North America Pallet Market Size, Share, Trends & Growth Forecast Report By Type (Wood, Plastic, Metal, Corrugated Paper), Application, Structural Design, and Country (The United States, Canada and Rest of North America), Industry Analysis From 2024 to 2033

North American Pallet Market Size

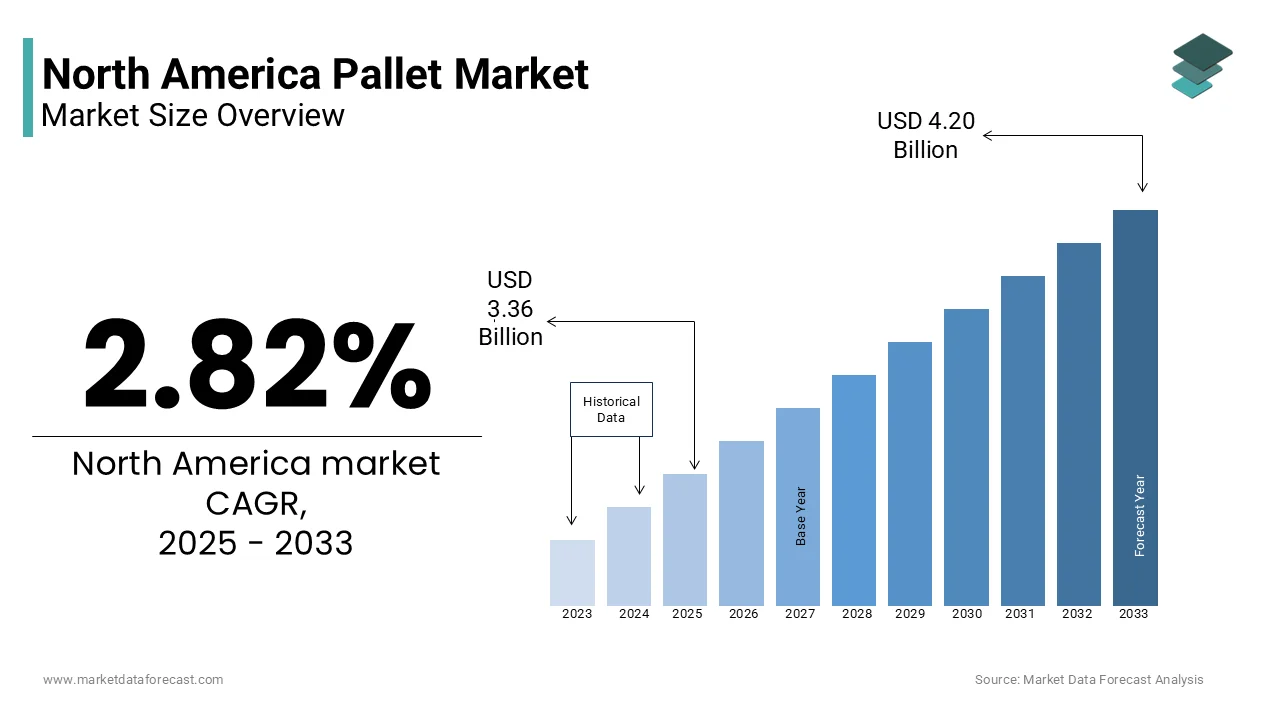

The Pallet market size in North America was valued at USD 3.27 billion in 2024 and is predicted to be worth USD 4.20 billion by 2033 from USD 3.36 billion in 2025 and grow at a CAGR of 2.82% from 2025 to 2033.

The North American pallet market is a vital segment of the logistics and supply chain industry, encompassing a diverse range of products designed to facilitate the storage and transportation of goods. Pallets serve as a foundational element in warehousing and distribution, providing a stable platform for stacking and moving products efficiently. The market includes various types of pallets, such as wood, plastic, metal, and corrugated paper, each catering to specific industry needs and applications. This growth is driven by several factors, including the expansion of e-commerce, increasing demand for sustainable packaging solutions, and the need for efficient supply chain management. The rise of automation in warehousing and logistics is also contributing to the demand for advanced pallet solutions that enhance operational efficiency. The market is expected to witness significant innovations in pallet design and materials that further enhances their functionality and sustainability in various applications.

MARKET DRIVERS

Growth of E-commerce and Retail

The North American pallet market is significantly driven by the rapid growth of e-commerce and retail sectors. As online shopping continues to gain traction, the demand for efficient logistics and supply chain solutions has surged. According to the U.S. Census Bureau, e-commerce sales in the United States reached approximately $870 billion in 2021 by reflecting a year-over-year increase of 14.2%. This growth has necessitated the use of pallets for the efficient storage and transportation of goods, as they provide a stable and standardized platform for handling products.

The increasing volume of goods being shipped directly to consumers has led to a greater reliance on pallets in distribution centers and warehouses. Additionally, the need for quick turnaround times and efficient inventory management has prompted retailers to invest in advanced pallet solutions that enhance operational efficiency. The trend towards automation in warehousing, including the use of automated guided vehicles (AGVs) and robotic systems will further amplifies the demand for pallets designed to accommodate these technologies.

Emphasis on Sustainability

Another major driver of the North American pallet market is the growing emphasis on sustainability and environmentally friendly practices. As consumers and businesses become increasingly aware of the environmental impact of packaging and transportation, there is a rising demand for sustainable pallet solutions. According to a survey conducted by the Sustainable Packaging Coalition, approximately 70% of consumers are willing to pay more for products packaged sustainably. This shift in consumer preferences is prompting companies to adopt eco-friendly materials and practices in their supply chains.

Wooden pallets, which are renewable and recyclable, continue to dominate the market; however, there is a notable increase in the adoption of alternative materials such as plastic and corrugated paper. These materials not only offer durability and reusability but also align with corporate sustainability goals. Additionally, companies are increasingly focusing on the lifecycle of pallets, seeking solutions that minimize waste and reduce carbon footprints. The North American pallet market is poised for growth with the rising demand for environmentally responsible packaging solutions.

MARKET RESTRAINTS

Fluctuating Raw Material Prices

One of the primary restraints affecting the North American pallet market is the fluctuating prices of raw materials used in pallet production. The cost of wood, plastic, and metal can vary significantly due to market conditions, supply chain disruptions, and geopolitical factors. According to the U.S. Bureau of Labor Statistics, the price of lumber experienced a dramatic increase of over 300% during the COVID-19 pandemic is impacting the cost of wooden pallets. Such volatility can lead to increased production costs for manufacturers, which may be passed on to consumers in the form of higher prices.

This fluctuation in raw material prices can deter companies from making long-term investments in pallet solutions, as they may be uncertain about future costs. Additionally, manufacturers may face challenges in maintaining competitive pricing while ensuring quality and sustainability. The reliance on specific materials also poses risks as any disruption in supply can lead to delays in production and delivery. Companies must adopt strategic sourcing practices and explore alternative materials that offer cost stability without compromising quality.

Competition from Alternative Solutions

The North American pallet market is also challenged by competition from alternative solutions that offer similar functionalities. For instance, companies are increasingly exploring the use of bulk containers, crates, and other forms of packaging that can reduce the need for traditional pallets. These alternative solutions often provide advantages such as enhanced durability, reduced weight, and improved space efficiency by making them attractive options for businesses seeking to optimize their logistics operations. Additionally, the rise of automation in warehousing and distribution has led to the development of specialized handling equipment that may not require traditional pallets. The competition from alternative packaging options may hinder the growth of the North American pallet market.

MARKET OPPORTUNITIES

Technological Advancements in Pallet Design

The North American pallet market presents significant opportunities for growth through technological advancements in pallet design and materials. Innovations such as smart pallets equipped with RFID technology and sensors are gaining traction, enabling real-time tracking and monitoring of goods throughout the supply chain. These smart pallets not only enhance inventory management but also improve supply chain transparency, allowing companies to optimize their operations and reduce costs. Additionally, advancements in materials science are leading to the development of lightweight and durable pallets that can withstand harsh conditions while minimizing environmental impact. The demand for innovative pallet solutions is expected to rise is creating lucrative opportunities for manufacturers in the North American pallet market.

Expansion of the Food and Beverage Sector

Another promising opportunity within the North American pallet market lies in the expansion of the food and beverage sector. The demand for efficient packaging and transportation solutions is increasing as consumer preferences shift towards convenience and ready-to-eat products. Pallets play a crucial role in the storage and transportation of food and beverage products, providing stability and protection during handling. The rising focus on food safety regulations and standards is further propelling the demand for high-quality pallets that meet industry requirements. Additionally, the trend towards sustainable packaging in the food and beverage sector is encouraging the adoption of eco-friendly pallet solutions. The North American pallet market is well-positioned to benefit from this growth as the food and beverage industry continues to expand by offering opportunities for manufacturers to innovate and cater to evolving consumer needs.

MARKET CHALLENGES

Supply Chain Disruptions

The North American pallet market faces significant challenges due to supply chain disruptions, which have been exacerbated by global events such as the COVID-19 pandemic. These disruptions have led to delays in the procurement of raw materials and components necessary for manufacturing pallets. Many manufacturers have experienced supply chain issues that have impacted their production schedules and delivery timelines. These delays can hinder the ability of companies to meet customer demands and regulatory requirements, ultimately affecting their competitiveness in the market. Additionally, rising costs of raw materials due to supply chain constraints can lead to increased prices for pallet products, further straining budgets for end-users. To mitigate these challenges, companies must adopt more resilient supply chain strategies, including diversifying suppliers and investing in local manufacturing capabilities.

Regulatory Compliance

The North American pallet market is also challenged by the need for compliance with various regulations and standards governing packaging and transportation. Different industries, particularly food and pharmaceuticals, are subject to stringent regulations regarding the materials and processes used in packaging. According to the Food and Drug Administration, compliance with food safety regulations is critical for ensuring the safety and quality of food products.

These regulatory requirements can impose additional costs and complexities for pallet manufacturers, as they must ensure that their products meet specific standards. Additionally, the evolving nature of regulations can create uncertainty for companies by making it challenging to keep up with compliance requirements. Manufacturers must navigate these challenges while also educating consumers about the benefits of compliance as the market shifts towards more stringent regulations. The pallet market can work towards achieving a balance between compliance and innovation by ensuring sustainable growth in the face of regulatory pressures.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

2.82% |

|

Segments Covered |

By Type, Application, Structural Design, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

The United States, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

Brambles Limited, Schoeller Allibert B.V., UFP Industries, Inc., Cabka Group GmbH, Rehrig Pacific Holding, Inc., Craemer Holding GmbH, Menasha Corporation, Loscam International Holdings Co., Ltd., Millwood, Inc., and Falkenhahn AG, and others |

SEGMENTAL INSIGHTS

By Type Insights

The wooden pallets segment was the largest and held 59.2% of the North America pallet market share in 2024. This dominance can be attributed to the widespread use of wooden pallets across various industries due to their durability, cost-effectiveness, and ease of repair. Wooden pallets are favored for their strength and ability to support heavy loads by making them ideal for industries such as food and beverage, chemicals, and manufacturing. Additionally, the renewable nature of wood and the ability to recycle or repurpose wooden pallets align with the growing emphasis on sustainability in supply chain practices. The wooden pallet segment is expected to maintain its leading position in the North American pallet market as companies increasingly prioritize eco-friendly solutions.

The plastic pallets segment is more likely to experience a CAGR of 7.3% from 2025 to 2033. This growth is primarily driven by the increasing demand for lightweight, durable, and hygienic pallet solutions in various applications. Plastic pallets offer several advantages over traditional wooden pallets, including resistance to moisture, chemicals, and pests by making them suitable for industries such as pharmaceuticals and food processing. Additionally, the growing focus on hygiene and cleanliness in supply chains in the wake of the COVID-19 pandemic that is propelling the adoption of plastic pallets. The plastic pallet segment is poised for significant growth in the coming years as industries continue to seek innovative and efficient solutions.

By Application Insights

The food and beverages segment dominated the North America pallet market by capturing 35.4% of the total share in 2024. This dominance is primarily due to the stringent requirements for packaging and transportation in the food industry, where safety and quality are paramount. Pallets play a crucial role in the storage and transportation of food products, providing stability and protection during handling. The rising focus on food safety regulations and standards is further propelling the demand for high-quality pallets that meet industry requirements. Additionally, the trend towards sustainable packaging in the food and beverage sector is encouraging the adoption of eco-friendly pallet solutions. The demand for effective pallet solutions is expected to remain strong is enhancing its position as the largest application segment in the North American pallet market.

The chemicals and pharmaceuticals segment is anticipated to achieve a significant CAGR of 8.4% from 2025 to 2033. This growth is driven by the increasing demand for safe and efficient packaging solutions in the chemical and pharmaceutical industries, where compliance with stringent regulations is critical. Pallets are essential in the transportation and storage of chemicals and pharmaceuticals, as they provide a stable platform that ensures the integrity of products during handling. The stringent regulations governing the storage and transportation of hazardous materials necessitate the use of high-quality pallets that can withstand various environmental conditions and prevent contamination. Additionally, the growing emphasis on sustainability within these industries is driving the adoption of eco-friendly pallet solutions, such as those made from recycled materials.

By Structural Design Insights

The block pallets segment was accounted in holding 50.2% of the North America pallet market share in 2024 due to the versatility and strength of block pallets, which are designed with blocks at each corner by allowing for entry from all four sides. Block pallets are favored for their ability to support heavy loads and withstand rigorous handling, making them ideal for automated systems and high-density storage. Their design also facilitates easy stacking and transportation, enhancing operational efficiency in warehouses and distribution centers. Additionally, the growing trend towards automation in logistics is further propelling the demand for block pallets, as they are compatible with automated guided vehicles (AGVs) and other material handling equipment.

The stringer pallets segment is swiftly emerging with a CAGR of 6.4% from 2025 to 2033. Stringer pallets are constructed with parallel stringers that provide support for the deckboards by allowing for entry from two sides. This design makes them a cost-effective option for many industries, particularly in the retail and consumer goods sectors. The growth of stringer pallets can be attributed to their lightweight nature and ease of handling, which make them suitable for various applications, including shipping and storage. Additionally, the increasing focus on sustainability is driving the adoption of stringer pallets made from recycled materials, appealing to environmentally conscious businesses.

REGIONAL ANALYSIS

The United States pallet market was the top performer with an estimated share of 75.6% in 2024. The U.S. market is characterized by a robust demand for pallets driven by the expansion of e-commerce, retail, and manufacturing sectors. The presence of major pallet manufacturers and a well-established distribution network further contribute to the country's dominant position in the market. Additionally, the growing emphasis on sustainability and compliance with environmental regulations is driving investments in innovative pallet solutions across various industries.

Canada pallet market is growing up with an esteemed CAGR of 6.7% during the forecast period. The Canadian pallet market is influenced by the country's diverse industrial landscape, which includes sectors such as food and beverage, chemicals, and manufacturing. According to Statistics Canada, the manufacturing sector is a significant contributor to the demand for pallets, as companies seek to optimize their logistics operations and ensure product safety. The Canadian government has implemented various initiatives aimed at promoting sustainability and reducing emissions, further driving the adoption of advanced pallet technologies. Additionally, the growing focus on health and safety standards in industrial operations is leading to increased investments in high-quality pallet solutions. The emphasis on environmental responsibility and product quality is expected to drive further growth in the Canadian pallet sector by positioning it as a key player in the North American market.

KEY MARKET PLAYERS

Brambles Limited, Schoeller Allibert B.V., UFP Industries, Inc., Cabka Group GmbH, Rehrig Pacific Holding, Inc., Craemer Holding GmbH, Menasha Corporation, Loscam International Holdings Co., Ltd., Millwood, Inc., and Falkenhahn AG are playing dominating role in the North America pallet market.

MARKET SEGMENTATION

This research report on the North America pallet market has been segmented and sub-segmented based on the following categories.

By Type

- Wood

- Plastic

- Metal

- Corrugated Paper

By Application

- Food and Beverages

- Chemicals and Pharmaceuticals

- Machinery and Metal

- Construction

- Others

By Structural Design

- Block

- Stringer

- Others

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

1. What is the expected growth rate (CAGR) for the North American Pallet market from 2025 to 2033?

The North American Pallet market is expected to grow at a CAGR of 2.82% during this period.

2. What factors are driving growth in the North American Pallet market?

Key drivers include the rising demand for efficient and sustainable packaging solutions, especially in e-commerce.

3. What challenges does the North American Pallet market face?

Supply chain disruptions and shortages of key materials such as wood and plastics have posed challenges to the market's growth.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]