North America Portable Medical Devices Market Research Report – Segmented By Device Type (Wearable Health and Fitness Devices, Medical Monitoring Devices) & Country (The United States, Canada and Rest of North America)- Industry Analysis From 2025 to 2033

North America Portable Medical Devices Market Size

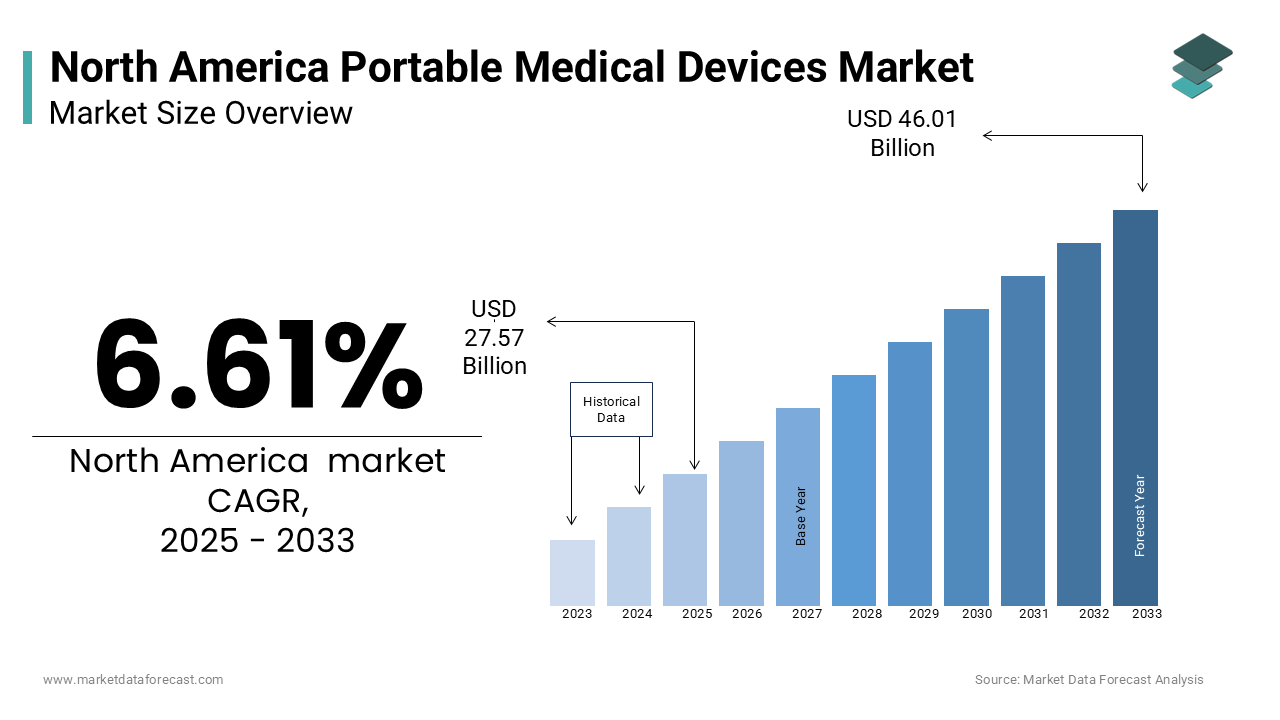

The North America portable medical devices market size was valued at USD 25.86 billion in 2024 and is estimated to reach USD 46.01 billion by 2033 from USD 27.57 billion in 2025, registering a CAGR of 6.61% from 2025 to 2033.

The North America portable medical devices market is experiencing robust growth due to the increasing demand for remote patient monitoring and wearable health technologies. According to the American Telemedicine Association, over 30% of U.S. healthcare providers now integrate portable medical devices into their practice, reflecting a shift toward decentralized care models. Wearable health and fitness devices, such as smartwatches and fitness trackers, dominate consumer adoption, with shipments exceeding 100 million units in 2023, as per data from the Consumer Technology Association. Canada has also embraced this trend, with provincial healthcare systems investing in telehealth initiatives that leverage portable devices for chronic disease management. A study published by the Canadian Medical Association highlights that remote monitoring reduces hospital readmissions by 25%, underscoring the critical role of portable devices in modern healthcare. Additionally, advancements in sensor technologies and artificial intelligence have enhanced the accuracy and functionality of these devices, ensuring sustained market momentum.

MARKET DRIVERS

Rising Adoption of Remote Patient Monitoring in North America

The growing adoption of remote patient monitoring (RPM) in North America is one of the major factors propelling the expansion of the portable medical devices market in North America. According to the Centers for Medicare & Medicaid Services, RPM programs in the U.S. have expanded by 40% annually since 2020, driven by the need for cost-effective and accessible healthcare solutions. Portable devices such as blood pressure monitors, glucose meters, and pulse oximeters are integral to these programs, enabling real-time data collection and analysis. A study published by the American Heart Association highlights that RPM reduces hospital readmissions by 30%, appealing to healthcare providers seeking to improve patient outcomes while lowering costs. Canada has also witnessed significant adoption, with provinces like Ontario integrating RPM into their public healthcare systems to manage chronic conditions such as diabetes and hypertension. These factors collectively underscore the critical role of remote monitoring in propelling market growth.

Increasing Focus on Preventive Healthcare

The increasing emphasis on preventive healthcare is further propelling the expansion of the North American portable medical devices market. According to the National Institutes of Health, wearable health and fitness devices are used by over 60 million Americans to track vital metrics such as heart rate, sleep patterns, and physical activity. These devices empower individuals to take proactive measures in managing their health, reducing the risk of chronic diseases. In Canada, the Public Health Agency reports a 20% annual increase in the use of wearable devices among adults aged 35-50, highlighting their appeal among health-conscious consumers. Additionally, advancements in biometric sensors and AI-driven analytics have improved the accuracy of these devices, making them more reliable for long-term health monitoring. A study published by the Canadian Institute for Health Information notes that preventive healthcare initiatives leveraging portable devices can reduce healthcare costs by 15%, reinforcing their importance in the market.

MARKET RESTRAINTS

High Costs of Advanced Devices

The high cost of advanced portable medical and healthcare devices is hindering the growth of the North American portable medical devices market. According to the Healthcare Cost and Utilization Project, premium wearable health devices equipped with advanced sensors and AI capabilities can cost upwards of $500, making them inaccessible for lower-income consumers. Even with insurance coverage, out-of-pocket expenses deter many individuals from adopting these technologies. This financial burden is further compounded by the rising costs of cutting-edge components, which are often passed on to consumers. For instance, a report by the American Medical Association reveals that only 40% of eligible patients utilize wearable devices due to affordability issues. In Canada, provincial healthcare systems face similar challenges, as budgetary constraints limit access to advanced portable devices. As per Statistics Canada, wait times for subsidized devices have increased by 12% annually over the past five years, hindering market growth and patient accessibility.

Data Privacy and Security Concerns

Data privacy and security concerns are further hampering the growth of the North American portable medical devices market. According to the Federal Trade Commission, over 20% of wearable device users express hesitation about sharing their health data due to fears of unauthorized access or misuse. This issue is particularly pronounced among older demographics, who prioritize confidentiality. Additionally, the lack of standardized regulations governing data protection exacerbates these concerns, as highlighted by the Canadian Cybersecurity Center. A study published by the International Journal of Medical Informatics notes that data breaches involving portable devices have increased by 15% over the past three years, undermining consumer trust. These challenges hinder market growth and limit the broader adoption of portable healthcare technologies.

MARKET OPPORTUNITIES

Integration with Artificial Intelligence

The integration of artificial intelligence (AI) into portable medical and healthcare devices is one of the major opportunities for the North American portable medical devices market. According to the National Institutes of Health, AI-driven analytics can enhance the accuracy of diagnostic tools by 30%, enabling early detection of conditions such as arrhythmias and sleep apnea. Canada has positioned itself as a leader in this space, with startups collaborating with academic institutions to develop AI-powered wearables tailored to chronic disease management. A study published by the Canadian Medical Association highlights that AI-enhanced devices reduce diagnostic errors by 25%, appealing to healthcare providers seeking precision medicine solutions. Additionally, advancements in machine learning algorithms have enabled predictive analytics, allowing users to anticipate potential health risks. These innovations position AI integration as a transformative force in the market.

Expansion into Rural and Underserved Areas

The expansion of portable medical devices into rural and underserved areas represents another major opportunity for growth. According to the U.S. Department of Health and Human Services, over 60 million Americans reside in rural regions with limited access to healthcare facilities, creating a robust demand for portable solutions. Devices such as handheld ultrasound scanners and portable ECG monitors are gaining traction, as they enable healthcare providers to deliver quality care remotely. Canada has also embraced this trend, with provincial governments investing in telehealth initiatives to bridge the urban-rural healthcare gap. A study published by the Canadian Rural Health Research Society highlights that portable devices reduce travel-related healthcare costs by 40%, appealing to regions seeking sustainable solutions. These factors position rural healthcare as a key growth driver for the market.

The North America portable medical devices market is experiencing robust growth due to the increasing demand for remote patient monitoring and wearable health technologies. According to the American Telemedicine Association, over 30% of U.S. healthcare providers now integrate portable medical devices into their practice, reflecting a shift toward decentralized care models. Wearable health and fitness devices, such as smartwatches and fitness trackers, dominate consumer adoption, with shipments exceeding 100 million units in 2023, as per data from the Consumer Technology Association. Canada has also embraced this trend, with provincial healthcare systems investing in telehealth initiatives that leverage portable devices for chronic disease management. A study published by the Canadian Medical Association highlights that remote monitoring reduces hospital readmissions by 25%, underscoring the critical role of portable devices in modern healthcare. Additionally, advancements in sensor technologies and artificial intelligence have enhanced the accuracy and functionality of these devices, ensuring sustained market momentum.

MARKET DRIVERS

Rising Adoption of Remote Patient Monitoring in North America

The growing adoption of remote patient monitoring (RPM) in North America is one of the major factors propelling the expansion of the portable medical devices market in North America. According to the Centers for Medicare & Medicaid Services, RPM programs in the U.S. have expanded by 40% annually since 2020, driven by the need for cost-effective and accessible healthcare solutions. Portable devices such as blood pressure monitors, glucose meters, and pulse oximeters are integral to these programs, enabling real-time data collection and analysis. A study published by the American Heart Association highlights that RPM reduces hospital readmissions by 30%, appealing to healthcare providers seeking to improve patient outcomes while lowering costs. Canada has also witnessed significant adoption, with provinces like Ontario integrating RPM into their public healthcare systems to manage chronic conditions such as diabetes and hypertension. These factors collectively underscore the critical role of remote monitoring in propelling market growth.

Increasing Focus on Preventive Healthcare

The increasing emphasis on preventive healthcare is further propelling the expansion of the North American portable medical devices market. According to the National Institutes of Health, wearable health and fitness devices are used by over 60 million Americans to track vital metrics such as heart rate, sleep patterns, and physical activity. These devices empower individuals to take proactive measures in managing their health, reducing the risk of chronic diseases. In Canada, the Public Health Agency reports a 20% annual increase in the use of wearable devices among adults aged 35-50, highlighting their appeal among health-conscious consumers. Additionally, advancements in biometric sensors and AI-driven analytics have improved the accuracy of these devices, making them more reliable for long-term health monitoring. A study published by the Canadian Institute for Health Information notes that preventive healthcare initiatives leveraging portable devices can reduce healthcare costs by 15%, reinforcing their importance in the market.

MARKET RESTRAINTS

High Costs of Advanced Devices

The high cost of advanced portable medical and healthcare devices is hindering the growth of the North American portable medical devices market. According to the Healthcare Cost and Utilization Project, premium wearable health devices equipped with advanced sensors and AI capabilities can cost upwards of $500, making them inaccessible for lower-income consumers. Even with insurance coverage, out-of-pocket expenses deter many individuals from adopting these technologies. This financial burden is further compounded by the rising costs of cutting-edge components, which are often passed on to consumers. For instance, a report by the American Medical Association reveals that only 40% of eligible patients utilize wearable devices due to affordability issues. In Canada, provincial healthcare systems face similar challenges, as budgetary constraints limit access to advanced portable devices. As per Statistics Canada, wait times for subsidized devices have increased by 12% annually over the past five years, hindering market growth and patient accessibility.

Data Privacy and Security Concerns

Data privacy and security concerns are further hampering the growth of the North American portable medical devices market. According to the Federal Trade Commission, over 20% of wearable device users express hesitation about sharing their health data due to fears of unauthorized access or misuse. This issue is particularly pronounced among older demographics, who prioritize confidentiality. Additionally, the lack of standardized regulations governing data protection exacerbates these concerns, as highlighted by the Canadian Cybersecurity Center. A study published by the International Journal of Medical Informatics notes that data breaches involving portable devices have increased by 15% over the past three years, undermining consumer trust. These challenges hinder market growth and limit the broader adoption of portable healthcare technologies.

MARKET OPPORTUNITIES

Integration with Artificial Intelligence

The integration of artificial intelligence (AI) into portable medical and healthcare devices is one of the major opportunities for the North American portable medical devices market. According to the National Institutes of Health, AI-driven analytics can enhance the accuracy of diagnostic tools by 30%, enabling early detection of conditions such as arrhythmias and sleep apnea. Canada has positioned itself as a leader in this space, with startups collaborating with academic institutions to develop AI-powered wearables tailored to chronic disease management. A study published by the Canadian Medical Association highlights that AI-enhanced devices reduce diagnostic errors by 25%, appealing to healthcare providers seeking precision medicine solutions. Additionally, advancements in machine learning algorithms have enabled predictive analytics, allowing users to anticipate potential health risks. These innovations position AI integration as a transformative force in the market.

Expansion into Rural and Underserved Areas

The expansion of portable medical devices into rural and underserved areas represents another major opportunity for growth. According to the U.S. Department of Health and Human Services, over 60 million Americans reside in rural regions with limited access to healthcare facilities, creating a robust demand for portable solutions. Devices such as handheld ultrasound scanners and portable ECG monitors are gaining traction, as they enable healthcare providers to deliver quality care remotely. Canada has also embraced this trend, with provincial governments investing in telehealth initiatives to bridge the urban-rural healthcare gap. A study published by the Canadian Rural Health Research Society highlights that portable devices reduce travel-related healthcare costs by 40%, appealing to regions seeking sustainable solutions. These factors position rural healthcare as a key growth driver for the market.

SEGMENTAL ANALYSIS

By Device Type

The wearable health and fitness devices segment accounted for 58.8% of the North America portable medical devices market share in 2024. The dominating position of wearable health and fitness devices segment in the North American market is driven by their widespread adoption among health-conscious consumers, particularly millennials and Gen Z. According to the Consumer Technology Association, over 60 million Americans use wearable devices such as smartwatches and fitness trackers to monitor vital metrics like heart rate, sleep patterns, and physical activity. The affordability and user-friendly design of these devices make them particularly appealing to younger demographics, who prioritize preventive healthcare. Additionally, advancements in biometric sensors and AI-driven analytics have improved the accuracy and functionality of wearables, enhancing their appeal. Government initiatives promoting healthy lifestyles have further solidified their dominance in the market. For instance, Canada’s ParticipACTION program encourages the use of wearable devices to track fitness goals, ensuring broader adoption.

The medical monitoring devices segment is projected to witness a promising CAGR of 16.2% over the forecast period owing to the increasing adoption of remote patient monitoring (RPM) programs, particularly for managing chronic conditions such as diabetes and hypertension. According to the Centers for Medicare & Medicaid Services, RPM programs in the U.S. have expanded by 40% annually since 2020, driving demand for portable devices such as blood pressure monitors and glucose meters. Canada has also witnessed significant adoption, with provinces like Ontario integrating RPM into their public healthcare systems. A study published by the Canadian Medical Association highlights that medical monitoring devices reduce hospital readmissions by 30%, appealing to healthcare providers seeking cost-effective solutions.

REGIONAL ANALYSIS

The United States ruled the portable medical devices market in North America by occupying a share of 84.7% of the North American market. The leading position of the U.S. in the North American market is driven by the country’s advanced healthcare infrastructure, high disposable income, and robust investments in telehealth and wearable technologies. According to the Centers for Medicare & Medicaid Services, over 60% of U.S. healthcare providers now integrate portable devices into their practice, reflecting a shift toward decentralized care models. Wearable health devices, such as smartwatches and fitness trackers, dominate consumer adoption, with shipments exceeding 100 million units in 2023, as per data from the Consumer Technology Association. Additionally, government initiatives promoting remote patient monitoring (RPM) have reinforced the U.S.’s dominance in the regional market. Collaborations between academia and industry foster innovation, with startups developing AI-driven portable solutions tailored to chronic disease management.

Canada is predicted to hold a considerable share of the North America portable medical devices market over the forecast period. The rising awareness of preventive healthcare and an increasing focus on telemedicine are propelling the Canadian market growth. According to Statistics Canada, provincial healthcare systems have allocated $2 billion annually to support telehealth initiatives, many of which rely on portable devices for remote monitoring. Medical monitoring devices, such as blood pressure monitors and glucose meters, are gaining traction, particularly among individuals aged 50 and above. Additionally, partnerships between academia and industry foster innovation, with collaborative efforts driving the development of next-generation wearables. While smaller in scale compared to the U.S., Canada’s strategic emphasis on accessibility and quality healthcare positions it as a key player in the regional market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Apple dominates with its flagship Apple Watch series, which integrates advanced health monitoring features such as ECG and blood oxygen tracking. Fitbit follows closely, offering affordable yet innovative fitness trackers that cater to diverse consumer needs. Philips Healthcare rounds out the top three, with a strong presence in medical-grade portable devices. Its commitment to research and development has enabled the launch of AI-driven solutions, reinforcing its global standing.

The North America Portable Medical Devices Market is characterized by intense competition, driven by the presence of established players and emerging innovators. The market is moderately consolidated, with Apple Inc., Fitbit, and Philips Healthcare dominating the landscape. These companies compete on the basis of product innovation, technological superiority, and strategic collaborations. Smaller firms, however, are gaining ground by focusing on niche segments, such as AI-driven diagnostics and medical-grade wearables. The competitive dynamics are further shaped by regulatory requirements, which mandate rigorous testing and compliance, creating barriers to entry for new entrants. Pricing pressures also influence competition, as companies strive to offer cost-effective solutions without compromising quality. Despite these challenges, the market’s growth potential remains robust, fueled by increasing demand for remote monitoring and advancements in wearable technologies.

Top Strategies Used by Key Market Participants

Key players in the North America Portable Medical Devices Market employ a variety of strategies to strengthen their positions. Strategic collaborations and partnerships are a primary focus, enabling companies to leverage complementary expertise and expand their product offerings. For instance, Apple has partnered with leading healthcare providers to integrate its devices into clinical workflows, enhancing their utility in remote patient monitoring. Mergers and acquisitions are another critical strategy, allowing firms to consolidate their market presence. Fitbit, for example, was acquired by Google to enhance its capabilities in AI-driven health analytics. Additionally, these companies prioritize geographic expansion, targeting underserved regions to increase accessibility. Philips Healthcare has invested heavily in establishing distribution networks across Canada, ensuring broader market penetration. Product innovation remains central to their strategies, with substantial R&D investments driving the development of advanced solutions tailored to evolving patient needs.

RECENT MARKET DEVELOPMENTS

- In January 2024, Apple launched a next-generation Apple Watch equipped with advanced glucose monitoring capabilities. This initiative aimed to address unmet clinical needs and expand its product portfolio.

- In March 2024, Fitbit introduced a low-cost fitness tracker designed for underserved communities. This move was anticipated to enhance accessibility and broaden its user base.

- In May 2024, Philips Healthcare partnered with a Canadian telehealth provider to integrate its portable devices into RPM programs. This collaboration sought to improve patient outcomes in rural areas.

- In July 2024, Garmin unveiled a wearable device with AI-powered stress management features. This innovation aimed to appeal to health-conscious consumers seeking holistic wellness solutions.

- In September 2024, Abbott Laboratories expanded its production facilities in the U.S. to meet the growing demand for portable glucose monitors. This investment was intended to enhance production capacity and reduce lead times.

MARKET SEGMENTATION

This research report on the North American portable medical devices market has been segmented and sub-segmented into the following categories.

By Device type

- Wearable Health and Fitness Devices

- Smart Wrist-Wearables

- Smart Garments

- Chest Straps

- Medical Monitoring Devices

- Vital Signs Monitoring Devices

- Foetal Monitoring Devices

- Neuromonitoring Devices

- Blood Glucose Monitoring Devices

- Anaesthesia Monitoring Devices

By Country

- The United States

- Canada

- Rest of North America

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]