth in the Health and Wellness Industry

Another significant driver of the North America Sugar-free chocolate market is the growth in the health and wellness industry. The increasing awareness of the importance of nutrition and wellness has led to a surge in demand for products that offer health benefits. Sugar-free chocolate, which is often marketed as a healthier alternative to traditional chocolate, is gaining popularity among health-conscious consumers. According to a report by the Global Wellness Institute, the global wellness economy is projected to reach $4.5 trillion by 2025, which is indicating a robust growth trajectory for health-oriented products. This trend is driving manufacturers to innovate and develop sugar-free chocolate products that cater to the growing demographic of health-conscious consumers seeking healthier alternatives. The versatility of sugar-free chocolate allows it to be used in various applications, including dietary supplements and functional foods, appealing to a wide range of consumer preferences.

MARKET RESTRAINTS

High Production Costs

One of the primary restraints affecting the North America Sugar-free chocolate market is the high production costs associated with sugar-free chocolate. The use of sugar substitutes, such as stevia and erythritol, can be more expensive than traditional sugar, which can increase the production costs of sugar-free chocolate. The cost of sugar substitutes can be up to 50% higher than traditional sugar, which can make it challenging for manufacturers to maintain profitability. Additionally, the complexity of sugar-free chocolate production, which requires specialized equipment and expertise, can further increase production costs. This can make it challenging for manufacturers to offer competitive pricing, which can limit the growth of the sugar-free chocolate market.

Limited Availability of Sugar-Free Chocolate Products

Another significant restraint in the North America Sugar-free chocolate market is the limited availability of sugar-free chocolate products. While there is a growing demand for sugar-free chocolate, the availability of these products is still limited compared to traditional chocolate. The availability of sugar-free chocolate products is limited to specialty stores and online retailers, which can make it challenging for consumers to access these products. Additionally, the limited availability of sugar-free chocolate products can make it challenging for manufacturers to reach a wider audience that can limit the growth of the market.

MARKET OPPORTUNITIES

Expansion into New Distribution Channels

The North America Sugar-free chocolate market presents significant opportunities for growth through the expansion into new distribution channels. The manufacturers are exploring new distribution channels to reach a wider audience as the demand for sugar-free chocolate continues to rise. The expansion into online retail can provide manufacturers with a wider reach and increased visibility, which can help to drive growth in the sugar-free chocolate market.

Increasing Demand for Premium and Artisanal Sugar-Free Chocolate

Another major opportunity in the North America Sugar-free chocolate market lies in the increasing demand for premium and artisanal sugar-free chocolate. There is a growing demand for high-quality and premium sugar-free chocolate products that offer unique flavors and textures as consumers become more health-conscious. The versatility of sugar-free chocolate allows it to be used in various applications, including baking, cooking, and as a snack, appealing to a wide range of consumer preferences. The manufacturers can attract a diverse consumer base and capitalize on the increasing trend towards healthier eating habits by focusing on premium and artisanal sugar-free chocolate products.

MARKET CHALLENGES

Competition from Alternative Sweeteners

One of the significant challenges facing the North America Sugar-free chocolate market is the competition from alternative sweeteners. The rise of alternative sweeteners, such as honey, maple syrup, and coconut sugar, can pose a challenge to the growth of the sugar-free chocolate market. The increasing trend of natural and organic food products is ascribed to fuel the growth of the market. This can make it challenging for sugar-free chocolate manufacturers to compete with alternative sweeteners, which can limit the growth of the market.

Regulatory Challenges and Compliance

Another challenge in the North America Sugar-free chocolate market is the regulatory challenges and compliance requirements imposed by government agencies. The production and sale of sugar-free chocolate are subject to stringent regulations regarding food safety, labeling, and quality assurance. According to the U.S. Food and Drug Administration, manufacturers must adhere to specific guidelines to ensure the safety and quality of sugar-free chocolate products. This regulatory landscape can pose challenges for sugar-free chocolate producers for smaller companies that may lack the resources to meet compliance requirements. Additionally, the lack of standardized definitions for terms such as "natural" or "organic" can create confusion among consumers and complicate marketing efforts. Companies must invest time and resources to ensure compliance with regulations while effectively communicating their product benefits to consumers. Failure to meet regulatory standards can result in product recalls, legal issues, and damage to brand reputation.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product Type, Distribution Channel, and Region. |

|

Various Analysis Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, Mexico and Rest of North America |

|

Market Leader Profiled |

The Hershey Company (U.S.), Ferrero SpA (Italy), Russell, Chocoladefabriken Lindt & Sprüngli AG (Switzerland), Godiva Chocolatier (U.S.), KOHLER Co. (U.S.), Jackie’s Chocolate (U.S.), Pascha Chocolate (Canada), Pobeda Confectionery Ltd. (Russia), Asher's Chocolate Company (U.S.), and Barry Callebaut AG (Switzerland). |

SEGMENTAL ANALYSIS

By Product Type Insights

The dark chocolate segment was the largest and held 50.4% of the North America Sugar-free chocolate market share in 2024. This dominance can be attributed to the increasing demand for dark chocolate, which is often perceived as a healthier alternative to milk chocolate. The increasing trend of health-conscious eating and the growing demand for low-calorie food options are majorly driving the growth of the market. The versatility of dark chocolate allows it to be used in various applications, including baking, cooking, and as a snack, appealing to a wide range of consumer preferences. Additionally, the growing trend of clean-label products and the increasing focus on sustainability are further solidifying the position of dark chocolate in the market.

The milk chocolate segment is lucratively growing with a projected CAGR of 9.4% during the forecast period. This segment's growth can be attributed to the increasing demand for milk chocolate, which is often perceived as a more indulgent and creamier alternative to dark chocolate. The increasing trend of gourmet and artisanal food products is quietly enhancing the growth of the market. The versatility of milk chocolate allows it to be used in various applications, including baking, cooking, and as a snack, appealing to a wide range of consumer preferences. Additionally, the growing trend of premium and artisanal sugar-free chocolate products has further propelled the demand for milk chocolate, as consumers seek high-quality and unique flavors.

By Distribution Channel Insights

The supermarkets and hypermarkets segment was accounted in occupying a dominant share of the North America Sugar-free chocolate market in 2024. This dominance is primarily due to the extensive reach and convenience offered by these retail formats, which provide consumers with easy access to a wide variety of sugar-free chocolate products. The increasing trend of one-stop shopping among consumers is also elevating the growth of the market. The ability to find sugar-free chocolate alongside other grocery items enhances the shopping experience by making supermarkets and hypermarkets a preferred choice for consumers. Additionally, promotional activities and in-store displays further boost the visibility of sugar-free chocolate products by contributing to their sustained popularity in this distribution channel. The growing trend of health-conscious eating has also led supermarkets and hypermarkets to expand their offerings of sugar-free options by catering to the increasing demand for healthier snacks and treats.

The online stores segment is estimated to achieve a CAGR of 10.6% during the forecast period. The surge in e-commerce has transformed the way consumers shop for food products, with many opting for the convenience of online purchasing. The online retail segment allows consumers to explore a wider range of sugar-free chocolate products by including specialty and gourmet options that may not be available in physical stores. Additionally, the COVID-19 pandemic has accelerated the shift towards online shopping, as consumers seek to minimize in-store visits. The convenience of home delivery and the ability to compare products easily have made online shopping increasingly appealing.

REGIONAL ANALYSIS

The United States was the top performer in the North American sugar-free chocolate market with an estimated share of 83.1% in 2024. The U.S. market is characterized by a robust demand for sugar-free chocolate products owing to the increasing popularity of health-oriented food options. According to the American Heart Association, the prevalence of diabetes and obesity has led to a growing trend of consumers seeking sugar-free alternatives. The U.S. market benefits from a well-established retail infrastructure, with a wide range of sugar-free chocolate products available in supermarkets, specialty stores, and online platforms. Additionally, the growing interest in organic and health-oriented sugar-free chocolate options has led to increased innovation among manufacturers, further driving market growth.

Canada is expected to exhibit a CAGR of 7.3% during the forecast period in the North American sugar-free chocolate. The Canadian market is experiencing a similar trend to that of the U.S., with an increasing number of consumers seeking sugar-free chocolate products for their health benefits. The rising popularity of natural and organic food products. The growing interest in sugar-free chocolate as a convenient source of indulgence is reflecting the broader trend towards healthier eating habits that shall fuel the growth of the market. Manufacturers are responding by introducing innovative products that cater to these demands as consumers become more aware of dietary preferences and ingredient sourcing. The expansion of retail channels, including online shopping, is further enhancing the accessibility of sugar-free chocolate products across Canada.

KEY MARKET PLAYERS

The Hershey Company (U.S.), Ferrero SpA (Italy), Russell, Chocoladefabriken Lindt & Sprüngli AG (Switzerland), Godiva Chocolatier (U.S.), KOHLER Co. (U.S.), Jackie’s Chocolate (U.S.), Pascha Chocolate (Canada), Pobeda Confectionery Ltd. (Russia), Asher's Chocolate Company (U.S.), and Barry Callebaut AG (Switzerland) are key players in the North America Sugar-free chocolate market.

OVERVIEW OF KEY PLAYERS

The North America sugar-free chocolate market is characterized by the presence of several key players who dominate the landscape. Notable companies include Hershey's, which has expanded its product line to include sugar-free options, and Russell Stover, known for its wide range of sugar-free chocolates. These companies leverage their extensive distribution networks and brand recognition to capture a significant share of the market. Additionally, smaller, niche players are emerging, focusing on innovative formulations and health-oriented products, such as organic and specialty sugar-free chocolates. The competitive landscape is further intensified by the growing trend of e-commerce, as brands increasingly adopt online sales strategies to reach a broader audience.

MAJOR STRATEGIES USED BY KEY PLAYERS

Key players in the North America sugar-free chocolate market employ various strategies to strengthen their market position and enhance competitiveness. One prominent strategy is product innovation, where companies continuously develop new formulations and flavors to cater to changing consumer preferences. For instance, introducing new flavors and textures in sugar-free chocolate has become a popular tactic to attract health-conscious consumers. Additionally, many manufacturers are focusing on sustainability initiatives, such as reducing packaging waste and sourcing ingredients responsibly to appeal to environmentally aware consumers.

Another strategy involves expanding distribution channels, particularly through e-commerce platforms, to enhance product accessibility. Companies are increasingly partnering with online retailers to reach a wider audience and capitalize on the growing trend of online shopping. Furthermore, marketing campaigns that emphasize the nutritional benefits and versatility of sugar-free chocolate in various culinary applications are being utilized to engage consumers and drive brand loyalty. Collaborations with food influencers and social media promotions are also becoming common practices to create buzz around new product launches.

COMPETITION OVERVIEW

The North America sugar-free chocolate market is characterized by a competitive landscape that includes both established brands and emerging players. Major companies such as Hershey's, Russell Stover, and Lindt dominate the market, leveraging their extensive distribution networks and brand recognition to capture significant market shares. These companies invest heavily in product innovation, focusing on new formulations and flavors to meet the evolving preferences of health-conscious consumers. Additionally, the rise of niche brands specializing in organic and specialty sugar-free chocolates has intensified competition, as these companies cater to a growing demographic seeking healthier alternatives. The increasing trend of e-commerce has further transformed the competitive landscape, with brands adopting online sales strategies to reach a broader audience. As consumer preferences continue to shift towards unique and health-oriented products, competition is expected to intensify, prompting manufacturers to differentiate themselves through quality, taste, and innovative marketing strategies. Overall, the North America sugar-free chocolate market is poised for continued growth, driven by a dynamic competitive environment that encourages innovation and responsiveness to consumer trends.

MAJOR ACTIONS TAKEN BY COMPANIES

- In January 2023, Hershey's launched a new line of sugar-free chocolate bars, expanding its product portfolio to cater to the growing demand for health-conscious options. This initiative aims to enhance consumer accessibility to clean-label products.

- In March 2023, Russell Stover introduced a new range of sugar-free chocolate candies, targeting the increasing interest in healthier confectionery options among consumers.

- In May 2023, Lindt announced a partnership with a popular health influencer to promote its sugar-free chocolate products through social media campaigns, aimed at increasing brand awareness and consumer engagement.

- In July 2023, Hershey's expanded its distribution network by partnering with major grocery chains across North America, enhancing the availability of its sugar-free chocolate products to a wider audience.

- In September 2023, Russell Stover launched a marketing campaign focused on educating consumers about the versatility of sugar-free chocolate in baking and cooking, aiming to increase brand loyalty and consumer engagement.

- In November 2023, Lindt participated in a major health expo, showcasing its sugar-free chocolate products and engaging with health-conscious consumers to promote brand awareness.

- In January 2024, Hershey's introduced a new line of flavored sugar-free chocolate options, capitalizing on the growing trend of gourmet products among consumers.

- In March 2024, Russell Stover announced the launch of a sugar-free chocolate subscription service, allowing consumers to receive regular shipments of their favorite products, thereby enhancing customer convenience and loyalty.

- In April 2024, Lindt collaborated with a renowned chef to create a series of sugar-free chocolate-based recipes, leveraging social media to reach a broader audience and drive interest in sugar-free chocolate as a versatile ingredient.

- In June 2024, Hershey's launched a limited-edition seasonal flavor of sugar-free chocolate, aiming to attract consumers looking for unique and festive options during the holiday season.

These strategic actions reflect the dynamic nature of the North America sugar-free chocolate market, as companies continuously adapt to consumer trends and preferences to strengthen their market presence.

MARKET SEGMENTATION

This research report on the North America Sugar-free chocolate market is segmented and sub-segmented into the following categories.

By Product Type

- Milk Chocolate

- Dark Chocolate

- White Chocolate

By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Retail

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

2. What factors are driving the growth of the North America sugar-free chocolate market?

Increasing demand for low-calorie food options, rising health consciousness, and product innovations are key growth drivers.

1. What is the expected CAGR of the North America sugar-free chocolate market?

The North America sugar-free chocolate market is projected to grow at a CAGR of 5.45% from 2025 to 2033.

3. Which product type holds the largest share in the North America sugar-free chocolate market?

Dark chocolate leads the market, accounting for 50.4% of the share in 2024.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]