North America Small UAV Market Research Report – Segmented By UAV Type ( Rotary Wing , Fixed-Wing ) Propulsion Technology, End-User Industries and Country (The U.S., Canada and Rest of North America) - Industry Analysis, Size, Share, Growth, Trends, & Forecasts 2025 to 2033.

North America Small UAV Market Size

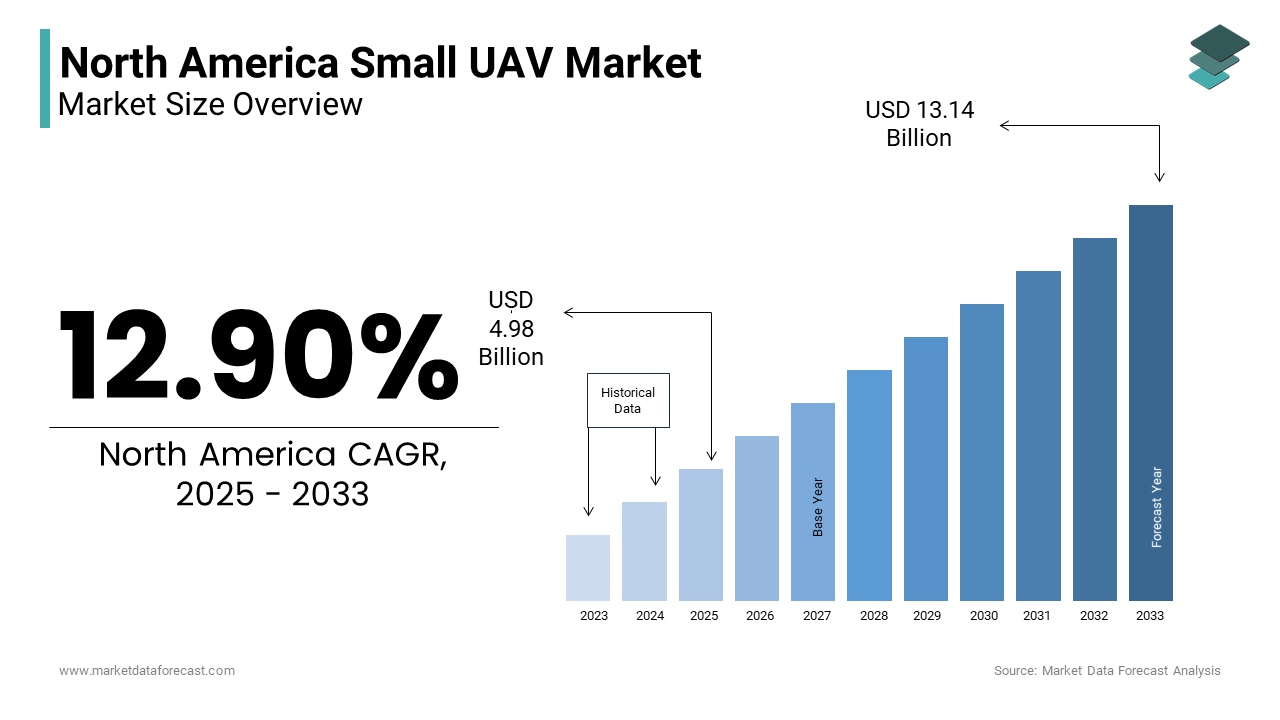

The North America Small UAV Market Size was valued at USD 4.41 billion in 2024. The North America Small UAV Market size is expected to have 12.90 % CAGR from 2025 to 2033 and be worth USD 13.14 billion by 2033 from USD 4.98 billion in 2025.

The North American small unmanned aerial vehicle (UAV) market has emerged as a pivotal player in the global UAV landscape, driven by technological advancements and increasing applications across industries. Regulatory frameworks have also played a crucial role in shaping the market environment. As per the Federal Aviation Administration (FAA), there were over 900,000 registered drones in the U.S. by mid-2023, signaling a surge in commercial and recreational UAV usage. However, stringent airspace regulations and safety concerns remain critical factors influencing market dynamics. With increasing investments in UAV technologies and supportive policies, the North American market is poised for sustained expansion, underpinned by innovation and rising demand.

MARKET DRIVERS

Rising Demand for Precision Agriculture

The integration of small UAVs in precision agriculture has become a transformative driver for the North American market. Farmers are increasingly adopting drones equipped with advanced sensors and imaging technologies to monitor crop health, optimize irrigation, and enhance yield predictions. Drones offer cost-effective solutions compared to traditional methods, with operational costs reduced NOTABLY. For instance, UAVs enable farmers to cover large areas quickly, reducing manual labor and time spent on field inspections. These factors have significantly contributed to the surge in demand for small UAVs in the agricultural sector. Furthermore, government subsidies promoting sustainable farming practices have bolstered the adoption of drones, positioning agriculture as a key growth vertical within the UAV market.

Expansion of E-commerce and Logistics

The rapid growth of e-commerce and the need for efficient last-mile delivery solutions have fueled the demand for small UAVs in North America. Companies like Amazon and UPS have invested heavily in drone delivery systems, with Amazon’s Prime Air service aiming to deliver packages within 30 minutes using UAVs. Like, drone-based logistics could reduce delivery costs in urban areas. In 2022, the FAA approved over 20,000 commercial drone operations for logistics purposes, exhibiting the growing acceptance of UAVs in this sector. Additionally, the pandemic-induced surge in online shopping accelerated the adoption of drones for contactless deliveries.

MARKET RESTRAINTS

Regulatory Hurdles and Airspace Restrictions

One of the most significant restraints impacting the North American small UAV market is the complex regulatory framework governing drone operations. While the FAA has made strides in streamlining approvals through programs like LAANC, airspace restrictions remain a major barrier. These restrictions limit the scalability of UAV operations, particularly in densely populated regions. Furthermore, compliance with regulations such as Part 107, which mandates operator certification and operational limitations, adds to the operational burden. A considerable share of businesses cite regulatory challenges as a primary obstacle to scaling their UAV initiatives. These constraints not only hinder market growth but also increase operational costs, impeding widespread adoption.

Cybersecurity Vulnerabilities

Cybersecurity risks pose another critical restraint for the small UAV market in North America. As drones increasingly rely on wireless communication and cloud-based platforms, they become vulnerable to hacking and data breaches. Like, cyberattacks targeting UAV systems increased in the last few years, with incidents ranging from unauthorized access to GPS spoofing. Such vulnerabilities raise concerns about data privacy and mission integrity, particularly in sensitive applications like defense and law enforcement. Moreover, the lack of standardized cybersecurity protocols exacerbates the issue, leaving operators exposed to threats. These factors collectively undermine trust in UAV technology, slowing market penetration and adoption rates.

MARKET OPPORTUNITIES

Integration of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) into small UAV systems presents a transformative opportunity for the North American market. AI-powered drones can perform complex tasks such as autonomous navigation, real-time data analysis, and predictive maintenance, enhancing operational efficiency. Also, the adoption of AI in UAVs is expected to boost productivity notably across various industries. For instance, in disaster management, AI-enabled drones can analyze terrain and identify survivors faster than human teams, reducing response times. Additionally, ML algorithms can optimize flight paths, reducing energy consumption. These advancements not only expand the scope of UAV applications but also attract investments in R&D, driving market growth.

Growth in Urban Air Mobility (UAM) Initiatives

Urban air mobility (UAM) represents another promising opportunity for the small UAV market in North America. Governments and private companies are investing heavily in UAM projects, leveraging drones for passenger transport and cargo delivery in urban areas. Cities like Los Angeles and Miami are already piloting drone-based transportation systems, supported by partnerships with companies like Joby Aviation and Volocopter. Like, integrating UAVs into urban ecosystems could reduce traffic congestion and lower carbon emissions greatly. These initiatives create a fertile ground for UAV manufacturers to innovate and cater to emerging demands, unlocking new revenue streams and solidifying the market’s future prospects.

MARKET CHALLENGES

High Initial Costs and Maintenance Expenses

A primary challenges facing the North American small UAV market is the high initial investment required for acquiring and maintaining advanced drone systems. These costs are often prohibitive for small and medium-sized enterprises (SMEs), limiting market accessibility. Additionally, ongoing expenses related to software updates, sensor calibration, and battery replacements further strain budgets. Like maintenance costs can account for notable share of the total lifecycle expenses of a UAV. These financial barriers deter potential adopters, particularly in price-sensitive industries like construction and environmental monitoring. As a result, the market faces challenges in achieving widespread penetration, despite the growing demand for UAV solutions.

Public Perception and Privacy Concerns

Public perception and privacy concerns represent another significant challenge for the small UAV market in North America. The increasing use of drones for surveillance and data collection has sparked debates about privacy violations and ethical implications. Also, a significant share of Americans express unease about drones capturing images or videos without consent. Such apprehensions have led to public resistance, particularly in residential areas, where UAV operations are often met with skepticism. Negative public perception can slow regulatory approvals and hinder market expansion. Moreover, incidents involving drones invading private spaces have fueled calls for stricter privacy laws, adding another layer of complexity for operators.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

12.90 % |

|

Segments Covered |

By UAV Type, Propulsion Technology ,End-User Industries, and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

DJI, Parrot Drones, Teledyne Technologies Inc, Northrop Grumman Corporation, AeroVironment Inc |

SEGMENTAL ANALYSIS

By UAV Type Insights

The Rotary-wing UAVs segment dominated the North American small UAV market by capturing 65.6% of the total share in 2024. This dominance is primarily driven by their versatility and ability to perform vertical take-offs and landings (VTOL), making them suitable for diverse applications such as surveillance, agriculture, and logistics. One key factor driving this segment’s prominence is its adaptability in urban environments. Like, rotary-wing drones are preferred in a notable share of urban operations due to their maneuverability in confined spaces. Additionally, advancements in battery technology have extended their operational range, with lithium-ion batteries enabling flight times. Another critical driver is the growing demand for precision agriculture. Similarly, rotary-wing UAVs account for a significant share of drones used in agricultural monitoring, thanks to their ability to hover over crops and capture high-resolution imagery.

The segment of Fixed-wing UAVs are projected to grow at the highest CAGR of 18.5% from 2025 to 2033. This rapid growth is fueled by their superior endurance and efficiency in long-range missions, particularly in sectors like defense and environmental monitoring. One significant driver is the increasing adoption of fixed-wing UAVs for border security operations. According to the U.S. Customs and Border Protection Agency, fixed-wing drones covered over 100,000 miles of surveillance in 2022, showing their strategic importance. Another factor is their cost-effectiveness in large-scale mapping projects. A study reveals that fixed-wing UAVs reduce mapping costs compared to traditional methods. Furthermore, technological innovations such as hybrid propulsion systems have enhanced their performance, enabling continuous operations for several hours. These advancements position fixed-wing UAVs as a rapidly expanding segment within the North American market.

By Propulsion Technology Insights

The Lithium-ion propulsion technology segment ledthe North American small UAV market, holding a commanding market share of 75.7% in 2024. Also, the widespread adoption of lithium-ion batteries is driven by their energy density, which allows drones to achieve flight durations of up to 50 minutes on a single charge. One key factor behind this dominance is the affordability of lithium-ion batteries, which have seen a price reduction over the past decade. This cost advantage has made them the go-to choice for commercial UAV operators. Additionally, their compatibility with advanced UAV designs has fueled their adoption in industries like entertainment and construction. Plus, lithium-ion-powered drones accounted for a substantial portion of aerial cinematography equipment used in Hollywood productions in recent years. Another contributing factor is the robust supply chain for lithium-ion batteries, supported by major manufacturers like Tesla and Panasonic, ensuring consistent availability and reliability.

The Hydrogen fuel cell propulsion is emerging as the rapidly expanding, with an estimated CAGR of 22.3% between 2025 and 2033. This progress is caused by the technology’s unparalleled energy efficiency and zero-emission capabilities, aligning with sustainability goals across industries. One significant factor is its application in long-duration missions. Like, hydrogen-powered UAVs can operate for several hours, significantly outperforming lithium-ion alternatives. Another driver is the increasing focus on green energy initiatives. Also, governments and private entities in North America invested considerable amount in hydrogen technologies in recent years, with UAVs being a key beneficiary. Furthermore, partnerships between aerospace companies and hydrogen fuel cell manufacturers, such as Plug Power, have accelerated innovation, reducing costs and improving scalability.

By End-User Industries Insights

The defense and law enforcement sector segment dominated the North American small UAV market by accounting for a 40.4% of the total revenue in 2024. This leading position is attributed to the critical role UAVs play in enhancing national security and public safety. One key factor is the integration of drones into military operations. Also, UAVs were deployed in a notable share of reconnaissance missions in the past years, showing their strategic importance. Another driver is the rising investment in counter-drone technologies. Additionally, law enforcement agencies are increasingly adopting drones for crowd monitoring and disaster response, with a major increase in drone usage for such purposes in the recent times.

The agriculture sector is poised to be the swift advancement end-user, with a projected CAGR of 20.7%. This development is associated by the increasing adoption of precision farming techniques, where UAVs play a vital role. One significant factor is the ability of drones to optimize resource usage. According to the Association for Unmanned Vehicle Systems International (AUVSI), UAV-based crop monitoring reduces water consumption and fertilizer usage. Another driver is the growing demand for food production to meet population needs. The Food and Agriculture Organization (FAO) estimates that global food demand will increase by 2050, necessitating innovative solutions like drones. Additionally, government subsidies for smart farming technologies have accelerated UAV adoption. For instance, the U.S. Farm Bill allocated $500 million in 2022 for precision agriculture initiatives, benefiting the UAV market.

COUNTRY LEVEL ANALYSIS

The United States spearheaded the largest share of the North American small UAV market by accounting for a 85.9% of the region’s total revenue in 2024. The country’s place in this market is credited to its robust ecosystem of UAV manufacturers, regulatory frameworks, and diverse applications. One key factor is the strong presence of defense contractors like Lockheed Martin and AeroVironment, which contribute significantly to the market. Another driver is the FAA’s supportive policies, such as the Low Altitude Authorization and Notification Capability (LAANC) program, which streamlined drone operations for over 900,000 registered UAVs in 2023. Additionally, the U.S. leads in UAV innovation, with investments in AI and machine learning enhancing drone capabilities.

Canada is experiencing a notable share of the market. The country’s market growth is driven by its focus on environmental monitoring and natural resource management. One significant factor is the use of UAVs in forestry and mining operations. Similarly, UAVs reduced carbon emissions in resource extraction projects. Additionally, Canada’s favorable regulatory environment, overseen by Transport Canada, has facilitated a substantial number commercial drone operations annually. These initiatives position Canada as a key contributor to the North American UAV market.

The Rest of North America, comprising Mexico and other regions, is contributing a notable share of the regional market in 2024. The segment’s growth is fueled by the increasing adoption of UAVs in infrastructure development and disaster management. One key factor is Mexico’s investment in smart city projects, where drones are used for urban planning. Another driver is the region’s vulnerability to natural disasters, prompting the use of drones for emergency response. Additionally, cross-border collaborations with the U.S. have accelerated technology transfer, fostering market expansion.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the North American small UAV market are DJI, Parrot Drones, Teledyne Technologies Inc, Northrop Grumman Corporation, AeroVironment Inc, Draganfly Inc Ordinary Shares, EHang Holdings Ltd ADR, 3D Robotics, BAE Systems PLC, Autel Robotics, Yuneec, Skydio.

The North American small UAV market is characterized by intense competition, driven by rapid technological advancements and diverse applications across industries. Leading players like AeroVironment, Lockheed Martin, and DJI Innovations dominate the landscape, each targeting specific niches—defense, logistics, and commercial sectors, respectively. The competitive environment is further intensified by the entry of new startups and the adoption of disruptive technologies such as AI and hydrogen propulsion. Regulatory frameworks also play a pivotal role, with companies striving to comply with FAA guidelines while innovating within constraints. Collaborations with research institutions and government bodies provide a competitive edge, fostering innovation. Additionally, price wars and feature differentiation are common tactics to capture market share.

Top Players in the Market

AeroVironment

AeroVironment is a leading innovator in the North American small UAV market, specializing in tactical drones for defense and commercial applications. The company has strengthened its position by focusing on lightweight, portable UAVs like the Raven and Puma systems, which are widely used for reconnaissance and surveillanceAdditionally, the company expanded its partnership with NASA to develop advanced AI-driven navigation systems, enhancing operational efficiency.

Lockheed Martin

Lockheed Martin is a key player in the North American UAV market, leveraging its expertise in aerospace and defense to deliver cutting-edge solutions. The company’s Desert Hawk III and Fury systems have gained prominence for their endurance and versatility in military operations. Furthermore, the company invested heavily in hydrogen fuel cell technology, aligning with sustainability goals. Through innovation and strategic investments, Lockheed Martin reinforces its place in the UAV sector.

DJI Innovations

DJI Innovations dominates the commercial UAV segment in North America, offering advanced drones for industries like agriculture, construction, and entertainment. The company’s Mavic and Matrice series are renowned for their imaging capabilities and ease of use. Additionally, DJI partnered with U.S.-based software developers to integrate AI analytics into its platforms, improving data accuracy.

Top Strategies Used by Key Players

Key players in the North American small UAV market employ strategies such as product innovation, strategic partnerships, and regulatory compliance to strengthen their positions. Companies like AeroVironment and Lockheed Martin focus on R&D to develop advanced AI and machine learning capabilities, enabling autonomous operations. Strategic alliances with government agencies and private firms help expand their reach, while investments in sustainable technologies, such as hydrogen fuel cells, address environmental concerns. DJI emphasizes affordability and usability, targeting commercial users through partnerships with software providers. Another common strategy is the acquisition of smaller firms to enhance technological portfolios. These approaches collectively drive growth and competitiveness in the UAV market.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, AeroVironment acquired Arcturus UAV, a developer of medium-altitude drones, to enhance its portfolio in long-endurance UAV systems.

- In June 2023, Lockheed Martin partnered with HyPoint to integrate hydrogen fuel cells into its Fury drone, aiming to extend flight durations and reduce emissions.

- In August 2023, DJI Innovations collaborated with U.S.-based software firm Skycatch to integrate AI analytics into its Matrice 300 RTK, improving data processing capabilities.

- In October 2023, AeroVironment launched its Quantix Recon hybrid drone, designed for agricultural mapping and disaster response, expanding its commercial applications.

- In December 2023, Lockheed Martin signed a $100 million contract with the U.S. Department of Defense to supply advanced UAVs for border surveillance, solidifying its defense market presence.

MARKET SEGMENTATION

This research report on the north america small uav market has been segmented and sub-segmented into the following.

By UAV Type

- Rotary Wing

- Fixed-Wing

By Propulsion Technology

- Lithium-Ion

- Hydrogen Cell

By End-User Industries

- Defense and Law Enforcement

- Agriculture

By Country

- The U.S.

- Canada

- Rest of North America

Frequently Asked Questions

What factors are driving the growth of the small UAV market in North America?

Key drivers include increased use in defense, agriculture, infrastructure inspection, aerial photography, logistics, and the rise of drone-based data collection services.

Which industries are the biggest users of small UAVs in North America?

The major industries are defense and security, agriculture, energy, construction, real estate, media and entertainment, and logistics.

What is considered a "small UAV" in the North America market?

Small UAVs typically weigh less than 55 pounds (25 kilograms) and are used for a wide range of commercial, military, and recreational purposes.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]