North America Osteoporosis Treatment Market Size, Share, Trends & Growth Forecast Report By Drug Class (Bisphosphonate, Hormone Replacement Therapy, Selective Estrogen Receptor Modulator (SERMs), RANK Ligand (RANKL) Inhibitor, Others), Route of Administration (Oral, Parenteral), Distribution Channel (Hospitals Pharmacies, Retail Pharmacies & Stores, Online Pharmacies), and Country (United States, Canada, Mexico, Rest of North America) – Industry Analysis From 2025 to 2033.

North America Osteoporosis Treatment Market Size

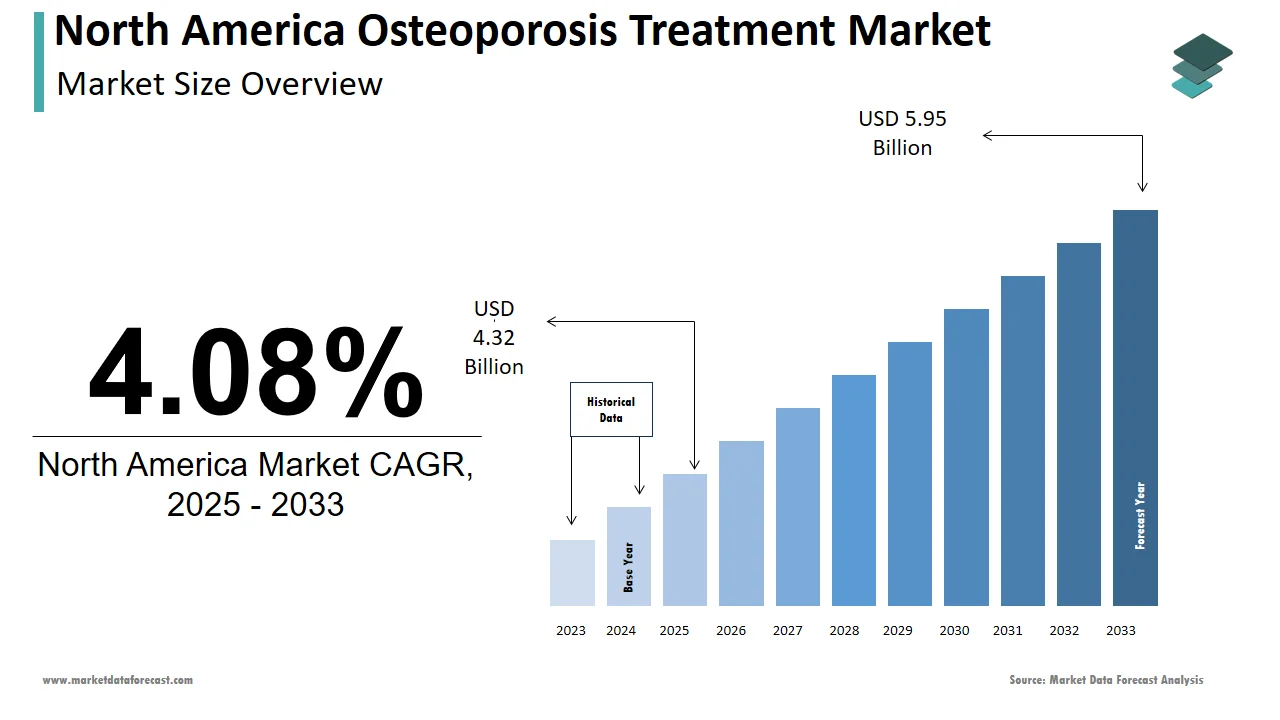

The size of the osteoporosis treatment market in North America was valued at USD 4.15 billion in 2024. This market is expected to grow at a CAGR of 4.08% from 2025 to 2033 and be worth USD 5.95 billion by 2033 from USD 4.32 billion in 2025.

The North America osteoporosis treatment market is a critical component of the region's healthcare landscape, driven by its role in addressing the growing prevalence of bone-related disorders. The National Osteoporosis Foundation (NOF) estimates that over 10 million Americans suffer from osteoporosis, with an additional 44 million at risk due to low bone density. Canada, with its publicly funded healthcare model, has seen steady adoption of treatments, supported by government initiatives to enhance preventive care. As per Deloitte, advancements in drug classes such as RANKL inhibitors and hormone replacement therapies have expanded their usability, catering to diverse patient needs. Furthermore, as per McKinsey, the integration of personalized medicine into osteoporosis care has improved treatment adherence is positioning the region as a leader in innovative therapeutic solutions.

MARKET DRIVERS

Rising Prevalence of Osteoporosis

The escalating incidence of osteoporosis is a primary driver propelling the North America osteoporosis treatment market forward. According to the National Osteoporosis Foundation (NOF), osteoporosis affects over 10 million Americans, with women accounting for approximately 80% of cases, particularly postmenopausal women. This demographic trend is compounded by the aging population, with the U.S. Census Bureau projecting that individuals aged 65 and above will constitute 22% of the population by 2030. Older adults are disproportionately affected by osteoporosis, amplifying the need for reliable treatment options. Furthermore, as per a study by the Centers for Disease Control and Prevention (CDC), over 2 million osteoporosis-related fractures occur annually in the U.S., underscoring the demand for effective therapies.

Technological Advancements in Drug Development

Technological advancements in drug development represent another significant driver shaping the North America osteoporosis treatment market. Innovations such as RANKL inhibitors and selective estrogen receptor modulators (SERMs) have revolutionized patient care, enhancing both efficacy and safety. According to a report by Frost & Sullivan, RANKL inhibitors reduce fracture risk by up to 70%, making them indispensable for severe cases. Additionally, as per a study by PwC, advancements in biologics manufacturing have enabled the development of targeted therapies, appealing to pharmaceutical companies. The growing emphasis on personalized medicine has further accelerated adoption, with over 60% of providers exploring biomarker-based treatments. These technological breakthroughs not only improve clinical outcomes but also expand the addressable market is driving widespread adoption across healthcare facilities.

MARKET RESTRAINTS

High Costs of Advanced Therapies

The substantial costs associated with advanced osteoporosis therapies pose a significant barrier to market growth, particularly for smaller healthcare providers. This financial burden often deters rural hospitals and clinics from prescribing these therapies is limiting access to cutting-edge treatments. Furthermore, as per a report by the Healthcare Financial Management Association (HFMA), ongoing monitoring and follow-up expenses can add an additional 15-20% to the total cost of treatment. These expenditures are particularly challenging for uninsured or underinsured patients, where affordability becomes a constant struggle. While larger institutions can absorb these costs, smaller entities face difficulties justifying the return on investment, especially in regions with limited patient volumes. This economic disparity creates a fragmented market landscape, hindering uniform adoption rates.

Stringent Regulatory Requirements

Stringent regulatory requirements governing the approval and usage of osteoporosis therapies present another major restraint impacting the market. The U.S. Food and Drug Administration (FDA) mandates rigorous testing and compliance with safety standards, which can delay product launches and increase development costs. According to a study by Ernst & Young, the average time required to bring a new osteoporosis drug to market is approximately 10-15 years is significantly longer than other therapeutic areas. Additionally, as per a report by Deloitte, manufacturers must adhere to evolving guidelines, such as those outlined in Good Manufacturing Practices (GMP), to ensure quality assurance. These regulatory hurdles often deter smaller companies from entering the market, consolidating dominance among established players. Furthermore, the complexity of navigating international standards, such as those set by Health Canada that adds another layer of difficulty for manufacturers seeking to expand their reach.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

The growing demand for osteoporosis treatments in emerging markets presents a transformative opportunity for the North America market. As per a study by Accenture, countries in Latin America and Asia-Pacific are witnessing a surge in osteoporosis cases due to urbanization and lifestyle changes, creating a strong demand for affordable therapies. For instance, Mexico and Brazil are projected to see a 20% increase in osteoporosis-related fractures by 2030, according to the International Osteoporosis Foundation (IOF). Additionally, as per a report by PwC, advancements in generic drug development have reduced production costs, enabling manufacturers to cater to price-sensitive markets. The growing emphasis on global health equity has further accelerated adoption, with over 60% of organizations exploring partnerships with local governments.

Integration with Digital Health Platforms

The integration of osteoporosis treatments with digital health platforms offers a lucrative opportunity for the North America market. Connected systems, equipped with AI-driven analytics and telehealth capabilities, enable seamless patient monitoring and adherence tracking. According to a report by Gartner, over 60% of healthcare providers plan to adopt digital health solutions by 2025 by creating a strong demand for interoperable platforms. These technologies facilitate early diagnosis and personalized treatment plans, reducing fracture risks by up to 40%. Additionally, as per a study by BCG, AI-driven platforms can analyze patient data to optimize dosing regimens is improving clinical outcomes. The shift towards value-based care models further amplifies the need for integrated systems that align financial incentives with patient outcomes.

MARKET CHALLENGES

Limited Awareness and Diagnosis Rates

Limited awareness and low diagnosis rates pose a significant challenge to the North America osteoporosis treatment market. According to a study by the American Bone Health Association (ABHA), over 60% of osteoporosis cases remain undiagnosed, particularly in rural areas where access to bone density screenings is limited. This issue is exacerbated by the asymptomatic nature of the disease, which delays patient intervention until fractures occur. Furthermore, as per a report by the Joint Commission, inadequate public education campaigns lead to a 30% increase in preventable fractures with the patient safety and healthcare efficiency. Academic institutions, in particular, face difficulties in raising awareness about preventive measures, further widening the gap in access to timely treatments. Addressing this challenge requires targeted initiatives and partnerships between healthcare providers and advocacy groups to promote early diagnosis and treatment.

Side Effects Associated with Long-Term Use

Side effects associated with long-term use of osteoporosis medications present another major challenge for the market. According to a study by the American Medical Association (AMA), prolonged use of bisphosphonates increases the risk of rare but serious complications, such as atypical femoral fractures and osteonecrosis of the jaw. These concerns have led to a decline in patient adherence, with over 50% discontinuing treatment within the first year, as per a report by the Centers for Disease control and Prevention. This trend is compounded by regulatory warnings, which require manufacturers to provide detailed risk disclosures. The complexity of managing side effects exacerbates the issue, particularly for elderly patients with comorbid conditions. These vulnerabilities not only compromise treatment efficacy but also hinder widespread adoption, impeding the realization of long-term financial gains.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Drug Class, Route of Administration, Distribution Channel, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, Mexico and Rest of North America. |

|

Market Leaders Profiled |

AbbVie Inc., Eli Lilly and Company, Amgen Inc., F. Hoffmann-La Roche Ltd, Novartis AG, Sanofi, Pfizer Inc., Merck & Co., Inc., GlaxoSmithKline plc, and others. |

SEGMENTAL ANALYSIS

By Drug Class Insights

The bisphosphonates segment was the largest by accounting for 45.3% of the North America osteoporosis treatment market share in 2024. The growth of the segment is driven by the widespread use in managing mild to moderate osteoporosis cases, where cost-effectiveness and proven efficacy are critical. According to the NOF, bisphosphonates reduce fracture risk by up to 50% is driving demand for reliable products. Furthermore, the advancements in formulation design, such as delayed-release tablets, have enhanced their appeal.

The RANKL inhibitors segment is deemed to have a significant CAGR of 12.5% from 2025 to 2033. The growth of the segment is fueled by their ability to target severe osteoporosis cases by making them ideal for high-risk populations. A study by Frost & Sullivan reveals that RANKL inhibitors reduce fracture risk by up to 70%, attracting widespread adoption. Additionally, as per a report by PwC, advancements in biologics manufacturing have expanded their usability, enabling faster identification of therapeutic targets. The growing emphasis on personalized medicine has further accelerated adoption, with over 70% of pharmaceutical companies exploring RANKL inhibitors.

By Route of Administration Insights

The oral administration segment dominated the North America osteoporosis treatment market with a share of 60.1% in 2024 with its convenience and ease of use among elderly patients who prioritize simplicity in their treatment regimens. According to the Center for Disease Control and Prevention, oral medications account for over 70% of prescribed osteoporosis therapies with their importance in clinical practice. Furthermore, as per a study by Deloitte, advancements in formulation design, such as chewable tablets and liquid suspensions, have enhanced their appeal. Retail pharmacies are increasingly stocking these products to meet patient preferences is reinforcing their prominence as the largest segment.

The parenteral administration segment is likely to register a CAGR of 11.8% from 2025 to 2033 owing to the increasing demand for long-acting therapies, which require fewer doses and improve adherence. According to a study by Frost & Sullivan, parenteral medications reduce dosing frequency by up to 50% by making them particularly appealing for severe osteoporosis cases. Additionally, as per a report by PwC, advancements in injection devices have expanded their usability, enabling easier self-administration. The growing emphasis on patient-centric care has further accelerated adoption, with over 60% of providers exploring parenteral options.

By Distribution Channel Insights

The retail pharmacies & stores segment was the largest by occupying 55.4% of the North America osteoporosis treatment market share in 2024. The growth is due to their widespread accessibility and convenience for elderly patients who prefer local procurement. According to a study by the American Pharmacists Association (APhA), over 60% of osteoporosis medications are dispensed through retail pharmacies, driving demand for reliable supply chains. The advancements in inventory management systems have enhanced their appeal, ensuring consistent availability of therapies. Retail pharmacies are increasingly investing in these systems to ensure compliance with regulatory standards and improve patient satisfaction is reinforcing their prominence as the largest segment.

The hospital pharmacies segment is anticipated to register a CAGR of 10.5% from 2025 to 2033. This growth is fueled by the increasing demand for specialized therapies, which require hospital-based administration and monitoring. A study by Frost & Sullivan reveals that hospital pharmacies reduce medication errors by 30% by making them particularly appealing for high-risk patients. Additionally, as per a report by PwC, advancements in electronic health records (EHR) have expanded their usability, enabling seamless integration with clinical workflows. The growing emphasis on precision medicine has further accelerated adoption, with over 70% of hospitals exploring hospital pharmacy solutions. These dynamics position hospital pharmacies as the fastest-growing segment in the market.

COUNTRY LEVEL ANALYSIS

The U.S. led the North America osteoporosis treatment market with an estimated share of 85.4% in 2024. The growth of the market in this country is attributed to the advanced healthcare system and high prevalence of osteoporosis among the aging population. Osteoporosis accounts for over 2 million fractures annually, which is driving demand for effective therapies. The aging population, projected to reach 22% by 2030, further amplifies this need. Investments in personalized medicine and digital health platforms are gaining traction, with over 60% of hospitals adopting these technologies. These innovations enhance patient safety and operational efficiency that is likely to fuel the growth of the market in the US.

Canada is likely to witness a fastest CAGR of 12.5% during the forecast period with the growing government support through funds in healthcare system. Government initiatives to enhance preventive care have spurred adoption, with over 50% of hospitals upgrading their treatment protocols. According to a study by Frost & Sullivan, parenteral therapies are gaining popularity, driven by their efficacy and scalability. These trends indicate steady growth potential in the Canadian market.

KEY MARKET PLAYERS

A few of the notable companies operating in the North America osteoporosis treatment market profiled in this report are AbbVie Inc., Eli Lilly and Company, Amgen Inc., F. Hoffmann-La Roche Ltd, Novartis AG, Sanofi, Pfizer Inc., Merck & Co., Inc., GlaxoSmithKline plc, and others.

TOP LEADING PLAYERS IN THE MARKET

Amgen Inc.

Amgen Inc. is a prominent player in the North America osteoporosis treatment market, renowned for its innovative and reliable products tailored to diverse patient needs. The company’s strengths lie in its ability to deliver cutting-edge therapies, such as RANKL inhibitors, which enhance treatment efficacy and safety. Amgen’s commitment to innovation is evident in its strategic partnerships with research institutions to develop next-generation osteoporosis drugs.

Eli Lilly and Company

Eli Lilly and Company is a key contributor to the North America osteoporosis treatment market, offering a comprehensive range of products tailored to the needs of hospitals and retail pharmacies. The company’s strengths include its scalable solutions and robust customer support services. Eli Lilly’s focus on interoperability ensures seamless integration with existing healthcare IT systems, enhancing operational efficiency.

Novartis AG

Novartis AG is a leading player in the North America osteoporosis treatment market, known for its user-friendly platforms and advanced service offerings. The company’s strengths lie in its ability to deliver customizable solutions that cater to the unique needs of healthcare providers. Novartis’ emphasis on patient-centric care has resulted in the development of therapies that prioritize convenience and compliance. Its strategic collaborations with digital health providers have expanded its reach by enabling it to address the growing demand for remote monitoring solutions.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players in the North America osteoporosis treatment market employ several strategies to maintain their competitive edge. Strategic acquisitions are a common approach, allowing companies to expand their product portfolios and enter new markets. Partnerships with technology firms, particularly those specializing in AI and IoT, are also prevalent, enabling the development of advanced therapies. Additionally, investments in research and development drive innovation, ensuring compliance with evolving regulatory standards. Companies also focus on enhancing customer engagement through training programs and support services.

COMPETITION OVERVIEW

The North America osteoporosis treatment market is characterized by intense competition, with numerous players vying for market share. Established companies leverage their extensive networks and technological expertise to maintain dominance, while emerging players focus on niche markets to differentiate themselves. The market is witnessing a wave of consolidation, with mergers and acquisitions becoming increasingly common. Additionally, the growing emphasis on digital transformation has intensified competition, as companies strive to offer innovative solutions that meet the evolving needs of healthcare providers.

TOP 5 MAJOR ACTIONS TAKEN BY COMPANIES

- In April 2024, Amgen Inc. launched a new RANKL inhibitor therapy by enhancing fracture prevention capabilities and improving patient outcomes.

- In June 2023, Eli Lilly and Company partnered with a telehealth provider to integrate remote monitoring features into its treatment protocols by expanding its service offerings.

- In January 2024, Novartis AG introduced a long-acting injectable therapy designed for hospital pharmacies by addressing the growing demand for convenience and adherence.

- In September 2023, Pfizer acquired a startup specializing in osteoporosis biologics, strengthening its position in the precision medicine segment.

- In November 2023, Merck collaborated with a research institution to develop next-generation osteoporosis therapies by focusing on energy efficiency and sustainability.

MARKET SEGMENTATION

This research report on the North America osteoporosis treatment market is segmented and sub-segmented into the following categories.

By Drug Class

- Bisphosphonate

- Hormone Replacement Therapy

- Selective Estrogen Receptor Modulator (SERMs)

- RANK ligand (RANKL) Inhibitor

- Others

By Route of Administration

- Oral

- Parenteral

By Distribution Channel

- Hospitals Pharmacies

- Retail Pharmacies & Stores

- Online Pharmacies

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What is the projected growth of the North America osteoporosis treatment market from 2025 to 2033?

The North America osteoporosis treatment market is expected to grow at a compound annual growth rate (CAGR) of 4.08%, increasing from USD 4.32 billion in 2025 to USD 5.95 billion by 2033.

2. What are the key drivers of growth in the North America osteoporosis treatment market?

Growth is driven by the aging population, advancements in drug classes such as RANKL inhibitors and SERMs, and the integration of personalized medicine into osteoporosis care, which improves treatment adherence and clinical outcomes.

3. Which segments dominate the North America osteoporosis treatment market?

The bisphosphonates segment accounted for 45.3% of the market share in 2024, while RANKL inhibitors are projected to grow at a significant CAGR of 12.5% from 2025 to 2033.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com