North America Soybean Oil Market Research Report – Segmented By Nature (Conventional, Organic), End Use, Distribution Channel, And Country (Us, Canada, And Rest Of North America) - Industry Analysis On Size, Share, Trends & Growth Forecast (2025 To 2033)

North America Soybean Oil Market Size

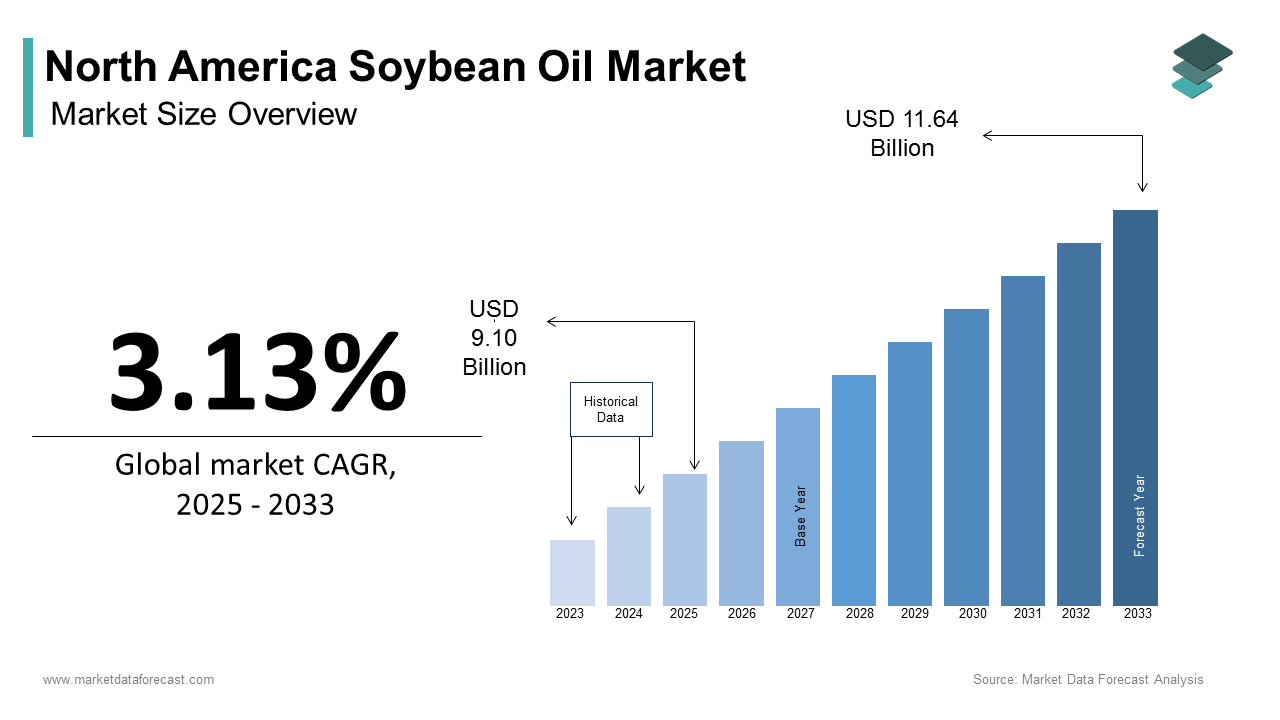

The North America soybean oil market size was valued at USD 8.82 billion in 2024 and is expected to reach USD 11.64 billion by 2033 from USD 9.10 billion in 2025. The market is projected to grow at a CAGR of 3.13%.

Current Scenario of the North America Soybean Oil Market

Soybean oil comes from soybeans which is a crop originally from East Asia but now mostly grown in the U.S. and Canada and is one of the most versatile vegetable oils in the world. The market is shaped by changing consumer preferences for healthier oils, the rise of plant-based products, and strict rules about trans fats in processed foods. The U.S. is the largest producer and exporter of soybean oil, supplying about 60% of global exports, according to the U.S. Department of Agriculture. In Canada, domestic use is increasing due to growth in the foodservice industry.

Soybean oil also plays a key role in environmental sustainability. The American Oil Chemists' Society notes that it is used to make biodiesel, which helps lower greenhouse gas emissions. The World Health Organization shows its nutritional benefits, pointing out that it has a good balance of omega-3 and omega-6 fatty acids, which are good for heart health. Interestingly, the National Center for Biotechnology Information reports that soybean oil makes up nearly 70% of all edible oils consumed in North America, showing how important it is in regional diets.

MARKET DRIVERS

Growing Demand for Plant-Based Products

More people are choosing plant-based foods, which is boosting the North America Soybean Oil Market. The Good Food Institute says plant-based food sales in the U.S. grew by 27% in 2022, reaching $8 billion. Soybean oil is a key ingredient in many vegan products like butter and spreads, making it essential for this trend. The United Nations Food and Agriculture Organization states that soybean oil makes up over 30% of global vegetable oil production, making it popular with food makers. It has a neutral taste and high smoke point, which makes it versatile.

Rising Biofuel Production

Another big driver is the growing use of soybean oil in biofuels. The U.S. Energy Information Administration says biodiesel production in the U.S. rose by 15% in 2022, with soybean oil being the main ingredient. The National Biodiesel Board notes that soybean oil accounts for over half of the feedstock used in U.S. biodiesel. This growth is supported by laws like the Renewable Fuel Standard, which requires blending renewable fuels into transportation fuels. The International Energy Agency adds that biofuels cut greenhouse gas emissions by up to 86% compared to fossil fuels, encouraging their use.

MARKET RESTRAINTS

Fluctuating Soybean Prices

One challenge for the North America Soybean Oil Market is the unstable price of soybeans. The World Bank reports that soybean prices swung by over 20% in 2022 due to supply chain issues and global tensions. These changes affect soybean oil production costs, creating uncertainty for producers and buyers. The U.S. Department of Agriculture says soybean oil prices rose by 10% in early 2023 because of higher raw material costs. Price swings are often caused by weather, trade policies, and supply-demand imbalances. Farmers and processors struggle to keep profits steady, while buyers may look for cheaper options. This instability can slow long-term investments in the market.

Health Concerns Over Processed Oils

Health worries about processed oils are another challenge for the market. The Harvard T.H. Chan School of Public Health says some processed vegetable oils, including certain types of soybean oil, may have harmful compounds or trans fats that hurt heart health. Even though refined soybean oil is free of trans fats, many consumers still avoid it. A survey by the International Food Information Council found that 60% of U.S. consumers avoid products labeled as containing "processed oils." The Centers for Disease Control and Prevention warns that too much omega-6 fatty acid, found in soybean oil, can cause inflammation if not balanced with omega-3s. These concerns and misconceptions could limit soybean oil's appeal to health-conscious buyers.

MARKET OPPORTUNITIES

Expansion of Export Markets

A huge opportunity for the North America Soybean Oil Market is expanding into export markets. The U.S. Department of Agriculture says global demand for vegetable oils will grow by 4% each year until 2030, with countries like India and China leading the way. North America, especially the U.S., has an advantage because of its high-quality soybean oil and advanced refining methods. The United Nations Comtrade Database shows that U.S. soybean oil exports grew by 18% in 2022, reaching $2.3 billion. Trade agreements like the United States-Mexico-Canada Agreement (USMCA) also help by allowing tariff-free access to key markets.

Adoption of Sustainable Practices

Another opportunity is using sustainable practices to attract eco-conscious consumers. The World Wildlife Fund says sourcing soybeans sustainably can reduce deforestation and habitat loss caused by farming. In 2022, the Round Table on Responsible Soy certified over 5 million metric tons of soybeans in North America, promoting environmentally friendly methods. The International Renewable Energy Agency adds that using soybean oil in biofuels supports global efforts to cut carbon emissions by up to 70%. Companies adopting these practices can appeal to green-minded buyers and follow stricter rules, opening new growth paths while improving their brand image.

MARKET CHALLENGES

Competition from Alternative Oils

One challenge is strong competition from other oils like palm oil and sunflower oil. The Food and Agriculture Organization says global palm oil production hit 77 million metric tons in 2022, more than soybean oil's 62 million metric tons. Palm oil is cheaper and produces more per hectare, making it popular with food makers and biofuel producers. The U.S. Department of Agriculture also notes that sunflower oil use in North America rose by 8% in 2022 due to its health benefits. These alternatives threaten soybean oil's market share, especially among cost-conscious or health-focused consumers, forcing producers to innovate to stay competitive.

Regulatory Hurdles in Labeling and Standards

Further challenge is dealing with strict labeling and quality rules set by regulators. The Food and Drug Administration requires all vegetable oils, including soybean oil, to list their trans-fat content, even if partially hydrogenated. This rule has cost manufacturers about $500 million yearly for reformulation, according to the Grocery Manufacturers Association. The Codex Alimentarius Commission also sets international limits for contaminants like glycidyl esters, sometimes found in refined oils. Meeting these standards requires heavy investment in technology and quality control. Smaller producers may struggle, which could lead to fewer players in the market and less innovation among smaller companies.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.13% |

|

Segments Covered |

By Nature, End User Insights, Distribution Channel, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

US, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

Cargill Incorporated, Archer Daniels Midland Company, Bunge Limited, Louis Dreyfus Company B.V., Wilmar International Limited, CHS Inc., AGP (AG Processing Inc), Richardson International Limited, DowDuPont Inc., and Fuji Vegetable Oil, Inc |

SEGMENTAL ANALYSIS

By Nature Insights

Conventional soybean oil segment dominated the North America Soybean Oil Market by holding a market share of 85.4% in 2024. Its rise is due to cost-effectiveness and widespread availability, making it a staple in food processing and industrial applications. The Food and Agriculture Organization states that conventional soybean oil accounts for over 60% of global vegetable oil usage due to its neutral flavor and high smoke point. Also, the National Biodiesel Board highlights that it serves as a primary feedstock for biofuel production, further boosting demand. Its affordability and versatility ensure its continued dominance in the market.

Organic soybean oil segment is the fastest-growing segment, with a CAGR of 9.2% from 2025 to 2033. This growth is fueled by rising consumer preference for chemical-free and eco-friendly products. The U.S. Department of Agriculture reports that organic farmland in North America expanded by 15% in 2022, supporting increased organic soybean oil production. Furthermore, the Environmental Working Group notes that organic farming reduces pesticide use by 90%, appealing to health-conscious buyers.

By End User Insights

The food service sector is the biggest consumer of soybean oil in North America by accounting for 40.7% of the market share in 2024. This prominence is driven by the widespread use of soybean oil in frying, baking, and salad dressings in restaurants and cafeterias. The National Restaurant Association states that the foodservice industry generated $900 billion in revenue in 2022, with cooking oils being a key ingredient. Additionally, soybean oil's affordability and versatility make it ideal for large-scale operations. Its neutral flavor and high smoke point further enhance its appeal.

Industrial

The industrial segment is the rapidly expanding, with a CAGR of 8.5% from 2025 to 2033 which is caused by rising demand for biofuels, where soybean oil serves as a renewable feedstock. The National Biodiesel Board shows that biodiesel production increased by 15% in 2022, with soybean oil making up over 50% of raw materials used. Furthermore, the International Energy Agency notes that biofuels reduce greenhouse gas emissions by up to 86%, encouraging their adoption. Governments promoting green energy solutions boost industrial applications.

By Distribution Channel Insights

Hypermarkets and supermarkets segment led the North America Soybean Oil Market by holding a 45.3% market share in 2024. Their dominance is propelled by their wide reach, offering convenience and variety to consumers under one roof. The Food Marketing Institute states that over 60% of grocery shoppers in North America prefer supermarkets for bulk purchases, including cooking oils. Additionally, these stores often run promotional discounts, attracting budget-conscious buyers. With established supply chains and trusted brands available, hypermarkets/supermarkets play a vital role in meeting household demands. Their accessibility ensures they remain the top choice for purchasing soybean oil.

Online Sales

The online sales are the fastest-growing segment, with a CAGR of 12.8% in the future. This progress is supported by increasing internet penetration and the popularity of e-commerce platforms like Amazon and Walmart. The U.S. Census Bureau reports that online grocery sales grew by 25% in 2022, reaching $100 billion as more consumers opt for home delivery. Also, McKinsey & Company highlights that 75% of shoppers now prioritize convenience, with online platforms offering easy comparisons and discounts. This trend supports sustainability by reducing carbon footprints through optimized logistics, making it a key growth driver.

REGIONAL ANALYSIS

In 2024, the United States spearheaded the North America Soybean Oil Market by having a 75.1% market share in 2024 as the world’s largest soybean producer, with over 120 million metric tons harvested in 2023. The National Biodiesel Board noted that the U.S. accounted for 60% of global soybean oil exports, driven by strong demand for biofuels and processed foods. Additionally, advanced refining technologies ensured high-quality output. The country’s vast agricultural infrastructure and trade agreements further solidified its position, making it a key player in meeting both domestic and international demands.

Canada is expected to grow at the fastest rate, with a CAGR of 6.8%. This growth will be fueled by rising consumer interest in plant-based diets and organic products. The Canadian Food Inspection Agency predicts a 20% increase in organic farmland by 2026, boosting organic soybean oil production. Furthermore, government initiatives promoting renewable energy will drive industrial use. Canada’s proximity to the U.S. provides easy access to export markets, while its focus on sustainable farming enhances its appeal. These factors will position Canada as a significant contributor to regional market expansion in the coming years.

LEADING PLAYERS IN THE MARKET

Bunge Limited

Bunge Limited is a dominant force in the North America Soybean Oil Market, leveraging its robust supply chain and global reach to meet rising demand. A key trend driving Bunge’s success is the growing preference for plant-based foods and sustainable oils. The company has capitalized on this by expanding its portfolio of eco-friendly products and investing in advanced refining technologies. In terms of competitive dynamics, Bunge differentiates itself through its commitment to sustainability, working closely with farmers to implement responsible farming practices. This aligns with regulatory pressures and consumer expectations for greener solutions.

Cargill Incorporated

Cargill Incorporated plays a pivotal role in shaping the competitive landscape of the soybean oil market. One notable trend Cargill has embraced is the shift toward healthier cooking oils with reduced saturated fats. To stay ahead, Cargill has invested in research and development to create oils tailored to health-conscious consumers. Competitive dynamics show that Cargill’s emphasis on transparency and traceability has set it apart from rivals. The company actively collaborates with stakeholders across the supply chain to ensure sustainable sourcing and reduce environmental impacts. Additionally, Cargill’s ability to adapt to fluctuating market demands, such as increasing exports or catering to foodservice industries, ensures its continued leadership.

Archer Daniels Midland Company (ADM)

Archer Daniels Midland Company (ADM) is a key innovator in the North America Soybean Oil Market, responding effectively to emerging trends like renewable energy and clean-label products. ADM has positioned itself as a leader in the biofuel sector by supplying soybean oil as a feedstock for biodiesel production, aligning with government mandates for greener energy solutions. Competitive dynamics highlight ADM’s focus on technological advancements, such as enzyme-based refining processes, which enhance efficiency and product quality. Furthermore, ADM addresses market trends by offering customized solutions for diverse end users, from food manufacturers to industrial clients. Its strategic partnerships with growers and processors strengthen its foothold in the market while promoting long-term sustainability.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Adoption of Circular Economy Models

Key players are increasingly exploring circular economy principles to minimize waste and maximize resource efficiency. For instance, they are repurposing byproducts from soybean oil production, such as soybean meal and hulls, into value-added products like animal feed, bio-composites, or even biodegradable packaging materials. This approach not only reduces environmental impact but also creates additional revenue streams.

Expansion into Niche Markets

Rather than solely focusing on mass-market products, some companies are targeting niche markets with specialized offerings. For example, they are developing premium soybean oil variants, such as cold-pressed or artisanal oils, for gourmet chefs and health-conscious consumers. Others are venturing into specialty applications, like using soybean oil in cosmetics, skincare products, or pharmaceutical formulations. These niche segments often command higher profit margins and allow companies to differentiate themselves in an otherwise commoditized market.

Digital Transformation and Data-Driven Insights

To enhance decision-making and operational agility, key players are embracing digital transformation. Advanced analytics, artificial intelligence (AI), and blockchain technologies are being used to monitor supply chains, predict market trends, and ensure product traceability. For instance, blockchain can track soybeans from farm to refinery, providing transparency to consumers and regulators. Additionally, AI-driven insights help optimize pricing strategies, forecast demand fluctuations, and identify emerging opportunities. This tech-forward approach ensures companies remain agile and responsive in a rapidly evolving market.

Localized Production and Regional Customization

Some companies are shifting toward localized production to reduce transportation costs and carbon footprints while better serving regional preferences. For example, they may establish smaller, flexible processing facilities closer to key agricultural hubs or urban centers. This strategy allows them to customize products based on local tastes or regulatory requirements, such as offering lower-trans-fat oils in regions with stricter health guidelines.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Major Key Market Players of the North America Soybean Oil Market include Cargill Incorporated, Archer Daniels Midland Company, Bunge Limited, Louis Dreyfus Company B.V., Wilmar International Limited, CHS Inc., AGP (AG Processing Inc), Richardson International Limited, DowDuPont Inc., and Fuji Vegetable Oil, Inc.

The competition in the North America Soybean Oil Market is changing in new and interesting ways. One big shift is how companies are using digital platforms to connect with customers. Some businesses now sell directly to consumers online, skipping middlemen. This lets them offer personalized products and learn more about what buyers want. It also helps them build stronger relationships with customers.

Another new trend is competitors working together to tackle shared challenges like sustainability. Instead of fighting all the time, some companies are teaming up to reduce emissions or improve farming practices. These partnerships show they care about the environment and help them follow stricter rules. For example, developing eco-friendly farming methods benefits everyone in the industry.

Global politics also play a bigger role now. Trade rules, tariffs, and supply chain problems affect how companies get soybeans and sell their oil. Businesses that adapt by finding new suppliers or using regional trade deals have an advantage over those that don’t.

Finally, companies are exploring new uses for soybean oil , like making bioplastics, lubricants, or even fuel for airplanes. Those investing in these innovative ideas are staying ahead of rivals still focused only on food or industrial uses.

RECENT HAPPENINGS IN THE MARKET

- In January 2025, Canada approved the $34 billion merger between U.S. grains merchant Bunge and Glencore-backed Viterra, creating a global agricultural trading and processing giant. This merger aims to capitalize on the anticipated surge in demand for biofuel crops like soybean and canola oil.

- In January 2025, the United Soybean Board (USB), U.S. Soybean Export Council (USSEC), and American Soybean Association (ASA) jointly updated their national sustainability goals for 2030. This strategic investment is expected to reduce land use impact by 10%, soil erosion by 25%, energy use by 10%, and greenhouse gas emissions by 10% in U.S. soybean production, supporting a more sustainable soybean oil supply chain.

- In December 2024, the U.S. Soybean Export Council (USSEC) announced the adoption of the first Codex Standard for high oleic soybean oil (HOSO) by the Codex Alimentarius Commission. This milestone, resulting from years of collaboration between USSEC, the USDA, the U.S. FDA, and Codex member states, is expected to standardize the global definition of HOSO and promote its international trade.

- In March 2024, Archer Daniels Midland (ADM) introduced re:source, a fully traceable North American soybean program. This initiative enrolled nearly 5,300 farmers across 15 states, covering over 4.6 million acres for the 2024 season. By utilizing advanced technology and ADM's logistical capabilities, the program aims to verify, trace, and segregate soybeans from farms to their final destinations, ensuring transparency and sustainability in the soybean oil supply chain.

- In May 2024, the U.S. Department of Agriculture projected that soybean oil use in biofuel production would increase by 1 billion pounds, reaching 14 billion pounds for the 2024-2025 period. This forecast reflects the growing demand for biofuels and underscores the pivotal role of soybean oil in renewable energy initiatives.

DETAILED SEGMENTATION OF NORTH AMERICA SOYBEAN OIL MARKET INCLUDED IN THIS REPORT

This research report on the North America soybean oil market has been segmented and sub-segmented based on nature, end user, distribution channel, & region.

By Nature

- Conventional

- Organic

By End User

- Household

- Industrial

- Food Service

By Distribution Channel

- Convenience store

- Hypermarket/Supermarket

- Direct Sales

- Online

- Others

By Region

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What are the key factors driving the North America soybean oil market?

The market is driven by increasing demand for plant-based oils, rising health awareness, growth in the food processing industry, and the expanding biodiesel sector.

2. Who are the major players in the North America soybean oil market?

Key players include Cargill, Bunge Limited, Archer Daniels Midland (ADM), Ag Processing Inc., and CHS Inc.

3. How is soybean oil processed and refined for commercial use?

Soybean oil is extracted from soybeans through solvent extraction or mechanical pressing, followed by refining processes like degumming, neutralization, bleaching, and deodorization.

4. Which trends are shaping the future of the North America soybean oil market?

Trends include the rise in organic and non-GMO soybean oil, increasing use in plant-based food products, and the expansion of biodiesel applications.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]