North America Plastic Compounding Market Size, Share, Trends & Growth Forecast Report By Source (Fossil-based, Bio-based, Recycled), Application, And Country (US, Canada, And Rest Of North America), Industry Analysis From 2025 To 2033

North America Plastic Compounding Market Size

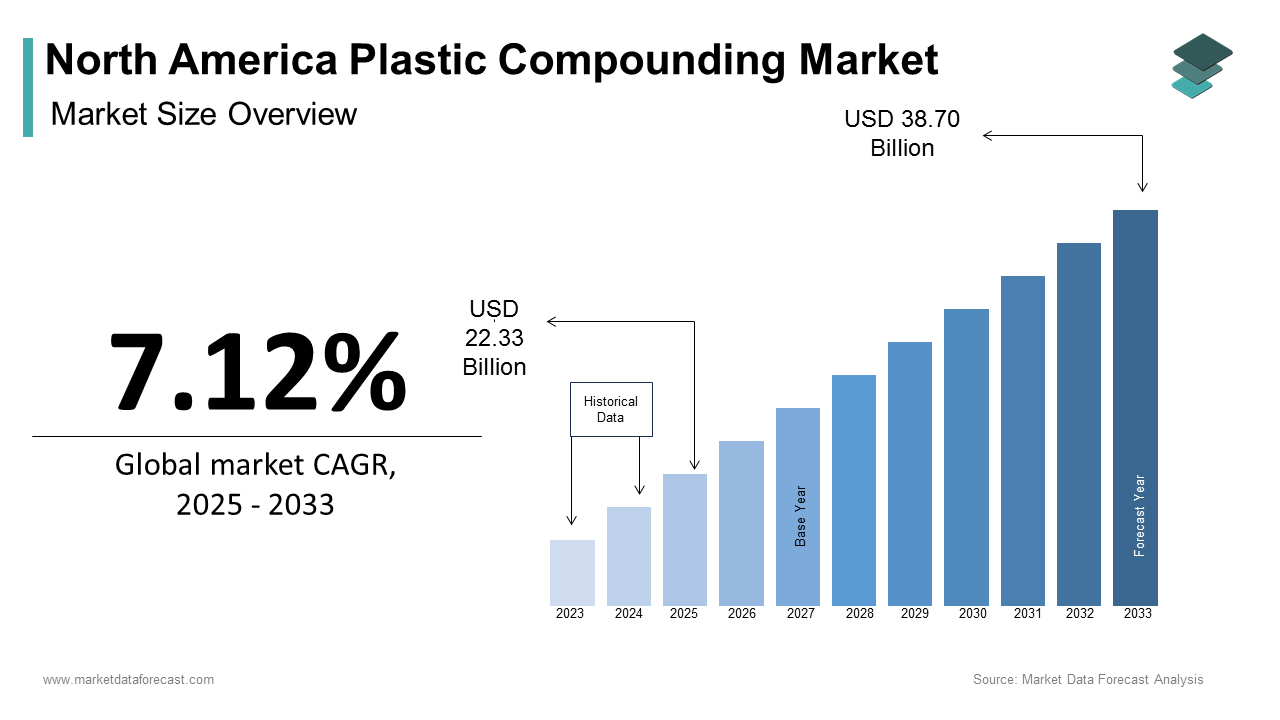

The North America plastic compounding market size was calculated to be USD 20.85 billion in 2024 and is anticipated to be worth USD 38.70 billion by 2033, from USD 22.33 billion in 2025, growing at a CAGR of 7.12% during the forecast period.

The North American plastic compounding market is a cornerstone of the region's manufacturing sector and is driven by its integral role in industries such as automotive, packaging, and consumer goods. Also, the U.S. dominates the regional landscape, accounting for a significant portion of the market share, due to its robust industrial base and technological advancements. On the other hand, Canada is witnessing steady growth fueled by investments in sustainable compounding solutions.

A key factor shaping the market is the rising demand for lightweight materials in the automotive sector, with plastics replacing metals to enhance fuel efficiency. According to the International Organization of Motor Vehicle Manufacturers, North America produced over 14 million vehicles in 2022, showcasing the importance of plastic compounds. Additionally, stringent environmental regulations are pushing manufacturers toward bio-based and recycled materials.

MARKET DRIVERS

Rising Demand for Lightweight Automotive Components

The automotive industry's shift toward lightweight materials is a pivotal driver of the plastic compounding market in North America. Like, reducing vehicle weight by around 10% can improve fuel efficiency by up to 6-8%, making plastic compounds indispensable for modern vehicle designs. This surge is attributed to the integration of engineering thermoplastics like polypropylene and polycarbonate, which offer superior strength-to-weight ratios compared to traditional materials. Furthermore, the rise of electric vehicles (EVs) has amplified this trend, with EV manufacturers prioritizing lightweight components to extend battery range. Similarly, EV sales in North America will grow considerably in the coming years, further boosting demand for advanced plastic compounds tailored for automotive applications.

Growing Adoption of Bio-Based Compounds

The increasing emphasis on sustainability is propelling the adoption of bio-based plastic compounds across North America. Consumer awareness and regulatory mandates are driving companies to adopt eco-friendly alternatives, particularly in packaging and consumer goods. For instance, California’s recent legislation, SB 54, mandates that 65% of single-use plastic packaging and foodware must be recycled or compostable by 2025, creating opportunities for bio-based compounds. Additionally, innovations in bioplastics, such as polylactic acid (PLA), have enhanced their performance characteristics, making them viable substitutes for fossil-based plastics. Also, bio-based products now account for eye-catching share of the U.S. manufacturing sector’s GDP, showing their growing economic significance.

MARKET RESTRAINTS

Volatility in Raw Material Prices

Fluctuations in the prices of raw materials, such as crude oil derivatives and natural gas, pose a significant challenge to the plastic compounding market in North America. Similarly, crude oil prices surged in the recent times due to geopolitical tensions and supply chain disruptions. Since fossil-based polymers constitute a major portion of compounded plastics, these price swings directly impact production costs and profit margins. For instance, polyethylene and polypropylene prices have also increased. Such volatility forces manufacturers to pass on additional costs to end-users, potentially stifling demand. Moreover, smaller players often struggle to absorb these price shocks, leading to consolidation within the industry. The unpredictability of raw material costs remains a persistent barrier to consistent growth in the plastic compounding sector.

Stringent Environmental Regulations

Stringent environmental regulations targeting plastic waste and emissions are increasingly constraining the plastic compounding market. Likewise, plastic waste accounts for over 80% of marine debris in North America, prompting governments to implement stricter policies. For example, Canada’s Single-Use Plastics Prohibition Regulations, effective from June 2022, ban the manufacture and import of certain plastic products, impacting demand for traditional compounded plastics. Similarly, California’s extended producer responsibility laws require manufacturers to manage the lifecycle of plastic products, adding compliance costs. While these measures aim to promote sustainability, they impose operational challenges and necessitate significant investments in R&D for alternative materials.

MARKET OPPORTUNITIES

Expansion of Recycled Plastic Applications

The growing emphasis on circular economy principles presents a lucrative opportunity for the plastic compounding market in North America. Also, the U.S. recycled over 6 billion pounds of plastics, yet only small percentage of total plastic waste was recycled. This gap shos immense potential for expanding recycled plastic applications. Innovations in mechanical and chemical recycling technologies are enabling the production of high-quality compounds suitable for diverse industries. For instance, Adidas announced in 2023 that it aims to use 100% recycled polyester in its products by 2025, creating a ripple effect across the supply chain. Furthermore, the Recycling Partnership estimates that investing substantial amount in recycling infrastructure could quadruple the current recycling rate by 2030.

Growth in Smart Packaging Solutions

The advent of smart packaging represents another promising avenue for the plastic compounding market. North America leads this trend, with retailers adopting features like QR codes, temperature sensors, and anti-counterfeiting tags embedded in plastic compounds. For example, Walmart partnered with Avery Dennison in 2023 to integrate RFID-enabled packaging for perishable goods, enhancing inventory management. Additionally, the rise of e-commerce has spurred demand for durable yet lightweight packaging solutions, benefiting the plastic compounding industry.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain disruptions remain a critical challenge for the plastic compounding market in North America, exacerbated by global events and logistical bottlenecks. Similarly, supply chain delays affected a significant number of U.S. manufacturers in 2022, with the plastics sector being particularly vulnerable. The reliance on imported raw materials such as resins and additives exposes the industry to geopolitical risks and transportation constraints. For instance, port congestion at major hubs like Los Angeles and Long Beach witnessed delayed shipments during peak periods. These disruptions not only inflate costs but also hinder timely product delivery, eroding customer trust. Smaller players, lacking the resources to diversify suppliers or invest in logistics optimization, face disproportionate impacts.

Public Perception of Plastics

Public perception of plastics as environmentally harmful continues to challenge the plastic compounding market. Also, a majority of Americans view plastic pollution as a major environmental issue, influencing purchasing decisions and policy advocacy. This sentiment fuels corporate commitments to reduce plastic usage, such as Coca-Cola’s pledge to collect and recycle the equivalent of every bottle it sells by 2030. However, such initiatives inadvertently suppress demand for compounded plastics, forcing manufacturers to innovate rapidly. Additionally, misinformation about the recyclability of certain plastics complicates efforts to promote sustainable alternatives.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.12% |

|

Segments Covered |

By Source, Application, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

Us, Canada, And Rest Of North America |

|

Market Leaders Profiled |

LyondellBasell Industries, BASF SE, Dow Inc., DuPont de Nemours Inc., SABIC, ExxonMobil Chemical, RTP Company, Celanese Corporation, Covestro AG, A. Schulman Inc. |

SEGMENTAL ANALYSIS

By Source Insights

The fossil-based compounds segment spearheaded the North American plastic compounding market by holding a market share of 65.7% in 2024. This dominance of the segment is credited to their extensive use in industries such as automotive, construction, and packaging, where cost-effectiveness and versatility are paramount. Also, fossil-based polymers like polyethylene and polypropylene are favored for their durability and ease of processing, making them ideal for mass production. The U.S., being a major hub for fossil fuel extraction, benefits from abundant raw material availability, reducing production costs. Furthermore, advancements in polymer science have enhanced the performance characteristics of fossil-based compounds, enabling their application in high-performance sectors like aerospace. According to the American Chemistry Council, the U.S. petrochemical industry invested over $200 billion in new projects between 2010 and 2022, bolstering the supply chain for fossil-based plastics. These factors collectively reinforce the segment’s leadership position.

The bio-based compounds segment is the fastest-growing in the North American plastic compounding market, with a projected CAGR of 12.3% from 2025 to 2033. This growth is fueled by increasing consumer demand for sustainable products and supportive government policies. For instance, the USDA’s BioPreferred Program mandates federal agencies to procure bio-based products, creating a stable market for bio-based compounds. Additionally, technological breakthroughs have improved the performance of bio-based plastics, making them competitive with fossil-based alternatives. Polylactic acid (PLA), derived from corn starch, is gaining traction due to its biodegradability and thermal stability. These developments underscore the segment’s potential to reshape the plastic compounding landscape.

By Application Insights

The automotive segment held the largest share of the North American plastic compounding market i.e. 40.5% of the total revenue in 2024. This leading position in the market is driven by the automotive industry’s reliance on plastic compounds for lightweighting, safety enhancements, and aesthetic appeal. For instance, Polypropylene widely used in interior trims and under-the-hood components due to its excellent chemical resistance and low density. The rise of electric vehicles (EVs) further amplifies demand, as manufacturers seek to reduce vehicle weight to maximize battery efficiency. Also, EV sales in North America grew by significantly in recent years, showing the segment’s growth trajectory. Additionally, regulatory mandates promoting fuel efficiency and emissions reduction incentivize automakers to adopt advanced plastic compounds.

The aerospace and defense segment is the rapidly expanding application in the North American plastic compounding market, with a CAGR of 9.8% during the forecast period. This progress is propelled by the increasing use of high-performance thermoplastics in aircraft interiors, structural components, and avionics. Polymers like PEEK (polyether ether ketone) are prized for their exceptional strength-to-weight ratio and resistance to extreme temperatures, making them ideal for aerospace applications. Furthermore, defense contractors are exploring lightweight composites to enhance military vehicle performance and survivability. In addition, the U.S. aerospace sector generated substantial revenues in 2022, exhibiting its contribution to the plastic compounding market’s expansion.

REGIONAL ANALYSIS

The United States is the cornerstone of the North American plastic compounding market by commanding 75.5% of the regional share in 2024. In addition, the country’s dominance is underpinned by a robust industrial ecosystem, technological innovation, and favorable trade policies that support manufacturing activities. The automotive sector, concentrated in states like Michigan, Ohio, and Indiana, drives significant demand for compounded plastics, particularly lightweight materials aimed at improving fuel efficiency and reducing emissions. Major automakers such as Ford, General Motors, and Tesla rely heavily on advanced plastic compounds to meet stringent regulatory standards and consumer expectations. Additionally, the U.S. benefits from its leadership in petrochemical production, with Texas alone accounting for considerable share of the nation’s petrochemical output, according to the American Chemistry Council. This abundant supply of raw materials ensures cost competitiveness and scalability for manufacturers. Investments in recycling infrastructure are also gaining momentum, with companies like Loop Industries collaborating with Suez to develop closed-loop recycling systems. Furthermore, government incentives for sustainable practices, such as tax credits for bio-based products, are encouraging manufacturers to innovate.

Canadian market is distinguished by its strong emphasis on sustainability and environmental stewardship. Like, the country has set ambitious targets to achieve zero plastic waste by 2030, fostering demand for recycled and bio-based plastic compounds. Ontario and Quebec serve as key manufacturing hubs, hosting facilities operated by multinational companies. These regions benefit from proximity to major automotive OEMs, including Toyota and Honda, which utilize compounded plastics for lightweighting and durability. Canada’s commitment to renewable energy further supports the development of bio-based plastics, as evidenced by BioAmber’s expansion of succinic acid production facilities, which provide feedstock for bioplastics. Additionally, trade agreements such as the USMCA enhance cross-border collaboration, positioning Canada as a vital link in the North American supply chain.

Mexico is moving ahead in this landscape by leveraging its strategic geographic location and competitive labor costs to attract investment. States like Nuevo León and Chihuahua host numerous compounding facilities catering to multinational OEMs such as Nissan, Volkswagen, and General Motors. These companies rely on compounded plastics for applications ranging from interior trims to structural components, benefiting from Mexico’s low-cost manufacturing capabilities. The Mexican government’s push for industrial modernization, outlined in the National Development Plan, further stimulates market growth by promoting technological adoption and infrastructure development. Besides, Mexico’s participation in trade agreements like the USMCA facilitates seamless integration into North American supply chains, ensuring steady demand for compounded plastics.

LEADING PLAYERS IN THE NORTH AMERICAN PLASTIC COMPOUNDING MARKET

LyondellBasell Industries

LyondellBasell is a global powerhouse in the plastic compounding market, contributing significantly to North America’s industrial landscape. The company specializes in producing high-performance polyolefins and engineered plastics, serving industries such as automotive, packaging, and consumer goods. Its proprietary Catalloy process enables the production of advanced compounds with superior impact resistance and flexibility, making them ideal for demanding applications.

BASF SE

BASF SE is another key player in the North American plastic compounding market, renowned for its innovative product portfolio and commitment to sustainability. These high-performance thermoplastics are widely used in automotive and electronics applications due to their excellent mechanical properties and thermal stability. BASF is investing heavily in circular economy initiatives, collaborating with partners like Quantafuel to advance chemical recycling technologies. Additionally, BASF’s focus on R&D ensures continuous innovation, enabling it to stay ahead in a competitive market.

SABIC

SABIC is a prominent player in the North American plastic compounding market, offering a diverse range of high-performance materials tailored to meet industry needs. Also, SABIC’s expertise in engineering thermoplastics positions it as a preferred supplier for aerospace, defense, and automotive applications. The company is also advancing its sustainability agenda. It’s TRUCIRCLE initiative promotes the use of certified circular polymers, reinforcing its commitment to environmental stewardship. In addition, SABIC’s recent expansion of its compounding plant in Ohio underscores its focus on enhancing production capacity and meeting growing demand for advanced materials.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players in the North American plastic compounding market employ a variety of strategies to maintain their competitive edge and capitalize on emerging opportunities. Mergers and acquisitions are a common tactic, allowing companies to expand their product portfolios and geographic reach.

Investments in research and development (R&D) are another critical strategy, with companies focusing on innovation to address evolving market demands. BASF’s ChemCycling project exemplifies this approach, as it seeks to convert plastic waste into valuable feedstock for new compounds. SABIC’s TRUCIRCLE initiative is another example, promoting the use of certified circular polymers to meet sustainability goals.

Collaborations and partnerships are also prevalent, enabling companies to leverage complementary strengths and accelerate growth. BASF collaborated with Quantafuel to advance chemical recycling technologies, while SABIC worked closely with OEMs to develop customized solutions for specific applications.

Expanding production capacity is another key strategy, with companies investing in new facilities to meet rising demand. SABIC’s recent expansion of its Ohio compounding plant highlights this trend, as does Dow Chemical’s introduction of a circular polymer platform aimed at recycling million metric tons of plastic waste annually by 2030. These strategies collectively enable companies to differentiate themselves, drive innovation, and strengthen their market positions.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players of the North America plastic compounding market include LyondellBasell Industries, BASF SE, Dow Inc., DuPont de Nemours Inc., SABIC, ExxonMobil Chemical, RTP Company, Celanese Corporation, Covestro AG, A. Schulman Inc.

The North American plastic compounding market is characterized by intense competition, driven by the presence of global giants, regional players, and niche innovators vying for market share. Companies like LyondellBasell, BASF, and SABIC dominate the landscape, leveraging their technological expertise, extensive distribution networks, and economies of scale to maintain leadership positions. These firms invest heavily in R&D to develop advanced materials that cater to evolving industry needs, such as lightweighting, electrification, and sustainability.

Smaller players, on the other hand, focus on specialized segments, such as bio-based and recycled compounds, to carve out a competitive edge. Their agility and ability to respond quickly to market trends allow them to capture niche opportunities that larger companies may overlook.

The market is witnessing increased consolidation, with mergers and acquisitions driving economies of scale and expanding product portfolios. Regulatory pressures and consumer demand for sustainable solutions are reshaping competitive dynamics, compelling companies to adopt circular economy principles and invest in recycling technologies. Innovation remains a key differentiator, with companies striving to develop cutting-edge materials that meet stringent performance and environmental standards.

Additionally, collaborations and partnerships are becoming more prevalent, enabling companies to pool resources and expertise to address complex challenges. For example, BASF’s collaboration with Quantafuel highlight the growing importance of joint ventures in driving innovation and achieving sustainability goals. These trends underscore the dynamic nature of the North American plastic compounding market, where competition is fierce but opportunities abound for those who can adapt and innovate.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, LyondellBasell partnered with Karo Recycling to establish a state-of-the-art mechanical recycling facility in Texas. This initiative aims to enhance the company’s recycled polymer offerings, aligning with its goal to produce 2 million metric tons of recycled and renewable-based polymers annually by 2030.

- In June 2023, BASF launched a new line of bio-based polyamides designed specifically for the automotive and electronics sectors. These materials are derived from renewable feedstocks and offer superior mechanical properties, addressing growing demand for sustainable alternatives.

- In August 2023, SABIC opened a new compounding plant in Ohio, expanding its production capacity for high-performance thermoplastics. This facility will cater to the aerospace, defense, and automotive industries, reinforcing SABIC’s position as a leader in advanced materials.

- In October 2023, Covestro acquired ResinTec, a leading provider of recycled plastic compounds. This acquisition strengthens Covestro’s portfolio of sustainable materials and enhances its ability to meet customer demand for eco-friendly solutions.

- In December 2023, Dow Chemical introduced a circular polymer platform aimed at recycling 1 million metric tons of plastic waste annually by 2030. This initiative underscores Dow’s commitment to sustainability and positions it as a frontrunner in the transition to a circular economy.

MARKET SEGMENTATION

This research report on the North American plastic compounding market has been segmented and sub-segmented based on source, application, and region.

By Source

- Fossil-based

- Bio-based

- Recycled

By Application

- Automotive

- Building & construction

- Electrical & electronics

- Packaging

- Consumer goods

- Industrial machinery

- Medical devices

- Optical media

- Aerospace & defense

- Others

By Region

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What factors are driving the market?

Major drivers include rising demand for customized plastics, sustainability initiatives, and increasing usage in electric vehicles and medical devices.

2. Who are the key players in the market?

Leading companies include LyondellBasell Industries, BASF SE, Dow Inc., DuPont de Nemours Inc., SABIC, and ExxonMobil Chemical.

3. How is the industry addressing sustainability?

The industry is focusing on bio-based and recycled compounds, along with efforts to reduce carbon footprints and improve recyclability.

4. Which factors are fueling the market’s growth?

Factors include the rising use of lightweight materials in automotive, growing demand for sustainable and recyclable plastics, and increased usage of plastics in packaging and electronics.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]