North America Small Off-Road Engines Market Size, Share, Trends & Growth Forecast Report By Engine Displacement (Upto 100cc, 100-500cc, 500cc to 800cc), Number of Cylinders (Single, Double, Multi), Drive Shaft Orientation (Horizontal, Vertical), End Use (Agriculture, Domestic, Gardening/Landscaping, Residential, Commercial, Industrial, Automotive, Construction), Distribution Channel (OEM, Aftermarket) and Country (United States, Canada, Mexico) Industry Analysis From 2025 to 2033.

North America Small Off-Road Engines Market Size

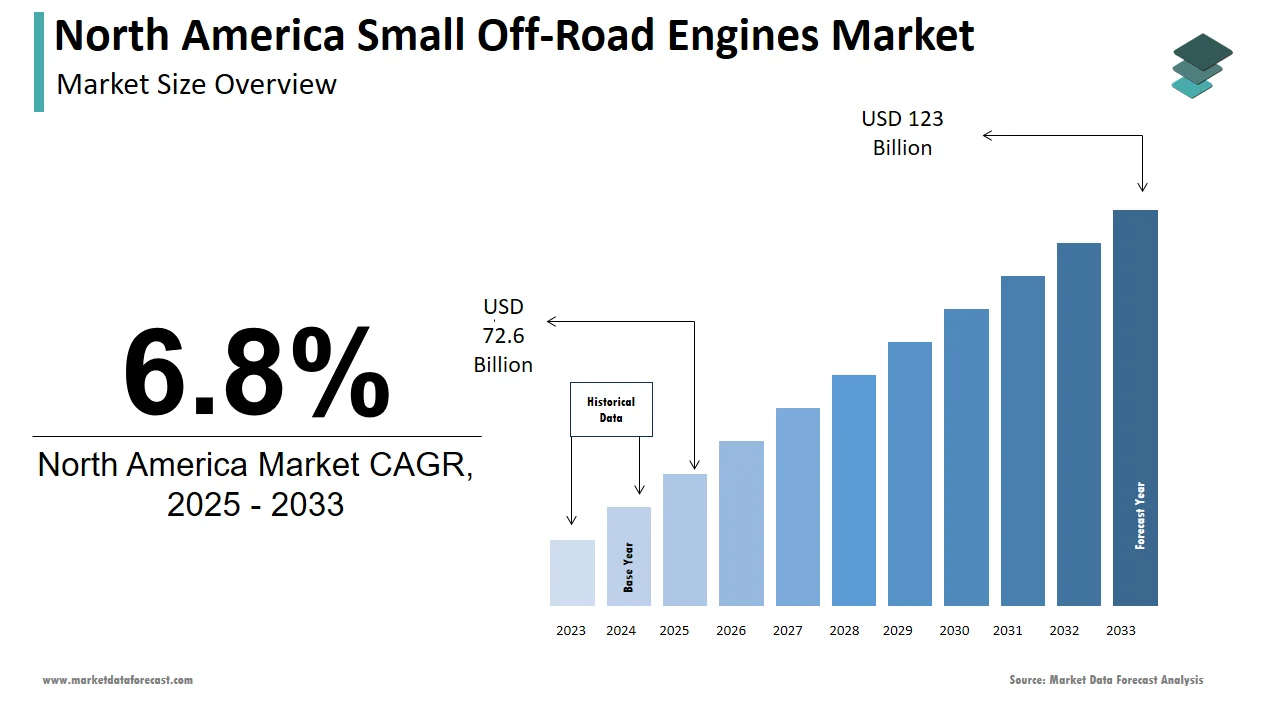

The size of the small off-road engines market in North America was valued at USD 68 billion in 2024. This market is expected to grow at a CAGR of 6.8% from 2025 to 2033 and be worth USD 123 billion by 2033 from USD 72.6 billion in 2025.

The North America small off-road engines market is defined by engines typically with a displacement of less than 800cc, utilized in various applications such as lawn and garden equipment, construction machinery, and recreational vehicles. These engines are essential for powering equipment that operates in off-road conditions by providing the necessary mobility and performance. The market has experienced robust growth, driven by increasing consumer interest in outdoor activities and landscaping, particularly in urban areas where green spaces are becoming more prevalent.

Technological advancements have played a pivotal role in shaping the market, with manufacturers focusing on enhancing engine efficiency and reducing emissions to comply with stringent environmental regulations. The integration of innovative features, such as electric start systems and improved fuel efficiency, has made small off-road engines more appealing to consumers. Additionally, the rising popularity of recreational activities, including off-road biking and ATV riding, has further contributed to the increasing sales of these engines.

MARKET DRIVERS

Rising Demand for Outdoor Power Equipment

The increasing demand for outdoor power equipment is a significant driver of the North America small off-road engines market. Homeowners are investing more in landscaping and gardening by leading to a heightened need for efficient and reliable outdoor power tools. This trend is further fueled by the growing popularity of DIY gardening and landscaping projects during the pandemic, which saw a surge in home improvement activities. The convenience and efficiency offered by small off-road engines make them indispensable for both residential and commercial users, thereby driving market growth.

Moreover, the construction sector's recovery post-pandemic has also contributed to the demand for small off-road engines. The need for compact and powerful engines in equipment such as mini-excavators and compactors has increased as infrastructure projects ramp up. The American Society of Civil Engineers reported that U.S. infrastructure investment is expected to reach $3.5 trillion by 2025 that further bolsters the market for small off-road engines. This combination of residential and commercial demand positions the North America small off-road engines market for sustained growth in the coming years, as consumers increasingly seek efficient solutions for their outdoor power needs.

Impact of Regulations and Technological Advancements

The trend towards eco-friendly and fuel-efficient engines is another significant driver of the North America small off-road engines market. Manufacturers are increasingly focusing on developing engines that meet these standards with growing environmental concerns and stringent regulations regarding emissions. The U.S. Environmental Protection Agency has implemented regulations that require manufacturers to reduce emissions from small engines, prompting innovation in engine design and technology. According to a report by the Engine Manufacturers Association, advancements in engine technology have led to a reduction in emissions by up to 30% over the past decade. This shift not only aligns with regulatory requirements but also appeals to environmentally conscious consumers who prioritize sustainability in their purchasing decisions.

The market has seen a rise in the adoption of electric and hybrid small off-road engines, which offer lower emissions and reduced noise levels. The increasing availability of battery-powered alternatives is expected to further drive market growth, as consumers seek quieter and more sustainable options for their outdoor power needs. This focus on eco-friendly solutions is likely to shape the future of the North America small off-road engines market, as manufacturers continue to innovate and adapt to changing consumer preferences and regulatory landscapes.

MARKET RESTRAINTS

Rising Raw Material Costs Impacting Production

One of the primary restraints affecting the North America small off-road engines market is the rising cost of raw materials. The production of small off-road engines relies heavily on various metals and components, which have experienced significant price fluctuations in recent years. According to the U.S. Bureau of Labor Statistics, the price of steel, a key material in engine manufacturing, increased by over 50% from 2020 to 2022. This surge in raw material costs has led to higher production expenses for manufacturers, which may ultimately be passed on to consumers in the form of increased prices for small off-road engines. The affordability of these engines could be compromised, potentially dampening consumer demand and hindering market growth.

Supply Chain Disruptions and Rising Costs Hindering Market Growth

Additionally, the ongoing global supply chain disruptions, exacerbated by the COVID-19 pandemic, have further complicated the procurement of essential components for engine manufacturing. Delays in the supply chain can lead to production halts and increased lead times, affecting manufacturers' ability to meet market demand. The National Association of Manufacturers reported that 78% of manufacturers in the U.S. faced supply chain challenges in 2022, with the pervasive impact of these issues on the industry. Consequently, the combination of rising raw material costs and supply chain disruptions poses a significant challenge to the North America small off-road engines market by potentially limiting growth opportunities in the near term.

Growing Competition from Electric Alternatives

Another significant restraint is the increasing competition from alternative power sources, particularly electric engines. The consumers are increasingly gravitating towards electric-powered outdoor equipment, which offers lower emissions and reduced noise levels. This shift towards electric alternatives poses a challenge for traditional small off-road engine manufacturers, who must adapt to changing consumer preferences and invest in new technologies to remain competitive.

Moreover, the initial higher cost of electric engines compared to traditional gasoline-powered engines is often offset by lower operating costs and maintenance requirements by making them an attractive option for consumers in the long run. The performance and affordability of electric engines are expected to enhance that further eroding the market share of small off-road engines. This competitive landscape necessitates that manufacturers innovate and diversify their product offerings to address the growing demand for sustainable and efficient power solutions, thereby posing a significant challenge to the North America small off-road engines market.

MARKET OPPORTUNITIES

Rising Adoption of Automation and Smart Technology

The increasing trend towards automation in landscaping and agricultural applications presents a significant opportunity for the North America small off-road engines market. More consumers and businesses are adopting automated solutions for tasks such as lawn care, gardening, and crop management as technology advances. This trend is likely to drive demand for small off-road engines that can power automated equipment, such as robotic lawn mowers and autonomous tractors. Manufacturers that can develop engines specifically designed for these applications stand to benefit from this burgeoning market segment.

Furthermore, the integration of smart technology into small off-road engines offers another avenue for growth. The Internet of Things (IoT) is increasingly being incorporated into outdoor power equipment by allowing for enhanced connectivity and performance monitoring. This presents an opportunity for manufacturers to innovate and create engines that are compatible with smart technology, enabling features such as remote monitoring, predictive maintenance, and improved fuel efficiency.

Growing Focus on Sustainability and Eco-Friendly Innovations

The growing emphasis on sustainability and eco-friendly practices also provides a favorable environment for the North America small off-road engines market. As consumers become more environmentally conscious, there is an increasing demand for engines that meet stringent emissions standards and utilize renewable energy sources. The U.S. government has implemented various initiatives to promote clean energy and reduce greenhouse gas emissions by creating a supportive regulatory framework for manufacturers of eco-friendly engines. According to the U.S. Department of Energy, the market for renewable energy is expected to grow significantly, with solar and wind energy projected to account for 50% of the U.S. electricity generation by 2030. This shift towards renewable energy sources presents an opportunity for small off-road engine manufacturers to develop hybrid or electric engines that align with consumer preferences for sustainability.

The manufacturers can position themselves favorably in the market and attract environmentally conscious consumers by investing in research and development to create innovative, eco-friendly products. The combination of automation, smart technology integration, and sustainability initiatives presents a multifaceted opportunity landscape for the North America small off-road engines market by enabling companies to drive growth and enhance their competitive advantage.

MARKET CHALLENGES

Stringent Emission Regulations Restrict Market Growth

One of the foremost challenges facing the North America small off-road engines market is the stringent regulatory environment surrounding emissions and environmental standards. Governments across the region have implemented increasingly rigorous regulations aimed at reducing air pollution and promoting cleaner technologies. The U.S. Environmental Protection Agency has established strict emissions standards for small engines, which manufacturers must comply with to remain competitive. According to the EPA, small engines must meet Tier 4 emissions standards, which require significant reductions in nitrogen oxides and particulate matter. Compliance with these regulations often necessitates substantial investments in research and development, as well as modifications to existing engine designs, which can strain the financial resources of smaller manufacturers.

Additionally, the complexity of navigating the regulatory landscape can pose challenges for companies seeking to enter the market. New entrants may find it difficult to meet the necessary compliance requirements, limiting competition and innovation. The National Association of Manufacturers has reported that 70% of manufacturers view regulatory compliance as a significant barrier to growth. The evolving regulatory framework presents a considerable challenge for the North America small off-road engines market as manufacturers must continuously adapt to changing standards while managing costs and maintaining product performance.

Technological Advancements Pressure Market Players

Another significant challenge is the rapid pace of technological advancements in the industry. Manufacturers are under constant pressure to innovate and upgrade their product offerings as consumer preferences shift towards more efficient and environmentally friendly solutions. The emergence of electric and hybrid engines has disrupted the traditional small off-road engine market, compelling manufacturers to invest in new technologies to remain relevant. This rapid technological evolution requires manufacturers to allocate substantial resources to research and development, which can be particularly challenging for smaller companies with limited budgets. Furthermore, the need for continuous innovation can lead to increased production costs, which may ultimately be passed on to consumers. The challenge of keeping pace with technological advancements and meeting evolving consumer expectations poses a significant hurdle for the North America small off-road engines market with strategic investments and agile business practices to thrive in this dynamic environment.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Engine Displacement, Number of Cylinders, Drive Shaft Orientation, End Use, Distribution Channel, and Region. |

|

Various Analysis Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, Mexico and Rest of North America |

|

Market Leader Profiled |

Briggs & Stratton, Chongqing Fuchai Industry Group, Chongqing Zongshen Power Machinery Co., Ltd., Greaves Cotton Ltd., Honda Motor Co., Ltd., Kawasaki Heavy Industries, Ltd., Kohler Co., Kubota Corporation, Lifan Industry (Group) Co., Ltd., Liquid Combustion Technology, LLC, Loncin Motor Co., Ltd., Mitsubishi Heavy Industries Engine & Turbocharger, Ltd., Motorenfabrik Hatz GmbH & Co. KG, Yamaha Motor Co., Ltd., Yanmar Co., Ltd., and Others. |

SEGMENTAL ANALYSIS

By Engine Displacement Insights

The 100-500cc segment held 45.3% of the North America small off-roads engines market share in 2024. This dominance can be attributed to the versatility and efficiency of engines within this displacement range, which are commonly used in a variety of applications, including lawn mowers, trimmers, and small construction equipment. The growing demand for landscaping and gardening tools, particularly in suburban areas, has significantly contributed to the popularity of these engines. According to the Outdoor Power Equipment Institute, the sales of lawn and garden equipment in the U.S. reached $12 billion in 2022, with a substantial portion driven by products utilizing 100-500cc engines. Moreover, the increasing trend of DIY gardening and landscaping projects has further fueled the demand for these engines, as consumers seek reliable and efficient tools for their outdoor activities. The ability of 100-500cc engines to provide a balance of power and fuel efficiency makes them particularly appealing to both residential and commercial users. The 100-500cc segment is expected to maintain its leading position owing to the ongoing consumer interest in outdoor power equipment and the need for efficient solutions in various applications.

The 500cc to 800cc segment is anticipated to witness a fastest CAGR of 6.4% during the forecast period. This growth can be attributed to the increasing demand for more powerful engines in applications such as utility vehicles, ATVs, and larger landscaping equipment. The 500cc to 800cc segment is becoming increasingly attractive as consumers seek enhanced performance and capabilities in their outdoor power tools. The rise in recreational activities, including off-road biking and ATV riding, has also contributed to the growth of this segment, as consumers look for engines that can deliver the necessary power and torque for demanding applications. Additionally, advancements in engine technology, such as improved fuel efficiency and reduced emissions, are making engines in this displacement range more appealing to environmentally conscious consumers. The 500cc to 800cc segment is poised for significant growth by reflecting the evolving preferences of consumers in the North America small off-road engines market.

By Number of Cylinders Insights

The single-cylinder segment was the largest by occupying 60.7% of the North America small off-road engines market share in 2024. This dominance is primarily due to the widespread use of single-cylinder engines in various applications, including lawn mowers, trimmers, and small garden equipment. The simplicity and cost-effectiveness of single-cylinder engines make them particularly appealing to both manufacturers and consumers. According to the Outdoor Power Equipment Institute, the demand for lawn and garden equipment has surged, with single-cylinder engines being the preferred choice for many residential and commercial applications. Their lightweight design and ease of maintenance contribute to their popularity, as they provide sufficient power for tasks such as mowing and trimming without the complexity associated with multi-cylinder engines. Moreover, the increasing trend of DIY gardening and landscaping projects has further bolstered the demand for single-cylinder engines. The need for reliable and efficient tools has grown by driving sales of equipment powered by single-cylinder engines. The affordability and accessibility of these engines make them an attractive option for consumers looking to invest in outdoor power equipment. The single-cylinder segment is expected to maintain its leading position by ongoing consumer interest in practical and efficient solutions for outdoor tasks.

The multi-cylinder segment is ascribed to hit a fastest CAGR of 7.5% during the forecast period. This growth can be attributed to the increasing demand for more powerful and efficient engines in applications such as commercial landscaping, agricultural machinery, and utility vehicles. Multi-cylinder engines offer enhanced performance, improved torque, and greater fuel efficiency by making them ideal for demanding tasks that require sustained power output. The need for robust engines capable of handling larger workloads is driving the growth of the multi-cylinder segment as the landscaping and agricultural sectors continue to expand. Additionally, advancements in engine technology, including the development of fuel-efficient multi-cylinder engines that comply with stringent emissions regulations are making these engines more appealing to environmentally conscious consumers.

REGIONAL ANALYSIS

The United States dominated the North America small off-road engines market with an estimated share of 75.5% in 2024. The U.S. market is characterized by a robust demand for outdoor power equipment that is driven by a combination of factors including a strong economy, a high rate of homeownership, and a growing interest in landscaping and gardening. The increasing trend of DIY home improvement projects, particularly during the pandemic, has further fueled the demand for these engines, as consumers seek reliable and efficient tools for their outdoor activities.

Moreover, the U.S. construction sector's recovery post-pandemic has also contributed to the demand for small off-road engines. The need for compact and powerful engines in equipment such as mini-excavators and compactors has increased as infrastructure projects ramp up. The American Society of Civil Engineers reported that U.S. infrastructure investment is expected to reach $3.5 trillion by 2025. This combination of residential and commercial demand positions the U.S. as a key player in the North America small off-road engines market, with continued growth anticipated in the coming years.

Canada is likely to gain huge traction over the growth of the market with an anticipated CAGR of 8.3% during the forecast period. The Canadian market is driven by a growing interest in outdoor recreational activities, including gardening, landscaping, and off-road sports. Additionally, the Canadian government's commitment to infrastructure development and environmental sustainability has led to a rise in demand for efficient and eco-friendly small off-road engines. The popularity of electric and hybrid engines is also gaining traction in Canada, as consumers become more environmentally conscious and seek sustainable alternatives. The Canadian government has implemented various initiatives to promote clean energy and reduce greenhouse gas emissions, creating a favorable regulatory environment for manufacturers of eco-friendly engines.

KEY MARKET PLAYERS

A few of the notable companies operating in the North America small off-road engines market profiled in this report are Briggs & Stratton, Chongqing Fuchai Industry Group, Chongqing Zongshen Power Machinery Co., Ltd., Greaves Cotton Ltd., Honda Motor Co., Ltd., Kawasaki Heavy Industries, Ltd., Kohler Co., Kubota Corporation, Lifan Industry (Group) Co., Ltd., Liquid Combustion Technology, LLC, Loncin Motor Co., Ltd., Mitsubishi Heavy Industries Engine & Turbocharger, Ltd., Motorenfabrik Hatz GmbH & Co. KG, Yamaha Motor Co., Ltd., Yanmar Co., Ltd., and Others.

TOP PLAYERS IN THE MARKET

In the North America small off-road engines market, several key players have established themselves as leaders, contributing significantly to the overall market dynamics. Honda Motor Co., Ltd. is one of the foremost manufacturers, renowned for its high-quality small engines that power a wide range of outdoor equipment. Honda's commitment to innovation and sustainability has positioned it as a market leader, with a strong focus on developing fuel-efficient and low-emission engines. The company's extensive distribution network and brand reputation further enhance its competitive advantage in the North American market.

Another major player is Briggs & Stratton Corporation, a well-known name in the marketplace. With a diverse product portfolio that includes engines for lawn mowers, generators, and pressure washers, Briggs & Stratton has a significant market presence. The company's emphasis on research and development has led to the introduction of advanced engine technologies, such as the InStart battery technology, which offers consumers greater convenience and efficiency. Briggs & Stratton's strong brand loyalty and commitment to customer service have solidified its position in the North America small off-road engines market.

Kohler Co. is also a prominent player in the small off-road engines market, recognized for its innovative engine solutions and commitment to sustainability. Kohler's engines are widely used in various applications, including landscaping equipment and agricultural machinery. The company's focus on developing eco-friendly engines that comply with stringent emissions regulations has resonated with environmentally conscious consumers. Kohler's strong emphasis on quality and performance has contributed to its reputation as a trusted manufacturer in the North America small off-road engines market.

MAJOR STRATEGIES USED BY KEY MARKET PLAYERS

Key players in the North America small off-road engines market employ a variety of strategies to strengthen their market position and enhance competitiveness. One prominent strategy is the focus on innovation and technological advancement. Companies like Honda and Briggs & Stratton invest heavily in research and development to create cutting-edge engine technologies that improve performance, fuel efficiency, and reduce emissions.

Another significant strategy is the expansion of product portfolios to cater to diverse consumer needs. Manufacturers are increasingly offering a wide range of engine options, including electric and hybrid models, to appeal to environmentally conscious consumers. For instance, Kohler has introduced eco-friendly engine solutions that align with sustainability trends, allowing the company to capture a broader market segment.

Strategic partnerships and collaborations also play a crucial role in enhancing market presence. Companies often collaborate with equipment manufacturers and distributors to expand their reach and improve distribution channels. For example, partnerships with outdoor power equipment manufacturers enable engine producers to integrate their products into a wider array of applications, thereby increasing sales and market penetration. The key players can enhance their competitive positioning and drive growth in the North America small off-road engines market by leveraging strategic alliances.

COMPETITION OVERVIEW

The competition in the North America small off-road engines market is characterized by a mix of established players and emerging manufacturers, all vying for market share in a rapidly evolving landscape. Major companies such as Honda, Briggs & Stratton, and Kohler dominate the market, leveraging their strong brand recognition, extensive distribution networks, and commitment to innovation. These industry leaders continuously invest in research and development to enhance engine performance, fuel efficiency, and compliance with stringent emissions regulations, thereby maintaining their competitive advantage.

Emerging players are also entering the market, often focusing on niche segments or innovative technologies, such as electric and hybrid engines. This influx of new entrants intensifies competition, as they seek to capture market share by offering unique value propositions and addressing the growing demand for sustainable solutions. Additionally, the increasing consumer preference for eco-friendly products is prompting established manufacturers to adapt their offerings and invest in cleaner technologies, further heightening competition.

Price competition is another significant factor influencing the market dynamics. As manufacturers strive to attract price-sensitive consumers, they may engage in competitive pricing strategies, which can impact profit margins. However, companies that prioritize quality, performance, and customer service are likely to differentiate themselves and build brand loyalty, allowing them to navigate the competitive landscape effectively. Overall, the North America small off-road engines market is poised for continued growth, driven by innovation, evolving consumer preferences, and a dynamic competitive environment.

MAJOR ACTIONS TAKEN BY KEY MARKET COMPANIES

- In March 2023, Honda announced the launch of its new line of fuel-efficient small engines designed to meet the latest emissions standards, reinforcing its commitment to sustainability and innovation.

- In January 2023, Briggs & Stratton introduced a new series of electric engines aimed at the residential market, catering to the growing demand for eco-friendly outdoor power equipment.

- In February 2023, Kohler Co. expanded its product portfolio by launching a new range of hybrid engines, combining traditional fuel technology with electric power to enhance performance and reduce emissions.

- In April 2023, Yamaha Motor Co. partnered with a leading outdoor equipment manufacturer to integrate its small engines into a new line of all-terrain vehicles, expanding its market reach.

- In May 2023, Generac Holdings Inc. acquired a small engine manufacturer to enhance its capabilities in the outdoor power equipment sector, strengthening its position in the North America market.

- In June 2023, Husqvarna Group announced a strategic partnership with a technology firm to develop smart engine solutions that incorporate IoT technology for improved performance monitoring.

- In July 2023, Toro Company launched a new line of battery-powered lawn mowers, reflecting its commitment to sustainability and addressing the growing consumer preference for electric solutions.

- In August 2023, Snapper announced the introduction of a new line of compact engines designed for residential landscaping equipment, targeting the DIY market segment.

- In September 2023, MTD Products Inc. expanded its distribution network by partnering with major retailers to increase the availability of its small off-road engines across North America.

- In October 2023, Tecumseh Products Company unveiled a new series of high-performance engines designed for commercial landscaping applications, aiming to capture a larger share of the professional market.

MARKET SEGMENTATION

This research report on the North America small off-road engines market is segmented and sub-segmented into the following categories.

By Engine Displacement

- Upto 100cc

- 100-500cc

- 500cc to 800cc

By Number of Cylinders

- Single

- Double

- Multi

By Drive Shaft Orientation

- Horizontal

- Vertical

By End Use

- Agriculture

- Domestic

- Gardening/ Landscaping

- Residential

- Commercial

- Industrial

- Automotive

- Construction

By Distribution Channel

- OEM

- Aftermarket

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What is driving the growth of the North America small off-road engines market?

The North America small off-road engines market is growing due to increasing demand for outdoor power equipment, rising interest in landscaping, and advancements in fuel-efficient and eco-friendly engine technologies.

2. What are the key challenges in the North America small off-road engines market?

High raw material costs, supply chain disruptions, and competition from electric alternatives pose challenges to the North America small off-road engines market.

3. Which industries use small off-road engines in the North America market?

The North America small off-road engines market serves industries such as agriculture, construction, gardening, landscaping, and outdoor power equipment manufacturing.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]