North America Shrimp Feed Market Size, Share, Trends & Growth Forecast Report By Form (Frozen Shrimp Feed, Processed Shrimp Feed), Distribution Channel, And Country (US, Canada, And Rest Of North America), Industry Analysis From 2025 To 2033

North America Shrimp Feed Market Size

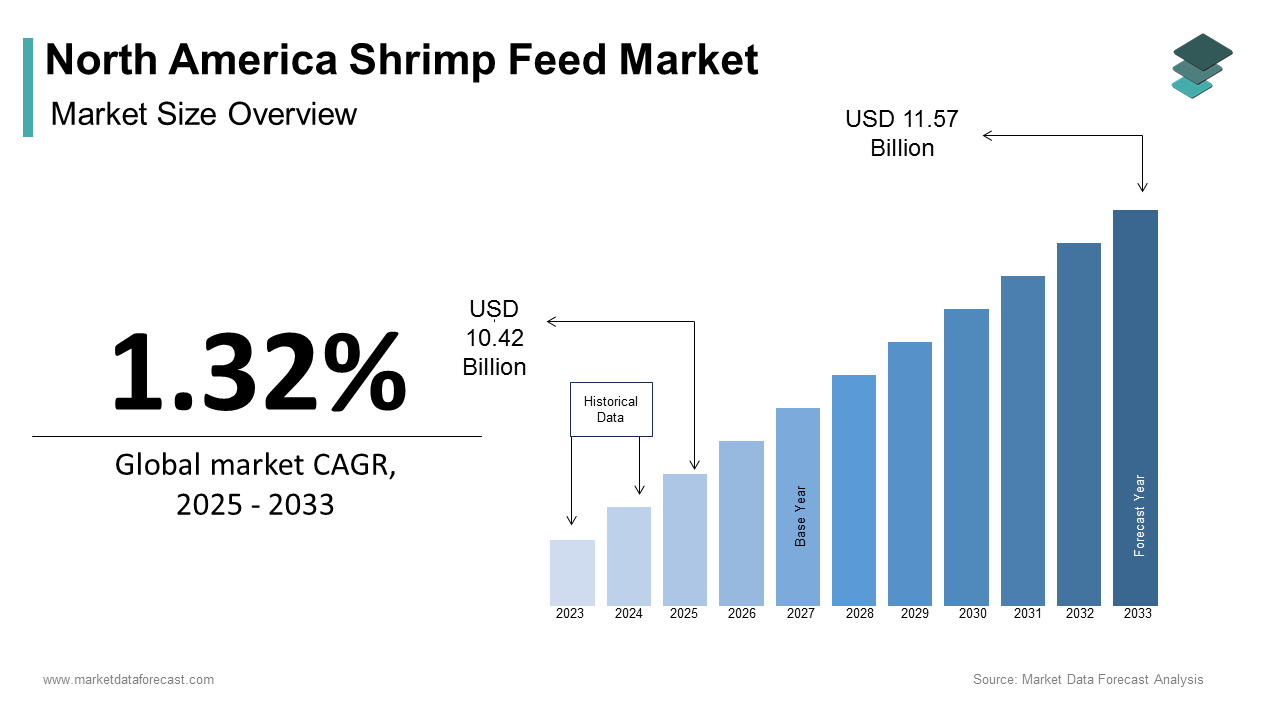

The North American shrimp feed market size was calculated to be USD 10.28 billion in 2024 and is anticipated to be worth USD 11.57 billion by 2033, from USD 10.42 billion in 2025, growing at a CAGR of 1.32% during the forecast period.

MARKET DRIVERS

Increasing Demand for High-Protein Diets

Among the primary drivers of the North American shrimp feed market is the escalating demand for high-protein diets among consumers. Like, global per capita consumption of seafood, including shrimp, has risen notably over the past decade. In North America, shrimp accounts for a significant portion of all seafood consumed, making it a staple protein source. This trend is particularly evident in urban areas, where health-conscious consumers prioritize nutrient-rich diets. Shrimp, being low in fat and rich in essential nutrients like omega-3 fatty acids, aligns perfectly with these dietary preferences. To meet this demand, shrimp farmers require specialized feed formulations that ensure optimal growth and nutritional value. Also, feed quality directly influences shrimp growth rates, with premium feed increasing productivity.

Technological Advancements in Feed Formulation

Technological innovations in shrimp feed formulation represent another major driver. The integration of precision nutrition and biotechnology has revolutionized feed production, enabling manufacturers to create tailored solutions for shrimp at various growth stages. Like, the use of microencapsulation techniques in feed has considerably improved nutrient absorption rates, enhancing shrimp health and yield. Furthermore, the adoption of alternative protein sources such as single-cell proteins and fermented plant-based ingredients has gained traction. Similarly, these innovations have reduced dependency on traditional fishmeal over the past five years. Such advancements not only address sustainability concerns but also cater to the rising demand for cost-effective and environmentally friendly feed options.

MARKET RESTRAINTS

Fluctuating Raw Material Prices

A significant restraint affecting the North American shrimp feed market is the volatility in raw material prices. Key ingredients such as fishmeal and soybean meal, which constitute a substantial portion of shrimp feed, are subject to price fluctuations due to global supply chain disruptions and climate-related challenges. Also, the cost of fishmeal increased considerably in the last few years, primarily due to reduced fish stocks caused by overfishing and unfavorable weather patterns. This unpredictability poses a financial burden on feed manufacturers and shrimp farmers, who must either absorb the costs or pass them on to consumers. In addition, rising input costs have led to an increase in shrimp feed prices over the past few years, impacting profitability across the value chain. The inability to secure stable pricing for raw materials creates uncertainty and hinders long-term planning, thereby constraining market growth.

Stringent Regulatory Standards

Another major restraint is the stringent regulatory environment governing aquaculture and feed production. In North America, regulatory bodies such as the Environmental Protection Agency and the Food and Drug Administration impose rigorous standards to ensure food safety and environmental sustainability. While these regulations are essential for maintaining quality, they often result in increased compliance costs for manufacturers. The compliance-related expenses can make up a key percenatges of total production costs for shrimp feed manufacturers. Additionally, the certification process for sustainable feed formulations is both time-consuming and resource-intensive. As per the Marine Stewardship Council, obtaining certifications can take up to two years and require significant investment in infrastructure and training. These barriers discourage new entrants and limit the ability of small-scale producers to compete, ultimately slowing market expansion despite growing demand.

MARKET OPPORTUNITIES

Expansion of Organic and Eco-Friendly Feed Solutions

A promising opportunity in the North American shrimp feed market lies in the growing demand for organic and eco-friendly feed solutions. Consumers are increasingly prioritizing sustainably sourced seafood, prompting shrimp farmers to adopt environmentally responsible practices. According to the Organic Trade Association, sales of organic seafood in the U.S. grew by 18% in 2022, reflecting shifting consumer preferences. This trend presents an opportunity for feed manufacturers to innovate and develop formulations using alternative protein sources such as insect meal, algae, and plant-based proteins. Also, feed containing these ingredients can considerably reduce the carbon footprint of shrimp farming. Moreover, partnerships with certification bodies can enhance market credibility and attract environmentally conscious buyers.

Rising Investments in Aquaculture Technology

Another significant opportunity stems from rising investments in aquaculture technology, particularly in precision feeding systems. Advanced technologies such as artificial intelligence and Internet of Things (IoT) devices enable real-time monitoring of shrimp health and feeding patterns, optimizing feed usage and reducing waste. According to the World Aquaculture Society, farms utilizing precision feeding systems have reported a 25% reduction in feed costs and a 15% improvement in shrimp growth rates. Additionally, government initiatives, such as grants and subsidies for adopting smart farming technologies, are encouraging shrimp farmers to modernize their operations. Also, federal funding for aquaculture innovation programs surged in the last few years, signaling strong institutional support.

MARKET CHALLENGES

Disease Outbreaks and Biosecurity Concerns

The most pressing challenge in the North American shrimp feed market is the prevalence of disease outbreaks, which significantly impact shrimp farming operations. Diseases such as Early Mortality Syndrome (EMS) and White Spot Syndrome Virus (WSSV) have caused widespread losses in shrimp production. Like, disease-related mortality rates can surge significantly in affected farms, leading to substantial economic losses. Poor biosecurity measures and inadequate feed formulations exacerbate these issues, as shrimp with compromised immune systems are more susceptible to infections. Also, improper nutrient balance in feed can otably increase disease vulnerability. However, the complexity of disease management continues to pose a significant hurdle for market participants.

Limited Awareness of Sustainable Practices

A further challenge is the limited awareness and adoption of sustainable shrimp farming practices among small-scale producers. Despite the availability of eco-friendly feed options, many farmers lack the knowledge or resources to transition to sustainable methods. According to the National Aquaculture Association, less than 40% of shrimp farms in North America currently follow certified sustainable practices. This gap is partly due to insufficient outreach and education programs targeting rural farming communities. Additionally, as per the Marine Stewardship Council, the perceived high costs of sustainable feed solutions deter smaller operators from making the switch. This lack of awareness not only undermines efforts to promote environmental stewardship but also limits market growth potential.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

1.32% |

|

Segments Covered |

By Form, Distribution Channel, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

Us, Canada, And Rest of North America |

|

Market Leaders Profiled |

Cargill, Incorporated, Nutreco N.V., BioMar Group, Avanti Feeds Ltd., Alltech Inc., Charoen Pokphand Foods Public Company Limited (CP Foods), ADM Animal Nutrition, Wilbur-Ellis Nutrition, LLC, Norel Animal Nutrition, SHV (Nutreco), Land O'Lakes, Thai Union Group PCL, Rangen, Inc., Biomin Holding GmbH. |

SEGMENTAL ANALYSIS

By Form Insights

The frozen shrimp feed segment spearheaded the North American shrimp feed market, with 55.7% of the total market share in 2024. This dominance is driven by the widespread preference for frozen shrimp among consumers due to its extended shelf life and convenience in storage and transportation. Also, a key factor propelling this segment’s ahead is the rise in large-scale commercial farming operations that rely on frozen feed formulations to ensure consistent nutrient delivery to shrimp. Like, farms utilizing frozen feed report an improvement in shrimp yield compared to other forms, as it preserves essential nutrients and minimizes spoilage.

Another driving factor is the growing demand for processed shrimp products, which require high-quality frozen feed to maintain product integrity. Similarly, processed shrimp accounts for a notable share of total shrimp consumption in North America, with frozen feed playing a pivotal role in meeting stringent quality standards. Additionally, advancements in freezing technologies have enabled manufacturers to produce cost-effective and nutrient-dense feed formulations. In addition, innovations in cryogenic freezing have considerably reduced production costs, making frozen shrimp feed more accessible to small and medium-sized farms.

The processed shrimp feed segment is projected to grow at the CAGR of 8.5% during the forecast period. This rapid growth is fueled by the increasing consumer demand for ready-to-cook and value-added shrimp products. Processed shrimp, such as breaded or marinated varieties, makes up a key portion of total shrimp sales in recent years. The need for specialized feed formulations tailored to processed shrimp production has become paramount, driving this segment’s expansion.

A significant factor contributing to this growth is the integration of advanced processing technologies, which enhance the nutritional profile of shrimp. Like, processed shrimp feed enriched with prebiotics and antioxidants has improved shrimp health, reducing mortality rates during processing. Furthermore, urbanization trends in North America have led to a surge in demand for convenient seafood options.

By Distribution Channel Insights

The off-trade distribution channel dominated the North American shrimp feed market by capturing 65.9% of the total share in 2024. This channel encompasses retail outlets such as supermarkets, hypermarkets, and specialty stores, where shrimp feed is purchased for household or small-scale farming use. In addition, the prominence of off-trade channels is mainly propelled by the rising popularity of backyard aquaculture and home-based shrimp farming, especially in suburban areas.

A further critical factor is the strategic placement of shrimp feed products in retail stores, which enhances visibility and consumer reach. Apart from these, the convenience of purchasing feed alongside other household essentials has bolstered consumer preference for off-trade channels. Also, a significant portion of first-time shrimp farmers opt for off-trade purchases due to accessibility and affordability.

The on-trade distribution channel is experiencing the fastest growth, with a CAGR of 9.2%. This segment includes restaurants, hotels, and catering services that directly source shrimp feed for large-scale farming operations supplying their establishments. The rapid expansion of the hospitality sector in North America has been a key driver of this growth. Also, the restaurant industry grew greatly in the last few years, creating a robust demand for high-quality shrimp feed to meet culinary standards.

One more contributing factor is the increasing emphasis on farm-to-table dining experiences, which prioritize sustainably sourced seafood. Similarly, a notable share of upscale restaurants now feature sustainably farmed shrimp on their menus, necessitating premium feed formulations. Additionally, partnerships between shrimp farmers and on-trade establishments have streamlined supply chains, reducing costs and improving efficiency. These developments show the on-trade distribution channel’s potential to lead future market growth.

REGIONAL ANALYSIS

The United States held the largest share of the North American shrimp feed market i.e. 60.6% of the regional trade in 2024 , as per the National Oceanic and Atmospheric Administration. This dominance is attributed to the country’s advanced aquaculture infrastructure and strong consumer demand for shrimp. A key factor driving the U.S. market is the government’s support for sustainable aquaculture practices.

Another driving aspect is the growing preference for locally sourced seafood. Also, domestic shrimp production increased notably in the past years, propelled by consumer awareness of food miles and environmental impact. Additionally, the U.S. boasts a robust research ecosystem, with institutions like the Gulf States Marine Fisheries Commission pioneering innovations in shrimp feed formulations. These initiatives have enhanced productivity, with feed efficiency improving in recent years.

Canada represents a key growing market for shrimp feed in North America. The country’s cold-water shrimp farming industry is a major contributor to this position, supported by favorable climatic conditions and abundant freshwater resources. A significant point supporting Canada’s market is the adoption of cutting-edge technologies in aquaculture. Like, investments in precision feeding systems have increased considerably in the recent years, optimizing resource utilization and boosting yields.

Another key factor is the emphasis on organic and non-GMO feed formulations. Additionally, Canada’s stringent regulatory framework ensures high-quality feed production, enhancing market credibility. The compliance with sustainability standards has reduced feed wastage notably.

Mexico is emerging as a significant player in the North American shrimp feed market. The country’s extensive coastline and tropical climate provide ideal conditions for shrimp farming, particularly in states like Sinaloa and Sonora. A primary driver of Mexico’s market growth is the export-oriented nature of its aquaculture industry.

A further aspect is the increasing adoption of integrated farming practices, which combine shrimp and crop cultivation. Also, integrated systems have reduced production costs, making shrimp farming more profitable. Additionally, government initiatives such as subsidies for sustainable feed production have encouraged small-scale farmers to adopt modern techniques.

The Rest of North America, including countries like Cuba and the Dominican Republic. Despite its smaller size, this segment is gaining traction due to international collaborations and foreign investments. A key point driving growth is the focus on community-based aquaculture projects.

Another propellent is the region’s strategic location, which facilitates trade with North American markets. These developments show the untapped potential of this segment within the broader regional market.

LEADING PLAYERS IN THE NORTH AMERICA SHRIMP FEED MARKET

Cargill Incorporated

Cargill has established itself as a key player in the North American shrimp feed market through its commitment to innovation and sustainability. The company focuses on developing high-performance feed formulations enriched with alternative proteins, such as insect meal and algae, to meet the growing demand for eco-friendly solutions. Additionally, the company collaborates with research institutions to advance aquaculture technologies, ensuring its products align with evolving industry standards.

Archer Daniels Midland (ADM)

ADM plays a pivotal role in the shrimp feed market by leveraging its expertise in agricultural processing and biotechnology. The company emphasizes precision nutrition, tailoring feed formulations to address specific growth stages of shrimp. Furthermore, ADM’s partnerships with aquaculture farms have enabled it to refine its product offerings, ensuring they cater to the unique needs of North American shrimp farmers while promoting sustainable practices.

Nutreco N.V.

Nutreco N.V. is renowned for its science-based approach to shrimp feed development, focusing on improving feed efficiency and environmental impact. The company invests heavily in R&D to create innovative formulations that reduce reliance on traditional fishmeal. Additionally, the company actively supports small-scale farmers through training programs, fostering long-term relationships and strengthening its presence in the region.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players in the North American shrimp feed market employ strategies such as product innovation, strategic partnerships, and sustainability initiatives to maintain their competitive edge. Product innovation involves developing advanced feed formulations using alternative proteins and bioactive compounds to improve shrimp health and yield. Strategic partnerships with research institutions and aquaculture farms enable companies to refine their offerings and expand their customer base. Sustainability initiatives focus on reducing environmental impact through eco-friendly ingredients and production methods. These strategies collectively drive market growth and ensure compliance with regulatory standards.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players in the North American shrimp feed market include Cargill, Incorporated, Nutreco N.V., BioMar Group, Avanti Feeds Ltd., Alltech Inc., Charoen Pokphand Foods Public Company Limited (CP Foods), ADM Animal Nutrition, Wilbur-Ellis Nutrition, LLC, Norel Animal Nutrition, SHV (Nutreco), Land O'Lakes, Thai Union Group PCL, Rangen, Inc., Biomin Holding GmbH.

The North American shrimp feed market is characterized by intense competition, driven by the presence of global giants and regional players striving to dominate the sector. Companies are increasingly investing in R&D to develop innovative feed formulations that cater to the evolving needs of shrimp farmers. The emphasis on sustainability has intensified competition, with firms vying to offer eco-friendly solutions that align with consumer preferences. Collaborations with aquaculture farms and certification bodies further enhance credibility and market reach. Additionally, technological advancements, such as precision feeding systems, have created new opportunities for differentiation. This dynamic landscape fosters innovation but also poses challenges, as participants must balance cost-efficiency with quality to remain competitive.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, Cargill Incorporated launched a new shrimp feed line fortified with prebiotics, aimed at boosting shrimp immunity and growth rates.

- In June 2023, Archer Daniels Midland introduced a microencapsulated feed solution, improving nutrient absorption by 30% for enhanced shrimp health.

- In August 2023, Nutreco N.V. unveiled a plant-based protein feed, reducing carbon emissions by 25% and promoting sustainable farming practices.

- In October 2023, Cargill partnered with aquaculture research institutions to develop climate-resilient feed formulations for North American farms.

- In December 2023, ADM initiated a farmer training program to promote precision feeding techniques, strengthening ties with small-scale shrimp producers.

MARKET SEGMENTATION

This research report on the North American shrimp feed market has been segmented and sub-segmented based on form, distribution channel, and region.

By Form

- Frozen Shrimp Feed

- Processed Shrimp Feed

By Distribution Channel

- Off-Trade Distribution

- On-Trade Distribution

By Region

- Us

- Canada

- Rest of North America

Frequently Asked Questions

1. What are the key factors driving the growth of the shrimp feed market in North America?

Rising shrimp consumption, expansion of aquaculture practices, and growing awareness of high-quality feed benefits are the main drivers.

2. Which countries dominate the shrimp feed market in North America?

The United States and Mexico are the major contributors due to large-scale shrimp farming and growing seafood consumption.

3. Who are the leading players in the North America shrimp feed market?

Key players include Cargill, BioMar Group, Nutreco N.V., Alltech Inc., and CP Foods.

4. How are technological innovations influencing shrimp feed production?

Technological innovations such as precision nutrition, enzyme supplementation, and probiotic-based feeds are helping optimize feed efficiency and sustainability in shrimp farming.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]