North America Seasonings Market Research Report – Segmented By Type (Oregano, Pepper, Paprika, Ginger, Cinnamon, Cumin, Turmeric, Garlic, Cardamom, Coriander, Cloves, Others), Application, And Country (Us, Canada, And Rest Of North America) - Industry Analysis On Size, Share, Trends & Growth Forecast (2025 To 2033)

North America Seasonings Market Size

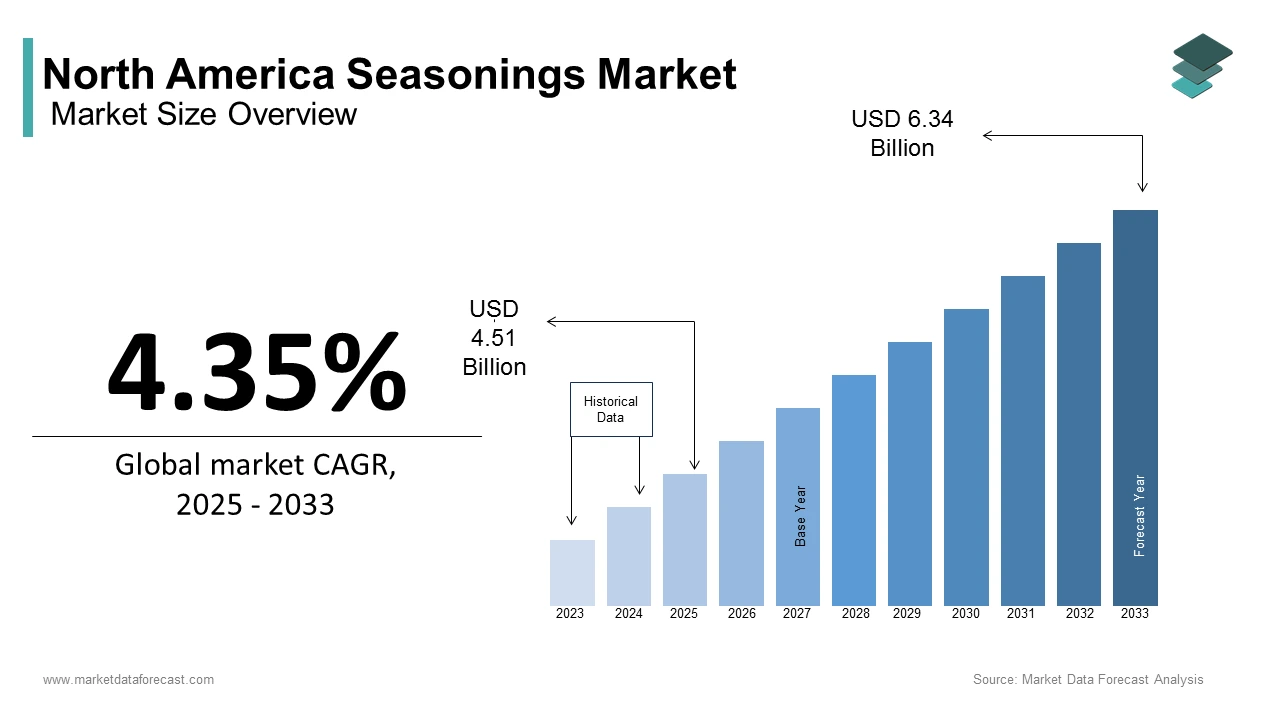

The North America seasonings market size was valued at USD 4.32 billion in 2024 and is expected to reach USD 6.34 billion by 2033 from USD 4.51 billion in 2025. The market is projected to grow at a CAGR of 4.35%.

Current Scenario of the North America Seasonings Market

The North America seasonings market is a part of the food industry and is offering spices, herbs, blends, and condiments that enhance the flavour of countless dishes. This sector has seen steady growth as consumers explore bold and diverse tastes, driven by the region's multicultural population and enthusiasm for global cuisines. The U.S. Census Bureau highlights that in 2019, immigrants accounted for 13.7% of the U.S. population, introducing unique culinary traditions that have influenced seasoning trends. Additionally, the growing emphasis on health has spurred demand for organic and natural options, with the Organic Trade Association reporting $56.4 billion in organic food sales in 2020. Convenience is also key, as pre-made seasoning mixes cater to busy lifestyles, while the booming foodservice industry further boosts consumption.

Interestingly, Americans have a strong appetite for flavour and the American Spice Trade Association reveals that each person uses about 3.2 pounds of spices annually. Meanwhile, Mexico stands out as a major player in spice production, churning out over 3 million tonnes of chili peppers in 2019, according to the Food and Agriculture Organization.

MARKET DRIVERS

Growing Demand for Ethnic and Global Cuisines

The rising popularity of ethnic and global cuisines is significantly driving the North American seasonings market. As cultural diversity expands, so does the interest in bold and unique flavors from regions like Asia, Latin America, and the Middle East. The U.S. Census Bureau reports that the Asian population in the U.S. grew by 35.5% between 2010 and 2020, contributing to the demand for spices like turmeric, ginger, and cumin. This trend has pushed manufacturers to innovate and introduce authentic seasoning blends. Restaurants and foodservice providers are also capitalizing on this shift, offering dishes infused with exotic spices, further fueling market growth.

Health-Conscious Consumer Trends

Health-consciousness is another major driver propelling the North America seasonings market. Consumers are increasingly seeking natural, organic, and preservative-free seasoning options to complement their wellness goals. According to the Organic Trade Association, organic spice sales in the U.S. grew by 14% in 2020, reaching $68 million. Spices like turmeric, known for their anti-inflammatory properties, have gained immense popularity. Furthermore, the growing awareness of reducing sodium intake has led to a surge in herb-based seasonings as healthier alternatives. These trends indicate a clear preference for functional ingredients, driving innovation and expanding the market's reach.

MARKET RESTRAINTS

Fluctuating Raw Material Prices

The North America seasonings market faces challenges due to the volatility of raw material prices, which directly impacts production costs. Spices like vanilla, saffron, and cardamom are highly sensitive to weather conditions, geopolitical factors, and labor shortages in producing countries. For instance, Madagascar, a leading producer of vanilla, experienced a 30% drop in vanilla bean production in 2021 due to cyclones, as reported by the International Trade Centre. This scarcity caused vanilla prices to spike by nearly 50% during the same period. Such fluctuations create uncertainty for manufacturers, who must either absorb the increased costs or pass them on to consumers, potentially reducing demand. Additionally, smaller companies with limited financial resources struggle to manage these price swings, further constraining their ability to compete effectively in the market.

Consumer Skepticism Toward Artificial Additives

Consumer skepticism toward artificial additives and preservatives in seasonings is another significant restraint for the market. While there is a growing preference for natural ingredients, some seasoning blends still contain synthetic enhancers like monosodium glutamate (MSG) or artificial flavors, which face backlash from health-conscious buyers. A survey conducted by the International Food Information Council in 2021 found that 60% of U.S. consumers actively avoid products containing artificial additives. This trend has led to a decline in sales of certain conventional seasoning products. Furthermore, misinformation or confusion about ingredient labels can deter purchases, as showcased by a study from the Grocery Manufacturers Association, which noted that 71% of shoppers feel overwhelmed by label claims.

MARKET OPPORTUNITIES

Expansion of E-Commerce Platforms

The rapid growth of e-commerce presents a great opportunity for the North America seasonings market. Online grocery shopping has surged, with McKinsey & Company reporting that 75% of U.S. consumers tried online grocery shopping during the pandemic, and 35% plan to continue using it. This shift allows seasoning brands to reach a broader audience, especially niche products like organic or ethnic blends that may not be available in traditional stores. Amazon and specialty platforms like Thrive have seen increased sales of spices and seasonings. Additionally, social media platforms like Instagram and Pinterest are driving awareness, as spotlighted by Sprout Social which found that 68% of consumers discover new food products through these channels. Leveraging digital marketing and partnerships with influencers can further boost brand visibility and revenue.

Rising Demand for Functional Ingredients

Functional ingredients represent another key opportunity in the North America seasonings market. Consumers are increasingly seeking spices with health benefits, such as turmeric, ginger, and cinnamon due to their anti-inflammatory and antioxidant properties. Similarly, the American Botanical Council reports that herbal supplement sales, including spices, reached $11.3 billion in 2020, reflecting growing interest in natural remedies. Seasoning brands can capitalize on this trend by developing products marketed for their functional benefits, such as immunity-boosting blends. Collaborations with health experts and certifications like Non-GMO Project Verified can enhance credibility, attracting health-conscious buyers and expanding market share.

MARKET CHALLENGES

Limited Awareness of Regional Spices

A lack of consumer awareness about lesser-known regional spices poses a challenge for the North America seasonings market. While popular spices like cinnamon and black pepper dominate shelves, unique ingredients like sumac, fenugreek, or epazote remain underutilized due to limited exposure. The Specialty Food Association notes that only 15% of U.S. consumers regularly experiment with unfamiliar spices, citing hesitation over preparation methods or flavor profiles. This reluctance limits innovation and restricts market diversification. Without proactive efforts to educate buyers, manufacturers face difficulty promoting regional spices, hindering their potential to tap into untapped markets.

Environmental Concerns in Spice Farming

Environmental concerns in spice farming present a major challenge for the North America seasonings market. Climate change, deforestation, and unsustainable farming practices threaten the availability of key spices. For example, the International Union for Conservation of Nature (IUCN) warns that wild cardamom populations in India are declining due to habitat loss, while erratic rainfall patterns have reduced global spice yields by 10% to 15%, according to the World Bank. These environmental issues increase costs and create supply chain vulnerabilities. Furthermore, consumers are becoming more eco-conscious, with a survey by IBM revealing that 57% of U.S. shoppers are willing to change their purchasing habits to reduce environmental impact. Brands must invest in sustainable sourcing practices, such as Fair Trade certification or regenerative agriculture, to meet these expectations. However, implementing these measures requires significant investment and collaboration with farmers, posing financial and logistical hurdles.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.35% |

|

Segments Covered |

By Type, Application, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

US, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

Archer Daniels Midland, Arboris, LLC, BASF SE, Cargill, Inc., Connoils, DRT, DuPont, Fenchem, Lipofoods, Nutrition Products Co. Ltd., PrimaPharma Inc., Raisio, The Unilever Group, Triple Crown, Vitae Naturals, and Wilmar Spring Fruit |

SEGMENTAL ANALYSIS

By Type Insights

The pepper was the largest segment in the North America seasonings market byholding a market share of 18.4% in 2024. Its dominance is due to its versatility and widespread use in both household kitchens and the foodservice industry. The U.S. Department of Agriculture reported that the U.S. imported over 250,000 metric tons of black pepper in 2023, making it a staple spice. Pepper’s importance lies in its ability to enhance flavors without overpowering dishes, appealing to diverse cuisines. Additionally, the American Spice Trade Association highlighted that pepper accounted for nearly 25% of total spice consumption in North America, underscoring its critical role in daily cooking.

The Turmeric segment is expected to be the fastest-growing segment, with a CAGR of 10.5% from 2025 to 2033. This growth is driven by increasing awareness of turmeric’s health benefits, particularly its anti-inflammatory properties linked to curcumin. The National Institutes of Health notes that turmeric-based supplements ranked among the top five natural remedies in the U.S., with sales growing by 20% annually. Consumers’ shift toward functional foods and clean-label products further fuels demand.

By Application Insights

The meat and poultry segment was the biggest of the other applications in the North America seasonings market by capturing a market share of 28.4%. This prominence was caused by the high consumption of seasoned meats, as Americans consumed an average of 225 pounds of red meat and poultry per person in 2023, according to the U.S. Department of Agriculture. Seasonings like pepper, garlic, and paprika are widely used to enhance flavor and meet consumer demand for ready-to-cook options. The National Chicken Council reported that seasoned chicken products accounted for over 35% of total poultry sales in 2023 which is showcasing the importance of seasonings in this category. Its leadership underscores the role of seasonings in making meat dishes more appealing and convenient.

The beverages segment is projected to rise at the swift pace, with a CAGR of 9.2% which is fueled by the rising popularity of spiced beverages like chai tea, turmeric lattes, and flavored coffees. According to the Specialty Food Association, the U.S. specialty beverage market grew by 15% in 2022, with spiced drinks gaining significant traction. The National Coffee Association reported that 60% of Americans drink coffee daily, and many are experimenting with spices like cinnamon and ginger for added flavor. Health-conscious consumers are also driving demand for functional beverages infused with turmeric or cardamom. These trends exhibit the growing importance of seasonings in beverages, as they cater to both taste and wellness preferences.

REGIONAL ANALYSIS

The USA dominated the North America seasonings market with an 85.4% share in 2024. Its diverse population of over 334 million in 2023, as reported by the U.S. Census Bureau, is one of the reasons behind this. The country’s appetite for global cuisines such as Mexican and Asian, drove seasoning demand. Spice imports hit $1.8 billion in 2023, according to the U.S. Department of Agriculture, reflecting reliance on these products. Daily spice usage was widespread, with 90% of households incorporating them into meals, per the American Spice Trade Association. This highlights the integral role seasonings play in American cooking.

Canada is set to grow at the fastest rate, with a CAGR of 7.8% from 2025 to 2033. Statistics Canada noted immigrants made up 23% of the population in 2023, increasing demand for spices like turmeric and cumin. A shift toward natural products was evident, as 70% of Canadians sought organic options, according to the Canadian Health Food Association. Cold weather also encouraged home cooking, boosting seasoning sales. Canada’s focus on sustainability and premium offerings positions it for significant expansion in the coming years.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Personalization and Custom Blending Services

Some leading companies are adopting a more customer-centric approach by offering personalized seasoning solutions. This strategy focuses on creating tailor-made spice blends for foodservice operators, private-label brands, and even direct-to-consumer platforms. By leveraging customer feedback, data analytics, and culinary expertise, companies can design unique seasoning profiles that align with specific brand identities or target demographics. This approach not only enhances customer loyalty but also positions the company as a collaborative partner rather than just a supplier.

Culinary Education and Brand Storytelling

Major seasoning brands are now engaging chefs, influencers, and consumers through culinary education programs and brand storytelling. Through online cooking classes, recipe development, chef collaborations, and social media campaigns, companies aim to inspire the use of their products in creative ways. This strategy helps build emotional connections with consumers and elevates the brand beyond being just a product on the shelf. Storytelling about sourcing origins, cultural heritage of spices, or farmer partnerships creates a more meaningful brand narrative.

Technology-Driven Supply Chain Transparency

In addition to ethical sourcing, some companies are leveraging blockchain and other digital tools to provide full transparency across their supply chain. This strategy allows customers and partners to track the journey of seasonings from farm to finished product. By integrating tech-driven solutions like QR codes and traceability platforms, brands enhance consumer trust and differentiate themselves from competitors that may not provide the same level of visibility into their sourcing and production practices.

TOP 3 PLAYERS IN THE MARKET

McCormick & Company, Inc.

McCormick & Company, Inc. is widely recognized as one of the most dominant players in the North America seasonings market. The company has built a strong brand presence through its broad range of spices, herbs, seasoning blends, and flavoring products that are available in both retail and foodservice sectors. McCormick's contribution to the market lies in its ability to consistently introduce new, innovative flavor profiles that align with evolving consumer tastes. By blending traditional spice offerings with global flavor trends, McCormick not only serves everyday cooking needs but also plays a pivotal role in shaping culinary preferences in North America. Their wide distribution network and partnerships with major retailers have helped them maintain market leadership.

Kerry Group plc

Kerry Group plc is a major force in the North American seasonings market, known for its expertise in delivering customized flavor solutions to food and beverage manufacturers. The company contributes by helping businesses create tailored seasoning blends that enhance the taste experience of finished products. Kerry is particularly strong in providing natural and clean-label seasoning options, meeting consumer demand for healthier, transparent ingredient lists. Through its advanced research and development capabilities, Kerry drives innovation in taste and nutrition, influencing how manufacturers across North America formulate snacks, ready meals, and other food categories.

Olam International

Olam International plays a key role in the North American seasonings market through its large-scale sourcing and processing of spices and herbs. Olam’s vertically integrated supply chain allows it to control quality from farm to finished product, ensuring consistency and sustainability. The company supplies a wide variety of raw and processed seasonings to manufacturers, wholesalers, and foodservice companies throughout North America. Olam’s contribution also includes its focus on sustainable and ethical sourcing, addressing growing consumer interest in traceability and environmental responsibility. By delivering diverse, high-quality seasonings at scale, Olam supports both large manufacturers and specialty food producers across the region.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Major Players of the North America Seasonings Market include Archer Daniels Midland, Arboris, LLC, BASF SE, Cargill, Inc., Connoils, DRT, DuPont, Fenchem, Lipofoods, Nutrition Products Co. Ltd., PrimaPharma Inc., Raisio, The Unilever Group, Triple Crown, Vitae Naturals, and Wilmar Spring Fruit

The North America seasonings market has strong competition, with many companies working hard to win over customers. Big companies, like McCormick & Company, Kerry Group, and Olam International, are some of the leaders in this market. They sell many types of seasonings, spices, and herbs to grocery stores, restaurants, and food companies across the United States and Canada.

These companies compete by offering a wide variety of flavors, such as spicy, sweet, smoky, or natural blends. Some companies focus on making new and exciting seasoning products, while others work on making healthier or organic options. Many companies also try to stand out by telling their story about where their spices come from and how they help local farmers or protect the environment.

Small and local businesses are also part of the competition. They make special blends or high-quality seasonings that some customers prefer because they feel more personal or unique.

In this market, companies compete to be the best by giving customers fresh products, good prices, and creative flavors. They also compete by working with food companies and restaurants to create custom seasonings just for them. As more people want bold and healthy flavors, the competition in the seasoning market continues to grow stronger.

RECENT HAPPENINGS IN THE MARKET

- In January 2025, McCormick & Company unveiled its 2025 Flavour of the Year, Aji Amarillo, a pepper native to South America known for its fruity, tropical notes with moderate heat. To celebrate, McCormick launched a new Aji Amarillo Seasoning and hosted its first-ever Flavor Night Market in Miami, Florida, in February.

DETAILED SEGMENTATION OF NORTH AMERICA SEASONINGS MARKET INCLUDED IN THIS REPORT

This research report on the North America seasonings market has been segmented and sub-segmented based on type, application & region.

By Type

- Oregano

- Pepper

- Paprika

- Ginger

- Cinnamon

- Cumin

- Turmeric

- Garlic

- Cardamom

- Coriander

- Cloves

- Others

By Application

- Bakery and confectionary

- Beverages

- Frozen foods

- Savory

- Meat and poultry

- Others (salads)

By Region

- US

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What are the key drivers of the North America seasonings market?

The market is driven by increasing consumer demand for convenience foods, rising interest in international cuisines, and growing awareness of health benefits associated with natural and organic seasonings.

2. Which types of seasonings are most popular in North America?

The most popular seasonings include salt, pepper, garlic, onion powder, paprika, oregano, basil, and various spice blends used in North American and global cuisines.

3. How is the North America seasonings market expected to grow in the coming years?

The market is expected to grow steadily due to increasing consumption of processed foods, rising demand for clean-label and organic products, and innovation in spice blends and seasoning formulations.

4. Who are the major players in the North America seasonings market?

Leading companies include McCormick & Company, Olam International, Ajinomoto Co., Kerry Group, and Sensient Technologies, among others.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]