North America Respiratory Protective Equipment Market Size, Share, Trends & Growth Forecast Report Segmented By Product Type, End-Use, And Country (US, Canada, Mexico, and Brazil), Industry Analysis From 2025 to 2033

North America Respiratory Protective Equipment Market Size

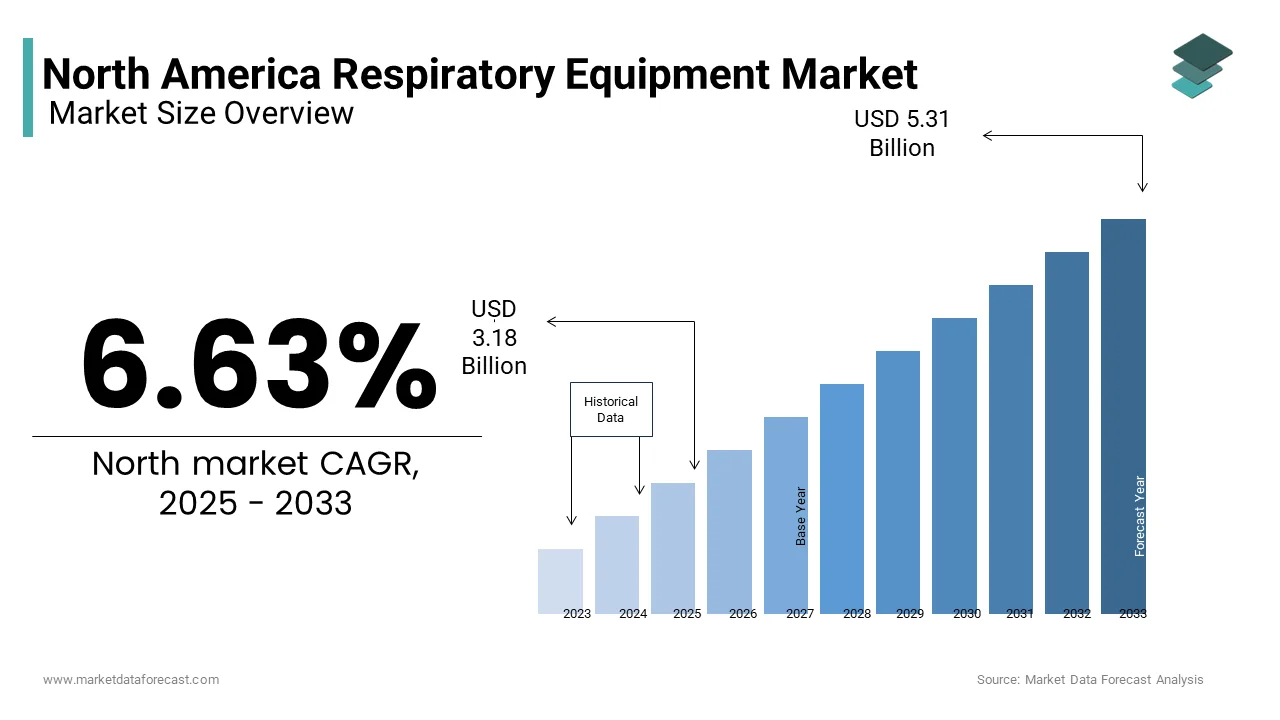

The North America respiratory protective equipment (RPE) market was valued at USD 2.98 billion in 2024 and is anticipated to reach USD 3.18 billion in 2025 from USD 5.31 billion by 2033, growing at a CAGR of 6.63% during the forecast period from 2025 to 2033.

The North American respiratory protective equipment (RPE) market is driven by stringent safety regulations and heightened awareness of occupational health hazards. According to the Occupational Safety and Health Administration (OSHA), approximately 5 million workers in the U.S. are required to wear RPE to safeguard against airborne contaminants. Canada follows closely, with its emphasis on workplace safety in industries such as oil and gas, mining, and healthcare. The market has witnessed significant growth due to the increasing prevalence of respiratory diseases and the need for compliance with safety standards. Innovations in lightweight, ergonomic designs and reusable respirators have enhanced user comfort and adoption rates.

MARKET DRIVERS

Stringent Occupational Safety Regulations

Stringent occupational safety regulations are a primary driver of the North American respiratory protective equipment market by ensuring widespread adoption across industries. Additionally, Canada’s Workplace Hazardous Materials Information System (WHMIS) mandates the use of certified RPE in hazardous environments. The healthcare sector has seen a surge in RPE usage due to regulatory requirements for infection control, as per the Centers for Disease Control and Prevention (CDC). These regulations create a stable demand pipeline are driving manufacturers to innovate and expand their product offerings.

Rising Awareness of Occupational Health Hazards

Growing awareness of occupational health hazards has significantly impacted the North American RPE market among workers in high-risk industries. The American Lung Association reports that occupational lung diseases account for 13% of all workplace illnesses by prompting employers to invest in advanced respiratory protection solutions. In Canada, according to the Mining Association of Canada, mining operations require mandatory use of RPE to mitigate exposure to silica dust and other contaminants. Similarly, the oil and gas sector has adopted RPE as a standard safety measure, as noted by the Canadian Energy Pipeline Association. Public awareness campaigns and educational initiatives by organizations like NIOSH have further emphasized the importance of respiratory safety, driving demand for innovative products.

MARKET RESTRAINTS

High Costs of Advanced RPE Solutions

The high costs associated with advanced respiratory protective equipment pose a significant restraint to market growth for small and medium-sized enterprises (SMEs). The premium RPE models, such as powered air-purifying respirators (PAPRs), are very expensive, which limits affordability for budget-constrained organizations. The National Safety Council notes that SMEs often opt for lower-cost alternatives by compromising on quality and safety. Additionally, the maintenance and replacement costs of reusable respirators add to the financial burden, as stated by the American Industrial Hygiene Association. Canada’s reliance on imported components further exacerbates pricing challenges, as noted by the Canadian Manufacturers & Exporters.

Limited Awareness in Non-Regulated Sectors

Limited awareness of respiratory safety in non-regulated sectors presents a persistent challenge to the North American RPE market. The industries such as agriculture and construction often lack comprehensive safety protocols by resulting in underutilization of RPE. According to the U.S. Environmental Protection Agency, only 40% of agricultural workers use respiratory protection despite exposure to pesticides and dust. Similarly, small-scale manufacturing units in Canada frequently overlook RPE requirements, as per the Canadian Centre for Occupational Health and Safety. This lack of awareness reduces overall market demand by forcing manufacturers to invest heavily in educational campaigns. Bridging this gap requires sustained efforts to educate stakeholders about the long-term benefits of respiratory protection.

MARKET OPPORTUNITIES

Technological Advancements in Smart RPE

Technological advancements in smart respiratory protective equipment offer untapped potential for innovation and market differentiation. According to Deloitte, the integration of IoT-enabled sensors in RPE allows real-time monitoring of air quality and user vitals by enhancing safety and compliance. Additionally, advancements in lightweight materials and ergonomic designs improve user comfort, as noted by the American Society of Safety Professionals.

MARKET CHALLENGES

Economic Uncertainty and Budget Constraints

Economic uncertainty significantly impacts the North American RPE market, as organizations face budget constraints during downturns. High interest rates on loans discourage businesses from investing in advanced safety measures, which will reduce the demand. The economic volatility often shifts priorities toward immediate operational needs by delaying RPE procurement. This unpredictable spending behavior complicates market forecasting and forces companies to adopt flexible pricing strategies to maintain competitiveness.

Intense Competition Among Established Players

Intense competition among established players poses a persistent challenge to the North American RPE market. Larger firms, such as 3M and Honeywell, dominate the market with extensive distribution networks and strong brand recognition by leaving limited room for smaller players to compete. The consolidation through mergers and acquisitions has further concentrated market share among the top players. Smaller manufacturers struggle to differentiate themselves without significant investments in innovation and marketing. Additionally, the rise of private-label products in retail chains offers affordable alternatives by eroding brand loyalty. This competitive landscape requires companies to continuously innovate and adapt to maintain their market position.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.63% |

|

Segments Covered |

By Product Type, End-Use, and Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

The United States, Canada, Mexico & Rest of North America |

|

Market Leaders Profiled |

Honeywell International (US), 3M (US), Kimberly-Clark (US), Avon Protection Systems (US), MSA Safety (US), Alpha Pro Tech (Canada), Bullard (US), Dragerwerk (Germany), Gentex (US), and Jayco Safety Products (India). |

SEGMENTAL ANALYSIS

By Product Type Insights

The air-purifying respirators segment was the largest and held 60.3% of the North America Respiratory protective equipment market share in 2024, with their versatility, affordability, and ease of use by making them ideal for both industrial and healthcare applications. The air-purifying respirators are widely used in healthcare settings to protect against airborne pathogens by aligning with infection control protocols. Additionally, innovations in filter technology have improved performance, driving adoption among professional users.

The supplied air respirators segment is likely to gain huge traction with a CAGR of 9.5% throughout the forecast period, with their ability to provide continuous airflow in high-hazard environments, such as mining and chemical manufacturing. The supplied air respirators are increasingly preferred for tasks involving prolonged exposure to toxic substances, where reliability and performance are critical. Additionally, their compatibility with advanced safety systems aligns with regulatory requirements. The segment’s affordability, combined with its innovative design, appeals to both industrial and emergency response sectors. These attributes position supplied air respirators as a dynamic and innovative category within the market.

By End-Use Industry Analysis

The healthcare and pharmaceuticals sector accounted in holding 35.4% of the North America RPE market share in 2024. The growth of the segment can be driven by the growing emphasis on infection control and worker safety in medical facilities. Additionally, the rise of pandemics and infectious diseases has amplified the importance of respiratory protection, favoring high-quality respirators for healthcare professionals. According to the Canadian Real Estate Association, hospitals with advanced safety protocols attract more patients is incentivizing institutions to invest in premium RPE.

The defense and public safety services sector is projected with a CAGR of 8.2% during the forecast period. This growth is fueled by the increasing focus on national security and disaster response, which prioritizes advanced RPE for first responders. Additionally, the rise of urban terrorism and natural disasters has created a niche market for specialized RPE designed for extreme conditions. These trends highlight the segment’s potential for sustained growth.

COUNTRY ANALYSIS

The United States held 75.6% of the North American respiratory protective equipment (RPE) market share in 2024, with its robust industrial landscape, stringent safety regulations, and high awareness of occupational health hazards. The Occupational Safety and Health Administration (OSHA) mandates the use of RPE in industries such as manufacturing, healthcare, and construction by creating a stable demand pipeline. According to the National Institute for Occupational Safety and Health (NIOSH), over 5 million workers in the U.S. rely on advanced RPE solutions daily, with the widespread adoption of these products. Urbanization and industrialization have further fueled demand, particularly in sectors like oil and gas, where prolonged exposure to hazardous environments necessitates reliable protection. The rise of smart RPE technologies, such as IoT-enabled respirators, has positioned the U.S. as a leader in innovation. Additionally, the country’s emphasis on sustainability aligns with consumer preferences for eco-friendly and reusable RPE, driving manufacturers to invest in cutting-edge designs.

Canada’s RPE market is gaining momentum through government initiatives promoting workplace safety and environmental sustainability. The country’s vast natural resources in mining and oil extraction create a strong demand for advanced respiratory protection solutions. Canada’s commitment to reducing carbon emissions under international agreements has also encouraged the development of lightweight, reusable respirators, as noted by Environment and Climate Change Canada. Furthermore, trade agreements with the U.S. facilitate the import and export of high-quality RPE, expanding market access and fostering cross-border collaboration.

KEY MARKET PLAYERS

Honeywell International (US), 3M (US), Kimberly-Clark (US), Avon Protection Systems (US), MSA Safety (US), Alpha Pro Tech (Canada), Bullard (US), Dragerwerk (Germany), Gentex (US), and Jayco Safety Products (India). are the market players that are dominating the respiratory protective equipment (RPE) market.

Top Players In The Market

3M Innovation and Product Leadership

3M is a global leader in the RPE market, renowned for its innovative product portfolio and commitment to sustainability. These products cater to environmentally conscious consumers, aligning with global sustainability goals. 3M’s acquisition of smaller firms specializing in advanced filtration technologies has expanded its production capabilities by enabling it to meet diverse consumer needs. The company’s emphasis on digital marketing and e-commerce platforms has enhanced its brand visibility by allowing it to reach a broader audience.

Honeywell Sustainability and Strategic Partnerships

Honeywell is a pioneer in sustainable manufacturing, with its products certified by NIOSH. The company’s acquisition of a safety equipment manufacturer in 2023 was made with its commitment to securing raw material supplies while adhering to eco-friendly practices. Honeywell’s focus on workplace safety aligns with consumer preferences for high-quality RPE is driving demand in both industrial and healthcare sectors. Additionally, Honeywell’s partnerships with government agencies and private organizations have strengthened its presence in high-end markets, where customization and reliability are paramount. The company’s investment in automation and smart manufacturing technologies has reduced operational costs by enabling it to offer competitive pricing without compromising on quality.

MSA Safety Industrial Expertise and Technological Integration

MSA Safety specializes in industrial applications. The company’s expertise in designing durable and efficient RPE has made it a preferred choice for oil and gas operations, mining, and emergency response teams. MSA Safety’s introduction of IoT-enabled respirators reflects its commitment to innovation by appealing to tech-savvy industries. The company’s integration of augmented reality tools for virtual training has enhanced customer engagement is setting it apart from competitors.

COMPETITION OVERVIEW

The North American RPE market is characterized by intense competition, with established players and emerging entrants vying for market share. The fragmented nature of the industry encourages mergers and acquisitions, as companies seek to consolidate their positions and expand their product portfolios. For instance, 3M’s acquisition of smaller firms specializing in advanced filtration technologies has enabled it to diversify its offerings and cater to evolving consumer preferences. The rise of e-commerce platforms has intensified competition, compelling brands to enhance their online presence and invest in digital marketing strategies. According to the International Society of Automation, companies that leverage technology, such as IoT-enabled sensors and smart RPE, gain a competitive edge by improving customer satisfaction and engagement. Additionally, the growing emphasis on sustainability has become a key differentiator, with consumers increasingly prioritizing eco-friendly products. Smaller players face significant challenges in competing with larger firms that possess greater resources and economies of scale. However, niche markets and specialized offerings provide opportunities for differentiation.

RECENT HAPPENINGS IN THIS MARKET

- In April 2024, 3M launched a new line of reusable respirators designed for industrial applications. This initiative aligns with the company’s strategy to capture the growing demand for sustainable and cost-effective solutions among environmentally conscious consumers.

- In June 2023, Honeywell acquired a safety equipment manufacturer to secure raw material supplies for its advanced RPE range. This move propels Honeywell’s commitment to sustainability and positions it as a leader in green manufacturing practices. Honeywell strengthens its competitive advantage in the market by ensuring a steady supply of responsibly sourced materials.

- In September 2023, MSA Safety partnered with a tech firm to integrate IoT-enabled sensors into its respirators for real-time monitoring of air quality and user vitals. This innovation enhances user experience by providing actionable insights to employers, setting MSA Safety apart from competitors.

- In January 2024, Kimberly-Clark expanded its distribution network across Canada. This strategic move increases market access and enables the company to tap into Canada’s growing demand for premium RPE. The expansion reinforces Kimberly-Clark’s position as a key player in the North American market.

- In March 2024, DuPont introduced a recyclable respirator range, emphasizing eco-friendliness. This product aligns with the company’s sustainability goals and appeals to environmentally conscious consumers. The launch highlights DuPont’s ability to adapt to changing market dynamics and innovate in response to consumer preferences.

MARKET SEGMENTATION

This research report on the North American respiratory protective equipment (RPE) market is segmented and sub-segmented into the following categories.

By Product Type

- Air-purifying Respirators

- Powered air-purifying respirators

- Non-powered air-purifying respirators

- Supplied Air Respirators

- Self-contained Breathing Apparatus

- Airline Respirators

- Loose-Fitting Hoods

By End-Use Industry

- Healthcare & Pharmaceuticals

- Defense & Public Safety Services

- Defense

- Firefighting & Law Enforcement

- Oil & Gas

- Manufacturing

- Automotive

- Chemical

- Metal Fabrication

- Food & Beverage

- Wood Working

- Paper & Pulp

- Mining

- Construction

- Others

- Agriculture & Forestry

- Cement Production

- Power Generation

- Shipbuilding

- Textile

By Country

- The USA

- Canada

- Mexico

Frequently Asked Questions

What is driving the growth of the respiratory protective equipment market in North America?

Growth is being fueled by increasing workplace safety regulations, rising awareness of airborne health risks, and the lasting impact of pandemics on health and safety standards.

How are respiratory protective equipment products used across different industries?

They are widely used in sectors like construction, healthcare, manufacturing, mining, and oil & gas for protecting workers from hazardous particles, gases, and airborne contaminants.

What are the most common types of respiratory protective equipment?

The most widely used types include air-purifying respirators (such as N95 masks, full-face respirators), and supplied-air respirators (like SCBA units), depending on exposure risks and environment.

What challenges are currently facing the RPE market in North America?

Key challenges include high production and maintenance costs, supply chain disruptions, and the need for ongoing user training to ensure effective protection.

What trends are shaping the future of RPE in North America?

There is growing demand for smart RPE with sensors, reusable mask systems, eco-friendly materials, and real-time air quality monitoring, aligning with sustainability and tech-forward safety standards.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]