North America Portable Generator Market Size, Share, Trends & Growth Forecast Report Segmented By Product, Fuel & Power Rating, Phase, End-User, And By Country (US, Canada, Mexico, and Brazil), Industry Analysis From 2025 to 2033

North America Portable Generator Market Size

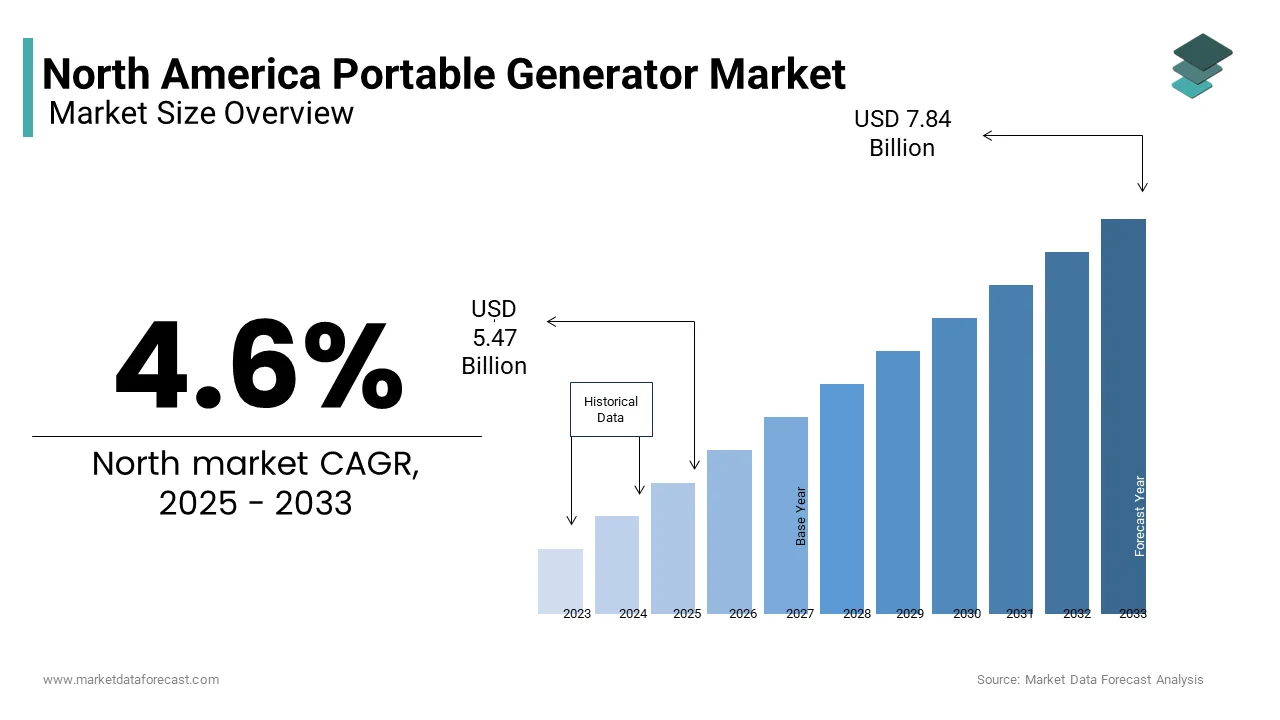

The North America portable generator market size was valued at USD 5.23 billion in 2024 and is anticipated to reach USD 5.47 billion in 2025 from USD 7.84 billion by 2033, growing at a CAGR of 4.6% during the forecast period from 2025 to 2033.

Current Scenario Of The North America Portable Generator Market

Portable generator is a solution for addressing power outages, outdoor activities, and emergency backup needs in North America. These compact devices, designed to provide temporary electricity, are increasingly popular due to their versatility and ease of use. In recent years, extreme weather events, such as hurricanes, wildfires, and winter storms, have heightened demand for reliable power sources. For instance, during Hurricane Ida in 2021, millions of households in Louisiana and surrounding areas experienced prolonged power outages, driving a surge in portable generator sales. Beyond emergencies, these devices are widely used in camping, construction sites, and tailgating events, reflecting their growing role in both urban and rural settings.

The market is characterized by advancements in technology, including fuel-efficient engines, quieter operations, and eco-friendly models powered by solar energy or hybrid systems. According to the U.S. Energy Information Administration, approximately 60% of electricity disruptions in the United States last year were weather-related, underscoring the critical need for backup power solutions. Interestingly, outside the market's direct scope, a report by the National Oceanic and Atmospheric Administration shows that 2023 has already seen 15 weather disasters exceeding $1 billion in damages each, further emphasizing the region's vulnerability to climate extremes.

Beyond its utility, the portable generator industry indirectly supports broader trends, such as the rise of remote work. A survey conducted by Pew Research Center found that 35% of Americans now work from home at least part-time, creating a niche demand for backup power to ensure uninterrupted productivity. These interconnected factors underscore the growing relevance of portable generators in modern life, blending practicality with innovation to meet evolving consumer needs.

MARKET DRIVERS

Increased Frequency of Extreme Weather Events

The rising frequency and intensity of extreme weather events are a significant driver for the North America portable generator market. Over the past decade, natural disasters such as hurricanes, wildfires, and winter storms have caused widespread power outages. As per the National Centers for Environmental Information, there were 20 separate billion-dollar weather and climate disasters in the U.S. alone in 2023 is marking one of the highest totals on record. These events often leave thousands without electricity, creating an urgent need for backup power solutions. For instance, during the February 2021 Texas power crisis, over 4.5 million households experienced prolonged blackouts is driving a surge in demand for portable generators. Experts at the National Oceanic and Atmospheric Administration suggest that this trend is likely to continue due to climate change, further solidifying the role of portable generators as a critical household and commercial necessity.

Growing Outdoor and Recreational Activities

The increasing popularity of outdoor recreational activities is another key factor propelling the portable generator market forward. Camping, tailgating, and RV travel have seen significant growth in North America, particularly post-pandemic. A report by Kampgrounds of America revealed that 2022 saw a 12% increase in camping participation compared to pre-pandemic levels, with nearly 90 million households engaging in outdoor activities. Portable generators play a vital role in enhancing these experiences by powering appliances, lighting, and electronic devices in remote locations. Additionally, the construction industry benefits from portable generators, with the U.S. Bureau of Labor Statistics reporting a 5% annual growth in construction projects requiring temporary power solutions. This dual demand from both recreational users and industrial applications underscores the versatility of portable generators, making them indispensable in diverse scenarios while contributing to market expansion.

MARKET RESTRAINTS

Noise Pollution and Operational Disruptions

Noise pollution caused by portable generators is a significant restraint on their widespread adoption and particularly in urban and suburban areas. Traditional gasoline-powered generators often produce noise levels between 60 to 75 decibels, which can be disruptive in residential neighbourhoods. As stated by the World Health Organization, prolonged exposure to noise levels above 65 decibels can lead to stress, sleep disturbances, and other health issues. This concern has led to stricter local ordinances in cities like New York and Los Angeles, where noise regulations limit generator usage during nighttime hours. Besides, quieter alternatives such as solar-powered systems or advanced inverter generators are gaining traction, but they come at a premium price. A report by the National Institute for Occupational Safety and Health brings to light that over 22 million Americans are exposed to hazardous noise levels annually, emphasizing the growing demand for quieter energy solutions. These factors collectively hinder the market growth of conventional portable generators.

Limited Fuel Storage and Supply Chain Vulnerabilities

The dependency on fuel availability and storage constraints presents another critical challenge for the portable generator market. Most traditional generators rely on gasoline, diesel, or propane, which require regular refueling during extended power outages. The U.S. Energy Information Administration notes that during major disasters, fuel supply chains often face disruptions, leaving consumers without access to essential resources. For instance, the Colonial Pipeline shutdown in 2021 caused widespread fuel shortages across the Southeast, severely impacting generator usability. Moreover, storing fuel safely at home poses additional risks, with the National Fire Protection Association reporting over 8,000 fires annually linked to improper fuel storage. These vulnerabilities show the limitations of fuel-dependent generators and push consumers toward alternative energy sources.

MARKET OPPORTUNITIES

Advancements in Eco-Friendly and Hybrid Generators

The development of eco-friendly and hybrid portable generators presents a significant opportunity for the North America market. As environmental concerns grow, manufacturers are innovating to produce models that combine solar energy with traditional fuel sources, reducing emissions and operational costs. As per the Solar Energy Industries Association, solar power adoption in the U.S. increased by 33% in 2022 is reflecting consumer demand for sustainable energy solutions. Hybrid generators which can operate on both solar panels and conventional fuels, are gaining traction among environmentally conscious buyers. A study by Bloomberg New Energy Finance highlights that renewable energy technologies could account for 75% of global power generation investments by 2030 is signaling a shift toward greener alternatives. These advancements position portable generator manufacturers to tap into a growing market segment while aligning with regulatory trends favoring low-emission products.

Expansion into Remote and Off-Grid Applications

Portable generators are increasingly being adopted for remote and off-grid applications, creating a lucrative opportunity for market players. Industries such as mining, oil and gas, and telecommunications rely heavily on temporary power solutions in isolated locations. The U.S. Bureau of Land Management states that over 10% of the country’s landmass lacks access to grid electricity, making portable generators indispensable for operations in these areas. Further, the rise of remote work has spurred demand for backup power in rural households. A survey by the National Rural Electric Cooperative Association reveals that nearly 12% of Americans live in rural areas, many of whom depend on generators during outages.

MARKET CHALLENGES

Rising Competition from Alternative Power Solutions

The increasing availability of alternative power solutions poses a significant challenge to the portable generator market. Technologies like home battery systems and microgrids are gaining popularity due to their ability to provide uninterrupted power without the noise and emissions associated with traditional generators. Tesla’s Powerwall, for instance, has seen a 30% annual increase in installations, according to data from BloombergNEF. These systems store energy from renewable sources like solar panels and offer long-term cost savings, making them an attractive option for homeowners. Furthermore, a report by Wood Mackenzie indicates that the residential energy storage market in North America is projected to grow by 15% annually through 2025.

Consumer Awareness and Education Gaps

A lack of consumer awareness and education about portable generator usage and safety remains a notable challenge for the market. Many users are unaware of the risks associated with improper operation like carbon monoxide poisoning which claims over 400 lives annually in the U.S., according to the Centers for Disease Control and Prevention. Misuse often stems from inadequate knowledge about ventilation requirements and safe fuel handling practices. Apart from this, a study by the Consumer Product Safety Commission found that 85% of generator-related fatalities occur during power outages draws attention to the need for better consumer education. Manufacturers must invest in awareness campaigns and user-friendly designs to mitigate these risks and build trust.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.6% |

|

Segments Covered |

By Product, Fuel & Power, By Country |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

U.S, Canada, Mexico Rest of North America |

|

Market Leaders Profiled |

A-iPower, Atlas Copco, Briggs & Stratton, Caterpillar, Champion Power Equipment, Cummins, Deere & Company, DuroMax Power Equipment, Energizer, FIRMAN Power Equipment, Generac Power Systems, Green Power America, Honda Motor, Kohler Co., Mitsubishi Heavy Industries, Powermate, Wacker Neuson, WEN Products, Westinghouse Electric Corporation, Yamaha Motor Corporation. |

SEGMENTAL ANALYSIS

By Product Insights

The conventional portable generators held the largest market share of 65.5% in the North America portable generator market in 2024. Their prominence is due to affordability and widespread use in emergency situations like power outages caused by extreme weather. The National Centers for Environmental Information reported 20 billion-dollar weather disasters in 2023, driving demand for cost-effective backup power solutions. Conventional generators are also popular in construction and outdoor activities, where budget-friendly options are prioritized. Their reliability and ease of maintenance make them a preferred choice for households and businesses, ensuring their continued importance in the market.

The inverter portable generator segment is projected to grow at the fastest CAGR of 9.8% from 2025 to 2033. This progress is driven by increasing consumer demand for quieter, fuel-efficient, and eco-friendly power solutions. Unlike conventional generators, inverters produce cleaner energy, making them ideal for sensitive electronics. Research from the Consumer Electronics Association states that over 70% of U.S. households own devices like laptops and smart TVs, which require stable power. Additionally, rising awareness of environmental concerns has pushed manufacturers to innovate. These factors position inverter generators as a key player in meeting modern energy needs while aligning with sustainability goals.

By Fuel & Power Rating Insights

The gasoline-powered portable generators accounted for the biggest market share of 60.2% in 2024. Their rule stems from low cost, extensive availability of gasoline, and suitability for small to medium power needs. Gasoline generators with a power rating of 2-5 kW are particularly popular, catering to households during power outages. The National Centers for Environmental Information noted that extreme weather caused over 20 billion-dollar disasters in 2023 is driving demand for reliable backup power. Also, their ease of use makes them ideal for outdoor activities like camping and tailgating. These factors ensure gasoline generators remain a critical solution for residential and recreational energy needs.

Hybrid portable generators are predicted to rise at the quickest CAGR of 11.5% in the future. This development is fueled by increasing consumer demand for eco-friendly and fuel-efficient power solutions. Hybrid models combine solar energy with traditional fuels, reducing emissions and operational costs. A report by the Solar Energy Industries Association shows that solar adoption in the U.S. grew by 33% in 2022 is reflecting a shift toward renewable energy. Furthermore, stricter emissions regulations, such as the EPA’s Tier 4 standards, encourage the adoption of cleaner technologies. These trends position hybrid generators as a key innovation in meeting sustainability goals while addressing power needs effectively.

By Phase Insights

In 2024, single-phase portable generators dominated the North America market with a share of 75.1% which is attributed to their suitability for residential and small-scale applications, where power demands are typically lower. Single-phase generators are widely used during power outages, which affected over 10 million households in the U.S. in 2023, according to the National Centers for Environmental Information. These generators are cost-effective, easy to operate, and ideal for powering household appliances and electronics. Their simplicity and affordability make them indispensable for emergency backup and recreational use, ensuring their continued dominance in the market.

Three-phase portable generators are forecasted to grow at the highest CAGR of 8.5% from 2025 to 2033 over the years. This expansion is supported by increasing industrial activities and the rising demand for high-power solutions in sectors like construction, mining, and manufacturing. As per the U.S. Bureau of Labor Statistics, the construction industry grew by 5% annually post-pandemic, requiring reliable power for heavy machinery and equipment. Three-phase generators are also gaining traction in rural electrification projects, supported by government initiatives. Their ability to deliver consistent and efficient power makes them vital for large-scale operations, positioning them as a key segment for future growth.

By End Use Insights

The residential segment accounted for the commanding market portion of 55.2% in the North America portable generator market in 2024. This dominance is propelled by frequent power outages caused by extreme weather events, with the National Centers for Environmental Information recording 20 billion-dollar disasters in 2023. Households rely on portable generators to power essential appliances like refrigerators and medical devices during emergencies. Further, the rise of remote work has increased demand, with Pew Research Center noting that 35% of Americans now work from home part-time. Affordable and easy-to-use generators make them indispensable for ensuring uninterrupted daily life.

The construction segment is estimated to grow at the swiftest rate of 9.2% in the future owing to a surge in infrastructure development and urbanization across North America. The construction industry grew by 5% annually post-pandemic, requiring reliable temporary power solutions for equipment and lighting on job sites. According to Natural Resources Canada, regions like Texas and Ontario are seeing significant investments in large-scale projects, boosting generator demand. Portable generators enable efficient operations in remote areas, making them critical for meeting energy needs in this expanding sector.

COUNTRY ANALYSIS

In 2024, the United States accounted for 85% of the North America portable generator market, according to data from the U.S. Department of Energy. This authority was backed by frequent power outages caused by extreme weather events, with the National Centers for Environmental Information reporting 25 separate billion-dollar disasters in 2023. The country’s vast geographic expanse and high reliance on electricity further solidified its leadership. Also, the growing popularity of outdoor activities and remote work fueled demand, making the U.S. a critical hub for innovation and adoption in the portable generator industry.

Canada is projected to grow at the fastest CAGR of 7.2% in the North America portable generator market. This growth will be fueled by increasing investments in renewable energy integration and rising awareness of emergency preparedness in rural areas. With over 20% of Canadians living in remote regions without reliable grid access, portable generators are becoming indispensable. The Canadian Climate Institute predicts a 20% rise in extreme weather events by 2030, further boosting demand. These factors highlight Canada’s potential to emerge as a key growth driver in the coming years.

Top 3 Players in This Market

Generac Holdings Inc.

Generac Holdings Inc. stands out as a key innovator in the North America portable generator market, offering a diverse range of products tailored to residential, commercial, and industrial needs. The company has built its reputation on providing reliable backup power solutions, particularly for households affected by frequent power outages caused by extreme weather events. Generac’s introduction of smart home integration features, such as mobile app controls for remote monitoring, reflects its commitment to meeting modern consumer demands. By investing heavily in research and development, Generac continues to lead with cutting-edge technologies like solar-powered generators, reinforcing its role as a pioneer in sustainable energy solutions.

Honda Power Equipment

Honda Power Equipment is widely recognized for its high-performance inverter generators, which have become a favorite among outdoor enthusiasts and homeowners seeking quiet, fuel-efficient power solutions. The company’s portable generators are celebrated for their durability, low noise levels, and ability to power sensitive electronics, making them ideal for recreational activities like camping and tailgating. Honda’s dedication to quality and innovation has enabled it to maintain a strong foothold in the North American market.

Cummins Inc.

Cummins Inc. is a prominent player in the North America portable generator market, specializing in heavy-duty and hybrid generator solutions designed for commercial and construction applications. The company’s portable generators are known for their robust performance and ability to deliver consistent power in demanding environments, such as large-scale construction sites and remote industrial operations. The company has also made significant strides in sustainability by integrating renewable energy sources into its hybrid generator models, reducing emissions and operational costs. Cummins’ focus on innovation and reliability has positioned it as a trusted provider of power solutions for critical industries, contributing significantly to the evolution of the portable generator market.

Top Strategies Used By The Key Market Participants

Customization for Niche Markets

Key players like Generac Holdings Inc. and Cummins Inc. have started tailoring their products to cater to niche markets, such as off-grid communities, remote mining operations, and disaster relief organizations. For instance, Generac has developed compact, lightweight generators specifically designed for outdoor enthusiasts who prioritize portability and ease of use during camping or RV trips. Similarly, Cummins has created heavy-duty portable generators with modular designs that can be easily transported to remote locations for emergency response teams.

Subscription-Based Service Models

A novel strategy gaining traction is the introduction of subscription-based or rental models for portable generators. Companies like Generac and smaller competitors are exploring partnerships with retailers and service providers to offer short-term rentals or pay-as-you-go plans. This approach is particularly appealing to consumers who need generators temporarily, such as during hurricane season or outdoor events. Additionally, this model allows manufacturers to collect valuable usage data, which can inform future product improvements and marketing strategies.

Focus on Education and Consumer Awareness Campaigns

To address gaps in consumer knowledge about safe generator usage, companies like Honda Power Equipment and Generac have launched extensive education and awareness campaigns. These initiatives focus on teaching consumers about proper ventilation, fuel storage, and maintenance practices to prevent accidents like carbon monoxide poisoning. Honda, for example, has partnered with local fire departments and safety organizations to distribute educational materials and host workshops. This proactive approach also aligns with regulatory requirements, further enhancing their credibility.

COMPETITIVE LANDSCAPE

The North America portable generator market is highly competitive, with several key players striving to gain an edge through innovation, quality, and customer focus. Companies like Generac Holdings Inc., Honda Power Equipment, and Cummins Inc. lead the market, each targeting different segments to meet diverse consumer needs. Generac focuses on residential customers by offering affordable, smart-enabled generators that integrate with home automation systems. Honda appeals to outdoor enthusiasts and homeowners with its quiet, fuel-efficient inverter models, while Cummins serves industrial clients with heavy-duty solutions for construction and remote operations.

Competition is driven by factors such as technological advancements, environmental regulations, and changing consumer preferences. For example, stricter emissions standards have pushed companies to develop eco-friendly models, like solar hybrids and low-emission generators. Additionally, the growing demand for backup power due to extreme weather events has intensified rivalry among manufacturers to provide reliable and cost-effective solutions.

To stay ahead, companies are adopting strategies like expanding distribution networks, launching educational campaigns, and exploring new business models such as rentals. Partnerships with local governments and disaster relief organizations also play a role in strengthening market presence. According to the U.S. Energy Information Administration, frequent power outages and rising energy needs further fuel this competition. Overall, the market’s dynamic nature ensures continuous innovation, benefiting consumers with better products and services while challenging manufacturers to adapt to evolving trends and demands.

KEY MARKET PLAYERS

A-iPower, Atlas Copco, Briggs & Stratton, Caterpillar, Champion Power Equipment, Cummins, Deere & Company, DuroMax Power Equipment, Energizer, FIRMAN Power Equipment, Generac Power Systems, Green Power America, Honda Motor, Kohler Co., Mitsubishi Heavy Industries, Powermate, Wacker Neuson, WEN Products, Westinghouse Electric Corporation, Yamaha Motor Corporation. are the market players that are dominating the North America portable generator market.

RECENT HAPPENINGS IN THIS MARKET

- In January 2025, Jackery, a portable power solutions provider, unveiled the XBC Curved Solar Tile at CES 2025. This solar tile, featuring a 25% conversion efficiency, integrates seamlessly into home designs and stores energy in the HomePower Energy System. The innovation received the TWICE Picks Award, recognizing Jackery’s commitment to clean energy solutions.

- In January 2025, The Portable Generator Manufacturers' Association (PGMA) introduced the ANSI/PGMA G300-2023 standard to enhance portable generator safety and performance. The revision includes updated carbon monoxide shutoff requirements and provisions for generators using natural gas, aiming to improve user safety.

- In February 2025, Nature’s Generator, a renewable energy solutions provider, announced its participation in the Intersolar & Energy Storage North America event. The company aims to showcase its latest advancements in renewable-powered portable generators to solar professionals and consumers.

- In January 2025, Bluetti, a portable energy storage company, introduced the Apex Series, including the AC300 modular energy storage system. The AC300 delivers a 3000W output and supports battery expansion up to 12,288Wh, designed for off-grid power and 24/7 home backup.

- In October 2024, Scout Motors, a subsidiary of Volkswagen, announced the Terra, an extended-range electric vehicle equipped with the Harvester™ Range Extender. This built-in gas-powered generator recharges the battery, offering an estimated range of 500 miles to enhance long-distance travel reliability.

MARKET SEGMENTATION

This research report on the North America portable generator market is segmented and sub-segmented into the following categories.

By Product

- Conventional Portable Generator

- Inverter Portable Generator

By Fuel & Power Rating

- Diesel

- 20 kW

- 20 - 50 kW

- > 50 - 100 kW

- Gasoline

- 2 kW

- 2 - 5 kW

- 6 - 8 kW

- > 8 - 15 kW

- Hybrid

By Phase

- Single Phase

- Three Phase

By End Use

- Residential

- Commercial

- Construction

By Country

- U.S

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

What factors are driving the demand for portable generators in North America?

Increasing power outages due to extreme weather, rising demand for backup power in residential and commercial sectors, and growth in outdoor recreational activities.

How do fuel types impact the portable generator market?

Gasoline, diesel, propane, and solar-powered generators cater to different needs, with propane and solar gaining popularity due to lower emissions and fuel efficiency.

Which industries rely heavily on portable generators in North America?

Construction, healthcare, residential backup power, outdoor events, and disaster recovery sectors significantly depend on portable generators.

What are the latest technological advancements in portable generators?

Smart generators with remote monitoring, inverter technology for fuel efficiency, and eco-friendly hybrid models are revolutionizing the market.

Who are the leading companies in the North America portable generator market?

Key players include Honda Power Equipment, Generac, Briggs & Stratton, Caterpillar, and Cummins, known for innovation and reliability in backup power solutions.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com