North America Microspheres Market Size, Share, Trends & Growth Forecast Report By Type And Raw Material (Hollow, Solid, Glass, Ceramic, Fly Ash, Polymer, Metallic, Others) Application and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Microspheres Market Size

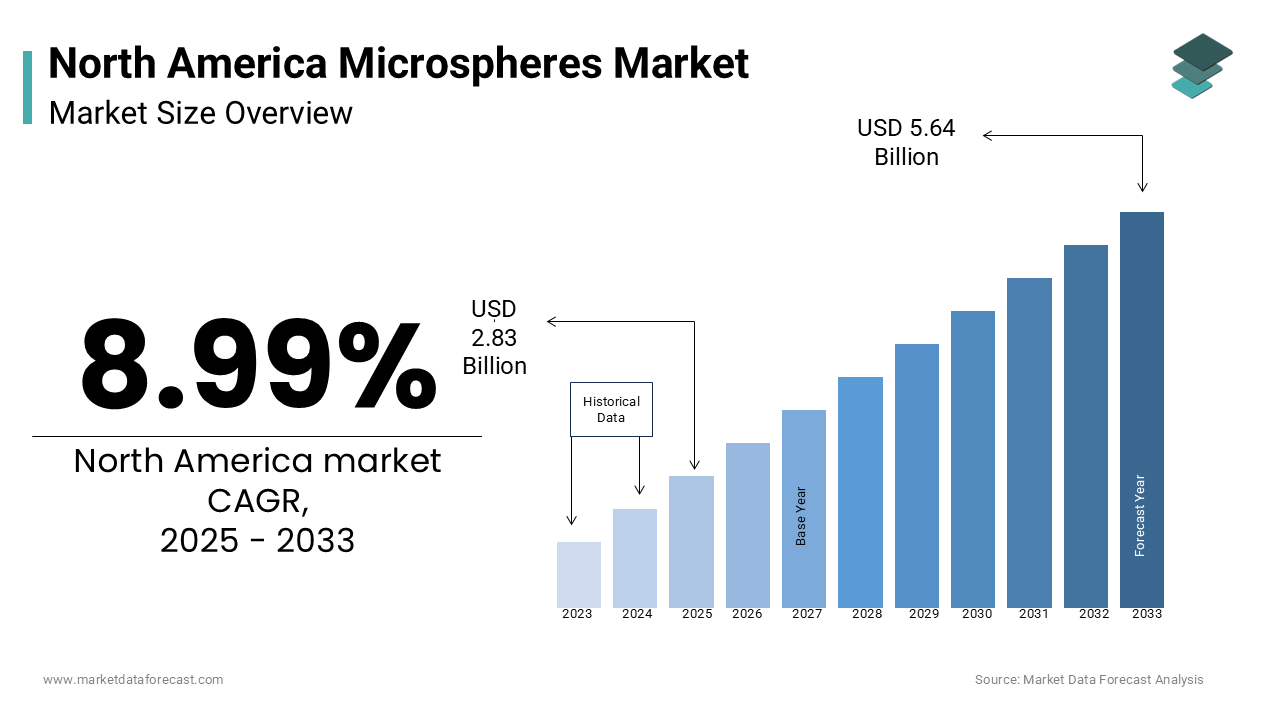

The North America microspheres market was worth USD 2.60 billion in 2024. The North America market is expected to reach USD 5.64 billion by 2033 from USD 2.83 billion in 2025, rising at a CAGR of 8.99% from 2025 to 2033.

MARKET DRIVERS

Rising Demand in Medical Technology

One of the primary drivers of the North America microspheres market is the surging demand for advanced materials in medical technology in drug delivery systems and imaging technologies. Microspheres are widely used in controlled-release formulations, enabling precise drug dosing and minimizing side effects. Their biocompatibility and ability to encapsulate active pharmaceutical ingredients make them ideal for oncology treatments and chronic disease management. Additionally, innovations in imaging technologies, such as contrast agents using metallic microspheres, have expanded their usability in diagnostic procedures. As per the American Society of Clinical Oncology, microsphere-based therapies accounted for 30% of all targeted cancer treatments in 2022.

Increasing Adoption in Lightweight Construction Materials

Another key driver is the increasing adoption of microspheres in lightweight construction materials, driven by the growing emphasis on energy efficiency and sustainability. These microspheres, typically made from glass or ceramic, are incorporated into cement, coatings, and adhesives to improve durability and reduce environmental impact. The rise of green building certifications, such as LEED, further amplifies demand for eco-friendly construction materials.

MARKET RESTRAINTS

High Production Costs

One of the primary restraints facing the North America microspheres market is the high cost associated with their production for advanced materials like ceramic and metallic microspheres. According to the International Journal of Advanced Manufacturing Technology, the production of ceramic microspheres involves complex processes such as sintering and plasma spraying, which significantly increase manufacturing expenses. These costs are passed onto consumers, making ceramic microspheres up to 50% more expensive than alternatives like glass or polymer-based microspheres. Additionally, fluctuations in raw material prices, such as silica and alumina, exacerbate cost pressures.

Technical Limitations in Application

Another significant restraint is the technical limitations associated with certain types of microspheres in high-performance applications. Solid microspheres, while offering superior strength, often lack the lightweight properties required for aerospace and automotive industries. Similarly, inconsistencies in particle size distribution and surface properties create operational inefficiencies in applications requiring precise material characteristics, such as medical imaging and drug delivery. These technical drawbacks force manufacturers to invest heavily in R&D to develop solutions that balance performance, cost-effectiveness, and scalability. Addressing these challenges is essential to ensuring broader market penetration and sustained growth.

MARKET OPPORTUNITIES

Expansion into Emerging Applications

Emerging applications present a lucrative opportunity for the North America microspheres market by technological advancements and evolving consumer preferences. Sectors such as cosmetics and personal care are increasingly adopting microspheres due to their unique properties, such as smooth texture and controlled release capabilities. Similarly, the automotive industry is incorporating polymer-based microspheres to enhance lightweight components by reducing vehicle weight and improving fuel efficiency. Innovations in microsphere blends, such as combining them with nanomaterials, have expanded their usability in high-performance applications.

Growing Adoption of Eco-Friendly Solutions

The growing adoption of eco-friendly solutions represents another promising opportunity for microspheres in the construction and oil & gas sectors. Consumers and industries alike are increasingly seeking sustainable alternatives to traditional materials by driving demand for fly ash and glass-based microspheres. According to the Environmental Protection Agency (EPA), the use of fly ash microspheres in cement reduced CO2 emissions by 20% in 2022 compared to conventional materials. Additionally, glass-based microspheres are gaining traction in oil & gas drilling operations, where they enhance buoyancy and reduce environmental impact. The rise of green building certifications, such as LEED, further amplifies adoption by positioning microspheres as a key enabler of innovation in sustainable manufacturing.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain disruptions pose a significant challenge to the North America microspheres market, exacerbated by geopolitical tensions and logistical bottlenecks. The COVID-19 pandemic escalated the vulnerabilities in global supply chains, with key raw materials like silica and alumina experiencing shortages and price volatility. According to the International Trade Administration, lead times for raw material imports increased by 25% in 2022 compared to pre-pandemic levels. These delays disrupt production schedules and inflate costs by forcing manufacturers to seek alternative suppliers or pass additional expenses onto customers. Furthermore, trade restrictions, such as tariffs on Chinese imports, have impacted the availability of affordable raw materials, further complicating procurement processes.

Intense Competition from Substitute Materials

Intense competition from substitute materials, such as traditional fillers and additives, presents another challenge for the microspheres market. Traditional materials like talc and calcium carbonate offer similar performance characteristics at a lower cost, making them a preferred choice for budget-conscious manufacturers. These substitutes not only compete on price but also benefit from established manufacturing processes and widespread availability. The microspheres manufacturers must differentiate their offerings through innovation and emphasize the unique advantages of microspheres, such as their lightweight properties and enhanced performance in specialized applications.

SEGMENTAL ANALYSIS

By Type and Raw Material Insights

The Hollow microspheres dominated the North America microspheres market by capturing 45.4% of share in 2024 due to their lightweight properties and excellent thermal insulation capabilities by making them ideal for applications in construction composites and oil & gas drilling. Their ability to reduce material weight while maintaining structural integrity aligns with the growing emphasis on sustainability and energy efficiency. Additionally, innovations in coating technologies have expanded their usability in high-performance applications, such as aerospace and automotive components.

The polymer-based microspheres segment is projected to register a represent a CAGR of 9.2% during the forecast period. This growth is fueled by their versatility and compatibility with emerging applications in cosmetics, medical technology, and automotive industries. Innovations in biodegradable polymers have further enhanced their suitability for eco-friendly applications, such as skincare products and lightweight automotive components. Additionally, the growing emphasis on sustainability and recyclability amplifies adoption, positioning polymer-based microspheres as a transformative force in the market.

By Application Insights

The construction composites segment dominated the North America microspheres market by holding 35.4% of share in 2024 with the growing demand for lightweight and durable materials in the construction industry. According to the U.S. Green Building Council (USGBC), hollow microspheres, particularly glass-based variants, are widely used in cement, coatings, and adhesives to reduce material weight while enhancing thermal insulation properties. The rise of green building certifications, such as LEED, has further amplified demand for eco-friendly construction materials. Additionally, innovations in microsphere blends, such as combining them with nanomaterials, have expanded their usability in high-performance applications like fire-resistant coatings and structural reinforcements.

The medical technology segment is projected to witness a CAGR of 10.5% in the next coming years. This growth is fueled by the increasing adoption of advanced materials in drug delivery systems, imaging technologies, and regenerative medicine. Microspheres are widely used in controlled-release formulations by enabling precise drug dosing and minimizing side effects. Their biocompatibility and ability to encapsulate active pharmaceutical ingredients make them ideal for oncology treatments and chronic disease management. Additionally, innovations in metallic microspheres have expanded their usability in diagnostic procedures, such as contrast agents for imaging.

REGIONAL ANALYSIS

The United States dominated the North America microspheres market with 80.4% of total share in 2024 with a robust industrial base, high demand for advanced materials, and stringent environmental regulations that favor lightweight and eco-friendly solutions. This shift aligns with the growing emphasis on sustainability in sectors like construction, automotive, and healthcare. The country’s strong focus on medical technology further amplifies demand for polymer and metallic microspheres. Additionally, the rise of e-commerce platforms has created opportunities for microspheres in cosmetics and personal care products, where their controlled-release properties are highly valued.

Canada was accounted in holding 15.2% of the North America microspheres market share in 2024 with the commitment to sustainable practices and adherence to stringent environmental regulations supports the adoption of eco-friendly microspheres, particularly in construction and oil & gas sectors. According to Natural Resources Canada, over 70% of new construction projects in urban centers like Toronto and Vancouver incorporate green materials by benefiting manufacturers of fly ash and glass-based microspheres. The pharmaceutical sector is another key growth driver in Canada. The rise of biotechnology companies and research institutions has increased demand for advanced microsphere applications, such as drug delivery systems and imaging technologies.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

3M Company, Nouryon, Trelleborg AB, Matsumoto Yushi-Seiyaku Co., Ltd., Chase Corporation, and Potters Industries LLC are some of the key market players in the North America microspheres market.

The North America microspheres market is characterized by intense competition, driven by the presence of established giants and emerging players vying for market share. Companies differentiate themselves through technological advancements, product innovation, and sustainability initiatives. 3M Company, AkzoNobel, and Potters Industries dominate the market are leveraging their extensive product portfolios, strong distribution networks, and focus on eco-friendly solutions to maintain their dominant positions. Smaller players, however, are gaining traction by targeting niche segments and offering specialized products tailored to specific applications. For instance, some manufacturers focus on luxury microspheres designed for high-end applications like aerospace and medical devices, appealing to affluent buyers. Others emphasize affordability and functionality by catering to budget-conscious consumers. The rise of e-commerce platforms has further intensified competition, as online retailers offer competitive pricing and convenience by challenging traditional brick-and-mortar stores. Aggressive marketing campaigns and continuous improvements in product quality further amplify rivalry by ensuring dynamic market evolution.

Top Players in the Market

3M Company

3M Company’s success is from its extensive product portfolio, which includes innovative microspheres made from polymers, glass, and ceramics. 3M’s hollow glass microspheres are widely used in construction composites and oil & gas drilling operations due to their lightweight properties and thermal insulation capabilities. Strategic investments in R&D enable 3M to stay ahead of market trends, while its global expansion initiatives ensure widespread accessibility.

AkzoNobel N.V.

AkzoNobel N.V. company leverages its strong brand reputation and extensive distribution network to capture significant market share. AkzoNobel’s focus on sustainability is reflected in its development of eco-friendly microspheres, such as those made from fly ash and recycled glass, which align with stringent environmental standards. The acquisition of smaller specialty chemical companies in 2021 significantly enhanced its capabilities in advanced materials by enabling it to cater to diverse customer needs. AkzoNobel’s ability to adapt to market trends and regulatory requirements ensures sustained competitiveness.

Potters Industries LLC

Potters Industries LLC distinguishes itself through its emphasis on innovation and quality by offering specialized microspheres tailored to specific applications. Potters’ glass-based microspheres are renowned for their durability and performance in high-demand sectors like automotive and construction. The company’s commitment to sustainability is reflected in its development of recyclable formulations that align with global environmental standards. Strategic partnerships with major OEMs and retailers further amplify Potters’ reach by ensuring widespread availability of its products. Its focus on customer-centric solutions strengthens its position as a key market player.

Top Strategies Used by Key Market Participants

Key players in the North America microspheres market employ strategies such as mergers and acquisitions, product innovation, and geographic expansion to maintain their competitive edge. For instance, 3M Company’s acquisition of a Brazilian specialty materials producer in 2021 significantly bolstered its raw material supply chain, addressing vulnerabilities in global logistics. Similarly, AkzoNobel’s partnership with Walmart in 2022 expanded its presence in the U.S. retail market by enabling it to cater to a broader customer base. Innovations in microsphere blends, such as combining them with biodegradable polymers, address evolving consumer preferences for premium and sustainable materials. Strategic investments in R&D enable companies to develop cutting-edge solutions that meet regulatory standards and consumer demands.

RECENT MARKET DEVELOPMENTS

- In April 2024, 3M Company launched EcoSphere Pro, a new line of biodegradable microspheres designed for cosmetics and skincare products. This move addresses the growing demand for sustainable solutions in the personal care sector.

- In June 2023, AkzoNobel partnered with Home Depot to expand its construction composites line, resulting in a 25% increase in sales. The collaboration leverages Home Depot’s vast customer base and retail infrastructure.

- In March 2023, Potters Industries introduced NanoSphere Tech, a microsphere-based solution focused on lightweight automotive components. This initiative aligns with growing consumer demand for fuel-efficient vehicles.

- In January 2023, BASF acquired a Canadian distributor by enhancing its supply chain efficiency and ensuring timely delivery of microspheres across North America.

- In November 2022, Dow Chemical invested $50 million in a new R&D facility to develop advanced microsphere technologies, focusing on recyclable and eco-friendly formulations to reduce environmental impact.

MARKET SEGMENTATION

This research report on the North America microspheres market is segmented and sub-segmented into the following categories.

By Type and Raw Material

- Hollow

- Solid

- Glass

- Ceramic

- Fly Ash

- Polymer

- Metallic

- Others

By Application

- Construction Composites

- Medical Technology

- Life Science & Biotechnology

- Paints & Coatings

- Cosmetics & Personal Care

- Oil & Gas

- Automotive

- Aerospace

- Others

By Country

- The United States

- Canada

- Rest of North America

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]