North America Smart Home Market Size, Share, Trends & Growth Forecast Report By Technology (Bluetooth, Wi-Fi, GSM/GPRS, ZigBee, RFID, EnOcean, Z-wave), Product and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Smart Home Market Size

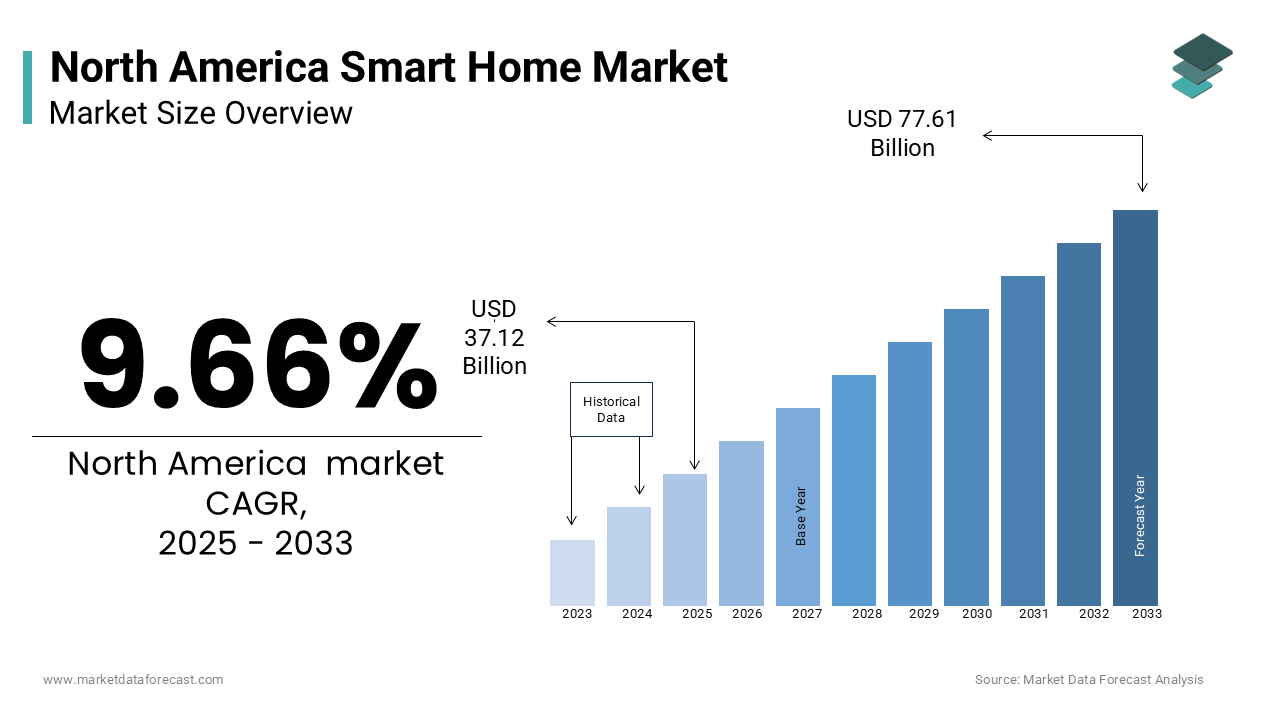

The North America smart home market was worth USD 33.85 billion in 2024. The North American market is estimated to grow at a CAGR of 9.66% from 2025 to 2033 and be valued at USD 77.61 billion by the end of 2033 from USD 37.12 billion in 2025.

The North America smart home market includes a wide array of interconnected devices and systems designed to enhance the convenience, security, and energy efficiency of residential environments. This market has gained significant traction due to the rapid advancement of technology, particularly in the realms of the Internet of Things (IoT), artificial intelligence (AI), and wireless communication. Smart home devices include smart thermostats, security cameras, lighting systems, and home automation hubs, all of which can be controlled remotely via smartphones or voice-activated assistants. This growth is driven by increasing consumer awareness of energy efficiency, the desire for enhanced home security, and the convenience offered by smart technologies. As per recent surveys, nearly 70% of U.S. households are expected to adopt at least one smart home device by 2025, indicating a robust shift towards smart living solutions. The convergence of technology and consumer demand positions the North America smart home market as a pivotal segment within the broader technology landscape.

MARKET DRIVERS

Growing Consumer Demand for Energy Efficiency

The increasing consumer demand for energy efficiency is a significant driver of the North America smart home market. As homeowners become more environmentally conscious, they are seeking solutions that not only reduce energy consumption but also lower utility bills. Smart home devices, such as smart thermostats and energy management systems, enable users to monitor and control their energy usage in real-time. The U.S. Department of Energy reports that smart thermostats can save homeowners an average of 10-12% on heating and cooling costs, translating to approximately $50 to $100 annually. This financial incentive, coupled with the growing awareness of climate change, has led to a surge in the adoption of energy-efficient smart home technologies. Furthermore, government initiatives and incentives aimed at promoting energy efficiency are further propelling this trend. As per a report by the American Council for an Energy-Efficient Economy, energy efficiency programs have saved U.S. consumers over $800 billion since 1980, highlighting the economic benefits of adopting smart home solutions.

Advancements in Technology and Connectivity

Advancements in technology and connectivity are pivotal factors fueling the growth of the North America smart home market. The proliferation of high-speed internet and the widespread adoption of wireless communication protocols, such as Wi-Fi, Zigbee, and Z-Wave, have made it easier for consumers to integrate smart devices into their homes. These technologies enable seamless communication between devices, allowing for enhanced automation and control. For instance, smart home hubs can connect various devices, enabling users to create customized routines and scenarios that enhance convenience and security. Also, the rise of voice-activated assistants, such as Amazon Alexa and Google Assistant, has further simplified the user experience, making it more accessible for consumers to interact with their smart home systems.

MARKET RESTRAINTS

High Initial Costs and Consumer Hesitance

High initial costs associated with purchasing and installing smart home devices is one of the primary restraints affecting the North America smart home market. While the long-term savings on energy bills can be significant, the upfront investment can deter many consumers from adopting smart home technologies. A survey conducted by the Consumer Technology Association states that nearly 40% of consumers cited cost as a significant barrier to purchasing smart home devices. The average cost of a comprehensive smart home system can range from $1,000 to $3,000, depending on the number and type of devices included. This financial barrier is particularly pronounced among lower-income households, which may prioritize essential expenses over technology upgrades. Moreover, consumer hesitance stemming from concerns about the complexity of installation and the perceived difficulty of using smart home systems can further inhibit market growth.

Security and Privacy Concerns

Security and privacy concerns represent a significant restraint in the North America smart home market. As smart home devices become increasingly interconnected, the potential for cyberattacks and data breaches raises alarms among consumers. As stated in a report by the Identity Theft Resource Center, data breaches in the U.S. reached an all-time high in 2021, with over 1,800 reported incidents. This growing trend has led to heightened awareness of the vulnerabilities associated with smart home technologies. Consumers are particularly concerned about the security of personal data collected by devices, such as smart cameras and voice assistants, which can be susceptible to hacking. A survey conducted by the Pew Research Center found that 81% of Americans feel they have little to no control over the data collected by companies. Hence, many potential buyers may hesitate to invest in smart home technologies due to fears of compromised privacy and security.

MARKET OPPORTUNITIES

Integration of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) technologies presents a significant opportunity for the North America smart home market. These advanced technologies enable smart home devices to learn user preferences and behaviors, allowing for more personalized and efficient automation. For instance, AI-powered thermostats can analyze historical data to optimize heating and cooling schedules, resulting in enhanced energy savings. Based on a report by McKinsey, the AI landscape in the smart home sector is predicted to advance at a substantial rate in the future and is driven by increasing consumer demand for intelligent home solutions. Furthermore, the incorporation of AI and ML can enhance security features, such as facial recognition in smart cameras, providing users with greater peace of mind.

Expansion of Smart Home Ecosystems

The expansion of smart home ecosystems represents another significant opportunity for growth in the North America smart home market. As more manufacturers enter the market, the development of interoperable devices and platforms is becoming increasingly important. Consumers are increasingly looking for solutions that allow seamless communication between devices from different manufacturers, enabling them to create customized smart home experiences. The rise of platforms such as Apple HomeKit, Google Home, and Amazon Alexa has facilitated this trend by providing a centralized hub for managing various smart devices. Additionally, the growing popularity of home automation services, such as IFTTT (If This Then That), allows users to create personalized routines that enhance convenience and efficiency.

MARKET CHALLENGES

Fragmentation of Standards and Protocols

The fragmentation of standards and communication protocols poses a significant challenge to the North America smart home market. With numerous manufacturers developing their own proprietary technologies, consumers often face compatibility issues when attempting to integrate devices from different brands. According to a study by the Consumer Technology Association, nearly 50% of consumers expressed frustration over the lack of interoperability among smart home devices. This fragmentation can lead to a disjointed user experience, discouraging potential buyers from investing in smart home technologies. Furthermore, the absence of universally accepted standards can hinder innovation, as manufacturers may be reluctant to invest in new technologies that may not be compatible with existing devices.

Rapid Technological Advancements

The rapid pace of technological advancements in the smart home sector presents both opportunities and challenges. While innovation drives market growth, it also creates pressure on manufacturers to continuously update and improve their products. As outlined by a report from the Gartner, nearly 70% of consumers expect their smart home devices to be updated regularly with new features and security enhancements. This expectation can strain resources for manufacturers, particularly smaller companies that may lack the capacity to keep up with the fast-evolving landscape. Also, the constant introduction of new technologies can lead to consumer confusion, as potential buyers may struggle to understand the differences between various products and their functionalities.

SEGMENTAL ANALYSIS

By Technology Insights

The Wi-Fi technology segment emerged as the biggest one in the North America smart home market by contributing 46.2% of the total market share in 2024. This command is backed by the widespread availability of Wi-Fi networks in residential settings, making it the most accessible communication protocol for smart home devices. The reliability and high bandwidth of Wi-Fi technology enable seamless streaming of data and real-time communication between devices, enhancing the overall user experience. Furthermore, the integration of Wi-Fi with voice-activated assistants, such as Amazon Alexa and Google Assistant, has further propelled its popularity is allowing users to control their smart home devices effortlessly.

The fastest-growing segment in the North America smart home market is ZigBee technology and is expected to see a CAGR of 28.1%. This rapid growth can be caused by the increasing demand for low-power, low-data-rate communication protocols that are ideal for smart home applications. ZigBee technology is particularly well-suited for devices such as smart lighting, security sensors, and home automation systems, which require reliable communication over short distances. The ability of ZigBee to support a large number of devices within a single network, along with its low power consumption, makes it an attractive option for consumers looking to create comprehensive smart home ecosystems.

By Product Type Insights

The security and surveillance systems represented the largest product category by accounting for 35.8% of the total market share in 2024.

This rule is driven by the growing consumer concern for home security and the increasing incidence of property crimes. Based on the FBI's Uniform Crime Reporting Program, property crimes in the United States totaled over 7 million incidents in 2020 is prompting homeowners to invest in advanced security solutions. Smart security systems including cameras, motion detectors, and smart locks offer enhanced monitoring capabilities and remote access, allowing homeowners to keep an eye on their properties from anywhere. The integration of AI and machine learning technologies into security systems has further improved their effectiveness, enabling features such as facial recognition and real-time alerts.

The energy management systems segment is projected to experience highest CAGR of 25.5% from 2025 to 2033. This development can be linked to the increasing consumer awareness of energy efficiency and the rising costs of utility bills. The U.S. Energy Information Administration states that residential energy consumption in the United States is expected to increase by 1.3% annually, driving the demand for solutions that help homeowners manage their energy usage effectively. Smart energy management systems enable users to monitor their energy consumption in real-time, identify inefficiencies, and optimize their usage patterns. The integration of renewable energy sources, such as solar panels, with energy management systems further enhances their appeal is allowing homeowners to reduce their reliance on grid electricity.

REGIONAL ANALYSIS

The United States took the forefront in the North America smart home market by capturing 71.2% of the total market share in 2024. This influence can be due to the country's advanced technological infrastructure and the presence of major technology companies driving innovation in the smart home sector. According to a report by the Consumer Technology Association, nearly 70% of U.S. households are expected to adopt at least one smart home device by 2025, reflecting a robust shift towards smart living solutions. The U.S. market is demonstrated by significant investments in research and development, leading to the introduction of innovative products and services. Additionally, the growing emphasis on energy efficiency and home security is propelling the demand for smart home technologies.

Canada surges ahead as the fastest riser in the North America smart home market and is forecast to escalate at a CAGR of 11.2% through the assessment period. This growth can be attributed to the increasing demand for smart home technologies driven by urbanization and the expansion of the Internet of Things (IoT). As per a report by the Canadian Internet Registration Authority, the number of smart home devices in Canada is projected to reach 30 million by 2025 is reflecting the growing reliance on digital solutions for home management. The Canadian market is defined by a substantial emphasis on energy efficiency and sustainability, with consumers increasingly adopting smart technologies to reduce their carbon footprint. Government initiatives aimed at promoting energy-efficient solutions further support this trend.

The rest of North America is moving forward steadily in the North America smart home market. This region is witnessing growth driven by the increasing demand for smart home solutions and the expansion of internet connectivity in the region. The market is characterized by a focus on affordability and accessibility, with consumers seeking cost-effective smart home solutions that enhance convenience and security. Additionally, the rising awareness of energy efficiency and sustainability is driving the adoption of smart technologies in residential settings.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Amazon is a leading player in the North America smart home market, primarily known for its Echo smart speakers and the Alexa voice assistant. The company's extensive ecosystem of smart home devices, including smart plugs, lights, and security cameras, has positioned it as a dominant force in the market. Amazon's commitment to innovation and customer-centric solutions has enabled it to capture a significant share of the smart home market, with millions of Alexa-enabled devices sold. The company's strategic partnerships with various manufacturers further enhance its product offerings, allowing for seamless integration of third-party devices into the Alexa ecosystem.

Google is another major player in the North America smart home market, recognized for its Google Nest product line, which includes smart speakers, thermostats, and security cameras. The integration of Google Assistant into its devices provides users with a powerful voice-activated control system, enhancing the overall user experience. Google's focus on AI and machine learning technologies has enabled it to offer advanced features, such as personalized recommendations and predictive analytics, further solidifying its position in the market. Its commitment to sustainability and energy efficiency also resonates with consumers, driving the adoption of its smart home solutions.

Apple is a prominent player in the North America smart home market, primarily through its HomeKit platform, which allows users to control a wide range of smart home devices using their iPhones and iPads. The company's emphasis on privacy and security has garnered consumer trust, making it a preferred choice for those concerned about data protection. Apple's ecosystem of smart home devices, including the HomePod smart speaker and various compatible products from third-party manufacturers, provides users with a seamless and integrated experience. The ongoing investments by Apple in research and development are expected to drive further innovation in the smart home sector.

The competition in the North America smart home market is characterized by a dynamic landscape where innovation, efficiency, and user experience are paramount. Major players are continuously striving to differentiate themselves through advanced technologies and comprehensive ecosystems. The market is witnessing a surge in the adoption of smart home devices, driven by increasing consumer demand for convenience, security, and energy efficiency. As organizations prioritize sustainability, companies that offer eco-friendly smart home solutions are gaining a competitive edge. Furthermore, the presence of both established players and emerging startups fosters a competitive environment that encourages rapid technological advancements. The ongoing digital transformation across various sectors is further intensifying competition, as consumers seek to optimize their home environments with smart technologies.

Strategies Employed by Key Players

Key players in the North America smart home market employ various strategies to strengthen their market position and enhance competitiveness. One prominent strategy is the focus on innovation and research and development, enabling companies to introduce cutting-edge smart home technologies that meet the evolving needs of consumers. For instance, Amazon has consistently invested in enhancing the capabilities of its Alexa voice assistant, integrating new features and expanding compatibility with third-party devices. Additionally, strategic partnerships and collaborations play a crucial role in expanding market reach and enhancing product offerings. Google, for example, has formed alliances with various manufacturers to ensure seamless integration of smart home devices within its ecosystem.

Furthermore, companies are increasingly prioritizing customer-centric approaches, offering tailored solutions and support services to address specific requirements of consumers. This focus on customer engagement not only fosters loyalty but also enhances the overall value proposition of their offerings. Additionally, many key players are actively pursuing mergers and acquisitions to expand their technological capabilities and market presence. For instance, Apple has acquired several startups specializing in smart home technologies to bolster its HomeKit platform.

RECENT MARKET DEVELOPMENTS

- In January 2024, Amazon announced the launch of a new line of smart home security cameras that integrate advanced AI features for enhanced monitoring capabilities. This move is expected to solidify Amazon's position in the security segment of the smart home market.

- In February 2024, Google unveiled an updated version of its Nest Hub, featuring improved display technology and enhanced integration with third-party smart devices, aimed at providing a more seamless user experience.

- In March 2024, Apple introduced new HomeKit-compatible devices, expanding its ecosystem and allowing users to control a wider range of smart home products through Siri.

- In April 2024, Samsung announced a partnership with a leading energy management company to develop smart home solutions that optimize energy consumption, aligning with the growing consumer demand for sustainability.

- In May 2024, Philips Hue launched a new range of smart lighting products that offer enhanced connectivity options and compatibility with various smart home platforms, further expanding its market reach.

- In June 2024, Ring, a subsidiary of Amazon, introduced a new line of smart doorbells with advanced motion detection and facial recognition capabilities, enhancing home security features.

- In July 2024, Ecobee announced a collaboration with a major utility company to provide smart thermostats to consumers, promoting energy efficiency and reducing overall energy consumption.

- In August 2024, Wyze launched a new suite of affordable smart home devices, including cameras and sensors, aimed at making smart home technology accessible to a broader audience.

- In September 2024, Honeywell expanded its smart home product line by introducing a new energy management system that integrates with existing home automation setups, enhancing user control over energy usage.

- In October 2024, Logitech announced the acquisition of a smart home startup specializing in home automation software, aiming to enhance its product offerings and strengthen its position in the smart home ecosystem.

MARKET SEGMENTATION

This research report on the North America smart home market is segmented and sub-segmented based on categories.

By Technology

- Bluetooth

- Wi-Fi

- GSM/GPRS

- ZigBee

- RFID

- EnOcean

- Z-wave

By Product Type

- Security and Surveillance Systems

- Lighting Systems

- HVAC Controls

- Energy Management

- Entertainment Controls

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

What challenges does the North American smart home market face?

Challenges include privacy concerns, interoperability issues, high upfront costs, and the complexity of setup and maintenance.

What is the market outlook for the smart home industry in North America?

The market is expected to grow rapidly, driven by technological advances and increasing consumer adoption of connected devices.

What is the future of smart homes in North America?

The future looks promising, with further integration of AI, machine learning, and IoT, leading to more intuitive and energy-efficient smart homes.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]