North America Power Sports Market Research Report – Segmented By Product ( ATVs (All-Terrain Vehicles) , SXS (Side-by-Side Vehicles) ) Fuel Type ( Gasoline-Powered Vehicles, Electric-Powered Vehicles ) and Country (The U.S., Canada and Rest of North America) - Industry Analysis, Size, Share, Growth, Trends, & Forecasts 2025 to 2033.

North America Power Sports Market Size

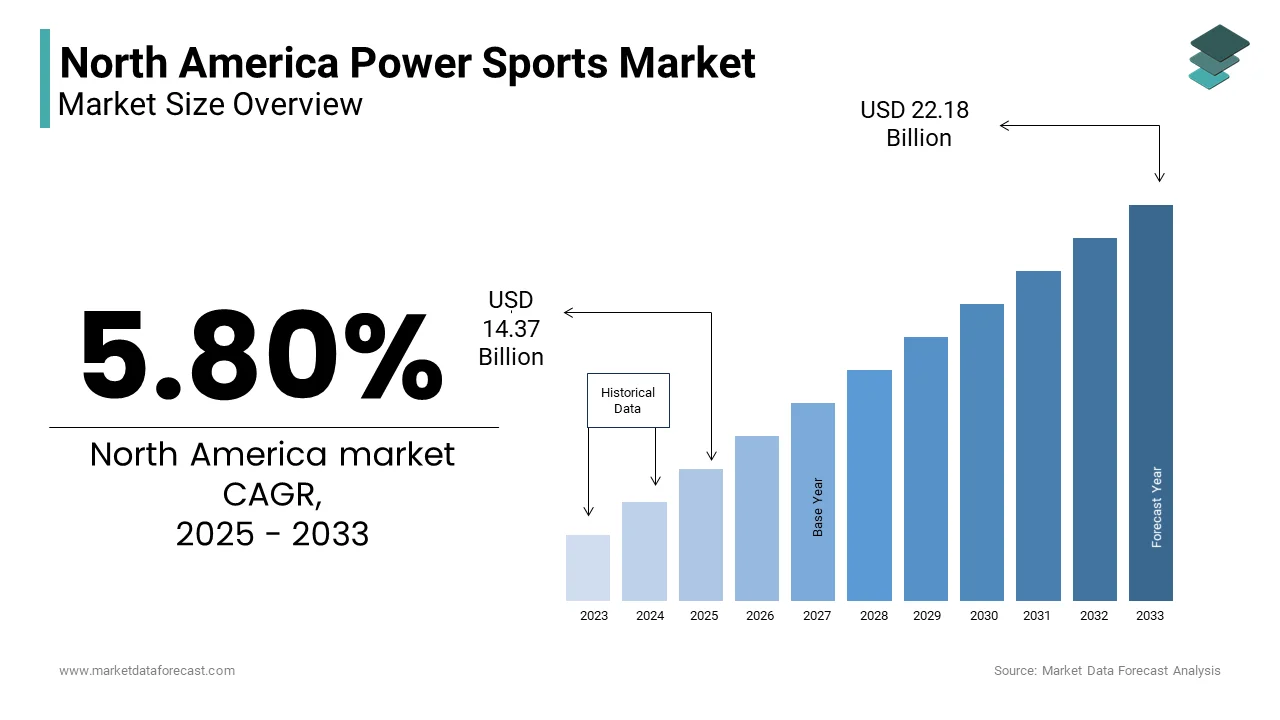

The North America Power Sports Market Size was valued at USD 13.62 billion in 2024. The North America Power Sports Market size is expected to have 5.80% CAGR from 2025 to 2033 and be worth USD 22.18 billion by 2033 from USD 14.37 billion in 2025.

The North American power sports market has established itself as a dynamic and rapidly evolving segment within the broader automotive and recreational industries. And, the United States dominates the regional landscape, with a significant majority of the revenue coming from within the country. A key aspect influencing this growth is the increasing popularity of outdoor recreational activities, particularly among millennials and Gen Z consumers. For instance, a significant portion of U.S. households own at least one type of power sports vehicle like ATVs or motorcycles which is reflecting a strong cultural affinity for adventure and off-road experiences. Additionally, advancements in vehicle technology, including electric powertrains and connectivity features, have expanded the appeal of these products.

MARKET DRIVERS

Rising Popularity of Outdoor Recreational Activities

The growing enthusiasm for outdoor recreational activities represents a significant driver for the North American power sports market. For example, national parks in the U.S., such as Yellowstone and Yosemite, reported a rise in ATV and off-road motorcycle usage during the same period. Additionally, social media platforms like Instagram and TikTok have amplified awareness of power sports, with influencers showcasing thrilling rides and off-road adventures. A major share of millennials in North America prioritize experiential purchases, further fueling demand for power sports vehicles.

Technological Advancements in Vehicle Design

Technological advancements in power sports vehicle design represent another major driver propelling the market forward. Sales of vehicles equipped with advanced features like GPS navigation, Bluetooth connectivity, and hybrid powertrains grew by approximately 25% annually from 2020 to 2022. For instance, brands like Polaris and Yamaha have introduced models with smart dashboards and voice-activated controls, appealing to tech-savvy consumers. Besides, the integration of electric powertrains has expanded applications in urban environments, where noise and emissions restrictions limit traditional gasoline-powered vehicles. A significant percentage of new power sports vehicles sold were equipped with eco-friendly technologies, emphasizing their growing popularity.

MARKET RESTRAINTS

Stringent Environmental Regulations

Stringent environmental regulations governing emissions and noise levels is a key restraint impacting the North American power sports market. It creates compliance challenges for manufacturers. According to McKinsey, a large share of power sports vehicles in North America were required to undergo redesigns in 2022 to meet stricter EPA guidelines on carbon emissions and sound pollution. This challenge is compounded by varying regulations across regions, complicating product standardization. For example, a report by the Environmental Protection Agency (EPA) brought to attention that a significant percentage of gas-powered ATVs fail to meet updated emission standards and is leading to increased costs for manufacturers.

High Costs of Advanced Models

Another critical restraint is the high cost associated with advanced power sports vehicles, which often price out budget-conscious consumers. This financial barrier limits adoption, particularly among rural populations and younger demographics. Additionally, the perception of limited value for money discourages repeat purchases. For instance, a significant portion of respondents hesitated to invest in premium power sports vehicles due to concerns about maintenance expenses and long-term durability. While technological advancements have reduced production costs over time, the premium pricing remains prohibitive for many, slowing market penetration.

MARKET OPPORTUNITIES

Expansion in Urban Mobility Solutions

The urban mobility segment presents a significant opportunity for the North American power sports market. This is supported by the increasing demand for compact and eco-friendly transportation options. For instance, brands like Zero Motorcycles and Segway have introduced lightweight electric models tailored for urban commuters, gaining popularity in cities like New York and Los Angeles. Apart from these, government incentives promoting sustainable transportation have accelerated adoption. There is a growing preference for zero-emission vehicles, especially in urban areas and is further reinforcing the market’s growth trajectory.

Adoption of Smart Connectivity Features

The escalating need for smart connectivity features represents another promising avenue for growth which is fueled by consumer desire for convenience and enhanced user experiences. For example, brands like Polaris and Can-Am have launched models with real-time diagnostics and remote monitoring capabilities, appealing to tech-savvy users. In addition, the integration of AI-driven navigation systems has expanded applications in adventure tourism that is enabling seamless route planning and safety alerts. A notable portion of consumers prioritize connectivity features when purchasing power sports vehicles, further accelerating adoption.

MARKET CHALLENGES

Intense Competition from Low-Cost Imports

Among the prime challenges encountring the North American power sports market is the intense competition posed by low-cost imports, particularly from Asia. The imports from countries like China and India account for a notable share of the market by offering cheaper alternatives to domestically produced vehicles. These imports often undercut local manufacturers on price, despite compromising on quality and durability. For instance, Chinese manufacturers reduced prices which is intensifying pricing pressure. This trend has forced North American companies to either lower their profit margins or invest heavily in differentiation strategies, such as unique designs or eco-friendly technologies.

Limited Awareness of Electric and Hybrid Options

Another challenge is the limited awareness of the benefits offered by electric and hybrid power sports vehicles, particularly among older demographics and rural populations. Like, a significant portion of consumers are not fully aware of the differences between traditional gas-powered and electric models. This lack of awareness creates hesitation among potential buyers, who may perceive premium electric vehicles as unnecessary or overly complex. Furthermore, misconceptions about the performance and range of electric models deter adoption. For example, a great share of respondents believed gas-powered vehicles were more reliable than electric alternatives.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.80 % |

|

Segments Covered |

By Product, Fuel Type Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

Yamaha Motor Co., Ltd., Arctic Cat Inc., BRP, Honda Motor Co., Ltd., Kawasaki Heavy Industries |

SEGMENTAL ANALYSIS

By Product Insights

The segment of ATVs under the North American market held 40.3% of the total share in 2024. This dominance of the segment is attributed to their versatility and widespread use in agriculture, recreation, and emergency services. For instance, market participants like Polaris and Honda are popularly used for off-road adventures and utility tasks such as plowing snow or hauling equipment. Apart from these, innovations in suspension systems and engine efficiency have expanded their appeal. For example, Yamaha launched a new line of utility-focused ATVs in 2022, which gained traction for their rugged design and durability.

The SXS vehicles segment is the fastest-growing category and is expected to have a CAGR of 18.5% from 2025 to 2033. This growth is influenced by their potential to combine off-road performance with passenger comfort and is appealing to families and adventure enthusiasts. Furthermore, the rise of adventure tourism has amplified demand, with destinations like Moab and Baja California becoming hotspots for SXS rentals. So, these innovations are accelerating adoption which is positioning SXS vehicles as a key growth driver.

By Fuel Type Insights

The gasoline-powered vehicles segment prevailed in the North American market and captured a significant portion of the overall share in 2024. This performance of the segment is credited to their affordability and widespread availability across retail channels. Moreover, gasoline vehicles often benefit from higher consumer trust, particularly for established brands like Honda and Yamaha. Besides, promotional campaigns and discounts during holiday seasons have boosted sales.

The electric-powered vehicles segment is accelerating in the market and is believed to attain a CAGR of 22.2% in the coming years. Such rise is caused by their focus on sustainability and eco-friendly operations, appealing to environmentally conscious consumers. For instance, Zero Motorcycles and Segway are the likes of brands that have introduced exclusive lines of electric power sports vehicles, gaining traction among urban professionals. Further, government incentives promoting green energy have accelerated adoption.

COUNTRY LEVEL ANALYSIS

The United States dominated the North American power sports market by commanding an 75.3% share in 2024. This is propelled by its robust automotive industry and strong emphasis on outdoor recreation. Similarly, a substantial number of U.S. consumers prioritize power sports vehicles for leisure activities, creating a fertile ground for innovation. Also, federal incentives promoting sustainable practices have bolstered adoption of eco-friendly vehicles.

Canada is experiencing a notable growth. It is fueled by investments in adventure tourism and green living initiatives. According to Natural Resources Canada, cities like Vancouver and Toronto are prioritizing eco-friendly vehicles, spurring demand for electric power sports solutions. For example, Canadian have expanded their offerings of hybrid motorcycles, gaining popularity among health-conscious consumers.

Mexico is predicted to see a notable growth in the market as it is seventh largest vehicle producer. This progress is likely to be fuelled by the expanding middle class and rising disposable incomes, supported by economic reforms. Urban centers like Mexico City have seen a surge in demand for affordable yet effective power sports vehicles, particularly during extreme weather conditions. Government-led health campaigns promoting sun protection have also accelerated adoption.

The Rest of North America collectively show promising rise in the market. This region’s growth is propelled by tourism and hospitality industries, which rely on power sports vehicles for guest comfort and well-being.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the North America power sports market are Yamaha Motor Co., Ltd., Arctic Cat Inc., BRP, Honda Motor Co., Ltd., Kawasaki Heavy Industries, Ltd., Polaris Inc., Textron Inc., Harley Davidson, CF Moto, KTM, KYMCO, Taiga Motors, Argo, Alpina, Suzuki Motor Corporation

The North American power sports market is characterized by fierce competition and is driven by rapid innovation and diverse consumer preferences. Key players like Polaris, Yamaha, and Honda continue to have lead in this landscape by by taking capitalising on their expertise in engine performance, durability, and creative branding to differentiate offerings. However, smaller firms face challenges due to high R&D costs and the dominance of established brands. Also, the market is also witnessing increased competition from low-cost private-label alternatives, which remain more affordable and accessible. Plus, regulatory pressures and the need for compliance with safety standards further complicate the competitive environment. Despite these challenges, opportunities abound in emerging segments like electric vehicles and smart connectivity. Companies that balance innovation with affordability while addressing regional needs are likely to thrive.

Top Players in the Market

Polaris Inc.

Polaris leads the North American power sports market. Its commitment to innovation and diverse product portfolio has positioned it as a trusted brand among adventure enthusiasts. For instance, its RZR series of SXS vehicles are widely used for their off-road performance and durability. The company’s focus on sustainability and eco-friendly technologies has strengthened its global presence.

Yamaha Motor Co., Ltd.

Yamaha is another key player in the market and is known for its high-performance engines and rugged designs, the company serves diverse demographics, from rural farmers to urban adventurers. Its Grizzly series of ATVs, launched in 2021, gained traction for its reliability and versatility. Its emphasis on ethical practices and community engagement has positioned it as a leader in socially responsible power sports solutions.

Honda Motor Co., Ltd.

Honda is vehicle maker. Specializing in visually appealing and innovative power sports vehicles, Honda serves younger demographics seeking trendy and functional solutions. Honda’s partnerships with retailers like Target and Walmart have expanded its footprint, solidifying its reputation for creativity and reliability.

RECENT HAPPENINGS IN THE MARKET

- In February 2023, Polaris launched a new line of electric ATVs featuring recyclable materials. This move strengthened its position in the eco-friendly segment.

- In April 2023, Yamaha acquired a startup specializing in hybrid engine technologies. This acquisition enhanced its capabilities in fuel-efficient power sports solutions.

- In July 2023, Honda partnered with Amazon to offer exclusive discounts on its SXS vehicles. This collaboration expanded its customer base and boosted sales.

- In October 2023, Polaris introduced a limited-edition holiday collection featuring festive designs, targeting gift shoppers. This launch boosted its brand appeal during the peak season.

- In December 2023, Yamaha unveiled a next-generation ATV with biodegradable components, positioning itself as a leader in sustainable power sports solutions.

MARKET SEGMENTATION

This research report on the north america power sports market has been segmented and sub-segmented into the following.

By Product

- ATVs (All-Terrain Vehicles)

- SXS (Side-by-Side Vehicles)

By Fuel Type

- Gasoline-Powered Vehicles

- Electric-Powered Vehicles

By Country

- The U.S.

- Canada

- Rest of North America.

Frequently Asked Questions

What are the major segments within the north america power sports market?

Key segments include All-Terrain Vehicles (ATVs), Side-by-Side Vehicles (SxS/UTVs), Snowmobiles, Personal Watercraft (PWC), and Motorcycles (especially off-road and dual-sport categories).

What is the current size of the North America power sports market?

The North American power sports market is valued in the tens of billions USD and continues to grow, with the U.S. holding the largest share due to high consumer spending on recreational vehicles and strong aftermarket services.

Which region in North America holds the largest market share?

The United States dominates the market, followed by Canada. The U.S. benefits from broader consumer adoption, a robust dealership network, and favorable financing options.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]