North America Oats Market Size, Share, Trends & Growth Forecast Report By Type (Whole Oats, Rolled Oats, Steel Cut, Instant Oats, and others), Application, Distribution Channel, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

North America Oats Market Size

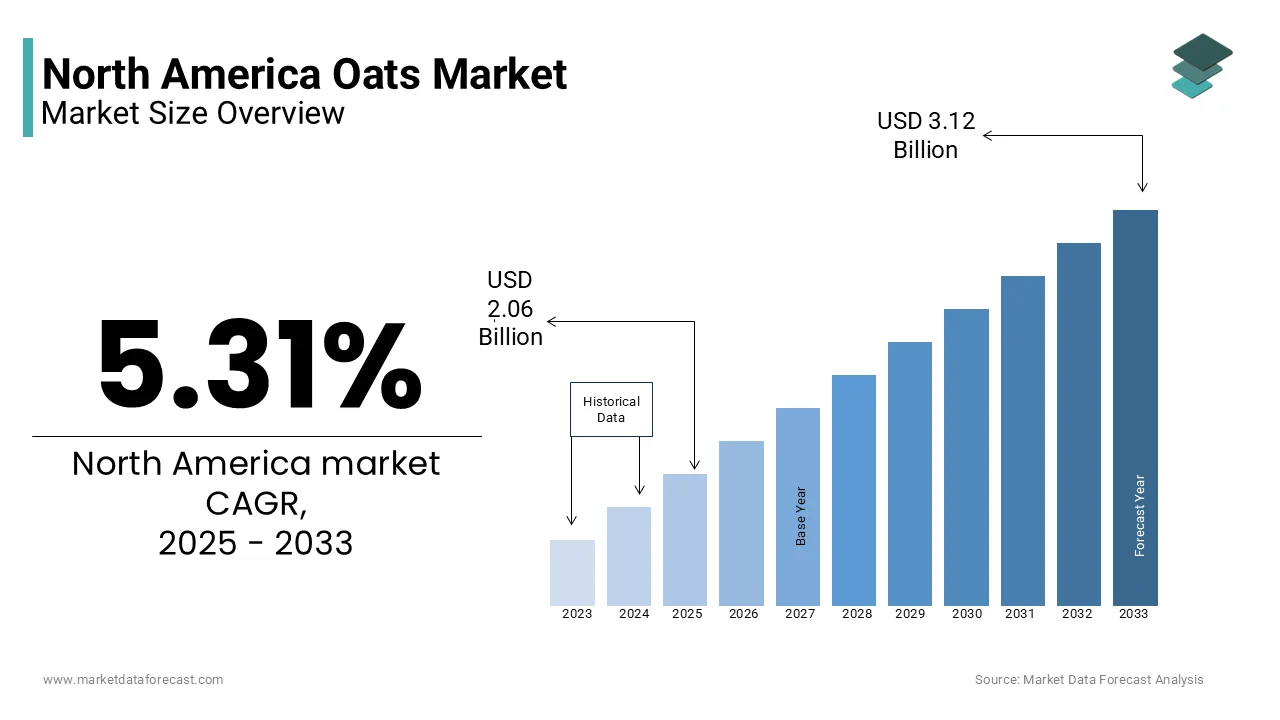

The North America oats market size was valued at USD 1.96 billion in 2024. The European market is estimated to be worth USD 3.12 billion by 2033 from USD 2.06 billion in 2025, growing at a CAGR of 5.31% from 2025 to 2033.

Oats, a nutrient-dense cereal grain, have long been integral to the North American diet, celebrated for their health benefits and versatility. In recent years, consumer preferences have shifted towards natural and wholesome foods, propelling oats into the spotlight as a favored choice for health-conscious individuals. This trend is elevated by the increasing demand for organic and non-GMO oat products by reflecting a broader movement towards clean eating and transparency in food sourcing.

The versatility of oats extends beyond traditional breakfast cereals as they are now commonly incorporated into snacks, beverages, and even personal care items by showcasing their adaptability in various industries. The well-established food processing sector in North America has embraced this versatility by integrating oats into a multitude of products to cater to evolving consumer tastes.

Furthermore, the rising popularity of plant-based diets has positioned oats as a valuable ingredient in meat and dairy alternatives by aligning with the growing interest in sustainable and ethical food choices. This shift is not merely a fleeting trend but reflects a significant change in dietary patterns with consumers seeking foods that are both nutritious and environmentally friendly.

MARKET DRIVERS

Growing Demand for Health-Conscious Food Choices

The increasing consumer preference for health-conscious food options is a significant driver of the North American oats market. Oats are recognized as a nutrient-rich grain, high in fiber and beneficial for heart health, which has led to their incorporation into various food products like cereals, granola bars, and plant-based beverages. According to the United States Department of Agriculture (USDA), per capita consumption of oats in the U.S. increased by approximately 6% between 2018 and 2022 with the rising awareness of dietary benefits. According to the Centers for Disease Control and Prevention, over 45% of Americans actively seek healthier food alternatives.

Expansion of Plant-Based and Dairy-Free Products

The rapid expansion of the plant-based food industry is another key factor propelling the oats market in North America. Oats are a critical ingredient in plant-based milk, yogurt, and other dairy alternatives with increasing veganism and lactose intolerance concerns. According to the USDA Economic Research Service, plant-based milk sales accounted for 15% of total retail milk sales in 2022, with oat milk being the fastest-growing segment. Additionally, the Good Food Institute reports that investments in plant-based companies surged by 60% in 2021 alone that further boosting production capacities for oat-derived products. This shift is supported by Canada’s Agricultural Policy Framework, which emphasizes sustainable crop cultivation, including oats, to meet global demand for eco-friendly food solutions.

MARKET RESTRAINTS

Fluctuating Agricultural Input Costs

The North American oats market faces challenges due to rising agricultural input costs, which impact production profitability. According to the United States Department of Agriculture (USDA), fertilizer prices surged by 30% in 2022 compared to the previous year with the supply chain disruptions and increased energy costs. According to the Canadian Federation of Agriculture, seed and pesticide expenses have risen by 15% annually over the past three years that further strains oat farmers. These escalating costs reduce profit margins, especially for small-scale producers, and may discourage oat cultivation. According to the USDA Economic Research Service, high input costs contributed to a 5% decline in oat acreage in the U.S. between 2021 and 2022. This trend threatens the long-term sustainability of oat production, as growers may shift to more cost-effective crops like corn or soybeans.

Climate Change and Weather Variability

Climate change poses a significant restraint to the North American oats market by increasing the frequency of extreme weather events, which disrupt crop yields. As per the National Oceanic and Atmospheric Administration (NOAA), droughts and unseasonal rainfall affected over 20% of oat-growing regions in the U.S. and Canada during 2021 by leading to a 10% drop in oat production. Additionally, the Intergovernmental Panel on Climate Change (IPCC) warns that rising temperatures could reduce oat yields by up to 15% in key growing areas by 2030. According to the USDA, such variability forces farmers to invest in costly adaptive measures, such as irrigation systems, which are not always feasible. These climate-related challenges create uncertainty in supply chains by impacting both domestic consumption and export potential for North American oats.

MARKET OPPORTUNITIES

Rising Export Potential to Global Markets

North America’s oats market is poised to benefit from increasing global demand for high-quality oats, creating significant export opportunities. According to the United States Department of Agriculture (USDA), the U.S. exported over 1.2 million metric tons of oats in 2022, with key destinations including Mexico, China, and the European Union. This growth is driven by the rising popularity of oat-based products worldwide, such as oat milk and health snacks. As per Agriculture and Agri-Food Canada, Canadian oat exports reached a record 2.3 million metric tons in 2021 by accounting for 70% of global oat trade. North American producers are well-positioned to capitalize on this trend as international markets increasingly prioritize sustainable and nutritious grains. The USDA Foreign Agricultural Service predicts a 10% annual increase in oat exports through 2025, underscoring the immense potential for expansion.

Growing Adoption in Functional Foods and Beverages

The integration of oats into functional foods and beverages presents a lucrative opportunity for the North American oats market. The Food and Drug Administration (FDA) recognizes oats as a heart-healthy ingredient due to their beta-glucan content, which supports cholesterol reduction. This has led to their inclusion in innovative products like fortified cereals, protein bars, and ready-to-drink shakes. Furthermore, the USDA Economic Research Service notes that the incorporation of oats into plant-based beverages has increased manufacturing investments by 25% since 2020. These trends leverage the potential for oats to dominate the expanding functional food sector.

MARKET CHALLENGES

Limited Infrastructure for Oat Processing

A significant challenge for the North American oats market is the lack of adequate infrastructure for oat processing, which hampers market growth. According to the United States Department of Agriculture (USDA), less than 30% of oats produced in the U.S. are processed domestically, with much of the raw grain exported to countries like Finland and Sweden, where advanced milling facilities are available. This dependency on foreign processing limits value addition within North America. The Canadian Grain Commission notes that only a handful of large-scale oat processing plants operate in Canada, which is leading to bottlenecks during peak harvest seasons. Furthermore, the USDA Economic Research Service reports that investments in oat-specific infrastructure have lagged behind other grains, with capital allocation for oat processing increasing by just 5% annually since 2018, when compared to 12% for wheat and barley.

Competition from Substitute Grains

The North American oats market faces stiff competition from substitute grains like barley, rye, and quinoa, which are gaining traction among health-conscious consumers. The United States Department of Agriculture (USDA) states that barley production in the U.S. increased by 8% in 2022, driven by its use in functional foods and beverages. Similarly, the Food and Agriculture Organization (FAO) reports that global quinoa consumption has risen by 15% annually over the past five years, cutting into the market share of oats. According to the Centers for Disease Control and Prevention, dietary trends favoring low-carb and gluten-free alternatives have led to a 10% decline in oat-based product sales in niche markets. These substitutes often command premium pricing and appeal to evolving consumer preferences is posing a challenge to the dominance of oats in the health food segment.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.31% |

|

Segments Covered |

By Type, Application, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Scoular Company, Quaker Oats Company, Morning Foods, General Mills, Richardson International, Grain Millers, Avena Foods, Blue Lake Milling, B&G Foods, Inc., and The Kellogg Company, along with Marico Limited, and others. |

SEGMENT ANALYSIS

By Type Insights

The rolled oats segment dominated the North American oats market with a share of 45.3% in 2024 owing to the versatility in culinary applications, including breakfast cereals, granola bars, and baked goods. According to the USDA, rolled oats are favored for their longer shelf life and ease of preparation compared to other oat types. According to the Centers for Disease Control and Prevention, nutritional benefits, such as high fiber content, which supports heart health. This segment's prominence is further bolstered by its widespread use in school meal programs, with over 30% of U.S. schools incorporating rolled oats into their menus.

The instant oats segment is likely to experience a CAGR of 8.2% from 2025 to 2033. This rapid growth is driven by the increasing demand for convenience foods among working professionals and urban consumers. According to the National Institutes of Health, instant oats are perceived as a quick yet nutritious option by accounting for 25% of total oat-based product sales in 2022.

By Application Insights

The Food & Beverage segment dominated the North American oats market by capturing 61.2% of share in 2024 with the widespread use of oats in breakfast cereals, snacks, and plant-based beverages like oat milk. According to the US Department of Agriculture, oat milk sales alone grew by 30% in 2021. Oats are favored for their nutritional benefits, including high fiber content and heart health properties, as per the Food and Drug Administration (FDA). Their versatility in food products makes this segment critical to the oats market's overall growth and consumer adoption.

The personal Care and Cosmetics segment is anticipated to witness a CAGR of 9.5% from 2025 to 2033. This rapid growth is fueled by increasing demand for natural and skin-friendly ingredients, with oats being widely recognized for their soothing and moisturizing properties. According to the Centers for Disease Control and Prevention, over 60% of consumers prefer skincare products with natural components, boosting oat-based formulations. Additionally, the USDA Economic Research Service states that investments in oat-derived personal care products surged by 20% in 2022. This trend aligns with the rising global focus on sustainability by making oats a key ingredient in eco-conscious beauty solutions.

By Distribution Channel Insights

The supermarkets and hypermarkets segment dominated the North American oats market by occupying a 45.5% of share in 2024 owing to the convenience they offer, with a wide variety of oat-based products available under one roof. According to the US Department of Agriculture, over 60% of consumers prefer purchasing oats from these channels due to competitive pricing and frequent promotions. Additionally, Nielsen reports that supermarkets/hypermarkets account for 70% of bulk oat sales.

The online segment is likely to pose a significant CAGR of 18.3% from 2025 to 2033. This rapid expansion is fueled by the increasing adoption of e-commerce platforms, especially post-pandemic. According to the U.S. Census Bureau, online grocery sales grew by 54% in 2020 alone, with oats being a staple purchase. Additionally, the USDA Economic Research Service notes that millennials and Gen Z consumers, who prioritize convenience and sustainability, contribute significantly to this trend. Subscription models and direct-to-consumer brands further accelerate growth. The importance of this segment lies in its ability to reach niche markets and provide innovative oat products by enhancing consumer engagement and market penetration.

REGIONAL ANALYSIS

The United States dominated the North American oats market and held 85.6% of share in 2024 due to its large-scale oat production, with over 1.5 million metric tons harvested annually, primarily in states like Minnesota and North Dakota. According to the USDA, the U.S. is also a major exporter, shipping over 1.2 million metric tons of oats globally in 2022. Its robust food processing industry, coupled with rising consumer demand for oat-based products like cereals and plant-based milk, reinforces its dominance.

Canada is swiftly emerging with a projected CAGR of 7.8% during the forecast period. This growth is driven by Canada’s status as the world’s largest oat exporter, accounting for nearly 70% of global trade. According with Canadian Grain Commission, oat exports reached a record 2.3 million metric tons in 2021, which is fueled by rising international demand for plant-based foods. According to the USDA Foreign Agricultural Service, Canada’s adoption of advanced milling technologies has boosted domestic processing capacity by 15% since 2020. These factors, combined with government support for sustainable farming practices to make Canada pivotal to the oats market’s expansion.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

The Scoular Company, Quaker Oats Company, Morning Foods, General Mills, Richardson International, Grain Millers, Avena Foods, Blue Lake Milling, B&G Foods, Inc., and The Kellogg Company, along with Marico Limited are playing dominating role in the North America oats market.

The North American oats market is characterized by intense competition, driven by the presence of established players, innovative startups, and a growing focus on health-conscious consumer trends. Major companies such as The Quaker Oats Company, General Mills, and Richardson International dominate the landscape, leveraging their strong brand recognition, extensive distribution networks, and commitment to quality. These players compete not only in terms of product offerings but also through strategic initiatives like sustainability, innovation, and global export capabilities. For instance, Quaker Oats has capitalized on its iconic brand by introducing gluten-free and organic oat products, while Richardson International focuses on exporting premium-quality oats to international markets.

In addition to these giants, smaller companies and regional players are gaining traction by targeting niche segments, such as plant-based beverages and functional foods. This has intensified competition, pushing larger firms to adopt advanced technologies and sustainable practices to maintain their edge. According to the Canadian Grain Commission, Canada’s oat exports, primarily managed by companies like Richardson, account for a significant share of global trade, further intensifying regional rivalry.

Moreover, the rise of private-label brands and increasing consumer demand for affordable yet nutritious options have added another layer of competition. Companies are investing heavily in marketing campaigns, emphasizing oats' health benefits and versatility. According to the USDA, the U.S. remains a key player in both production and consumption, with Canada focusing on exports. This dynamic interplay between domestic and international demand ensures a highly competitive yet evolving market environment, fostering innovation and growth across the North American oats market.

TOP PLAYERS IN THE MARKET

The Quaker Oats Company

The Quaker Oats Company, a subsidiary of PepsiCo, is a dominant force in the North American oats market. Known for its iconic brand and wide product portfolio, the company has established itself as a leader in oat-based foods and beverages. Quaker Oats focuses on health-conscious consumers, offering products like oatmeal, cereals, and snacks that emphasize nutritional benefits. Its strong global presence and extensive distribution network have allowed it to maintain a significant influence on the market. The company’s commitment to innovation, such as introducing gluten-free and organic options, ensures it remains at the forefront of industry trends. Additionally, Quaker Oats' emphasis on sustainable sourcing practices strengthens its reputation as a responsible and reliable player in the global oats trade.

General Mills

General Mills is another major contributor to the North American oats market, with a focus on breakfast cereals and snacks. The company leverages oats as a core ingredient in popular brands like Cheerios and Nature Valley, which are household names across the region. General Mills has capitalized on the growing demand for functional foods by escalating the health benefits of oats, such as their role in promoting heart health. The company is also committed to sustainability, working closely with farmers to source high-quality, responsibly grown oats. This approach not only supports local agriculture but also aligns with consumer preferences for eco-friendly products. General Mills' strong brand equity and innovation-driven strategy make it a key player in shaping the future of the oats market.

Richardson International

Richardson International is a significant player in the oats market, particularly in Canada, where it plays a critical role in oat exports. As one of the largest grain handlers in North America, Richardson specializes in processing and exporting oats to international markets, including Europe and Asia. The company operates advanced oat processing facilities, enabling it to meet the growing global demand for oat-based products. Richardson International’s focus on quality and innovation has positioned it as a trusted supplier in the global oats trade. By partnering with farmers and investing in sustainable practices, the company ensures a steady supply of premium oats while supporting the agricultural community. Its export-oriented approach reinforces North America's dominance in the global oats market.

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

Product Innovation and Diversification

Key players in the North American oats market, such as The Quaker Oats Company and General Mills, focus heavily on product innovation to cater to evolving consumer preferences. These companies have introduced gluten-free, organic, and functional oat-based products to align with health-conscious trends. For instance, General Mills has expanded its Cheerios line to include multigrain and protein-enriched variants, while Quaker Oats has launched ready-to-eat oatmeal cups and plant-based oat beverages. This diversification strategy helps them capture niche markets and appeal to a broader audience. By continuously innovating, these companies ensure their offerings remain relevant in a competitive landscape.

Sustainability and Responsible Sourcing

Sustainability is a cornerstone strategy for major players like Richardson International and General Mills. Richardson International emphasizes sustainable grain handling by partnering with farmers to promote eco-friendly farming practices. Similarly, General Mills has committed to sourcing oats from farms that adhere to regenerative agriculture principles, reducing environmental impact while ensuring supply chain resilience. These efforts not only enhance brand reputation but also meet growing consumer demand for ethically produced goods, strengthening their market position.

Strategic Partnerships and Acquisitions

To expand their reach and capabilities, key players engage in strategic partnerships and acquisitions. For example, B&G Foods, Inc. acquired brands to diversify its portfolio, including oat-based products, to tap into new customer segments. Richardson International collaborates with international buyers to boost exports, while Quaker Oats partners with retailers to improve product visibility. Such alliances enable companies to scale operations, access new markets, and leverage shared expertise to stay competitive.

Brand Marketing and Consumer Engagement

Effective marketing strategies play a vital role in strengthening market presence. Companies like Kellogg’s and The Quaker Oats Company invest in campaigns is leveraging the oats' nutritional benefits, targeting health-conscious consumers. Social media, influencer collaborations, and educational content are used to engage audiences and build brand loyalty. By positioning oats as a versatile, healthy ingredient, these players reinforce their prominence in the market while driving long-term growth.

RECENT HAPPENINGS IN THE MARKET

- In February 2018, General Mills acquired Blue Buffalo Pet Products for $8 billion. This acquisition allowed General Mills to expand into the pet food sector, diversify its product offerings, and leverage its distribution networks.

- In March 2019, General Mills launched a pilot program for regenerative agriculture, aiming to improve soil health on 1 million acres of farmland by 2030. This initiative strengthened its sustainability efforts and oat sourcing strategy.

- In May 2022, General Mills acquired TNT Crust, a supplier of frozen pizza crusts. This acquisition diversified General Mills’ product portfolio and bolstered its position in the North American food market.

- In July 2022, General Mills sold its Helper and Suddenly Salad businesses to Eagle Family Foods Group for $610 million. This move allowed the company to refocus on its core categories like cereals and snacks.

- In November 2023, General Mills acquired Fera Pets, Inc., expanding its pet product segment. This acquisition enhanced its presence in the pet supplement market and aligned with its broader pet food strategy.

- In September 2024, General Mills sold its North American yogurt business to Groupe Lactalis and Sodiaal. This decision helped streamline operations and enabled the company to concentrate on higher-growth product categories.

- In July 2024, the FDA issued a warning to Quaker Oats regarding potential Salmonella contamination at a production facility. Quaker Oats addressed these safety concerns to maintain consumer trust and protect its market position.

- In December 2024, General Mills increased its promotional investments, particularly in media campaigns for its Pillsbury brand. This strategy was implemented to attract cost-conscious consumers and boost sales volumes.

- In December 2024, General Mills reduced product pricing across its range, including snacks and pet food. This move aimed to remain competitive and appeal to value-conscious shoppers.

- In February 2025, Quaker Oats recalled 10,000 boxes of Pearl Milling Company Original Pancake & Waffle Mix due to undeclared milk. This recall addressed allergen risks and reinforced the company’s commitment to consumer safety.

MARKET SEGMENTATION

This research report on the North America oats market is segmented and sub-segmented into the following categories.

By Type

- Whole Oats

- Rolled Oats

- Steel Cut

- Instant Oats

- Others

By Application

- Food & Beverage

- Animal Feed

- Personal Care and Cosmetics

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Grocery Stores

- Online

- Others

By Country

- The United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What is the expected growth rate for the North America Oats market from 2025 to 2033?

The market is expected to grow at a compound annual growth rate (CAGR) of 5.31% during this period.

2. How does the North America Oats market compare globally?

The North America Oats market is a significant segment within the global oats market, characterized by strong demand driven by health trends and a well-established food processing industry, although it faces competition from rapidly growing markets in other regions.

3. What factors are driving the growth of the North America Oats market?

Key drivers include increasing consumer demand for healthy and nutritious food options, rising awareness of the health benefits of oats, and a growing trend towards organic and gluten-free products.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]