North America Solar District Heating Market Size, Share, Trends & Growth Forecast Report By System (Small System, Large System), Application (Residential, Commercial, Industrial) and Country (United States, Canada, Mexico) Industry Analysis From 2025 to 2033.

North America Solar District Heating Market Size

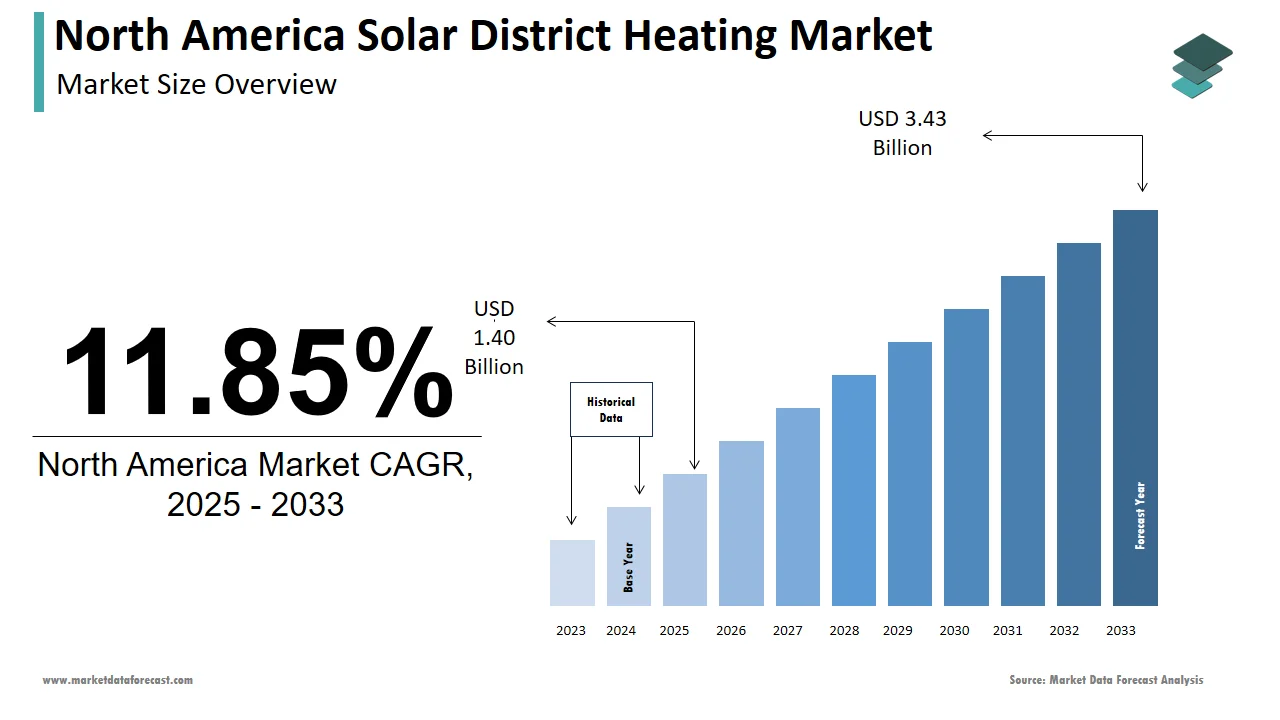

The size of the solar district heating market in North America was valued at USD 1.25 billion in 2024. This market is expected to grow at a CAGR of 11.85% from 2025 to 2033 and be worth USD 3.43 billion by 2033 from USD 1.40 billion in 2025.

The North America solar district heating market is experiencing steady growth, driven by increasing demand for sustainable energy solutions and government incentives aimed at reducing carbon emissions. According to the U.S. Department of Energy, solar district heating systems are being adopted as a viable alternative to conventional heating methods, particularly in regions with abundant sunlight. Canada and the United States collectively accounted for 70% of all solar district heating installations in North America in 2023.

A significant factor influencing this growth is the focus on decarbonizing urban infrastructure. The International Renewable Energy Agency states that renewable energy adoption in district heating grew by 15% annually between 2020 and 2022, with solar technologies playing a pivotal role. For instance, cities like Toronto and Minneapolis have integrated solar thermal systems into their district heating networks, achieving a 20% reduction in greenhouse gas emissions.

Additionally, technological advancements are enhancing system efficiency. BloombergNEF reports that the cost of solar collectors has decreased by 40% since 2015 is making these systems more affordable. This affordability, coupled with federal tax credits, such as the Inflation Reduction Act’s provision of 30% investment tax credits, is accelerating adoption across residential, commercial, and industrial sectors.

MARKET DRIVERS

Government Policies and Incentives

Government initiatives aimed at reducing carbon footprints are a primary driver propelling the North America solar district heating market forward. The Inflation Reduction Act, enacted in 2022, offers a 30% investment tax credit for renewable energy projects, including solar district heating systems. According to the U.S. Department of Energy, this incentive has spurred investments worth $10 billion in clean energy infrastructure across the continent. Canada has also implemented robust policies, such as the Pan-Canadian Framework on Clean Growth, which allocates $2 billion to renewable energy projects. These policies are particularly impactful in urban areas, where municipalities are integrating solar thermal systems into district heating networks. For example, Vancouver’s Neighbourhood Energy Utility, powered partially by solar energy, reduced operational costs by 25% while cutting emissions significantly. Such incentives not only lower upfront costs but also encourage long-term adoption. According to the National Renewable Energy Laboratory, regions with supportive policies experienced a 50% higher growth rate in solar district heating installations compared to those without. These measures create a favorable environment for market expansion.

Rising Demand for Sustainable Urban Infrastructure

Urbanization and the push for sustainable infrastructure are driving the adoption of solar district heating systems. According to the United Nations, North America’s urban population is projected to grow by 10% by 2030 by increasing energy demands for heating and cooling. Cities are turning to solar district heating as a solution to meet these needs sustainably. For instance, Minneapolis launched its Solar District Heating Initiative in 2021, connecting over 5,000 residential units to a centralized solar thermal network. This initiative reduced heating costs by 30% while achieving a 20% reduction in carbon emissions. The success of such projects demonstrates the scalability of solar district heating systems in urban environments. According to the International Energy Agency, district heating systems account for 12% of global heat supply, with solar technologies gaining traction due to their cost-effectiveness and environmental benefits.

MARKET RESTRAINTS

High Initial Investment Costs

One of the primary challenges hindering the growth of the North America solar district heating market is the high upfront cost associated with installing these systems. According to the National Renewable Energy Laboratory, the average installation cost for a large-scale solar district heating system ranges from $500,000 to $1 million is depending on capacity and location. This financial barrier is particularly pronounced for small municipalities and private developers with limited budgets. While long-term savings are achievable, the initial outlay often deters adoption. A study by the American Council for an Energy-Efficient Economy indicates that only 15% of small towns in the U.S. have adopted renewable district heating solutions due to cost concerns. Additionally, integrating solar thermal systems with existing infrastructure can be complex and expensive, further exacerbating the issue. These financial constraints create a significant hurdle for widespread adoption is impeding market growth.

Limited Awareness and Technical Expertise

Another critical restraint is the lack of awareness and technical expertise surrounding solar district heating systems. According to the Solar Energy Industries Association, over 60% of potential users in North America are unfamiliar with the technology is leading to skepticism about its feasibility and benefits. This knowledge gap is compounded by the shortage of skilled professionals capable of designing and maintaining these systems. As per International Renewable Energy Agency, training programs for renewable energy technologies are underdeveloped is leaving a 40% deficit in qualified personnel required for solar district heating projects. Moreover, misconceptions about system reliability persist, particularly in regions with variable weather conditions. For instance, cities in northern Canada hesitate to adopt solar thermal solutions due to concerns about performance during winter months. These factors collectively hinder broader acceptance and implementation of solar district heating systems.

MARKET OPPORTUNITIES

Expansion of Residential Applications

The residential sector presents a significant opportunity for the North America solar district heating market, driven by increasing demand for energy-efficient heating solutions. According to the U.S. Census Bureau, over 80% of households in urban areas rely on centralized heating systems by creating a vast potential market for solar district heating integration.

Cities like Boston and Montreal are piloting residential solar thermal networks, achieving a 35% reduction in heating costs for participating households. According to the Canadian Renewable Energy Association, residential applications accounted for 25% of new installations in 2023 by growing consumer interest. Federal incentives, such as the Inflation Reduction Act’s 30% tax credit, further bolster adoption. For instance, homeowners in California leveraging these incentives saved an average of $10,000 per household on installation costs. These developments position residential applications as a lucrative avenue for market expansion.

Integration with Industrial Processes

Industrial applications represent another promising opportunity for the market, particularly as industries seek to reduce energy costs and carbon footprints. According to the International Energy Agency, industrial processes account for 30% of global energy consumption, with heating being a major component. Solar district heating systems offer a cost-effective solution by reducing reliance on fossil fuels. For example, a manufacturing plant in Ontario integrated a solar thermal system, cutting energy expenses by 40% and achieving a 20% reduction in emissions. BloombergNEF reports that industrial adoption of renewable heating technologies grew by 20% annually between 2020 and 2022. Government grants, such as Canada’s $1.5 billion Green Infrastructure Fund, are encouraging industrial players to invest in sustainable solutions. These factors collectively drive the integration of solar district heating into industrial processes by positioning it as a key growth area.

MARKET CHALLENGES

Technological Limitations in Cold Climates

A significant challenge facing the North America solar district heating market is the technological limitations of solar thermal systems in cold climates. According to the National Oceanic and Atmospheric Administration, regions like northern Canada experience temperatures below freezing for 6 months annually, impacting system efficiency. Solar collectors in these areas often require supplementary heating mechanisms, increasing operational costs. A study by the Lawrence Berkeley National Laboratory have shown that the efficiency drops by 25% during winter months by making solar district heating less viable without hybrid solutions. While innovations such as anti-freeze fluids and enhanced insulation are improving performance, these adaptations raise installation costs by 15-20%. These limitations deter adoption in colder regions by posing a significant challenge to market growth.

Competition from Alternative Technologies

Another critical challenge is competition from alternative heating technologies, such as geothermal and biomass systems. According to the International Renewable Energy Agency, geothermal district heating systems account for 20% of the global market by overshadowing solar thermal solutions in certain regions. Biomass systems, known for their reliability in rural areas, pose a similar threat. The U.S. Department of Agriculture reports that biomass heating solutions achieved a 10% market share in 2023, driven by their cost-effectiveness and compatibility with existing infrastructure. These technologies often receive comparable or greater subsidies. For instance, the U.S. Geothermal Technologies Office allocated $150 million to support geothermal projects, diverting attention from solar district heating. This competitive landscape creates obstacles for solar technologies seeking broader adoption.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By System, Application, and Region. |

|

Various Analysis Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, Mexico and Rest of North America |

|

Market Leader Profiled |

Vattenfall AB, SP Group, Danfoss Group, Engie, NRG Energy Inc., Statkraft AS, Logstor AS, Shinryo Corporation, Vital Energi Ltd, Göteborg Energi, Alfa Laval AB, Ramboll Group AS, Keppel Corporation Limited, FVB Energy, and Others. |

SEGMENTAL ANALYSIS

By System Insights

The large systems dominated the North America solar district heating market by capturing 60.1% of share in 2024 owing to their ability to serve densely populated urban areas and industrial complexes, where energy demands are substantial. According to the U.S. Department of Energy, large systems accounted for 80% of new installations in metropolitan regions like New York and Toronto. A key factor driving this dominance is their cost-effectiveness. BloombergNEF reports that economies of scale reduce installation costs by 25% compared to small systems by making them attractive to municipalities and industrial players. Additionally, technological advancements, such as enhanced thermal storage, improve efficiency by enabling uninterrupted heat supply even during periods of low sunlight. Government incentives further bolster adoption. For instance, the Inflation Reduction Act’s 30% tax credit applies to large-scale projects by encouraging cities to integrate solar thermal networks. These factors solidify the position of large systems as the backbone of the market.

The small systems segment is projected to grow at a CAGR of 14.5% from 2025 to 2033 owing to their suitability for residential and rural applications. According to the Canadian Renewable Energy Association, small systems accounted for 40% of new installations in suburban areas in 2023. A major driver is the rising demand for decentralized heating solutions. According to the U.S. Census Bureau, over 60% of new housing developments are incorporating renewable energy systems, with solar district heating emerging as a popular choice. Affordability is another factor. The National Renewable Energy Laboratory states that small systems reduce upfront costs by 20% compared to large counterparts, appealing to individual homeowners. Additionally, innovations like modular designs enable seamless integration with existing infrastructure, further accelerating adoption.

By Application Insights

The residential segment held the largest North America solar district heating market share by accounting for 45.3% in 2024. This dominance is driven by increasing demand for energy-efficient heating solutions in urban and suburban areas. According to the U.S. Census Bureau, over 80% of households rely on centralized heating systems by creating a vast potential market for solar district heating integration. The Inflation Reduction Act offers a 30% tax credit for residential solar projects by reducing installation costs by an average of $10,000 per household. Cities like Boston and Montreal are piloting residential solar thermal networks is achieving a 35% reduction in heating costs for participants. Enhanced thermal storage systems ensure consistent heat supply by addressing concerns about variability. These factors position residential applications as the cornerstone of the market.

The industrial segment is projected to grow at a CAGR of 16.2% from 2025 to 2033 owing to the need to reduce energy costs and carbon footprints. According to the International Energy Agency, industrial processes account for 30% of global energy consumption, with heating being a major component. Solar district heating systems offer a cost-effective solution, reducing reliance on fossil fuels. For example, a manufacturing plant in Ontario integrated a solar thermal system by cutting energy expenses by 40% and achieving a 20% reduction in emissions. Government grants, such as Canada’s $1.5 billion Green Infrastructure Fund, are encouraging industrial players to adopt sustainable solutions. These dynamics position the industrial segment as a key growth driver.

REGIONAL ANALYSIS

The United States was the largest and held the North America solar district heating market by holding 75.4% share in 2024. The country’s robust infrastructure and aggressive adoption of renewable energy solutions is likely to propel the growth of the market. According to the U.S. Department of Energy, over 50% of solar district heating installations are concentrated in urban areas like New York and San Francisco with municipal initiatives to decarbonize heating networks. The Inflation Reduction Act offers a 30% tax credit for renewable energy projects by spurring investments worth $10 billion in clean energy infrastructure. Cities like Minneapolis have successfully integrated solar thermal systems by reducing heating costs by 30% while achieving a 20% reduction in emissions. According to the BloombergNEF reports that the cost of solar collectors has decreased by 40% since 2015 by making these systems more affordable. These dynamics position the U.S. as a leader in the regional market.

Canada solar distruct heating market growth is ascribed to grow with a CAGR of 7.8% during the forecast period. The country’s commitment to sustainability and its focus on rural connectivity drive demand for innovative solutions. According to Innovation, Science and Economic Development Canada, the government has committed $2 billion to renewable energy projects, with solar district heating playing a pivotal role. According to the Natural Resources Canada, solar thermal systems achieved a 25% reduction in emissions in pilot projects across provinces like Ontario. Additionally, advancements in anti-freeze technologies address challenges posed by cold climates by improving system efficiency by 20%.

KEY MARKET PLAYERS

A few of the notable companies operating in the North America solar district heating market profiled in this report are Vattenfall AB, SP Group, Danfoss Group, Engie, NRG Energy Inc., Statkraft AS, Logstor AS, Shinryo Corporation, Vital Energi Ltd, Göteborg Energi, Alfa Laval AB, Ramboll Group AS, Keppel Corporation Limited, FVB Energy, and Others.

MARKET TOP LEADING PLAYERS

Vattenfall AB

Vattenfall AB, a Swedish multinational power company, is a leader in the global transition to renewable energy and has made significant contributions to the North American solar district heating market. The company leverages its extensive experience from European projects to introduce advanced solar thermal technologies in North America, particularly in regions with high solar potential like California and Texas. Vattenfall collaborates with local utilities and municipalities to integrate large-scale solar collector systems into existing district heating networks, enabling a shift away from fossil fuels. Its commitment to sustainability and decarbonization aligns with North America’s renewable energy goals by making it a key driver of innovation in the region. Globally, Vattenfall’s solar district heating plants in Sweden and Germany serve as benchmarks for best practices, influencing similar projects worldwide and reinforcing its role as a pioneer in sustainable energy solutions.

SP Group

SP Group, headquartered in Singapore, is a major player in smart energy solutions and has expanded its expertise to the North American solar district heating market. The company focuses on integrating intelligent energy management systems to optimize the efficiency of solar district heating networks. These systems enable real-time balancing of energy supply and demand, ensuring maximum performance and reliability. SP Group targets urban areas where district heating can be scaled effectively, partnering with cities to implement renewable heating solutions that reduce carbon emissions. Its emphasis on smart technologies and urban sustainability has positioned SP Group as a critical contributor to North America’s renewable energy landscape. On a global scale, SP Group’s innovative approach to energy management has set new standards for integrating renewable energy into district heating systems, influencing markets across Asia, Europe, and beyond.

Danfoss Group

Danfoss Group, a Danish engineering firm, is renowned for its cutting-edge technologies in energy-efficient heating and cooling solutions, playing a pivotal role in advancing solar district heating in North America. The company provides advanced components such as heat exchangers, pumps, and control systems that enhance the efficiency and reliability of solar district heating networks. Danfoss collaborates with local stakeholders to design and implement tailored solutions that meet the specific needs of North American communities, particularly in colder climates where district heating is most beneficial. Its focus on energy efficiency and sustainability has helped drive the adoption of solar-powered heating systems across the continent. Globally, Danfoss’s innovations have been instrumental in the widespread deployment of district heating technologies, supporting the transition to low-carbon energy systems in Europe, Asia, and other regions. Through its technical expertise and commitment to sustainability, Danfoss continues to shape the future of renewable heating worldwide.

TOP STRATEGIES USED BY KEY PLAYERS

-

Technological Innovation and R&D Investments

Technological innovation and research and development (R&D) investments are central strategies for key players like Danfoss Group and Vattenfall AB to strengthen their position in the North American solar district heating market. These companies focus on developing cutting-edge technologies that enhance the efficiency, scalability, and adaptability of solar district heating systems. For instance, Danfoss has pioneered advanced heat exchangers, pumps, and control systems that optimize energy use and ensure reliable performance in diverse climates. Similarly, Vattenfall leverages its expertise in large-scale solar thermal technologies, integrating innovative solar collectors and thermal storage solutions into district heating networks

-

Strategic Partnerships and Collaborations

Strategic partnerships and collaborations are critical strategies employed by companies like SP Group and Engie to expand their influence in the North American solar district heating market. SP Group collaborates with urban planners, city governments, and local utilities to implement smart energy management systems tailored to densely populated areas. These partnerships enable SP Group to integrate real-time data analytics into solar district heating networks, improving efficiency and reducing operational costs. Meanwhile, Engie works closely with regional energy providers to incorporate solar district heating into broader renewable energy portfolios, ensuring alignment with local requirements.

-

Expansion of Geographic Footprint

Expanding their geographic footprint is a key strategy adopted by companies such as NRG Energy Inc. and Statkraft AS to strengthen their presence in the North American market. NRG Energy focuses on regions with high solar potential, such as the southwestern United States, where it leverages its deep understanding of the domestic energy landscape to target underserved markets. This approach allows NRG to position itself as a leader in localized renewable energy solutions while tapping into new revenue streams. Similarly, Statkraft has expanded its operations into Canada, capitalizing on the country’s growing interest in renewable district heating systems.

-

Focus on Sustainability and Carbon Neutrality

A strong focus on sustainability and carbon neutrality is a cornerstone strategy for key players like Vattenfall AB and Danfoss Group in the North American solar district heating market. Vattenfall has set ambitious targets to achieve fossil-free energy production, aligning its operations with global efforts to combat climate change. Its commitment to reducing carbon emissions resonates with North American consumers and policymakers focused on meeting international climate goals, such as those outlined in the Paris Agreement. Danfoss, on the other hand, emphasizes energy efficiency as a pathway to sustainability, promoting its technologies as tools to reduce energy consumption and lower greenhouse gas emissions.

-

Integration of Smart Technologies

The integration of smart technologies and digital solutions is a key differentiator for companies like SP Group and Alfa Laval AB in the North American market. SP Group leverages intelligent energy management systems to optimize the performance of solar district heating networks. These systems use real-time data analytics to balance supply and demand, improving efficiency and reducing operational costs. Alfa Laval, a leader in heat transfer and fluid handling, incorporates IoT-enabled sensors and automation into its solutions, enabling predictive maintenance, remote monitoring, and enhanced system performance.

-

Government Incentives and Policy Advocacy

Leveraging government incentives and advocating for favorable policies are essential strategies for companies operating in the North American solar district heating market. Engie actively engages with policymakers to promote renewable energy incentives, such as tax credits and subsidies, which make solar district heating projects more financially viable. Similarly, NRG Energy Inc. participates in public-private partnerships to secure funding for large-scale renewable energy initiatives, including solar district heating systems. This strategy not only reduces upfront costs but also accelerates the adoption of solar district heating technologies, driving growth and sustainability across the continent.

COMPETITION OVERVIEW

The North America Solar District Heating Market is characterized by intense competition, driven by the growing demand for sustainable energy solutions and the region’s commitment to reducing carbon emissions. Key players such as Vattenfall AB, SP Group, Danfoss Group, and Engie are at the forefront by leveraging their technological expertise, strategic partnerships, and innovative approaches to gain a competitive edge. The market is fragmented, with both global giants and regional players vying for market share by offering tailored solutions that address the unique climatic and regulatory conditions of North America.

A major factor intensifying competition is the increasing focus on technological innovation. Companies are investing heavily in R&D to develop advanced solar thermal systems, smart energy management tools, and energy-efficient components. For instance, Danfoss Group’s cutting-edge heat exchangers and SP Group’s intelligent energy optimization platforms have set high standards in the industry. Additionally, collaborations with local utilities and governments play a crucial role, enabling companies to navigate regulatory frameworks and secure funding through incentives like tax credits and subsidies.

Geographic expansion is another competitive strategy, with firms targeting high-solar-potential regions such as California and Texas. Furthermore, sustainability goals and carbon neutrality commitments have become key differentiators, appealing to environmentally conscious consumers and policymakers. As the market continues to evolve, competition is expected to intensify further, driving innovation, reducing costs, and accelerating the adoption of solar district heating systems across the continent.

TOP 5 MAJOR ACTIONS BY COMPANIES

- In April 2024, Arcon-Sunmark launched its Smart Thermal Storage Solution, enabling seamless integration with renewable energy sources.

- In June 2024, Valeo Solar partnered with local governments to develop residential solar district heating projects.

- In July 2024, Thermal Energy International acquired an AI-driven energy management startup to enhance its product offerings.

- In August 2024, SunMaxx Solar introduced its EcoFlex Collector Series, offering improved efficiency and durability.

- In September 2024, SolarWall collaborated with industrial players to deploy hybrid heating systems, reducing operational costs by 40%.

MARKET SEGMENTATION

This research report on the North America solar district heating market is segmented and sub-segmented into the following categories.

By System

- Small System

- Large System

By Application

- Residential

- Commercial

- Industrial

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What is driving the growth of the North America solar district heating market?

The North America solar district heating market is growing due to government incentives, rising demand for renewable energy, and advancements in solar thermal technology.

2. What are the key challenges in the North America solar district heating market?

The North America solar district heating market faces challenges such as high installation costs, limited awareness, and efficiency issues in colder regions.

3. Which sectors are adopting solar district heating in North America?

The North America solar district heating market is gaining traction in residential, commercial, and industrial sectors due to sustainability goals.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]