North America Railroad Ties Market Size, Share, Trends & Growth Forecast Report By Type (Wooden Tie, Concrete Tie, Steel Tie, and Other), Application, and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Railroad Ties Market Size

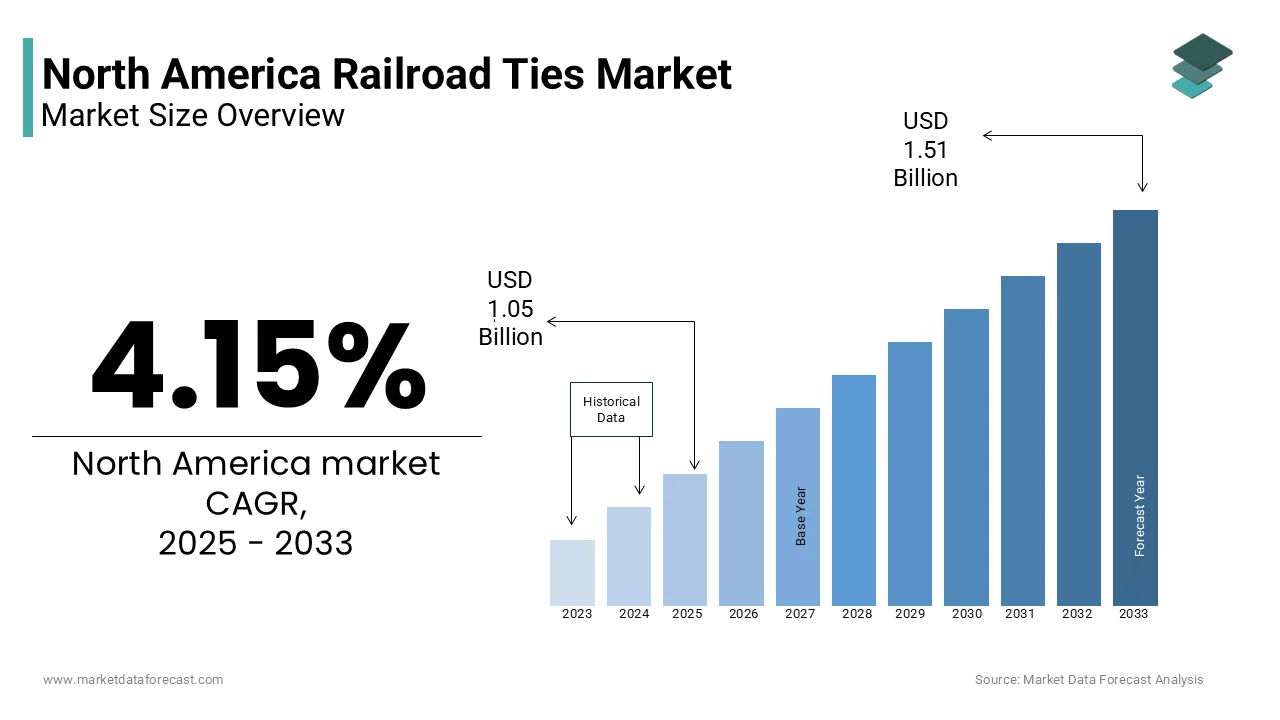

The Railroad Ties market size in North America was valued at USD 1.05 billion in 2024 and is predicted to be worth USD 1.51 billion by 2033 from USD 1.09 billion in 2025 and grow at a CAGR of 4.15% from 2025 to 2033.

Railroad ties, also known as crossties, are essential components that ensure the stability and longevity of railway tracks. Market conditions reflect a blend of traditional wooden ties and emerging alternatives like concrete and composite materials.

MARKET DRIVERS

Expansion of Freight Rail Networks

The expansion and modernization of freight rail networks serve as a primary driver for the railroad tie market. Like, freight rail volumes in North America are expected to increase significantly by 2030, driven by the rise in e-commerce and industrial activities. This surge necessitates the replacement and reinforcement of aging rail infrastructure, including ties. For instance, the average lifespan of wooden ties is 25-30 years, requiring periodic replacements to maintain operational efficiency. Plus, a substantial amount is invested annually in rail infrastructure maintenance and upgrades in the U.S. alone. This investment directly impacts the demand for railroad ties, particularly in high-traffic corridors like the Midwest and Texas. Additionally, the shift toward heavier freight loads has increased the need for durable ties capable of withstanding greater stress.

Government Investments in Passenger Rail

Government initiatives aimed at enhancing passenger rail services significantly influence the railroad tie market. Projects like the California High-Speed Rail and Northeast Corridor upgrades require substantial quantities of railroad ties to support new track installations and refurbishments. Also, passenger rail projects often prioritize concrete ties due to their durability and lower maintenance costs compared to wooden alternatives. This preference has created opportunities for manufacturers specializing in advanced materials. Furthermore, federal funding programs, such as the Infrastructure Investment and Jobs Act, allocate resources for rail modernization, ensuring steady demand for railroad ties.

MARKET RESTRAINTS

Environmental Concerns with Wooden Ties

A significant restraint facing the railroad tie market is the environmental impact associated with traditional wooden ties. According to the Environmental Protection Agency (EPA), the treatment of wooden ties with creosote—a common preservative—poses risks to soil and water quality. This chemical is classified as a hazardous substance, leading to stricter regulations on its use and disposal. Similarly, approximately 20 million wooden ties are replaced annually in the U.S., generating substantial waste that requires careful management. These environmental concerns have prompted rail operators to explore alternative materials, which often come at a higher cost. Like, transitioning to eco-friendly options like composite ties can increase project expenses. While these alternatives mitigate environmental risks, their adoption is hindered by budget constraints, particularly for smaller rail operators.

Supply Chain Disruptions

Supply chain disruptions have emerged as another major restraint, impacting the availability and cost of raw materials for railroad ties. Similarly, global supply chain challenges have led to a notable increase in the cost of timber—a primary material for wooden ties—since the last few years. These disruptions are exacerbated by geopolitical tensions and logistical bottlenecks, affecting manufacturers' ability to meet demand.

Also, delays in sourcing materials have caused project timelines to extend to several months. This issue is particularly acute for large-scale infrastructure projects reliant on timely delivery of railroad ties. Besides, the rising cost of steel and cement has impacted the production of concrete ties, further complicating market dynamics.

MARKET OPPORTUNITIES

Adoption of Composite Ties

The adoption of composite railroad ties presents a transformative opportunity for the market. Like, composite ties are designed to last up to 50 years—nearly double the lifespan of wooden ties—offering significant long-term savings. These ties are made from recycled plastics and other sustainable materials, aligning with growing environmental consciousness. Also, the use of composite ties can reduce lifecycle maintenance costs greatly, making them an attractive option for rail operators. Cities like Chicago and Toronto have already begun piloting composite tie installations, demonstrating their potential for widespread adoption. Furthermore, advancements in manufacturing technologies have reduced production costs, enhancing affordability.

Urbanization and Commuter Rail Expansion

The rapid pace of urbanization and the expansion of commuter rail networks create significant opportunities for the railroad tie market. In support of this, urban populations in North America are projected to grow significantly by 2040, increasing demand for efficient public transportation. Projects like the Dallas Area Rapid Transit (DART) expansion and Toronto’s GO Transit enhancements require extensive track installations, driving demand for ties. As per the American Public Transportation Association, investments in commuter rail systems have considerably expanded annually over the past five years. This trend is further supported by federal funding programs aimed at reducing road congestion and carbon emissions. Manufacturers can leverage this momentum by supplying durable and cost-effective ties tailored to urban transit needs.

MARKET CHALLENGES

High Initial Costs of Advanced Materials

The high initial costs associated with advanced materials, such as concrete and composite ties, pose a significant challenge to market growth. This price disparity makes it difficult for smaller rail operators to justify the upfront investment, despite the long-term benefits. Plus, many regional rail networks operate on tight budgets, limiting their ability to adopt premium materials. For example, rural freight operators often prioritize cost savings over durability, opting for cheaper wooden ties. While lifecycle cost analyses show the economic advantages of advanced materials, overcoming the initial cost barrier remains a hurdle.

Regulatory Hurdles for New Materials

Regulatory hurdles present another challenge for the railroad tie market, particularly concerning the approval of new materials. According to the Federal Railroad Administration, rigorous testing and certification processes are required before alternative materials can be used in rail infrastructure. This regulatory scrutiny often delays the commercialization of innovative products, stifling market growth. Moreover, obtaining approvals for composite ties can take up to two years, deterring manufacturers from investing in research and development. Apart from these, inconsistent regulations across states and provinces complicate compliance efforts. For instance, standards for tie performance vary between the U.S. and Canada, creating additional barriers for cross-border suppliers.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.15% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

The United States, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

Koppers Inc., CXT Concrete Ties, Inc., Stellar Industries, Harsco Rail Norfolk, Southern Corporation, Hickman Williams & Company, Balfour Beatty Rail, Inc., Glen Raven, Inc., U.S. Concrete, Inc., Amsted Rail, Texas Creosoting, Inc., and others |

SEGMENTAL ANALYSIS

By Type Insights

The segment of wooden ties dominated the North American railroad tie market, with a 85.2% of the total share in 2024. This dominance is primarily driven by their cost-effectiveness and ease of installation, making them the preferred choice for both freight and passenger rail networks. Like, wooden ties are used in over 90% of track installations across rural and suburban areas, where budget constraints often dictate material selection. A key factor behind this segment's rise is its widespread availability and established supply chain. These innovations, coupled with their compatibility with existing rail infrastructure, solidify wooden ties' position as the backbone of the market.

The composite tie segment is projected to grow at a CAGR of 12.5%. This rapid expansion is fueled by the increasing demand for sustainable and durable alternatives to traditional materials. Composite ties, made from recycled plastics and other eco-friendly materials, align with environmental regulations and sustainability goals. In addition, a significant driver of this growth is their superior durability. Cities like Chicago and Toronto have begun adopting composite ties for urban transit projects, further accelerating adoption. Apart from these, government incentives for green infrastructure have bolstered demand. Plus, federal grants supporting eco-friendly rail projects have majorly increased annually, creating a favorable environment for composite tie manufacturers.

By Application Insights

The train application segment captured the maximum share of the North American railroad tie market in 2024. This segment's prominence is driven by the extensive freight rail network spanning over 140,000 miles, which relies heavily on robust and reliable ties. According to the Association of American Railroads (AAR), freight rail accounts for nearly 40% of all freight movement in the U.S., displaying the critical role of ties in maintaining operational efficiency. A critical element behind this segment's position is the high volume of rail traffic. Also, freight corridors in regions like the Midwest and Texas require frequent tie replacements due to heavy usage, driving sustained demand. Besides, the rise of e-commerce has increased freight volumes, with projections indicating a notable growth by 2030.

The subway application segment is witnessing a rapid progress in this market, with a CAGR of 9.8%. This growth is fueled by urbanization and investments in public transportation systems. In support of this, urban populations in North America are projected to grow significantly by 2040, increasing reliance on subways for daily commutes. A major driver of this expansion is government funding for urban rail projects. Also, substantial investments in subway systems were made in the past few years, supporting expansions in cities like New York and Toronto. In addition of these, the adoption of advanced materials like concrete and composite ties in subway applications enhances durability, reducing maintenance costs.

REGIONAL ANALYSIS

The United States secured the majority shares of the North American railroad tie market i.e. 80.6% of the total business in 2024. This leading position is fuelled by the country's extensive rail infrastructure and supports both freight and passenger services. A key driver of this dominance is the focus on modernizing aging infrastructure. Plus, a significant amount is invested annually in rail maintenance and upgrades. Projects like the Northeast Corridor enhancements and California High-Speed Rail are driving demand for durable ties. Besides, the shift toward sustainable materials aligns with federal environmental policies, further strengthening the market.

Canada remains an important player in the regional market. The country's vast geography and reliance on rail for freight transportation make it a significant player in the market. A major factor driving growth is the government's commitment to rail modernization. Initiatives like the VIA Rail expansion and GO Transit enhancements are boosting demand for advanced ties, particularly concrete and composite options.

The Rest of North America, including Mexico and smaller economies, accounts for a smaller portion of the market. Mexico's growing industrial sector and expanding rail networks are key contributors to this segment. Government investments in cross-border rail projects, such as the Tren Maya, are also propelling growth. These initiatives prioritize eco-friendly materials, aligning with broader sustainability goals. While smaller in scale, these economies offer untapped potential for future expansion.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Koppers Inc., CXT Concrete Ties, Inc., Stellar Industries, Harsco Rail Norfolk, Southern Corporation, Hickman Williams & Company, Balfour Beatty Rail, Inc., Glen Raven, Inc., U.S. Concrete, Inc., Amsted Rail, Texas Creosoting, Inc.

The North American railroad tie market is characterized by intense competition, driven by the presence of established players like Koppers Inc., Stella-Jones, and Progress Rail, alongside emerging innovators. Smaller firms compete by targeting niche markets, such as urban transit systems or eco-friendly materials. Strategic collaborations with governments and private entities intensify rivalry. The growing emphasis on sustainability and technological advancements creates opportunities for differentiation. However, challenges like high initial costs for advanced materials and regulatory hurdles persist, shaping the competitive dynamics. Innovation and adaptability remain critical for success in this evolving landscape.

TOP PLAYERS IN THE MARKET

Koppers Inc.

Koppers Inc. is a leading player in the North American railroad tie market, renowned for its expertise in producing high-quality wooden ties. The company has established itself as a key supplier to major freight and passenger rail networks across the U.S. and Canada. In recent years, Koppers has focused on sustainability by developing eco-friendly preservative treatments for wooden ties, aligning with stringent environmental regulations.

Stella-Jones

Stella-Jones is a prominent name in the railroad tie industry, specializing in treated wood products for rail infrastructure. The company’s ties are widely used in both urban and rural rail networks, thanks to their durability and cost-effectiveness. Additionally, the company has invested in R&D to explore composite materials, positioning itself as a forward-thinking player. Stella-Jones’ emphasis on quality and innovation has solidified its reputation as a trusted supplier in the region.

Progress Rail

Progress Rail, a subsidiary of Caterpillar Inc., is a trailblazer in advanced railroad tie solutions, particularly concrete and composite alternatives. The company focuses on delivering durable and low-maintenance products tailored to heavy freight and urban transit applications. This strategic move aligns with growing demand for eco-friendly options. Progress Rail’s partnerships with major rail operators, including Canadian Pacific Rail, highlight its role in driving modernization efforts across the industry.

TOP STRATEGIES USED BY KEY PLAYERS

Key players in the North American railroad tie market employ strategies such as product diversification, sustainability initiatives, and strategic acquisitions to maintain a competitive edge. Partnerships with rail operators and government entities ensure access to large-scale projects. Acquisitions of startups specializing in innovative materials expand service portfolios. Offering customized solutions for freight and urban transit applications addresses diverse customer needs. These strategies collectively drive growth and foster differentiation in the evolving market landscape.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Koppers Inc. partnered with Amtrak to supply eco-friendly composite ties for the Northeast Corridor project, enhancing sustainability efforts.

- In June 2023, Progress Rail acquired a startup specializing in recycled plastic ties, expanding its portfolio of sustainable materials.

- In September 2023, Stella-Jones launched a new line of creosote-treated wooden ties designed for longer lifespans, addressing durability concerns.

- In January 2024, Canadian Pacific Rail signed a 50million deal with Green Tie Solution store place aging ties with composite alternative sacrists network.

- InMarch2024, the Federal Railroad Administration announced 200 million in grants for rail modernization projects, prioritizing the use of advanced materials like concrete and composite ties.

MARKET SEGMENTATION

This research report on the North America railroad ties market has been segmented and sub-segmented based on the following categories.

By Type

- Wooden Tie

- Concrete Tie

- Steel Tie

- Other

By Application

- Train

- Subway

- Other

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

1. What are the key opportunities in the North America railroad ties market?

The market is benefiting from increasing investments in railway infrastructure modernization, growing demand for durable materials, and expansion of freight transportation networks.

2. What challenges are impacting the North America railroad ties market growth?

Major challenges include fluctuating raw material prices, environmental concerns related to wood preservatives, and competition from alternative materials like concrete and composite ties.

3. Who are the key players operating in the North America railroad ties market?

Key players include Stella-Jones Inc., Koppers Holdings Inc., Gross & Janes Co., Nisus Corporation, and Vossloh AG, focusing on sustainable product development and supply chain enhancements.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]