North America Steel Roofing Market Size, Share, Trends & Growth Forecast Report By Product (Color coated roofing sheets, Profile Sheets, Galvanized Sheets, Curving Sheets, Tile roof sheets, Louvers, Roof Ventilators, C & Z purlins, Others), End Use, And Country (US, Canada, And Rest Of North America), Industry Analysis From 2025 To 2033

North America Steel Roofing Market Size

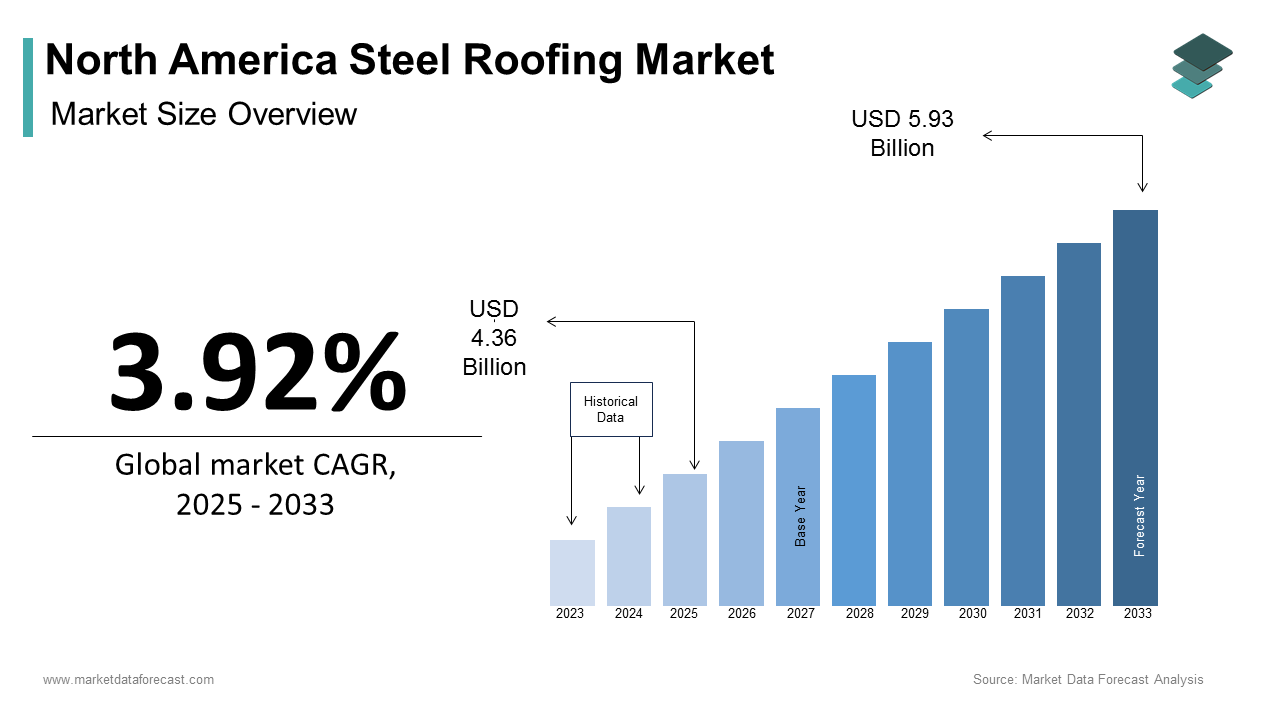

The North America Steel Roofing Market size was calculated to be USD 4.20 billion in 2024 and is anticipated to be worth USD 5.93 billion by 2033, from USD 4.36 billion in 2025, growing at a CAGR of 3.92% during the forecast period.

MARKET DRIVERS

Rising Demand for Energy-Efficient Solutions

The growing emphasis on energy efficiency has significantly propelled the demand for steel roofing, particularly in residential and commercial sectors. Steel roofing offers superior thermal performance by reflecting up to 70% of solar energy, which reduces cooling costs by an average of 20%, as per the Cool Roof Rating Council. Additionally, advancements in reflective coatings, such as cool roofs, have enhanced their appeal in regions with high temperatures, like Texas and Arizona. Regulatory mandates, such as California’s Title 24 Energy Efficiency Standards, have further incentivized the adoption of energy-efficient roofing materials.

Increasing Investments in Infrastructure Development

Infrastructure development initiatives across North America have created a robust demand for durable and long-lasting roofing materials, with steel roofing emerging as a preferred choice. According to the American Society of Civil Engineers (ASCE), the U.S. government allocated $1.2 trillion under the Infrastructure Investment and Jobs Act in 2021, targeting improvements in transportation, schools, and public facilities. Steel roofing’s resistance to extreme weather conditions, fire, and corrosion makes it ideal for such projects. For instance, galvanized steel sheets are widely used in industrial applications due to their longevity and minimal maintenance requirements. Furthermore, Canada’s National Housing Strategy, which aims to build 100,000 affordable housing units by 2030, has amplified the demand for cost-effective yet durable roofing solutions. These investments and policy initiatives ensure sustained growth for the steel roofing market.

MARKET RESTRAINTS

Volatility in Raw Material Costs

The production of steel roofing heavily relies on raw materials such as iron ore, aluminum, and zinc, which are subject to price volatility. These fluctuations create uncertainty for manufacturers, who often struggle to maintain competitive pricing without compromising profit margins. Additionally, geopolitical tensions and trade restrictions have disrupted the availability of critical inputs, exacerbating the issue. For example, tariffs imposed on imported steel from Asia-Pacific countries have impacted North American producers reliant on cost-effective materials. Such economic pressures hinder market expansion for smaller players with limited financial resilience.

Competition from Alternative Roofing Materials

Steel roofing faces significant competition from alternative materials such as asphalt shingles and concrete tiles in the residential segment. According to the National Roofing Contractors Association, asphalt shingles dominate the U.S. roofing market by accounting for over 70% of installations due to their lower upfront costs. This affordability poses a challenge for steel roofing, which typically requires higher initial investment despite offering long-term savings. Additionally, aesthetic preferences play a role, as homeowners often perceive traditional materials as more visually appealing. While innovations in color coatings and design have broadened steel roofing’s application scope, overcoming consumer biases remains a persistent challenge.

MARKET OPPORTUNITIES

Growing Adoption of Sustainable Construction Practices

Sustainability initiatives present a significant opportunity for the steel roofing market owing to the increasing consumer awareness and regulatory mandates. According to the U.S. Green Building Council, over 60% of new commercial buildings incorporate sustainable materials by creating demand for recyclable and energy-efficient roofing solutions. Steel roofing, which is 100% recyclable, aligns with these trends by offering a lifecycle advantage over traditional materials. Innovations in cool roof technologies, such as reflective coatings, have further expanded its application scope. For instance, the Cool Roof Rating Council reports that reflective steel roofing can reduce urban heat island effects by up to 30%. Additionally, corporate sustainability goals, such as Walmart’s commitment to achieving zero waste by 2025, have incentivized suppliers to adopt eco-friendly materials.

Expansion into Emerging Applications

The steel roofing is finding applications in emerging sectors such as modular housing and renewable energy installations. Steel roofing’s durability and lightweight properties make it ideal for modular structures by ensuring structural integrity and ease of installation. Similarly, the solar energy sector presents untapped potential, with photovoltaic panels increasingly integrated into steel roofing systems.

MARKET CHALLENGES

Stringent Environmental Regulations

Environmental regulations, while fostering sustainable practices, impose significant compliance costs on steel roofing manufacturers. The EPA mandates strict emission controls during steel production, requiring substantial investments in advanced technologies and infrastructure. According to the National Association of Manufacturers, compliance costs for steel producers rose by 12% annually over the past five years, impacting profitability. Additionally, water usage regulations have tightened, with states like California imposing limits on industrial water consumption. These measures, though essential for environmental preservation, increase operational complexities and reduce production efficiency. Furthermore, public scrutiny of manufacturing practices has intensified by leading to stricter enforcement of safety standards.

Intense Market Competition

The steel roofing market faces intense competition with the presence of numerous established players and new entrants. Price wars and aggressive marketing strategies have eroded profit margins, compelling smaller firms to innovate or exit the market. Furthermore, the influx of low-cost imports from Asia-Pacific countries, where production costs are significantly lower, has added pressure on domestic manufacturers. According to the International Trade Administration, steel roofing imports into North America increased by 15% in 2023 with the competitive threat.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.92% |

|

Segments Covered |

By Product, Application, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

Us, Canada, And Rest of North America |

|

Market Leaders Profiled |

CertainTeed, Metal Sales Manufacturing Corporation, ATAS International, ABC Supply Co., Drexel Metals, McElroy Metal, Firestone Building Products, Owens Corning, Tamko Building Products, BlueScope Steel |

SEGMENTAL ANALYSIS

By Product Type Insights

The color-coated roofing sheets segment dominated the North American steel roofing market with 30.5% of share in 2024. Their widespread adoption is attributed to their aesthetic appeal, durability, and energy efficiency by making them ideal for both residential and commercial applications. The surge in demand for cool roofs, which reflect up to 70% of solar energy, has further amplified their popularity. Additionally, innovations in coating technologies, such as anti-corrosive and UV-resistant finishes, have extended their lifespan and application scope.

The tile roof sheets segment is likely to register a CAGR of of 9.5% during the forecast period with their increasing use in residential applications in regions with Mediterranean and tropical climates. The aesthetic resemblance to traditional clay tiles, combined with superior durability and lighter weight, has broadened their appeal. Additionally, advancements in embossing and coating technologies have enhanced their visual appeal and functionality by catering to evolving consumer preferences.

By Application Insights

The residential segment led the North America steel roofing market with a share of 45.3% in 2024. The growth of the segment is underpinned by the growing adoption of steel roofing in single-family homes and multifamily housing projects. Homeowners are increasingly prioritizing durability and energy efficiency by driving demand for products like color-coated sheets and tile roof sheets. For instance, the Cool Roof Rating Council reports that steel roofing reduces cooling costs by up to 20% by making it an attractive option for homeowners.

The industrial segment is esteemed to register a CAGR of 10.2% in the next coming years. This acceleration is fueled by infrastructure development initiatives, which rely heavily on durable and long-lasting roofing solutions. Steel roofing’s resistance to extreme weather conditions, fire, and corrosion makes it ideal for industrial applications. Additionally, innovations in purlin systems, such as C & Z purlins, have enhanced structural integrity and ease of installation, catering to evolving industry demands.

REGIONAL ANALYSIS

The United States dominated the North American steel roofing market with a 65.6% of share in 2024 due to the robust construction industry, which benefits from strong infrastructure development initiatives and increasing consumer preferences for sustainable building materials. According to the Cool Roof Rating Council, steel roofing reduces cooling costs by up to 20%, making it particularly appealing in regions like Texas and Arizona, where high temperatures drive energy consumption. Additionally, regulatory mandates promoting green building practices, such as California’s Title 24 Energy Efficiency Standards, have incentivized the adoption of reflective coatings and recyclable materials. Innovations in design aesthetics, such as color-coated sheets and tile roof sheets that have further broadened its appeal among homeowners and architects.

Canada held 25.4% to the North America steel roofing market share in 2024. The country’s expertise in cold-climate construction and robust steel manufacturing sector position it as a key player. Regions like Quebec and British Columbia are major production hubs by leveraging advanced manufacturing technologies to produce high-quality steel roofing products. For example, Canadian producers specialize in galvanized steel sheets and C & Z purlins, which are widely used in industrial applications due to their resistance to extreme weather conditions. According to the Canadian Construction Association, the demand for steel roofing in the residential sector grew by 8% annually between 2020 and 2023, driven by increasing investments in affordable housing projects under Canada’s National Housing Strategy. Additionally, sustainability initiatives, such as the government’s commitment to achieving net-zero emissions by 2050, have bolstered the adoption of eco-friendly roofing solutions.

LEADING PLAYERS IN THE NORTH AMERICA STEEL ROOFING MARKET

Nucor Corporation

Nucor Corporation specializes in producing high-quality galvanized steel sheets and color-coated roofing products, which are critical for both residential and industrial applications. Its strategic partnerships with key industries, such as modular housing developers and solar energy providers, ensure steady demand. Additionally, Nucor’s investments in R&D have led to the development of specialized formulations tailored to specific applications will enhance the company’s position in the marketplace.

Owens Corning

Owens Corning is specializing in innovative roofing solutions. The company’s focus on customization and functionality has strengthened its competitive edge, particularly in the residential and commercial sectors. Owens Corning’s production facilities are equipped with advanced embossing and coating technologies by enabling the development of aesthetically pleasing and durable steel roofing products. In 2023, the company acquired a Canadian steel roofing plant by expanding its capacity to meet rising demand. Owens Corning’s emphasis on sustainability is reflected in its proprietary technologies, which minimize waste generation and enhance operational efficiency. Furthermore, its strategic alliances with end-users, such as architects and contractors, have diversified its revenue streams.

GAF Materials Corporation

GAF Materials Corporation’s strategic partnerships with key industries, such as renewable energy providers and modular housing developers to ensure steady demand. According to the Solar Energy Industries Association, GAF’s integration of photovoltaic panels into steel roofing systems has positioned it as a leader in the renewable energy segment. The company’s commitment to sustainability is evident in its Green Roofing Solutions program, launched in January 2023, which reduces greenhouse gas emissions by 30%. Additionally, GAF’s investments in green technologies, such as cool roof coatings, have enhanced production efficiency.

TOP STRATEGIES USED BY KEY PLAYERS

Key players in the North American steel roofing market employ a range of strategies to strengthen their market position and capitalize on emerging opportunities. One prominent strategy is mergers and acquisitions, which enable companies to expand their production capacities and geographic reach. For instance, Owens Corning’s acquisition of a Canadian steel roofing plant in June 2023 enhanced its market presence and operational capabilities. Another critical strategy is technological innovation, with companies investing heavily in R&D to develop advanced formulations and production methods. Nucor Corporation’s Vision 2030 program exemplifies this approach, focusing on sustainability and cost optimization. Strategic partnerships with end-users, such as solar energy providers and modular housing developers, are also prevalent by ensuring steady demand and fostering long-term relationships. Additionally, companies emphasize compliance with stringent environmental regulations by adopting cleaner technologies and reducing carbon footprints. These strategies collectively enable key players to navigate market challenges and maintain a competitive edge.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players of the North America steel roofing market include CertainTeed, Metal Sales Manufacturing Corporation, ATAS International, ABC Supply Co., Drexel Metals, McElroy Metal, Firestone Building Products, Owens Corning, Tamko Building Products, BlueScope Steel

The North American steel roofing market is highly competitive, characterized by the presence of established players and new entrants vying for market share. Intense rivalry drives innovation and cost optimization, with companies striving to differentiate themselves through advanced technologies and sustainable practices. Price wars and aggressive marketing strategies have eroded profit margins, compelling smaller firms to innovate or exit the market. Additionally, the influx of low-cost imports from Asia-Pacific countries, where production costs are significantly lower, poses a significant threat to domestic manufacturers. Regulatory mandates promoting sustainable practices further shape strategic priorities, as companies invest in eco-friendly solutions to align with consumer preferences.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Nucor Corporation launched a line of energy-efficient roofing sheets designed to reduce cooling costs by up to 20%. This initiative aligns with global sustainability trends and appeals to environmentally conscious consumers by reinforcing the company’s dominance in eco-friendly solutions.

- In June 2023, Owens Corning acquired a Canadian steel roofing plant to expand its production capacity. The acquisition strengthens its market presence and enables the company to meet rising demand in North America in the residential and commercial sectors.

- In January 2023, GAF Materials Corporation introduced anti-corrosive coatings tailored for industrial applications. This innovation addresses the need for durable roofing solutions in harsh climates and positions GAF as a key supplier in the industrial segment.

- In September 2022, CertainTeed invested $50 million in R&D for tile roof sheets used in residential applications. The investment enhances product performance and broadens its application scope by catering to evolving consumer preferences for aesthetic and functional roofing solutions.

- In March 2022, Drexel Metals partnered with a leading solar energy provider to integrate photovoltaic panels into its steel roofing systems. This collaboration focuses on advancing renewable energy solutions by ensuring compatibility with modern sustainability goals and meeting consumer demands for eco-friendly options.

MARKET SEGMENTATION

This research report on the North America steel roofing market has been segmented and sub-segmented based on product, application, and region.

By Product

- Color coated roofing sheets

- Profile Sheets

- Galvanized Sheets

- Curving Sheets

- Tile roof sheets

- Louvers

- Roof Ventilators

- C & Z purlins

- Others

By Application

- Residential

- Commercial

- Industrial

By Region

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What is driving the demand for steel roofing in North America?

Growing demand is driven by durability, energy efficiency, fire resistance, and increasing preference for sustainable and long-lasting roofing materials.

2. Who are the key players in the North America steel roofing market?

Major players include CertainTeed, Metal Sales Manufacturing Corporation, ATAS International, Drexel Metals, and McElroy Metal.

3. How do steel roofing systems contribute to energy efficiency?

Steel roofs reflect solar heat, which helps reduce cooling costs in warmer climates, and some systems are compatible with solar panel installations.

4. Which factors are driving the growth of the steel roofing market in North America?

Growth is driven by increased demand for durable, energy-efficient, and fire-resistant roofing materials, as well as rising investments in residential and commercial construction.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]