North America Oil Storage Market Size, Share, Trends & Growth Forecast Report By Product (Fixed roof, Floating roof, Spherical, Others), End-Use and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Oil Storage Market Size

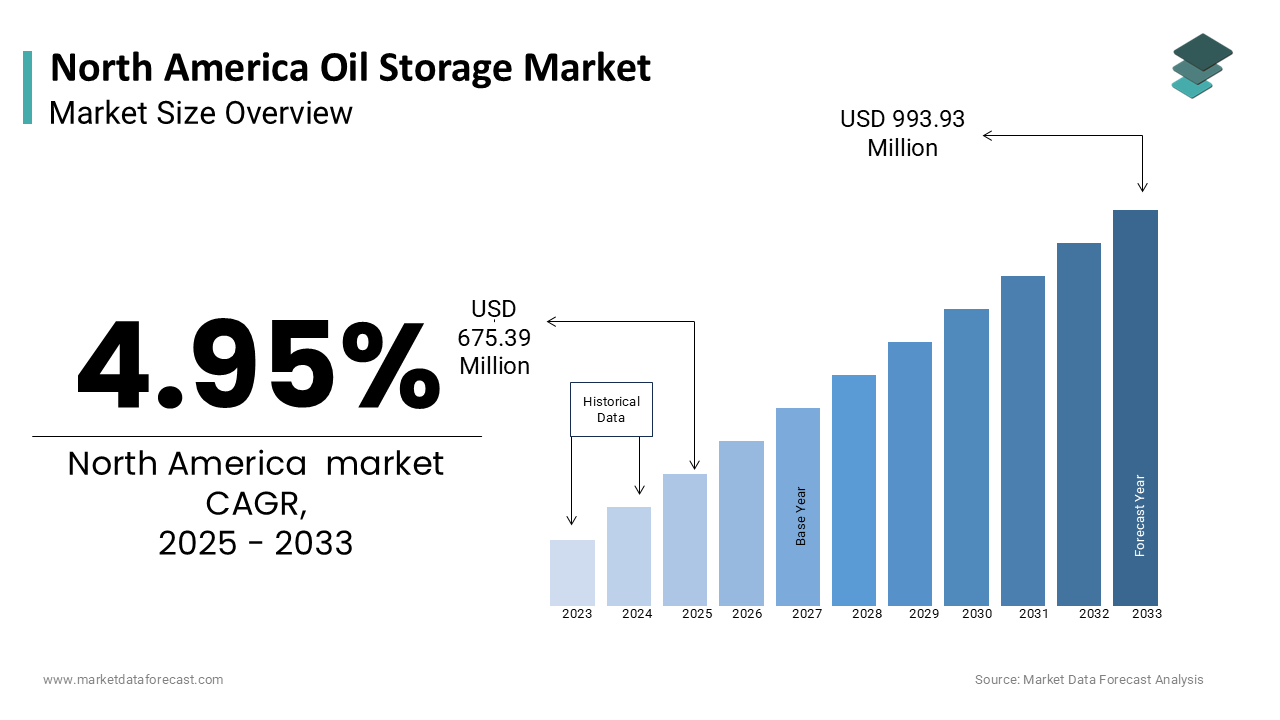

The North America oil storage market was worth USD 643.45 million in 2024. The North American market is estimated to grow at a CAGR of 4.95% from 2025 to 2033 and be valued at USD 993.93 million by the end of 2033 from USD 675.39 million in 2025.

The North America oil storage market is focusing on the facilities and infrastructure used to store crude oil, refined petroleum products, and other liquid hydrocarbons. Oil storage plays ensures the stability and reliability of the oil supply chain, allowing for the management of fluctuations in production and consumption. This growth is driven by several factors, including the increasing demand for oil and gas, the need for strategic reserves, and the expansion of refining capacities. As per market insights, the North America oil storage market is poised for continued expansion, with advancements in storage technologies and safety regulations further enhancing operational efficiency. The market is also benefiting from the growing trend of energy independence, as countries seek to bolster their domestic oil production and storage capabilities to mitigate supply chain vulnerabilities.

MARKET DRIVERS

Rising Demand for Oil and Gas

The North America oil storage market is significantly driven by the rising demand for oil and gas across various sectors, including transportation, manufacturing, and power generation. As global energy consumption continues to increase, the need for efficient storage solutions becomes paramount. In line with the U.S. Energy Information Administration, U.S. petroleum consumption reached approximately 19.6 million barrels per day in 2020, with projections indicating a steady increase in demand as the economy recovers from the impacts of the COVID-19 pandemic. This surge in consumption directly correlates with the need for adequate storage facilities to manage supply and ensure a stable flow of products to end-users. Additionally, the growing focus on energy security and the establishment of strategic petroleum reserves are further propelling the demand for oil storage solutions. As countries strive to enhance their energy independence and mitigate the risks associated with supply disruptions, investments in oil storage infrastructure are expected to rise.

Expansion of Refining Capacities

Another significant driver of the North America oil storage market is the expansion of refining capacities across the region. As the demand for refined petroleum products, such as gasoline, diesel, and jet fuel, continues to grow, refiners are investing in new facilities and upgrading existing ones to increase production capabilities. The American Petroleum Institute found that U.S. refining capacity reached approximately 18.1 million barrels per day in 2020, with ongoing projects aimed at enhancing efficiency and output. This expansion necessitates the development of additional storage facilities to accommodate the increased volumes of crude oil and refined products. Moreover, the shift towards cleaner fuels and the implementation of stricter environmental regulations are prompting refiners to invest in advanced technologies that require efficient storage solutions. The growing trend of integrating renewable energy sources into the refining process is also driving the need for innovative storage options.

MARKET RESTRAINTS

Environmental Regulations and Compliance Costs

Among the mainly restraints affecting the North America oil storage market is the stringent environmental regulations and compliance costs associated with the construction and operation of storage facilities. The oil and gas industry is subject to a myriad of regulations aimed at minimizing environmental impact, ensuring safety, and protecting public health. According to the Environmental Protection Agency, compliance with these regulations can impose significant operational costs on storage facility operators, particularly in terms of monitoring, reporting, and remediation efforts. The need to adhere to regulations such as the Clean Water Act and the Resource Conservation and Recovery Act can complicate the development of new storage facilities and increase the costs associated with maintaining existing ones. Additionally, the growing focus on sustainability and the transition towards greener energy solutions may lead to further scrutiny of oil storage practices, prompting companies to invest in more environmentally friendly technologies.

Market Volatility and Price Fluctuations

A key restraint in the North America oil storage market is the inherent volatility and price fluctuations associated with the oil and gas industry. The prices of crude oil and refined products are influenced by a myriad of factors, including geopolitical tensions, supply and demand dynamics, and economic conditions. As per the U.S. Energy Information Administration, crude oil prices experienced significant fluctuations in recent years, with prices ranging from $20 to over $70 per barrel. This volatility can create uncertainty for storage facility operators, as fluctuating prices may impact the profitability of storage operations and the willingness of companies to invest in new storage infrastructure. Besides, the risk of overcapacity in the storage market can arise during periods of low demand or oversupply is leading to decreased revenues for operators.

MARKET OPPORTUNITIES

Growth of Strategic Petroleum Reserves

The North America oil storage market presents significant opportunities for growth through the expansion of strategic petroleum reserves (SPR). As countries seek to enhance their energy security and mitigate the risks associated with supply disruptions, the establishment and maintenance of strategic reserves have become increasingly important. According to the U.S. Department of Energy, the U.S. SPR is the largest government-owned stockpile of emergency crude oil in the world, with a capacity of approximately 714 million barrels. The ongoing geopolitical tensions and the need for energy independence are prompting governments to invest in expanding their strategic reserves, thereby driving demand for oil storage facilities. Apart from these, the growing focus on energy transition and the integration of renewable energy sources into national energy strategies are further emphasizing the importance of maintaining adequate oil storage capacity.

Increasing Investment in Renewable Energy Integration

A major opportunity in the North America oil storage market lies in the increasing investment in renewable energy integration.

As the energy landscape evolves, there is a growing need for flexible storage solutions that can accommodate both traditional oil and gas products and renewable energy sources. According to the International Energy Agency, global investment in renewable energy is projected to reach $10 trillion by 2030, with North America playing a pivotal role in this growth. The integration of renewable energy into existing oil storage facilities presents an opportunity for operators to diversify their offerings and enhance their operational efficiency. Additionally, the rise of hybrid energy systems, which combine fossil fuels with renewable sources, is driving the demand for innovative storage solutions that can effectively manage the variability of renewable energy generation.

MARKET CHALLENGES

Supply Chain Disruptions

Potential for supply chain disruptions is one of the significant challenges facing the North America oil storage market. The production of oil storage facilities relies on key materials and components, which can be affected by fluctuations in supply and demand. The industry reports suggest that disruptions in the supply chain, particularly during adverse weather conditions or global events like the COVID-19 pandemic, have led to increased prices and shortages of essential materials. This situation poses a challenge for storage facility operators who must ensure a consistent supply of high-quality components to meet consumer demand. Further, the sourcing of materials can be impacted by geopolitical factors is leading to uncertainties in the availability of critical components.

Competition from Alternative Energy Sources

Intensifying competition from alternative energy sources is also a serious challenge for the North America oil storage market. The rise of renewable energy technologies, such as solar and wind, is reshaping the energy landscape and reducing reliance on traditional fossil fuels. In line with the U.S. Energy Information Administration, renewable energy is projected to account for 50% of total electricity generation in the United States by 2050. This shift towards cleaner energy sources poses a challenge for the oil storage market, as demand for oil may decline in favor of more sustainable alternatives. Also, the growing focus on energy efficiency and the implementation of stricter environmental regulations may further impact the demand for oil storage solutions.

SEGMENTAL ANALYSIS

By Product Insights

The fixed roof tanks segment of the North America oil storage market retained its position as the largest product category by holding a market share of 62.1% in 2024. This influence can be caused by the extensive use of fixed roof tanks in the storage of crude oil and refined petroleum products, where they are favoured for their durability and cost-effectiveness. Fixed roof tanks are designed to withstand varying environmental conditions and provide a secure storage option for liquid hydrocarbons. Also, the escalating trend of expanding refining capacities and the need for strategic reserves are further propelling the demand for fixed roof tanks, as they offer a practical solution for storing large volumes of oil.

On the other hand, the floating roof tank segment is seeing quick growth, with a CAGR of 7.6% over the forecast period. This segment's progress can be attached to the increasing adoption of floating roof tanks in applications where minimizing evaporation losses and maintaining product quality are critical. The market insights reveal that the demand for floating roof tanks is on the rise, driven by the growing need for environmentally friendly storage solutions in the oil and gas sector. Floating roof tanks are designed to reduce vapor emissions and prevent contamination of stored products, making them an attractive option for companies seeking to comply with environmental regulations. Apart from this, the rise of government incentives and regulations promoting the use of sustainable storage technologies is making floating roof tanks more accessible to operators.

By End-User Industries Insights

The crude oil segment represented the largest end-user category by commanding a market share of 52.4%. This dominance is primarily due to the extensive need for storage facilities to accommodate the large volumes of crude oil produced and transported across the region. The U.S. Energy Information Administration reported that U.S. crude oil production reached approximately 11.3 million barrels per day in 2020, necessitating robust storage solutions to manage supply fluctuations and ensure market stability. Crude oil storage facilities are essential for balancing supply and demand, particularly during periods of high production or low consumption. Moreover, the growing focus on energy independence and the establishment of strategic petroleum reserves are further propelling the demand for crude oil storage solutions.

Conversely, the LNG (Liquefied Natural Gas) segment is experiencing rapid growth, with a projected CAGR of 8.1%. This segment's growth can be attributed to the increasing demand for natural gas as a cleaner alternative to traditional fossil fuels, particularly in power generation and transportation. The market insights states that the demand for LNG storage solutions is on the rise, driven by the growing trend of natural gas exports and the expansion of LNG infrastructure in North America. The U.S. has become one of the largest exporters of LNG, with export capacity reaching approximately 9.5 billion cubic feet per day in 2020, necessitating the development of efficient storage facilities to accommodate this growth. Additionally, the rise of government incentives and regulations promoting the use of natural gas as a transitional fuel is making LNG storage solutions more accessible to operators

REGIONAL ANALYSIS

The United States led by virtue of its unparalleled midstream infrastructure in the North America oil storage market by accounting for 76.1% of the total market share in 2024. The U.S. market is characterized by a robust demand for oil storage solutions, driven by the increasing production levels and the need for efficient storage facilities. Based on the U.S. Energy Information Administration, U.S. crude oil production reached approximately 11.3 million barrels per day in 2020, necessitating significant storage capacity to manage supply fluctuations. The U.S. market benefits from a well-established infrastructure for oil storage, with a wide range of facilities available to accommodate various types of oil products. Besides, the growing focus on energy independence and the establishment of strategic petroleum reserves are further driving the demand for oil storage solutions.

Canada is progressing steadily in the North America oil storage market, with a projected CAGR of 6.3% during the forecast period. The Canadian market is experiencing a similar pattern to that of the U.S., having an increasing number of companies seeking efficient storage solutions to accommodate rising production levels. As per the Canadian Association of Petroleum Producers, Canada’s oil production is projected to reach approximately 5.5 million barrels per day by 2025, necessitating robust storage infrastructure. The demand for oil storage in Canada is further supported by the growing focus on energy security and the need for strategic reserves. As consumers become more aware of the importance of effective storage solutions, companies are responding by introducing innovative technologies that cater to these demands. The expansion of pipeline infrastructure and the increasing availability of storage facilities are enhancing the accessibility of oil storage solutions across Canada.

Rest of America accelerates ahead in terms of pace in the North America oil storage market. It is driven by modernization efforts in Mexico’s petroleum industry and new capacity expansions in the Caribbean. In Mexico, the awareness of oil storage solutions is gradually increasing, particularly among businesses and government agencies looking to enhance their energy infrastructure. The growing trend of energy reform and the increasing investments in oil infrastructure are further contributing to the market's expansion. Also, the increasing penetration of technology and the development of strategic reserves are enhancing consumer access to a wider variety of oil storage solutions.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

The North America oil storage market is characterized by the presence of several key players who dominate the landscape. Notable companies include Magellan Midstream Partners, which is recognized for its extensive network of storage terminals and pipelines, and Kinder Morgan, a leading provider of oil and gas transportation and storage services. These companies leverage their extensive distribution networks and technological expertise to capture a significant share of the market. Additionally, smaller, niche players are emerging, focusing on innovative storage solutions and specialized applications. The competitive landscape is further intensified by the growing trend of partnerships and collaborations, as companies seek to enhance their technological capabilities and expand their market reach.

Major Strategies Used by Key Players in the North America Oil Storage Market

Key players in the North America oil storage market employ various strategies to strengthen their market position and enhance competitiveness. One prominent strategy is product innovation, where companies continuously develop new storage technologies and applications to cater to changing consumer preferences. For instance, the introduction of advanced floating roof tanks and environmentally friendly storage solutions has become a popular tactic to attract companies looking for sustainable options. Additionally, many manufacturers are focusing on enhancing operational efficiency by integrating smart technologies and automation into their storage facilities, thereby increasing safety and reducing costs.

Another strategy involves expanding distribution channels, particularly through partnerships with oil and gas companies and government agencies, to enhance product accessibility. Companies are increasingly collaborating with local businesses and organizations to promote oil storage solutions as viable options for energy security. Furthermore, marketing campaigns that emphasize the benefits of effective oil storage in ensuring supply stability and compliance with environmental regulations are being utilized to engage consumers and drive brand loyalty.

RECENT MARKET DEVELOPMENTS

- In January 2023, Magellan Midstream Partners announced the expansion of its storage capacity at its terminal in Cushing, Oklahoma, to accommodate increasing demand for crude oil storage solutions.

- In March 2023, Kinder Morgan launched a new initiative to enhance the safety and efficiency of its oil storage facilities, targeting the growing focus on operational excellence in the industry.

- In May 2023, Enbridge Inc. introduced a new line of environmentally friendly storage solutions designed to minimize emissions and enhance sustainability in oil storage operations.

- In July 2023, Magellan Midstream Partners expanded its distribution network by partnering with major oil producers to enhance the availability of its storage solutions across North America.

- In September 2023, Kinder Morgan participated in a major energy conference, showcasing its latest innovations in oil storage technology and engaging with industry professionals to promote brand awareness.

- In November 2023, Enbridge Inc. launched a marketing campaign focused on educating consumers about the importance of effective oil storage in ensuring energy security and compliance with environmental regulations.

- In January 2024, Magellan Midstream Partners introduced a new line of smart storage tanks equipped with advanced monitoring systems to enhance operational efficiency and safety.

- In March 2024, Kinder Morgan announced the launch of a training program for its employees, aimed at enhancing knowledge and skills related to oil storage technologies and safety protocols.

- In April 2024, Enbridge Inc. collaborated with a renowned environmental organization to create educational materials on the importance of sustainable oil storage practices, leveraging social media to reach a broader audience.

- In June 2024, Magellan Midstream Partners launched a limited-edition storage solution designed for specific industries, aiming to attract clients looking for tailored options to their storage needs.

MARKET SEGMENTATION

This research report on the North American oil storage market is segmented and sub-segmented based on categories.

By Product

- Fixed roof

- Floating roof

- Spherical

- Others

By End Use

- Crude Oil

- Gasoline

- Aviation fuel

- Middle distillates

- LNG

- LPG

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

What factors are driving the North America Oil Storage Market?

Growth is driven by fluctuating production and consumption, increasing shale oil production, and rising crude oil exports.

What is the future outlook for the North America Oil Storage Market?

The market is expected to see steady growth, driven by increasing crude oil production, strategic reserves, and export expansion.

What are the challenges facing the North America Oil Storage Market?

Challenges include regulatory restrictions, environmental concerns, fluctuating oil prices, and the transition to cleaner energy sources.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com