North America Orthopedic Devices Market Research Report - Segmented By Anatomical Location (Knee , Shoulder), Type Of Consumable ( Orthopedic Staples , Orthopedic Suture Anchors ), Country (United States, Canada and Rest of North America) - Industry Analysis on Size, Share, Trends & Growth Forecast (2025 to 2033)

North America Orthopedic Devices Market Size

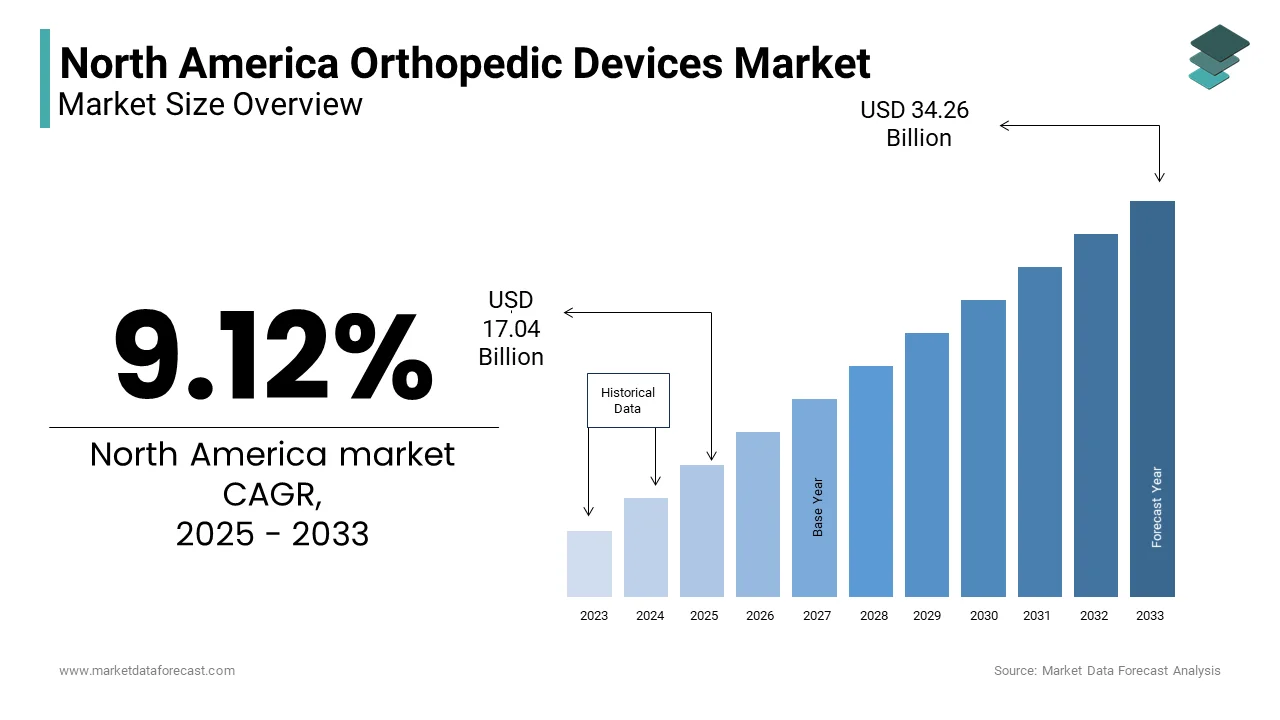

The North American orthopedic devices market was valued at USD 15.62 billion in 2024. The North American cardiac assist devices market is expected to have a 9.12 % CAGR from 2024 to 2033 and be worth USD 34.26 billion by 2033 from USD 17.04 billion in 2025.

Orthopedic devices is a wide array of products, including joint replacement implants, spinal devices, fracture repair equipment, orthobiologics, and arthroscopic instruments. These devices are integral in treating conditions such as osteoarthritis, fractures, spinal deformities, and sports injuries, which are increasingly prevalent due to aging populations and rising incidences of lifestyle-related ailments. The market is driven by advancements in material sciences, minimally invasive surgical techniques, and the growing emphasis on enhancing patient outcomes through innovative solutions.

In recent years, the demand for orthopedic interventions has surged, partly fueled by demographic shifts. According to the U.S. Census Bureau, individuals aged 65 and above accounted for over 16% of the American population in 2022 is a figure projected to rise significantly in the coming decades. This demographic trend correlates with higher incidences of degenerative bone diseases that is amplifying the need for orthopedic care. According to the National Center for Health Statistics, approximately 54 million adults in the United States suffer from arthritis with the widespread prevalence of conditions requiring orthopedic attention. Furthermore, the increasing participation in sports and physical activities has contributed to a rise in musculoskeletal injuries, with the American Academy of Orthopaedic Surgeons estimating that musculoskeletal injuries account for nearly 6.5 million hospitalizations annually.

MARKET DRIVERS

Aging Population and Increased Prevalence of Chronic Conditions

The aging population in North America is a significant driver of the orthopedic devices market, as older adults are more susceptible to musculoskeletal disorders and degenerative conditions. According to the U.S. Census Bureau, the number of people aged 65 and above is expected to reach 73 million by 2030 by representing nearly 21% of the total population. This demographic shift has led to a higher incidence of age-related conditions such as osteoporosis and osteoarthritis. According to the Centers for Disease Control and Prevention, osteoarthritis affects over 32 million adults in the United States, with its prevalence increasing significantly after the age of 45. Additionally, the National Osteoporosis Foundation reports that approximately 54 million Americans have low bone density or osteoporosis, further amplifying the demand for orthopedic interventions.

Rising Obesity Rates and Associated Orthopedic Complications

Obesity is another critical factor propelling the demand for orthopedic devices in North America, as excess body weight places additional stress on joints, particularly the knees and hips is leading to chronic pain and mobility issues. The Centers for Disease Control and Prevention states that the prevalence of obesity among U.S. adults was 41.9% between 2017 and 2020, with severe obesity affecting 9.2% of the population. Obesity is a well-documented risk factor for osteoarthritis, with the Arthritis Foundation noting that individuals who are overweight are at least twice as likely to develop knee osteoarthritis compared to those with a healthy weight. According to the Agency for Healthcare Research and Quality, obesity-related musculoskeletal conditions account for a significant proportion of hospitalizations annually.

MARKET RESTRAINTS

High Cost of Orthopedic Procedures and Devices

The high cost associated with orthopedic procedures and devices serves as a significant restraint in the North America orthopedic devices market, limiting accessibility for certain patient groups. According to the Healthcare Cost and Utilization Project, the average cost of a total knee replacement procedure in the United States can range from $30,000 to $50,000 by depending on the facility and complexity of the case. Such expenses are often compounded by additional costs related to post-operative care, rehabilitation, and physical therapy. According to the Kaiser Family Foundation, approximately 27 million Americans remain uninsured by making these costly interventions financially prohibitive for many. Even among insured individuals, high deductibles and copayments often deter patients from seeking timely treatment. Furthermore, the Centers for Medicare & Medicaid Services notes that rising healthcare costs disproportionately affect low-income households with the disparities in access to orthopedic care. These financial barriers hinder the broader adoption of advanced orthopedic solutions.

Stringent Regulatory Approval Processes

Stringent regulatory requirements for the approval of orthopedic devices pose another major restraint by creating delays in the introduction of innovative products to the market. The U.S. Food and Drug Administration mandates rigorous clinical trials and extensive documentation to ensure the safety and efficacy of medical devices, a process that can take several years and incur substantial costs. According to the FDA's own reports, the premarket approval process for Class III devices, which include many orthopedic implants, can take an average of 18 to 36 months. Additionally, the National Center for Biotechnology Information emphasizes that the complexity of regulatory compliance often discourages smaller companies from entering the market by stifling innovation. These prolonged timelines and high costs of compliance not only delay patient access to cutting-edge technologies but also increase the financial burden on manufacturers that is ultimately slowing the growth of the orthopedic devices market in North America.

MARKET OPPORTUNITIES

Advancements in Minimally Invasive Surgical Techniques

The growing adoption of minimally invasive surgical techniques presents a significant opportunity for the North America orthopedic devices market, as these procedures offer faster recovery times and reduced complications. The Agency for Healthcare Research and Quality states that minimally invasive surgeries account for approximately 30% of all orthopedic procedures performed annually in the United States. These techniques often utilize specialized orthopedic devices, such as small incision tools and robotic-assisted systems, which are in high demand. According to the Centers for Disease Control and Prevention, patients undergoing minimally invasive joint replacements experience shorter hospital stays by averaging 1.5 days compared to 3-4 days for traditional surgeries. This shift not only improves patient outcomes but also reduces healthcare costs by minimizing post-operative care needs. The integration of advanced technologies into minimally invasive procedures is likely to drive further growth in the orthopedic devices market.

Increasing Focus on Personalized Medicine and Custom Implants

The rising emphasis on personalized medicine and custom orthopedic implants offers another promising avenue for market expansion in North America. According to the National Institutes of Health, personalized implants, tailored to an individual’s anatomy, improve surgical precision and long-term outcomes, in complex cases like spinal deformities or severe joint damage. A study published by the National Center for Biotechnology Information reveals that the use of patient-specific implants has increased by over 20% in the past five years, driven by advancements in 3D printing and imaging technologies. Additionally, the American Academy of Orthopaedic Surgeons notes that custom implants reduce the risk of implant misalignment and enhance functionality by leading to higher patient satisfaction rates. The demand for bespoke orthopedic solutions is expected to grow by fostering innovation and creating new revenue streams within the market.

MARKET CHALLENGES

Limited Access to Orthopedic Care in Rural Areas

A significant challenge facing the North America orthopedic devices market is the limited access to orthopedic care in rural and underserved regions, where healthcare infrastructure is often inadequate. The U.S. Department of Health and Human Services reports that over 80 million Americans reside in areas designated as Health Professional Shortage Areas (HPSAs), with orthopedic specialists being among the most scarce. This disparity disproportionately affects rural populations, where the Centers for Disease Control and Prevention notes that musculoskeletal conditions remain a leading cause of disability. According to the National Rural Health Association, individuals in rural areas are more likely to delay or forgo treatment due to long travel distances and insufficient insurance coverage. These barriers result in untreated conditions worsening over time by increasing the complexity and cost of eventual interventions.

Rising Concerns Over Surgical Site Infections and Complications

Another pressing challenge in the orthopedic devices market is the growing concern over surgical site infections (SSIs) and post-operative complications, which can undermine patient outcomes and increase healthcare costs. The Centers for Disease Control and Prevention estimates that SSIs occur in approximately 1% to 3% of all surgical procedures, with orthopedic surgeries being particularly vulnerable due to the use of implants. According to the Agency for Healthcare Research and Quality, SSIs contribute to an additional USD 3.5 billion in annual healthcare expenditures in the United States due to extended hospital stays and antibiotic treatments. Moreover, the National Institutes of Health emphasizes that implant-related infections pose unique challenges, often requiring complex revision surgeries and prolonged recovery periods. Addressing infection risks becomes even more critical as the prevalence of antimicrobial resistance rises. Mitigating these complications through improved sterilization techniques and advanced coatings on devices remains a key focus for manufacturers.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.12 % |

|

Segments Covered |

By Anatomical Location , Type Of Consumable and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

Medtronic,Stryker,Zimmer Inc.,DePuy,Synthes,Smith |

SEGMENTAL ANALYSIS

By Anatomical Location Insights

The knee orthopedic devices segment was the largest by occupying 35.4% of the North America orthopedic devices market share in 2024. This dominance is primarily attributed to the widespread prevalence of osteoarthritis, a degenerative joint disease that predominantly affects the knee. According to the Centers for Disease Control and Prevention, over 32 million adults in the United States suffer from osteoarthritis, with the knee being one of the most commonly affected joints due to its weight-bearing function. Additionally, the aging population plays a significant role, as the risk of osteoarthritis increases significantly after the age of 45. According to the Healthcare Cost and Utilization Project, over 700,000 knee replacement surgeries are performed annually in the U.S. by making it one of the most frequently conducted orthopedic procedures. The rising obesity rates further exacerbate the burden on knee joints, with the CDC reporting that obesity-related musculoskeletal conditions contribute to a substantial proportion of these cases. Knee orthopedic devices, including total knee arthroplasty systems and revision implants, are critical in restoring mobility and alleviating chronic pain, thereby improving patients' quality of life. Their widespread use escalatees their importance in addressing the growing demand for effective musculoskeletal solutions.

The spine orthopedic devices segment is swiftly emerging in the North America orthopedic devices market with a CAGR of 8.2% during the forecast period. This rapid expansion is driven by the increasing prevalence of degenerative spinal conditions, such as herniated discs, spinal stenosis, and spondylosis, which collectively affect nearly 12% of the U.S. population, according to the National Institute of Arthritis and Musculoskeletal and Skin Diseases. Sedentary lifestyles, prolonged screen time, and work-related stress have contributed to a rise in spinal disorders among younger adults by expanding the patient pool beyond the traditional elderly demographic. Technological advancements are also propelling this segment's growth, with innovations such as minimally invasive spinal surgeries, robotic-assisted systems, and biocompatible implants enhancing surgical precision and patient outcomes. Moreover, the increasing adoption of regenerative therapies, such as bone grafts and spinal fusion devices, is addressing unmet clinical needs and driving market expansion.

By Type Of Consumable Insights

The metallic suture anchors segment dominated the North America orthopedic devices market with share of 60.2% in 2024. Their prominence stems from their superior strength and reliability in securing soft tissues to bone during surgeries like rotator cuff repairs. According to the National Center for Biotechnology Information, over 250,000 rotator cuff repair procedures are performed annually in the U.S., with metallic anchors being the preferred choice due to their durability. These anchors are critical in ensuring long-term stability by making them indispensable in sports medicine and trauma care.

The resorbable suture anchors segment is likely to witness a fastest CAGR of 8.5% during the forecast period. This growth is driven by their ability to degrade naturally within the body by eliminating the need for secondary surgeries to remove implants. According to the Centers for Disease Control and Prevention, resorbable materials reduce post-operative complications, such as infections, which account for nearly 1% of all surgical cases. Furthermore, the National Institutes of Health emphasizes that advancements in biocompatible polymers have improved the mechanical strength and degradation rates of these anchors by making them ideal for pediatric and elderly patients.

Country Level Analysis

The United States orthopedic devices market was the largest by accounting for 85.2% of the share in 2024 due to its highly developed healthcare system, extensive research and development investments, and a population with significant orthopedic care needs. The Centers for Disease Control and Prevention reports that musculoskeletal conditions affect over 126 million adults annually, with arthritis alone impacting 54 million individuals. Additionally, the National Institutes of Health notes that the U.S. performs nearly 1 million joint replacement surgeries each year which was driven by advancements in minimally invasive techniques and robotic-assisted surgeries. The presence of leading orthopedic device manufacturers that is coupled with robust regulatory oversight by the FDA that ensures innovation and quality.

Canada orthopedic devices market is projected to witness a CAGR of 6.2% during the forecast period. This growth is fueled by an aging population, with the Canadian Institute for Health Information projecting that individuals aged 65 and above will account for 23% of the population by 2030, significantly increasing the prevalence of age-related musculoskeletal disorders. According to the Public Health Agency of Canada, chronic conditions such as osteoarthritis and osteoporosis are among the leading causes of disability by driving demand for advanced orthopedic solutions. Moreover, rising adoption of minimally invasive procedures and patient-specific implants is transforming care delivery. Government initiatives to improve healthcare accessibility and affordability that is combined with increased awareness of innovative treatments, are propelling Canada’s market growth. These factors position Canada as a key contributor to the expansion of the orthopedic devices sector in North America.

Top 3 Players in the market

Medtronic

Medtronic stands as a dominant force in the North America orthopedic devices market, particularly excelling in spinal and musculoskeletal solutions. The company’s leadership is driven by its commitment to technological innovation, including the development of robotic-assisted surgeries and minimally invasive spinal devices. Its Mazor Robotics platform has redefined precision in spinal surgeries, enabling accurate implant placements and improving patient outcomes. Medtronic’s extensive investments in research and development have positioned it at the forefront of addressing the needs of aging populations and chronic musculoskeletal conditions.

Stryker

Stryker is a trailblazer in the orthopedic devices market that is renowned for its expertise in joint replacement systems, trauma devices, and advanced surgical equipment. The company’s Mako Robotic-Arm Assisted Surgery System has gained widespread recognition for enhancing precision in joint replacements, setting new standards in surgical outcomes. Stryker’s dedication to innovation is reflected in its continuous efforts to address unmet clinical needs, particularly in areas like personalized medicine and minimally invasive procedures. Through strategic investments in cutting-edge technologies, Stryker has expanded access to advanced orthopedic care by improving recovery times and patient satisfaction on a global scale.

Zimmer Biomet

Zimmer Biomet is a key player in the orthopedic devices market, with a strong focus on joint reconstruction, orthobiologics, and sports medicine. The company’s Rosa Knee System has emerged as a game-changer in total knee replacements, offering enhanced accuracy and superior patient outcomes. Zimmer Biomet’s emphasis on regenerative therapies and biologics promotes its commitment to addressing complex orthopedic challenges. Zimmer Biomet continues to advance treatment standards globally by leveraging innovative technologies and fostering collaborations with healthcare providers.

Top strategies used by the key market participants

Strategic Collaborations and Partnerships

Key players in the North America orthopedic devices market, such as Medtronic, Stryker, and Zimmer Biomet, have actively pursued collaborations with healthcare institutions, research organizations, and technology firms. These partnerships aim to co-develop innovative solutions, such as robotic-assisted surgical systems and advanced biomaterials, to address unmet clinical needs. By leveraging external expertise, these companies enhance their product portfolios and expand their reach into underserved markets. Collaborations also enable them to stay ahead of technological advancements and regulatory requirements by ensuring compliance while driving innovation.

Focus on Research and Development (R&D)

Investing in R&D is a cornerstone strategy for orthopedic device manufacturers. Leading companies prioritize the development of cutting-edge technologies, including minimally invasive devices, 3D-printed implants, and regenerative therapies. These innovations cater to the growing demand for personalized care and improved patient outcomes. By continuously refining their offerings, companies ensure they remain competitive in a rapidly evolving market. Additionally, R&D efforts help them address challenges such as antimicrobial resistance and implant durability that is strengthening their market position.

Expansion of Product Portfolios

To meet diverse patient needs, key players are expanding their product portfolios by introducing new devices and upgrading existing ones. For instance, companies are developing specialized implants for complex cases like spinal deformities or pediatric orthopedics. This diversification allows them to cater to a broader range of medical conditions and demographics. These companies enhance their brand reputation and establish themselves as one-stop providers for orthopedic care by offering comprehensive solutions.

Geographic Expansion and Market Penetration

Orthopedic device manufacturers are focusing on geographic expansion to strengthen their presence in North America. This includes targeting rural and underserved areas where access to advanced orthopedic care is limited. Companies are investing in training programs for surgeons, establishing distribution networks, and collaborating with local healthcare providers to improve accessibility. They not only expand their customer base but also contribute to reducing healthcare inequities by addressing regional disparities.

Acquisitions and Mergers

Acquisitions and mergers are strategic tools used by key players to consolidate their market position. The larger firms can integrate innovative products into their portfolios by acquiring smaller companies or startups specializing in niche technologies. These acquisitions also provide access to new markets, intellectual property, and skilled talent pools. Mergers allow companies to streamline operations, reduce costs, and achieve economies of scale by enabling them to compete more effectively in the global market.

Emphasis on Training and Education

Training and education initiatives play a crucial role in strengthening market position. Companies like Stryker and Zimmer Biomet invest in surgeon training programs to promote the adoption of their advanced technologies, such as robotic-assisted systems. By educating healthcare professionals on the benefits and usage of their products, these companies ensure higher acceptance and utilization rates. Additionally, educational outreach helps build trust and long-term relationships with healthcare providers.

Sustainability and Cost-Effectiveness Initiatives

In response to rising healthcare costs, key players are focusing on sustainability and affordability. This includes developing cost-effective devices without compromising quality, as well as adopting eco-friendly manufacturing practices. The companies can expand their customer base and enhance their reputation as socially responsible entities by addressing financial barriers to care. These initiatives not only strengthen their market position but also align with broader healthcare goals of improving accessibility and reducing the economic burden of musculoskeletal disorders.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a leading role in the North American orthopedic devices market profiled in the report are Medtronic,Stryker,Zimmer Inc.,DePuy,Synthes,Smith & Nephew,Biomet.

The North America orthopedic devices market is characterized by intense competition, driven by the presence of established global players and emerging niche companies striving to innovate and capture market share. Key players such as Medtronic, Stryker, Zimmer Biomet, DePuy Synthes, and Smith & Nephew dominate the landscape, leveraging their extensive R&D capabilities, broad product portfolios, and strong distribution networks to maintain its dominance. These companies focus on technological advancements, particularly in robotics, minimally invasive surgeries, and personalized implants, to differentiate themselves and address the growing demand for advanced orthopedic solutions. The competitive environment is further intensified by strategic initiatives such as mergers, acquisitions, and partnerships. Companies frequently acquire smaller firms specializing in cutting-edge technologies to expand their offerings and enter new markets. Collaborations with healthcare providers and research institutions also play a pivotal role in fostering innovation and ensuring compliance with stringent regulatory standards. Additionally, manufacturers are investing in surgeon training programs and educational outreach to promote the adoption of their advanced devices.

While large corporations hold significant market share, smaller firms and startups contribute to competition by introducing cost-effective and innovative solutions tailored to specific patient needs. This dynamic interplay between industry giants and emerging players fosters a highly competitive yet collaborative ecosystem, driving continuous advancements in orthopedic care.

RECENT HAPPENINGS IN THE MARKET

- In January 2025, Stryker announced the acquisition of Inari Medical for $4.9 billion to enhance its portfolio in treating peripheral vascular diseases.

- In March 2024, Stryker completed the acquisition of France-based joint replacement company SERF SAS, expanding its orthopedic offerings.

- In January 2025, Zimmer Biomet announced plans to acquire Paragon 28 for approximately $1.1 billion, aiming to enhance its range of orthopedic surgical devices, particularly in foot and ankle treatments.

- In November 2024, major investors urged Smith & Nephew to consider spinning off its orthopaedics division following underperformance, amplifying the need for strategic reevaluation to strengthen its market position.

- In 2023, DePuy Synthes achieved revenue growth of 4.4%, reflecting a recovery to pre-pandemic levels and strengthening its market position.

- In 2023, Medtronic reported a 6.9% increase in revenue in its Cranial & Spinal Technologies division, indicating a strengthening position in the orthopedic devices market.

- In 2023, Zimmer Biomet reported a 6.5% increase in revenue, demonstrating growth in its orthopedic devices segment.

- In 2023, Smith & Nephew reported a 5.6% increase in revenue in its Orthopaedics and Sports Medicine division, reflecting growth in its orthopedic devices segment.

- In 2023, Stryker reported a 10.5% increase in revenue in its Orthopaedics and Spine division, indicating significant growth in its orthopedic devices segment.

- In 2023, DePuy Synthes reported a 4.4% increase in revenue, indicating growth in its orthopedic devices segment

MARKET SEGMENTATION

This research report on the North American Orthopedic Devices Market has been segmented and sub-segmented into the following categories.

By Anatomical Location

- Knee

- Shoulder

- Foot

- Ankle

- Hip

- Spine

- Elbow

- Craniomaxillofacial

By Type Of Consumable

- Orthopedic Staples

- Orthopedic Suture Anchors

- Resorbable Suture Anchors

- Metallic Suture Anchors

By Country

- The U.S.

- Canada

- Rest of North America.

Frequently Asked Questions

What factors are driving the growth of the orthopedic devices market in North America?

Key drivers include an increasing geriatric population and a growing burden of orthopedic diseases.

What are the emerging trends in the orthopedic devices market?

Emerging trends include the adoption of minimally invasive techniques and robotic-assisted surgeries, enhancing surgical precision and patient outcomes.

What challenges does the orthopedic devices market face?

Challenges include increasing competition, market saturation in certain device categories, and the need for continuous innovation to meet patient demands.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]