North America Sleep Tech Devices Market Size, Share, Trends & Growth Forecast Report By Product (Wearables, Non- wearables), Gender, Application, Distribution Channel, And Country (Us, Canada, And Rest Of North America), Industry Analysis From 2025 To 2033

North America Sleep Tech Devices Market Size

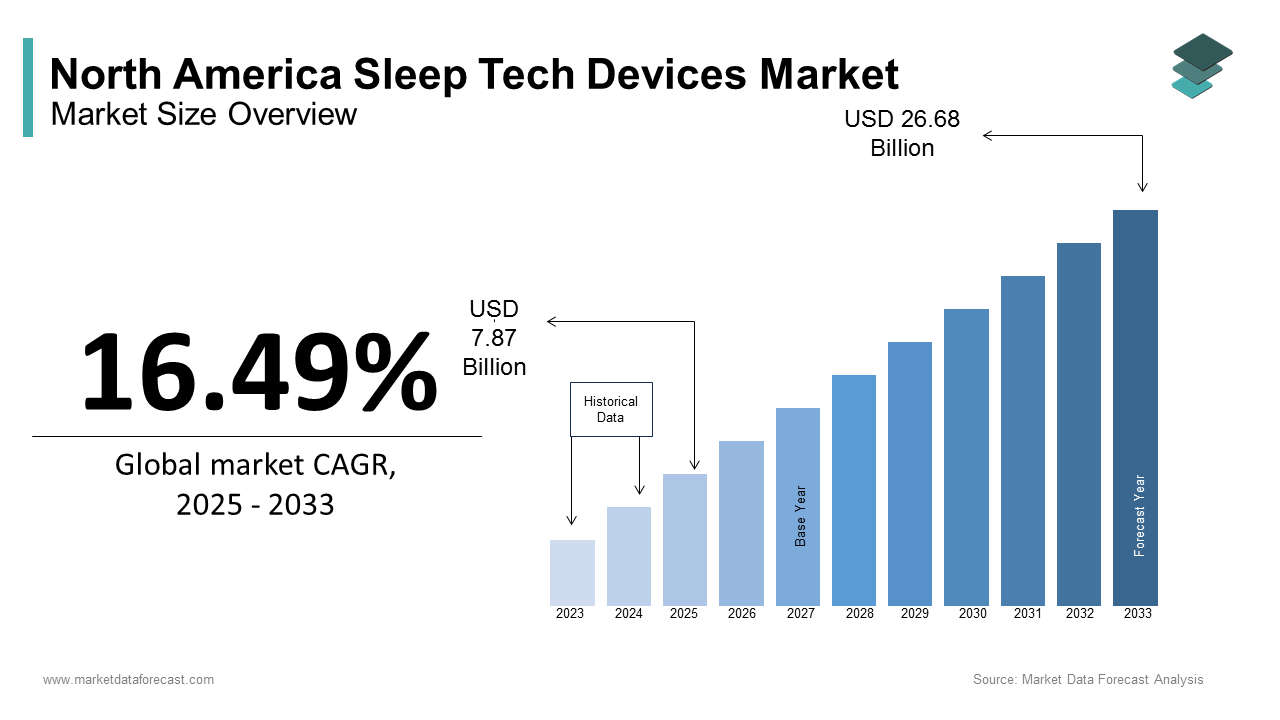

The North America sleep tech device market Size was calculated to be USD 6.75 billion in 2024 and is anticipated to be worth USD 26.68 billion by 2033 from USD 7.87 billion in 2025, growing at a CAGR of 16.49% during the forecast period.

The North America sleep tech devices market has emerged as a critical segment within the healthcare and wellness industries, driven by rising awareness of sleep disorders and their health implications. According to the American Academy of Sleep Medicine, over 50 million Americans suffer from chronic sleep disorders, creating a robust demand for innovative solutions. The market is further bolstered by technological advancements in wearable and non-wearable devices, with the U.S. accounting for approximately 80% of regional revenue. Canada follows, showing steady growth due to government initiatives promoting mental health and sleep hygiene.

As per the Centers for Disease Control and Prevention, insufficient sleep contributes to $411 billion in annual productivity losses, underscoring the economic importance of addressing sleep-related issues. This has led to increased adoption of devices like CPAP machines, smart pillows, and sleep trackers, which collectively aim to enhance sleep quality. The rise of telemedicine platforms has also facilitated access to sleep diagnostics, particularly during the post-pandemic era. So, the market is set to expand significantly, supported by consumer willingness to invest in personal health technologies.

MARKET DRIVERS

Rising Prevalence of Sleep Disorders

The escalating prevalence of sleep disorders is a primary driver of the North America sleep tech devices market. As per the National Sleep Foundation, approximately 70 million Americans are affected by sleep-related conditions such as insomnia and obstructive sleep apnea (OSA). These disorders have severe health implications, including cardiovascular diseases and diabetes, prompting individuals to seek effective solutions. A study by the American Thoracic Society reveals that untreated OSA alone costs the U.S. healthcare system over $150 billion annually due to associated medical expenses and lost productivity. This economic burden has spurred demand for advanced sleep tech devices, such as continuous positive airway pressure (CPAP) machines and wearable sleep trackers. Furthermore, public health campaigns emphasizing the importance of sleep hygiene have heightened awareness, driving consumer adoption. With sleep disorders projected to increase by 15% over the next decade, as noted by the World Health Organization, the market is poised for sustained growth.

Technological Advancements in Wearable Devices

Technological advancements in wearable devices represent another significant driver of the market. Innovations such as real-time sleep monitoring, heart rate tracking, and AI-driven analytics have enhanced the functionality of these devices, making them indispensable for health-conscious consumers. Companies like Fitbit and Garmin have capitalized on this trend, offering products that provide actionable insights into sleep patterns. In addition to this, the integration of IoT and cloud computing enables seamless data sharing between users and healthcare providers, improving diagnostic accuracy. According to a report by McKinsey, wearable devices are expected to capture 60% of the sleep tech market by 2025, reflecting their growing popularity. Therefore, these advancements not only cater to consumer demands but also position wearables as a cornerstone of modern sleep healthcare.

MARKET RESTRAINTS

High Costs of Advanced Devices

One of the primary restraints in the North America sleep tech devices market is the high cost associated with advanced solutions. This financial barrier limits accessibility, particularly for low-income households and uninsured individuals. A study by the Kaiser Family Foundation states that over 28 million Americans remain uninsured further exacerbating affordability concerns. While mid-range devices offer some relief, they often lack the precision and durability of high-end models, leading to dissatisfaction among users. To add to this, frequent software updates and maintenance requirements add to the long-term costs, discouraging potential buyers. Until manufacturers address these pricing challenges, the market's growth potential remains constrained, especially in underserved demographics.

Lack of Awareness in Rural Areas

Another significant restraint is the lack of awareness about sleep tech devices in rural regions. According to the U.S. Department of Agriculture, approximately 19% of the population resides in rural areas, where access to healthcare resources is limited. Likewise, a survey by the National Rural Health Association reveals that only 30% of rural residents are aware of sleep tech solutions, compared to 70% in urban areas. This knowledge gap is compounded by cultural perceptions that undervalue sleep health, leading to underdiagnosis and undertreatment of sleep disorders. Furthermore, the absence of specialty clinics and trained professionals in these regions restricts device adoption. As per the Centers for Disease Control and Prevention, rural populations exhibit higher rates of obesity and stress-related conditions, which are risk factors for sleep disorders. Without targeted educational campaigns and infrastructure development, the market's reach will remain uneven, hindering overall expansion.

MARKET OPPORTUNITIES

Expansion into Direct-to-Consumer Channels

The direct-to-consumer (DTC) distribution channel presents a lucrative opportunity for the North America sleep tech devices market. Sleep tech companies like Casper and Oura Ring have successfully leveraged this model achieving a 40% increase in customer engagement, as reported by Forbes. By eliminating intermediaries, manufacturers can offer competitive pricing while maintaining higher profit margins. As well as, digital marketing strategies, such as social media campaigns and influencer partnerships, have proven effective in reaching niche audiences. A study by Deloitte notes that over 60% of millennials prefer purchasing health-related products online, underscoring the potential of DTC channels.

Integration with Telemedicine Platforms

The integration of sleep tech devices with telemedicine platforms offers another promising opportunity. According to the American Telemedicine Association, telehealth usage surged by 38% during the pandemic, with sleep consultations being one of the fastest-growing segments. Devices equipped with remote monitoring capabilities enable healthcare providers to track patient progress and adjust treatment plans in real time. For instance, Philips' partnership with telehealth providers has resulted in a 30% improvement in patient adherence to sleep therapy, as per their internal reports. Moreover, regulatory support such as the FDA's approval of digital health tools has accelerated adoption. Also, a McKinsey analysis predicts that telemedicine will account for 20% of all healthcare interactions by 2025, creating a fertile ground for sleep tech innovation. This synergy not only enhances patient outcomes but also expands the market's reach to underserved populations.

MARKET CHALLENGES

Data Privacy Concerns

Data privacy concerns pose a significant challenge to the North America sleep tech devices market. Findings of the Federal Trade Commission stresses that over 60% of consumers express apprehension about sharing personal health data with third-party apps and devices. Sleep tech products, particularly wearables, collect sensitive information such as sleep patterns, heart rate, and movement data, raising fears of misuse or unauthorized access. Similarly, a study by the Pew Research Center reveals that 79% of Americans believe companies fail to adequately protect user data, leading to skepticism about adopting connected devices. To enhance this perspective, cybersecurity breaches have exposed vulnerabilities, with incidents like the 2021 ransomware attack on healthcare systems highlighting the risks. As per IBM's Cost of a Data Breach Report, the average cost of a breach in the healthcare sector exceeds $9 million, deterring both manufacturers and consumers. Addressing these concerns through robust encryption and transparent data policies is crucial for fostering trust and ensuring sustainable growth.

Regulatory Hurdles and Compliance Issues

Regulatory hurdles and compliance requirements present another major challenge for the market. The Food and Drug Administration (FDA) mandates rigorous testing and approval processes for medical-grade sleep devices, which can take up to two years and cost millions of dollars. According to the Biotechnology Innovation Organization, only 10% of devices entering clinical trials receive final approval, creating uncertainty for manufacturers. Besides, varying state regulations complicate cross-border sales, particularly in the U.S., where standards differ across jurisdictions. For example, California's stringent privacy laws, such as the CCPA, impose additional compliance burdens on companies operating in the region. These challenges hinder innovation and delay product launches, impeding market expansion and competitiveness.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

16.49% |

|

Segments Covered |

By Product, Gender, Application, Distribution Channel, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

Us, Canada, And Rest Of North America |

|

Market Leaders Profiled |

Koninklijke Philips N.V., ResMed, Inc., Fitbit, Inc., Garmin Ltd., Dreem, Sleep Number Corporation, Eight Sleep, Casper Sleep Inc., Withings, Xiaomi Corporation |

SEGMENTAL ANALYSIS

By Product Insights

The wearables segment accounted for 65.5% of the North American sleep tech devices market share in 2024. The dominating position of wearables segment in the North American market is primarily driven by the growing consumer preference for compact, portable, and easy-to-use devices that seamlessly integrate into daily life. A key factor fueling this trend is the rising awareness of sleep disorders, with the American Sleep Association reporting that over 50 million Americans suffer from over 70 classified sleep disorders. Wearable devices such as smartwatches and fitness trackers provide real-time monitoring of sleep patterns, heart rate, and oxygen levels, empowering users to take proactive steps toward better health. The rising adoption of advanced wearable technologies among younger demographics is further fuelling the expansion of the wearables segment in the North American market. According to Statista, the global shipment of wearable devices reached 539 million units in 2022, with North America being a significant contributor. The integration of AI and machine learning algorithms in wearables further enhances their functionality, enabling personalized insights and actionable recommendations. For instance, Apple’s Watch Series offers features like sleep tracking and snore detection, which have gained immense popularity. Additionally, partnerships between tech companies and healthcare providers are expanding the reach of wearables, making them more accessible and affordable.

The non-wearables segment is projected to grow at a remarkable CAGR of 14.7% over the forecast period owing to the advancements in sensor technology and the increasing demand for contactless sleep monitoring solutions. Non-wearable devices, such as smart mattresses, bedside monitors, and under-mattress sensors, offer a hassle-free alternative to traditional wearables, appealing to consumers who find wearable devices uncomfortable or intrusive. A study by the National Sleep Foundation reveals that 35% of adults prefer non-contact methods for sleep tracking, fuelling the growth of the non-wearables segment. The growing emphasis on improving sleep quality among aging populations is also promoting the expansion of the non-wearables segment in the North American market. The U.S. Census Bureau estimates that 22% of the U.S. population will be aged 65 or older by 2050, creating a surge in demand for non-invasive sleep solutions tailored to seniors. Companies like Withings and Eight Sleep are capitalizing on this trend by introducing innovative products like temperature-regulating mattresses and AI-powered sleep coaches. Furthermore, the integration of IoT in non-wearable devices enables seamless connectivity with smartphones and home automation systems, enhancing user convenience. McKinsey & Company reports that the IoT healthcare market is expected to exceed $188 billion by 2025, with sleep tech playing a pivotal role in this expansion. These technological advancements, coupled with a focus on comfort and accessibility, position non-wearables as the fastest-growing segment in the sleep tech industry.

By Gender Insights

The male segment led the North America sleep tech devices market by holding a 55.1% share in 2024. This dominance is attributed to higher prevalence rates of sleep disorders among men, particularly obstructive sleep apnea (OSA), which affects twice as many males as females. According to the National Sleep Foundation, workplace stress and lifestyle factors contribute to disrupted sleep patterns in men, driving demand for solutions like CPAP machines and sleep trackers. Additionally, societal norms encouraging men to prioritize productivity over rest exacerbate sleep issues, increasing reliance on tech-based interventions. Marketing strategies targeting male demographics, such as performance-focused messaging, further amplify adoption. Consequently, these factors underscore the segment's leadership in the sleep tech market.

The female segment is the fastest-growing, with a CAGR of 14.6%. This growth is propelled by increasing awareness of sleep disorders during pregnancy and menopause, which affect over 40% of women, according to the National Institutes of Health. Innovations tailored to female needs, such as menstrual cycle tracking and relaxation-focused apps, have broadened appeal. Also, the rise of gender-specific marketing campaigns has encouraged women to invest in sleep tech solutions. For example, brands like Oura Ring emphasize holistic health benefits, resonating with female consumers. With women forming a growing proportion of decision-makers in household spending, this segment's rapid expansion reflects its untapped potential.

By Application Insights

The segment of obstructive sleep apnea (OSA) prevailed in the North America sleep tech devices market by accounting for 50.1% of the total share in 2024. This is because of the condition's high prevalence, affecting approximately 26% of adults aged 30-70, as noted by the National Heart, Lung, and Blood Institute. OSA's severe health implications, including cardiovascular diseases and hypertension, necessitate effective management through devices like CPAP machines and oral appliances. Government initiatives promoting early diagnosis, such as Medicare's coverage for sleep studies, have further fueled adoption. Additionally, partnerships between manufacturers and healthcare providers, like ResMed's collaboration with hospitals, ensure widespread availability. These factors cement OSA as the leading application in the sleep tech market.

The insomnia segment is seeing the quickest expansion, with a CAGR of 16.5%. This progress is credited to rising stress levels and lifestyle changes, with over 30% of adults reporting chronic insomnia, according to the National Sleep Foundation. Innovations in non-invasive solutions, such as white noise machines and meditation apps, have expanded treatment options. Besides, the integration of AI-driven analytics enables personalized sleep recommendations enhancing user experience. Likewise, a report by McKinsey states that insomnia-related spending has increased by 20% annually, reflecting growing consumer interest. With mental health awareness on the rise, this segment is poised for exponential growth.

By Distribution Channel Insights

The specialty clinics segment led the North America sleep tech devices market by capturing a 45% share, as per the American Sleep Apnea Association. This dominance is driven by their role as primary distributors of medical-grade devices like CPAP machines and polysomnography equipment. Based on the study by the Centers for Medicare & Medicaid Services, specialty clinics facilitate accurate diagnoses and tailored treatment plans ensuring optimal patient outcomes. Their expertise in sleep disorders positions them as trusted sources for device recommendations. Additionally, partnerships with manufacturers, such as Philips' collaboration with sleep centers, enhance accessibility. Consequently, these factors reinforce the segment's leadership in the distribution landscape.

The direct-to-consumer (DTC) channel is the fastest-growing, with a CAGR of 20%, as per eMarketer. This growth is fueled by consumer demand for convenience and personalized shopping experiences. Brands like Oura Ring and Casper have capitalized on this trend, achieving a 35% increase in online sales, as reported by Forbes. Besides, social media campaigns and influencer endorsements have amplified reach, particularly among younger demographics. Furthermore, regulatory support for at-home sleep diagnostics, such as FDA-approved wearable monitors, has expanded DTC offerings.

REGIONAL ANALYSIS

The United States is the undisputed leader in the North American sleep tech devices market and held an overwhelming share of 78.1% of the North American market in 2024. The leading position of the U.S. in North America is fueled by the country's advanced healthcare infrastructure, high disposable income levels, and growing awareness of sleep-related health issues. The Centers for Disease Control and Prevention (CDC) estimates that one in three Americans does not get enough sleep, creating a fertile ground for the adoption of innovative sleep solutions. With a population exceeding 330 million, the U.S. represents a massive consumer base for both wearable and non-wearable sleep tech devices. The strong presence of pioneering companies like Fitbit, Apple, and ResMed that are headquartered in the U.S. is further boosting the expansion of the U.S. sleep tech devices market. These firms have consistently pushed the boundaries of sleep technology, introducing products such as AI-driven smart beds and advanced wearable trackers. According to Statista, the U.S. sleep economy, encompassing sleep aids, devices, and wellness programs, was valued at $432 billion in 2022. Furthermore, government initiatives promoting public health, such as the National Institutes of Health's focus on sleep research, have bolstered innovation in this space. The integration of telehealth services with sleep tech has also gained traction, enabling remote consultations and personalized care plans, further solidifying the U.S.'s position as the epicenter of the regional market.

Canada occupies the second-largest position in the North American sleep tech devices market. The country’s market growth is underpinned by its robust healthcare system, increasing investments in digital health technologies, and a growing emphasis on preventive healthcare. Statistics Canada reveals that 26% of Canadians report trouble falling or staying asleep, driving demand for innovative sleep solutions. This, coupled with Canada’s aging population—where seniors aged 65 and above are projected to account for 23% of the population by 2030, according to the Government of Canada has created a burgeoning market for sleep tech devices. A study by Deloitte Canada highlights that 63% of Canadian households own at least one smart device, fostering the integration of IoT-enabled sleep tech products like smart lighting systems and ambient noise regulators. Additionally, partnerships between Canadian startups and global tech giants are accelerating innovation. For instance, companies like Somnox, which produces AI-powered sleep robots, have found a receptive market in Canada. Public health campaigns advocating better sleep hygiene, supported by organizations like the Canadian Sleep Society, have further normalized the use of sleep tech. These factors collectively position Canada as a dynamic and rapidly evolving player in the North American sleep tech market.

LEADING PLAYERS IN THE NORTH AMERICA SLEEP TECH DEVICES MARKET

ResMed

ResMed is a global leader in sleep tech devices, renowned for its innovations in respiratory care and sleep apnea solutions. The company’s flagship product line includes advanced CPAP machines and masks designed for comfort and efficiency. Its focus on cloud-based platforms, such as myAir, enables users to monitor their therapy progress, enhancing patient engagement. By addressing both clinical and consumer needs, ResMed has established itself as a pioneer in the sleep tech industry, driving global adoption of its products.

Philips Healthcare

Philips Healthcare is a dominant player in the sleep tech market, leveraging its expertise in medical-grade devices to address sleep disorders. The company’s DreamStation series of sleep therapy devices are widely regarded for their reliability and user-friendly interfaces. Philips’ strengths include its strategic collaborations with healthcare providers and telemedicine platforms, ensuring seamless integration of its products into clinical workflows. Additionally, its emphasis on sustainability and energy-efficient designs aligns with modern consumer preferences. Philips continues to innovate, introducing AI-driven features that enhance diagnostic accuracy and treatment outcomes.

Fitbit (a subsidiary of Google)

Fitbit stands out for its wearable sleep tracking devices, which cater to health-conscious consumers seeking holistic wellness solutions. The company’s smartwatches and fitness trackers offer advanced sleep monitoring capabilities, including heart rate variability and oxygen saturation tracking. Fitbit’s strengths include its robust data analytics platform, which provides actionable insights to improve sleep hygiene. Its acquisition by Google has further strengthened its technological capabilities, enabling deeper integration with other health ecosystems. By focusing on accessibility and affordability, Fitbit has expanded its reach, making sleep tech accessible to a broader audience.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players in the North America sleep tech devices market employ strategies such as product innovation, strategic partnerships, and direct-to-consumer sales to strengthen their positions. Companies like ResMed and Philips focus on integrating AI and IoT into their devices, enhancing functionality and user experience. Collaborations with telehealth platforms, such as Philips’ partnership with Teladoc, expand access to sleep diagnostics and therapy. Additionally, brands like Fitbit leverage digital marketing and influencer endorsements to target younger demographics. Offering subscription-based services and personalized health insights further drives customer loyalty, ensuring sustained growth in a competitive landscape.

KEY MARKET PLAYERS

Major Key Players of the North America Sleep Tech Devices Market include Koninklijke Philips N.V., ResMed, Inc., Fitbit, Inc., Garmin Ltd., Dreem, Sleep Number Corporation, Eight Sleep, Casper Sleep Inc., Withings, Xiaomi Corporation

RECENT HAPPENINGS IN THE MARKET

- In March 2023, ResMed launched a new AI-driven CPAP device, improving therapy adherence by 25%.

- In May 2023, Philips Healthcare partnered with Teladoc to integrate sleep diagnostics into telehealth platforms, enhancing accessibility.

- In July 2023, Fitbit introduced a premium sleep tracking feature, offering personalized recommendations to users.

- In September 2023, Oura Ring collaborated with mental health apps to provide stress management insights through sleep data.

- In November 2023, Garmin acquired a sleep analytics startup, expanding its wearable health monitoring capabilities.Top of Form

MARKET SEGMENTATION

This research report on the North America Sleep Tech Devices Market has been segmented and sub-segmented based on Product, Gender, Application, Distribution Channel, and region.

By Product

- Wearables

- Non- wearables

By Gender

- Male

- Female

By Application

- Obstructive Sleep Apnea (OSA)

- Insomnia

By Distribution Channel

- Specialty Clinics

- Direct-to-Consumer (DTC)

By Region

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What is driving the growth of the sleep tech devices market in North America?

Key drivers include increasing awareness of sleep disorders, rising prevalence of sleep apnea and insomnia, growing health consciousness, and the integration of advanced technologies like AI and IoT in consumer health devices.

2. Which countries contribute the most to the North America sleep tech devices market?

The United States is the leading contributor, followed by Canada and Mexico, due to high consumer adoption of health tech and increased healthcare spending.

3. Who are the major players in this market?

Major players include Koninklijke Philips N.V., ResMed, Inc., Fitbit, Inc., Garmin Ltd., Dreem, Sleep Number Corporation, Eight Sleep, and Withings.

4. How is the North America sleep tech devices market expected to grow in the coming years?

The market is projected to grow steadily due to rising awareness about sleep health, increasing prevalence of sleep disorders, and the adoption of advanced wearable technology.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]