North America Power Rental Market Research Report – Segmented By Power Rating ( Below 75 kVA , Above 750 Kva ) Fuel Type ( Diesel,Gas) Application ( Standby Load , Peak Load ) End-user ( Mining , Construction) and Country (The U.S., Canada and Rest of North America) - Industry Analysis, Size, Share, Growth, Trends, & Forecasts 2025 to 2033.

North America Power Rental Market Size

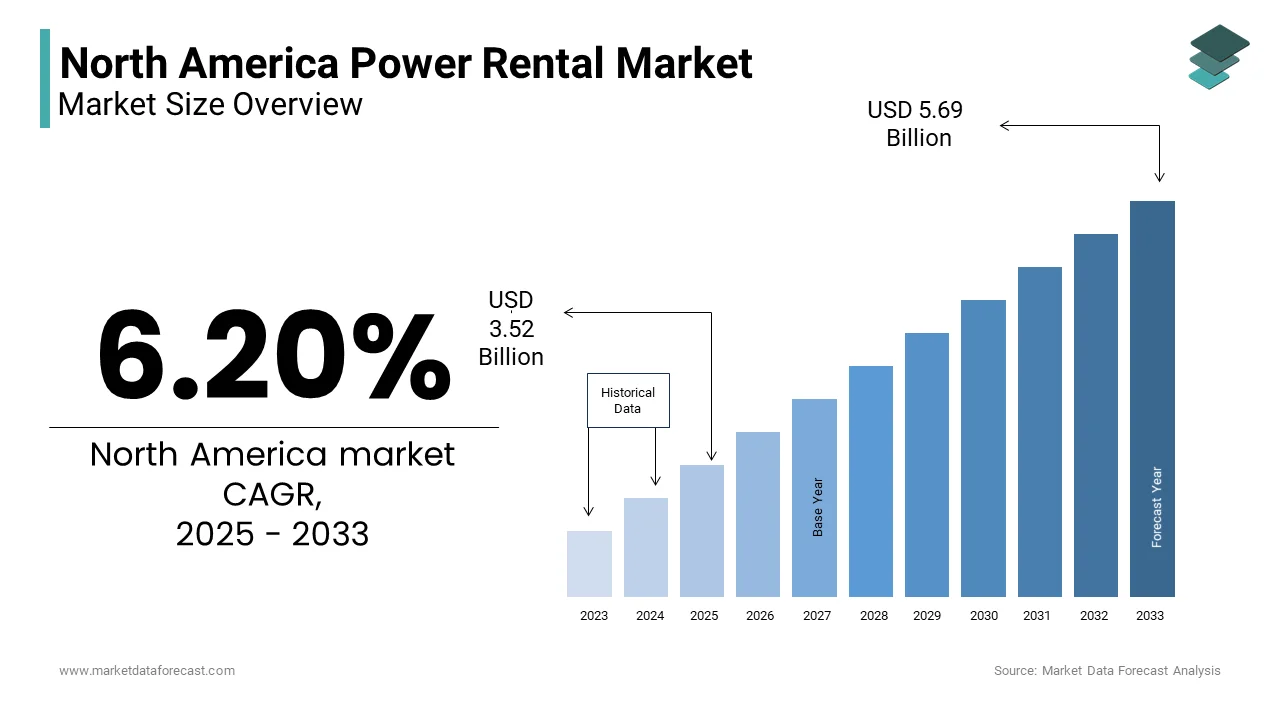

The North America Power Rental Market Size was valued at USD 3.31 billion in 2024. The North America Power Rental Market size is expected to have 6.20 % CAGR from 2025 to 2033 and be worth USD 5.69 billion by 2033 from USD 3.52 billion in 2025.

The North America power rental market is offering tailored solutions for industries and communities grappling with fluctuating power demands. From natural disasters to planned industrial activities, these systems have become indispensable in ensuring uninterrupted electricity supply. The interplay between rising energy needs and infrastructure challenges has created fertile ground for this sector’s growth. For instance, experts at the National Oceanic and Atmospheric Administration show that extreme weather events are becoming more frequent and severe, with 2023 witnessing 20 separate billion-dollar disasters in the U.S. alone. These events not only disrupt lives but also amplify the reliance on temporary power solutions, showcasing how external factors shape market dynamics.

Historically, the demand for power rental services has been cyclical and is influenced by economic activity and regional energy policies. Analysis from the U.S. Energy Information Administration reveals that industrial energy consumption remains steady, accounting for nearly one-third of total usage. This consistency acts as a stabilizing force for the market, even as renewable energy adoption reshapes traditional energy landscapes. Globally, the International Energy Agency projects electricity demand to surge by 50% by 2050, signaling an evolving terrain where power rental systems will play a pivotal role.

While the push toward renewables reduces reliance on fossil fuel-based generators, it simultaneously creates opportunities for hybrid power rental solutions. For example, aging infrastructure that is estimated by the American Society of Civil Engineers to require $2 trillion in upgrades over the next decade presents both a challenge and an opportunity for innovation.

Apart from these, the average power outage duration in the U.S. has doubled since 2000, according to research published by Climate Central. This trend underscores the growing importance of adaptable energy systems, yet unintended consequences, such as increased emissions from diesel generators, must also be addressed.

MARKET DRIVERS

Advancements in Renewable Energy Integration

The integration of renewable energy sources into power rental systems is a key driver for the North America market. As industries and governments prioritize sustainability, hybrid power solutions which is combining solar panels, battery storage, and traditional generators are gaining traction. The International Energy Agency spotlights that renewable energy capacity in North America grew by 15% in 2022, with solar and wind leading the charge. This shift has encouraged power rental companies to innovate, offering cleaner and more efficient systems. For instance, analysis from BloombergNEF shows that the cost of lithium-ion batteries, a critical component of hybrid systems, has dropped by 89% since 2010 is making renewable-integrated rentals more affordable. These advancements not only align with environmental goals but also cater to industries seeking long-term energy resilience, driving demand for modernized power rental solutions.

Expansion of Data Centers and Technology Hubs

The rapid expansion of data centers and technology hubs across North America is another significant driver for the power rental market. Data centers consume vast amounts of energy, accounting for approximately 2% of total U.S. electricity usage, according to the U.S. Department of Energy. Temporary power solutions are essential during the construction and commissioning phases of these facilities, ensuring uninterrupted operations. Furthermore, experts estimate that hyperscale data centers which support cloud computing and AI will exceed 1,000 globally by 2024, with a substantial portion located in North America. Power rental systems are also critical for managing peak loads and backup power needs in these energy-intensive facilities.

MARKET RESTRAINTS

Grid Modernization Challenges

Despite its potential, the North America power rental market faces challenges due to ongoing grid modernization efforts. Investments in smart grids and energy storage systems aim to enhance grid reliability and reduce dependency on temporary power solutions. The American Society of Civil Engineers estimates that over $300 billion is needed to upgrade the U.S. power grid by 2030, with a focus on integrating renewable energy and improving efficiency. While these upgrades are essential for long-term energy stability, they reduce the frequency of power outages, indirectly impacting the demand for rental systems. Additionally, research from the Edison Electric Institute suggests that smart grid technologies can reduce outage durations by up to 50%, further limiting the need for emergency power. These developments, since beneficial for consumers, pose a restraint for the power rental market by addressing root causes of energy instability.

Economic Uncertainty and Budget Constraints

Economic uncertainty and budget constraints present another major restraint for the North America power rental market. During periods of financial instability, businesses and municipalities often delay or scale back investments in infrastructure projects, reducing the need for temporary power solutions. The Conference Board reports that economic growth in North America is expected to slow to 1.8% in 2024 is reflecting tighter monetary policies and reduced consumer spending. This slowdown impacts industries reliant on power rental services, such as construction and event management. Moreover, inflationary pressures have increased operational costs for rental companies, including fuel and transportation expenses. For example, the U.S. Bureau of Labor Statistics notes that diesel prices rose by 25% in 2023, squeezing profit margins. These economic headwinds create challenges for market players striving to maintain profitability amid fluctuating demand.

MARKET CHALLENGES

Increasing Demand for Emergency Preparedness Solutions

The North America power rental market is poised to benefit significantly from the growing emphasis on emergency preparedness. Natural disasters, cyberattacks, and grid vulnerabilities have heightened awareness about the need for resilient energy systems. The Federal Emergency Management Agency (FEMA) reports that over 60% of U.S. states are at high risk of severe weather events, which has led to a surge in demand for temporary power solutions. Hospitals, schools, and critical infrastructure facilities are increasingly investing in backup power systems to ensure continuity during emergencies. For instance, the American Hospital Association calculates that healthcare facilities spend approximately $750 million annually on emergency power systems. This trend is further bolstered by state-level mandates requiring facilities to maintain reliable backup power.

Expansion into Emerging Applications Like EV Charging

The rise of electric vehicles (EVs) presents an untapped opportunity for the North America power rental market. With the Biden administration aiming for 50% of new vehicle sales to be electric by 2030, the demand for EV charging infrastructure is skyrocketing. However, many regions face challenges in upgrading grids to support widespread charging stations. Temporary power rental systems can fill this gap by providing scalable energy solutions for EV charging hubs, especially in underserved areas. According to the International Council on Clean Transportation, the U.S. will need approximately 1.2 million public chargers by 2030, but current installations fall short by over 80%. Power rental providers can collaborate with EV manufacturers and municipalities to deploy mobile charging stations powered by generators or hybrid systems. This emerging application not only diversifies revenue streams but also positions the industry as a key enabler of the EV revolution.

MARKET CHALLENGES

Rising Costs of Fuel and Operational Expenses

One of the major challenges facing the North America power rental market is the rising cost of fuel and operational expenses. Diesel-powered generators, which dominate the market, are heavily reliant on fossil fuels, whose prices are subject to volatility. The U.S. Energy Information Administration reports that diesel prices increased by over 40% in 2022 due to global supply chain disruptions and geopolitical tensions. These fluctuations directly impact the profitability of power rental companies, as fuel costs account for up to 60% of operational expenses, according to the National Association of Manufacturers. Additionally, inflationary pressures have driven up maintenance and labor costs, further squeezing margins. While companies can pass some of these costs to customers, doing so risks pricing out smaller businesses and municipalities. This challenge underscores the need for innovation in fuel-efficient technologies and alternative energy sources to remain competitive.

Regulatory Hurdles for Emissions Compliance

Stringent emissions regulations pose another significant challenge for the North America power rental market. Environmental agencies are tightening rules to curb greenhouse gas emissions from diesel generators, which are a primary source of air pollution. The California Air Resources Board (CARB), for example, has introduced Tier 4 Final standards, requiring generators to reduce particulate matter and nitrogen oxide emissions by up to 90%. Compliance with such regulations often necessitates costly upgrades, including advanced filtration systems and cleaner fuels. A study by the Environmental Defense Fund estimates that retrofitting older generators to meet these standards can cost between $20,000 and $50,000 per unit. For smaller players, these expenses create barriers to entry and limit growth opportunities. Furthermore, stricter regulations may discourage industries from renting traditional diesel generators are forcing companies to pivot toward greener alternatives despite their higher upfront costs.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

|

Market Size Available |

2024 to 2033 |

|

|

Base Year |

2024 |

|

|

Forecast Period |

2025 to 2033 |

|

|

CAGR |

6.20 % |

|

|

Segments Covered |

By Power Rating,Fuel Type,Application,End-user and Country. |

|

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

|

Country Covered |

The U.S., Canada and Rest of North America |

|

|

Market Leader Profiled |

|

SEGMENTAL ANALYSIS

By Power Rating Insights

The Below 75 kVA segment dominated the North America power rental market BY capturing 45.1% of the market share in 2024. This segment's rise comes from its widespread use in small-scale applications like residential backup power and small businesses. The Federal Emergency Management Agency reported that over 60 million households in the U.S. experienced at least one power outage lasting more than four hours in 2023, driving demand for compact generators. Additionally, these systems are cost-effective and easy to transport, making them ideal for disaster-prone areas. Their affordability and versatility ensured their dominance in meeting everyday energy needs.

Looking ahead, the Above 750 kVA segment is projected to grow at the fastest rate, with a CAGR of 8.5% from 2025 to 2033. This rapid growth is fueled by increasing demand from large-scale industries such as mining, oil and gas, and data centers. For instance, the U.S. Department of Energy estimates that data centers will consume 73 billion kilowatt-hours of electricity annually by 2030 , requiring robust power solutions to manage peak loads. Furthermore, the American Society of Civil Engineers shows that infrastructure projects worth over $1 trillion are underway in North America, creating a need for high-capacity generators. These factors draws attention to the segment's importance in supporting energy-intensive operations and driving industrial growth.

By Fuel Type Insights

The Diesel segment led the North America power rental market by holding a dominant market share of 65.2% in 2024. Diesel generators have remained the preferred choice due to their reliability and widespread availability, especially during emergencies. The National Oceanic and Atmospheric Administration stressed that extreme weather events caused over 100 million people to face power outages in 2023 is driving demand for diesel-powered backup systems. Additionally, diesel fuel prices, though volatile, averaged $3.50 per gallon in 2023 , making it an economical option for short-term needs. Their robust performance in remote areas and compatibility with existing infrastructure ensured their authority in meeting critical energy demands.

Going forward, the Gas segment is expected to grow at the fastest rate, with a CAGR of 9.2%. This growth is driven by the increasing availability of natural gas and its lower environmental impact compared to diesel. The U.S. Department of Energy projects that natural gas production will rise by 15% by 2030 , ensuring stable supply and competitive pricing. Furthermore, stricter emissions regulations, such as those introduced by the California Air Resources Board, mandate cleaner energy solutions, favoring gas-powered generators. These systems are also gaining traction in urban areas, where noise pollution and emissions are major concerns.

By Application Insights

The Standby Load segment emerged as the biggest in the North America power rental market by accounting for 50.1% of the market share in 2024. This dominance was supported by the increasing frequency of power outages caused by extreme weather events and aging infrastructure. The National Oceanic and Atmospheric Administration reported that over 20 billion-dollar disasters struck the U.S. in 2023 is leading to widespread blackouts. Standby generators are critical for hospitals, data centers, and emergency services, with the Federal Emergency Management Agency estimating that 90% of critical facilities rely on backup power. Their ability to provide instant energy during emergencies underscores their importance in ensuring safety and operational continuity.

In contrast, the Peak Load segment is predicted to grow at the quick rate, with a CAGR of 10.3% in the future. This rapid growth is fueled by rising electricity demand during peak hours, particularly in urban areas. The U.S. Energy Information Administration forecasts that electricity consumption will increase by 20% by 2030 is driven by population growth and industrial expansion. Additionally, renewable energy integration creates variability in grid supply, necessitating temporary power solutions to manage surges. For instance, California’s grid operator reported a record peak demand of 52,000 MW in 2023 is spotlighting the need for scalable systems.

By End-user Insights

The Utility segment commanded the North America power rental market by having 35% of the market share in 2024 owing to the growing need for temporary power solutions during grid maintenance and outages. The American Society of Civil Engineers estimated that over 70% of the U.S. power grid is outdated , requiring frequent upgrades and repairs. Utilities also rely on rental systems to manage peak demand during extreme weather events. For instance, the National Oceanic and Atmospheric Administration reported that heatwaves in 2023 caused a 15% surge in electricity demand across major cities. The utility sector’s reliance on power rentals highlights their critical role in ensuring energy reliability and grid stability.

The Events segment is believed to grow at the fastest pace, with a CAGR of 12.5% in the coming years which is driven by the increasing number of large-scale events, such as concerts, sports tournaments, and festivals. The Bureau of Labor Statistics estimates that the entertainment and recreation industry will expand by 20% by 2030 is creating higher demand for temporary power solutions. Additionally, sustainability trends are pushing event organizers to adopt hybrid or renewable-powered generators. For example, California mandated that all outdoor events exceeding 5,000 attendees must use eco-friendly energy systems by 2025.

REGIONAL ANALYSIS

The USA led the North America power rental market in 2024 by accounting for 85.4% of the market share. This dominance was propelled by its large industrial base, frequent extreme weather events, and aging energy infrastructure. The National Oceanic and Atmospheric Administration highlighted that the U.S. experienced 20 separate billion-dollar weather disasters in 2023 , increasing demand for temporary power solutions. Additionally, the U.S. Department of Energy noted that over 70% of the nation’s grid infrastructure is over 25 years old , necessitating reliable backup systems. The USA’s influence shows its critical role in driving innovation and adoption of advanced power rental technologies.

Looking ahead, Canada is anticipated to grow at the swiftest rate, with a CAGR of 7.8% from 2025 to 2033 . This progress is fueled by increased investments in renewable energy projects and remote mining operations. The Canadian government estimates that renewable energy capacity will expand by 30% by 2030 creating opportunities for hybrid power rental systems. Additionally, Canada’s vast rural and off-grid areas, home to over 6 million people rely heavily on temporary power solutions. The Mining Association of Canada reports that mining contributes $106 billion annually to the economy , further boosting demand for scalable energy systems.

Top 3 Players in the market

Caterpillar Inc.

Caterpillar Inc. is one of the most important companies in the North America power rental market. It is known for making strong and reliable generators that can be used in many different situations, like construction sites, mining operations, and utility projects. The company also focuses on creating hybrid systems, which combine traditional generators with renewable energy sources like solar power. This helps customers reduce their environmental impact while still getting the energy they need. Caterpillar has a large network of dealers across the region, making it easy for customers to get help when they need it. By keeping up with new trends and rules about clean energy, Caterpillar continues to lead the way in providing temporary power solutions that people trust.

Aggreko PLC

Aggreko PLC is another big name in the North America power rental market. What makes Aggreko special is its ability to create custom energy solutions for its customers. For example, it offers hybrid systems that use solar panels, batteries, and traditional generators to provide power in places where there is no access to the main electricity grid. These systems are especially useful in remote areas or for big events like concerts and sports games. Aggreko also helps during emergencies, like natural disasters, by quickly setting up temporary power systems. The company is always looking for ways to make its products more sustainable and efficient, which is why so many customers turn to Aggreko when they need reliable energy solutions.

Generac Power Systems

Generac Power Systems is well-known for making affordable and easy-to-use generators that are perfect for homes and small businesses. When there’s a power outage or extra energy is needed, Generac’s generators step in to keep things running smoothly. The company has also added smart technology to its products, so users can control their generators from their phones or computers. In recent years, Generac has started making natural gas-powered generators, which are better for the environment than traditional diesel models. By focusing on innovation and customer needs, Generac has become a popular choice for people who want dependable and eco-friendly temporary power solutions.

Top strategies used by the key market participants

Exploring New Geographic Frontiers

Leading companies in the North America power rental market are actively targeting underdeveloped or remote areas to broaden their reach. Firms like Caterpillar Inc. and Generac Power Systems have recognized the potential of rural communities, isolated mining operations, and off-grid locations where access to stable electricity is limited. By collaborating with local partners and establishing service hubs in these regions, they can ensure faster delivery and more responsive support. This approach not only opens up new revenue streams but also reinforces their image as providers of reliable energy solutions tailored to challenging environments. By addressing the unique needs of underserved areas, these companies are expanding their footprint while fostering trust among diverse customer bases.

Leveraging Advanced Technologies for Enhanced Operations

A growing trend among industry leaders is the adoption of cutting-edge digital tools to streamline operations and improve customer experiences. For instance, Aggreko PLC has been pioneering the use of smart systems that enable users to monitor generator performance, fuel usage, and maintenance schedules in real time. These innovations allow for better decision-making and help prevent unexpected breakdowns through predictive maintenance. By incorporating IoT (Internet of Things) capabilities, companies can offer seamless, data-driven solutions that enhance efficiency and reliability. This tech-forward approach not only sets them apart from competitors but also positions them as innovators committed to delivering smarter and more sustainable energy services.

Empowering Customers Through Knowledge-Sharing Initiatives

Another creative approach being implemented by major players involves educating customers to maximize the value of their rented equipment. Many users lack the expertise to operate or maintain power systems effectively, which can lead to inefficiencies or equipment damage. To bridge this gap, companies such as Generac Power Systems and Caterpillar Inc. are rolling out training programs, interactive workshops, and online resources to build customer confidence. These initiatives focus on teaching proper usage, troubleshooting techniques, and maintenance tips, ensuring smoother operations and longer equipment life. By prioritizing customer education, these firms foster deeper engagement, boost satisfaction, and establish themselves as trusted partners dedicated to empowering their clients with practical knowledge.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the North America Power Rental Market are Caterpillar Inc. (United States),Cummins Inc. (United States),Aggreko (United Kingdom),Atlas Copco (Sweden),Kohler-SDMO (France),Shenton Group (United Kingdom),NIDS GROUP (India),Jassim Transport & Stevedoring Co. K.S.C.C. (Kuwait),Pump Power Rental (United Kingdom),United Rentals (United States),Sudhir Power Ltd. (India),Modern Hiring Service (India),Newburn Power Rental Ltd (United Kingdom),Global Power Supply (United States),FG Wilson (United Kingdom),ProPower Rental (United States),APR Energy (United States)

The competition in the North America power rental market is evolving beyond traditional product offerings and pricing wars. One emerging trend is the growing emphasis on customized energy solutions tailored to specific industries or events. For instance, companies are now designing modular systems that can be easily scaled up or down depending on the customer’s needs, whether it’s for a small outdoor wedding or a large-scale mining operation. This flexibility allows businesses to differentiate themselves by addressing niche markets that larger players might overlook.

Another unique aspect of the competition is the focus on long-term partnerships rather than one-time rentals. Instead of simply renting out equipment, some companies are offering comprehensive energy management services, including system design, installation, and ongoing maintenance. This approach builds deeper relationships with customers and creates recurring revenue streams. For example, firms are partnering with utility companies to provide temporary power during grid upgrades, ensuring minimal disruption for communities.

Additionally, the rise of shared economy models is reshaping the market. Some companies are exploring peer-to-peer rental platforms where businesses or individuals can rent out underutilized generators to others in need. This not only reduces waste but also opens up new opportunities for smaller players to compete without heavy investments in inventory.

Finally, sustainability is driving innovation in unexpected ways. Competitors are experimenting with biofuels and hydrogen-powered generators, moving beyond solar hybrids to explore truly carbon-neutral solutions. This positions them as pioneers in an eco-conscious market. These fresh strategies highlight how companies are finding creative ways to stand out in a crowded field.

RECENT HAPPENINGS IN THE MARKET

In March 2025, Schneider Electric announced a $700 million investment in the U.S. energy sector to enhance infrastructure, support AI growth, and increase domestic manufacturing. This initiative aims to bolster energy security and create over 1,000 new jobs across multiple states.

MARKET SEGMENTATION

This research report on the North America Power Rental Market has been segmented and sub-segmented into the following categories.

By Power Rating

- Below 75 kVA

- Above 750 Kva

By Fuel Type

- Diesel

- Gas

- Others

By Application

- Continuous Load

- Standby Load

- Peak Load

By End-user

- Mining

- Construction

- Manufacturing

- Utility

- Events

- Oil & Gas

- Others

By Country

- The U.S.

- Canada

- Rest of North America.

Frequently Asked Questions

What are the key drivers of growth in the North America power rental market?

Key drivers include increasing demand for uninterrupted power supply, aging power infrastructure, and frequent power outages.

Which fuel type dominates the North America power rental market?

Diesel generators hold a significant market share due to their reliability and robustness.

Which application segment leads the North America power rental market?

The continuous power segment is expected to be the highest contributor to the market.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]