North America Pet Insurance Market Size, Share, Trends & Growth Forecast Report By Policy Type, Policy and Country (United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033.

North America Pet Insurance Market Size

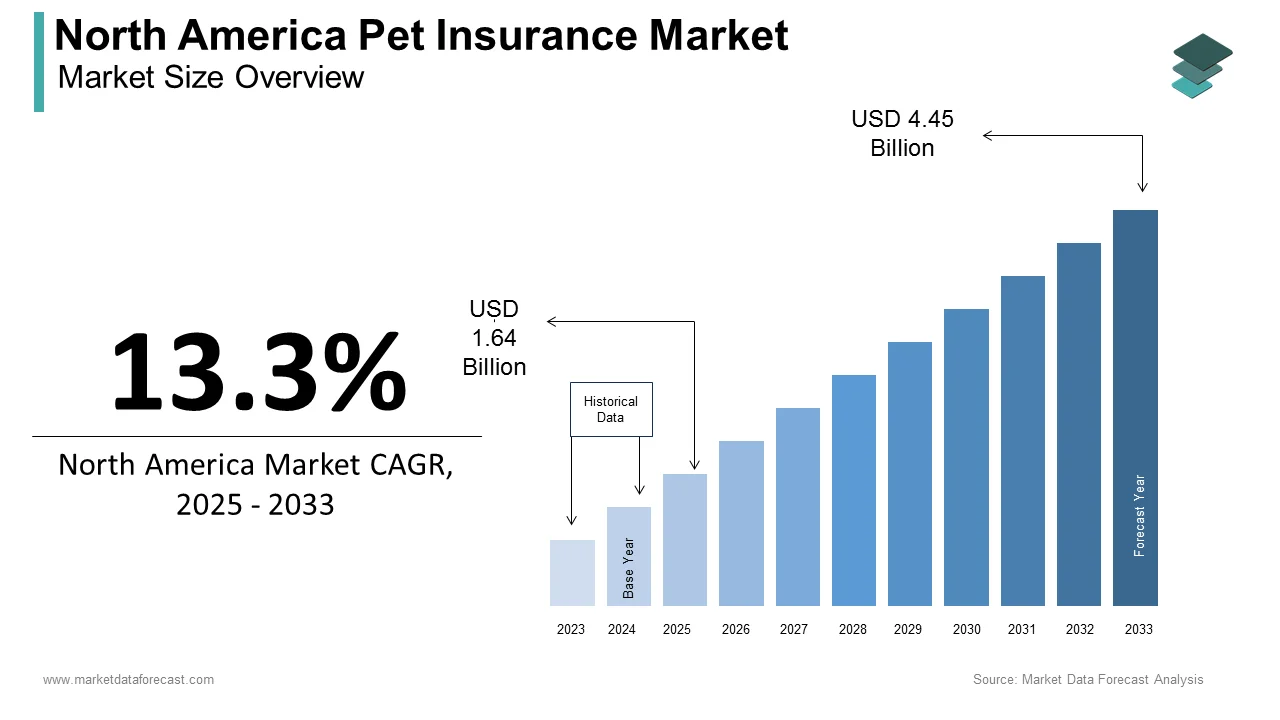

The size of the North American pet insurance market was valued at USD 1.45 billion in 2024. This market is expected to grow at a CAGR of 13.3% from 2025 to 2033 and be worth USD 4.45 billion by 2033 from USD 1.64 billion in 2025.

The pet insurance is a range of financial products designed to cover veterinary expenses for pets, including dogs, cats, and other domesticated animals. The demand for pet insurance has grown significantly, driven by the increasing awareness of the importance of pet health and the rising costs of veterinary care. Pet insurance provides pet owners with peace of mind by allowing them to make healthcare decisions based on their pets' needs rather than financial constraints. This growth is fueled by several factors, including the increasing number of pet owners and the rising costs of veterinary services, and the growing trend of pet humanization, where pets are treated as family members.

MARKET DRIVERS

Rising Veterinary Costs

The North American pet insurance market is significantly driven by the rising costs of veterinary care, which have increased substantially over the past decade. According to the American Pet Products Association, the average annual veterinary expense per pet has risen to approximately $500, with costs for specialized treatments and emergency care often exceeding $1,000. This trend has prompted pet owners to seek insurance solutions to mitigate the financial burden associated with unexpected veterinary expenses.

The demand for pet insurance is expected to grow. Pet owners are increasingly recognizing the value of having insurance coverage to help offset the costs of routine check-ups, vaccinations, and emergency procedures. Additionally, the growing prevalence of chronic health conditions in pets, such as obesity and diabetes that further drives the need for insurance as these conditions often require ongoing treatment and management. The demand for pet insurance solutions is anticipated to increase that is propelling the growth of the North American pet insurance market.

Increasing Pet Ownership and Humanization Trends

Another major driver of the North American pet insurance market is the increasing rates of pet ownership and the growing trend of pet humanization. As more households adopt pets, the demand for pet care products and services, including insurance, has surged. According to the American Pet Products Association, approximately 70% of U.S. households own a pet, translating to around 90 million homes. This significant pet population drives substantial spending on pet care, with total expenditures reaching over $100 billion in 2022.

The humanization of pets has led owners to invest more in their pets' health and well-being is treating them as family members. This shift in perception has resulted in a greater willingness to purchase pet insurance as a means of ensuring access to quality veterinary care. Pet owners are increasingly seeking comprehensive insurance plans that cover a wide range of services, including preventive care, dental treatments, and alternative therapies. The demand for pet insurance is expected to rise significantly that is driving the expansion of the North American pet insurance market.

MARKET RESTRAINTS

Limited Awareness and Understanding of Pet Insurance

One of the primary restraints affecting the North American pet insurance market is the limited awareness and understanding of pet insurance among pet owners. Despite the growing popularity of pet insurance, many pet owners remain unaware of the benefits and coverage options available to them. According to a survey conducted by the North American Pet Health Insurance Association, only about 30% of pet owners have pet insurance is indicating a significant gap in awareness.

This lack of understanding can lead to misconceptions about the cost and value of pet insurance, deterring potential customers from purchasing policies. Many pet owners may believe that insurance is too expensive or that their pets do not require coverage is leading to missed opportunities for financial protection against unexpected veterinary expenses. The industry stakeholders must focus on educating consumers about the importance of pet insurance and the various options available. The pet insurance market can expand its customer base and drive growth by increasing awareness.

MARKET OPPORTUNITIES

Expansion of Coverage Options and Customization

The North American pet insurance market presents significant opportunities for growth through the expansion of coverage options and customization of insurance plans. The insurers have the opportunity to develop innovative policies that cater to a diverse range of pets and health conditions. According to a report by the North American Pet Health Insurance Association, the demand for customizable insurance plans has been steadily increasing, with many pet owners expressing interest in policies that cover alternative therapies, preventive care, and wellness services.

The insurers can attract a broader customer base by offering a variety of coverage options, including accident-only plans, comprehensive plans, and add-ons for specific treatments. Additionally, the ability to customize policies allows pet owners to select coverage that aligns with their pets' unique health needs and lifestyles. As the trend towards personalized pet care continues to grow, the demand for flexible and customizable pet insurance solutions is expected to rise significantly by creating lucrative opportunities for market participants.

Growth of E-commerce and Digital Platforms

Another promising opportunity within the North American pet insurance market lies in the growth of e-commerce and digital platforms for purchasing insurance. The increasing adoption of online shopping and digital services has transformed the way consumers interact with pet insurance providers. E-commerce platforms enable pet owners to easily compare insurance options, read reviews, and purchase policies from the comfort of their homes. Additionally, the rise of mobile applications allows for seamless access to policy information, claims processing, and customer support. The demand for online pet insurance services is expected to grow significantly as pet owners increasingly embrace digital solutions. Insurers that invest in user-friendly digital platforms and enhance their online presence will be well-positioned to capitalize on this trend is driving growth in the North American pet insurance market.

MARKET CHALLENGES

Another significant challenge facing the North American pet insurance market is the regulatory landscape and market fragmentation. The pet insurance market is subject to varying regulations across different states and provinces, which can complicate the development and marketing of insurance products. According to a report by the National Association of Insurance Commissioners, the lack of uniformity in regulations can create challenges for insurers seeking to operate in multiple jurisdictions.

This regulatory complexity can lead to increased operational costs and legal risks for pet insurance providers, potentially hindering market growth. Additionally, the fragmented nature of the market, with numerous small and regional players, can make it difficult for consumers to navigate their options and find the best coverage for their needs. To address these challenges, industry stakeholders must advocate for clearer regulations and work towards standardizing practices across jurisdictions. The pet insurance market can enhance consumer confidence and drive growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product Type, Animal, Distribution Channel, and Region. |

|

Various Analysis Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, Mexico and Rest of North America |

|

Market Leader Profiled |

Trupanion, Inc., Jab Holding Company, Nationwide Mutual Insurance Company, Allianz, Fetch Pet Insurance, Spot Pet Insurance, MetLife, Inc., Odie Pet Insurance, Crum & Foster, ManyPets (EQT Group), Lemonade Inc., and Others. |

SEGMENT ANALYSIS

By Product Type Insights

The accident & Illness coverage segment helkd the dominant share of the North American pet insurance market in 2024. This dominance can be attributed to the comprehensive nature of this coverage, which protects pet owners against a wide range of veterinary expenses related to both accidents and illnesses. Accident & Illness policies typically cover a variety of veterinary services, including emergency care, surgeries, and diagnostic tests by providing pet owners with peace of mind when it comes to their pets' health. The rising costs of veterinary care, coupled with the growing number of pet owners seeking financial protection against unexpected expenses that further propels the demand for this type of coverage.

The accident only coverage segment is projected to experience a CAGR of 20.4% from 2025 to 2033. This growth is driven by the increasing demand for affordable and straightforward insurance options among pet owners. Accident Only policies provide coverage for unexpected injuries resulting from accidents by making them an attractive option for budget-conscious pet owners who may not require comprehensive illness coverage. The affordability of these plans allows pet owners to protect their pets without incurring high premiums, thereby expanding the potential customer base. The demand for Accident Only coverage is expected to grow significantly by positioning this segment for rapid expansion in the North American pet insurance market.

By Animal Insights

The dogs segment was the largest and held 65.4% share of the North American pet insurance market in 2024. This dominance can be attributed to the popularity of dogs as pets, with approximately 69 million households in the U.S. owning at least one dog, according to the American Pet Products Association. The dog care market encompasses a wide range of offerings, including food, grooming, training, and healthcare services. The growing trend of pet humanization has led to an increase in spending on premium dog products, such as organic food, specialized diets, and high-quality grooming services. Additionally, the rise of dog-related activities, such as training classes and dog parks, has further fueled the demand for dog care products and services. The demand for dog-related offerings is expected to remain strong as the focus on dog ownership continues to grow.

The cats segment is likely to witness a significant CAGR of 15.4% during the forecast period. This growth is driven by the increasing popularity of cats as pets, with approximately 42 million households in the U.S. owning at least one cat, according to the American Pet Products Association. The cat segment is expected to reach approximately $500 million by 2030 is reflecting the rising trend towards cat ownership and care. The growing awareness of cat health and wellness, coupled with the increasing availability of specialized cat products, is propelling the demand for cat care offerings. Pet owners are increasingly investing in high-quality cat food, litter, and healthcare services to ensure their feline companions lead healthy lives. Additionally, the rise of e-commerce has made it easier for consumers to access a wider variety of cat products.

By Distribution Channel Insights

The agency segment dominated the market and held 55.6% of the North American pet insurance market share in 2024. This dominance can be attributed to the traditional role of insurance agents in educating pet owners about the benefits of pet insurance and guiding them through the selection process. Insurance agencies provide valuable services, including personalized consultations and tailored policy recommendations, which help pet owners make informed decisions about their coverage options. The trust and rapport built between agents and clients can significantly influence purchasing behavior in a market where many consumers may be unfamiliar with pet insurance.

The broker segment is esteemed to register a CAGR of 18.6% from 2025 to 2033. This growth is driven by the increasing number of pet owners seeking independent advice and comparisons of various insurance products. Brokers play a crucial role in helping consumers navigate the complexities of pet insurance by providing access to multiple carriers and policy options. This allows pet owners to compare coverage, premiums, and benefits, ultimately leading to more tailored insurance solutions. The growing emphasis on transparency and consumer empowerment in the insurance industry is driving demand for broker services. The demand for this distribution channel is expected to grow significantly is positioning it for rapid expansion in the North American pet insurance market.

REGIONAL ANALYSIS

The United States pet insurance market was the top performer in the North America with an expected share of 70.5% in 2024. The robust demand for pet insurance solutions driven by high pet ownership rates and a growing trend of pet humanization are expected to fuel the growth of the market in the US. According to the American Pet Products Association, approximately 70% of U.S. households own a pet, which translates to around 90 million homes. This significant pet population drives substantial spending on pet care, with total expenditures reaching over $100 billion in 2022. The presence of major pet insurance providers and a well-established regulatory framework further contribute to the country's dominant position in the market. Additionally, the increasing focus on pet health and wellness, coupled with the rise of e-commerce is driving investments in innovative pet insurance solutions.

Canada is attributed to grow with an expected CAGR of 24.5% during the forecast period. The Canadian pet insurance market is influenced by the country's diverse pet ownership landscape, which includes a significant number of households with pets. According to Statistics Canada, approximately 41% of Canadian households own at least one pet is contributing to a growing demand for pet insurance products and services. The Canadian government has implemented various initiatives aimed at promoting responsible pet ownership and enhancing animal welfare, further driving the adoption of pet insurance solutions. Additionally, the increasing focus on premium pet products and services, such as organic food and specialized veterinary care is leading to increased investments in the Canadian pet insurance market. The emphasis on innovation and consumer education is expected to drive further growth in the Canadian pet insurance sector by positioning it as a key player in the North American market.

KEY MARKET PLAYERS

A few of the notable companies operating in the North American pet insurance market profiled in this report are Trupanion, Inc., Jab Holding Company, Nationwide Mutual Insurance Company, Allianz, Fetch Pet Insurance, Spot Pet Insurance, MetLife, Inc., Odie Pet Insurance, Crum & Foster, ManyPets (EQT Group), Lemonade Inc., and Others.

MARKET SEGMENTATION

This research report on the North American pet insurance market is segmented and sub-segmented into the following categories.

By Product Type

- Accident & Illness

- Accident only

- Others

By Animal

- Dogs

- Cats

- Others

By Distribution Channel

- Agency

- Broker

- Direct

- Bancassurance

- Others

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What is the size of the North America Pet Insurance Market?

The North America Pet Insurance Market was valued at USD 1.45 billion in 2024 and is projected to reach USD 4.45 billion by 2033.

2. What is the expected CAGR of the North America Pet Insurance Market?

The North America Pet Insurance Market is expected to grow at a CAGR of 13.3% from 2025 to 2033.

3. What factors are driving the North America Pet Insurance Market?

Increasing pet adoption, rising veterinary costs, growing awareness about pet insurance, and the availability of customized policies are key drivers of the North America Pet Insurance Market.

4. Which country holds the largest share in the North America Pet Insurance Market?

The United States dominates the North America Pet Insurance Market due to high pet adoption rates and increased spending on pet healthcare.

5. Which pet insurance policies are popular in the North America Pet Insurance Market?

The market includes policies for dogs, cats, horses, rabbits, and exotic pets, with lifetime and non-lifetime coverage options.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]