North America Specialty Paper Market Size, Share, Trends & Growth Forecast Report By Type (Kraft paper, Container Board/Paper Board, Label Papers, Silicon-based papers), Application, And Country (US, Canada, And Rest Of North America), Industry Analysis From 2025 To 2033

North America Specialty Paper Market Size

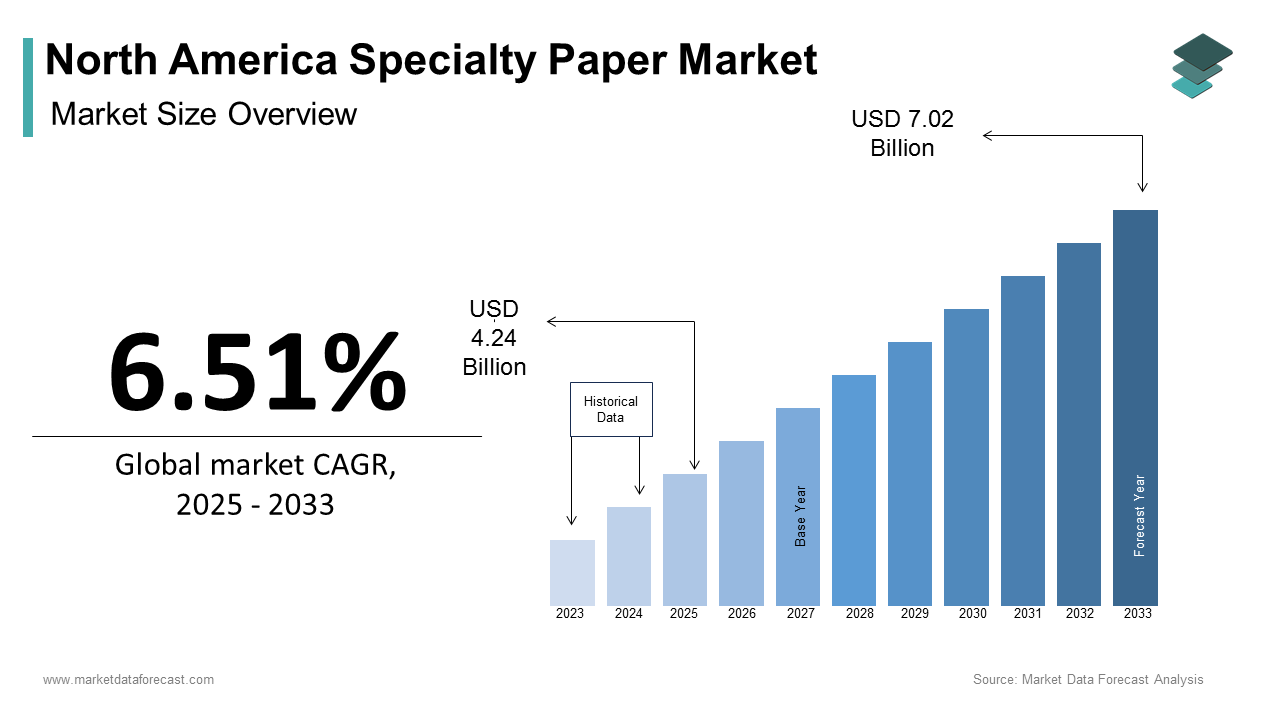

The North America specialty paper market size was calculated to be USD 3.98 billion in 2024 and is anticipated to be worth USD 7.02 billion by 2033, from USD 4.24 billion in 2025, growing at a CAGR of 6.51% during the forecast period.

The North American specialty paper market has emerged as a critical segment within the broader paper industry which is driven by its diverse applications across sectors such as packaging, labelling, and food service. Also, the region’s robust industrial base along with increasing consumer preferences for sustainable and recyclable materials has bolstered the adoption of specialty papers. For instance, the U.S. Environmental Protection Agency (EPA) reported that over 68% of paper consumed in the U.S. is recycled, creating opportunities for eco-friendly specialty paper products. Canada is another key contributor to the market and benefits from its abundant forestry resources, enabling cost-effective production. However, challenges such as fluctuating raw material costs and competition from digital alternatives persist.

MARKET DRIVERS

Surge in E-commerce Packaging Demand

The exponential growth of e-commerce has significantly propelled the demand for specialty papers, particularly in the packaging sector. As per data from the U.S. Census Bureau, e-commerce sales in North America crossed $1 trillion in 2024, representing a 8.1% increase from 2023. This surge has created a parallel demand for durable, lightweight, and customizable packaging materials, with specialty papers like kraft paper and container board gaining prominence. Kraft paper, known for its strength and recyclability, accounts for a notable portion of specialty paper consumption in the packaging segment. Additionally, stringent regulations promoting sustainable packaging, such as California’s Plastic Pollution Prevention Act, have incentivized companies to adopt paper-based alternatives. Specialty papers offer unique advantages, including enhanced printability and barrier properties, making them ideal for branding and product protection.

Rising Demand for Label Papers in Food and Beverage Industries

Label papers represent another significant driver of the specialty paper market and is fueled by the expanding food and beverage sector. This growth has amplified the need for high-quality label papers used in packaging, branding, and regulatory compliance. Specialty label papers, such as those with silicon coatings, are increasingly preferred due to their ability to withstand moisture, heat, and abrasion, ensuring product integrity. For instance, silicon-based label papers makes up a significant share of the total label paper market. Furthermore, consumer demand for transparency and traceability in food products has necessitated advanced labeling solutions, driving innovation in this segment.

MARKET RESTRAINTS

Volatility in Raw Material Costs

The production of specialty papers heavily relies on raw materials such as pulp and chemical coatings, which are subject to price volatility. According to the U.S. Department of Agriculture, wood pulp prices increased notably in 2023 due to supply chain disruptions and rising energy costs. Similarly, the cost of specialty coatings, such as silicone and polyethylene, also surged. These fluctuations create uncertainty for manufacturers, who often struggle to maintain competitive pricing without compromising profit margins. Besides, geopolitical tensions and trade restrictions have disrupted the availability of critical inputs, exacerbating the issue. For example, China’s export tariffs on specialty chemicals have impacted North American producers reliant on imported materials. Such economic pressures hinder market expansion, particularly for smaller players with limited financial resilience. Addressing these challenges requires strategic investments in alternative sourcing and innovative production methods.

Competition from Digital Alternatives

The rise of digital technologies poses a significant threat to the specialty paper market, particularly in segments like printing and publication. Like, the demand for printed materials declined between 2020 and 2023, as businesses increasingly transition to digital platforms for communication and marketing. This shift has reduced the reliance on specialty papers traditionally used in brochures, catalogs, and magazines. Furthermore, advancements in digital labeling and packaging technologies, such as QR codes and augmented reality, offer cost-effective alternatives to traditional label papers. For instance, the adoption of digital labels in the retail sector grew in recent years. While specialty papers remain essential for certain applications, the encroachment of digital solutions limits growth potential in specific end-user industries, requiring companies to innovate and diversify their offerings.

MARKET OPPORTUNITIES

Growing Adoption of Sustainable Solutions

Sustainability initiatives present a significant opportunity for the specialty paper market that is driven by increasing consumer awareness and regulatory mandates. Likewise, a large percentage of consumers prefer products with eco-friendly packaging, creating demand for specialty papers made from recycled materials. Innovations in biodegradable coatings and plant-based fibers have further expanded the application scope of specialty papers. For instance, the development of cellulose-based barrier papers has enabled their use in food packaging, replacing single-use plastics. Apart from these, corporate sustainability goals such as Walmart’s commitment to achieving zero waste by 2025 have incentivized suppliers to adopt environmentally friendly materials.

Expansion into Emerging Applications

Beyond traditional uses, specialty papers are finding applications in emerging sectors such as healthcare and electronics. Also, the demand for antimicrobial-coated papers used in medical packaging elevated in the last few years, supported by heightened hygiene standards post-pandemic. Similarly, specialty papers with conductive coatings are gaining traction in the electronics industry for applications like flexible circuits and sensors. These innovations highlight the versatility of specialty papers and their ability to cater to niche markets.

MARKET CHALLENGES

Stringent Environmental Regulations

Environmental regulations, while fostering sustainable practices, impose significant compliance costs on specialty paper manufacturers. The EPA mandates strict emission controls and waste management protocols, requiring substantial investments in advanced technologies and infrastructure. Besides, water usage regulations have tightened, with states like California imposing limits on industrial water consumption. These measures, though essential for environmental preservation, increase operational complexities and reduce production efficiency. Furthermore, public scrutiny of manufacturing practices has intensified, leading to stricter enforcement of safety standards. While these regulations ensure responsible production, they also act as barriers to entry for new players and constrain existing operators’ ability to expand capacity.

Intense Market Competition

The specialty paper market faces intense competition, driven by the presence of numerous established players and new entrants. Similarly, the top five producers account for a major portion of the market share, intensifying rivalry among key stakeholders. Price wars and aggressive marketing strategies have eroded profit margins, compelling smaller firms to innovate or exit the market. Furthermore, the influx of low-cost imports from Asia-Pacific countries, where production costs are significantly lower, has added pressure on domestic manufacturers. However, limited access to funding and intellectual property constraints often hinder innovation efforts, making it challenging to sustain long-term growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.51% |

|

Segments Covered |

By Type, End Use, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

Us, Canada, And Rest Of North America |

|

Market Leaders Profiled |

Domtar Corporation, Glatfelter, International Paper, Mondi Group, Nippon Paper Industries Co. Ltd., Stora Enso, UPM-Kymmene Corporation, Sappi Limited, Twin Rivers Paper Company, WestRock Company |

SEGMENTAL ANALYSIS

By Type Insights

The segment of kraft paper dominated the North American specialty paper market by commanding a 35.3% share in 2024. Segment’s widespread adoption is attributed to its durability, recyclability, and versatility, making it ideal for packaging applications. The surge in e-commerce has further amplified demand, with kraft paper accounting for notable share of specialty paper consumption in the packaging segment. Like, the demand for kraft paper grew 2020 and 2023, backed by its ability to meet sustainability requirements. Regulatory mandates promoting eco-friendly packaging, such as California’s Plastic Pollution Prevention Act, have also bolstered its adoption.

The silicon-based papers segment is the fastest-growing, registering a CAGR of 8.5% during the forecast period. This rise is fueled by their extensive use in label papers and release liners, particularly in the food and beverage industries. The U.S. foodservice industry drives demand for silicon-based label papers due to their moisture-resistant and heat-stable properties. Additionally, innovations in coating technologies have broadened their application scope, catering to niche markets such as pharmaceuticals and electronics. These attributes position silicon-based papers as a key growth driver within the specialty paper market.

By End-User Insights

The packaging and labeling segment represented the largest end-user industry i.e. 45.5% market share in 2024. This dominance is supported by the growing demand for sustainable and customizable packaging solutions, driven by the rise of e-commerce. Moreover, regulatory mandates promoting recyclable materials have further bolstered adoption, ensuring the segment’s continued leadership in the regional market.

The food service segment is experiencing rapid growth, with a CAGR of 9.2% projected through 2033. This acceleration is caused by the expanding food and beverage industry, which relies heavily on specialty papers for packaging, branding, and regulatory compliance. Innovations in antimicrobial coatings and barrier properties have broadened their application scope, catering to evolving consumer demands.

REGIONAL ANALYSIS

The United States remained the largest contributor to the North American specialty paper market with a 65.6% share in 2024. This leading position is strengthened by the country’s robust industrial base, particularly in sectors such as e-commerce, foodservice, and packaging. In addition, the surge in online shopping has significantly driven demand for specialty papers like kraft paper and label papers, which are integral to sustainable packaging solutions. This growth has amplified the need for durable, lightweight, and recyclable materials, with specialty papers offering unique advantages such as enhanced printability and barrier properties. Additionally, stringent environmental regulations, such as California’s Plastic Pollution Prevention Act, have incentivized companies to adopt paper-based alternatives. Furthermore, investments in R&D and technological advancements, such as biodegradable coatings and antimicrobial treatments, have positioned the U.S. as a hub for innovation in the specialty paper industry.

Canada is next in terms of contributing to the total share of the market. The country’s vast forestry resources and expertise in sustainable practices position it as a key player. Quebec and British Columbia serve as major production hubs, leveraging advanced manufacturing technologies to produce high-quality specialty papers. For example, Canadian producers have adopted cellulose-based barrier papers, enabling their use in food packaging and reducing reliance on single-use plastics. Like, the adoption of sustainable packaging solutions grew in recent years, showing the potential for specialty papers in this segment. Additionally, Canada’s strategic trade agreements, such as the Canada-United States-Mexico Agreement (CUSMA), facilitate exports, strengthening its market presence.

Mexico holds a small but noticeable share in the North American specialty paper market which is driven by its growing industrial base and proximity to the U.S. business. The country’s focus on economic diversification has spurred investments in chemical manufacturing, benefiting the specialty paper sector. Increasing demand for eco-friendly packaging solutions, particularly in the foodservice and retail industries, further supports growth. Additionally, Mexico’s strategic geographic location enables efficient exports to North American markets, enhancing its competitive position. Collaborative initiatives with larger economies, such as joint ventures with U.S.-based companies, have unlocked new opportunities.

LEADING PLAYERS IN THE NORTH AMERICA SPECIALTY PAPER MARKET

International Paper

International Paper is one of the key players in the North American specialty paper market by leveraging its extensive distribution network and focus on sustainability. The company specializes in producing high-quality kraft paper and container board, which are critical for the packaging and labeling segments. Also, the company’s commitment to sustainability, which aims to reduce greenhouse gas emissions significantly across its operations. Its strategic partnerships with key industries, such as e-commerce giants and foodservice providers, ensure steady demand. Additionally, International Paper’s investments in R&D have led to the development of specialized formulations tailored to specific applications, further reinforcing its leadership.

WestRock Company

WestRock Company is specializing in innovative packaging solutions. The company’s focus on customization and functionality has strengthened its competitive edge, particularly in the foodservice and retail sectors. WestRock’s production facilities are equipped with advanced coating technologies, enabling the development of moisture-resistant and heat-stable specialty papers. WestRock’s emphasis on sustainability is reflected in its proprietary technologies, which minimize waste generation and enhance operational efficiency. Furthermore, its strategic alliances with end-users, such as pharmaceutical and electronics manufacturers, have diversified its revenue streams. These initiatives ensure WestRock remains a key player in the regional market.

Domtar Corporation

Domtar Corporation IS focusing on eco-friendly products. The company’s strategic partnerships with key industries, such as healthcare and foodservice, ensure steady demand. The company’s commitment to sustainability, which reduces greenhouse gas emissions considerably. Additionally, Domtar’s investments in green technologies, such as conductive coatings for electronics, have enhanced production efficiency. Its focus on customer-centric solutions, including customized formulations for specific applications, reinforces its market standing. These attributes position Domtar as a key player with significant growth potential.

TOP STRATEGIES USED BY KEY PLAYERS

Key players in the North American specialty paper market employ a range of strategies to strengthen their market position and capitalize on emerging opportunities. One prominent strategy is mergers and acquisitions, which enable companies to expand their production capacities and geographic reach.

Another critical strategy is technological innovation, with companies investing heavily in R&D to develop advanced formulations and production methods.

Strategic partnerships with end-users, such as e-commerce platforms and foodservice providers, are also prevalent, ensuring steady demand and fostering long-term relationships.

Additionally, companies emphasize compliance with stringent environmental regulations by adopting cleaner technologies and reducing carbon footprints.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players of the North America Speciality paper market include Domtar Corporation, Glatfelter, International Paper, Mondi Group, Nippon Paper Industries Co. Ltd., Stora Enso, UPM-Kymmene Corporation, Sappi Limited, Twin Rivers Paper Company, WestRock Company

The North American specialty paper market is highly competitive, characterized by the presence of established players and new entrants vying for market share. Intense rivalry drives innovation and cost optimization, with companies striving to differentiate themselves through advanced technologies and sustainable practices. Price wars and aggressive marketing strategies have eroded profit margins, compelling smaller firms to innovate or exit the market. Additionally, the influx of low-cost imports from Asia-Pacific countries, where production costs are significantly lower, poses a significant threat to domestic manufacturers. Regulatory mandates promoting sustainable practices further shape strategic priorities, as companies invest in eco-friendly solutions to align with consumer preferences. Despite these challenges, the market offers substantial growth opportunities for players capable of leveraging technological advancements and forging strategic partnerships.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, International Paper launched a line of biodegradable packaging papers designed to replace single-use plastics. This initiative aligns with global sustainability trends and appeals to environmentally conscious consumers, reinforcing the company’s leadership in eco-friendly solutions.

- In June 2023 , WestRock Company acquired a Canadian specialty paper plant to expand its production capacity. The acquisition strengthens its market presence and enables the company to meet rising demand in North America, particularly in the foodservice and retail sectors.

- In January 2023, Domtar Corporation introduced antimicrobial-coated papers tailored for medical packaging. This innovation addresses heightened hygiene standards post-pandemic and positions Domtar as a key supplier in the healthcare sector.

- In September 2022, Clearwater Paper invested $75 million in R&D for silicon-based papers used in label applications. The investment enhances product performance and broadens its application scope, catering to niche markets such as pharmaceuticals and electronics.

- In March 2022, Georgia-Pacific partnered with a leading foodservice provider to develop sustainable packaging solutions. This collaboration focuses on advancing functional properties like moisture resistance and thermal stability, ensuring product integrity and meeting consumer demands for eco-friendly options.

MARKET SEGMENTATION

This research report on the North America specialty paper market has been segmented and sub-segmented based on type, end use, and region.

By Type

- Kraft paper

- Container Board/Paper Board

- Label Papers

- Silicon-based papers

By End Use

- Packaging & Labelling

- Food Service

- Printing & Publication

- Building & Construction

By Region

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What is driving the growth of the North America specialty paper market?

Key growth drivers include the expansion of the packaging industry, increasing demand for sustainable and recyclable paper products, and technological advancements in paper processing.

2. How is specialty paper different from regular paper?

Unlike standard paper, specialty paper is engineered for specific purposes and often includes coatings, additives, or unique manufacturing processes to enhance its performance.

3. Who are the key players in the North America specialty paper market?

Major players include Domtar Corporation, Glatfelter, International Paper, Mondi Group, Nippon Paper Industries, Stora Enso, UPM-Kymmene, Sappi Limited, Twin Rivers Paper, and WestRock.

4. Which industries use specialty paper?

Industries such as packaging, healthcare, food & beverage, automotive, construction, and printing rely heavily on specialty paper for various applications.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]