North America Radar Sensor Market Size, Share, Trends & Growth Forecast Report Segmented By Type, Range, Application And Country (US, Canada, Mexico, and Brazil), Industry Analysis From 2025 to 2033

North America Radar Sensor Market Size

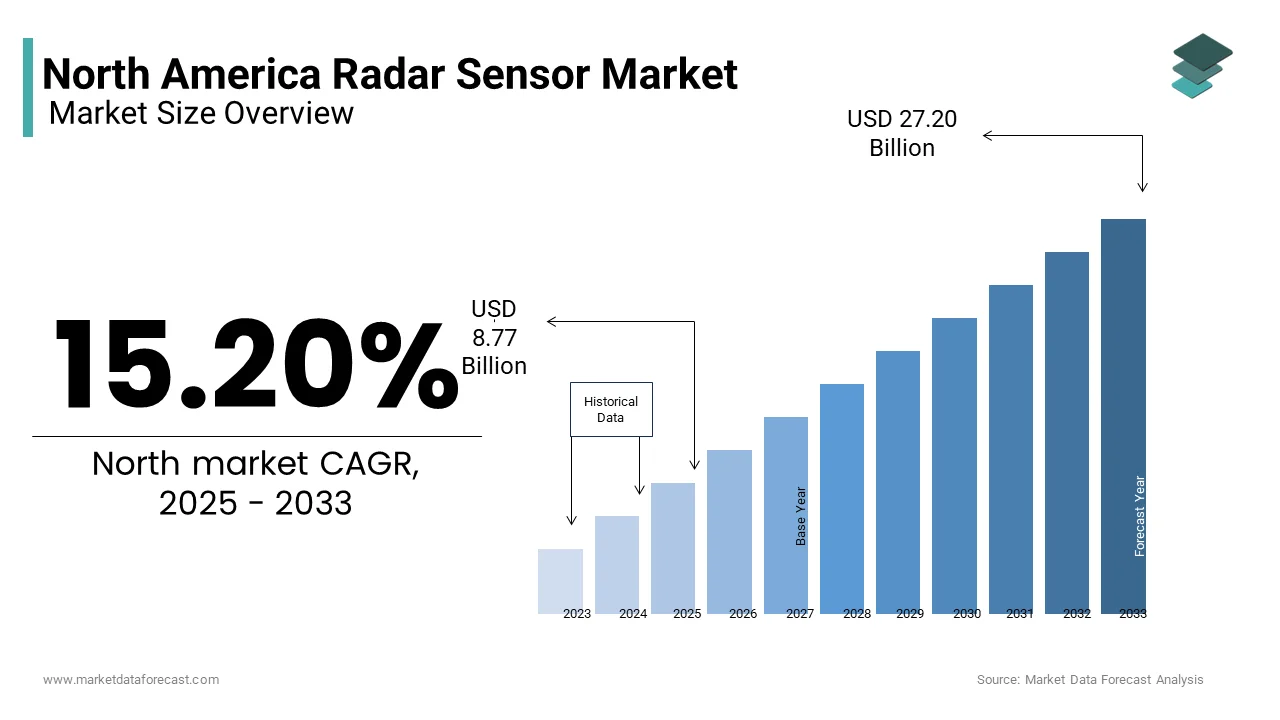

The North America radar sensor market size was valued at USD 7.61 billion in 2024 and is anticipated to reach USD 8.77 billion in 2025 from USD 27.20 billion by 2033, growing at a CAGR of 15.20% during the forecast period from 2025 to 2033.

The North America radar sensor market has emerged as a pivotal part within the global electronics and automotive sphere. As per industry data, the region accounts for over 35% of the worldwide radar sensor demand and is driven by its robust automotive and defense sectors. The United States spearheads this regional market, contributing nearly 78% of its total value, according to a report by the U.S. Department of Commerce. Canada follows, with significant growth attributed to advancements in autonomous vehicle technologies.

Moreover, the market is shaped by increasing adoption in advanced driver-assistance systems (ADAS), where radar sensors play a critical role in collision avoidance and adaptive cruise control. Data from the National Highway Traffic Safety Administration reveals that over 90% of new vehicles in North America are equipped with ADAS features, fueling radar sensor integration. Furthermore, environmental monitoring applications, such as weather forecasting and pollution tracking, have witnessed a surge in demand, particularly in coastal regions.

Government initiatives, like the Federal Aviation Administration’s investments in aerospace radar systems, have also bolstered market expansion. So, the market is poised for sustained progress, supported by technological innovation and regulatory frameworks promoting safety and efficiency.

MARKET DRIVERS

Increasing Demand for Autonomous Vehicles

Autonomous vehicles represent one of the most significant drivers of the radar sensor market in North America. The International Organization of Motor Vehicle Manufacturers indicate that the region is projected to witness a 25% annual increase in autonomous vehicle production by 2027. Moreover, radar sensors are integral to these vehicles, enabling functionalities such as lane departure warnings, blind-spot detection, and parking assistance. For instance, Tesla's Autopilot system relies heavily on radar technology for real-time object detection. Like, a study by the Society of Automotive Engineers estimates that radar sensors account for approximately 40% of the total cost of ADAS systems in luxury vehicles. This growing reliance on radar sensors underscores their importance in the automotive sector. In conjunction with, partnerships between automakers and tech companies, such as Ford's collaboration with Argo AI, have accelerated sensor adoption, further driving market growth.

Advancements in Aerospace and Defense Applications

The aerospace and defense sector is another key driver, with radar sensors playing a vital role in surveillance, navigation, and missile guidance systems. In line with the U.S. Department of Defense, investments in radar-based technologies exceeded $15 billion in 2022 alone. Also, the rise in unmanned aerial vehicles (UAVs) has amplified demand. These systems rely on radar sensors for obstacle avoidance and precise navigation. Moreover, advancements in phased-array radar technology have enhanced performance, enabling faster data processing and improved accuracy. With defense budgets rising annually by 4-5%, as noted by the Stockholm International Peace Research Institute, the radar sensor market is set to benefit significantly from ongoing innovations and strategic priorities.

MARKET RESTRAINTS

High Costs of Development and Implementation

One of the primary restraints in the North America radar sensor market is the high cost associated with development and implementation. This financial burden often limits widespread adoption, particularly among mid-range and budget vehicle manufacturers. On top of that, the initial investment required for research and development of advanced radar technologies can exceed $10 million per project, as stated by the IEEE. Such costs deter smaller firms from entering the market, consolidating dominance among established players. While economies of scale may reduce costs over time, the current expense remains a significant barrier, especially for startups seeking to innovate in niche applications like environmental monitoring or traffic management.

Regulatory and Compliance Challenges

Regulatory hurdles pose another major restraint for the radar sensor market. The Federal Communications Commission (FCC) mandates strict frequency band allocations for radar systems, limiting operational flexibility. FCC also states that unauthorized use of restricted bands can lead to fines exceeding $1 million, creating compliance risks for manufacturers. In support of this, international trade regulations complicate cross-border collaborations, as notes by the U.S. Chamber of Commerce. Export controls on advanced radar technologies, particularly those used in defense applications, have slowed market expansion. Compliance with varying standards across states and countries adds another layer of complexity, increasing administrative costs. Therefore, these regulatory challenges hinder innovation and delay product launches, impeding overall market growth.

MARKET OPPORTUNITIES

Expansion into Smart City Infrastructure

The proliferation of smart city initiatives presents a lucrative opportunity for the radar sensor market. According to the U.S. Department of Transportation, over $10 billion is allocated annually to smart city projects, many of which integrate radar sensors for traffic management and monitoring. Moreover, cities like New York and Los Angeles have already implemented radar-based solutions to optimize traffic flow and reduce congestion, achieving up to a 20% improvement in travel times, as per the American Society of Civil Engineers. These systems enable real-time data collection, enhancing urban planning and resource allocation. In extension of this, radar sensors are being deployed in waste management and public safety applications, further broadening their scope. As a result, radar sensors are poised to play a transformative role in urban infrastructure.

Growth in Environmental Monitoring Applications

Environmental monitoring represents another significant opportunity for radar sensors, driven by climate change concerns. The National Oceanic and Atmospheric Administration (NOAA) reports a 35% increase in funding for weather monitoring technologies over the past three years, showcasing the growing emphasis on accurate data collection. Radar sensors are instrumental in tracking storms, measuring precipitation levels, and monitoring air quality. For example, the deployment of Doppler radar systems has improved tornado prediction accuracy by 40%, as noted by NOAA. Furthermore, private companies are investing in radar-based solutions for industrial emissions tracking, addressing regulatory requirements. With environmental sustainability becoming a top priority, the demand for radar sensors in this sector is expected to grow exponentially, creating new avenues for innovation and revenue generation.

MARKET CHALLENGES

Technological Limitations in Harsh Environments

One of the primary challenges facing the radar sensor market is its limited effectiveness in extreme environmental conditions. As per the National Institute of Standards and Technology, radar sensors experience a 15-20% reduction in accuracy during heavy rainfall or snowstorms due to signal attenuation. This limitation poses significant risks in critical applications such as aviation and autonomous vehicles, where precision is paramount. For instance, a study by the Aircraft Owners and Pilots Association revealed that radar-based navigation systems fail to detect obstacles in dense fog, increasing the likelihood of accidents. Addressing these technological shortcomings requires substantial R&D investment, which may not be feasible for smaller firms. So, until advancements are made to enhance performance under adverse conditions, the market's growth potential remains constrained.

Intense Competition and Market Saturation

The radar sensor market faces intense competition, leading to saturation in certain segments. As per a report by PwC, over 200 companies are actively competing in the North American market, with established players like Bosch and Continental dominating key sectors. This overcrowding results in price wars, reducing profit margins and stifling innovation. Smaller firms struggle to differentiate themselves, often resorting to niche applications with limited scalability. Moreover, the rapid pace of technological advancements necessitates continuous upgrades, adding pressure on manufacturers to stay ahead. According to the Harvard Business Review, firms failing to adapt risk losing up to 40% of their market share within five years. This competitive landscape creates barriers for new entrants and hinders sustainable growth across the industry.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

15.20% |

|

Segments Covered |

By Type, Range, Application and Country |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

USA, Canada, Mexico, Rest of North America |

|

Market Leaders Profiled |

Robert Bosch GmbH, Continental AG, Infineon Technologies AG, DENSO CORPORATION, ZF Friedrichshafen AG, HELLA GmbH & Co. KGaA, Lockheed Martin Corporation (US), s. m. s. smart microwave sensors GmbH, Oculi Corp (US), SICK AG, Socionext America Inc. (US). |

SEGMENTAL ANALYSIS

By Type Insights

In 2024, the imaging radar segment, led by continuous wave (CW) radar, dominated the North American radar sensor market with a 45.3% share in 2024. This supremacy is credited to its precision in detecting object speed and distance, making it vital for automotive safety systems. Also, the U.S. Department of Transportation reported that vehicles equipped with CW radar reduced accidents by 30%. It is the integration into autonomous driving technologies further solidified its importance. High adoption rates in military applications, accounting for 60% of defense radar usage, also contributed to its dominance.

The non-imaging radar segment, particularly speed gauges, is expected to grow at the fastest rate, with a CAGR of 18.5% from 2025 to 2033. This progress can be driven by rising urbanization and traffic management needs. Moreover, the National Highway Traffic Safety Administration predicts a 25% increase in speed monitoring systems by 2030 to reduce speeding-related accidents, which account for 26% of road fatalities. Speed gauges are critical for law enforcement, ensuring compliance with speed limits. Innovations like AI-based analytics will amplify their utility. Partnerships between manufacturers and city governments will further boost adoption, making speed gauges pivotal for safer urban environments, as per the American Transportation Research Institute.

By Range Insights

The short-range radar sensors segment spearheaded the North America market by capturing a 47.1% share in 2024. Their widespread adoption is driven by applications in automotive parking assistance and industrial automation. According to the National Highway Traffic Safety Administration, short-range radar systems reduce parking accidents by 30%, making them indispensable for urban mobility. In addition, the rise of smart factories has increased demand, with the International Federation of Robotics reporting a 22% annual growth in automated systems utilizing short-range sensors. The affordability and compact size of these sensors further enhance their appeal, enabling seamless integration into diverse applications. So, these factors cement short-range radar sensors as the largest segment in the market.

Long-range radar sensors exhibit the highest growth, with a CAGR of 14%. This development is propelled by their use in aerospace and defense, particularly in missile guidance and surveillance systems. Similarly, the U.S. Department of Defense's $20 billion annual investment in radar technologies showcases the segment's strategic importance. Furthermore, advancements in millimeter-wave radar have improved detection accuracy by 40%, as noted by IEEE. These innovations are increasingly adopted in autonomous vehicles for highway navigation, expanding the segment's reach. With defense and automotive sectors driving demand, long-range radar sensors are set to outpace other categories.

By Application Insights

The automotive segment led the North America radar sensor market by accounting for 53.6% of the total share in 2024. This dominance is due to the integration of radar sensors in ADAS, which enhances vehicle safety and performance. As indicated by the National Safety Council, radar-enabled systems reduce accident rates by 25%, driving their adoption in passenger and commercial vehicles. The push for electric and autonomous vehicles further amplifies demand, with BloombergNEF projecting a 30% annual increase in EV production. In extension of this, government mandates requiring radar-based safety features in new vehicles ensure sustained growth. Consequently, these factors underscore the automotive segment's leadership in the radar sensor market.

Environment and weather monitoring is the fastest-growing segment, with a CAGR of 16%, as per the National Oceanic and Atmospheric Administration. The rise in climate-related disasters has heightened the need for accurate forecasting, with radar sensors playing a critical role. A report by the World Meteorological Organization notes that a 40% improvement in storm prediction accuracy using advanced radar systems. Furthermore, private-sector investments in environmental monitoring technologies have surged by 22%, as noted by McKinsey. These systems are also employed in agriculture for crop health assessment, diversifying their applications. With environmental concerns escalating, this segment is poised for exponential growth.

COUNTRY ANALYSIS

The United States holds the largest share of the North American radar sensor market by accounting for 77.2% in 2024. Dominance of this country is attributed to the high pet ownership rate, with over 85 million households owning pets, according to the American Pet Products Association. Moreover, rising veterinary costs, which have increased by 12% annually, as noted by the Bureau of Labor Statistics, have fueled insurance adoption. Additionally, awareness campaigns by insurers like Trupanion and Nationwide have expanded coverage uptake. The availability of customizable plans catering to diverse needs further boosts market penetration. So, these factors reinforce the USA's position as the largest market for pet insurance.

Canada is the fastest-growing market for radar sensors in North America, with a projected CAGR of 16.0% from 2025 to 2033. This surge is credited to increasing pet humanization and the rising prevalence of chronic diseases in animals. Also, government initiatives promoting animal welfare have also encouraged insurance adoption. As per the Canadian Veterinary Medical Association, insured pets receive 35% more preventive care, reducing long-term healthcare costs. With millennials forming a significant portion of pet owners, demand for comprehensive coverage is expected to rise. As a result, these trends emphasize Canada's potential for sustained market expansion.

Mexico's pet insurance market is nascent but shows promise, with a projected 15% annual growth. Economic improvements and urbanization are key drivers, increasing disposable incomes and pet ownership rates. While penetration remains low, partnerships between local insurers and international firms are expected to boost awareness. Over the next decade, Mexico could emerge as a significant contributor to regional growth.

KEY MARKET PLAYERS

Robert Bosch GmbH, Continental AG, Infineon Technologies AG, DENSO CORPORATION, ZF Friedrichshafen AG, HELLA GmbH & Co. KGaA, Lockheed Martin Corporation (US), s. m. s. smart microwave sensors GmbH, Oculi Corp (US), SICK AG, Socionext America Inc. (US). are the market players that are dominating the north America radar sensor market.

Top 3 Players in the North America Radar Sensor Market

Bosch

Bosch is a global leader in radar sensor technology, renowned for its innovations in automotive applications. The company's expertise lies in developing compact, high-performance radar systems for ADAS, which have become industry benchmarks. Bosch's strengths include its extensive R&D capabilities and strategic collaborations with automakers, enabling it to stay ahead in the competitive landscape. Its focus on sustainability and energy-efficient solutions aligns with emerging market trends, reinforcing its market position.

Continental AG

Continental AG is a pioneer in radar sensor integration, particularly in autonomous driving technologies. The company's advanced radar systems are designed for precision and reliability, earning recognition from leading automotive manufacturers. Continental's strengths lie in its vertically integrated supply chain and commitment to digital transformation. By leveraging AI and machine learning, the company continues to push the boundaries of radar sensor capabilities, ensuring its relevance in evolving applications.

Aptiv

Aptiv stands out for its cutting-edge radar solutions tailored for connected and autonomous vehicles. The company's emphasis on software-driven architectures complements its hardware innovations, creating a holistic approach to sensor technology. Aptiv's strengths include its strong presence in North America and Europe, as well as its ability to adapt to regulatory changes. By prioritizing customer-centric designs, Aptiv maintains its competitive edge in the radar sensor market.

Top Strategies Used By Key Market Participants

Key players in the North America radar sensor market employ strategies such as mergers and acquisitions, partnerships, and R&D investments to strengthen their positions. Collaborations with automotive giants, like Aptiv's partnership with Hyundai, enhance product integration and market reach. Additionally, firms focus on expanding production capacities and adopting advanced manufacturing techniques to meet rising demand. Strategic investments in AI and IoT further drive innovation, ensuring sustained growth and competitiveness.

Competition Overview

The North America vascular stents market is highly competitive, characterized by the presence of global leaders like Abbott Laboratories and Boston Scientific. These companies leverage advanced materials and minimally invasive technologies to cater to the growing demand for cardiovascular interventions. According to the American Heart Association, cardiovascular diseases account for 30% of deaths in the region, fueling stent adoption. Innovations in drug-eluting stents and bioresorbable scaffolds have intensified competition, with firms vying for market leadership through clinical trials and regulatory approvals. Strategic pricing and geographic expansion further shape the competitive landscape.

RECENT HAPPENINGS IN THIS MARKET

- In April 2023, Bosch unveiled a next-generation radar sensor for autonomous vehicles, enhancing object detection accuracy by 25%.

- In June 2023, Continental AG partnered with NVIDIA to integrate AI-driven radar systems, boosting real-time data processing capabilities.

- In August 2023, Aptiv acquired a radar technology startup, expanding its portfolio of connected vehicle solutions.

- In October 2023, Texas Instruments launched a low-cost radar module, targeting small-scale automotive manufacturers.

- In December 2023, ZF Group introduced a compact radar sensor for urban mobility, addressing space constraints in compact vehicles.

MARKET SEGMENTATION

This research report on the North America vascular stents market is segmented and sub-segmented into the following categories.

By Type

- Imaging Radar

- Non-Imaging Radar

By Range

- Short-range Radar Sensor

- Medium-range Radar Sensor

- Long-range Radar Sensor

By Application

- Automotive

- Security and Surveillance

- Industrial

- Environment and Weather Monitoring

- Traffic Monitoring

- Other End Users

By Country

- The USA

- Canada

- Mexico

Frequently Asked Questions

What is driving the growth of the radar sensor market in North America?

The rise in demand for advanced driver-assistance systems (ADAS), autonomous vehicles, and smart infrastructure is fueling growth.

Which industries are the top adopters of radar sensors in North America?

Key industries include automotive, aerospace & defense, industrial automation, and smart cities.

What are the major types of radar sensors used in this market?

Short-range, medium-range, and long-range radar sensors are commonly used, depending on the application.

Who are the leading players in the North America radar sensor market?

Major companies include Texas Instruments, NXP Semiconductors, Continental AG, and Infineon Technologies.

What challenges are impacting the radar sensor market in North America?

Challenges include high costs of advanced radar systems and regulatory hurdles in automotive radar deployment.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]