North America Oxo Alcohol Market Research Report – Segmented By Type ( 2-ethylhexanol , iso-butanol ) and Country (The U.S., Canada and Rest of North America) - Industry Analysis, Size, Share, Growth, Trends, & Forecasts 2025 to 2033.

North America Oxo Alcohol Market Size

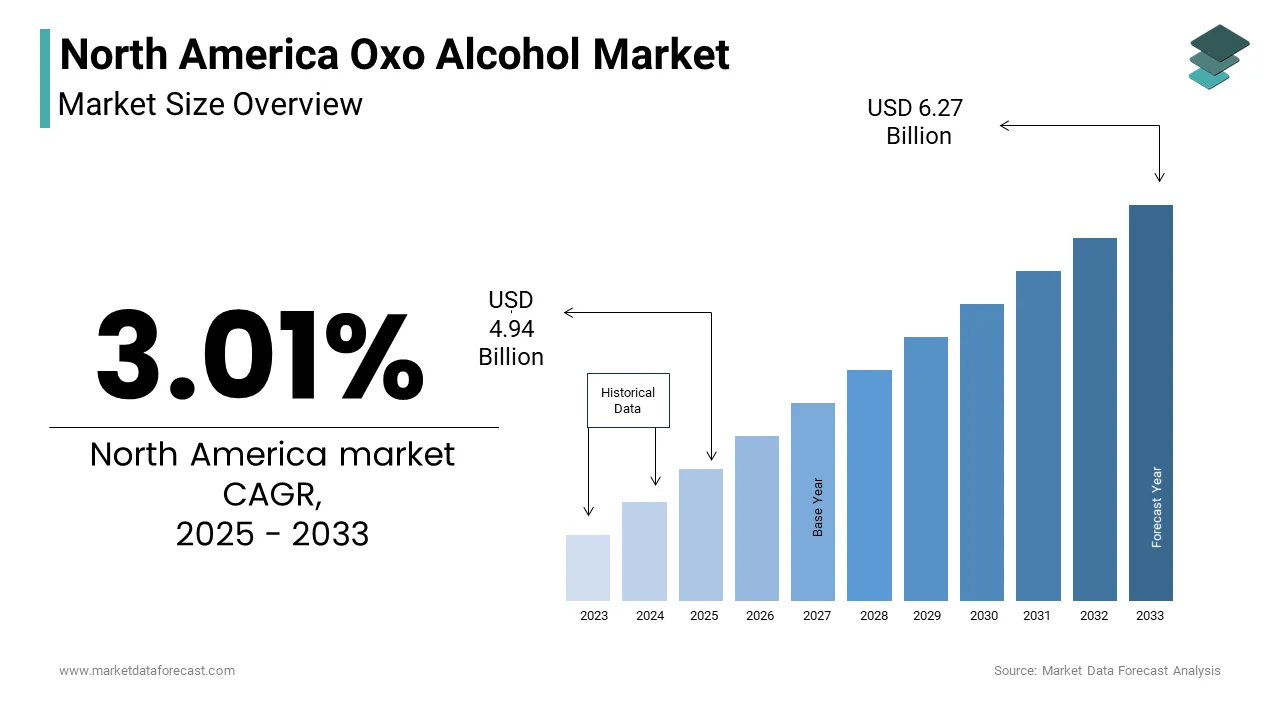

The North America Oxo Alcohol Market Size was valued at USD 4.8 billion in 2024. The North America Oxo Alcohol Market size is expected to have 3.01 % CAGR from 2025 to 2033 and be worth USD 6.27 billion by 2033 from USD 4.94 billion in 2025.

MARKET DRIVERS

Growth in Construction and Infrastructure Development

The construction and infrastructure sector serve as a primary driver for the North America oxo alcohol market. This, particularly 2-ethylhexanol, are widely used in the production of plasticizers, which enhance the flexibility and durability of PVC materials. The U.S. Department of Commerce notes that construction spending is driven by federal infrastructure initiatives such as the Bipartisan Infrastructure Law. Additionally, the rise in residential and commercial construction projects has amplified demand for PVC-based products like flooring, cables, and pipes. These factors collectively position the construction sector as a cornerstone of the market, ensuring sustained demand for oxo alcohols in the foreseeable future.

Expansion of Automotive and Paints & Coatings Industries

The automotive and paints & coatings industries represent another major driver for the North America oxo alcohol market. Like, the number of vehicle production in North America was substantial in 2022, creating substantial demand for oxo alcohol-based plasticizers and solvents. These chemicals are essential for manufacturing automotive interiors, coatings, and adhesives, ensuring durability and aesthetic appeal. Similarly, the paints & coatings sector relies heavily on n-butanol and iso-butanol as solvents for high-performance formulations. Furthermore, the shift toward lightweight vehicles and eco-friendly coatings has spurred innovations in oxo alcohol formulations, aligning with sustainability goals.

MARKET RESTRAINTS

Volatility in Feedstock Prices

Fluctuating feedstock prices pose a significant restraint to the North America oxo alcohol market. Propylene, a key raw material for oxo alcohol production, is subject to price volatility due to shifts in crude oil prices and geopolitical tensions. This volatility creates uncertainty for manufacturers, who face challenges in maintaining stable pricing for end-users. Furthermore, supply chain disruptions, exacerbated by events like the Russia-Ukraine conflict, have led to shortages of critical raw materials. Also, these disruptions increased production costs notably, forcing companies to either absorb losses or pass costs onto consumers. Such price instability not only hampers profitability but also discourages investment in large-scale production facilities, limiting market expansion.

Stringent Environmental Regulations

Stringent environmental regulations present another major restraint, particularly regarding oxo alcohol production and disposal. The U.S. Environmental Protection Agency (EPA) mandates strict emission controls for volatile organic compounds (VOCs), including oxo alcohols, which are classified as hazardous air pollutants. According to the EPA, industries must invest heavily in pollution control technologies to comply with these standards, increasing operational costs. Non-compliance can result in hefty penalties per violation. Besides, improper disposal of oxo alcohol waste poses risks to soil and water ecosystems, leading to stricter waste management protocols. In addition, VOC emissions contribute to smog formation, prompting tighter regulations. These regulatory hurdles not only strain manufacturers financially but also elongate production timelines, hindering the market's ability to respond swiftly to rising demand.

MARKET OPPORTUNITIES

Adoption of Bio-Based Oxo Alcohols

The growing demand for sustainable and eco-friendly solutions presents a lucrative opportunity for the North America oxo alcohol market. Bio-based oxo alcohols, derived from renewable resources such as plant oils and sugars, offer reduced carbon footprints and enhanced biodegradability compared to petroleum-based alternatives. The U.S. Department of Agriculture (USDA) highlights that bio-based chemicals can reduce greenhouse gas emissions significantly, aligning with corporate sustainability goals. Regulatory support further amplifies this trend; for example, the USDA BioPreferred Program incentivizes the use of renewable materials in industrial applications. With industries like automotive and construction prioritizing eco-conscious practices, the adoption of bio-based oxo alcohols is expected to surge.

Growth in Emerging Applications

Emerging applications, particularly in electronics and packaging industries, offer significant growth avenues for the North America oxo alcohol market. Oxo alcohols are widely used as solvents and intermediates in the formulation of high-performance adhesives and coatings. Similarly, the packaging sector relies on oxo alcohol derivatives for producing flexible and durable packaging materials. Like, e-commerce packaging demand will grow considerably through 2030, creating additional demand for oxo alcohol-based solutions. Furthermore, innovations in high-purity oxo alcohol formulations have expanded their application scope, enhancing their adoption in precision cleaning tasks.

MARKET CHALLENGES

Intense Market Competition

Intense market competition poses a formidable challenge, with numerous players vying for market share in a saturated landscape. Established players leverage economies of scale to offer competitive pricing, making it challenging for smaller firms to penetrate the market. Furthermore, rapid technological advancements necessitate continuous innovation, placing additional pressure on companies to differentiate their offerings. Similarly, marketing and branding efforts account for a key portion of operational expenses for mid-sized firms, further straining resources. Price wars and aggressive promotional strategies exacerbate the situation, eroding profit margins.

Supply Chain Disruptions

Supply chain disruptions represent another significant challenge, particularly in light of recent global events. The Russia-Ukraine conflict and ongoing trade tensions have disrupted the availability of propylene, a critical raw material for oxo alcohol production. Also, these disruptions caused a eye-catching reduction in propylene supply in past years, leading to production delays and increased costs. Additionally, logistical bottlenecks, such as port congestion and labor shortages, have further strained supply chains. In addition, supply chain disruptions can increase operational costs significantly, impacting profitability. For instance, the U.S. West Coast ports experienced a decline in throughput during peak months in 2022, delaying shipments of oxo alcohols and other chemicals. These challenges not only hinder production efficiency but also create uncertainty for manufacturers, making it difficult to meet rising demand consistently.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.01 % |

|

Segments Covered |

By Type and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

BASF Petronas, Dow Chemical Company, Evonik Industries, Exxon Mobil Corporation |

SEGMENTAL ANALYSIS

By Type Insights

The 2-ethylhexanol segment dominated the North America oxo alcohol market by holding a market share of approximately 50% in 2024. This dominance of the segment is attributed to its critical role in the production of phthalate plasticizers, which are integral to flexible PVC applications. The rise in construction and infrastructure development has significantly amplified demand for 2-ethylhexanol. Industries such as automotive, packaging, and paints & coatings rely heavily on 2-ethylhexanol derivatives for manufacturing durable and high-performance materials. Additionally, innovations in bio-based formulations have expanded its application scope is enhancing its adoption in eco-friendly products.

The iso-butanol segment is the fastest-growing type, with a projected CAGR of 7.2% through 2033. This growth is fueled by its versatility as a solvent and intermediate in various industries, including paints & coatings, adhesives, and electronics. The rise of the electronics industry has created substantial demand for iso-butanol in semiconductor manufacturing and precision cleaning tasks. Similarly, semiconductor exports grew notably in 2022, directly boosting demand for iso-butanol derivatives. Besides, the automotive sector’s shift toward lightweight vehicles has spurred the adoption of iso-butanol in coatings and adhesives, ensuring durability and aesthetic appeal. Innovations in bio-based formulations have further enhanced its appeal, aligning with sustainability trends.

COUNTRY LEVEL ANALYSIS

The United States led the North America oxo alcohol market by commanding a market share of 70.3% in 2024. This leading position is emphasized by the country’s robust construction and automotive industries, which rely heavily on oxo alcohols for various applications. Additionally, the rise in vehicle production has bolstered demand for oxo alcohol derivatives in automotive interiors, coatings, and adhesives. The presence of major manufacturers and suppliers ensures a highly competitive yet innovative environment, fostering continuous advancements in oxo alcohol formulations.

Canada is contributing considerably to the regional revenue. The country’s growing automotive and construction sectors create a substantial demand for oxo alcohols, particularly in the production of flexible PVC materials and coatings. Additionally, Canada’s commitment to reducing greenhouse gas emissions, outlined in its Net-Zero Emissions by 2050 plan, has spurred the adoption of bio-based oxo alcohols. The growing prevalence of oxo alcohols in industrial cleaning applications further amplifies demand, with the manufacturing sector accounting for a significant portion of energy consumption. These dynamics position Canada as a key player in the regional market, balancing industrial growth with sustainability objectives while maintaining steady contributions to the overall market.

The Rest of North America, comprising smaller economies like Mexico and the Caribbean nations, adds marginally to the market but shows potential for growth. Like, renewable energy projects in these regions are gaining momentum, supported by international funding. Apart from these, tourism-driven hygiene practices in the Caribbean create a steady demand for cleaning agents, which rely on oxo alcohols for effective disinfection.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the North America Oxo Alcohol Market are BASF Petronas, Dow Chemical Company, Evonik Industries, Exxon Mobil Corporation, The Perstorp Group, Eastman Chemical, LG Chem, OXEA GmbH, Arkema, and Bax Chemicals B.V.

The North America oxo alcohol market is characterized by intense competition, with established players and emerging entrants vying for dominance. The market’s competitive landscape is shaped by factors such as technological advancements, regulatory compliance, and sustainability trends. Key players like BASF SE, Dow Inc., and Royal Dutch Shell leverage their extensive R&D capabilities to introduce innovative products, setting high standards for performance and environmental safety. However, niche players focusing on bio-based and specialized oxo alcohol formulations are gaining traction, challenging traditional leaders. Price wars and aggressive marketing further intensify competition, particularly in price-sensitive industries like construction and automotive.

Top Players in the Market

The North America oxo alcohol market is dominated by key players such as BASF SE, Dow Inc., and Royal Dutch Shell, each contributing significantly to the global market. BASF SE, headquartered in Germany with operations in North America, specializes in high-purity oxo alcohol formulations, catering to industries like automotive and construction. Dow Inc., based in Michigan, focuses on bio-based oxo alcohols, aligning with sustainability trends. The company is driven by increasing demand for renewable energy applications. Royal Dutch Shell, a leader in petrochemicals, supplies oxo alcohols derived from propylene, ensuring a steady flow of raw materials.

Top Strategies Used by Key Players

Product innovation is central, with companies investing heavily in R&D to develop bio-based and high-purity oxo alcohol formulations. Also, strategic partnerships are another critical strategy, exemplified by Dow Inc.’s collaboration with renewable energy developers to enhance bio-based oxo alcohol production. Geographic expansion is also prominent, with Royal Dutch Shell establishing new manufacturing facilities in Mexico to cater to growing demand. Additionally, mergers and acquisitions are utilized to consolidate market share; for example, Chevron Phillips Chemical acquired a specialty chemicals manufacturer in 2021 to expand its portfolio. These strategies collectively enable companies to adapt to evolving market dynamics and maintain a competitive edge.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, BASF SE launched a new line of bio-based oxo alcohol formulations designed for automotive coatings, enhancing its sustainability portfolio.

- In June 2023, Dow Inc. partnered with a renewable energy developer to optimize bio-based oxo alcohol production, achieving a 12% cost reduction.

- In August 2023, Royal Dutch Shell opened a manufacturing facility in Monterrey, Mexico, to meet rising demand in Latin America and expand its regional footprint.

- In October 2023, Chevron Phillips Chemical acquired a specialty chemicals manufacturer, broadening its product range and strengthening its market position.

- In December 2023, ExxonMobil introduced a next-generation high-purity oxo alcohol with enhanced solvent properties, aiming to capture a larger share of the electronics market.

MARKET SEGMENTATION

This research report on the north america oxo alcohol market has been segmented and sub-segmented into the following.

By Type

- 2-Ethylhexanol

- Iso-Butanol

By Country

- The U.S.

- Canada

- Rest of North America.

Frequently Asked Questions

What are oxo alcohols and how are they used in North America?

Oxo alcohols are alcohols produced by the hydroformylation of olefins, followed by hydrogenation. In North America, they are primarily used in the manufacture of plasticizers, solvents, coatings, adhesives, and detergents.

What factors are driving the growth of the North American oxo alcohol market?

Key drivers include rising demand for plasticizers in PVC products, growth in the construction and automotive sectors, and increased use of oxo alcohol-based solvents in coatings and paints.

Which oxo alcohol types are most in demand in North America?

The most commonly used oxo alcohols are n-butanol, 2-ethylhexanol (2-EH), and isobutanol, with 2-EH seeing particularly high demand due to its use in plasticizer production.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]