North America OTR Tire Market Size, Share, Trends & Growth Forecast Report Segmented By Tire Size, Tire Type, Vehicle Type, And By Country (US, Canada, Mexico, and Brazil), Industry Analysis From 2025 to 2033

North America OTR Tire Market Size

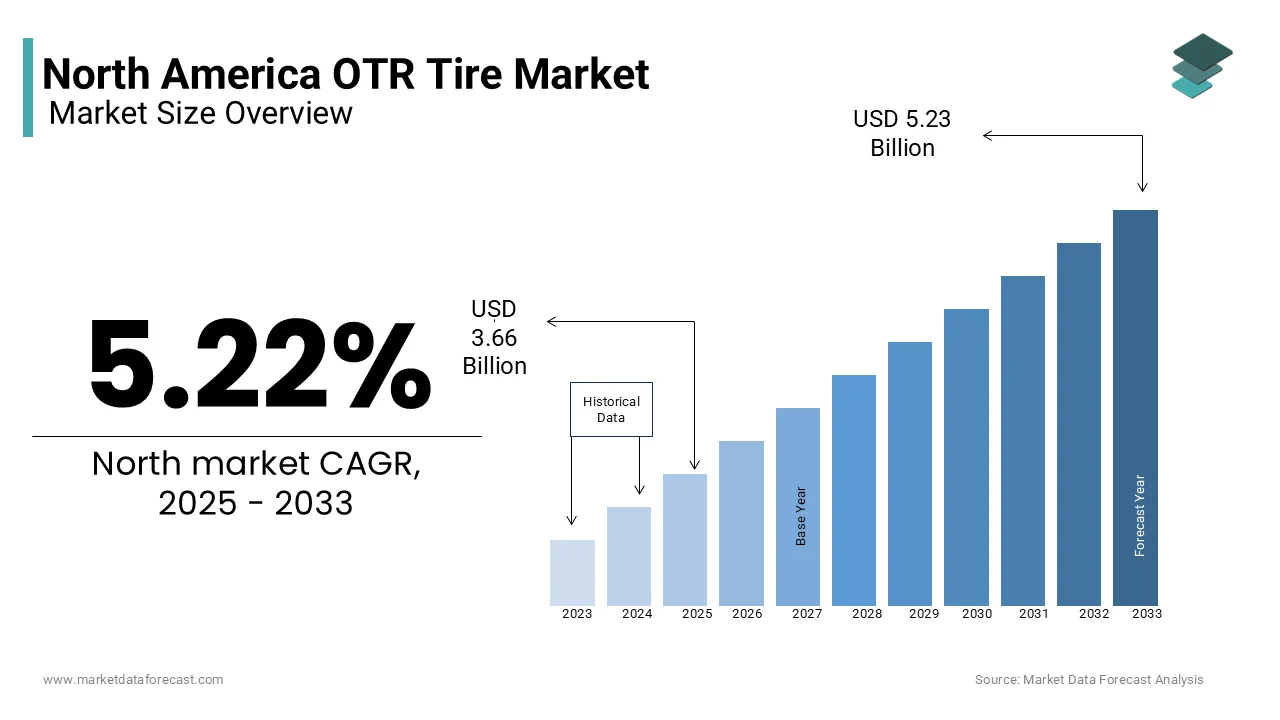

The North America OTR tire market size was valued at USD 3.48 billion in 2024 and is anticipated to reach USD 3.66 billion in 2025 from USD 5.23 billion by 2033, growing at a CAGR of 5.22% during the forecast period from 2025 to 2033.

The Off-The-Road (OTR) OTR tires are engineered to withstand the demanding conditions of rugged terrains, heavy loads, and extreme weather by making them essential for the efficient operation of heavy machinery and equipment. This growth is driven by several factors by including increasing investments in infrastructure development, the expansion of mining activities, and the rising demand for agricultural machinery. Additionally, advancements in tire technology, such as improved tread designs and materials, are enhancing the performance and durability of OTR tires. The North American OTR tire market is poised for significant growth with the growing innovation and the need for reliable tire solutions in challenging environments.

MARKET DRIVERS

Infrastructure Development and Construction Activities

The increasing investment in infrastructure development and construction activities is a primary driver of the North American OTR tire market. Governments and private entities are prioritizing infrastructure projects to enhance transportation networks, utilities, and public facilities. According to the American Society of Civil Engineers, the United States requires an estimated $4.5 trillion investment in infrastructure by 2025, which is expected to spur a wave of construction activities. This substantial funding is anticipated to drive demand for heavy machinery and equipment, which in turn increases the need for OTR tires designed to withstand the rigors of construction sites. The construction sector's reliance on heavy equipment, such as excavators, bulldozers, and loaders, necessitates durable and high-performance tires that can handle challenging terrains and heavy loads. The demand for OTR tires will continue to rise as public and private sectors collaborate to modernize aging infrastructure.

Growth in Mining Operations

Another significant driver of the North American OTR tire market is the growth in mining operations across the region. The demand for minerals and resources, including metals and aggregates, is on the rise due to increased industrial activity and urbanization. According to the U.S. Geological Survey, the value of non-fuel mineral production in the United States reached approximately $86 billion in 2020, reflecting a steady demand for mining activities. OTR tires are essential for mining vehicles, such as haul trucks and loaders, which operate in harsh environments and require tires that can endure extreme conditions. The expansion of mining operations necessitates the use of specialized OTR tires that provide enhanced traction, durability, and load-carrying capacity. The demand for high-quality OTR tires is expected to grow significantly as mining companies invest in expanding their operations and upgrading their fleets.

MARKET RESTRAINTS

High Initial Costs of OTR Tires

The North American OTR tire market faces notable restraints for concerning the high initial costs associated with purchasing OTR tires. The price of OTR tires can be substantial, with costs for specialized tires often ranging from several hundred to several thousand dollars by depending on the size and specifications. The average cost of a large OTR tire can exceed $1,500, which can be a significant investment for construction and mining companies. This financial barrier can deter some businesses for small and medium-sized enterprises, from investing in high-quality OTR tires by leading them to opt for lower-cost alternatives that may not provide the same level of performance and durability. Additionally, the ongoing maintenance and replacement costs associated with OTR tires can further complicate the financial feasibility for potential buyers. As a result, the high initial investment required for OTR tires represents a significant restraint that could hinder market growth, particularly among price-sensitive consumers who may prioritize immediate cost savings over long-term benefits.

Environmental Regulations and Sustainability Concerns

Another significant restraint impacting the North American OTR tire market is the increasing focus on environmental regulations and sustainability concerns. The tire manufacturing companies faces pressure to develop eco-friendly products and manufacturing processes as governments and organizations prioritize reducing carbon emissions and promoting sustainable practices. According to the Environmental Protection Agency, the transportation sector accounts for approximately 29% of total greenhouse gas emissions in the United States by prompting regulatory bodies to implement stricter emissions standards. OTR tire manufacturers must invest in research and development to create tires that meet these evolving regulations while also addressing sustainability concerns related to raw material sourcing and end-of-life disposal. The transition to more sustainable tire solutions may require significant investments in new technologies and processes, which can pose challenges for manufacturers and potentially increase production costs. This shift towards sustainability can create uncertainty in the market, as companies must navigate the complexities of compliance while maintaining profitability. Consequently, the pressure to adhere to environmental regulations and the growing emphasis on sustainability represent significant challenges for the North American OTR tire market is requiring manufacturers to innovate and adapt to meet the changing landscape of consumer expectations and regulatory requirements.

MARKET OPPORTUNITIES

Technological Advancements in Tire Design

The North American OTR tire market is poised to capitalize on technological advancements in tire design and manufacturing as a significant opportunity for growth. Innovations in materials, tread patterns, and manufacturing processes are enhancing the performance and durability of OTR tires, making them more suitable for demanding applications in construction, mining, and agriculture. The adoption of advanced materials, such as synthetic rubber and reinforced composites, can improve tire longevity and reduce the risk of punctures and failures. Additionally, the integration of smart technologies, such as tire pressure monitoring systems and predictive maintenance tools is enabling operators to optimize tire performance and extend service life. The demand for technologically advanced OTR tires is expected to rise significantly as companies increasingly seek to enhance operational efficiency and reduce downtime. This trend presents a substantial opportunity for manufacturers to innovate and develop cutting-edge tire solutions that meet the untapped needs in the marketplace.

Expansion of Renewable Energy Projects

Another promising opportunity for the North American OTR tire market lies in the expansion of renewable energy projects in the wind and solar sectors. There is a growing demand for heavy machinery and equipment to support the construction and maintenance of renewable energy infrastructure as the transition to sustainable energy sources accelerates. According to the U.S. Department of Energy, the capacity of installed wind power in the United States reached over 100 gigawatts in 2020, with projections for continued growth in the coming years. OTR tires are essential for the heavy equipment used in these projects, including cranes, excavators, and transport vehicles. The increasing focus on renewable energy and the need for efficient construction solutions present a significant opportunity for OTR tire manufacturers to supply high-quality tires that can withstand the rigors of renewable energy projects.

MARKET CHALLENGES

Supply Chain Disruptions

The North American OTR tire market faces significant challenges due to supply chain disruptions that have emerged in recent years. The COVID-19 pandemic has exposed vulnerabilities in global supply chains that is leading to delays in the procurement of critical components for tire manufacturing. Many manufacturers have experienced significant lead time increases for essential materials, such as rubber and steel, which are vital for OTR tire production. These disruptions not only affect production schedules but also escalate costs, as manufacturers may need to source materials from alternative suppliers at higher prices. Additionally, the semiconductor shortage has further complicated the supply chain for OTR tires for those used in advanced machinery that relies on electronic components. The ongoing supply chain challenges pose a significant hurdle for the North American OTR tire market with the strategic planning and risk management to mitigate their impact.

Fluctuating Raw Material Prices

Another formidable challenge facing the North American OTR tire market is the volatility of raw material prices. The prices of essential materials, such as natural rubber, synthetic rubber, and steel, can fluctuate significantly due to various factors, including global supply chain disruptions, geopolitical tensions, and changes in demand. The price of natural rubber has seen fluctuations of up to 25% in recent years by impacting the overall cost of manufacturing OTR tires. These price variations can create uncertainty for manufacturers by making it challenging to maintain consistent pricing for their products. Additionally, rising raw material costs can erode profit margins for smaller manufacturers that may lack the financial resources to absorb these increases. As a result, the volatility of raw material prices represents a significant challenge for the North American OTR tire market with the strategic planning and risk management to mitigate their impact.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.22% |

|

Segments Covered |

By Tire Size, Tire Type, Vehicle Type And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

United States, Canada, Mexico, Rest of North America |

|

Market Leaders Profiled |

Bridgestone Corporation, CMA, LLC, Continental AG, Cooper Tire & Rubber Company, Titan International, Inc., Michelin, Nokian Tyres plc, The Yokohama Rubber Co, Ltd., Toyo Tire Corporation, Trelleborg AB, Triangle Tyre Co., Ltd, Pirelli & C. S.p.A. |

SEGMENTAL ANALYSIS

By Tire Size Insights

The 24’’-30’’ tire size segment was the largest and held 35.4% of the North American OTR tire market share in 2024. This dominance can be attributed to the extensive use of these tire sizes in various applications, including construction and agricultural machinery. The ongoing demand for reliable and durable tires in these sectors is attributed in leveraging the growth of the market. The versatility of tires in this size range makes them suitable for a wide array of equipment, including compact loaders, backhoes, and small excavators. The dominance of the 24’’-30’’ tire segment is expected to persist with the technological advancements and the growing need for efficient construction and agricultural solutions.

The 51’’-55’’ tire segment is projected to exhibit a CAGR of 7.4% during the forecast period. This growth can be attributed to the increasing demand for larger tires in heavy machinery used in mining and large-scale construction projects. The need for high-performance tires that can withstand the rigors of demanding applications becomes paramount as companies invest in larger equipment to enhance productivity and efficiency. This segment is expected to capture a larger share of the market as more manufacturers seek to implement advanced tire solutions that enhance operational reliability in the next coming years. The growing emphasis on safety and performance further positions this segment for significant growth in the coming years.

By Tire Type Insights

The radial tires segment was the largest and held 60.4% of the North American OTR tire market share in 2024. This dominance is driven by the widespread adoption of radial tires in various applications, including construction, mining, and agricultural vehicles. Radial tires are favored for their superior performance, improved fuel efficiency, and enhanced durability compared to bias tires. The ongoing demand for high-quality tires that can withstand challenging operating conditions is ascribed to propel the growth of the market. The increasing focus on operational efficiency and the need for reliable tire solutions further contribute to the continued dominance of radial tires in the North American OTR tire market.

The bias tire segment is expected to achieve a dominant CAGR of 8.3% from 2025 to 2033. This growth can be attributed to the increasing demand for bias tires in specific applications where their design offers advantages, such as improved traction and stability on soft or uneven surfaces. The bias tire segment is expected to capture a larger share of the market as more companies recognize the benefits of using bias tires in certain operational contexts. The growing emphasis on cost-effective solutions and the need for specialized tire performance further position this segment for significant growth in the coming years.

By Vehicle Type Insights

The construction vehicles segment was the largest by capturing 45.3% of the North America OTR tire market share in 2024. This dominance is driven by the extensive use of heavy construction equipment, such as excavators, bulldozers, and loaders, which require durable and high-performance tires to operate effectively in demanding environments. The increasing focus on infrastructure development and urbanization further drives the demand for OTR tires in construction applications.

The mining vehicle segment is expected to grow with a projected CAGR of 7.4% in the next coming years. This growth can be attributed to the increasing demand for heavy machinery in mining operations with the rising need for minerals and resources. This segment is expected to capture a larger share of the market as more companies seek to implement advanced equipment that enhances productivity and safety in mining operations. The growing emphasis on sustainable mining practices and the need for efficient resource extraction further position this segment for significant growth in the coming years.

COUNTRY ANALYSIS

The United States led the North American OTR tire market share of 70.4% in 2024. The rising demand for OTR tires driven by significant investments in infrastructure development and urbanization. According to the American Society of Civil Engineers, the U.S. requires an estimated $4.5 trillion investment in infrastructure by 2025, which is expected to spur a wave of construction activities. Major manufacturers and suppliers are investing heavily in advanced tire technologies to meet the growing demand.

Canada OTR tire market is more likely to register a CAGR of 5.6% during the forecast period. The Canadian market is driven by similar factors as the U.S., including increasing government support for infrastructure projects and a growing focus on sustainable construction practices. According to Statistics Canada, the construction industry has been experiencing steady growth, with significant investments in residential and commercial projects. The Canadian government has implemented various initiatives aimed at promoting energy efficiency and sustainability, further supporting the growth of the OTR tire market.

KEY MARKET PLAYERS

Bridgestone Corporation, CMA, LLC, Continental AG, Cooper Tire & Rubber Company, Titan International, Inc., Michelin, Nokian Tyres plc, The Yokohama Rubber Co, Ltd., Toyo Tire Corporation, Trelleborg AB, Triangle Tyre Co., Ltd, Pirelli & C. S.p.A. are the market players that are dominating the North America OTR tires market.

MARKET SEGMENTATION

This research report on the North America OTR market is segmented and sub segmented into the following categories.

By Tire Size

- Top Tire Sizes in 24’’-30’’

- Top Tire Sizes in 31’’-35’’

- Top Tire Sizes in 36’’-39’’

- Top Tire Sizes in 40’’-50’’

- Top Tire Sizes in 51’’-55’’

- Top Tire Sizes in 56’’-63’’

By Tire Type

- Radial Tire

- Bias Tire

By Vehicle Type

- Mining Vehicles

- Construction & Industrial Vehicles

- Agricultural Vehicles

- Others

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

Why is the demand for OTR tires growing in North America?

The market is expanding due to increased construction, mining, and agricultural activities, along with advancements in tire technology for durability and efficiency.

What are the primary applications of OTR tires in the region?

These tires are widely used in construction & mining equipment, agricultural machinery, and industrial vehicles for off-road terrains.

Which factors influence OTR tire pricing in North America?

Raw material costs, supply chain disruptions, government regulations, and technological innovations play a significant role in pricing.

Which companies dominate the North American OTR tire market?

Leading players include Michelin, Bridgestone, Goodyear, Continental, and Yokohama, known for their advanced tire solutions.

How is sustainability impacting the OTR tire market?

Growing emphasis on eco-friendly materials, tire recycling programs, and fuel-efficient tire designs is shaping the future of OTR tires in North America.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]