North America Sodium Chloride Market Size, Share, Trends & Growth Forecast Report By Product (Industrial, Food, Medical Grade Salt), End Use, And Country (US, Canada, And Rest Of North America), Industry Analysis From 2025 To 2033

North America Sodium Chloride Market Size

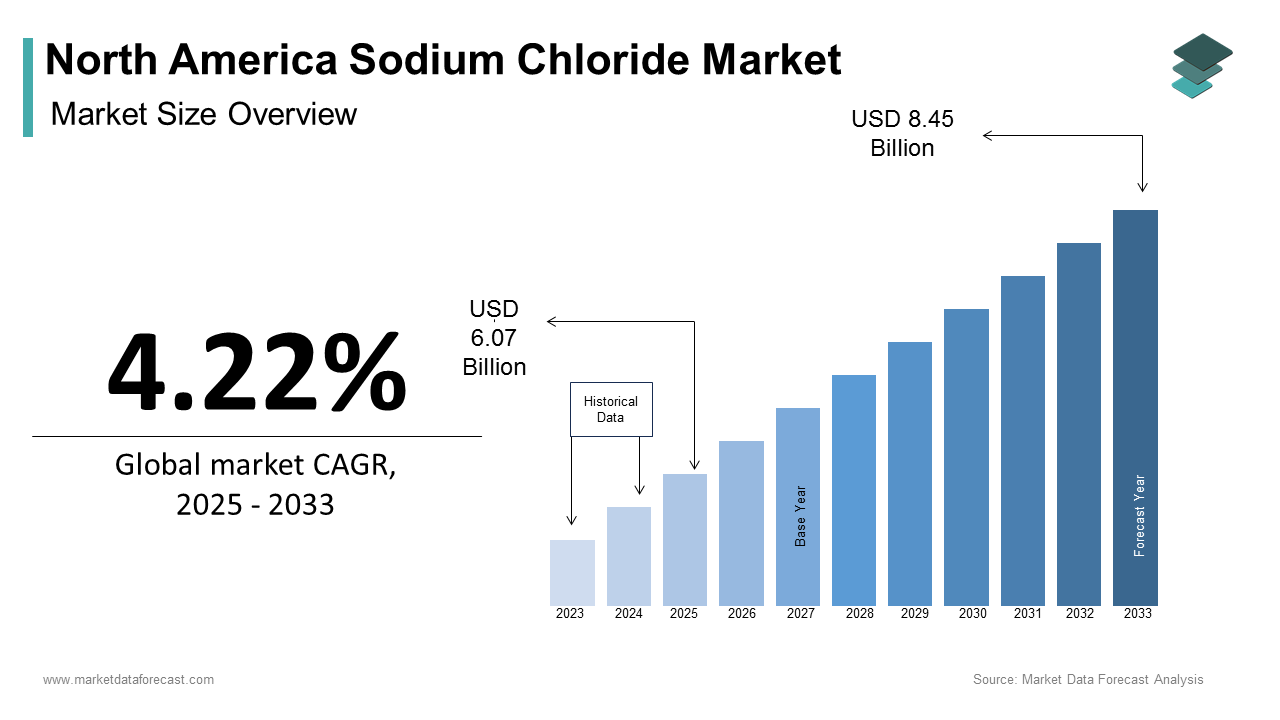

The North America sodium chloride market size was calculated to be USD 5.83 billion in 2024 and is anticipated to be worth USD 8.45 billion by 2033, from USD 6.07 billion in 2025, growing at a CAGR of 4.22% during the forecast period.

MARKET DRIVERS

Rising Demand in Water Treatment Applications

Water treatment is a primary driver of the North America sodium chloride market. Sodium chloride is widely used in water softening processes, which remove calcium and magnesium ions to prevent scaling in industrial and residential systems. The growing emphasis on clean water infrastructure has amplified demand, with the U.S. government allocating substantial funds for water system upgrades under the Infrastructure Investment and Jobs Act. Additionally, the rise in urbanization has increased municipal water treatment needs, with an annual increase in sodium chloride usage for water softening in some regions.

Expansion in Food Processing and Preservation

Sodium chloride’s use in food processing represents another major driver, particularly in the meat and dairy industries. The compound acts as a preservative is enhancing shelf life while maintaining flavor and texture. Like, the U.S. processed food market consumes a notable percentage of sodium chloride produced domestically. Also, the rise in consumer demand for ready-to-eat and shelf-stable products has further amplified its usage. Additionally, regulatory approvals for sodium chloride as a safe food additive have expanded its application scope, driving sustained market growth.

MARKET RESTRAINTS

Environmental Concerns Over Brine Disposal

Environmental concerns over brine disposal pose a significant challenge to the North America sodium chloride market, particularly in regions with strict water management regulations. According to the National Oceanic and Atmospheric Administration, improper brine discharge can lead to salinity imbalances in freshwater ecosystems, prompting regulatory bodies like the Environmental Protection Agency to impose stringent limits on brine disposal practices. Compliance costs for manufacturers surged in the past few years is impacting operational efficiency. Furthermore, public scrutiny over industrial waste management has led to calls for greener alternatives, reducing sodium chloride’s appeal in certain applications. These regulatory and environmental challenges necessitate innovation in sustainable production methods to ensure long-term viability.

Fluctuating Raw Material Costs

Fluctuating raw material costs present another major restraint, particularly concerning the extraction and refining of natural salt deposits. Like, the cost of mining and processing sodium chloride rose in 2022 due to labor shortages and rising energy prices. Additionally, geopolitical tensions and trade restrictions have disrupted supply chains, forcing manufacturers to operate below capacity or absorb higher expenses. Also, unstable pricing dynamics often deter small-scale producers from entering the market, limiting competition and innovation. Such economic pressures hinder the competitiveness of sodium chloride against alternative compounds.

MARKET OPPORTUNITIES

Growth in Deicing Applications

Deicing applications represent a significant opportunity for the North America sodium chloride market, driven by the region’s harsh winters and increasing urbanization. According to the Federal Highway Administration, road deicing accounts for a significant portion of sodium chloride consumption in the U.S., with demand surging during peak winter months. Municipal governments rely heavily on sodium chloride to ensure road safety, with notable expenditures in 2023, as stated by the American Public Works Association. Additionally, advancements in anti-caking agents and corrosion inhibitors have improved the efficiency of sodium chloride-based deicers, expanding their application scope.

Advancements in Medical-Grade Sodium Chloride

Medical-grade sodium chloride is emerging as a transformative opportunity, driven by the compound’s critical role in healthcare applications such as intravenous solutions and wound care. The aging population, projected to grow by 2030, is expected to drive demand for medical-grade sodium chloride products. Additionally, regulatory approvals for innovative formulations have expanded its application scope, creating a lucrative niche for manufacturers. This shift not only enhances brand reputation but also positions companies as leaders in the healthcare sector.

MARKET CHALLENGES

Competition from Alternative Compounds

Competition from alternative compounds remains a persistent challenge for the North America sodium chloride market. Calcium chloride and magnesium chloride are increasingly being adopted as substitutes in deicing applications due to their lower environmental impact and enhanced performance in colder temperatures. Also, the market share of these alternatives grew in the last few years, particularly in regions with strict environmental regulations. Additionally, the perception of sodium chloride as environmentally harmful further erodes its market share.

Supply Chain Vulnerabilities

Supply chain vulnerabilities pose another significant challenge, particularly concerning raw material availability. Natural salt deposits, the primary source of sodium chloride, are susceptible to geological and logistical disruptions. Similarly, transportation bottlenecks caused by severe weather events likely led to a reduction in sodium chloride supply in 2022, directly impacting industrial users. Addressing these logistical complexities requires investments in localized sourcing and diversified supply chain strategies to ensure market stability.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.22% |

|

Segments Covered |

By Product, End Use, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

Us, Canada, And Rest of North America |

|

Market Leaders Profiled |

Cargill, Compass Minerals, K+S Aktiengesellschaft, Morton Salt, CIECH Group, Tata Chemicals North America, Dominion Salt, INEOS Enterprises, American Elements, Altiras Chemicals |

SEGMENTAL ANALYSIS

By Product Insights

The industrial sodium chloride segment dominated the North America sodium chloride market by accounting for 45.8% of total production in 2024. This dominance of the segment is driven by its widespread use in chemical manufacturing and water treatment applications. The chemical industry, which consumes a notable share of industrial sodium chloride, benefits from its role as a precursor in chlorine and caustic soda production. Additionally, the rise in urbanization has increased municipal water treatment needs, amplifying sodium chloride usage in water softening processes.

The medical-grade sodium chloride segment is the fastest-growing, registering a CAGR of 7.5% in the future. This growth is fueled by its critical role in healthcare applications such as intravenous solutions and wound care. Additionally, the aging population in North America, projected to grow by 2030 is expected to drive demand for medical-grade sodium chloride products. These innovations have expanded the application scope of medical-grade sodium chloride, driving rapid market expansion.

By End Use Insights

The chemical manufacturing segment commanded the end-use of the North America sodium chloride market by accounting for 40.7% of total consumption in 2024. This leading position is driven by sodium chloride’s role as a precursor in chlorine and caustic soda production, essential chemicals for various industrial processes. The chlorine market, which consumes significant share of sodium chloride. Additionally, the rise in urbanization has increased demand for chlorine-based disinfectants and plastics, amplifying sodium chloride usage.

Water treatment is the rapidly advancing end-use segment, registering a CAGR of 6.2% in the coming years. This progress is influenced by stricter water quality standards and increasing urbanization, which have amplified municipal water treatment needs. Additionally, advancements in anti-scaling technologies have improved the efficiency of sodium chloride-based water softeners, expanding their application scope. These factors display the segment’s rapid growth trajectory.

REGIONAL ANALYSIS

The United States stood as the cornerstone of the North America sodium chloride market with a 70.4% share in 2024. This is driven by the country’s robust industrial base. Additionally, the rise in urbanization has amplified demand for sodium chloride in water treatment applications, with municipal water softening processes consuming more sodium chloride in last few years compared to the previous year. These factors strengthen the U.S.’s position as the regional leader and a key driver of innovation in the sodium chloride market.

Canada which is key player in this market is leveraging its vast natural salt reserves to establish itself as a major producer and exporter. The deicing segment, which consumes a notable portion of sodium chloride in Canada, benefits significantly from federal investments in road safety.

Mexico is having a decent growth in the North America sodium chloride market and is driven by its rapidly expanding industrial base and favorable trade policies. The shift toward sustainable industrial practices has bolstered demand, particularly in green chemistry. The processed food industry, which greatly consumes sodium chloride, is also experiencing growth due to increasing exports to the U.S. and Europe. This strategic geographic location, coupled with cost-effective labor and abundant natural resources, further solidifies Mexico’s position as a vital contributor to the regional sodium chloride market.

LEADING PLAYERS IN THE NORTH AMERICA SODIUM CHLORIDE MARKET

Compass Minerals International Inc.

Compass Minerals International Inc. is a global leader in the sodium chloride market. The company operates state-of-the-art integrated mining and refining facilities, ensuring cost efficiency and supply chain resilience. Its strong R&D capabilities and partnerships with industries like agriculture and healthcare enable Compass Minerals to maintain its leadership position.

Cargill Incorporated

Cargill Incorporated specializes in high-purity sodium chloride tailored for food and industrial applications. The company’s strategic collaborations with food processors and municipalities underscore its commitment to innovation. Cargill has developed advanced formulations optimized for water softening and food preservation, addressing the growing demand for efficient and safe sodium chloride solutions. Additionally, Cargill invests heavily in research to enhance product quality and expand its application scope. Its focus on customer-centric solutions and operational excellence ensures sustained growth in a competitive market.

AkzoNobel N.V.

AkzoNobel N.V. is leveraging its expertise in sustainable production methods to align with global environmental goals. The company’s strategic partnerships with downstream industries ensure a steady demand pipeline, while its global presence enhances market reach. AkzoNobel’s emphasis on innovation and sustainability positions it as a key player in the evolving sodium chloride landscape.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players in the North America sodium chloride market employ a range of strategies to maintain their competitive edge and drive growth. One prominent approach is vertical integration, which allows companies to streamline operations and reduce dependency on external suppliers. For instance, Compass Minerals operates integrated mining-to-refining facilities, minimizing costs and enhancing supply chain reliability, as per the Society of Plastics Engineers. Another critical strategy is investing in research and development (R&D) to innovate sustainable products. Sustainability initiatives are also a focal point, with AkzoNobel spearheading biobased sodium chloride projects to meet regulatory requirements and consumer preferences. Strategic partnerships and acquisitions further strengthen market positions, enabling companies to expand their portfolios and tap into new application areas.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players of the North America sodium chloride market include Cargill, Compass Minerals, K+S Aktiengesellschaft, Morton Salt, CIECH Group, Tata Chemicals North America, Dominion Salt, INEOS Enterprises, American Elements, Altiras Chemicals

The North America sodium chloride market is characterized by intense competition, with established players and new entrants vying for market share. Established companies like Compass Minerals, Cargill, and AkzoNobel dominate the landscape, leveraging their scale, technological expertise, and brand reputation to maintain leadership. However, the entry of smaller firms specializing in eco-friendly sodium chloride introduces fresh competition, particularly in sustainability-focused segments. Price wars often arise due to the influx of low-cost imports from Asia, forcing companies to adopt cost-saving measures or differentiate their offerings. Additionally, stringent environmental regulations and the need for sustainable practices add complexity, compelling firms to innovate continuously. Despite these challenges, the market remains resilient, driven by strategic investments and a focus on meeting diverse industrial needs.

RECENT HAPPENINGS IN THE MARKET

- In June 2023, Compass Minerals launched a sustainable sodium chloride production facility, enhancing its portfolio of eco-friendly products and aligning with global environmental goals.

- In March 2023, Cargill partnered with U.S. municipalities to co-develop efficient water softening solutions using advanced sodium chloride formulations, addressing the growing demand for clean water infrastructure.

- In January 2023, AkzoNobel announced a $500 million investment in renewable feedstock research, aiming to produce biobased sodium chloride and cater to environmentally conscious consumers.

- In October 2022, K+S AG acquired a sodium chloride refinery in Texas, expanding its production capacity and strengthening its position in the North American market.

- In July 2022, Tata Chemicals introduced a low-corrosion sodium chloride derivative designed for eco-conscious consumers, targeting applications in sustainable agriculture and water treatment.

MARKET SEGMENTATION

This research report on the North America sodium chloride market has been segmented and sub-segmented based on product, end use, and region.

By Product

- Industrial

- Food

- Medical Grade Salt

By End Use

- Chemical Manufacturing

- Water Treatment

By Region

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What factors are driving the growth of the sodium chloride market in North America?

Key growth drivers include increased demand for de-icing during winter, expansion in the food processing industry, and growing applications in water treatment and pharmaceuticals.

2. Which are the major countries contributing to the North American sodium chloride market?

The United States and Canada are the primary contributors due to their large-scale industrial use and extensive road de-icing needs.

3. Who are the key players in the North America sodium chloride market?

Major companies include Cargill, Compass Minerals, Morton Salt, K+S Aktiengesellschaft, and Tata Chemicals North America.

4. How is sodium chloride distributed in the North American market?

Depending on the end-use industry, it is distributed through direct sales, distributors, wholesalers, and online platforms.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]