North America Microgrid Market Size, Share, Trends & Growth Forecast Report By Grid Type (AC Microgrid. DC Microgrid, Hybrid), Connectivity, Power Source, Storage Device, Application and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Microgrid Market Size

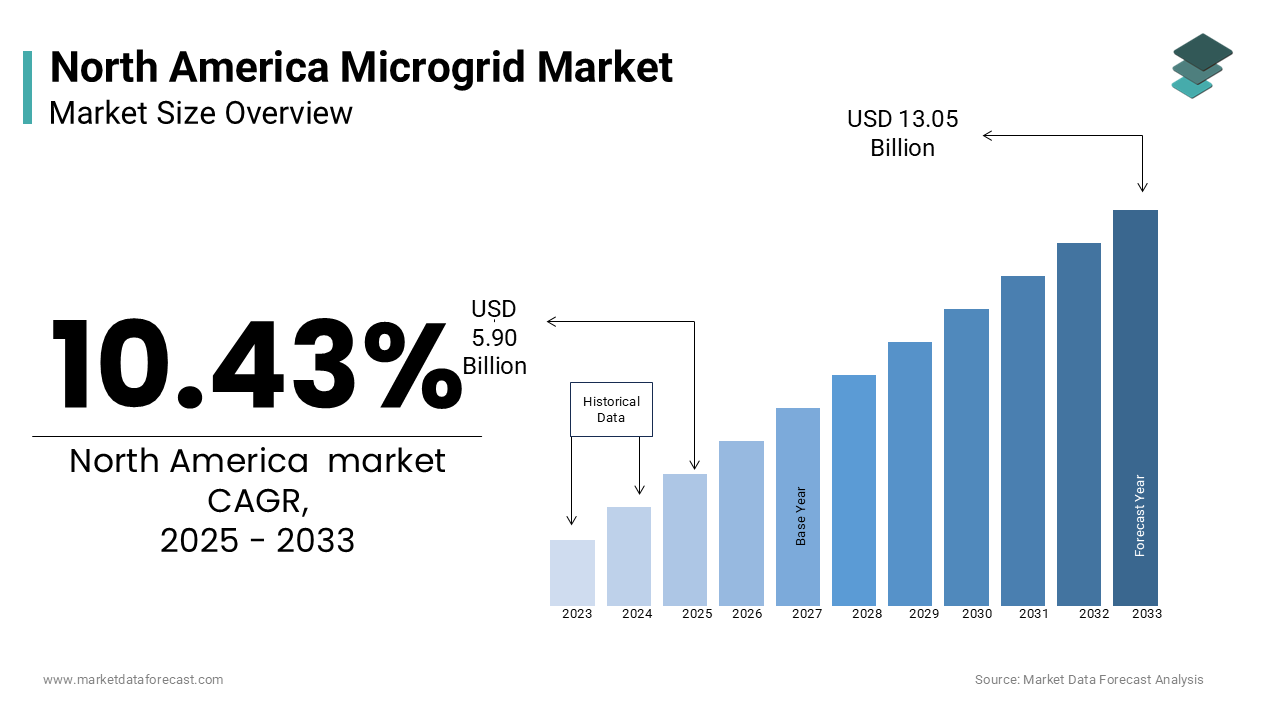

The North America microgrid market was worth USD 5.34 billion in 2024. The North American market is estimated to grow at a CAGR of 10.43% from 2025 to 2033 and be valued at USD 13.05 billion by the end of 2033 from USD 5.90 billion in 2025.

Microgrids are localized energy systems capable of operating independently or in conjunction with the main power grid, integrating various energy sources such as solar, wind, and battery storage to enhance energy efficiency and sustainability.

The adoption of microgrids has been accelerated by the rising frequency of extreme weather events. According to the National Oceanic and Atmospheric Administration (NOAA), the United States experienced 28 separate weather and climate disasters in 2023, each causing damages exceeding $1 billion, highlighting the vulnerability of centralized power systems.

In response to these challenges, the U.S. Department of Energy (DOE) has set ambitious goals for microgrid development. The DOE aims to create commercial-scale microgrid systems (with capacities under 10 megawatts) that can reduce outage times by over 98%, lower emissions by more than 20%, and improve system energy efficiencies by over 20%, all at a cost comparable to traditional solutions like uninterruptible power supplies combined with diesel generators.

Government initiatives further bolster microgrid deployment. For instance, the DOE's Microgrid Research and Development Program focuses on advancing microgrid technologies to enhance grid resilience and reliability. With ongoing technological advancements and supportive policies, the North American microgrid market is well-positioned for significant growth, contributing to a more sustainable and resilient energy infrastructure.

MARKET DRIVERS

Electrification of Remote and Off-Grid Areas

In North America, numerous rural and remote communities face challenges in accessing reliable electricity due to geographical isolation and the prohibitive costs associated with extending traditional power grids. To address this, the Canadian government initiated the Clean Energy for Rural and Remote Communities (CERRC) program in 2018, committing $453 million until 2027 to fund renewable energy projects aimed at reducing diesel dependency in these areas. Also, CERRC has supported over 190 renewable energy and capacity-building projects across Canada. Similarly, in the United States, the Department of Energy (DOE) launched the Community Microgrid Assistance Partnership (C-MAP) in October 2024 to assist remote, rural, and underserved communities in developing resilient microgrid systems. These initiatives aim to enhance energy security and sustainability by integrating renewable energy sources into localized microgrid system

Growing Role of Microgrids in EV Charging Infrastructure

The rapid adoption of electric vehicles (EVs) in North America is increasing electricity demand, particularly for fast-charging stations. Traditional grid infrastructure may struggle to support these growing energy needs, especially during peak hours. Microgrids offer a decentralized solution by integrating renewable energy sources, managing demand fluctuations, and reducing stress on the main power grid. While specific statistics on electricity consumption from transportation are evolving, the integration of microgrids with EV charging infrastructure is gaining attention as a strategy to enhance energy efficiency and reduce emissions. For instance, community solar projects are expanding to fill gaps in the clean energy transition, providing localized energy solutions that can support EV charging needs.

MARKET RESTRAINTS

Challenges in Energy Storage and Battery Costs

One of the key limitations of microgrid adoption is the high cost of energy storage systems, which are essential for balancing renewable energy generation and demand. While battery prices have declined over the years, they remain a major expense, particularly for large-scale microgrid installations. The U.S. Department of Energy has been investing in alternative storage technologies such as solid-state and flow batteries, which promise cost reductions and improved efficiency. However, commercial-scale deployment of these advanced solutions is still limited. Without affordable and scalable energy storage, microgrids relying on intermittent renewables face challenges in providing continuous power, limiting their widespread adoption across industries and communities.

Limited Standardization and Interoperability Issues

Microgrid deployment in North America is hindered by regulatory fragmentation and a lack of standardized technical frameworks. Different states and provinces have varying rules for grid interconnection, utility ownership, and financial incentives, creating uncertainty for investors and developers. The National Renewable Energy Laboratory shows that the absence of uniform permitting and operational standards leads to delays and increased project costs. Additionally, interoperability challenges arise when integrating microgrids with legacy grid infrastructure, requiring customized solutions for each deployment. The lack of standardization discourages large-scale investments and slows down adoption.

MARKET OPPORTUNITIES

Enhancing Grid Resilience and Reliability

Microgrids play a crucial role in improving grid resilience and ensuring reliable power supply, especially in regions prone to extreme weather events and natural disasters. North America has witnessed an increase in power outages due to hurricanes, wildfires, and winter storms. In line with the U.S. Energy Information Administration, the average duration of power outages in the United States reached nearly eight hours in 2021 is significantly impacting businesses and essential services. Microgrids mitigate these challenges by functioning independently from the main grid during disruptions. The U.S. Department of Energy has been actively promoting microgrid deployment to support emergency response infrastructure, reduce blackout risks, and enhance grid flexibility. Increased adoption of microgrids can significantly improve energy security and operational stability.

Advancements in Energy Storage Technologies

Technological progress in energy storage systems is driving the growth of microgrids across North America. Batteries are a critical component of microgrids, allowing for efficient energy storage and distribution, particularly when integrating renewable energy sources like solar and wind. Innovations such as solid-state and flow batteries are enhancing energy density, lifespan, and cost-effectiveness. The U.S. Department of Energy has been investing in next-generation storage solutions to improve grid reliability and efficiency. By 2030, lithium-ion battery prices are projected to decline further, making microgrid adoption more financially viable. Better storage technologies enable microgrids to operate autonomously for extended periods, reducing dependence on fossil fuels and supporting carbon reduction goals.

MARKET CHALLENGES

Cybersecurity Risks and Vulnerability to Cyberattacks

As microgrids become increasingly digital and connected, cybersecurity threats pose a growing challenge to their widespread adoption. Microgrids rely on advanced control systems, smart meters, and cloud-based energy management platforms, making them potential targets for cyberattacks. The U.S. Department of Energy has warned that cyber threats to the energy sector are evolving, with attacks on grid infrastructure becoming more sophisticated. In 2021, a major ransomware attack on Colonial Pipeline brought to light the vulnerability of critical infrastructure. A successful cyberattack on a microgrid could disrupt power supply, manipulate energy pricing, or compromise essential services. Strengthening cybersecurity protocols, implementing robust encryption methods, and enhancing threat detection capabilities are necessary to safeguard microgrids from cyber risks.

Challenges in Scaling Microgrids for Large-Scale Deployment

While microgrids have proven effective for localized energy resilience, scaling them for widespread deployment presents technical and economic challenges. Many existing microgrid projects are limited to small communities, military bases, or university campuses. Expanding microgrids on a larger scale requires seamless integration with the broader grid, advanced interoperability standards, and significant infrastructure investment. The National Renewable Energy Laboratory notes that developing standardized microgrid solutions that can be deployed at scale remains a key industry challenge. Additionally, ensuring that microgrids can efficiently handle dynamic energy loads and diverse generation sources is essential for their broader adoption.

SEGMENTAL ANALYSIS

By Grid Type Insights

The AC microgrids segment in 2024 accounted for 65.3% of the North America microgrid market that is making them the largest segment. These are widely used because they are compatible with existing power infrastructure and support easy integration with renewable energy sources like solar and wind. According to the U.S. Energy Information Administration, over 70% of renewable energy installations in North America are based on AC systems, making AC microgrids the preferred choice. Apart from this, the Department of Energy reported that over 85% of commercial and industrial buildings operate on AC power, increasing demand for AC-based microgrids. Their scalability, reliability, and compatibility with the traditional grid make them the leading choice for large-scale applications.

The Hybrid microgrids segment is projected to advance at a CAGR of 17.5% from 2025 to 2033 to place them as the fastest-growing segment in the North America microgrid market. These microgrids combine AC and DC power, allowing greater efficiency and flexibility, especially for remote and off-grid locations. The National Renewable Energy Laboratory (NREL) states that over 40% of microgrid projects in development involve hybrid models due to their ability to integrate solar, wind, and battery storage seamlessly. Besides, microgrid deployment in military bases has increased by 30% over the last five years, as per the U.S. Department of Defense, which prefers hybrid systems for energy security and operational resilience. The growing demand for resilient, energy-efficient solutions is driving the rapid adoption of hybrid microgrids across multiple sectors.

By Connectivity Insights

The grid-connected microgrids segment captured a substantial portion of the North America microgrid market. These are preferred because they allow seamless integration with existing utility grids, improving energy stability while reducing reliance on fossil fuels. Based on the U.S. Energy Information Administration (EIA), more than 80% of electricity consumption in North America comes from grid-connected sources is making this the dominant segment. Additionally, the Department of Energy (DOE) reported that over 500 grid-connected microgrid projects were deployed across the U.S. and Canada by 2024, supporting hospitals, universities, and corporate facilities. The rising demand for reliable, cost-effective power solutions has driven large-scale adoption of grid-connected microgrids.

The Off-grid microgrids segment anticipated to rice at a CAGR of 15.8%. This progress is propelled by rural electrification programs, energy independence needs, and resilience against natural disasters. As indicated by the National Renewable Energy Laboratory (NREL), over 2 million people in North America live in remote or rural areas where extending traditional power grids is costly. The U.S. Department of Defense has increased investment in off-grid microgrids for military bases and emergency operations, with spending on energy resilience programs rising by 40% in the past five years. Also, the Canadian Renewable Energy Association reported that off-grid solar and wind installations grew by 25% in 2024 is reflecting increasing demand for self-sustaining energy solutions in remote communities.

By Power Source Insights

In 2024, natural gas-powered microgrids possessed 40.1% of the North America microgrid market. Their dominance is due to high fuel availability, lower carbon emissions than diesel, and cost efficiency. According to the U.S. Energy Information Administration (EIA), natural gas contributed to 43% of total electricity generation in the U.S. in 2024, making it a reliable power source for microgrids. The Department of Energy (DOE) also reported that over 60% of newly installed microgrids in the last five years used natural gas generators, particularly in industrial and commercial facilities. The preference for cleaner, cost-effective energy solutions has solidified natural gas as the leading segment in the market.

Solar PV microgrids are predicted to advance at a CAGR of 18.2% owing to the falling solar panel costs, government incentives, and a strong push for renewable energy adoption. The National Renewable Energy Laboratory (NREL) states that solar installation costs have decreased by 70% over the past decade, making solar microgrids more affordable. Additionally, the U.S. Department of Energy’s Solar Energy Technologies Office has set a goal for solar to provide 40% of the nation's electricity by 2035, increasing investment in microgrids powered by solar PV. Canada is also expanding its renewable infrastructure, with the Canadian Renewable Energy Association reporting that solar energy capacity grew by 20% in 2024, boosting demand for solar-based microgrids.

By Storage Device Insights

The lithium-ion (Li-ion) batteries segment dominated the market by having for 65.1% portion of the North America microgrid market's energy storage segment. Their dominance is due to high energy density, longer lifespan, and declining costs. According to the U.S. Department of Energy (DOE), Li-ion battery costs have dropped by over 85% since 2010, making them the preferred choice for microgrid storage. Apart from this, the National Renewable Energy Laboratory (NREL) reported that more than 70% of new microgrid projects in the U.S. included Li-ion storage due to its superior efficiency, rapid charge cycles, and scalability.

Flow batteries segment is forecasted to grow at a CAGR of 16.9% from 2025 to 2033. These batteries are gaining traction because of longer cycle life, deep discharge capability, and scalability, which are essential for large-scale microgrids. The U.S. Department of Energy found that flow batteries offer over 10,000 charge cycles is significantly outperforming Li-ion in longevity. The National Renewable Energy Laboratory (NREL) emphasized that flow battery projects in microgrids increased by 30% in 2024, particularly in remote and utility-scale applications. Besides these, the California Energy Commission is funding flow battery storage projects to enhance grid stability and energy resilience, further accelerating adoption.

By Application Insights

The industrial/commercial sector commanded the market i.e. 38.4% of the North America microgrid market. This authority is backed by the high energy demand, cost savings from microgrid deployment, and resilience against power outages. According to the U.S. Department of Energy (DOE), industrial and commercial facilities consume over 35% of total U.S. electricity, making reliable power solutions essential. Also, the National Renewable Energy Laboratory (NREL) reported that more than 60% of operational microgrids in the U.S. serve industrial and commercial users, as these sectors benefit from reduced electricity costs and improved energy independence. The demand for sustainable and uninterrupted power has solidified this segment’s leadership in the microgrid market.

Remote microgrids are projected to grow at a CAGR of 17.4. The increasing need for reliable electricity in off-grid and disaster-prone areas is driving growth. The U.S. Department of Agriculture (USDA) reported that over 4.5 million people in North America rely on off-grid power solutions, highlighting the critical role of microgrids. The U.S. Federal Emergency Management Agency (FEMA) has also increased funding for disaster-resilient microgrid projects, further boosting adoption. Additionally, the Canadian government’s Clean Energy for Rural and Remote Communities program has invested $220 million to support microgrid installations in Indigenous and off-grid areas, increasing future growth potential.

REGIONAL ANALYSIS

In 2024, the United States dominated the North American microgrid market by accounting for 80.3% of the region's total capacity. This rule was driven by substantial investments in grid modernization and resilience initiatives. The U.S. Department of Energy reported that microgrids played a crucial role in enhancing grid reliability and integrating renewable energy sources. By the end of 2024, the U.S. had over 500 operational microgrids, providing a combined capacity exceeding 3.5 gigawatts. These microgrids were instrumental in ensuring energy security for critical infrastructure and communities, particularly during extreme weather events.

Looking ahead, Canada is expected to experience the fastest growth in the North American microgrid market, with a CAGR of 12.8% over the years. This anticipated growth is driven by the government's focus on providing reliable energy solutions to remote and Indigenous communities, many of which currently rely on diesel generators. Natural Resources Canada has emphasized the importance of microgrids in reducing greenhouse gas emissions and improving energy security in these areas. The implementation of microgrids is expected to significantly decrease diesel consumption is aligning with Canada's commitment to achieving net-zero emissions by 2050

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Schneider Electric continues to lead the North American microgrid market through smart energy management systems and digital automation solutions. The company's EcoStruxure Microgrid Advisor platform has been widely adopted, allowing real-time optimization of energy flows. In 2024, Schneider Electric focused on expanding AI-driven microgrid solutions to improve efficiency and sustainability. Additionally, its partnerships with utilities and industrial clients accelerated grid modernization efforts. With a growing emphasis on decarbonization, the company is strategically investing in renewable energy microgrid integration, aligning with regional policies supporting clean energy adoption.

Siemens has leveraged its strong utility partnerships and advanced grid control technologies to enhance microgrid deployment in North America. The company's Spectrum Power Microgrid Management System is designed to improve grid stability and cybersecurity, key concerns amid rising energy demand and cyber threats. In 2024, Siemens expanded its presence in military microgrids by securing contracts for energy-resilient bases. The company's ongoing investments in grid-edge solutions, energy storage integration, and AI-driven demand response technologies position it competitively as utilities seek scalable, resilient microgrid networks.

ABB remains a major player in hybrid microgrids and remote energy solutions, focusing on off-grid and industrial applications. The company's Ability™ Microgrid Plus platform optimizes energy flows, ensuring seamless integration of renewable and conventional power sources. ABB's competitive strength lies in its ability to provide scalable microgrid solutions for industries facing power reliability challenges. In 2024, ABB launched AI-enhanced predictive analytics for microgrid performance, driving efficiency gains in remote areas and industrial sectors. With increasing investments in modular microgrid designs, ABB is well-positioned to support the transition to decentralized energy networks.

Advanced Microgrid Systems, Caterpillar, Eaton, General Microgrids, General Electric, Honeywell, Helia Technologies, Hitachi Energy Ltd, S&C Electric Company, Tesla, and Toshiba Corporation.

The North America microgrid market is not just about big companies fighting for control. It is a fast-changing space where technology, cost, and reliability shape competition. Major players like Schneider Electric, Siemens AG, and ABB Group lead the market with smart energy management, AI-powered automation, and strong security systems. But competition is not only about big names—it is also about who can provide the best solutions at the right price.

Unlike traditional power companies, microgrid providers must build trust with customers. Military bases, schools, hospitals, and remote towns are not just buying a product; they need reliable, long-term energy solutions. This has led to more partnerships between big firms, local energy providers, and tech startups. Smaller companies are gaining ground by offering customized, flexible microgrid systems that fit local needs better.

Sustainability is also a big driver of competition. As the U.S. and Canada push for clean energy laws and net-zero goals, companies focusing on solar, wind, and battery storage have an advantage. While large firms secure big contracts, local energy companies and start-ups are growing by offering smaller, community-based microgrids, proving that innovation, not just size, wins in this market

Top strategies used by the key market participants

Digitalization and AI-Driven Microgrid Management

Leading players in the North America microgrid market, such as Schneider Electric and ABB Group, are leveraging artificial intelligence (AI) and digital twin technologies to enhance microgrid performance. These technologies enable real-time energy optimization, predictive maintenance, and automated demand-side management. Schneider Electric’s EcoStruxure Microgrid Advisor allows users to monitor and control energy flows efficiently, reducing downtime and enhancing grid stability. Similarly, ABB’s Ability Microgrid Plus integrates AI-driven predictive analytics, optimizing decentralized energy distribution. As the adoption of intelligent microgrid control systems grows, companies that invest in AI and automation gain a competitive edge, ensuring increased efficiency and resilience in microgrid operations.

Expansion Through Strategic Partnerships and Acquisitions

Market leaders such as Siemens AG and Schneider Electric are strengthening their positions through strategic collaborations and acquisitions. Siemens has actively partnered with utility providers and government-funded initiatives to develop resilient microgrid solutions for military bases and smart cities. Meanwhile, Schneider Electric expanded its influence by acquiring Autogrid Systems, enhancing AI-based energy flexibility solutions, and collaborating with Renewvia Energy to scale solar-powered microgrid projects. These alliances enable companies to expand their market reach, integrate cutting-edge energy storage solutions, and accelerate microgrid adoption across diverse sectors, reinforcing their leadership in the evolving energy landscape.

Focus on Renewable Energy and Sustainability

With increasing emphasis on carbon neutrality and clean energy adoption, leading companies are investing heavily in renewable-integrated microgrid solutions. Schneider Electric is driving sustainability efforts by integrating solar, battery storage, and hydrogen fuel cells into microgrid infrastructure, ensuring reduced reliance on fossil fuels. ABB Group is focusing on hybrid microgrid systems, combining solar, wind, and battery storage to improve energy security in industrial applications. Siemens AG is exploring green hydrogen-powered microgrids, aligning with federal incentives for decarbonization. As sustainability becomes a primary driver for microgrid expansion, companies with strong renewable energy portfolios are positioned to capitalize on regulatory support and long-term industry growth.

Strengthening Cybersecurity and Grid Resilience

Cybersecurity has emerged as a critical concern in the microgrid market, particularly with the rise in cyber threats targeting energy infrastructure. Siemens AG has introduced AI-driven grid security solutions, offering real-time detection and mitigation of cyber risks. Schneider Electric is integrating blockchain-based energy trading platforms, ensuring secure peer-to-peer transactions within microgrids. The demand for cyber-resilient microgrid systems is increasing, especially in sectors such as military, healthcare, and critical infrastructure, where energy security is paramount. Companies investing in robust cybersecurity frameworks are gaining a competitive advantage by providing resilient, secure, and future-proof microgrid solutions.

RECENT MARKET DEVELOPMENTS

- In January 2025, the Texas Legislature allocated $1.8 billion for the Texas Backup Power Package Program. This initiative aims to fund backup power installations at critical facilities, enhancing community resilience and energy security.

- In October 2024, New York City introduced a fleet of 12 solar-powered electric school buses in collaboration with First Student and Con Edison. These buses integrate vehicle-to-everything (V2X) technology, supplying clean energy to the grid during peak demand periods.

- In January 2025, the Texas Legislature convened to address environmental challenges, prioritizing upgrades to the state’s electric grid with clean energy solutions. Lawmakers are considering streamlining permitting processes and improving backup power funding for critical infrastructure.

- In January 2025, the Texas Solar Energy Society (TXSES) advocated for the full appropriation of $1.8 billion for the Texas Backup Power Package Program. The organization is working to educate legislators and promote solar-related policies that enhance energy resilience.

- In January 2025, Environment Texas outlined key legislative priorities, including securing funding for backup power in nursing homes and hospitals. This effort supports the broader push for clean energy adoption and improved power reliability across the state.

MARKET SEGMENTATION

This research report on the North America microgrid market is segmented and sub-segmented based on categories.

By Grid Type

- AC Microgrid

- DC Microgrid

- Hybrid

By Connectivity

- Grid Connected

- Off Grid

By Power Source

- Diesel Generators

- Natural Gas

- Solar PV

- CHP

- Others

By Storage Device

- Lithium-ion

- Lead Acid

- Flow Battery

- Flywheels

- Others

By Application

- Healthcare

- Educational Institutes

- Military

- Utility

- Industrial/ Commercial

- Remote

- Others

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

What factors are driving microgrid growth in North America?

Renewable energy adoption, grid stability concerns, government incentives, and advancements in battery storage drive growth.

What is the future of the North America microgrid market?

Growth is expected due to increasing demand for decentralized energy, AI-driven grid management, and renewable integration.

How big is the North America microgrid market?

The market is growing rapidly due to increasing investments in renewable energy, grid modernization, and government support.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]