North America Offshore Wind Energy Market Size, Share, Trends & Growth Forecast Report Segmented By Component, Depth And By Country (US, Canada, Mexico, and Brazil), Industry Analysis From 2025 to 2033

North America Offshore Wind Energy Market Size

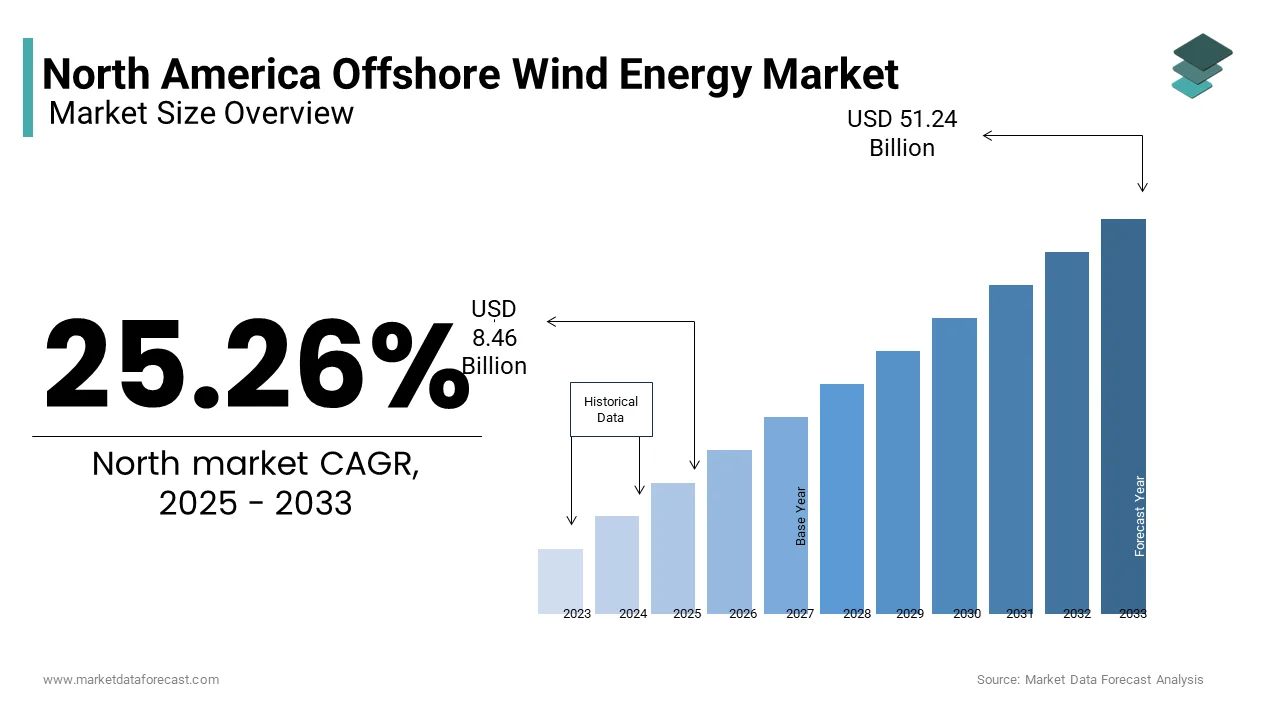

The North America offshore wind energy market was valued at USD 6.75 billion in 2024 and is anticipated to reach USD 8.46 billion in 2025 from USD 51.24 billion by 2033, growing at a CAGR of 25.26% during the forecast period from 2025 to 2033.

Current Scenario Of The North America Offshore Wind Energy Market

Offshore wind energy refers to electricity generated by wind turbines installed in bodies of water, typically oceans or large lakes, where wind speeds are higher and more consistent compared to onshore locations. This renewable energy source has gained significant traction due to its potential to deliver large-scale, clean energy while minimizing land use conflicts. In recent years, governments across North America have introduced supportive policies and incentives to accelerate the deployment of offshore wind projects. For instance, the U.S. Department of Energy has showcased that offshore wind could supply nearly double the current electricity consumption of the United States if fully harnessed.

The East Coast of the United States remains the focal point for offshore wind development, with states like New York, Massachusetts, and New Jersey leading ambitious initiatives. The Vineyard Wind project off the coast of Massachusetts, one of the first large-scale offshore wind farms in the U.S., exemplifies this progress. Meanwhile, Canada is also exploring its offshore wind potential, particularly in the Atlantic provinces, where strong coastal winds provide an untapped resource.

Apart from market dynamics, offshore wind energy contributes significantly to job creation and economic growth. According to a report by the National Renewable Energy Laboratory, the U.S. offshore wind industry could support over 83,000 jobs annually by 2030. Additionally, offshore wind farms help reduce carbon emissions; the Global Wind Energy Council states that offshore wind could prevent approximately 3.5 billion tons of CO2 emissions globally by 2050 if current growth trends continue.

MARKET DRIVERS

Government Policies and Incentives Driving Growth

Government support has been a cornerstone in propelling the North America offshore wind energy market forward. Federal and state-level initiatives, such as tax credits, grants, and renewable energy mandates, have significantly reduced financial barriers for developers. The U.S. government’s Inflation Reduction Act of 2022 introduced a 30% investment tax credit for offshore wind projects, making them more economically viable. Also, according to the American Clean Power Association, these incentives are expected to spur investments worth $150 billion in offshore wind infrastructure by 2030. Furthermore, state-level targets, like New York’s goal of 9,000 MW of offshore wind capacity by 2035, provide clear long-term visibility for investors. The International Energy Agency brings to light that supportive policies could help offshore wind account for 18% of global electricity generation by 2050 is showcasing the transformative impact of regulatory frameworks.

Technological Advancements Enhancing Efficiency

Technological innovations have played a critical role in reducing costs and improving the feasibility of offshore wind projects. Advances in turbine design, such as larger rotors and floating platforms, have significantly increased energy output. The National Renewable Energy Laboratory states that modern offshore wind turbines can now generate up to 15 MW per unit, compared to 6 MW a decade ago. Floating offshore wind technology which allows turbines to be installed in deeper waters, is projected to have an additional 2,000 GW of potential capacity in the U.S. alone, according to the Department of Energy. These advancements have reduced the levelized cost of energy (LCOE) for offshore wind by 60% over the past decade, making it competitive with traditional energy sources. Bloomberg New Energy Finance notes that continued innovation will further drive down costs, boosting adoption rates globally.

MARKET RESTRAINTS

Supply Chain Bottlenecks and Infrastructure Gaps

The North America offshore wind energy market faces significant challenges due to underdeveloped supply chains and infrastructure. The region lacks dedicated manufacturing facilities and ports capable of handling large offshore wind components like turbine blades and monopile foundations. As per the Special Initiative on Offshore Wind at the University of Delaware, the U.S. currently imports nearly 80% of its offshore wind equipment is leading to higher costs and logistical complexities. Besides, port upgrades required to accommodate these massive components could cost up to $500 million per site, as estimated by the American Association of Port Authorities. These gaps in infrastructure not only increase project timelines but also create dependency on international suppliers. Strengthening domestic supply chains and investing in port modernization will be crucial to overcoming these barriers and ensuring long-term growth in the sector.

Public Opposition and Social Acceptance Issues

Public opposition to offshore wind projects is another critical restraint affecting market expansion. Concerns over visual impacts, noise during construction, and potential effects on property values often lead to resistance from coastal communities. A study by the National Renewable Energy Laboratory highlights that local opposition has delayed or halted several high-profile project, including Cape Wind in Massachusetts which faced years of legal battles before being abandoned. Similarly, the Ocean Conservancy notes that misinformation about offshore wind farms can amplify fears, making it harder to gain public support. Engaging communities through transparent communication and addressing their concerns is essential to mitigate resistance.

MARKET OPPORTUNITIES

Unlocking Untapped Regions through Regional Collaboration

The North America offshore wind energy market stands to benefit immensely from regional collaboration especially in untapped areas like the Gulf Coast and the Pacific Northwest. These regions, often overshadowed by the Northeast’s dominance, hold vast potential due to their unique wind resources and coastal geography. Experts at the Southern Alliance for Clean Energy suggest that the Gulf Coast could support up to 50 GW of offshore wind capacity by leveraging its shallow waters and proximity to industrial hubs. Meanwhile, California’s deep-water sites are ideal for floating offshore wind farms, with projections indicating a 10-fold increase in capacity by 2040. Collaborative efforts between states, such as shared infrastructure investments and joint procurement strategies, can reduce costs and accelerate deployment.

Technological Synergies with Other Renewable Sectors

A significant opportunity lies in integrating offshore wind energy with other renewable sectors, such as hydrogen production and energy storage. Research indicates that offshore wind farms can power electrolyzers to produce green hydrogen, a clean fuel increasingly sought after for heavy industries and transportation. The International Renewable Energy Agency stresses that coupling offshore wind with hydrogen production could reduce costs by 30% compared to standalone systems. In addition, advancements in battery storage technologies allow offshore wind to address intermittency challenges is making it a more reliable energy source. For instance, pilot projects in Texas are exploring hybrid systems that combine offshore wind with solar and storage, enhancing grid stability. This convergence of technologies not only amplifies the market impact of offshore wind but also positions it as a cornerstone of a broader renewable energy ecosystem is driving innovation and economic growth across multiple sectors.

MARKET CHALLENGES

Navigating Complex Permitting Processes Amid Rising Demand

One of the most pressing challenges in the North America offshore wind energy market is the labyrinthine permitting process, which often delays project timelines and increases costs. A single offshore wind project may require approvals from over a dozen federal, state, and local agencies, each with its own set of regulations. Analysis from the Bureau of Ocean Energy Management reveals that the average permitting timeline stretches to five years or more is creating bottlenecks in an already strained system. While this complexity aims to ensure environmental and safety compliance, it inadvertently stifles progress. For example, the South Fork Wind project off Long Island faced nearly three years of regulatory hurdles before construction began.

Balancing Economic Growth with Community Resistance

As offshore wind projects expand, striking a balance between economic benefits and community resistance becomes increasingly complex. Coastal residents often voice concerns about visual impacts, noise pollution, and potential effects on tourism. Industry analysts point out that opposition can escalate into costly legal battles as seen with the Cape Wind project, which was ultimately abandoned after years of disputes. At the same time, these projects promise substantial economic rewards, including job creation and increased tax revenues. For instance, a study by the National Ocean Industries Association estimates that every $1 billion invested in offshore wind generates 8,000 jobs. However, the unintended consequences of poorly managed community engagement can overshadow these benefits.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

25.26% |

|

Segments Covered |

By Component, Depth By Country |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

U.S, Canada, Mexico Rest of North America |

|

Market Leaders Profiled |

Atlantic Shores Offshore Wind, EnBW North America, ENESSERE S.r.l., FURUKAWA ELECTRIC CO., LTD, General Electric, IMPSA, LS Cable & System Ltd, Nexans, Prysmian Group, RWE Renewables, Shell WindEnergy Inc, Southwire Company, LLC, Sumitomo Electric Industries, Ltd., US Wind Inc., Vestas. |

SEGMENTAL ANALYSIS

By Component Insights

The turbine segment and particularly turbines rated >10≤12 MW category held the largest market share at 45.8% in the North America offshore wind energy market in 2024. This prominence is propelled by break-throughs in turbine technology, enabling higher energy output and cost efficiency. The U.S. Department of Energy states that these large turbines can generate enough electricity to power over 10,000 homes annually. Their potential to harness stronger winds farther offshore makes them crucial for meeting renewable energy targets. Also, larger turbines reduce the number of installations needed, cutting costs significantly. These factors show their critical role in scaling offshore wind capacity across the region.

The floating turbine installation segment is growing at the fastest rate, with a projected CAGR of 28.5% during the forecast period. This rapid growth is fueled by the increasing focus on deep-water offshore wind projects, where traditional fixed-bottom turbines are not feasible. According to the National Renewable Energy Laboratory, floating turbines could unlock an additional 2,000 GW of potential capacity along North America’s coasts. Unlike fixed installations, floating turbines can operate in water depths exceeding 60 meters, accessing stronger and more consistent wind resources. For instance, California’s planned floating wind farms aim to add 5 GW of capacity by 2030. The Global Wind Energy Council emphasizes that technological advancements and declining costs are making floating installations commercially viable is positioning them as a game-changer for expanding offshore wind energy into untapped regions.

By Depth Insights

The >0 ≤ 30 m depth segment dominated the North America offshore wind energy market by holding 60.5% of the market share in 2024. This segment benefits from the widespread availability of shallow coastal waters, particularly along the Atlantic Coast, where fixed-bottom turbines are most feasible. The U.S. Department of Energy brings to light that shallow-water projects require lower installation costs due to simpler foundation designs, such as monopiles. For instance, the Block Island Wind Farm, located in shallow waters, generates 30 MW and powers over 17,000 homes annually. These depths also allow easier access for maintenance and grid connectivity. Shallow-water projects are critical for scaling offshore wind capacity quickly, making them a cornerstone for early-stage renewable energy adoption.

The >50 m depth segment is the quickly growing, with a CAGR of 32.4% is driven by advancements in floating offshore wind technology. Floating turbines enable harnessing strong winds in deep waters, which were previously inaccessible. Research from the National Renewable Energy Laboratory indicates that deep-water areas could unlock an additional 2,000 GW of potential offshore wind capacity in North America. The Hywind Maine project, one of the pioneers in this space, demonstrates how floating installations can operate efficiently in harsh marine environments. Bloomberg New Energy Finance reports that the cost of floating wind is projected to decline by 40% by 2030 is making it increasingly competitive. As deeper waters offer stronger and more consistent winds, this segment will play a pivotal role in meeting long-term renewable energy goals while diversifying deployment locations.

REGIONAL ANALYSIS

The USA led the North America microgrid landscape is driven by extensive federal support and renewable energy adoption. The U.S. Department of Energy invested $14.7 million in July 2023 to deploy microgrids in underserved regions, enhancing energy access. By mid-2024, the U.S. Energy Information Administration reported 83 gigawatts of solar capacity installed nationwide, reflecting a strong foundation for microgrid growth. The country’s importance lay in its resilience against power disruptions, with the National Oceanic and Atmospheric Administration noting 18 billion-dollar weather disasters in 2023 alone. This vulnerability underscored the USA’s push for localized energy solutions, cementing its leadership in the region’s microgrid efforts throughout 2024.

Canada will lead as the rapidly growing country in the North America microgrid sector and is projecting a CAGR of 14.5% from 2025 to 2033. This momentum will arise from electrifying remote areas, where Statistics Canada identifies over 300 off-grid communities reliant on diesel. Natural Resources Canada’s CAD 220 million Clean Energy for Rural and Remote Communities program, launched in 2023, will cut emissions by 1.2 million tonnes annually by 2030. Environment and Climate Change Canada estimates renewable energy will power 90% of these communities by 2035. Canada’s focus on sustainability and energy equity will make it a trailblazer by addressing climate challenges and improving living standards in isolated regions.

Mexico will see consistent microgrid growth in the coming years, with a projected CAGR of 9.8% from 2025 to 2033. The U.S. Energy Information Administration recorded Mexico’s renewable capacity at 25 gigawatts in 2024, highlighting its energy transition potential. The Mexican Secretariat of Energy’s USD 1.2 billion clean energy investment, announced in 2023, will boost rural access, targeting a 15% increase in coverage by 2030. The National Institute of Statistics and Geography reported 12.3 million people lacked reliable electricity in 2023, emphasizing the need for microgrids. Mexico’s efforts will strengthen energy security, narrowing gaps with the USA and Canada while advancing regional sustainability goals.

Top 3 Players in This Market

GE Vernova

GE Vernova, a subsidiary of General Electric, is a prominent player in the North America Offshore Wind Energy Market, focusing on innovative solutions for renewable energy generation. The company specializes in the design and manufacturing of advanced offshore wind turbines, which are engineered to maximize energy output while minimizing costs. GE Vernova's Haliade-X turbine, one of the most powerful offshore wind turbines in the world, exemplifies their commitment to efficiency and sustainability. By leveraging cutting-edge technology and extensive industry experience, GE Vernova is actively contributing to the growth of offshore wind projects across North America. Their efforts not only support the transition to cleaner energy but also create jobs and stimulate economic development in coastal regions.

Vestas

Vestas is a leading global manufacturer of wind turbines and a key player in the North America Offshore Wind Energy Market. With a strong commitment to sustainability, Vestas designs and produces high-quality offshore wind turbines that optimize energy production while minimizing environmental impact. The company’s innovative solutions, such as the V236-15.0 MW turbine, are tailored to meet the unique challenges of offshore wind energy generation. Vestas also provides comprehensive services, including project development, installation, and maintenance, ensuring the long-term performance of wind farms.

Siemens

Siemens is a significant player in the North America Offshore Wind Energy Market, offering a wide range of solutions that encompass wind turbine technology, grid integration, and energy management systems. The company is known for its innovative offshore wind turbines, which are designed to operate efficiently in challenging marine environments. Siemens' commitment to sustainability is evident in its efforts to promote renewable energy sources and reduce carbon emissions. The company also provides advanced digital solutions that enhance the performance and reliability of offshore wind farms.

Top Strategies Used By The Key Market Participants

Investment in Infrastructure

Key players in the North America Offshore Wind Energy Market are making significant investments in infrastructure to strengthen their competitive position. This includes the development of manufacturing facilities for wind turbine components, specialized ports for assembly and deployment, and dedicated vessels for installation and maintenance. By establishing a robust infrastructure, companies can streamline their supply chains, reduce logistical costs, and enhance project timelines. This strategic investment not only supports large-scale offshore wind deployments but also fosters local job creation and economic growth. Additionally, having the right infrastructure in place allows companies to respond more effectively to market demands and regulatory requirements, positioning them as leaders in the rapidly evolving offshore wind sector.

Collaboration and Partnerships

Collaboration and partnerships are essential strategies for key players in the North America Offshore Wind Energy Market. By forming strategic alliances with local governments, research institutions, and other industry stakeholders, companies can leverage shared resources, expertise, and technology to facilitate smoother project execution. These collaborations often lead to joint ventures that enhance innovation and reduce risks associated with large-scale offshore projects. Furthermore, partnerships with local communities can help address regulatory challenges and build public support for wind energy initiatives.

Focus on Innovation

A strong focus on innovation is a critical strategy for companies in the North America Offshore Wind Energy Market. Continuous research and development efforts are aimed at improving turbine efficiency, enhancing energy output, and reducing operational costs. Companies are investing in advanced technologies, such as larger and more efficient turbines, as well as floating wind farms that can be deployed in deeper waters, expanding the geographical reach of offshore wind energy. By prioritizing innovation, these companies can stay ahead of competitors and adapt to changing market dynamics. Furthermore, innovative solutions can help address environmental concerns and regulatory requirements, further solidifying their position in the market as leaders in sustainable energy technology.

COMPETITIVE LANDSCAPE

The North America Offshore Wind Energy Market is becoming very competitive as more companies enter the field. Offshore wind energy uses large wind turbines placed in oceans or lakes to generate electricity. This type of energy is clean and helps reduce pollution. Many countries, especially the United States and Canada, are investing in offshore wind projects to meet their energy needs and fight climate change.

Several big companies, like GE Vernova, Vestas, and Siemens, are leading the market. They are working hard to create better and more efficient wind turbines. These companies are also investing in new technologies and building strong partnerships with local communities and governments. This helps them gain support for their projects and ensures they follow environmental rules.

As the demand for renewable energy grows, more companies are trying to enter the offshore wind market. This competition encourages innovation and helps lower costs, making wind energy more affordable for everyone. Overall, the North America Offshore Wind Energy Market is growing quickly, and the competition among companies is helping to create a cleaner and more sustainable energy future for the region.

KEY MARKET PLAYERS

Atlantic Shores Offshore Wind, EnBW North America, ENESSERE S.r.l., FURUKAWA ELECTRIC CO., LTD, General Electric, IMPSA, LS Cable & System Ltd, Nexans, Prysmian Group, RWE Renewables, Shell WindEnergy Inc, Southwire Company, LLC, Sumitomo Electric Industries, Ltd., US Wind Inc., Vestas. are the market players that are dominating the North offshore wind energy market.

RECENT HAPPENINGS IN THIS MARKET

- In March 2025, RWE, Germany's largest utility, announced a reduction in its investment program by over 20%, amounting to €10 billion. This decision, driven by uncertainties in renewable energy returns, impacts their offshore wind projects in the U.S., where they hold substantial renewable capacity. The company also raised return requirements for new investments to over 8.5%.

- In March 2025, OEG, a UK-based offshore wind farm service provider, shifted its acquisition strategy back to the oil and gas industry. This decision follows their acquisition by U.S. private equity firm Apollo in a deal valued at over $1 billion, aligning with renewed investments in drilling by oil majors.

- In January 2025, President Donald Trump issued a Presidential Memorandum temporarily withdrawing all areas on the Outer Continental Shelf from offshore wind leasing. This directive also initiated a review of federal leasing and permitting practices for wind projects, introducing substantial policy changes affecting both onshore and offshore wind development.

- In January 2025, offshore wind approvals and lease auctions were paused in response to the Presidential Memorandum. Analysts predict that while projects with secured approvals and financing may proceed, early-stage projects are unlikely to advance under the current administration.

- In January 2025, the Presidential Memorandum took effect, enforcing the temporary withdrawal of all areas within the Outer Continental Shelf from wind energy leasing. This directive is expected to significantly impact the wind industry, affecting both existing and future projects.

MARKET SEGMENTATION

This research report on the North American offshore wind energy market is segmented and sub-segmented into the following categories.

By Component

- Turbine

- Rating

- ≤ 2 MW

- >2≤ 5 MW

- >5≤ 8 MW

- >8≤10 MW

- >10≤ 12 MW

- > 12 MW

- Installation

- Floating

- Axis

- Horizontal (HAWTs)

- Up-wind

- Down-wind

- Vertical (VAWTs)

- Horizontal (HAWTs)

- Component

- Blades

- Tower

- Others

- Axis

- Fixed

- Axis

- Horizontal (HAWTs)

- Up-wind

- Down-wind

- Vertical (VAWTs)

- Horizontal (HAWTs)

- Component

- Blades

- Tower

- Others

- Axis

- Floating

- Rating

- Support structure

- Substructure Steel

- Foundation

- Monopile

- Jacket

- Others

- Electrical infrastructure

- Wires & Cables

- Substation

- Others

- Others

By Depth

- >0 ≤ 30 m

- >30 ≤ 50 m

- > 50 m

By Country

- U.S

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

What factors are driving the growth of offshore wind energy in North America?

Government incentives, advancements in turbine technology, declining costs, and a strong push for renewable energy are fueling market expansion.

Which U.S. states are leading in offshore wind energy development?

States like New York, Massachusetts, New Jersey, and Virginia are at the forefront, with ambitious targets and major project investments.

How does offshore wind energy compare to onshore wind in terms of efficiency?

Offshore wind farms generally generate higher and more consistent energy output due to stronger and steadier wind speeds over oceans.

What are the major challenges facing the offshore wind sector in North America?

High initial costs, complex permitting processes, environmental concerns, and the need for advanced grid infrastructure pose key challenges.

Who are the leading companies investing in offshore wind projects in North America?

Major players include Ørsted, Equinor, Shell, BP, GE Renewable Energy, and Avangrid, developing large-scale offshore wind farms.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]