North America Roofing Materials Market Research Report – Segmented By Material ( bituminous roofing materials , metal roofing materials) End-Use Industry and Country (The U.S., Canada and Rest of North America) - Industry Analysis, Size, Share, Growth, Trends, & Forecasts 2025 to 2033.

North America Roofing Materials Market Size

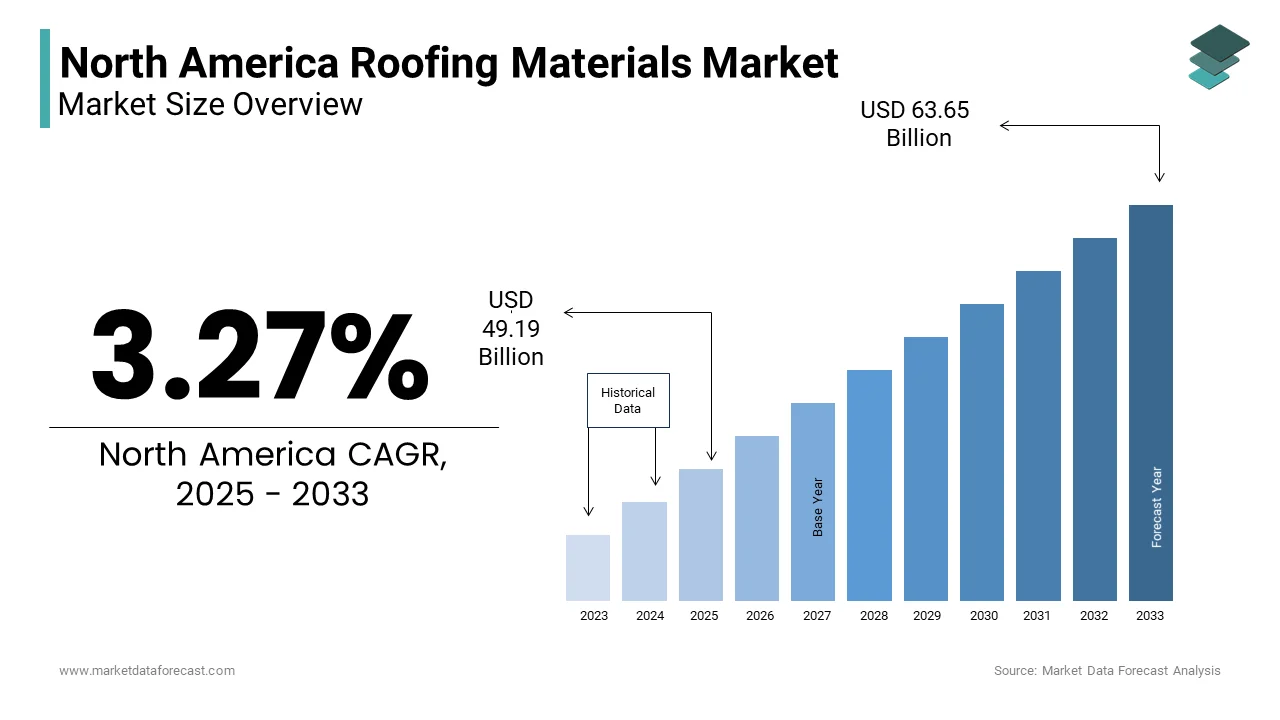

The North America Roofing Materials Market Size was valued at USD 47.63 billion in 2024. The North America Roofing Materials Market size is expected to have 3.27 % CAGR from 2025 to 2033 and be worth USD 63.65 billion by 2033 from USD 49.19 billion in 2025.

MARKET DRIVERS

Increasing Residential Construction Activities

The residential construction serves as a primary driver for the North America roofing materials market, fueled by a surge in new housing starts and renovation projects. Millennials, representing the largest demographic of first-time homebuyers, prioritize cost-effective yet aesthetically pleasing materials by driving adoption of options like asphalt shingles and metal roofing. Additionally, rising disposable incomes and favorable mortgage rates have encouraged homeowners to undertake roof replacement projects in regions prone to extreme weather conditions. For instance, Texas and Florida witnessed heightened demand for impact-resistant roofing materials due to frequent hurricanes.

Growing Emphasis on Energy Efficiency and Sustainability

Sustainability has become a pivotal factor influencing the adoption of advanced roofing materials across North America. Roofing materials like elastomeric coatings and cool roofs are increasingly favored for their ability to reduce energy consumption by reflecting sunlight and minimizing heat absorption. Federal incentives for energy-efficient upgrades, such as tax credits for solar panel installations will further stimulate demand. This alignment with environmental goals ensures sustained demand for innovative roofing solutions.

MARKET RESTRAINTS

Fluctuating Prices of Raw Materials

One significant restraint facing the North America roofing materials market is the volatility in raw material prices, particularly asphalt, metal, and polymers. These materials are sensitive to geopolitical tensions and supply chain disruptions, causing price fluctuations that impact production costs. According to Plastics Today, the cost of asphalt surged by 20% in early 2023 due to limited availability caused by logistical bottlenecks. Such instability forces manufacturers to either absorb additional expenses or pass them on to consumers, which is potentially dampening demand. Smaller players with limited financial resilience face greater difficulties navigating these uncertainties by intensifying competitive pressures. While larger firms may mitigate risks through long-term supplier contracts, the overall market remains vulnerable to external economic shocks.

Stringent Environmental Regulations

Stringent environmental regulations governing chemical usage and waste management present another hurdle for the roofing materials market. Regulatory bodies like the EPA mandate strict adherence to emission standards is compelling manufacturers to invest heavily in compliance measures. For example, California’s Proposition 65 requires explicit labeling of hazardous substances, adding complexity to product development. Non-compliance risks hefty fines and reputational damage. As per the Vinyl Institute, regulatory compliance costs account for approximately 15% of total production expenses. These financial burdens constrain innovation budgets and slow down market responsiveness for smaller firms lacking robust infrastructure. Balancing regulatory requirements with cost efficiency remains a persistent challenge for industry participants.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

A burgeoning opportunity lies in expanding roofing material usage into emerging markets within North America. Advanced roofing materials, such as metal and tile, play a crucial role in enabling cost-effective construction while ensuring longevity and energy efficiency. Similarly, rural areas in the U.S. and Canada are witnessing increased infrastructure development, supported by federal funding programs aimed at bridging the urban-rural divide.

Technological Advancements in Smart Roofing Solutions

Technological advancements in smart roofing solutions present another promising avenue for market growth. Innovations in IoT-enabled systems and photovoltaic-integrated roofing materials enable real-time monitoring of roof performance and energy generation by addressing unmet needs in specialized sectors. The companies adopting advanced manufacturing processes achieve up to a 30% reduction in operational costs while improving product quality. These innovations cater to niche applications, including green buildings and smart cities by aligning with global sustainability trends. Additionally, digital tools like AI-driven predictive maintenance systems optimize roof lifespan by ensuring consistent performance.

MARKET CHALLENGES

Intense Competition from Alternative Materials

Intense competition from alternative materials poses a significant challenge for the roofing materials market. Traditional options like wood and clay remain popular due to their lower cost and familiarity among contractors. Similarly, advancements in bio-based alternatives, derived from renewable resources, threaten to disrupt the dominance of synthetic materials. Consumer skepticism regarding the long-term performance of newer formulations further complicates adoption. Smaller manufacturers face difficulties competing with established brands in price-sensitive markets. Differentiating products through superior performance and sustainability attributes remains critical for overcoming this challenge.

Economic Uncertainty and Project Delays

Economic uncertainty and project delays hinder the growth of the roofing materials market, particularly during periods of inflation and interest rate hikes. These delays disrupt supply chains and create inventory backlogs by impacting manufacturers’ profitability. Additionally, labor shortages exacerbate project timelines that further delays material procurement. Navigating these economic headwinds requires strategic planning and collaboration with stakeholders to ensure timely execution of projects and sustained demand for roofing materials.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.27 % |

|

Segments Covered |

By Material, End-Use Industry and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

Owens-Corning Inc, Compagnie de Saint-Gobain SA, Johns Manville, Wienerberger AG |

SEGMENTAL ANALYSIS

By Material Insights

The bituminous roofing materials segment was the largest in the North America market with 45.3% of share in 2024 with the cost-effectiveness, durability, and ease of installation, which is making them ideal for both residential and commercial applications. Asphalt shingles, a key product in this category, are widely used in regions prone to extreme weather conditions, such as hurricanes and heavy snowfall. Technological advancements have enabled the development of modified bitumen membranes by offering enhanced waterproofing and thermal insulation properties. For example, GAF’s WeatherWatch series offers superior leak resistance and UV protection by appealing to contractors and homeowners alike.

The metal roofing materials segment is likely to register a CAGR of 9.5% from 2025 to 2033. The growth of the segment is driven by their durability, energy efficiency, and recyclability by aligning with sustainability goals and gaining traction among environmentally conscious consumers. Government incentives for green building projects further stimulate adoption. For instance, the Canada Greener Homes Grant program promotes the use of sustainable materials, indirectly boosting metal roofing demand. Additionally, advancements in coating technologies have improved aesthetic appeal and corrosion resistance, addressing earlier concerns about limited design options.

By End-Use Industry Insights

The residential applications segment was accounted in holding a 55.8% of the North America roofing materials market share in 2024 owing to the widespread adoption in new housing projects and roof replacement activities. Homeowners prioritize cost-effective yet durable materials, with asphalt shingles being a popular choice due to their affordability and ease of installation. Urbanization trends and rising disposable incomes further amplify demand in metropolitan areas. Additionally, the growing trend of DIY home improvement projects, supported by online tutorials and e-commerce platforms, has simplified access to roofing materials, enabling homeowners to undertake projects independently.

The industrial applications segment is likely to grow with a CAGR of 10.2% in the next coming years. This acceleration is propelled by increasing investments in manufacturing facilities and warehouses, requiring durable and weather-resistant roofing solutions. Metal roofing, known for its strength and longevity, is extensively used in industrial settings to withstand harsh environmental conditions. Technological advancements enabling energy-efficient and fire-resistant formulations further enhance its appeal. Additionally, climate change concerns drive the adoption of resilient materials, particularly in hurricane-prone regions like Florida and Texas.

COUNTRY LEVEL ANALYSIS

The United States held the North America roofing materials market with 80.6% of share in 2024 by a confluence of factors, including robust infrastructure investments, rapid urbanization, and technological advancements in construction materials. The government initiatives have significantly increased demand for durable and energy-efficient roofing solutions in regions prone to extreme weather conditions like Texas, Florida, and California. Rising consumer awareness about sustainable and weather-resistant materials further bolsters market growth. Additionally, federal tax incentives for energy-efficient upgrades, such as solar panel installations, indirectly stimulate demand for advanced roofing solutions. Key states like Texas and Florida witness heightened adoption due to frequent hurricanes, while colder regions like Minnesota favor metal roofing for its thermal insulation properties.

Canada was positioned second by holding 15.3% of the North America roofing materials market share in 2024 by stringent building codes that mandate the use of eco-friendly and energy-efficient materials. Advanced roofing materials, such as elastomeric coatings and cool roofs, gain traction in provinces like Ontario and British Columbia. Government-backed retrofitting schemes aimed at reducing carbon emissions further stimulate demand. For example, the Canada Greener Homes Grant program, launched in 2021, provides financial incentives for homeowners to upgrade to sustainable materials by indirectly boosting roofing material adoption.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the North America roofing materials market are Owens-Corning Inc, Compagnie de Saint-Gobain SA, Johns Manville, Wienerberger AG, Atlas Roofing, Carlisle Companies Inc, TAMKO Building Products, GAF, Crown Building Services, CertainTeed Corporation, CSR

The North America roofing materials market is characterized by intense competition, with leading players vying for market share through innovation, strategic alliances, and customer-centric services. The landscape is dominated by giants like GAF Materials Corporation, Owens Corning, and CertainTeed Corporation, each employing unique strategies to differentiate themselves. GAF’s emphasis on technological advancements and sustainability sets it apart, while Owens Corning’s focus on specialized applications and customization resonates well with engineers and contractors. CertainTeed’s commitment to customer-centric solutions and bio-based alternatives addresses niche market needs in residential and industrial applications. Despite occasional price wars, value-added features such as enhanced durability, energy efficiency, and compatibility with green building practices mitigate margin pressures.

Top Players in the Market

GAF Materials Corporation

GAF Materials Corporation reigns supreme as the leading player in the North America roofing materials market. Renowned for its innovative asphalt shingle series, GAF leverages cutting-edge technologies to deliver high-performance solutions tailored to diverse applications. The company’s focus on sustainability is evident in its efforts to develop recyclable and energy-efficient products, appealing to environmentally conscious consumers. For instance, GAF’s Timberline HDZ shingles, introduced in 2023, offer enhanced wind resistance and aesthetic appeal by making them ideal for regions prone to extreme weather conditions. Strategic partnerships with contractors, architects, and builders enhance its reach across North America. Furthermore, GAF’s commitment to R&D ensures continuous innovation, addressing evolving consumer needs and maintaining its domiannt position in the competitive landscape.

Owens Corning

Owens Corning is known for its Duration series, Owens Corning focuses on developing customized roofing solutions for specialized applications, including high-rise buildings, industrial facilities, and residential projects. The company’s commitment to R&D ensures continuous innovation, addressing unmet needs in niche segments. For example, Owens Corning’s TruDefinition Duration series enables superior leak resistance and UV protection by catering to the growing demand for resilient materials capable of withstanding harsh environmental conditions. Owens Corning’s global distribution network amplifies its market penetration with its dominant position. Additionally, the company’s sustainability-focused initiatives, such as reducing carbon emissions in production processes, resonate well with eco-conscious stakeholders. Strategic acquisitions and collaborations further strengthen its competitive edge by ensuring sustained growth in the North America market.

CertainTeed Corporation

CertainTeed Corporation is its flagship brand, Landmark, offers superior durability and aesthetic appeal by making it a preferred choice for residential and commercial projects. CertainTeed’s acquisition of Guardian Glass in 2022 expanded its portfolio of sustainable roofing materials, reinforcing its competitive edge. The company’s focus on customer-centric solutions is evident in its tailored formulations for specific applications, such as hurricane-resistant roofing and energy-efficient cool roofs. Additionally, CertainTeed’s commitment to sustainability aligns with global trends, as seen in its efforts to develop bio-based alternatives and reduce environmental impact. Strategic partnerships with distributors and contractors enhance its reach across North America, ensuring consistent growth of the market.

Top Strategies Used by Key Players

Key players in the North America roofing materials market employ a variety of strategies to maintain their competitive edge and expand their market presence. Mergers and acquisitions remain a cornerstone strategy, enabling companies to broaden their product portfolios and enter new markets. For instance, CertainTeed Corporation’s acquisition of Guardian Glass in 2022 enhanced its capabilities in sustainable roofing materials by addressing growing consumer demand for eco-friendly solutions. Product innovation is another critical tactic, with companies introducing next-generation formulations tailored to specific applications. GAF’s launch of Timberline HDZ shingles exemplifies this approach by offering superior performance attributes that cater to regions prone to extreme weather conditions. Geographic expansion is equally vital, with manufacturers targeting underserved regions through strategic partnerships and distribution networks. Sustainability-focused initiatives also play a pivotal role, as seen in Owens Corning’s efforts to develop energy-efficient formulations and reduce carbon emissions. Digital transformation further amplifies competitiveness, with companies leveraging AI-driven quality control systems and online platforms to streamline operations and engage customers.

RECENT HAPPENINGS IN THE MARKET

- In March 2023 , GAF Materials Corporation launched Timberline HDZ shingles, offering enhanced wind resistance and aesthetic appeal. This product introduction expanded GAF’s offerings and addressed consumer demands for superior performance in extreme weather conditions.

- In June 2023 , Owens Corning partnered with Habitat for Humanity, donating over 1 million square feet of roofing materials for affordable housing projects across North America. This initiative not only supported community development but also enhanced Owens Corning’s brand visibility and reputation.

- In September 2023 , CertainTeed Corporation acquired Guardian Glass, a leader in sustainable roofing materials. This acquisition broadened CertainTeed’s product range by enabling it to offer comprehensive eco-friendly solutions for modern construction needs.

- In December 2023 , IKO Industries introduced Dynasty shingles, featuring advanced UV protection and thermal insulation properties. This launch aligned with growing consumer demand for durable and energy-efficient roofing materials by reinforcing IKO’s commitment to innovation.

- In February 2024 , TAMKO Building Products implemented AI-driven quality control systems across its production facilities. This technological upgrade improved operational efficiency, reduced waste, and ensured consistent product quality by strengthening TAMKO’s competitive position in the market.

MARKET SEGMENTATION

This research report on the north america roofing materials market has been segmented and sub-segmented into the following.

By Material

- bituminous roofing materials

- metal roofing materials

By End-Use Industry

- residential applications

- industrial applications

By Country

- The U.S.

- Canada

- Rest of North America.

Frequently Asked Questions

Which roofing material types are most popular in North America?

The leading materials includ are Asphalt shingles (most dominant, especially in residential) Metal roofing Clay & concrete tiles Bitumen Slate and wood shingles (niche use)

What role does climate play in roofing material selection in North America?

Climate significantly influences choices are Cold climates (e.g., Canada, Northern US), Metal and asphalt shingles with strong insulation Hot and sunny regions, Reflective and UV-resistant materials Hurricane-prone areas, Impact-resistant and wind-rated options

What is the growth outlook for the North America roofing materials market?

The market is expected to grow at a CAGR of around 4–6% over the next 5 years, driven by urban development, energy-efficient upgrades, and climate-resilient infrastructure investments.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]