North America Salmon Market Research Report – Segmented By Type (Farmed, Wild Captured), Species, End-Product Type, Distribution Channel, And Country (Us, Canada, And Rest Of North America) - Industry Analysis On Size, Share, Trends & Growth Forecast (2025 To 2033)

North America Salmon Market Size

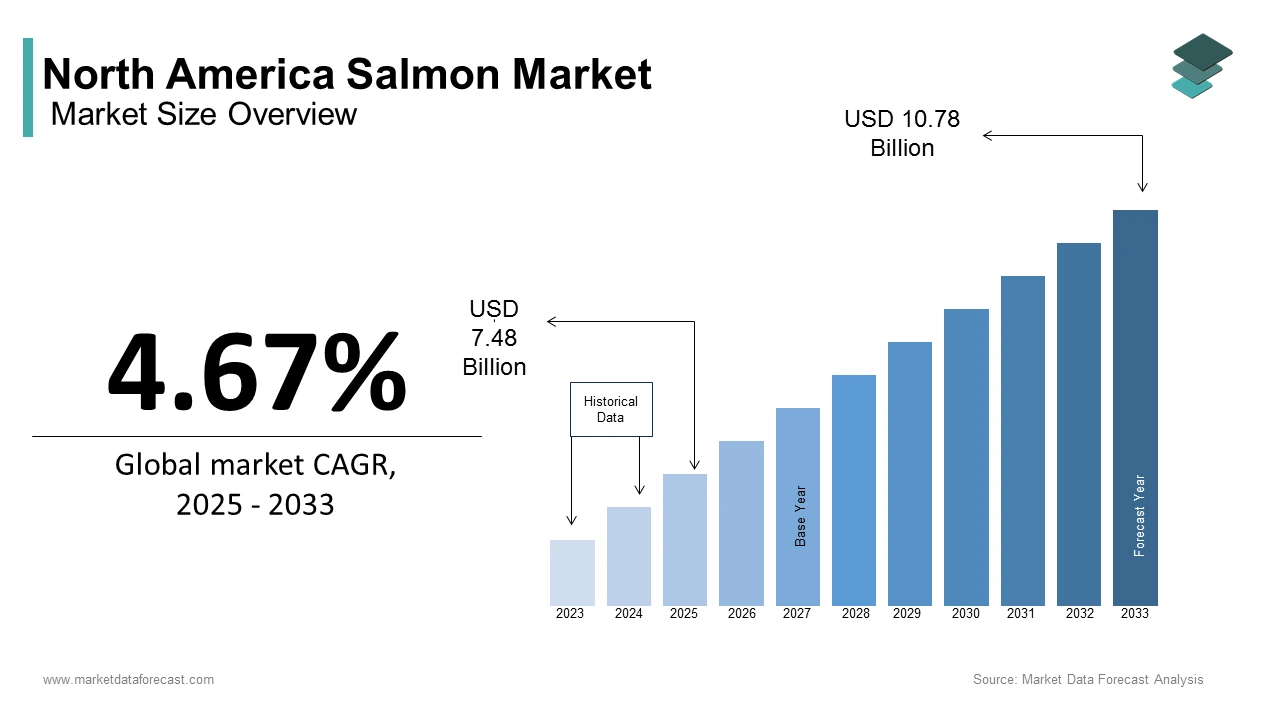

The North America salmon market size was valued at USD 7.15 billion in 2024 and is expected to reach USD 10.78 billion by 2033 from USD 7.48 billion in 2025. The market is projected to grow at a CAGR of 4.67%.

Current Scenario of the North America Salmon Market

People in the United States and Canada love salmon because it is healthy, full of protein, and rich in omega-3 fatty acids, which are good for the heart and brain. Salmon can be wild-caught or farmed, and both types are popular. Wild salmon is often seen as more natural and sustainable, but farmed salmon is easier to find in stores because it is available all year round. This mix of wild and farmed salmon makes the market interesting but also complicated, as people try to balance environmental concerns with the need for affordable food.

Salmon is not just important for food, it also plays a big role in nature and culture. For example, the National Oceanic and Atmospheric Administration explains that salmon migration helps scientists understand how healthy rivers and oceans are. A study from the University of Washington shows that when salmon swim upstream to lay eggs, they bring nutrients from the ocean into forests, helping trees grow stronger. Salmon is also very meaningful to Indigenous communities in North America. The Smithsonian Institution has written about how salmon fishing is a tradition passed down through generations, connecting people to their history and way of life. These facts show that salmon is much more than just a fish which is key to ecosystems, culture, and health in North America.

MARKET DRIVERS

Rising Health Awareness and Nutritional Benefits

The growing focus on health and wellness is a key driver of the North American salmon market. Salmon is widely regarded as a superfood due to its rich omega-3 fatty acid content, which supports heart and brain health. Medical professionals have long recommended fish like salmon as part of a balanced diet, especially for individuals seeking to reduce their risk of chronic diseases. Historically, diets rich in seafood have been linked to lower rates of heart disease in coastal communities. Additionally, salmon's high protein content makes it a popular choice among athletes and fitness enthusiasts. As more people adopt healthier lifestyles, traditional red meats are being replaced by leaner protein options like salmon. This cultural shift toward mindful eating has naturally increased salmon's popularity, making it a staple in many households across North America.

Expansion of Aquaculture Production

The development of aquaculture has played a pivotal role in meeting the rising demand for salmon. Fish farming has allowed producers to supply salmon consistently, even when wild catches are limited by seasonal or environmental factors. Over the years, advancements in aquaculture technology have improved efficiency and reduced costs, making farmed salmon more affordable than wild varieties. For example, innovations in water filtration and feed optimization have made it possible to raise salmon in controlled environments, minimizing reliance on natural habitats. These advancements have also helped address food security concerns by ensuring a steady supply of salmon year-round. The ability to produce salmon locally within North America has further reduced transportation costs and environmental impacts, making farmed salmon an attractive option for consumers and retailers alike.

MARKET RESTRAINTS

Environmental Concerns and Sustainability Issues

Environmental challenges present a significant restraint on the North American salmon market. Wild salmon populations face threats from habitat destruction, dam construction, and climate change, which disrupt their natural migration patterns. Historically, rivers in the Pacific Northwest were teeming with salmon, but over the past century, many runs have dwindled due to human activity. Farmed salmon, while addressing supply issues, has its own set of environmental concerns. Critics argue that poorly managed fish farms can lead to water pollution and the spread of diseases to wild fish populations. Additionally, the use of antibiotics in aquaculture has raised questions about food safety and ecological balance. These issues have sparked debates among environmentalists and consumers which is leading to calls for stricter regulations and sustainable practices in both wild and farmed salmon production.

Price Volatility and Economic Challenges

Economic factors, particularly price volatility, act as a major restraint in the salmon market. Salmon prices are influenced by a variety of unpredictable factors, including weather conditions, fuel costs, and labor shortages. For instance, extreme weather events can disrupt fishing seasons, reducing wild salmon availability and driving up costs. Similarly, global economic instability often leads to fluctuations in currency exchange rates, affecting import and export prices. Historically, periods of inflation have made luxury foods like salmon less accessible to middle- and low-income families. Labor disputes in key salmon-producing regions have also caused temporary spikes in prices, creating uncertainty for retailers and consumers. These economic challenges make it difficult for producers to maintain stable pricing, ultimately impacting consumer purchasing power and market growth.

MARKET OPPORTUNITIES

Adoption of Sustainable Practices

The growing emphasis on sustainability presents a significant opportunity for the North American salmon market. Consumers are increasingly favoring products that align with eco-friendly values, and companies adopting sustainable practices can capitalize on this trend. The United Nations has spotlighted that sustainable aquaculture can reduce environmental impacts while meeting global food demands. For instance, innovations such as closed-containment systems minimize water pollution and prevent fish escapes, addressing key criticisms of traditional salmon farming. Additionally, certifications like the Aquaculture Stewardship Council label help producers differentiate their products in competitive markets. According to the World Wildlife Fund, sustainably farmed salmon has the potential to meet 60% of global seafood demand by 2050.

Rising Demand for Plant-Based Alternatives

The emergence of plant-based salmon alternatives offers another promising opportunity for innovation. As more consumers adopt vegetarian or flexitarian diets, companies developing plant-based seafood products are gaining traction. The Good Food Institute reports that sales of plant-based foods in the U.S. grew by 27% in 2020, reflecting a broader shift toward meat substitutes. Plant-based salmon not only appeals to vegetarians but also addresses concerns about overfishing and environmental degradation. For example, startups like New Wave Foods have created plant-based shrimp, paving the way for similar salmon innovations. These products often use pea protein, algae, and other natural ingredients to mimic the taste and texture of real salmon.

MARKET CHALLENGES

Climate Change Impact on Wild Salmon Populations

Climate change poses a severe challenge to the North American salmon market by threatening wild salmon populations. Rising ocean temperatures and changing river conditions disrupt salmon migration and spawning cycles. The National Oceanic and Atmospheric Administration has observed that warming waters have led to a decline in salmon survival rates and particularly in the Pacific Northwest. For instance, sockeye salmon populations in the Columbia River Basin have decreased by nearly 40% over the past two decades due to habitat loss and temperature stress. Additionally, reduced snowpack and altered rainfall patterns affect freshwater availability, further endangering salmon habitats. These environmental changes create uncertainty for fisheries reliant on wild salmon, leading to inconsistent supplies and increased costs.

Regulatory and Trade Barriers

Stringent regulations and trade barriers present another significant challenge for the salmon market in North America. International trade policies, tariffs, and import/export restrictions can disrupt supply chains and increase operational costs. For example, the Office of the United States Trade Representative shows that tariffs imposed during trade disputes have raised prices for imported salmon, affecting retailers and consumers alike. Domestically, aquaculture operations face complex permitting processes and compliance requirements, which can delay production timelines. Furthermore, cross-border trade between the U.S. and Canada is occasionally strained by disagreements over fishing quotas and environmental standards. These regulatory hurdles complicate market access and limit growth potential, especially for small-scale producers. Navigating these challenges requires collaboration between governments and industry stakeholders to streamline policies and promote fair trade practices.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.67% |

|

Segments Covered |

By Type, Species, End-Product Type, Distribution Channel, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

US, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

Mowi ASA, Cermaq Group AS (Mitsubishi Corporation), Leroy Seafood Group ASA, Marine Harvest ASA, Grieg Seafood ASA, Multiexport Foods S.A., Bakkafrost P/F, Austevoll Seafood ASA, SalMar ASA, and Camanchaca Inc. |

SEGMENTAL ANALYSIS

By Type Insights

The farmed salmon segment was the biggest part of the North America salmon market. It took up about 70.8% of all salmon sold in 2024. It was the leader because farmers could grow it all year long, not just when the weather was right. The National Oceanic and Atmospheric Administration, a trusted U.S. group, said over 500 million pounds of farmed salmon were made in the U.S. in 2020. This part was super important because people wanted more seafood for healthy eating. The U.S. Department of Agriculture said seafood eating went up 10% from 2019 to 2023.

From 2024 to 2032, the wild captured salmon segment will grow the fastest. It will grow at a speed of about 5.15% each year. Wild salmon will grow fast because people like it for being natural and good for the planet. The U.S. National Marine Fisheries Service said Alaska caught 490 million pounds of wild salmon in 2020, so there’s plenty of it! It’s important because it’s super healthy and full of omega-3s, says the U.S. Food and Drug Administration. People will love it for being eco-friendly too!

By Species Insights

The Atlantic salmon segment was the largest category of the North America salmon market by holding 65.3% of all salmon sold in 2024. It led because it’s mostly raised on farms, so it was available all year, not just in certain seasons. The National Oceanic and Atmospheric Administration reported that U.S. farmed salmon production reached over 500 million pounds in 2020, showing its huge supply. This type was important because more people wanted salmon for healthy eating.

The Sockeye salmon segment will rise the fastest from 2025 to 2033, with a growth speed of about 5.8% each year. It will grow fast as people love its bright red color, rich taste, and natural wild catch. The U.S. National Marine Fisheries Service said wild salmon catches in Alaska hit 490 million pounds in 2020, with sockeye being a big share. The U.S. Food and Drug Administration notes sockeye is packed with healthy omega-3s, making it a top pick for people wanting tasty, good-for-you fish. It will stand out for health and quality.

By End-Product Type Insights

The frozen salmon segment was the dominant part of the North America salmon market by contributing 64.8% of all sales in 2024. It prevailed owing to it lasts longer on shelves and stays fresh, making it easy for people to buy anytime. The National Oceanic and Atmospheric Administration said the U.S. imported over 800 million pounds of salmon in 2020, with most frozen to keep quality. This type was important because it met the growing need for seafood.

The Fresh salmon segment will surge at the fastest pace from 2025 to 2033, with a CAGR of 8.7% in the forecast period. It will grow quickly because consumer want healthy, natural food with no added stuff. The U.S. National Marine Fisheries Service said fresh salmon sales hit 75% of U.S. imports in 2020, showing big demand. The U.S. Food and Drug Administration says fresh salmon keeps more nutrients like omega-3s, making it key for health-focused eaters. Its importance will rise as folks choose tasty, good-for-you options over processed foods, driving more sales across North America.

By Distribution Channel Insights

The foodservice held the substantial share of the North America salmon market of 55.3% in 2024. It was on top because chefs in restaurants and catering used salmon in fancy dishes like sushi and grilled plates, drawing big crowds. The National Oceanic and Atmospheric Administration said U.S. commercial fisheries supplied over 9 billion pounds of seafood in 2020, with foodservice taking a huge chunk. This part mattered a lot since it boosted tourism and local eateries, with the U.S. Department of Agriculture reporting a 14% rise in seafood restaurant visits from 2019 to 2023 due to flavour trends.

On the other hand, the Retail will zoom ahead from 2025 to 2033, with a CAGR of 6.5%. It’ll advance fast as sustomers are buying salmon for home freezers, loving its convenience for quick meals like tacos or salads. The U.S. National Marine Fisheries Service noted salmon imports reached 800 million pounds in 2020, with more heading to stores as online grocery shopping boomed. The U.S. Department of Agriculture said 20% more households stocked seafood at home by 2023. This shift will matter as families save money and enjoy cooking fresh, healthy salmon together.

REGIONAL ANALYSIS

The USA led the North America salmon market by grabbing 75.4% of the total share in 2024. It was ahead since Americans ate tons of salmon, loving it for meals at home and out, thanks to its healthy reputation. The National Oceanic and Atmospheric Administration reported the U.S. brought in over 800 million pounds of salmon in 2020, showing its massive reach. The U.S. Department of Agriculture said seafood eating jumped 10% from 2019 to 2023, making the USA the heart of the salmon market that year.

Canada will speed ahead as the fastest-growing country in the North America salmon market from 2025 to 2033, with a CAGR of about 7.2%. It’ll grow fast as its wild salmon catches are strong, and people want fish that’s natural and earth-friendly. The U.S. National Marine Fisheries Service said Canada pulled in around 200 million pounds of wild salmon in 2020, setting it up for more. The U.S. Food and Drug Administration highlights salmon’s omega-3 goodness, so Canada’s supply will matter a lot for healthy eating trends.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Sustainability and Certification Strategy

Companies are actively implementing sustainability strategies to align with the rising demand for eco-friendly and certified seafood. This includes obtaining certifications like ASC or BAP and investing in responsible farming techniques. Firms like Mowi ASA and Grieg Seafood, for example, use sustainability as a core strategic pillar to differentiate themselves and meet evolving regulatory and consumer expectations.

Product Diversification and Value-Added Strategy

The trend toward value-added and convenience products leads companies to adopt product diversification strategies. This involves expanding offerings to include ready-to-eat, marinated, smoked, or portion-controlled salmon products. Companies like Cooke Aquaculture, for instance, are diversifying their product lines to capture new consumer segments seeking convenience without sacrificing quality.

Technological and Operational Efficiency Strategy

The rise of technological advancements in aquaculture is driving firms to adopt innovation and automation strategies. This includes the use of offshore farming technologies, Recirculating Aquaculture Systems (RAS), and AI-driven monitoring tools to improve operational efficiency, fish health, and environmental compliance. Firms such as Mowi and Grieg Seafood are leveraging these technologies to enhance productivity and sustainability simultaneously.

Regionalization and Supply Chain Localization Strategy

In response to supply chain disruptions and consumer demand for local products, companies are pursuing localization or reshoring strategies. By increasing investments in North American farming and processing facilities, these companies are strengthening domestic supply chains to reduce dependency on imports and improve supply chain resilience. Cooke Aquaculture is a good example of a company that emphasizes regional production to serve local markets more efficiently.

LEADING PLAYERS IN THE MARKET

Mowi ASA

Mowi ASA is one of the most influential players in the North America salmon market, known for its vertically integrated operations that span the entire salmon value chain, from farming to processing and distribution. The company leverages its extensive global farming network and advanced aquaculture practices to deliver high-quality, sustainably farmed salmon to North American consumers. Mowi’s contribution to the market is significant, as it helps shape industry standards around sustainable seafood production, traceability, and product innovation. Its emphasis on premium quality and eco-friendly operations supports the growing demand for responsibly sourced protein options in North America, positioning it as a key driver of sustainability and supply chain excellence in the regional salmon industry.

Cooke Aquaculture

Cooke Aquaculture has established itself as a major player in the North American salmon market, driven by its family-owned, customer-focused business model and strong operational presence across Canada and the United States. The company plays a pivotal role in providing fresh, value-added, and frozen salmon products to retail, foodservice, and wholesale markets. Cooke’s contribution lies in its ability to meet regional demand for locally farmed and processed salmon, thereby promoting food security and reducing reliance on imports. By prioritizing sustainable farming practices and investing in regional supply chains, Cooke strengthens North America’s capacity to produce high-quality salmon that aligns with evolving consumer preferences for fresh and traceable seafood.

Grieg Seafood ASA

Grieg Seafood ASA is a prominent force in the North American salmon market, particularly through its farming operations in Canada and the Pacific Northwest. The company has focused on responsible aquaculture, prioritizing environmental stewardship, fish welfare, and community engagement. Grieg Seafood’s contribution to the market is centered around its ability to supply fresh and sustainable salmon to key retail and foodservice partners across North America. Its commitment to minimizing environmental impact and collaborating with Indigenous and coastal communities helps foster positive social and ecological outcomes. Grieg’s role in the market is instrumental in enhancing the regional supply of responsibly farmed salmon, contributing to the industry's efforts to balance growth with sustainability.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Major Players of the North America Salmon Market include Mowi ASA, Cermaq Group AS (Mitsubishi Corporation), Leroy Seafood Group ASA, Marine Harvest ASA, Grieg Seafood ASA, Multiexport Foods S.A., Bakkafrost P/F, Austevoll Seafood ASA, SalMar ASA, and Camanchaca Inc.

The North America salmon market is shaped by growing complexity as companies compete on multiple levels beyond just price and volume. Today, leading firms are differentiating themselves through sustainability practices, technological innovation, and the ability to adapt to changing consumer values. Industry leaders like Mowi ASA and Grieg Seafood are focusing on transparency and responsible farming, meeting the rising demand for traceable and eco-certified salmon.

Meanwhile, smaller regional producers are finding success by targeting niche markets, offering locally sourced or specialty products that appeal to health-conscious and premium consumers. This creates a dynamic market where both large-scale producers and artisanal brands are competing side by side.

Another defining feature of the competitive landscape is the increased focus on supply chain resilience. Companies are investing in domestic production and advanced farming technologies to safeguard against global trade disruptions and regulatory shifts. Those who adopt smart farming systems, such as AI-based monitoring and offshore aquaculture, are not only improving efficiency but also gaining customer trust through higher product quality and consistency.

Additionally, partnerships and acquisitions are becoming key tactics, as companies seek to expand their geographic reach and diversify product lines. Firms are collaborating with technology providers, sustainability organizations, and foodservice giants to strengthen market positions. This collaborative approach allows businesses to respond faster to market shifts and capitalize on emerging consumer trends.

RECENT HAPPENINGS IN THE MARKET

- In October 2024, the Canadian government announced a ban on open-net pen salmon farming by 2029 to protect wild salmon and promote sustainable aquaculture. This decision aims to address environmental concerns, particularly regarding sea lice outbreaks and diseases among farmed fish, which can affect wild salmon populations. The ban has been praised by conservation groups but criticized by the salmon farming industry, which argues that transitioning to closed containment systems is logistically and financially challenging.

- In March 2025, the Government of Canada unveiled its inaugural strategy to restore and rebuild Atlantic salmon populations and their habitats. This initiative includes an investment of $6.1 million from four funding programs to support conservation efforts. An additional $1 million is allocated for the 2025-26 fiscal year to fund new projects targeting Atlantic salmon conservation, with a call for proposals to be launched in the coming months.

- In November 2024, the Conservation Law Foundation (CLF) filed a notice of intent to sue Cooke Aquaculture, alleging violations of the Clean Water Act at its salmon farming sites off the coast of Maine. The CLF claims that the company's operations are polluting marine environments with waste, posing threats to local ecosystems and endangered wild salmon populations. Cooke Aquaculture disputes these allegations, asserting compliance with environmental regulations.

DETAILED SEGMENTATION OF NORTH AMERICA SALMON MARKET INCLUDED IN THIS REPORT

This research report on the North America Salmon market has been segmented and sub-segmented based on type, species, end-product type, distribution channel & region.

By Type

- Farmed

- Wild Captured

By Species

- Atlantic

- Pink

- Chum/Dog

- Coho

- Sockeye

- Others

By End-Product Type

- Frozen

- Fresh

- Canned

- Others

By Distribution Channel

- Foodservice

- Retail

By Region

- US

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What are the key factors driving the North America salmon market?

The market is driven by increasing consumer demand for high-protein diets, the growing popularity of seafood, rising health awareness, and advancements in aquaculture technology.

2. Which types of salmon are most commonly consumed in North America?

The most commonly consumed types include Atlantic salmon, Chinook (King) salmon, Coho salmon, Sockeye salmon, and Pink salmon.

3. How is the North America salmon market expected to grow in the coming years?

The market is expected to grow steadily due to increasing demand for sustainable seafood, rising investments in aquaculture, and expanding availability of processed and ready-to-eat salmon products.

4. Who are the major players in the North America salmon market?

Leading companies include Mowi ASA, Cermaq Group, Cooke Aquaculture, AquaBounty Technologies, and Marine Harvest, among others.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]