North America Smart Lighting Market Research Report – Segmented By Installation (New Installations, Retrofit Installations) Offering ( Hardware ,Post Installation Service ) Application ( Indoor, Commercial, Highways Roadways Lighting ) Technology (wireless, BLE (Bluetooth Low Energy) ) and Country (The U.S., Canada and Rest of North America) - Industry Analysis, Size, Share, Growth, Trends, & Forecasts 2025 to 2033.

North America Smart Lighting Market Size

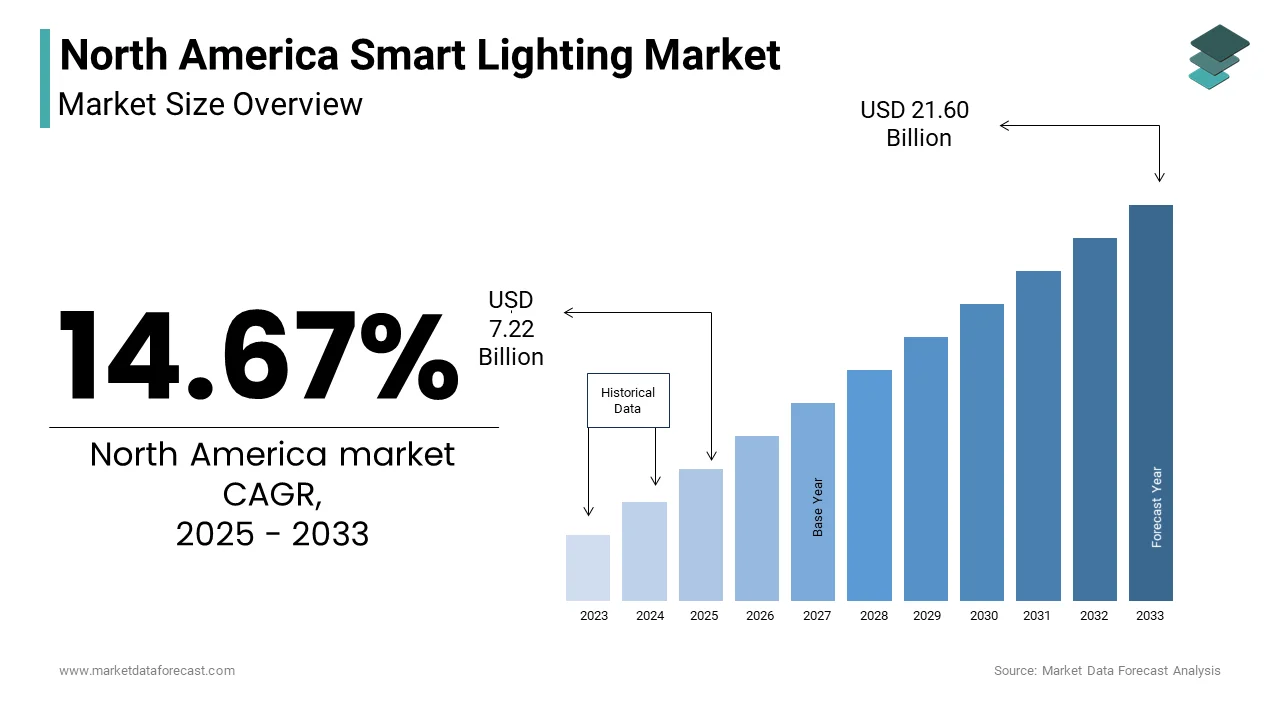

The North America Smart Lighting Market Size was valued at USD 6.3 billion in 2024. The North America Smart Lighting Market size is expected to have 14.67 % CAGR from 2025 to 2033 and be worth USD 21.60 billion by 2033 from USD 7.22 billion in 2025.

The North America smart lighting market refers to the deployment and adoption of intelligent, connected lighting systems that integrate Internet of Things (IoT) technologies, automation, energy efficiency, and adaptive control mechanisms. These lighting solutions are used across residential, commercial, industrial, and outdoor applications, offering benefits such as remote monitoring, occupancy sensing, daylight harvesting, and integration with building management systems.

The United States and Canada form the core of this market, driven by increasing urbanization, strong government support for energy-efficient infrastructure, and growing investments in smart cities and green buildings. According to the U.S. Department of Energy, a significant share of commercial buildings constructed after 2020 incorporated smart lighting controls, reflecting a shift toward intelligent energy management strategies. Similarly, Natural Resources Canada has been promoting smart lighting upgrades under its energy efficiency programs, particularly in municipal street lighting and public facilities.

Another key factor contributing to market growth is the rise of home automation and voice-controlled ecosystems, where smart lighting plays a central role in enhancing convenience, security, and energy savings. As per the Consumer Technology Association (CTA), smart home device sales in the U.S. surpassed $35 billion in 2023, with smart bulbs and lighting systems representing one of the fastest-growing categories.

MARKET DRIVERS

Increasing Adoption of IoT and Connected Home Technologies

One of the primary drivers fueling the North America smart lighting market is the widespread adoption of Internet of Things (IoT) devices and connected home ecosystems, which have significantly influenced consumer preferences for intelligent lighting solutions. According to the Consumer Technology Association (CTA) , over 70% of U.S. households now own at least one smart home device , with smart lighting being among the most popular due to its ease of installation, immediate usability, and compatibility with voice assistants like Alexa, Google Assistant, and Apple HomeKit. Smart lighting serves as a foundational element in home automation, allowing users to control brightness, color temperature, and scheduling via mobile apps or voice commands. This level of personalization enhances both comfort and energy efficiency, appealing to tech-savvy homeowners and renters alike. Additionally, the integration of smart lighting with security systems, climate control, and entertainment platforms has reinforced its appeal beyond simple illumination. Retailers such as Amazon, Philips Hue, and Lutron have capitalized on this trend by offering bundled smart lighting kits that provide seamless interoperability and user-friendly interfaces.

Government Initiatives Promoting Energy Efficiency and Green Building Standards

Another significant driver behind the growth of the North America smart lighting market is the robust policy framework supporting energy efficiency, sustainability, and smart infrastructure development. Governments at federal, state, and municipal levels have introduced incentive programs, tax credits, and regulatory mandates aimed at reducing energy consumption and carbon emissions from lighting systems, which historically accounted for a substantial portion of electricity use.

The Department of Energy’s GATEWAY program has funded numerous pilot projects demonstrating the economic and environmental benefits of smart lighting in public institutions, transit hubs, and office complexes. In Canada, similar efforts are underway through Natural Resources Canada’s Office of Energy Efficiency , which promotes smart lighting as part of its broader initiative to meet national greenhouse gas reduction targets. Provincial authorities in Ontario and British Columbia have also mandated the use of motion-sensitive and daylight-responsive lighting in new commercial constructions, reinforcing market penetration. Moreover, LEED certification requirements for green buildings increasingly prioritize smart lighting integration, encouraging developers and facility managers to invest in advanced lighting controls.

MARKET RESTRAINTS

High Initial Installation Costs and Complex Integration Requirements

A major restraint affecting the North America smart lighting market is the relatively high upfront investment required for smart lighting systems, especially when considering hardware, software, and professional installation services. While long-term energy savings and operational efficiencies are well-documented, many consumers and small businesses hesitate due to initial cost barriers and uncertainty about return on investment timelines. These figures pose challenges for budget-conscious adopters, particularly in the residential and small business segments. Also, the technical complexity of integrating smart lighting with legacy electrical systems and incompatible protocols adds another layer of difficulty. Many older buildings lack the necessary wiring or network infrastructure to support full smart lighting capabilities without costly modifications.

Consumer Concerns Over Data Privacy and Cybersecurity

Another critical challenge hindering the North America smart lighting market is the growing concern over data privacy and cybersecurity risks associated with connected lighting systems. Since smart lighting relies on internet-connected devices, cloud-based platforms, and real-time data analytics, it exposes users to potential vulnerabilities if not properly secured. These concerns extend beyond the residential segment into commercial and institutional settings. Facility managers and IT departments are increasingly cautious about incorporating smart lighting systems into their networks due to potential entry points for hackers. According to the Cybersecurity and Infrastructure Security Agency (CISA) , several cases of smart device breaches in recent years involved poorly configured smart lighting systems that allowed unauthorized access to internal networks. Moreover, the proliferation of proprietary and non-standardized communication protocols increases the risk of insecure device configurations. Like, many smart lighting products lack uniform security certification , making it difficult for buyers to assess safety and compliance levels before deployment.

MARKET OPPORTUNITIES

Expansion of Smart Cities and Municipal Lighting Projects

One of the most promising opportunities for the North America smart lighting market lies in the accelerating development of smart city initiatives and large-scale municipal lighting upgrades. As urban centers seek to enhance sustainability, reduce energy expenditures, and improve public safety, smart street lighting has emerged as a foundational component of modern urban infrastructure. These systems not only reduce power consumption but also serve as nodes in broader smart city networks, supporting applications such as traffic management, air quality sensing, and emergency response coordination. A notable example is Los Angeles, which has installed over 220,000 smart streetlights, achieving significant reductions in energy use and maintenance costs. Furthermore, the integration of smart poles—streetlights equipped with 5G antennas, surveillance cameras, and environmental sensors—is opening new revenue streams and expanding the role of smart lighting beyond illumination.

Growth in Commercial and Industrial Automation

Another significant opportunity for the North America smart lighting market is the expanding integration of smart lighting into commercial and industrial automation systems. As enterprises seek to optimize operations, reduce overhead costs, and enhance workplace efficiency, smart lighting has become a key enabler of intelligent building management and Industry 4.0-ready environments. Smart lighting systems in commercial spaces—such as offices, retail stores, and warehouses—are increasingly being deployed alongside HVAC controls, occupancy sensors, and asset tracking solutions to create fully integrated smart buildings. According to the U.S. Green Building Council (USGBC) , buildings equipped with smart lighting and control systems achieved significant reductions in energy consumption , improving both sustainability and operating margins. In industrial settings, smart lighting is being adopted as part of broader automation strategies that include predictive maintenance, task-specific illumination, and safety-enhancing features such as motion-triggered lighting in manufacturing zones. Additionally, the convergence of smart lighting with artificial intelligence and edge computing allows for dynamic adjustments based on worker movement, time of day, and ambient conditions, further boosting efficiency and safety.

MARKET CHALLENGES

Fragmentation of Standards and Interoperability Issues

A major challenge confronting the North America smart lighting market is the fragmentation of technical standards and interoperability limitations among smart lighting systems, which hinder seamless integration across brands, platforms, and building infrastructures. Unlike traditional lighting, smart lighting involves multiple components—including control modules, gateways, and cloud-based management systems—that often operate on proprietary protocols, limiting cross-compatibility. This diversity creates confusion for consumers and complicates integration efforts for building engineers and automation specialists. As noted by the National Electrical Manufacturers Association (NEMA) , lack of standardization was a top barrier to smart lighting adoption in commercial retrofits , contributing to delays and increased implementation costs. This issue extends to software ecosystems as well, where compatibility problems between lighting platforms and building management systems prevent unified control and data aggregation.

Limited Awareness and Education Among End Users

Another critical challenge facing the North America smart lighting market is the limited awareness and understanding among end users regarding the benefits, functionality, and long-term value proposition of smart lighting solutions. Despite growing media attention and marketing efforts by major vendors, many consumers and even some commercial stakeholders remain hesitant due to misconceptions about complexity, reliability, and actual cost savings. This knowledge gap prevents widespread adoption, particularly among older demographics and first-time smart home buyers who rely heavily on word-of-mouth and peer recommendations. Apart from these, resistance from electricians and contractors unfamiliar with smart lighting controls has slowed deployment in new construction and renovation projects. Addressing this challenge requires targeted education campaigns, hands-on demonstrations, and collaboration between manufacturers, utility providers, and trade associations to build trust and familiarity with smart lighting benefits.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

14.67 % |

|

Segments Covered |

By Installation, Offering, Application, Technology and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

Cree,Sengled,Eaton,Cisco,Caseta by Lutron,Honeywell,Kichler |

SEGMENTAL ANALYSIS

By Installation Insights

The retrofit installations segment dominated the North America smart lighting market by capturing 58.6% of total deployment activity in 2024. This leading position is primarily driven by the vast existing building stock across residential and commercial sectors that are undergoing modernization to meet energy efficiency targets without necessitating full-scale infrastructure overhauls. One of the key factors behind this dominance is the cost-effectiveness and scalability of retrofitting legacy lighting systems with smart controls and LED components , allowing property owners to upgrade illumination without replacing entire electrical setups. According to the U.S. Department of Energy’s Building Technologies Office, a significant share of commercial buildings constructed before 2010 remain operational today, making retrofits a strategic choice for improving energy performance and reducing utility costs. Another major contributor to the segment's growth is the availability of government incentives and utility rebates specifically targeting retroactive upgrades , which make smart lighting more financially accessible to homeowners and small businesses. As reported by Natural Resources Canada, many provinces offer direct subsidies for smart lighting retrofits under broader energy conservation programs , encouraging adoption among older housing developments and aging commercial facilities.

The new installations segment is emerging as the fastest-growing category within the North America smart lighting market , projected to expand at a CAGR of 13.6%. While initially smaller in volume compared to retrofits, new builds—particularly in residential and commercial construction—are increasingly incorporating smart lighting as a standard feature due to evolving building codes and consumer demand for intelligent home environments. A primary driver behind this rapid growth is the integration of smart lighting into newly constructed homes and commercial buildings, where developers prioritize energy-efficient and future-ready infrastructure. In addition, the expansion of green building certifications such as LEED and WELL has reinforced the appeal of smart lighting in new constructions, particularly in office complexes, educational institutions, and healthcare facilities.

By Offering Insights

The hardware segment had the biggest share of the North America smart lighting market by accounting for a 67.8% of total revenue in 2024. This leading position is because of the foundational nature of smart lighting solutions, which require physical components such as smart bulbs, sensors, gateways, and control panels to enable connectivity, automation, and energy optimization. One of the primary drivers of this segment’s dominance is the increasing incorporation of smart lighting hardware into both residential and commercial projects, where upfront investment in lighting fixtures and control modules remains essential for system functionality. Another major factor supporting market growth is the rising popularity of DIY smart lighting kits and plug-and-play smart bulbs , which have made it easier for consumers to adopt connected lighting without requiring professional installation.

The post-installation service segment is experiencing the fastest growth rate in the North America smart lighting market , projected to grow at a CAGR of 14.9%. This surge reflects the growing recognition of the importance of ongoing support, cloud integration, software updates, and remote diagnostics to ensure optimal performance and longevity of smart lighting systems. A key driver behind this expansion is the increased reliance on managed services and cloud-based lighting platforms, especially in large-scale commercial and municipal deployments. Facility managers and city planners now seek end-to-end service packages that include predictive maintenance, usage analytics, and cybersecurity monitoring. Another contributing factor is the evolving complexity of smart lighting ecosystems , which often integrate with building automation systems, occupancy sensors, and artificial intelligence-driven control interfaces.

By Application Insights

The commercial application segment commanded the North America smart lighting market by capturing a 43.5% of total sector revenue in 2024. This is attributed to the widespread adoption of smart lighting in offices, retail spaces, hospitals, and industrial facilities, where energy efficiency, automation, and occupant comfort are critical considerations. One of the key factors behind this dominance is the growing implementation of smart lighting in corporate campuses and co-working environments , where adaptive lighting enhances productivity while reducing operational expenses. Another major contributor to the segment's growth is the integration of smart lighting with facility management systems , enabling real-time occupancy sensing, daylight harvesting, and space utilization tracking.

The highways and roadways lighting segment is experiencing the highest progress rate in the North America smart lighting market , projected to expand at a CAGR of 15.2%. This rapid expansion is largely driven by the increasing adoption of smart streetlights in urban mobility initiatives, traffic management systems, and public safety enhancements. A primary driver behind this surge is the accelerated rollout of smart poles and IoT-enabled streetlights across major cities, aimed at reducing energy use and enhancing infrastructure resilience. Another key factor fueling this segment’s momentum is the integration of smart lighting into broader smart city frameworks , where streetlights serve as data collection nodes for environmental sensors, video surveillance, and 5G signal transmission. Cities like New York, Chicago, and Toronto have launched large-scale smart roadway lighting projects that not only illuminate streets but also support intelligent transportation networks and air quality monitoring.

By Technology Insights

The wireless communication technology segment dominates the North America smart lighting market by capturing 72.6% of total technology-based deployments in 2024. This is attributed to the flexibility, scalability, and ease of integration offered by wireless protocols such as Zigbee, Wi-Fi, and Z-Wave, which facilitate seamless connectivity between lighting systems, mobile apps, and centralized control platforms. One of the key factors behind this dominance is the widespread adoption of wireless smart lighting in residential and small business settings, where hardwiring is either impractical or cost-prohibitive. Another major contributor to the segment's growth is the integration of wireless lighting controls into enterprise and municipal infrastructure projects , particularly in smart cities and adaptive outdoor lighting networks.

The Bluetooth Low Energy (BLE) segment is emerging as the swiftest advancing technology within the North America smart lighting market. While still a niche compared to broader wireless standards, BLE is gaining traction due to its low power consumption, localized control capabilities, and ability to function independently of Wi-Fi networks. A primary driver behind this rapid growth is the increased use of BLE in proximity-based smart lighting applications, particularly in indoor positioning, asset tracking, and beacon-enabled lighting systems. Another contributing factor is the growing preference for BLE in battery-powered smart lighting fixtures , including portable lamps, emergency lighting, and smart furniture-integrated luminaires.

COUNTRY LEVEL ANALYSIS

United States led the North America smart lighting market by capturing a 76.6% of regional market share in 2024. As a global leader in smart home adoption, commercial building automation, and municipal smart city initiatives, the U.S. plays a central role in shaping demand for intelligent lighting solutions across multiple verticals. One of the primary drivers of the U.S. market is the strong presence of major smart lighting vendors, tech giants, and semiconductor manufacturers , all of which contribute to rapid product development and ecosystem integration. Companies like Philips Hue (operating under Signify North America), Lutron Electronics, and Acuity Brands have been instrumental in scaling residential and commercial smart lighting offerings. Another key factor supporting market growth is the expanding network of smart city pilot projects and state-level energy efficiency programs , particularly in states like California, Texas, and New York.

Canada has demonstrated consistent growth in smart lighting adoption, particularly in commercial buildings, institutional facilities, and municipal lighting upgrades. A major driver behind Canada’s market position is the government-backed push toward energy efficiency and climate action , particularly through provincial energy-saving incentive programs. Natural Resources Additionally, contributing factor is the rising adoption of smart lighting in institutional and public sector buildings , including schools, universities, and government offices.

Mexico is reflecting a nascent but gradually developing presence in the regional smart infrastructure ecosystem. While still in the early stages of adoption compared to the U.S. and Canada, Mexico is beginning to explore opportunities in smart lighting, particularly in urban centers and industrial zones. One of the primary drivers influencing Mexico’s market trajectory is the increased focus on energy efficiency and grid modernization, particularly in commercial and municipal sectors. Another contributing factor is the emerging trend of smart city development in metropolitan areas such as Mexico City, Guadalajara, and Monterrey, where authorities are piloting intelligent street lighting and adaptive illumination systems to improve public safety and reduce energy expenditures.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the North America Smart Lighting Market are Cree,Sengled,Eaton,Cisco,Caseta by Lutron,Honeywell,Kichler,Cooper Lighting.

The North America smart lighting market features a highly dynamic and competitive environment, shaped by the convergence of traditional lighting manufacturers, tech innovators, and home automation specialists. Established industry leaders like Signify (Philips Hue), Lutron, and Acuity Brands leverage decades of expertise in lighting engineering and building integration to maintain strong footholds in both residential and commercial segments. Their deep-rooted relationships with contractors, architects, and utility providers give them an edge in large-scale deployments and retrofit projects.

Simultaneously, emerging technology firms and direct-to-consumer brands are disrupting the space with agile product development cycles, app-first interfaces, and subscription-based service models. These newer entrants appeal to digitally savvy consumers who prioritize ease of use, affordability, and DIY installation capabilities. Additionally, semiconductor and connectivity solution providers are playing an increasingly influential role by enabling next-generation lighting controls based on Bluetooth Low Energy (BLE), Zigbee, and Wi-Fi standards.

Market competition extends beyond product performance to encompass ecosystem compatibility, cybersecurity features, and sustainability commitments. As smart lighting becomes more embedded in the broader Internet of Things (IoT) landscape, differentiation hinges not only on brightness and color but also on data handling, integration flexibility, and long-term service offerings. Companies must continuously innovate in software, interoperability, and value-added services to stay ahead in this fast-evolving market.

Top Players in the market

Signify North America (Philips Hue) is a global leader in smart lighting and holds a dominant position in the North America market. The company has played a pivotal role in mainstreaming smart lighting through its Philips Hue product line, which offers intuitive control, color customization, and seamless integration with leading voice assistants and home automation platforms. Its focus on consumer-centric design and software-driven user experiences has made it a household name in residential smart lighting.

Lutron Electronics is a key player known for its advanced lighting controls, dimmers, and whole-home and commercial automation systems. Lutron’s contributions to the global smart lighting landscape include pioneering wireless lighting control technologies that are now widely adopted in both residential and institutional settings. Its solutions support energy efficiency, comfort, and adaptive lighting, making it a preferred choice among architects, builders, and facility managers across North America.

Acuity Brands is a major force in commercial and industrial smart lighting solutions, offering integrated systems that combine LED fixtures, IoT-enabled sensors, and intelligent building management tools. The company plays a critical role in shaping large-scale deployments in corporate campuses, airports, and smart city infrastructure. Acuity's emphasis on connected lighting ecosystems and data-driven energy optimization has positioned it as a strategic contributor to the evolution of smart lighting beyond illumination into broader digital infrastructure.

Top strategies used by the key market participants

One of the primary strategies employed by key players in the North America smart lighting market is deep ecosystem integration , where companies ensure their products work seamlessly with major smart home platforms such as Amazon Alexa, Google Assistant, Apple HomeKit, and Samsung SmartThings. This compatibility enhances user adoption and strengthens brand loyalty by aligning with existing consumer technology habits.

Another crucial strategy involves product diversification and expansion into vertical-specific lighting solutions , allowing manufacturers to cater to distinct use cases in residential, hospitality, healthcare, and industrial environments. By developing tailored lighting experiences that address specific needs—such as circadian lighting in hospitals or task-based illumination in offices—companies enhance their market relevance and competitive edge.

The third major approach is strategic partnerships and acquisitions, particularly with software developers, lighting analytics firms, and building automation providers. These collaborations enable companies to expand their technological capabilities, improve system intelligence, and offer more comprehensive smart lighting services that go beyond hardware, reinforcing long-term value and customer retention in an increasingly interconnected marketplace.

RECENT HAPPENINGS IN THE MARKET

In February 2024, Signify North America launched a new AI-powered lighting assistant within the Philips Hue app, designed to personalize lighting scenes based on user behavior patterns and ambient conditions, enhancing engagement and deepening brand loyalty.

In April 2024, Lutron Electronics introduced a modular smart lighting control panel that allows homeowners to customize lighting without relying on smartphone apps, catering to users who prefer physical interfaces while maintaining full smart functionality and interconnectivity.

In July 2024, Acuity Brands acquired a San Francisco-based lighting analytics startup to integrate real-time occupancy sensing and predictive maintenance capabilities into its commercial lighting portfolio, strengthening its position in enterprise and municipal smart lighting contracts.

In September 2024, a leading U.S. smart lighting manufacturer entered into a co-development agreement with a major cloud computing provider to launch an edge-computing enabled lighting platform, improving response times and reducing dependency on centralized servers for smart lighting operations.

In November 2024, a Canadian lighting solutions firm expanded its distribution network by partnering with a major U.S. home improvement retailer, ensuring nationwide availability of its smart lighting products and increasing visibility among mainstream consumers seeking accessible, high-performance options.

MARKET SEGMENTATION

This research report on the north america smart lighting market has been segmented and sub-segmented into the following categories.

By Installation

- New Installations

- Retrofit Installations

By Offering

- Hardware

- Lights and Luminaries

- Lighting Controls

- Software

- Services

- Pre Installation Service

- Post Installation Service

By Application

- Indoor

- Commercial

- Industrial

- Residential

- Others

- Outdoor

- Highways Roadways Lighting

- Architectural Lighting

- Lighting for Public Spaces

By Technology

- Wired

- DALI

- Power Over Ethernet

- Power line Communications

- Wired Hybrid Protocols

- Wireless

- Zigbee

- Wi Fi

- BLE

- EnOcean

- 6LoWPAN

- Wireless Hybrid Products

By Country

- The U.S.

- Canada

- Rest of North America.

Frequently Asked Questions

What is the North America Smart Lighting Market?

The North America Smart Lighting Market refers to the industry focused on advanced lighting systems integrated with IoT, sensors, and automation, enabling energy efficiency

How big is the North America Smart Lighting Market?

The market is experiencing rapid growth, with projections suggesting a multi-billion-dollar valuation by the end of the decade, driven by increasing demand for smart homes and energy-efficient solutions.

How does smart lighting contribute to energy efficiency?

Smart lighting systems use LED technology, sensors, and automation to optimize energy usage, reducing power consumption by up to 50-80% compared to traditional lighting systems.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com