North America Sleep Aids Market Size, Share, Trends & Growth Forecast Report By Sleep Disorder(Insomnia, Sleep Apnea, Restless legs syndrome, Narcolepsy, Sleepwalking), Product, Medication and Country (the United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Sleep Aids Market Size

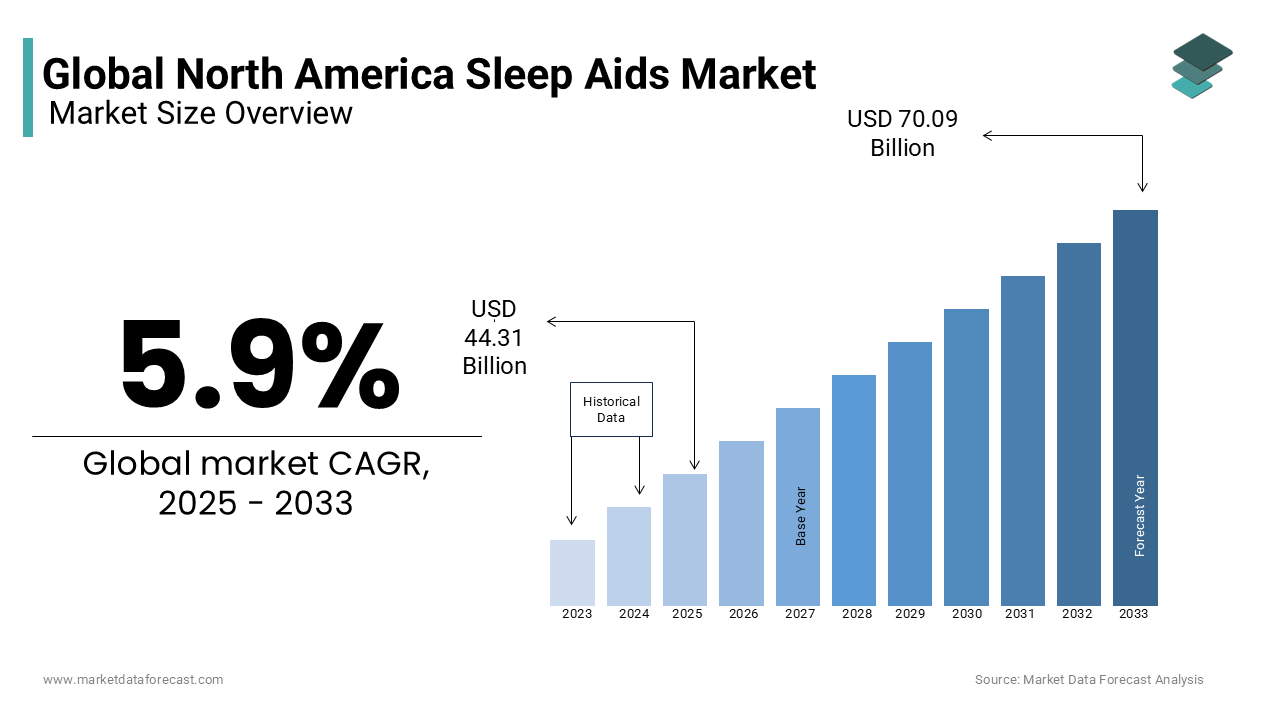

The sleep aids market size in North America was valued at USD 41.48 billion in 2024. The North American market size is forecasted to be worth USD 70.09 billion by 2033 from USD 44.31 billion in 2025 and is estimated to grow at a CAGR of 5.9% from 2025 to 2033.

Sleep aids encompass a range of products, including medications, sleep apnea devices, and wearable sleep trackers that are designed to improve sleep quality and address conditions such as insomnia, sleep apnea, and restless leg syndrome. According to the Centers for Disease Control and Prevention, one in three adults in the United States does not get sufficient sleep, and more than 70 million Americans suffer from chronic sleep disorders. Similarly, as per the Canadian Sleep Society, more than 40% of Canadians experience symptoms of insomnia at some point in their lives. This growing prevalence underscores the need for effective sleep aids to enhance overall health and productivity.

MARKET DRIVERS

Rising Prevalence of Sleep Disorders in North America

The growing incidence of sleep disorders such as insomnia and sleep apnea is a major driver of the sleep aids market. According to the National Institutes of Health, approximately 30% of adults in the United States suffer from short-term insomnia, while 10% experience chronic insomnia. Furthermore, as per the American Academy of Sleep Medicine, obstructive sleep apnea affects nearly 25 million Americans. This growing prevalence requires effective solutions including CPAP devices, oral appliances and medications to improve sleep quality and mitigate associated health risks like cardiovascular diseases and cognitive decline.

Growing Elderly Population

The aging population in North America significantly drives the demand for sleep aids. Sleep disturbances are more common among older adults. According to the U.S. Census Bureau, individuals aged 65 and older accounted for 16.9% of the population in 2022 and are projected to reach 22% by 2050. Sleep disorders, including insomnia and periodic limb movement disorder are prevalent in this demographic and fuelling the need for specialized solutions such as sleep medications, melatonin supplements, and advanced sleep technologies. The vulnerability of the aging population to sleep-related health issues emphasizes the critical role of sleep aids in enhancing their overall quality of life.

MARKET RESTRAINTS

Side Effects and Dependency on Sleep Medications

The overuse and side effects of sleep medications pose a major restraint to the sleep aids market in North America. According to the U.S. Food and Drug Administration, long-term use of sedative-hypnotics such as benzodiazepines can lead to dependency, cognitive impairment and withdrawal symptoms. As per the Centers for Disease Control and Prevention, approximately 4% of U.S. adults report regular usage. These risks discourage healthcare providers and patients from relying on pharmacological solutions and limit the sleep aids market expansion in North America.

High Costs of Advanced Sleep Technologies

The cost of advanced sleep aids such as CPAP machines and wearable sleep trackers limits their adoption among middle- and low-income populations. According to reports from the American Academy of Sleep Medicine, the average cost of a CPAP machine ranges from USD 500 to USD 3,000, depending on features and customization. Additionally, wearable sleep technologies that appeal to tech-savvy consumers can cost between $100 and $400. Such expenses create financial barriers for many individuals and hampering the market penetration. While insurance coverage is available for some devices, coverage limitations and out-of-pocket costs deter broader adoption and limit the regional market growth.

MARKET OPPORTUNITIES

Rising Adoption of Wearable Sleep Technologies

The increasing popularity of wearable devices and mobile applications for sleep monitoring offers a significant opportunity in the sleep aids market. As per the reports of the Consumer Technology Association, more than 20% of U.S. adults use wearable health devices for sleep-tracking features. Devices such as smartwatches and fitness trackers provide valuable insights into sleep patterns and enable users to adopt healthier sleep habits. The integration of artificial intelligence and machine learning in sleep technology further enhances personalized solutions and addresses a growing consumer demand for data-driven and non-invasive sleep aids, which is also providing a boost to regional market growth.

Growth in Cognitive Behavioral Therapy for Insomnia (CBT-I)

The shift toward non-pharmacological treatments such as Cognitive Behavioral Therapy for Insomnia (CBT-I) represents a key growth opportunity. According to the American Academy of Sleep Medicine, CBT-I is a highly effective and evidence-based treatment for chronic insomnia, with long-lasting benefits compared to medications. Healthcare providers increasingly recommend CBT-I and often delivered through digital platforms and apps due to the increasing awareness of the risks associated with sleep drugs. This trend supports the development of digital therapeutics and creates opportunities for companies to innovate and provide accessible and scalable solutions to manage sleep disorders across diverse demographics.

MARKET CHALLENGES

Lack of Awareness and Underdiagnosis of Sleep Disorders

The underdiagnosis of sleep disorders poses a critical challenge to the sleep aids market in North America. According to the American Academy of Sleep Medicine, approximately 80% of individuals with obstructive sleep apnea (OSA) remain undiagnosed. Similarly, as per the Centers for Disease Control and Prevention, many people who suffer from insomnia and other sleep disorders are unaware of their condition or do not seek medical intervention. This lack of awareness limits the demand for sleep aids as untreated sleep issues often go unaddressed, which is reducing the potential of the North American market.

Insurance Coverage Limitations

Inadequate insurance coverage for advanced sleep aids and therapies is a significant restraint in North America. According to the American Sleep Apnea Association, while some insurance plans cover CPAP machines and diagnostic tests, many policies impose restrictive criteria, high deductibles, or partial reimbursements. For example, wearable sleep trackers and cognitive behavioral therapy for insomnia (CBT-I) are often excluded from coverage and leave patients to bear high out-of-pocket expenses. This financial burden discourages individuals from adopting necessary treatments, particularly among low- and middle-income populations, and creates barriers to market expansion.

SEGMENTAL ANALYSIS

By Sleep Disorder Insights

The insomnia segment is expected to account for the leading share of the North American sleep aids market during the forecast period owing to the growing prevalence of insomnia and the increasing aging population.

The sleep apnea segment remains the fastest-growing segment of other sleep disorders and accounts for a promising share of the sleep aids market in North America.

By Product Insights

The mattresses and pillows segment holds the major share of the North American sleep aids market during the forecast period.

By Medication Insights

The prescription medications segment is anticipated to hold the largest share of the North American market during the forecast period.

REGIONAL ANALYSIS

The United States dominated the sleep aids market in North America in 2024. The domination of the U.S. in the North American market is expected to continue throughout the forecast period. The growth of the U.S. market is majorly driven by the high prevalence of sleep disorders and robust healthcare infrastructure. According to the Centers for Disease Control and Prevention, more than 70 million Americans suffer from chronic sleep disorders, including insomnia and sleep apnea. Advanced therapeutic solutions, such as CPAP devices and sleep trackers are widely adopted due to technological innovation and strong consumer awareness. The U.S. also leads in research and development, with significant investments in sleep health initiatives. The growing aging population in the U.S. is also aiding the sleep aids market growth in the U.S.

Canada is a significant contributor to the North American sleep aids market. The growing awareness of sleep health and an increasing number of initiatives by the Canadian government to combat sleep issues are propelling the Canadian sleep aids market growth. According to the Canadian Sleep Society, more than 40% of Canadians experience insomnia symptoms and sleep apnea affects nearly 6% of adults. Advanced diagnostic facilities and increasing adoption of CPAP devices are further fuelling the growth of the Canadian market. Additionally, the universal healthcare system of Canada ensures broader access to sleep disorder treatments. Public campaigns promoting sleep health and the growing popularity of non-pharmacological options, such as wearable sleep trackers also strengthen the sleep aids market in Canada.

KEY MARKET PLAYERS

A few prominent companies in the North America Sleep Aids Market profiled in this report are Sanofi, Pfizer, Koninklijke Philips N.V. (Philips), Merck & Co., Cadwell, Care Fusion Corporation, GlaxoSmithKline Plc, SleepMed, DeVilbiss Healthcare LLC and Natus Medical manufactures.

MARKET SEGMENTATION

This research report on the North American sleep aids market is segmented and sub-segmented based on the following categories.

By Sleep Disorder

- Insomnia

- Sleep Apnea

- Restless legs syndrome

- Narcolepsy

- Sleepwalking

By Product

- Mattresses & Pillows

- Sleep Laboratories

- Medication

- Sleep Apnea Devices

By Medication Type

- Prescription-based Drugs

- OTC drugs

- Herbal Drugs

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

What is the CAGR of the North American sleep aids market?

The sleep aids market in North America is estimated to grow at a CAGR of 5.9% from 2025 to 2033.

Which country held major share of the North American sleep aids market in 2024?

The U.S. accounted for the major share of the North American market in 2024.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]